INTERNATIONAL FINANCIAL MANAGEMENT FOR BUSINESS

Introduction

The aim of preparing this assignment is to analyze and find out the issues in the capital structure of the EcoE Bars while investing in security. The chief financial officer of EE bars has made a three stage process to determine the area of investment. This assignment has been conducted to represent those three areas in the form of question answers. Besides that, an effective investment decision has been provided through the eight questions. These questions include finding the expected return on the securities, determination of the firm’s cost of capital and selection of appropriate securities.

Question 1

Capital structure of EcoE Bars can be explained from the perspective of book value and market value. Therefore, this part of the assignment has been conducted to evaluate the capital structure based on the provided information in the case study. As per the view of Aggarwal and Padhan (2017), it is essential for the company to make an effective capital investment decision based on the consideration of the capital structure. It is required to note that the EcoE Bar’s capital structure has been made based on several assumptions that can be explained based on the following lists.

List of assumption for calculating Book value

- The calculation of book value has been prepared based on the information available in the Exhibit 2 of the given case study

- Current liability has not been considered in the calculation process of book value of debt as these debts are repayable within one year

- Long term debt of 524.24 million and other long term liabilities valued 96 million has been considered in the calculation (An et al. 2016)

- Deferred income taxes are not actual borrowings thus it has not considered as debt capital of the company

- It has been assumed that the Shareholders’ equity 1,866.48 million is the total equity capital available in the EcoE Bars’ books of account.

- It has been assumed that total book value of debt is (524.24 + 96.00) = 620.24 million

- Debt capital ratio has been prepared as (620.24 / (624.24 + 1866.48)) = 0.25

List of assumption for calculating Market value

- The market value of debt and equity has been constructed based on the information associated with market prices that are mentioned in the case study.

- It is mentioned in the case study that the company has two AA+ rated bonds outstanding. Thus, 324 million and 200 million are the value of two outstanding bonds

- It has been assumed that per value of these bonds is £100 per share while the value as per London Stock Exchange is £95.

- Total number of bonds has been determined as (324 / 100) = 3.24million and (200 / 100) = 2million

- The assumption made for calculation of market value of debt is (number of share x market price per bond) (An et al. 2016)

- The company has two types of shares issued in the market, that are 150 Class A ordinary shares and 20 Class B shares. It is required to note the current market price of both types of shares £36.

- Total market value of equity share has been determined as (number of shares x current market price per share)

| Book value | |

| Long-term debt | 524.24 |

| Other long-term liabilities | 96.00 |

| Total Book value of Debt | 620.24 |

| Shareholders’ equity | 1,866.48 |

| Total Book value of Equity | 1,866.48 |

| Debt capital ratio | 25% |

| (D / (D + E)) |

Table 1: Capital structure based on book value

(Source: Created by the learner)

| Market value | |

| First debenture | 324.00 |

| Per debenture price | 100.00 |

| Number of bonds | 3.24 |

| London Stock Exchange price | 95.00 |

| Market value | 307.80 |

| Second debenture | 200.00 |

| Per debenture price | 100.00 |

| Number of bonds | 2.00 |

| London Stock Exchange price | 95.00 |

| Market value | 190.00 |

| Total market value of debt | 497.80 |

| Number of ordinary share | 150.00 |

| Current market price | 36.00 |

| Market value | 5,400.00 |

| Number of Class B shares | 20.00 |

| Current market price | 36.00 |

| Market value | 720.00 |

| Total market value of equity | 6,120.00 |

| Debt capital ratio | 8% |

| (D / (D + E)) |

Table 2: Capital structure based on market value

(Source: Created by the learner)

Question 2

This part of the assignment is concerned in the determination of cost of equity and before tax cost of term debt. As per the view of Bajaj et al. (2020), these calculations are essential for making effective investment decisions as these costs of capital are used in the weighted average cost of capital process. The cost of capital represents the cost EcoE Bars is required to bear for holding debt capital and equity capital in the capital structure. There are several assumptions that have been made in the process of preparing the cost of capitals.

List of assumptions for calculation of before-tax cost of long-term debt

- The concept of yield to maturity has been used for determination of cost of debt

- Information available in the case study associated with the debts, debentures and bonds has been considered in the calculation process (Belas et al. 2018).

- It is mentioned in the case study that the yield to maturity of the debt capital of EcoE Bars is 6.87%.

- The process used for calculation of cost of debt capital is (1 + YTM / 2) ^ 2 – 1, where YTM is representing yield to mature

List of assumptions for calculation of cost of equity

- Two alternative cost of capital calculation models have been assumed for this part of the assignment that are dividend growth model and capital assets pricing model.

- It is assumed that all investment is financed from retention at the time of calculation of “cost of equity” of a firm.

- Dividend growth rate is essential for the determination of the cost of equity share capital using the “dividend growth model”. As per the view of Brusov et al. (2018), geometric mean has been used for determination of dividend growth rate; it is assumed that firm is un-geared and it means 100% funded by equity.

- Dividend per share percentage change from the Exhibit 3 of the case study has been used for implementing the geometric mean; at the time of calculation of “cost of equity”, it is assumed that all existing investment is remaining unchanged over time.

- Dividend in the first period (d1) has been determined as (£1 x (1 + 5.92%)) where £1 is the dividend per share of the last year and 5.92% is the dividend growth rate

- The process of determining cost of equity by using dividend growth model is (D1 / P0) + g, where P0 is representing current stock price which is £36 per share

- The capital assets pricing model is determined as rf + B (rm – rf), here ‘rf’ refers to as risk free return, B is representing Beta of stock and ‘rm’ is expected market return and ‘IRR” is remain constant. In this case it also be assumed that “all investor are price takers”

- “Capital assets pricing model” (CAPM) indicates the expected return on Assets, and this return is normally distributed. Risk free assets exist and investor can borrow or lend unlimited amount of money at this rate as per “CAPM”.

- It is assumed that there are no market imperfections such as are no taxes and regulation or restriction on short selling as per “CAPM”.

- It has been stated in the case study that the Beta of the EcoE Bars is 0.96.

- The current Treasury bill rate is 3% which has been considered as risk free rate and return on the FT all share indexes is 10% that has been considered as market return.

| Cost of Long-Term Debt | |

| Yield to maturity (YTM) | 6.87% |

| Cost of debt is calculated using below formula | |

| Cost of Debt = (1 + YTM / 2) ^ 2 – 1 | |

| Before-tax cost of long-term debt (rd) | 6.99% |

Table 3: Calculation of cost of Long-Term Debt

(Source: Created by the learner)

| Calculation of dividend growth rate using geometric mean | ||

| Years | Returns | Growth factor |

| 2015 | 6.67% | 1.07 |

| 2016 | 6.25% | 1.06 |

| 2017 | 5.88% | 1.06 |

| 2018 | 5.56% | 1.06 |

| 2019 | 5.26% | 1.05 |

| Dividend growth return = | 5.92% | |

Table 4: Calculation of dividend growth rate using geometric mean

(Source: Created by the learner)

| Cost of equity (re) using DGM | |

| Dividend in first period (D1) | 1.06 |

| Stock price now (P0) | 36.0 |

| Growth rate (g) | 5.92% |

| Cost of equity is calculated using below formula | |

| Cost of Equity = (D1 / P0) + g | |

| Cost of Equity | 8.87% |

Table 5: Calculation of cost of Equity using DGM

(Source: Created by the learner)

| Cost of equity (re) as per the CAPM | |

| Risk free returns (rf) | 3% |

| Beta (B) | 0.96 |

| Expected market return (rm) | 10% |

| Cost of equity is calculated using below formula | |

| Cost of Equity = rf + B(rm – rf) | |

| Cost of Equity | 9.72% |

Table 6: Calculation of cost of Equity as per the CAPM

(Source: Created by the learner)

Comment on models

Based on the calculation table 5 and 6 it can be noticed that there is a significant difference between the costs of equity in the result (Čámská, 2020). The outcome of cost of equity as per dividend growth model is 8.87% while it is 9.72% by using the capital assets pricing model.

Question 3

Cost of equity required to be use

Based on the previous calculation of cost of equity by using the dividend growth model and CAPM model it has been noticed that there exists a significant difference between the outcomes. The cost of equity based on the dividend growth model is determined from the perspective of company performance. As per the view of D’Amato (2019), weighted average cost of capital of the EcoE Bars is required to be determined from the perspective of company performance. It will be beneficial for the company in making effective decisions rather than using the CAPM model. This model emphasizes on the market performance and beta of the EcoE Bars. Therefore, the dividend growth model is appropriate for this calculation process as it provides close to accurate results.

