AAF044-6 Accounting and Finance Sample

Introduction

This search is able to show the financial possession of an organization that is able to develop the idea of the details about the organization to maintain progress in the global market to deal with the organizational developments. The cushion organization of this research is Morrison’s supermarket plc and this organization was established in 189 in Bradford, UK. This organization was able to generate £ 3495000 as revenue in 2019 and maintain £110,000 in the workplace (Wsj. com 2022). This organization is able to generate more profits from 2018 to 2019 and that shows this organization has developed its ability to get profits from the market. This is a large retail supermarket chain based in the UK and the majority of its resources came from the supermarket business. Huge competition in the retail chain market and the lack of supply chain management are the two most important issues that this organization is vacations to continue its business.

This research has developed the two years ratio analysis to develop a complete understanding of the organization to maintain the progress about the organization to understand its performance in two financial years, the ratio analysis is able to develop the complete understanding of the organization to maintain development activity and flexibility in the global market. This research is also able to develop the competitor’s analysis to understand the organizational potential to maintain sustainability in the global market. In this research, the other two organizations are Walmart and Tesco and unlike Morrison, the other organizations are also retail chains in the UK. This research provides a critical understanding of the organization and develops a complete understanding of the performance of Morrison in the global market. In this research, ratio analysis is used as a measurement tool that defines the details of the organization to maintain the progress of the comparison between the other two organizations.

Part A

Evaluation of financial statement

The financial statement of the company helps the company and the shareholders to make the analysis of the performance of the company which the company has done in a particular period of time. The financial statement includes the statement of the balance sheet and the income statement of the company.

From the balance sheet of the company Morrison’s supermarket plc, it can be seen that the company’s performance is not the same every year. The performance of the company is fluctuating which means the financial position of the company is not equal every year. It’s fluctuating and from the income statement of the company Morrison’s supermarket plc, it can be seen that the performance of the company is deteriorating because the gross profit of the company in 2020 was 629 which will decrease to 501 in 2021. From the analysis of the income statement and the balance sheet of the company, it can be said that the company is required to improve its performance.

Performance of the company for the last two years

Ratio analysis

Ratio analysis is the type of quantitative method which helps the company in knowing about its “liquidity, efficiency and profitability” through the analysis of the financial statement of the company.

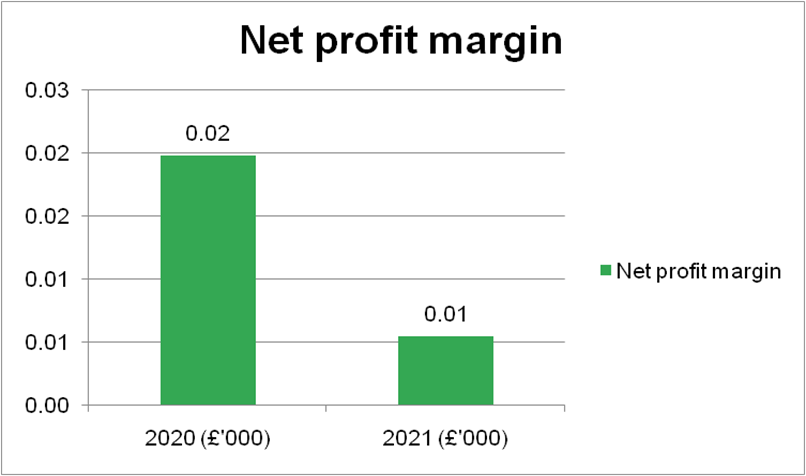

Net profit ratio

The net profit ratio provides information about the profitability of the company which it is able to get after paying all the expenses which incur for the production of the product and the expenses also include the expenses of the tax(Nariswar et al. (2020).

From the calculation of the net profit of the company Morrison’s supermarket plc, it can be seen that in 2020 the net profit of the company was 1.98% which was changed to 0.55% in 2021. When the percentage of the net profit ratio is between “ 0.5% to 3.5%” then the net profit of the company is good. From the result, it can be said that the net profit of the company is good but compared to the percentage of 2020 the performance of the company has been dented.

Figure 1: net profit margin

(Source: Self-created)

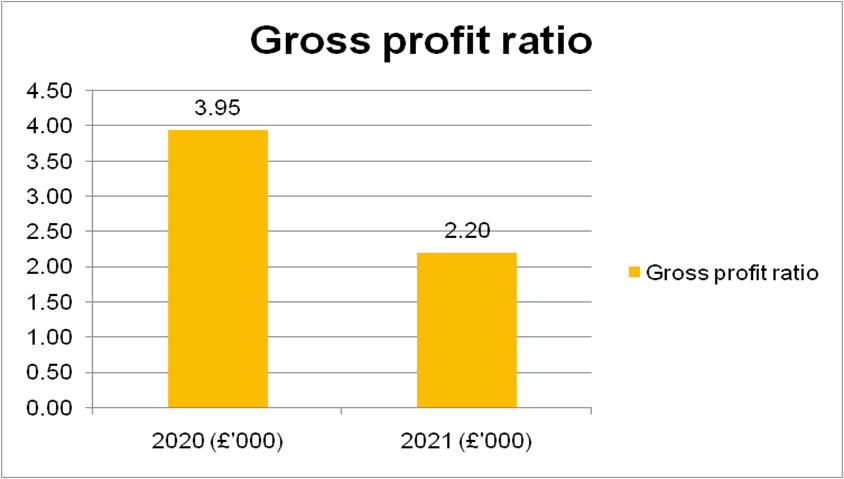

Gross profit ratio

Gross profit ratio is the type of financial ratio which helps in measuring the “performance and the efficiency of the company”.

From the calculation of the gross profit of the company Morrison’s supermarket plc, it can be seen that in 2020 the gross profit of the company was 3.95% which was changed to 2.20% in 2021. The percentage of the gross profit ratio is between “0.5% to 3.5%) then the net profit of the company is good. From the result, it can be said that the net profit of the company is good but compared to the percentage of 2020 the performance of the company has been dented.

Figure 2: Gross profit margin

(Source: Self-created)

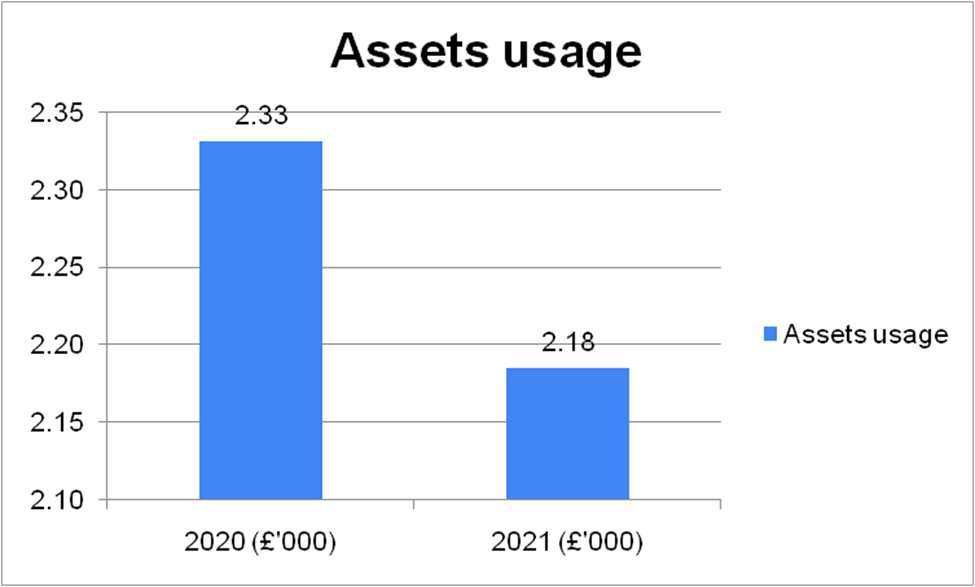

Asset usage

The asset usage ratio provides the ability of the company in earning revenue by using its assets.

From the calculation of the asset usage ratio of the company Morrisons supermarket plc, it can be seen that in 2020 the asset usage ratio of the company was 2.33% which was changed to 2.18% in 2021. When the percentage of the asset usage ratio is more than 70% then the asset usage ratio of the company is good. From the result, it can be said that the asset usage ratio of the company is not good and compared to the percentage of 2020 the performance of the company has been dented.

Figure 3: asset usage ratio

(Source: Self-created)

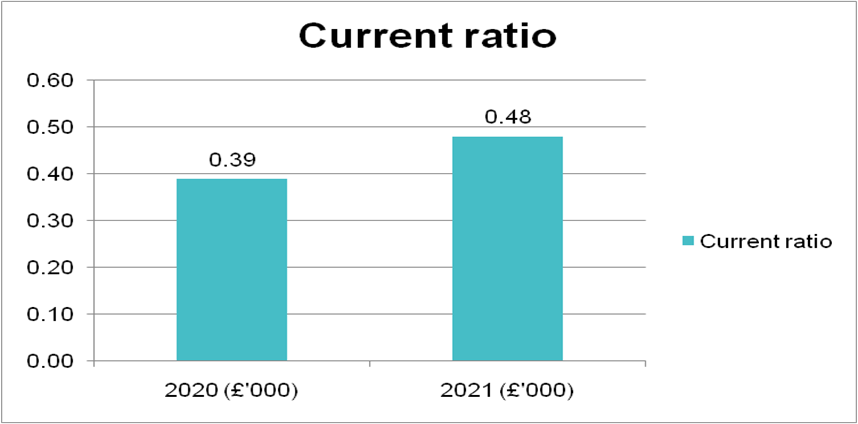

Current ratio

The current ratio of the company provides information regarding the ability of the company in paying its short-term obligations or the liabilities which are due for a particular period of time (Bashir et al. (2021).

Figure 4: Current ratio

(Source: Self-created)

From the calculation of the current ratio of the company Morrison’s supermarket plc, it can be seen that in 2020 the current ratio of the company was 0.39% which was changed to 0.48% in 2021. When the percentage of the current ratio is between 1.2 to 2% then the current ratio of the company is good. From the result, it can be said that the current ratio of the company is not good and compared to the percentage of 2020 the performance of the company has improved.

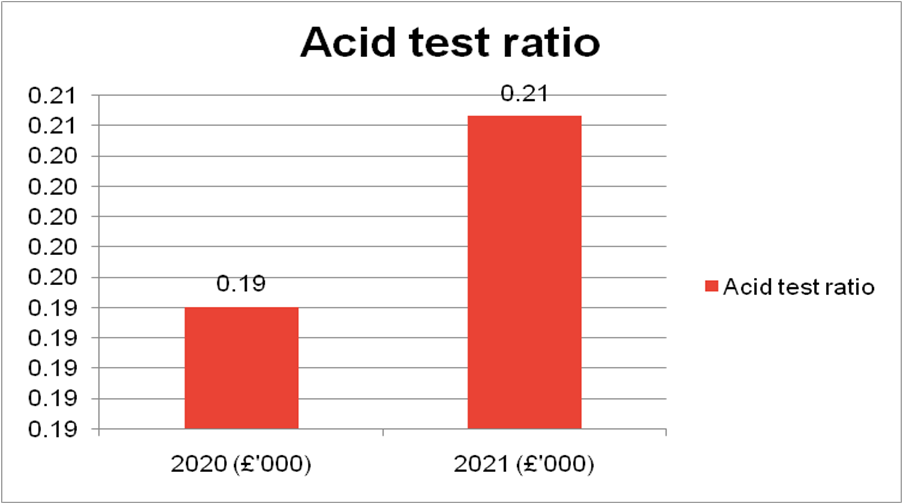

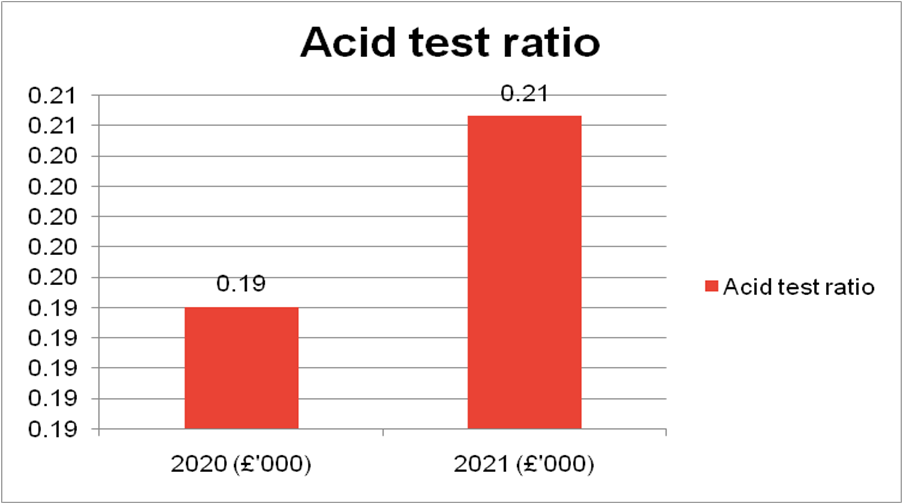

Acid test ratio

The acid test ratio is the liquidity ratio which helps in measuring the efficiency of the company’s short-term assets in paying off current liabilities of the company (Simamora et al. (2019).

Figure 5: Acid test ratio

(Source: Self-created)

From the calculation of the Acid test ratio of the company Morrisons supermarket plc, it can be seen that in 2020 the Acid test ratio of the company was 0.19% which was changed to 0.21% in 2021 (Wsj. com 2022). When the percentage of the Acid test ratio is 1:1 then the Acid test ratio of the company is good. From the result, it can be said that the Acid test ratio of the company is not good and compared to the percentage of 2020 the performance of the company has improved.

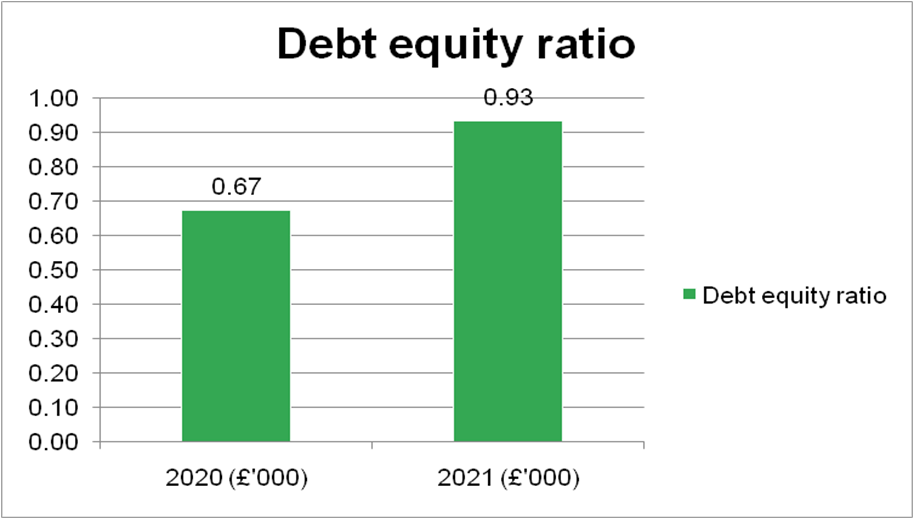

Debt equity ratio

The debt-equity ratio helps in measuring the total debt of the company compared to the amount of invested capital through the owner and the profitability of the company which has been made over time (Yanto et al. (2021).

Figure 6: Debt-equity ratio

(Source: Self-created)

From the calculation of the debt-equity ratio of the company Morrisons supermarket plc, it can be seen that in 2020 the debt-equity ratio of the company was 0.67% which was changed to 0.93% in 2021 (Wsj. com 2022). When the percentage of the debt-equity ratio is between 0.3 to 6.0% then the debt-equity ratio of the company is good. From the result, it can be said that the debt-equity ratio of the company is good and compared to the percentage of 2020 the performance of the company has improved.

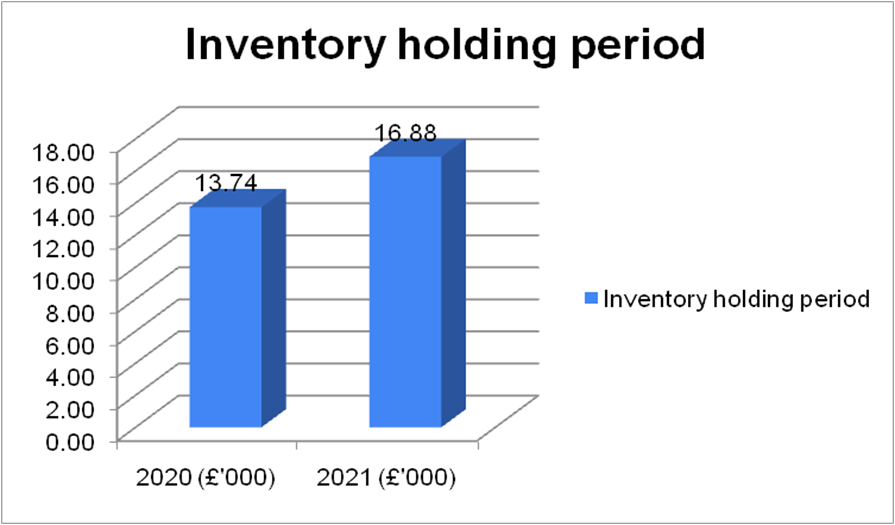

Inventory holding period

The inventory holding period provides information regarding the number of days the company is able to keep its inventory before the sales (Wahyudi et al. (2019).

Figure 7: Inventory holding periods

(Source: Self-created)

From the calculation of the inventory holding period of the company Morrisons supermarket plc, it can be seen that in 2020 the inventory holding period of the company was 13.7 days which was changed to 16.9 days in 2021. When the days of the inventory holding period are between 30 to 60 then the inventory holding period of the company is good. From the result, it can be said that the inventory holding period of the company is good and compared to the performance of 2020 the performance of the company has deteriorated.

Part B

Comparison with competitors

In this research, there are two competitors have been chosen to measure the organizational performances of the chosen organization Morrison. The ratio analysis has been used in this research to develop a complete understanding of the organizational progress in the global market (Krstić. and Fedajev, 2020). The ratio analysis has provided support by analisis the details about the organization to maintain the development activity with the other competitors. In this research, the profitability, liquidity and efficiency ratios have been used in this research to develop a complete understanding of the chosen organization [Referred to appendix 1].

Comparison of Profitability

Gross profit margin and net profit margin ratios have been used in this search to develop a complete understanding of the organization and develop a thorough understanding of organizational profitability. The gross profit margin is able to show the organizational potential to develop a complete understanding of the organization’s potential to earn profits from its sales. Net profit is another profitability ratio that is able to develop a thorough understanding of the chosen organization to measure its performance in the global market (Küçük et al. 2021). In this research, the organization has to develop a thorough understanding of the organization to develop the details about the profitability (Wang et al. 2021). The net profit ratio measures the details about the organizational potential to make the development in this search to maintain the progress in the global market. The measurement men chart of this research is able to develop a complete understanding of the organizational development of the chosen organization and its competitors (Vunvulea et al. 2022). The revenue of this organization in 2021 and 2020 are 17536 and 17598 the gross profit margin of this organization in 2021 and 2020 are 1.98 and 0.55 and all this data shows that this organization may develop its organizational position in the global market to deal with the huge competition (Wsj. com 2022).

Figure 8: Comparison of profitability

(Source: Self-created)

The gross profit ratio of all organizations is 6.67 (Tesco, 2021), 7.59 (Tesco, 2020), 23.09 (Walmart, 2021), 24.15 (Walmart, 2020), and 1.98 (Morison, 2021), 0.55 (Morison, 2020).

