EC0701 Economics and the business environment Assignment Sample

Question 1

Answer: I in this question, the case is for the monopoly that sells the portable heating units. The answer regarding this question can be solved below.

- From the theory of monopoly market, the level of profit maximisation and its respective price and quantity can be determined. The intersection point of the marginal revenue and the marginal cost is the point from which the profit maximising output and price is determined.From the theories of microeconomics, it is seen that when MR=MC condition for any monopoly undertaken company holds, the company is interested to produce that amount of goods and services charging that particular price. The diagram in the question has clearly shown that the in this case, the marginal revenue and marginal cost curve intersects at the price of 280 units and quantity of 240 units which is profit maximising.

- In this case, the total revenue of the company is total quantity multiplied by total cost=

240*280= 67200 units

Total cost of the company is the multiplied value of average cost and quantity.

Hence the Total cost = 240* 200= 48000 units.

- The Profit of the company= Total revenue-Total cost.

In this case,total cost is 48000 units andtotal revenue is 67200 units.

The calculated Profit= 67200-48000= 19200 units.

In this case, the firm earns supernormal profit. According to the theory of monopoly, the earning of supernormal profit is dependent on the gap between the total revenue and total cost. In this case, the total revenue is higher than total cost of the firm.

- From the theory of perfect competition, it can be determined. In case of perfect competitive market, there are lots of firms that produce same or identical goods with least distinction that leads to higher mobility of the customers from one firm to another. The total structure of the demand supply and the equilibrium gets changed in perfect competition from monopoly (Boyce, 2020).

- The equilibrium in a perfectly competitive market is achieved at the point of intersection of the price and marginal cost curve or P=MC. Equilibrium quantity is 280 units and equilibrium price is 240 units.

Question 2

- Option B is correct.From the theories of microeconomics, it is seen that all the public goods are non-excludable and non-rival in nature. This is the indication of the property of those goods that represent the case that the providers of these goods cannot prevent others from the use of these goods and the without paying use of these goods is another case which is easily included in its properties.

The private goods, on the other hand, are totally excludable and rival in nature. In case, the providers of public goods start to produce the public goods for people, the market demand and supply position will change drastically. Public goods naturally do it create any profit in monetary terms. On thither hand, private companies are on the motive of profit maximisation. In other words, it can be said that the companies which are privately owned have their most strategies driven by the profit maximising behaviour. \The people are rational and the free rider. The free rider problem is the case where people use the public goods without paying their price and this case can reduce the rewards and return to the private companies that decided to produce the public goods. Cost and debt of the company will rise highly without any return due to the non-paying tendency of people who try the free rider theory.

- Option d is correct.From the theory of perfect competition, it is seen that the market produces at a lower rate than the socially optimum level in case of the perfect competition. From the theories of microeconomics it is also seen that the benefit of the positive externality is not directly possessed by the society.For example, education can be taken as a major example to understand this case. The influence of violence is responsible to decrease the violence inside the society and it is also evident that the higher the educational rate in the society, the lower the case of unhealthy living and thus students can be benefitted throughout the externality. On the other hand, Vaccinations are considered as a positive externality which creates enormous benefit to the public. The people must take the vaccine in order to be safer from diseases which will generally increase the marginal cost. The private social cost and this also revises its use in case of vaccination. The negative externality on the other hand leads the perfectly competitive market to produce higher level of output than the optimal quantity of output which was produced in the positive externality.

- Government subsidies always are considered as a crucial role player in the research and development sector of any nation which is developed or developing.In this case whether the government may increase the subsidy to the government research centre or private is not mentioned but only the research and development sector is specified in the question. From the theories of market and the nature of government and firms, it should be noted that they both have the same interest in the investment and decision making. As mentioned by Chernozhukov et al. (2019), many countries have been facing diseases and medical issues and tackling these is a big challenge for any government for which they decide to subsidise the research and development centres which are associated with medical research. Improvement in the healthcare services has been taken inside the expenditure of the government through subsidising. On the other hand, the quality of the research and its movement towards true success is quite important because healthcare is highly sensitive sector as this involves lives of million people. Healthcare expenses has been increased in many countries due to high disease rate and in countries where the government takes control of the hospitals, need to take responsibility of the expenses which raises the expenditure of government again and this drives the government to invest in medical research and development sector. Many diseases with lifestyle diseases can be tackled with the improvement of the medical sector. This case is the motivator of government.

On the other hand, the alcohol should be taxed with a high levelwhich can be beneficial in order to reduce the rate of crime as well as the consumption and addiction of it. It is seen that the alcoholic deaths are not less than any other diseases which is an incident of high concern. The life of teenagers and students who just passed out of school and have license of alcohol can be destroyed with excess use of it. In case of increment in tax rate the consumption will decline.

Question 3

In the given case, Autonomous consumption = 10000

MPC= 0.3

Investment= 11000

Government spending= 30000

Net export= -5000

Income tax rate= 20%.

Government wants to increase Y upto 45000

Current Y= 10000+0.3Y +3000-5000+11000

= 27142.85

After increase in government spending upto 30000, Y increases to 57142 and it exceeds 45000.

- To increase Y upto 45000 the government has to increase its expenditure upto 17857 units.

Question 4

- In any corporate market like the UK, the corporate tax matter a lot in ensuring the growth and sustainability of the economy. According to the taxation policies of the government, corporate tax play a vital role which goes in the decision of investment in more capita or production of the firms. On the other hand, it is also observed that the corporate tax possesses some harmful characteristics that can harm the progress of the economy. Taxation has some serious sensitive effect on the Capital.

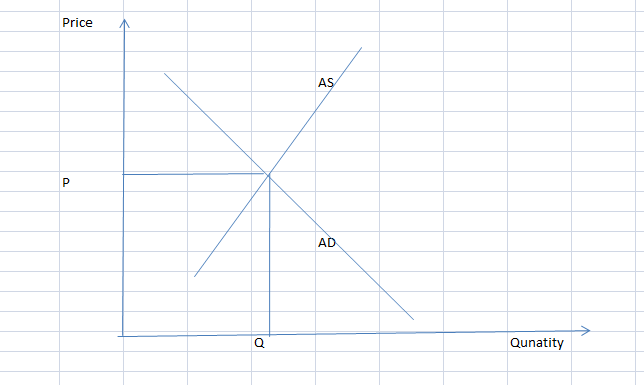

Figure 1: Aggregate demand and aggregate supply

In case, the government increases the corporate tax rate, it can be dividedthroughout the corporate sector and the workers in terms of the profit and wages. This is the case where the wage is dependent on the rate of corporate tax. Higher level of tax will lower the income of the workers and this will lead to lower consumption and lower demand of goods. On the other hand, lower tax rate will encourage the firm for investing in more developed and creative innovations that needs more workers which will raise the employment. The income tax rate cut can encourage many companies to enter the market. Reducing taxes often shifts the aggregate demand and supply towards the capital formation.

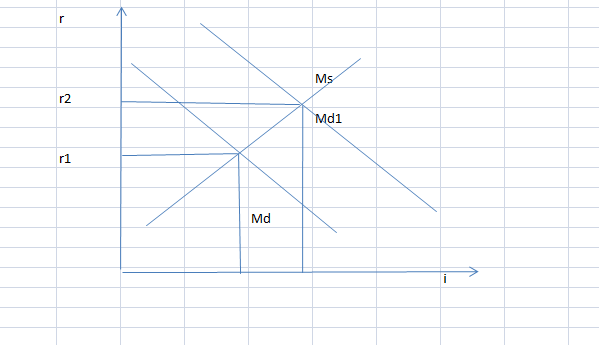

- The theories of macroeconomics shows the relation between the interest rate and inflation.Both of them have an inverse relationship. In general when interest rate is lower, the inflation hits the economy highly. In the lower rate of interest, the investment is high. In this case, people borrow money from the bank thatraises the quantity of liquid money which raises the purchasing power of the people at that time. At this point, investors take loans from bank which determines that increasing money supply increases the inflation. On the other hand, when the interest rate is higher, people only save money in the bank as this generates more interest for them. As the return payable higher in case of higher interest, people don’t want to borrow money. This reduces the inflation.

