ACC4029 – Managing Operations and Finance Assignment Sample 2023

1. Management Accounting

Business organization and development is necessary and management accounting helps a company by analysing financial data and performance of the company. It can be seen that in the 21st-century businesses are growing at a rapid speed, so the company requires good management skills in order to make a stable business growth.

As per the view of Babich and Kouvelis (2018, p15), a good manager critically evaluates past financial performance and finds errors, after that implication process starts in the company so that present performance can be improved. Decisions making skills enhance with proper management process so managers are required to market information and present cost structure.

As per the view of Butler, K.C., (2016, p.19), a management accountant’s job is mainly based on the implication of professional knowledge in a way so that internal control and development can be done effectively.

2. Role of Management Accounting

Management accounting is also known as the backbone of a growing business firm hence it can be said that it has a vital role for a company. As per the view of Canyakmaz, Karaesmen and Özekici (2017, p.110), a good manager involves analysing financial data and actual business conditions and makes necessary changes in order to improve the performance. Therefore the role of management accountant is as follows:

- Decision making:It can be seen that during the management process several crucial decisions decide the future growth of a company. As per the view of English and Miller (2019, p.395), managerial accounting critically analyses internal business conditions and estimates the possible future, as a result, effective decision making becomes possible.

- Maintaining capital structure:Firms often require funds and in the market, several sources of funds are available to the company however, there exist several drawbacks in such sources. As per the view of Helo, Gunasekaran and Rymaszewska (2017, p.13), managerial accountant examines the present capital structure and after that, a proper source of funds for the company is selected.

- Planning:Good planning is necessary in order to attain the firm’s goal in a short period of time and at minimum costs. As per the view of Kamrad, Ji and Schmidt (2017, p.70), management accounting is deeply involved in analysis activities and available data is used to make proper future planning. Budget preparation is also part of a management accountant’s job and it helps the company to maintain cash flow.

- Controlling activities:Budgetary control is an essential role of managerial accountant and a proper control became possible through calculating standard cost and variances. As per the view of Kerr and Moloney (2019, p.19), liquidity and performance evaluation is necessary for a growing firm and through a good controlling activity, the goal of the company can be obtained.

- Identifying business problems:There often lie several business problems such as communication problems between two internal sectors of business. As per the view of Mian (2019, p.17), a managerial accountant takes a great role in establishing a good communication system and also finds internal business problems.

- Productivity:A manufacturing firm widely depends on the number of production hence, it is necessary to increase the productivity power of a company. As per the view of Luo and Shang (2019, p.470), managerial accounting provides budget plans and maintains target based achievement systems as a result productivity power increases.

Figure 1: Role of the managerial accountant

(Source: Magutu, 2018)

3. Differences between Management Accounting and Financial Accounting

Management accounting and financial accounting are used for the development and maintenance of company performance. However, the field of both accounting job is different to another such as:

- The main role of a financial accountant is to prepare a financial report and maintain financial data. Managerial accountant critically evaluates the financial report and prescribes plans and future budgets to the organization.

- Based on the past data, a financial report has been prepared, so it can be said that a financial accountant’s focuses on past performance. On the other side development and planning is oriented on the future possible performance of an organization so managerial accounting focuses on the future.

- Financial statement accuracy can be increased by auditing the annual report however there is no opportunity of auditing in case of future judgments. As per the view of Magutu (2018, p.18), it can be said that the company requires a knowledgeable managerial accountant as based on his guidance future performance of the company is dependable. However, the faults of a financial accountant can be rectified during the cross-check process of auditing.

- It can be seen that a company requires an annual at the end of the fiscal year, so the importance of a financial accountant for a company is lower compared to a managerial accountant. The budget and planning is a continuous process, so the need for a managerial accountant is higher compared to a financial accountant.

4. Uses of costing models in operational management

4.1. BEP Analysis Technique

Based on the analysing cost structure of N-Tech it can be seen that the company currently sells its product at £200. There exist variable costs of £150 per unit of production, so it increases as the number of units produced. Apart from that, the fixed costs will be £2,500,000 and it will be constant against the number of unit production. Therefore,

Sales per unit £200

Less: VC per unit £150

Contribution per unit £50

Hence, the BEP unit is (£2,500,000 / £50) = 50,000 units, so in order to meet the total costs, B-Tech will be required to sell 50,000 smart phones.

4.2. Uses of different models

N-Tech is a big Smartphone manufacturing company hence simple and traditional operational management techniques may not work properly. Activity based costing model has wide uses in the operational management as through this model overhead costs and indirect costs can be identified.

As per the view of Obaidullah (2018, p.26), an operational decision depends on the classification of incomes and expenses and the ABC model helps management to identify costs as a result a proper decision can be taken easily.

Historical costing model helps analyze the past financial performance of a company and thus proper planning regarding operation can be taken by the manager of N-Tech. Apart from that, the company also can use a weighted average costing model if the company started to sell different kinds of products other than smart phones.

5. Capital Investment Appraisal Technique

There are several investment appraisal techniques available which help to identify the attractiveness of investment options. It can be seen that N-Tech has four different options to invest hence a critical analysis of several appraisal techniques will help to make a proper decision.

| Proposal 1 | ||||||

| Cash flows (£ms) | Cash Flows | CCF | DCF @10% | PV (@10%) | DCF @30% | PV (@30%) |

| Year 0 | -24 | -24 | 1 | -24 | 1 | -24 |

| Year 1 | 16 | -8 | 0.91 | 14.56 | 0.77 | 12.32 |

| Year 2 | 12 | 4 | 0.83 | 9.96 | 0.59 | 7.08 |

| Year 3 | 8 | 12 | 0.75 | 6 | 0.46 | 3.68 |

| Year 4 | 4 | 16 | 0.68 | 2.72 | 0.35 | 1.4 |

| Year 5 | -8 | 8 | 0.62 | -4.96 | 0.27 | -2.16 |

| NPV = | 4.28 | -1.68 | ||||

| Residual value | 0 | |||||

| PBP = | 1 | year | 8 | month | ||

| IRR = ra + {Na * (rb – ra) / (Na – Nb)} | ||||||

| Where, | ||||||

| ra = Lower DCF = | 10% | |||||

| rb = Higher DCF = | 30% | |||||

| Na = NPV at ra = | 4.28 | |||||

| Nb = NPV at rb = | -1.68 | |||||

| Therefore, | ||||||

| IRR = | 24.4% | |||||

Table 1: Investment Appraisal Proposal 1

(Source: Created by learner)

| Proposal 2 | ||||||

| Cash flows (£ms) | Cash Flows | CCF | DCF @10% | PV (@10%) | DCF @30% | PV (@30%) |

| Year 0 | -19 | -19 | 1 | -19 | 1 | -19 |

| Year 1 | 2 | -17 | 0.91 | 1.82 | 0.77 | 1.54 |

| Year 2 | 8 | -9 | 0.83 | 6.64 | 0.59 | 4.72 |

| Year 3 | 8 | -1 | 0.75 | 6 | 0.46 | 3.68 |

| Year 4 | 12 | 11 | 0.68 | 8.16 | 0.35 | 4.2 |

| Year 5 | 10 | 21 | 0.62 | 6.2 | 0.27 | 2.7 |

| NPV = | 9.82 | -2.16 | ||||

| Residual value | 0 | |||||

| PBP | 3 | year | 1 | month | ||

| IRR = ra + {Na * (rb – ra) / (Na – Nb)} | ||||||

| Where, | ||||||

| ra = Lower DCF = | 10% | |||||

| rb = Higher DCF = | 30% | |||||

| Na = NPV at ra = | 9.82 | |||||

| Nb = NPV at rb = | -2.16 | |||||

| Therefore, | ||||||

| IRR = | 26.4% | |||||

Table 2: Investment Appraisal Proposal 2

(Source: Created by learner)

| Proposal 3 | ||||||

| Cash flows (£ms) | Cash Flows | CCF | DCF @10% | PV (@10%) | DCF @30% | PV (@30%) |

| Year 0 | -16 | -16 | 1 | -16 | 1 | -16 |

| Year 1 | 6 | -10 | 0.91 | 5.46 | 0.77 | 4.62 |

| Year 2 | 8 | -2 | 0.83 | 6.64 | 0.59 | 4.72 |

| Year 3 | 6 | 4 | 0.75 | 4.5 | 0.46 | 2.76 |

| Year 4 | 6 | 10 | 0.68 | 4.08 | 0.35 | 2.1 |

| Year 5 | 4 | 14 | 0.62 | 2.48 | 0.27 | 1.08 |

| NPV = | 7.16 | -0.72 | ||||

| Residual value | 0 | |||||

| PBP | 2 | year | 4 | month | ||

| IRR = ra + {Na * (rb – ra) / (Na – Nb)} | ||||||

| Where, | ||||||

| ra = Lower DCF = | 10% | |||||

| rb = Higher DCF = | 30% | |||||

| Na = NPV at ra = | 7.16 | |||||

| Nb = NPV at rb = | -0.72 | |||||

| Therefore, | ||||||

| IRR = | 28.2% | |||||

Table 3: Investment Appraisal Proposal 3

(Source: Created by learner)

| Proposal 4 | ||||||

| Cash flows (£ms) | Cash Flows | CCF | DCF @10% | PV (@10%) | DCF @30% | PV (@30%) |

| Year 0 | -32 | -32 | 1 | -32 | 1 | -32 |

| Year 1 | 6 | -26 | 0.91 | 5.46 | 0.77 | 4.62 |

| Year 2 | 10 | -16 | 0.83 | 8.3 | 0.59 | 5.9 |

| Year 3 | 18 | 2 | 0.75 | 13.5 | 0.46 | 8.28 |

| Year 4 | 16 | 18 | 0.68 | 10.88 | 0.35 | 5.6 |

| Year 5 | 12 | 30 | 0.62 | 7.44 | 0.27 | 3.24 |

| Residual value | 8 | 38 | 0.62 | 4.96 | 0.27 | 2.16 |

| NPV = | 18.54 | -2.2 | ||||

| PBP | 2 | year | 11 | month | ||

| IRR = ra + {Na * (rb – ra) / (Na – Nb)} | ||||||

| Where, | ||||||

| ra = Lower DCF = | 10% | |||||

| rb = Higher DCF = | 30% | |||||

| Na = NPV at ra = | 18.54 | |||||

| Nb = NPV at rb = | -2.2 | |||||

| Therefore, | ||||||

| IRR = | 27.9% | |||||

Table 4: Investment Appraisal Proposal 4

(Source: Created by learner)

-

Net present value

The calculation of NPV is necessary to identify which option provides the highest value in the present day’s currency. The company maintains a 10% discounting factor based on which the present value of cash flows has been calculated. Therefore, it can be seen that the NPV of proposals 1 is £4.28 and in case of proposal 2 it is £9.82. Similarly, NPV of proposal 3 and 4 has been founded as £7.16 and £18.54.

-

Payback Period

N-Tech requires to know the time when the total cash inflow will be equal to the initial investment. Therefore, PBP calculation provides the time duration when the initial investment will be completely converted from the cash inflows. Based on the calculation it has been found that the PBP of option 1 is 1 year 8 months, option 2 is 3 years and 1 month. It is 2 years 4 months in case of option 3 and 2 years 11 months for option 4.

-

Internal Rate of Return

IRR is a discounting rate which helps to identify the profitability percentage of investments in different sectors. Thus it has a vital role in measuring the profit rate of return in available three options. This calculation has preceded with NPV calculation @30% discounting factor and the original discounting factor @10%. It has been found that the IRR of the four proposals is 24.4%, 26.4%, 28.2% and 27.9% respectively.

5.1. Decision

Investment appraisal technique has been used to make a decision regarding acceptance of one proposal among available four alternative options. It can be seen that the proposal 4 has a high net present value and also a high IRR which is 27.9%. Hence, it will be a good opportunity for N-Tech to earn a high profit in future while having a payback period of 2 years and 11 months.

6. Business Plan and Budget

Business plans are such planning made by a company which ensures the path of obtaining the common goal of an organization. Budget is a part of a business plan through which a company tries to restrict its cash outflow. It is important for a business to maintain the provided budget plan and managerial accountant able to make a comparison of actual and budgeted results thus improvement can be monitored.

7. Role of Business Plan and Budget in operational management

N-Tech UK Ltd. requires a proper business plan in order to get a clearer view of their goal. The main goal of a business plan is to set a target and through the path, the company will be able to meet the goal. As per the view of Purba (2017, p.22), the operational management needs to prepare a proper budget in order to track the variances.

The company has an option to increase the number of products based on actual performance and sales. Apart from that, the existing budgetary plan of N-Tech has an opportunity to reduce the variable costs. As per the view of Shang, Wang and Yang (2017, p.330), a good business plan can increase production power as well as be able to reduce the overall costs.

8. Improvement areas analysis

Based on the analysis of the role of business plans and budgets in N-Tech several improvement areas have been found. A business plan requires to be clear to all however, it can be seen that there was no clear description regarding achieving PBT of £7.5 million.

Hence, it can be said that it is essential for the management to look into the cost sheet and make an estimated forecast. The forecast needs to be made in the context of production so that the company is able to meet the total production costs.

Amount of total profit is depending on the number of units sold by the company, so a calculation is required which will indicate the required production unit. Apart from that, it can be seen that the electronic components in the month of November have been produced for 6,000 units while the budget was for 5,000 units. The situation was created because of the lack of proper business plans. Based on the analysis of issues if Mr Pavel it can be said that budget is required to make based on analysing market demands and supply but a lack in the business plan has been noticed here.

| Budget | Actual | Variances | Variances % | |

| Unit | 50,000 | 6000 | 44,000 | 88% |

| Budget | Actual | Variances | Variances % | |

| Material | 410,000.00 | 49000 | 361,000.00 | 88% |

| Suppliers | 210,000.00 | 22500 | 187,500.00 | 89% |

| Direct Labour | 100,000.00 | 10500 | 89,500.00 | 90% |

| Indirect Labour | 60,000.00 | 6200 | 53,800.00 | 90% |

| Depreciation | 30,000.00 | 3000 | 27,000.00 | 90% |

| Share of sales costs | 45,000.00 | 4800 | 40,200.00 | 89% |

| Apportioned overhead | 200,000.00 | 25000 | 175,000.00 | 88% |

| 1,055,000.00 | 121,000.00 | 934,000.00 | 89% |

Table 5: Budget

(Source: Created by learner)

8.1. Recommendation

The recommendation can be made to N-Tech UK Ltd. regarding preparing a detailed and analytical budget forecast. The company will be required to critically survey the market regarding its products demands so that management can guess the number of units it will sell.

Therefore, the amount of total sales and its production costs is required to be calculated and through this process, electronic departments are able to produce an accurate number of materials. It is expected in a budget control report to have a lower number variances and it can be possible by maintaining a business plan effectively.

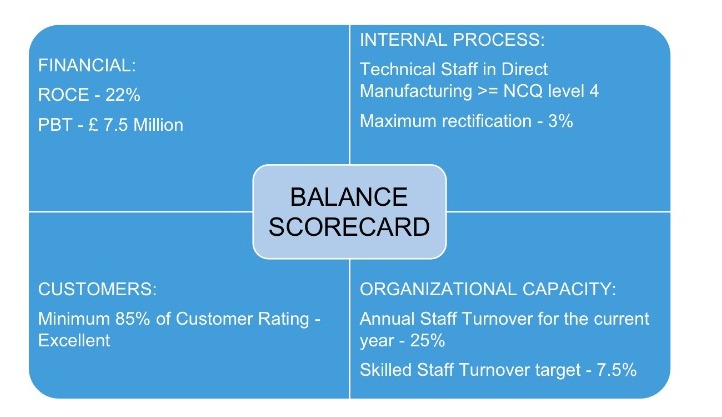

9. Balanced Scorecard Approach

Business development is necessary in a competitive market place thus strategic management has a huge impact on the overall performance. Based on the collected data and providing feedback to each sector of business this balanced scorecard approach works.

As per the view of Shen, Bao, Yu and Hua (2019, p.30), it is a good decision making tool as it tracks the original business frameworks. It can be seen that the smart phone market is full of competition hence strategic enhancement into the business is necessary in order to make profits. The balanced scorecard approach was founded by Norton and Kaplan in 1922 while they were facing troubles in financial measurement.

10. The usefulness of the Balanced Scorecard Approach

There are several uses of a balanced scorecard approach for N-Tech UK Ltd. as it looks into the internal functions, how efficiently solving the external problems. An effective balanced scorecard analyses learnings and growth of the company, as a result, it can provide the condition employees training condition.

Through providing good training to employees the company will be able to increase the production power thus the company is able to meet the required production in a short time.

As per the view of Yang and Birge (2018, p.68), through this approach business processes are also taken into consideration thus, increase in manufacturing rate can be monitored easily.

Improvement and growth are the primary keys for a business organization which ensures the path of success thus manufacturers are required to make improvement on a regular basis. Customer’s satisfaction is also another crucial sector of this approach and it is necessary to look into the feedback of customers and try to solve as fast as possible.

The balanced scorecard helps to monitor the rate of customer’s satisfaction and with proper care of customer, goodwill of the company increases. Quality sales with proper value to customers help the company in building a good amount of profit, so a company can use this approach as a managerial tool.

11. Balance Scorecard of N-Tech UK Ltd

| Objectives | Goals | Indicators | Initiative | |

| Learning and Growth | Skilled and knowledgeable employees | Increasing training by 100% | Certified employees and an increase in production | Establishing an online and offline training program |

| Customers Satisfaction | Satisfied with the product | Increase the quality of products by 10% | Collections of feedbacks from customers | Implementing product mix and providing offers to customers |

| Financial Perspectives | Enhancing the revenue margin | Increasing PBT to £7.5 million | Annual report | Reducing variable costs |

| Business Process | Development of products | Produce the required number of products in time | Budget report analysis | Preparing a quality business plan and budget |

12. Conclusion

It can be concluded that business strengths are dependable on proper business planning hence it is necessary to prepare a proper business plan, However, it requires good decision making skills, so managerial accountant requires to be knowledgeable.

A good analysis of financial performance is required by a managerial accountant in order to make a proper decision. Apart from that, investment appraisal techniques are widely used to place an effective investment.

This assignment has analysed several important roles of business plans and its usefulness in the IT industry thus managerial accountant’s role has is increasing in every sector. It can be said further that a company has the importance of a managerial accountant rather than a financial accountant.

References

Babich, V. and Kouvelis, P., 2018. Introduction to the special issue on research at the interface of finance, operations, and risk management (iFORM): Recent contributions and future directions.

Butler, K.C., 2016. Multinational Finance: Evaluating the Opportunities, Costs, and Risks of Multinational Operations. John Wiley & Sons.

Canyakmaz, C., Karaesmen, F. and Özekici, S., 2017. Minimum-variance hedging for managing risks in inventory models with price fluctuations. Foundations and Trends® in Technology, Information and Operations Management, 11(1-2), pp.107-123.

English, R. and Miller, W., 2019. A new approach to managing ACRL’s assets. College & research libraries news, 58(6), pp.393-397.

Helo, P., Gunasekaran, A. and Rymaszewska, A., 2017. Designing and managing industrial product-service systems. Cham: Springer.

Kamrad, B., Ji, R. and Schmidt, G.M., 2017. Managing Supply Risk in Fixed Price Contracts: A Contingent Claims Perspective. Foundations and Trends® in Technology, Information and Operations Management, 11(1-2), pp.65-88.

Kerr, W.R. and Moloney, E., 2019. Vodafone: Managing Advanced Technologies and Artificial Intelligence.

Luo, W. and Shang, K.H., 2019. Managing inventory for firms with trade credit and deficit penalty. Operations Research, 67(2), pp.468-478.

Magutu, P., 2018. Managing Seed Enterprises Operations (SEMIs).

Mian, A.S., 2019. HOW ICT IMPLEMENTATIONS IMPACT ON MANAGING REAL ESTATE: AT DIRECTORATE GENERAL STATE ASSET MANAGEMENT, MINISTRY OF FINANCE, INDONESIA. PLANNING MALAYSIA, 17(9).

Obaidullah, M., 2018. Managing climate change: the role of Islamic finance. IES journal Article, 26(1).

Purba, R.B., 2017. Capacity Apparatus Improvement in Managing Economics and Finance towards Independent Village. IOSR J. Econ. Financ. Ver. I, 8(1), pp.2321-5933.

Shang, K., Wang, J. and Yang, Y., 2017. Managing Inventory for a Multidivisional Firm with Cash Pooling. Foundations and Trends® in Technology, Information and Operations Management, 10(3-4), pp.324-337.

Shen, X., Bao, L., Yu, Y. and Hua, Z., 2019. Managing Supply Chains with Expediting and Multiple Demand Classes. Production and Operations Management, 28(5), pp.1129-1148.

Yang, S.A. and Birge, J.R., 2018. Trade credit, risk sharing, and inventory financing portfolios. Management Science, 64(8), pp.3667-3689.

Know more about UniqueSubmission’s other writing services:

Im obliged for the blog. Much obliged.

https://elliotta708bfi0.dm-blog.com/profile

I really liked your blog. Great.

https://temazepam-kopen-duitsland48774.lotrlegendswiki.com/606383/not_known_factual_statements_about_asus_proart_pa602

Major thanks for the blog post.Much thanks again. Much obliged.

https://travisxncq65431.digiblogbox.com/50794522/the-benefit-of-custom-plastic-parts

Thank you ever so for you post.Really looking forward to read more. Cool.

https://nsfws.ai/

Muchos Gracias for your post.Really thank you! Really Cool.

https://crushon.ai/

Very good post.Much thanks again. Really Great.

https://www.laifentech.com/

Looking forward to reading more. Great blog post.Really thank you! Great.

https://www.orangenews.hk

Really informative blog article.

https://inspro2.com/

Major thankies for the article. Great.

https://talkietalkie.ai/

I really liked your blog post.Really looking forward to read more. Much obliged.

https://meencantalapinturadediamantes.es/collections/los-mas-vendidos

I appreciate you sharing this blog article. Really Cool.

https://nsfws.ai/

wow, awesome blog article.Much thanks again. Fantastic.

https://nsfw-ai.chat/

Major thanks for the blog.Much thanks again. Keep writing.

https://crushon.ai/

A big thank you for your article.Really looking forward to read more. Cool.

https://summerseasiren.com/collections/period-underwear

Thanks a lot for the blog post. Keep writing.

https://elliottkxkw86532.pennywiki.com/3722200/unleashing_the_power_of_all_in_one_99_114_121_112_116_111_your_ultimate_companion_in_the_world_of_99_114_121_112_116_111_currency

Really informative article post. Really Great.

https://https-jun88online-co91233.xzblogs.com/66209132/5-essential-elements-for-best-time-to-visit-andaman-and-nicobar

Say, you got a nice blog article.Really looking forward to read more. Fantastic.

https://caidennwgpy.laowaiblog.com/25383974/5-simple-techniques-for-dairy-in-raj-nagar-extension-price

Im obliged for the post.Really looking forward to read more. Really Great.

https://knoxdqeq64320.answerblogs.com/25215281/your-trusted-partner-for-top-notch-air-conditioning-repair-and-ac-mechanic-services

Very informative blog post.Thanks Again. Keep writing.

https://emilianothvg21987.blogprodesign.com/46820266/your-gateway-to-best-nift-coaching-classes-in-delhi

A big thank you for your blog article.Really looking forward to read more. Awesome.

https://e-web-directory.com/listings12677333/little-known-facts-about-name-plate-for-house

Appreciate you sharing, great blog.Much thanks again. Want more.

https://raymondyijlr.worldblogged.com/31409021/mastering-safety-the-ultimate-guide-to-osha-general-industry-courses

Awesome blog post.Really thank you! Really Cool.

https://judahmzny98653.full-design.com/what-is-osha-courses-online-67914220

I really enjoy the post. Keep writing.

https://arenaplus.ph/

I really enjoy the article post.Really thank you! Much obliged.

https://www.sonhungbac.com/

I appreciate you sharing this post.Really thank you! Will read on…

https://atop-education.degree/

Fantastic article.Much thanks again. Cool.

https://gbdownload.cc/

A big thank you for your blog post.Really looking forward to read more. Great.

https://fouadmods.net/

Major thankies for the blog article. Great.

https://gbdownload.cc/

I think this is a real great article.Much thanks again. Awesome.

https://fouadmods.net/

Appreciate you sharing, great article post.Really looking forward to read more. Keep writing.

https://nsfwgenerator.ai/

Thanks for sharing, this is a fantastic post.Much thanks again. Will read on…

http://animegenerator.ai/

Really appreciate you sharing this blog post.Much thanks again. Awesome.

https://best-accounting-software01234.tkzblog.com/25659745/unlocking-success-with-kabaddi-dream11-predictions-your-ultimate-guide

wow, awesome blog.Thanks Again. Awesome.

https://simonlblud.humor-blog.com/25405698/mastering-fantasy-basketball-on-dream11-tips-for-winning-predictions

Thank you for your blog post.Much thanks again. Really Cool.

https://holdenpjbr76432.national-wiki.com/582734/trip_package_tips

I am so grateful for your article.Really thank you! Want more.

https://eduardordpa98653.blog-a-story.com/4743205/the-advantage-of-satta-matka-game

Muchos Gracias for your post.

https://trevorwkyk32198.wikimidpoint.com/3861225/the_advantage_of_satta_matka

I really like and appreciate your blog.Thanks Again. Really Cool.

https://mbti86174.blogcudinti.com/24601270/top-latest-five-deluxe-tempo-traveller-urban-news

Great post about this. I’m surprised to see someone so educated in the matter. I am sure my visitors will find that very useful.

https://https-jun88online-co70012.estate-blog.com/25517280/indulge-in-luxurious-spa-and-beauty-services-at-the-best-spas-in-ahmedabad

A round of applause for your post. Will read on…

https://alexiscqdo54319.azuria-wiki.com/586687/silver_bracelet_for_men

Looking forward to reading more. Great blog article.Thanks Again. Want more.

https://cruzcauj44321.blogdiloz.com/25500879/silver-bracelet-for-men

Appreciate you sharing, great blog.

https://www.hommar.com/products-47088

A big thank you for your post.Really looking forward to read more. Will read on…

https://blog.huddles.app

I really liked your blog post. Awesome.

https://blog.huddles.app

Say, you got a nice blog post.Thanks Again. Much obliged.

https://crushon.ai/

Great, thanks for sharing this blog article.Really looking forward to read more. Will read on…

https://crushon.ai/

Thanks-a-mundo for the article post.Really thank you! Awesome.

https://www.hommar.com/

I value the blog.Thanks Again. Keep writing.

https://humanornot-ai.com/

Really appreciate you sharing this post.Really thank you! Much obliged.

https://crushon.ai/

A big thank you for your post. Great.

https://crushon.ai/

Wow, great blog post.Really thank you!

https://crushon.ai/

Very good article.Really thank you! Great.

https://crushon.ai/

Really informative post.Really thank you! Fantastic.

https://smashorpass.app/

Thanks a lot for the article post.Much thanks again. Awesome.

https://www.kol.kim/custom-design/

Thank you for your blog.Much thanks again. Fantastic.

https://www.yinraohair.com/wigs/shop-by-style/long-silky-straight-wigs

Really appreciate you sharing this post.Much thanks again. Great.

https://www.yinraohair.com/human-hair/front-lace-wig

Thanks for the blog.Really thank you! Awesome.

https://www.yinraohair.com/cosplay/shop-by-person

Fantastic article post.Thanks Again. Cool.

https://www.metalfenceworks.com/e_productshow/?34-Anti-Climb-Fence-PanelsHigh-Security-Mesh-Fence-34.html

This is one awesome post.Really looking forward to read more. Really Cool.

https://umhom13.com

I am so grateful for your blog article. Cool.

https://umhom13.com

I value the article.Really thank you! Really Cool.

https://honista.io/

Looking forward to reading more. Great article.Really thank you!

https://honista.io/

I really like and appreciate your blog.Really looking forward to read more.

https://honorcase.com/

Thank you for your blog article.Really thank you! Awesome.

https://aura-circle.com/collections/aura-sleep-mask-collection

Im grateful for the blog.Really thank you! Keep writing.

https://aura-circle.com/collections/aura-sleep-mask-collection

wow, awesome blog.Much thanks again. Really Great.

https://x.yupoo.com/photos/lireplica/categories/2878105

Great, thanks for sharing this blog post.Really looking forward to read more.

https://www.piaproxy.com

Very good blog.Really thank you!

https://telagrnm.org

Really enjoyed this article.Much thanks again. Awesome.

https://telcgrnm.org/

Great blog.Thanks Again. Keep writing.

https://cncmachining-custom.com

Im thankful for the blog post.Much thanks again.

https://www.topbet.game/?ch=110019

Really informative article post.

https://www.haijiao.cn

Appreciate you sharing, great blog. Great.

https://www.haijiao.cn

Thanks again for the blog article. Really Cool.

https://www.slsmachinery.com

Im grateful for the blog.Really thank you! Great.

https://www.yqwakan.com

Really informative blog article.Really thank you! Want more.

https://www.jingpailianghao.com/

I really liked your blog post. Great.

https://crushon.ai/

This is one awesome article post.Much thanks again. Much obliged.

https://crushon.ai/

Great, thanks for sharing this blog article. Great.

https://crushon.ai/

I truly appreciate this blog article.Really looking forward to read more. Really Great.

https://crushon.ai/

I appreciate you sharing this blog.Much thanks again. Want more.

https://crushon.ai/

Thanks-a-mundo for the blog post.Really thank you! Much obliged.

https://crushon.ai/character/f5757531-9a53-4c38-85ef-cd5ae51cdc13/details

Thanks so much for the article.Much thanks again. Great.

https://crushon.ai/character/503eeebe-1626-45bf-89e9-8614106dc5ab/details

A big thank you for your blog article.Much thanks again. Much obliged.

https://crushon.ai/character/0370eef1-b4fb-4c24-b4e5-8f66b79d401d/details

Muchos Gracias for your post. Will read on…

https://crushon.ai/character/99c19d47-db59-4202-ad4a-d00c10edff2e/details

I think this is a real great post.Really looking forward to read more. Will read on…

https://crushon.ai/character/99c19d47-db59-4202-ad4a-d00c10edff2e/details

Thanks-a-mundo for the post.Thanks Again. Really Cool.

https://ai-sexting.top/

Appreciate you sharing, great post.Thanks Again. Will read on…

https://aihentai.fun/

A round of applause for your blog.Really thank you! Really Cool.

http://ai-gf.top/

Thanks so much for the article.Really looking forward to read more. Cool.

https://spicychat-ai.online/

Major thankies for the blog.Much thanks again. Will read on…

https://janitorai.chat/

Hey, thanks for the blog article.Thanks Again. Really Cool.

https://pygmalion-ai.com/

I really enjoy the article.Really thank you!

http://www.place123.net/place/web-gacor-kuala-lumpur-malaysia

I appreciate you sharing this blog article. Great.

https://www.greatdryermachinery.com

Major thankies for the blog.Really thank you! Much obliged.

https://www.greatdryermachinery.com

Really appreciate you sharing this blog. Much obliged.

https://vapzvape.com/

Hey, thanks for the blog.Thanks Again. Fantastic.

https://vapzvape.com/

Thank you ever so for you blog article.Really looking forward to read more. Really Great.

https://www.wavlinkstore.com

Fantastic article post.Thanks Again.

https://www.vibratorfactory.com

I really liked your post. Fantastic.

https://www.vibratorfactory.com

I really liked your blog.Thanks Again. Great.

https://inspro2.com/

Looking forward to reading more. Great article.Much thanks again. Much obliged.

https://honista.io/