The net profit ratio of all organizations is 0.91(Tesco, 2021), 1.27 (Tesco, 2020), 1.19 (Walmart, 2021), 1.88 (Walmart, 2020), and 3.95 (Morison, 2021), 2.20 (Morison, 2020).

The asset usage ratio is also used in this research to develop a complete understanding of the position of this dress to develop a complete understanding of organizational usage. The asset usage ratio of all organizations is 1.61 (Tesco, 2021), 2.26 (Tesco, 2020), 3.94(Walmart, 2021), 4.16 (Walmart, 2020), 2.33, and (Morison, 2021), 2.18 (2020) (WSJ. com 2022). After all this analysis it can be said that Martha’s developed a better position in the gross profit margin and asset usage ratio. Compared to Morison the other two organizations are better in the margin of profitability.

Comparison of liquidity

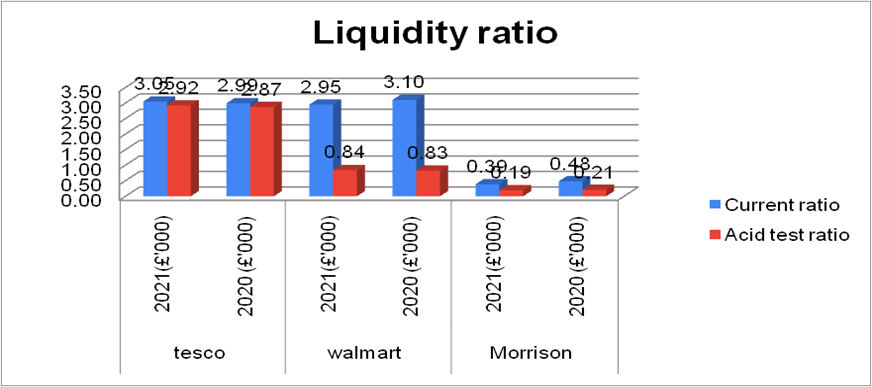

A current ratio is a measurement tool that shows the organization to develop ideas about organizational flexibility to develop the organizational position in this search. The current ratio and the quick ratio are able to measure the organizational profitability in the global market to deal with the organizational development in the global market to pay the short-term obligation by only using the current assets (Mecke et al. 2022). Liquidity is a process that is able or develops a complete understanding of the organization to deal with the organization to maintain the profitability in this research.

The current ratio of all organizations in this research are 3.05 (Tesco, 2021), 2.99(Tesco, 2020), 2.95(Walmart, 2021), 3.10(Walmart, 2020), 0.39(Morison, 2021), 0.48 (Morison, 2020). The quick ratio of all organizations in this research are 2.92 (Tesco, 2021), 2.87 (Tesco, 2022), 0.84 (Walmart, 2021), 0.83(Walmart, 2020), and 0.19(Morison, 2021), 0.21(Morison, 2020) (Wsj. com 2022).

After this analysis, it can be said that the other organizations are in a better position compared to Morison in the global market. Liquidity is a position that shares the organizational flexibility bij the global market today with the organizational progress by measuring its flexibility in the global markets (Choi et al. 2021). According to the profit margin, it can be said that the Tesco have better current ratio and the Morrison have a lower liquidity ratio compared to the both of these organizations.

Figure 9: Comparison of liquidity

(Source: Self-created)

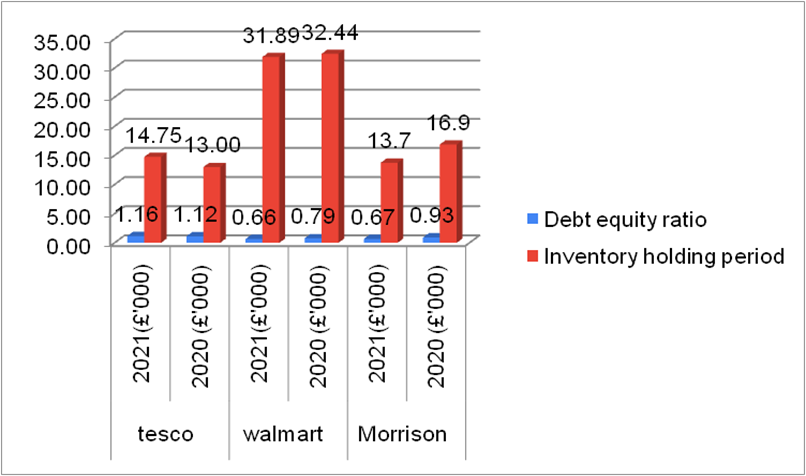

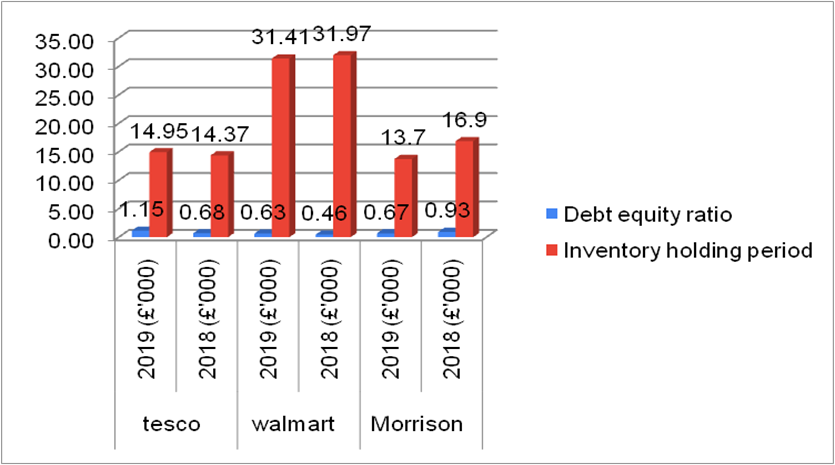

Comparison of efficiency

The efficiency ratio is a ratio that is able to show the organization to measure organizational efficiency to generate profitability through action in the global market. The efficiency ratio measures the organizational development or ability to generate profitability from the assets in the organization (Haydar et al. 2022). The three organization debt equity ratio has been measured in this research to develop a complete understanding of this research to develop a complete understanding of this research to maintain the development in this research (DEVILLE, and CHARLIER, 2022). The debt-equity ratio of all organizations is after the analysis of this debt-equity ratio it can be seen that this chsoen organistaion are not performed well in the global market to deal.

Figure 10: Comparison of efficiency

(Source: Self-created)

The debt-equity ratio of all organization are 1.16 (Tesco, 2021), 1.12 (Tesco, 2020 ), 0.66 (walmart, 2021), 0.79 (Walmart, 2020), and 0.67 (Morison, 2021), 0.93(Morison, 2020). The inventory holding period of all organizations are 14.75 (walmart, 2021), 13.00 (Walmart, 2020), 31.89 (Walmart, 2021), 32.44 (Walmart, 2020), 13.7(Morison, 2021), 16.9 (Morison, 2020). After all this assumption it can be said that the organization are not performing well in the2021 and the other organisational performances are well in 2021 (Wsj. com 2022).

Figure 11: Comparison of efficiency

(Source: Self-created)

Conclusion

This research provides a critical understanding of the organization and develops a complete understanding of the performance of Morrison in the global market. In this research, ratio analysis is used as a measurement tool that defines the details of the organization to maintain the progress of the comparison between the other two organizations. After this analysis, it can be said that the chosen organization Morison is performing well in the global market but fails to perform well in the comparison with its competitors. It can be said that the compilation of the Morison performs well compared to Morison. Huge competition in the retail chain market and the lack of supply chain management are the two most important issues that this organization is vacations to continue its business. This research has developed the two years ratio analysis to develop a complete understanding of the organization to maintain the progress about the organization to understand its performance in two financial years, the ratio analysis is able to develop the complete understanding of the organization to maintain development activity and flexibility in the global market.

Reference

Bashir, Z., 2021. Current Asset Management as the driver of financial efficiency in the Textile Industry of Pakistan. Arshad, MU, Bashir, Z., Asif, M., Shuja, SM, & Hussain, G.(2021),“Current Asset Management as the driver of financial efficiency in the Textile Industry of Pakistan”. Jinnah Business Review, 9(1), pp.68-84.

Choi, J.S., Lee, J.S. and Kwon, Y.M., 2021. A Study on the Importance Analysis for Improving the Efficiency of Seafarer’s Policy. Journal of the Korean Society of Marine Environment & Safety, 27(2), pp.219-227.

DEVILLE, M. and CHARLIER, C., 2022. When immuno analysis seems more reliable than LC-MS-MS Importance of ion ratio calculation. In 2022 Current Trends in Seized Drug Analysis Symposium.

Haydar, F.G., Otal, Y. and Avcioglu, G., 2022. Evaluation of patients with acute pancreatitis associated with SARS-CoV-2 (COVID-19); The importance of lipase//lymphocyte ratio in predicting mortality. CLINICAL STUDY, 428, p.434.

Krstić, S. and Fedajev, A., 2020. The role and importance of large companies in the economy of the Republic of Serbia. Serbian Journal of Management, 15(2), pp.335-352.

Küçük, U., Duygu, A. and Emine, G.A.Z.İ., 2021. The clinical importance of triglyceride/glucose ratio in the primary prevention of cardiovascular diseases: A retrospective cohort study. Journal of Surgery and Medicine, 5(10), pp.1020-1023.

Mecke, L., Ignatov, A. and Redlich, A., 2022. The importance of the cerebroplacental ratio for the prognosis of neonatal outcome in AGA fetuses. Archives of Gynecology and Obstetrics, pp.1-7.

Nariswari, T.N. and Nugraha, N.M., 2020. Profit growth: impact of net profit margin, gross profit margin and total assets turnover. International Journal of Finance & Banking Studies (2147-4486), 9(4), pp.87-96.

Simamora, R.A. and Hendarjatno, H., 2019. The effects of audit client tenure, audit lag, opinion shopping, liquidity ratio, and leverage to the going concern audit opinion. Asian Journal of Accounting Research, 4(1), pp.145-156.

Vunvulea, V., Suciu, B.A., Cocuz, I.G., Bacalbașa, N., Molnar, C., Ghiga, D.V. and Hălmaciu, I., 2022. Importance of the neutrophil to lymphocyte ratio as a prognostic factor in patients with spleen trauma: A single center experience. Biomedical Reports, 17(4), pp.1-8.

Wahyudi, R.I. and Prasetya, R.Y., 2019. Analisa Pengaruh Ukuran Partikel Abu Dasar Batubara Dan Waktu Tahan (Holding Time) Terhadap Sifat Mekanik Material Komposit Polimer Polypropylene (Doctoral dissertation, Untag 1945 Surabaya).

Wang, X., Li, Z. and Shafieezadeh, A., 2021. Seismic response prediction and variable importance analysis of extended pile-shaft-supported bridges against lateral spreading: Exploring optimized machine learning models. Engineering Structures, 236, p.112142.

Yanto, E., Christy, I. and Cakranegara, P.A., 2021. The influences of return on asset, return on equity, net profit margin, debt equity ratio and current ratio toward stock price. International Journal of Science, Technology & Management, 2(1), pp.300-312.

Website

www. wsj, (2022), the financial statement of Morison”, Available on, at: https://www.wsj.com/market-data/quotes/NG/XNSA/MORISON/financials/annual/income-statement.

www. wsj, (2022), the financial statement of Tesla”, Available on, at: https://www.wsj.com/market-data/quotes/UK/TSCO/financials/annual/balance-sheet.

www. wsj, (2022), the financial statement of walmart”, Available on, at: https://www.wsj.com/market-data/quotes/WMT/financials/annual/income-statement.

Know more about UniqueSubmission’s other writing services: