ASSIGNMENT QUESTION

Q 1.

An organization has the power to increase and decries the price and supply of the product or service in a monopoly. The organization also has the ability to increase and decrease the demand by the fluctuation in the price. This ability of the organization is the market power of the organization. The concept of elasticity measures the supply and demand of the product or service by the change in the price (Söderholm and Wårell, 2011). The elasticity also provides the response to demand and supply by the change in the price where other things should remain the same.

Both water supply and landline Telephone Company have a high cost of the network to provide the service. Water is a basic need or necessary thing for the human being, so it can be said that water supply organization has a greater market power than landline Telephone Company. The company has the power of reducing the supply of water that can affect the daily life of people. On the other hand, if the telephone company restricts the service for some time it does not high impact on the people. There is no high impact of the small change in the price of the water and landline to the public but water supply can affect the daily life of the people.

Q 2.

The market structure of the KFC, MacDonald’s and Hungry Jack have an oligopoly market structure. The oligopoly market structure described the few seller’s markets and they provide some differentiated products and services. There is a small number of the large seller in the fast-food industry that dominates the market (Wallis, et al., 2010). The entire sellers have a high market share and restrict the new competitors in the market. It is because there is a need for high investment with effective and homogeneous products. The KFC, MacDonald’s and Hungry Jack is known for small profit by the use of cost leadership market. They are offering basic fast food meals in restaurants at a low prices to attract customers.

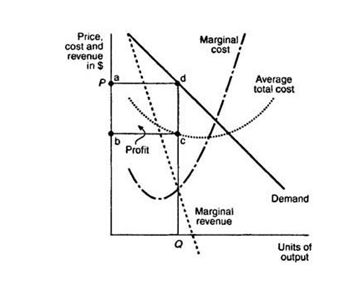

Figure- Firm in Oligopolistic Market

In this industry, the firms are interdependent in the price of the competitors and always keep eyes on the strategy of competitors to survive in the competition. Each firm advertises their products to attract the customer in the oligopoly market structure. The figure shows that each firm faces two demand curves according to the kinked‐demand theory. It is because the oligopoly situation increases the competition in the market (Liu, and Wu, 2012). The demand curve becomes highly elastic if prices are increased more than profit level because consumers do not prefer the very high price in the oligopoly market situation.

Q 3.

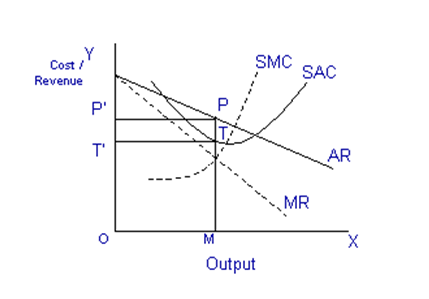

Charles Darwin University is facing competition between the Darwin and Sydney campus. The level of the composition is monopolistic because the university is providing similar services (homogeneous products) in both places. The campus at Darwin is providing the high price of the courses that affect the student. In this competitive market, the students compare the price with the other universities and can choose other campuses in Darwin due to the rise in the price. The demand curve of Charles Darwin University is sloping downward due to high prices. The distance courses and extracurricular activities differentiate the university but the price restricts the enrollment of the students. The sloping downward demand curve is indicating to the university that they should restrict the increasing price. At the same time, the price may quite high from competitors but it should be affordable to the students (Barnett, 2011). The different universities are present in overall Australia indicates an elastic demand. Brand loyalty can also solve the problem of Charles Darwin University, where it can increase the advertisement at Darwin location. The campus can maximize the profit by achieving the level of output.

Figure- Pricing and output in short-run

Q 4.

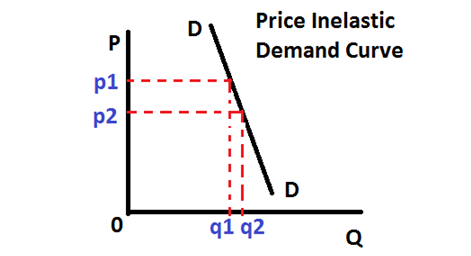

The price elasticity of demand is a relationship between the price and demand that reflects the proportion change in the quantity demanded by the proportion change in price. In this case, if the fire emergency service will be provided by any private organization then the price elasticity of demand will be inelastic in Australia. The main cause of inelastic demand is the public does not have any substitute for this service. The change in price will not affect the demand because there is no any other substitute for fire emergency services (Ishida, et al., 2011). So, it can be said that the number of substitutes increases the elasticity of the demand in the market.

Figure- Price Inelastic Demand

In addition to this, inelastic demand is also helpful to the firm because it increases the revenue by an increase in the price of the fire service. The following diagram is showing the price and revenue of the firm.

Figure- Increase in price and revenue

Q 5.

In this unit, monopoly and monopolistic competition are used. Monopoly competition is a market situation where a firm has full control over the price and supply of the product and service. The goods and services do not have any substitute in the monopoly. The firm is a price maker in the market and does not change pricing decisions (Twomey and Neuhoff, 2010). Mostly, the monopolist increases the price of the product but in the case of lower costing conditions, he can decrease the price of the product. The monopolist does not have any competitors in the marketplace.

Monopolistic competition is a kind of imperfect competition. In this competition, there are many producers of products but they differentiated the product from other competitors. In addition, the product is not a perfect substitute for the given product because it has a change in taste or quality. There is no single business that controls on the market price. The cost curve and demand curve are being identical under this competition. If some firms produce similar products in the market then the market leads to be an oligopolistic market situation. The demand of goods and services are highly elastic in monopolistic competition. So, if any producer small changes a price it provides a high response (Janssen, et al., 2011). In the short run, the firm can earn high profits in monopolistic competition. The new entrance is very easy in this competition.

In the concern of the Australian market, monopolistic competition is the most realistic model that provides advantages to the buyers and sellers. In the Australian market, the firm can easily enter in the market and differentiate the product with the competitor. Additionally, the firms also offer a new products to the people for command in the market (Alderighi, et al., 2012). But in the long run, most of the firms can earn normal profit due to close substitutes of the product.

Figure- Long-run in monopolistic competition

Q 6.

Charles Darwin University will be impacted by the increase in the pass marks of the students. The student enrollment will be decreasing because the demand of passing marks has an inverse relation with the enrolment. The demand curve will slope downward due to the negative relationship between the enrolments and pass marks. There is no price factor that affects the demand curve, the demand will be affected by the increase in price (Hunt, 2011). The university should not change the pass marks, otherwise, the students will enrol in another university.

Figure- Shift in the demand curve

Q 7.

- The marginal cost curve represents the relationship between the marginal cost and the quantity of output. The graphical representation of the slope of the marginal cost curve is showing downward in the starting. After an increase in productivity, the marginal cost decreases at the point but regular increment can increase the marginal cost at a high level. The overall marginal cost shows the U-shape.

Figure- Marginal cost curve

The marginal cost is linked with the opportunity cost because it refers to the cost of a single unit that is increased in productivity (Ionescu, 2011). The opportunity cost helps the organization because it scarifies the highest cost unit of the production. The opportunity cost is that cost which is saved by the firm by a reduction in the production of one or more unit that has a high marginal cost.

The concept of the marginal cost is important in economics because it defines the cost addition in production units. Marginal cost is very important for a firm because it helps the firm to take the production-related decision. In addition, it represents the cost of increases in productivity by a single unit. The marginal cost affects the total cost, if the marginal cost increases the total cost will also increase. The marginal cost also helps the firm to develop an effective pricing policy and used it in the cost and benefit analysis of the firm.

The marginal cost can be calculated by the change cost divided by the change in price. So, the marginal cost of adding an additional unit of household in the NBN network will change in the opportunity cost (Kufel-Gajda, 2017). The opportunity cost will rise due to an increase in the quantity of production. The marginal cost of the household will be high than the last unit added.

Q 8.

The success of the supermarket is done by the contribution of an oligopoly market structure. The supermarket provides many different products at a low price to the customers. The oligopoly market structure provided imperfect competition by differentiating the products and customers use the different products from the supermarket. The supermarket has a large portion in the share market of the different firms. Price cutting is a good method that is used by supermarkets to attract the customer of oligopoly firms (Schmidt, et al., 2014). The supermarkets do not concentrate on the increased price and they always compete on the pricing strategy and decrease the price of rivals firms.

References

Alderighi, M., Cento, A., Nijkamp, P. and Rietveld, P., (2012) Competition in the European aviation market: the entry of low-cost airlines. Journal of Transport Geography, 24, pp.223-233.

Barnett, R., (2011) The marketised university: defending the indefensible. The marketisation of higher education and the student as consumer, pp.39-51.

Hunt, S.D., (2011) The theory of monopolistic competition, marketing’s intellectual history, and the product differentiation versus market segmentation controversy. Journal of Macromarketing, 31(1), pp.73-84.

Ionescu, L., (2011) Bureaucratic Values and Modes of Governance. Contemp. Readings L. & Soc. Just., 3, p.181.

Ishida, J., Matsumura, T. and Matsushima, N., (2011) Market competition, R&D and firm profits in asymmetric oligopoly. The Journal of Industrial Economics, 59(3), pp.484-505.

Janssen, M., Pichler, P. and Weidenholzer, S., (2011) Oligopolistic markets with sequential search and production cost uncertainty. The RAND Journal of Economics, 42(3), pp.444-470.

Kufel-Gajda, J., (2017) Monopolistic markups in the Polish food sector. Equilibrium. Quarterly Journal of Economics and Economic Policy, 12(1), pp.147-170.

Liu, Y. and Wu, F.F., (2012) July. Generator bidding in oligopolistic electricity markets using optimal control: fundamentals and application. In Power and Energy Society General Meeting, 2012 IEEE (pp. 1-12). IEEE.

Schmidt, K.M., Spann, M. and Zeithammer, R., (2014) Pay what you want as a marketing strategy in monopolistic and competitive markets. Management Science, 61(6), pp.1217-1236.

Söderholm, P. and Wårell, L., (2011) Market opening and third party access in district heating networks. Energy Policy, 39(2), pp.742-752.

Twomey, P. and Neuhoff, K., (2010) Wind power and market power in competitive markets. Energy Policy, 38(7), pp.3198-3210.

Wallis, I., Bray, D. and Webster, H., (2010) To competitively tender or to negotiate–Weighing up the choices in a mature market. Research in Transportation Economics, 29(1), pp.89-98.