Calculation of weighted average cost of capital based on market value

| Cost of capital based on market value | |

| Market value of debt (D) | 497.80 |

| Market value of equity (E) | 6,120.00 |

| Total (D+E) | 6,617.80 |

| Weight of Market value of debt (D/(D+E)) | 0.08 |

| Weight of Market value of equity (E/(D+E)) | 0.92 |

| Cost of debt (rd) | 6.99% |

| Cost of equity (re) | 8.87% |

| Marginal corporate tax rate (t) | 20% |

| Weighted average cost of capital | 8.62% |

Table 7: Calculation of weighted average cost of capital based on market value

(Source: created by the learner)

This part of the assignment has been prepared to calculate weighted average cost of capital by assuming market value of debt and equity as weights. Based on the capital structure calculation in table 2, market value of debt has been found 497.80 million and the value of equity is 6,120 million. As per the view of Das and Swain (2018), the weight as per the market values is 0.08 debt capital and 0.92 equity share capital. Tax of 20% has been deducted from the before tax cost of debt capital. Therefore, the result is 8.62% weighted average cost of capital on using market value of debt and equity share capital as weight.

Calculation of weighted average cost of capital based on book value

| Cost of capital based on book value | |

| Book value of debt (D) | 620.24 |

| Book value of equity (E) | 1,866.48 |

| Total (D+E) | 2,486.72 |

| Weight of book value of debt (D/(D+E)) | 0.25 |

| Weight of book value of equity (E/(D+E)) | 0.75 |

| Cost of debt (rd) | 6.99% |

| Cost of equity (re) | 8.87% |

| Marginal corporate tax rate (t) | 20% |

| Weighted average cost of capital | 8.05% |

Table 8: Calculation of weighted average cost of capital based on book value

(Source: created by the learner)

The calculation of WACC can be made by taking book values of debt and equity as the medium of weight. Based on the capital structure prepared in the table 1, it can be noticed that the book value of debt is 620.24 million and the book value of equity is 1,866.48 million. Hence, the weight of debt capital in the capital structure is 0.25 and the remaining 0.75 is the weight of equity. As per the view of Gunardi et al. (2020), the cost of debt is 6.99% and as per DGM cost of equity is 8.87%. Based on this process the WACC is 8.05% considering 20% tax on the cost of debt.

Modigliani proposition incorporating corporate tax

| Beta of assets | |

| Beta of equity (Bequity) | 0.96 |

| Market value of Debt (D) | 497.80 |

| Market value of Eqity (E) | 6,120.00 |

| Corporate tax rate (t) | 20% |

| Beta of assets (Bassets) | 0.90 |

Table 9: Calculation of Beta of assets

(Source: created by the learner)

| Return on ungeared firm | |

| Beta of assets (Bassets) | 0.90 |

| Risk free returns (rf) | 3% |

| Expected market return (rm) | 10% |

| Return on ungeared firm (rus) | 9.31% |

Table 10: Calculation of return on ungeared firm

(Source: created by the learner)

| MM proposition 2 incorporating corporate taxes | |

| Return on ungeared firm (rus) | 9.31% |

| Cost of debt (rd) | 6.99% |

| Corporate tax rate (t) | 20% |

| Market value of Debt (D) | 497.80 |

| Market value of Eqity (E) | 6,120.00 |

| Incorporating corporate taxes (rgs) | 9.46% |

Table 11: Calculation of incorporating corporate tax

(Source: created by the learner)

Modigliani proposition II incorporated with corporate tax has been determined in the table 11. However, there is a requirement of determining beta of assets before corporate tax calculation. As per the view of Kanatani and Yaghoubi (2017), market value of debt and equity has been considered for the beta of assets calculation. Beta of equity is stated in the case study is 0.96 and the corporate tax rate is 20%. Hence, the result of beta of assets as per table 9 is 0.90. The second part of this MM proposition is calculation of return on ungeared firm. This part of the calculation has been provided based on the risk free return of 3% and expected market return 10%. Thus, the return on ungeared firms is 9.31%. Finally, based on the consideration of 6.99% cost of debt, incorporating corporate taxes has resulted in 9.46%.

Reasons of not using capital asset pricing model to estimate the firm’s cost of capital

CAPM is a good technique for estimating cost of equity share capital; however, this technique has several drawbacks associated with the inputs and assumptions. As per the view of Karacaer et al. (2016), these drawbacks and assumptions are the main reason for not considering CAPM to estimate the firm’s cost of capital. Therefore, the reasons are as follows:

- The rate Treasury bill changes often while this rate has been used in the cost of equity as risk free return.

- It can be stated that these changes in the risk free rate creates volatility in the outcome.

- The present market return cannot be representative of future market return, thus the assumption of 10% expected market return is a vague assumption.

- There is another irrelevant assumption that exists in the CAPM approach that is it assumes that investors can borrow and lend at a risk-free rate.

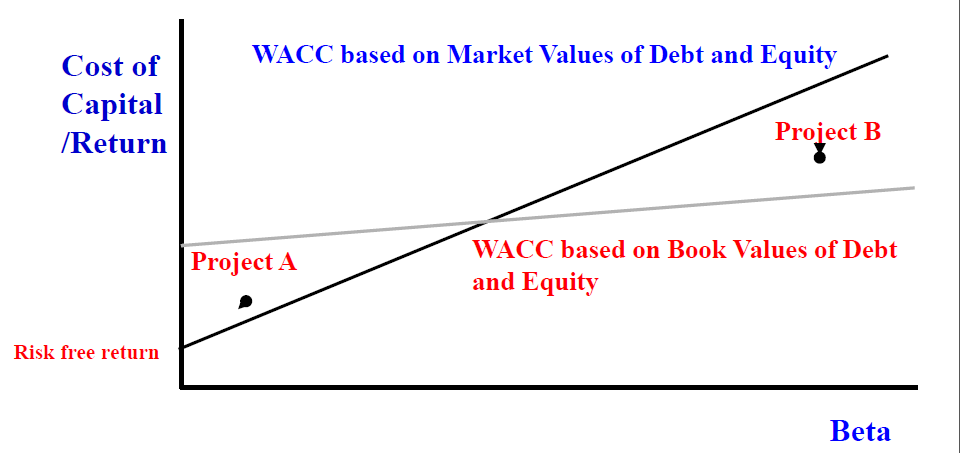

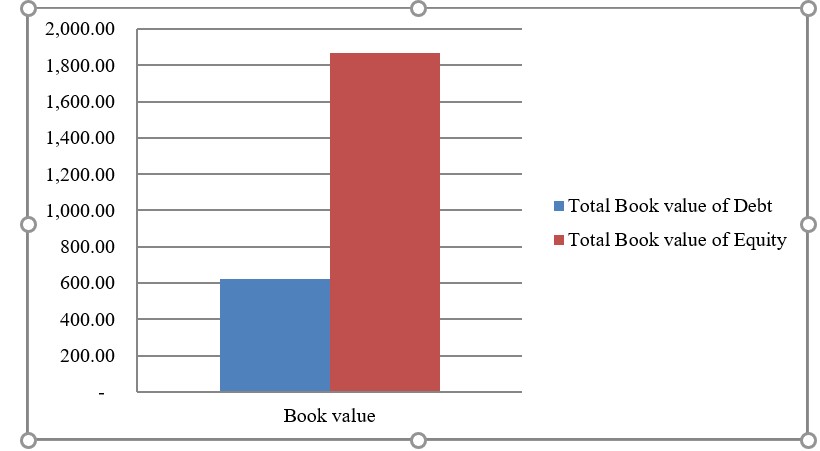

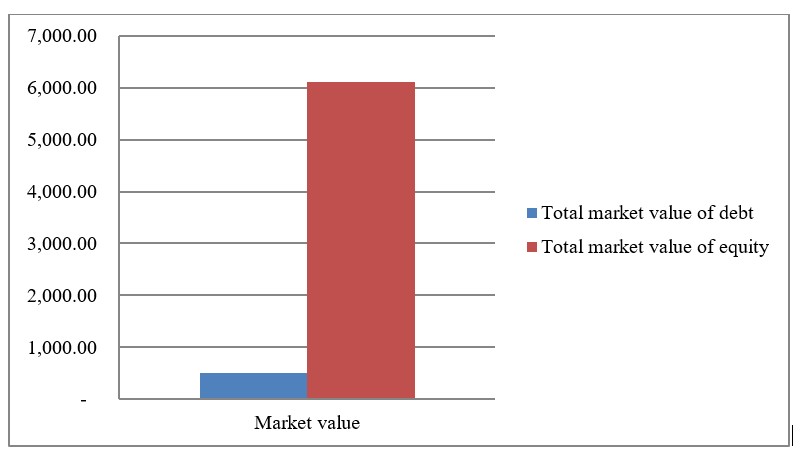

Question 4

Figure 1: Book value and Market value

(Source: Created by learner)

Capital structure of the EcoE Bars can be explained from two alternative perspectives, from the perspective of market value and from the perspective of book value. Based on table 1 and table 2, a clear difference has been noticed between the two capital structures. The information of table 1 and table 2 regarding capital structures has been represented in figure 1. This figure is effective for making an effective decision by visualizing the two capital structures. As per the view of Mahdaleta et al. (2016), it is noticed that there is a huge difference between the market value of equity share and book value of equity share. The book value of equity share is 1,866.48 million and the market value of equity share is 6,120 million.

On the other hand, there is a low difference between the market value of debt capital and book value of debt capital. The market value of debt capital is 497.80 million and it is 620.24 million in book value of debt capital. This situation has a major impact over the weight of debt and equity. As per the view of Mardones and Cuneo (2020), the cost of capital EcoE Bar has been determined based on the weights of debt and equity, thus, there is different outcome in the result of cost of capital with different capital structure.

Based on the table 7, cost of capital considering market value as weight has been found 8.62%. On the other hand, as per the table 8, cost of capital is 8.05% by considering book value of capital structure. As per the view of Matias and Serrasqueiro (2017), the cost of capital in the capital structure of book value is lower than the market value. Thus, it is encouraging for EcoE Bar as the company will have low cost and a better capital budgeting decision can be made.

Question 5

Cost of capital is determined based on the consideration of either book value of capital structure or market value of capital structure (Nouri et al. 2016). Cost of capital on using book value is considered as superior to the book value due to the following reasons:

Weakness of book value

- Book value of equity share capital represents total number of shares multiplied by the book value share. As per the view of Petrovskaya et al. (2016), this value has no direct connection with the market value of share price thus very low fluctuating in the price is noticed.

- Book value is determined based on the accounting concept and it is subject to change in through the accounting procedure.

- Book value of capital structure often locks essential claims in the assets value due to presence of depreciation policy.

Strength of market value

- The biggest strength of using market value in the capital structure is that it represents the actual market value of share price.

- Investment decisions can be made easily based on the actual conditioning performance of the company in the business market.

- The market value of capital structure does not consider depreciation rather it is dependable on the performance of the company.

- Effective and reliable cost of capital can be determined based on the market value as it does not consider the assets and liability condition. As per the view of Pham (2020), market value focuses on goodwill and good reputation of the company.

Question 6

Cost of capital of the EcoE Bar can be used as the hurdle rate for the evaluation of acquisition of Urbani Foods. The cost of capital represents the cost; EcoE Bar will be required to bear. As per “Capital market theory” a firm can use their “cost of capitals” as the hurdle rate and in the situation when the risk of assets is same. The cost of capital mainly shows the financial costs of the company. The equity capital is used by the company for equity share holders and “debt capital” is used by the company for debt. It is assumed that all the risk is same, at the time of using it (Ramli et al. 2019). It can also be assumed as per “capital market theory” that all assets quantities are fixed and perfectly divisible. The “IRR” should be higher than cost of capital of a company as per “Capital market theory”. Therefore, it is clear that a firm can use the “cost of capital” for acquisition.

As per the view of Podile and Sree (2018), the hurdle rate should be the cost of capital involved in acquiring Urbani Foods. The rate of return for the investment required to be higher than the cost of capital in order to avoid loss from the investment. Hurdle rate is effective for EcoE Bar as it helps the managers and CFO on making effective capital investment decisions considering its effective return from investment.

| Beta of assets | |

| Beta of equity (Bequity) | 1.25 |

| Market value (D/E) | 25% |

| Corporate tax rate (t) | 20% |

| Beta of assets (Bassets) | 1.04 |

Table 12: Beta of assets

(Source: Created by the learner)

The table 12 is representing Beta of assets which enlightens risks involved in the investment process. Beta of equity has been stated in the case study which is 1.25 and the market value has been assumed 25%. Besides that, the corporate tax rate is 20%, thus, Beta of assets is 1.04. As per the view of Ramli et al. (2019), risk involved in the investment is another essential part for the capital investment procedure. Based on the calculation it has been found that the Beta of assets is close to 1 and it represents less volatile.

Question 7

This part of the assignment is concerned with business financing as the company is required to arrange £200 million for the investment process. The company can arrange funds from the internal financial sources such as sale of fixed assets. As per the view of Setiadharma and Machali (2017), the main benefit of this financial source is that the capital structure of the company stays the same. Based on this process, assets balance reduces while the cash balance increases and no changes made in the equity and liability.

It is often found that the available internal funds are not sufficient to acquire a company, in that situation the company is required to depend on external financial sources. £200 million can be arranged from short term loans and it will put an impact on the capital structure. EcoE Bars can maintain the ratio of debt and equity to borrow long term loans and issue equity shares. As per the view of Sheikh and Qureshi (2017), this process is effective for the company on arranging the required finds while maintaining the weight of capital structure.

Question 8

Acquisition solely with long-term debt

It is suggested to the firm to make an acquisition process on the complete long-term debt process. The main reason behind the suggestion of debt financing is that there is no risk of losing control over the business. As per the view of Siddik et al. (2017), it will be also effective for the company to repay the debt capital as the company is able to make an effective return from the investment. Tax benefits can be obtained by the organization while paying interest for the debt capital. However, there is no exception available to the company on paying dividend and share of profit to the shareholders.

Voting rights cause conflict in the business and equity shareholders have the voting rights while making business decisions. On the other hand, there are no voting rights that exist to the lenders thus, unnecessary business conflicts can be avoided. As per the view of Sivalingam and Kengatharan (2018), the company does not need to sell any business assets for arranging long-term debts as financial institutions provide mortgage loan options. Based on this overall discussion it can be stated that the firm should finance the acquisition with long term debt.

Excess cash flows

It has been stated that the expected net income from EcoE Bar in 2020 is £400 million thus the excess cash flow can be used for repayment of the loan if the acquisition is financed by long term debt. As per the view of Sofat and Singh (2017), it is essential for the company to repay its debt capital as fast as possible in order to reduce the burden of interest expenses. Therefore, utilization of excess cash flow for repayment of debt capital will help the company in enhancing the optimum cash flow of the business.

Advantages of share repurchase instead of cash dividend payment

- The main advantage of repurchase of share is that it reduces the number of issued share, this company can issue more share in the future for collection of funds

- Reduction of number of shares is good for the company as the company will be required to distribute low share of profit (Takhumova et al. 2018).

- It is a good way of enhancing retained earnings of the business as the company will be able to transfer a large portion of share of profit to the retained earnings account from the net financial period.

- Repurchase of shares is encouraging for the shareholder as it represents good financial condition of the business.

Disadvantages of share repurchase instead of cash dividend payment

- The disadvantage of share repurchase is instead of cash dividend payment such as increase in debt-equity ratio.

- Good dividend per share is attractive for the investors and it enhances the share value in the market while in the repurchase this type of effects get ignored (Yazdanfar et al. 2019)

- There is a high risk of judgment error in the valuation of repurchase of shares while distribution of excess cash as dividend is an easy process.

Conclusion

Based on the discussion of the whole assignment it can be concluded that the capital structure has a vital role for business. It can be summarized that there are two possible ways to measure capital structure that are based on book value and market value. This assignment has covered the calculation of cost of capital based on equity and debt values. It can be stated that the company has maintained an attractive cost of capital in the business and there is a good opportunity for business expansion. Several financial sources have been described through this assignment. Besides, advantages and disadvantages of share repurchase over cash dividend payment have been stated.

References

Aggarwal, D. and Padhan, P.C., 2017. Impact of capital structure on firm value: evidence from Indian Hospitality Industry. Theoretical Economics Letters, 7(4), pp.982-1000.

An, Z., Li, D. and Yu, J., 2016. Earnings management, capital structure, and the role of institutional environments. Journal of Banking & Finance, 68, pp.131-152.

Bajaj, Y., Kashiramka, S. and Singh, S., 2020. Application of capital structure theories: a systematic review. Journal of Advances in Management Research.

Belas, J., Gavurova, B. and Toth, P., 2018. Impact of selected characteristics of SMES on the capital structure. Journal of Business Economics and Management.

Brusov, P., Filatova, T., Orekhova, N. and Eskindarov, M., 2018. New meaningful effects in modern capital structure theory. In Modern Corporate Finance, Investments, Taxation and Ratings (pp. 537-568). Springer, Cham.

Čámská, D., 2020. Capital structure of insolvent companies in the Czech Republic. International Advances in Economic Research, 26(3), pp.319-320.

D’Amato, A., 2019. Capital structure, debt maturity, and financial crisis: empirical evidence from SMEs. Small Business Economics, pp.1-23.

Das, C.P. and Swain, R.K., 2018. Influence of capital structure on financial performance. Parikalpana: KIIT Journal of Management, 14(1), pp.161-171.

Gunardi, A., Firmansyah, E.A., Widyaningsih, I.U. and Rossi, M., 2020. Capital Structure Determinants of Construction Firms: Does Firm Size Moderate the Results?. Montenegrin Journal of Economics, 16(2), pp.93-100.

Kanatani, M. and Yaghoubi, R., 2017. Determinants of corporate capital structure in New Zealand. AMR, 1(1), pp.1-9.

Karacaer, S., Temiz, H. and Gulec, O.F., 2016. Determinants of capital structure: An application on manufacturing firms in Borsa Istanbul. International Academic Journal of Accounting and Financial Management, 3(2), pp.47-59.

Mahdaleta, E., Muda, I. and Nasir, G.M., 2016. Effects of capital structure and profitability on corporate value with company size as the moderating variable of manufacturing companies listed on Indonesia Stock Exchange. Academic Journal of Economic Studies, 2(3), pp.30-43.

Mardones, J.G. and Cuneo, G.R., 2020. Capital structure and performance in Latin American companies. Economic Research-Ekonomska Istraživanja, 33(1), pp.2171-2188.

Matias, F. and Serrasqueiro, Z., 2017. Are there reliable determinant factors of capital structure decisions? Empirical study of SMEs in different regions of Portugal. Research in International Business and Finance, 40, pp.19-33.

Nouri, B.A., Bagheri, F. and Fathi, A., 2016. Comparison of working capital management, capital structure and real investment policies among active and bankrupt firms in tehran stock exchange. International Business and Management, 13(1), pp.8-15.

Petrovskaya, M.V., Zaitseva, N.A., Bondarchuk, N.V., Grigorieva, E.M. and Vasilieva, L.S., 2016. Scientific methodological basis of the risk management implementation for companies’ capital structure optimization. International Electronic Journal of Mathematics Education, 11(7), pp.2571-2580.

Pham, C.D., 2020. The Effect of Capital Structure on Financial Performance of Vietnamese Listing Pharmaceutical Enterprises. The Journal of Asian Finance, Economics, and Business, 7(9), pp.329-340.

Podile, V. and Sree, C.H.V.S., 2018. Capital structure analysis of a micro enterprise-A case study of pl plast private limited. International Journal of Management, IT and Engineering, 8(10), pp.183-198.

Ramli, N.A., Latan, H. and Solovida, G.T., 2019. Determinants of capital structure and firm financial performance—A PLS-SEM approach: Evidence from Malaysia and Indonesia. The Quarterly Review of Economics and Finance, 71, pp.148-160.

Setiadharma, S. and Machali, M., 2017. The effect of asset structure and firm size on firm value with capital structure as intervening variable. Journal of Business & Financial Affairs, 6(4), pp.1-5.

Sheikh, N.A. and Qureshi, M.A., 2017. Determinants of capital structure of Islamic and conventional commercial banks. International Journal of Islamic and Middle Eastern Finance and Management.

Siddik, M., Alam, N., Kabiraj, S. and Joghee, S., 2017. Impacts of capital structure on performance of banks in a developing economy: Evidence from Bangladesh. International journal of financial studies, 5(2), p.13.

Sivalingam, L. and Kengatharan, L., 2018. Capital structure and financial performance: A study on commercial banks in Sri Lanka. Asian Economic and Financial Review, 8(5), pp.586-598.

Sofat, R. and Singh, S., 2017. Determinants of capital structure: an empirical study of manufacturing firms in India. International Journal of Law and Management.

Takhumova, O.V., Kadyrov, M.A., Titova, E.V., Ushakov, D.S. and Ermilova, M.I., 2018. Capital Structure Optimization in Russian Companies: Problems and Solutions J. Journal of Applied Economic Sciences, 13(7), pp.1939-1945.

Yazdanfar, D., Öhman, P. and Homayoun, S., 2019. Financial crisis and SME capital structure: Swedish empirical evidence. Journal of economic studies.

Know more about UniqueSubmission’s other writing services:

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://accounts.binance.com/pt-BR/register-person?ref=IJFGOAID