ACC97003M Financial Analysis Assignment Sample

Here’s the best sample of ACC97003M Financial Analysis Assignment, written by the expert.

Executive Summary

The current report has been conducted on the BGC Ltd for understanding the financial health of the firm which has resulted in low profitability and liquidity levels which has been recommended to improve their current assets level. Cash budget analysis has highlighted increasing costs for wages and office refurbishments that are recommended to be reduced via performance appraisal and breaking down costs per month respectively. Lastly, recommendation has been provided for carrying on investments within the office and retail sector due to reduced damage from recession or static period.

Introduction

Financial analysis and decision making through effective understanding of a company’s financial health is important for further increasing its profitability levels after mitigation of the challenges. The current report is conducted over the case scenario of BGC Ltd providing cleaning services and has significantly suffered and faltered a decline in growth after the impact of Covid-19 pandemic. Thus, the aim for conducting the current report is to analyse its financial stability through conducting ratio analysis, cash budget analysis and recommendations along with critical discussion from the company’s plans regarding justified recommendations towards the directors.

Part A: Ratio Analysis

Ratio analysis is calculated on the magnitude of two different numerical or financial values from the financial statements of an organisation. The current section shall highlight upon the profitability, liquidity and solvency ratios for BGC ltd and focus on areas of concern or opportunity.

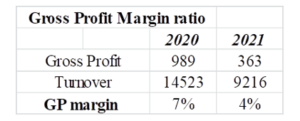

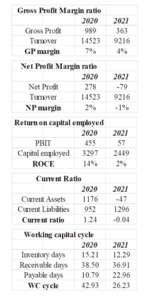

Gross Profit margin

Gross profit margin of the firm has been calculated through dividing the total gross profit from the total revenue section. Focusing on the results, the gross profit margin of the company has significantly reduced from 7% in 2020 to 4% in 2021. The overall revenue levels have reduced, which has significantly affected the overall GP levels in 2021. Therefore, the company is making less money from their cleaning products.

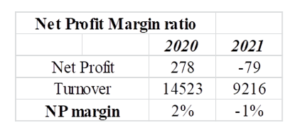

Net Profit margin

Net profit margin helps in the assessment of the amount of income generated from the percentage of revenue earned (Nariswari and Nugraha, 2020). The results highlighted a decline in NP margin from 2% to -1% in 2020-21. This has emerged due to a net loss of 79,000 pounds in 2021 along with a reduction in total turnover. Decline in net profits to negative highlights less money earned than spent along with its inability to control costs.

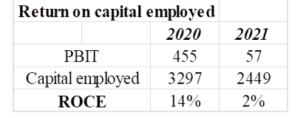

Return on capital employed

ROCE is another financial ratio that calculates the firm’s profitability based on the capital utilised within a financial period (Camelia, 2013). The profitability of the firm has reduced drastically as ROCE recorded 14% in 2020 while reducing to 2% in 2021. The reduction has been recorded due to a decline in profit before interests and taxes from 455,000 pounds to 57000 pounds in 2020-21.

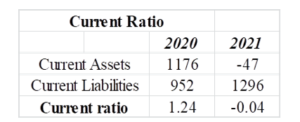

Current ratio

Current ratio for the firm has been calculated to understand its liquidity levels which has also resulted in a decline from 1.24 in 2020 to -0.04 in 2021. Current assets for the firm in 2021 emerged to be negative resulting in stagnancy in business operations for the year due to lack of monetizability.

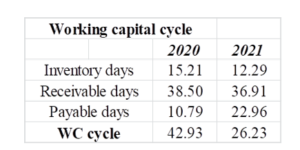

Working capital cycle

Working capital cycle refers to the amount of time required to convert “net current assets and current liabilities” to liquid assets or cash (Sensini, 2020). However, the WC cycle has reduced from 42.93 days in 2020 to 26.23 days in 2021, highlighting a shorter business cycle helping in freeing up cash for better agility in the organisation.

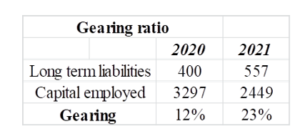

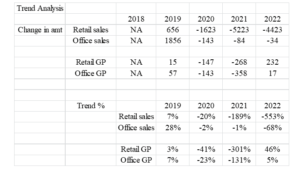

Gearing ratio

Gearing ratios are found to compare the organisational equity to their debts or funds borrowed by the same (Kiarie et al. 2019). Gearing ratio for BGC ltd has increased from 12% to 23% in 2020-21 showing the firm’s transition towards debt financing for improving its financial stability. This is a positive outcome for the firm in future.

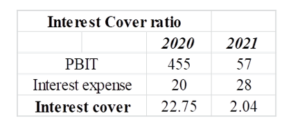

Interest cover ratio

Interest coverage ratio has been calculated to understand the ability of the firm to pay interest over their outstanding debt levels. However, the results highlight a decline in interest cover from 22.75 to 2.04 that means current earnings for BGC are unable to service its outstanding debt levels.

Part B: Cash Budget Analysis

The current section incorporates the analysis of a cash budget for BGC Ltd during the financial period of July to October. Upon closer analysis of the cash budget, it can be seen that the overall cash inflow within the firm has increased gradually over the period of four months. According to the words of Harris and Roark (2019), positive cash flows within organisations indicates an increased rate of liquid assets that are further responsible for mitigation of financial obligations and buffer against financial challenges in the future. Therefore, increasing trend of cash inflow within the firm shall be a positive opportunity for the firm’s directors on improving their profitability levels.