- Phillips curve is the relation of the unemployment and inflation. In long run Phillip’s curve shows the inverse relation between rate of inflation and rate of unemployment. The Phillips curve is the vertical linein the long run. It indicates the absence of permanent trade-off between the unemployment and inflation in the long run.

Inflatio Unemployment Normally it is an L shaped curve that shows that as unemployment decreases, inflation increases and as inflation reduces, unemployment increases. In long run, it can be stated that the inflation will be stable. The rational expectation theory also suggests that inflation has some temporary errors and its expectations of inflation can be equal to the previous one.

- Option 2 is the correct answer.

Different types of natural occurrence are responsible for the cyclical unemployment. Different recession and downturn or any other factors which changes natural level of employment of the economy are considered as the occurrence. During recession and downturn, corporate sectors deploy a high number of employees for receiving lower cost advantage and this creates unemployment. As mentioned by Cogoljevic et al. (2019), the demand for goods and services are lowered drastically, the case is also observed. On the other hand, during the recession, unemployment increaseswith the rise in price of the goods withlower the demand of the market. This again leads to the decrease in the wage and employment. It is seen that only one fiscal and one monetary stimulation is quite enough to reduce its effect in the long run.

Question 5

Due to higher advancement in the infrastructure of education, the UK attractsa lots of people for studying inside it. This also determines the lower power of the currency compared to other nations. According to the theories of monetary policy and currencies it is noted that the strength of a currency is determined through the interaction of the factors which are related to the forex or foreign exchange. The strength of the currency is also determined through the Interest rate of the central bank and balance of trade of the country. The exchange rate is also effected through the relative purchasing power of the goods and services compared to other nations. The purchasing power parity is also a factor. As mentioned by Asongu et al. (2019) the money supply is Australian market is lower which indicates the lower inflation of the country. In case of higher interest rate also tends to lower investment and lower return and this shows that Australian market is not a good place to invest. It is also seen that Singapore is facing high demand of holiday visits indicating the popularity of the venue that is good for investment. These all factors play vital role to show the higher exchange rate and also represents the strength of the currency of the country.

The increase in the truism in Singapore will enhance the demand for the currency however in this situation it cane seen this demand for the currency is increasing it will creates a positive impact on the value one currency which will enhance the rates of currency. Similary, in case of UK it can be seen the demand for studying in UK is increasing which allow them in increase in the demand for the steeling pond which will also enhances the price of sterling pound.

Reference list

Asongu, S., Folarin, O. and Biekpe, N., 2019. The stability of demand for money in the proposed Southern African Monetary Union. International Journal of Emerging Markets.

Boyce.P, 2020. What is Supply and Demand?. Available at: https://boycewire.com/supply-and-demand/[Accessed 4 th December 2021]

Chernozhukov, V., Hausman, J.A. and Newey, W.K., 2019. Demand analysis with many

Cogoljevic, M., Tosovic-Stevanovic, A. and Nikitovic, Z., 2019. Internationalization Of Marketing Activities In Global Business Environment. Economic and Social Development: Book of Proceedings, pp.56-64.

Coulombel, N. and Monchambert, G., 2019. Diseconomies of scale and subsidies in urban public transportation, Nicolas Coulombel, Guillaume Monchambert, 2(7), pp. 1-42.

………………………………………………………………………………………………………………………..

Know more about UniqueSubmission’s other writing services:

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.