Focusing on the payments side of the cash budget, the wages for the workers in the organisation has significantly increased over the concerned months which are a threat towards the same. Moreover, a reduction in pay cuts can impact upon the performance levels of workers to reduce due to reduced spending abilities or purchasing power. Therefore, the directors of the firm should

turn towards alternative options by implementing an assessment of the work performance among the workers. This shall help the organisation to find out least performing workers whose wages can be thereby reduced for lack of engagement within the firm. In addition to that, the cash outflows recorded during months of August and September can also be significantly controlled by the above mentioned procedure.

Moreover, a reduction in purchases has been recorded during October by more than 50% which can emerge to be a significant threat for the firm. The firm’s directors are hereby recommended to increase their purchases for October whilst reducing the underperforming workers within the organisation. Furthermore, it shall aid in the increase of net cash inflow of the firm along with a positive value for the closing cash balance at the end of October.

In addition to that, the additional expenditures highlighted for office refurbishments can be reduced or further divided among other months to reduce the gap of net cash outflow from the firm.

Part C: Market trend analysis

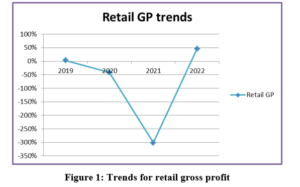

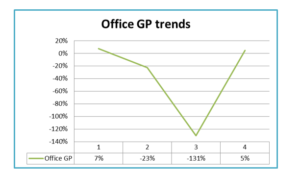

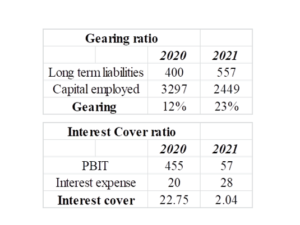

The current section has hereby incorporated a trend analysis for the office, retail and domestic sectors of BGC Ltd. Furthermore, focusing on the discussion among the directors of the firm, it has come into purview that both Bev and Gio have highlighted upon incorporating the business potential over the domestic sector and leaving out the retail sector due to the increased sufferings of the High Street. Furthermore, we shall focus on the trends of gross profits depicted by the office sector and retail sector of the organisation as depicted below,

The above figure highlights the trends for the retail gross profit sector of the company that has highlighted an increase in 2022 to approximately 46% from the negative trends in the past years of 2020 and 2021. Therefore, the sector can be profitable for the company. [Refer to Appendix 2]

On the contrary, trends for office gross profit have hardly detected a positive profitability rate

which is a riskier investment for the firm. Thus, incorporating the decisions made by the company’s directors it can be stated that the selection of the domestic sector for the firm shall be beneficial due to the higher cash inflow of 1100,000 pounds being predicted for the concerned market in the current year of 2022. On the contrary, the rate of recession within the domestic sector is higher than that of the office and retail sector combined. In addition to that, the domestic sector might emerge to lose money from the company as the chance of recession is 40%.

In addition to that, the firm upon closer discussion and compliance with the directors may further consider investing within the retail sector. Moreover, the trend has highlighted positive growth of 46% in the retail sector which shall be beneficial as there are chances of booming by 25%. Therefore, the company should not move or shift their businesses to the domestic market due to a higher chance of recession within the market. Moreover, it shall remain focused on carrying out their businesses within office and retail sectors.

Recommendations

The current report has analysed three different parts of the firm while recommendations for ratio analysis would be to further improve the company’s profitability margin as it has constantly reduced across three ratios of GP margin, NP margin and ROCE in 2021. Moreover, the firm should also improve their liquidity levels as it has failed to gain profits from its current assets in 2021. Focusing on the analysis of cash budget, recommendations have been provided to incorporate a work performance assessment technology within the company to assess the hardworking employees for better financial benefits and cut down on wages for underperforming employees. The recommendation has been made to reduce excessive rise in wage payments of the firm.

The final part’s recommendation has been provided for carrying on investments within the office and retail sector due to reduced damage from recession or static period. However, the domestic sector with increased profitability was not suggested as during recession, it shall bring additional losses and liabilities for the firm.

Conclusion

The current report has analysed the ratio analysis of BGC Ltd concerning the profitability and liquidity levels and has analysed the cash budget recommending reducing the wages and office refurbishments for reducing net cash outflow. Moreover, analysis of current market trends have found the importance of the office and retail sector to be more important than the domestic sector for reducing chances of additional losses during recession.

Reference List

Camelia, B., 2013. Analysis model for return on capital employed. Annals of the “Constantin Brâncuşi” University of Târgu Jiu, Economy Series, (1), pp.82-87.

Kiarie, J., Kirori, G.N. and Wachira, D., 2019. Moderating Effect of Gearing Ratio on the Relationship between Loyalty Programs and Financial Performance of Selected Firms in Service Industry in Kenya. Journal of Economics, 3(1), pp.1-14.

Nariswari, T.N. and Nugraha, N.M., 2020. Profit Growth: Impact of Net Profit Margin, Gross Profit Margin and Total Assests Turnover. International Journal of Finance & Banking Studies (2147-4486), 9(4), pp.87-96.

Sensini, L., 2020. Working capital management and performance: evidence from Italian SME’s. International Journal of Business Management and Economic Research (IJBMER), 11(2), pp.1749-1755.

Appendices

Appendix 1: Ratio Analysis calculations

Appendix 2: Market Trend analysis

________________________________________________________________________________

Know more about UniqueSubmission’s other writing services: