Audit strategy FINM012 Sample

Answer 1 (Audit strategy FINM012 Sample)

The argument for and against the auditor’s responsibility for fraud and illegal acts

- Recently the Accounting profession has been affected so much due to fraud that is going on these days. To maintain confidence in the accounting profession the directors and auditors must know their role in the detection of fraud. Fraud is a criminal activity so it is not the work of the auditor to find whether the fraud occurs or not (Blythe, 2021). It is the responsibility of the country’s legal system. In accounting, fraud can be divided into two-part.

- Fraudulent financial report: – It is a misrepresentation of the organization or company’s financial condition. The main type of fraudulent financial reports is “Overstament of assets”, “Understatement of liabilities, revenue recognition, improper disclosure, and missed portion of assets. The most common type of fraudulent financial report is revenue recognition.

- Misappropriation of assets:- It is the theft of asset that can issue in the financial statements. Because of this, the accounting principle will not fully fill in the financial statement. The risk factor arises in the financial statement due to Misappropriation of assets. Most internal frauds are happened due to the Misappropriation of assets. Even it can be said internal fraud are happened due to the Misappropriation of assets

In UK ISA 240 deals with auditors’ issues regarding fraud in financial statements. It helps to recognize the factor from which the fraud and error have occurred. With the help of audit evidence and charities of fraud the auditor can find a reasonable reason, It is not important whether it is correct or not. Some external auditors are responsible for finding reasonable assurance for the error and fraud. ISA 315 helps to identify and access “the risk of material misstatement through understanding the entity and its environment”.

When the performance risk procedures the engagement team tries to obtain the data for the use in identifying the error and fraud that occur in financial files (Al-Mamun et al 2022). Due to the fraud, there is financial loss this is the biggest impact of fraud. Most of the internal fraud is done by the supplier of the government, staff, or employees. The fraud cloud is internally or externally. Fraud is not only attacking the private or public but it also attacks an individual organization.

There are two types of audit Public audit and private audit. In Uk, a public audit has wide scope than a private audit. For the audits, the local auditor must give an opinion on the financial statement of a public body and also the truth. Public auditors are also given the information about that whether the public made a proper arrangement for securing efficiency, economy, and effectiveness. In the case of private audits, they deal with the private organization.

The auditor is interested in both types of risk that are management level and the fraud that are existing right now Auditor’s responsibility to consider the error and fraud in the final statement (Handoyo, and Bayunitri, 2021).

If any fraud is identified by an auditor, then the auditor should have communicated to their higher authorities about this matter. If the fraud is related to some management work then the auditor should have to communicate with the governance who is appointed to this work.

But if the auditor has some confusion about the fraud that is related to the management then the auditor has to go for the legal advice. Identifying the fraud is not only the responsibility of the auditor but also the director has also some responsibility. The director has primary responsibility for the prevention and detection of fraud. for the detection or prevention of fraud. The director must have an idea about the potential for fraud.

The auditor’s responsibility is not only to detect fraud but also to have some responsibilities aspect of illegal acts. There are some illegal acts for which the auditor is responsible. An auditor is responsible for the financial statement and pressing them self as a proficient person in accounting and auditing. The auditor can understand the need of the company and its clients.

Their training and experience will help them to identify the needs of the company and clients. In the term “relation to financial statements,” the illegal acts generally occur. The illegal acts in “relation to financial statements” in the financial statement most of the time the auditor is aware of the illegal acts or easily recognize their illegality.

The auditor generally focuses on the laws and rules based on the financial statement. Such as tax laws are always considered by auditor. The auditor is responsible for the detection and reporting of the illegal acts which happened in the financial statement (Habbe et al. 2019). The acts are related to safety, food, health, environmental protection, drug, and price-fixing are ore more entity operating compares to accounting and financial laws. But these acts are related to the accounting and financial laws. The auditor is also responsible for these acts or laws.

And there is a huge chance that the auditor has an idea about these laws or acts. If the auditor has some information or any kind of evidence of any illegal act about these kinds of acts that are related to the accounting and financial laws then the auditor can apply for the audit process for the illegal act that is occurring (Alawi et al 2018).

Generally, the audit process happened on auditing standards it is designed to detect illegal acts that are going on any type of law or act which is connected to accounting and financial laws directly or indirectly. When the auditor has any information about the illegal act that is going on, then the auditor has to collect the information about the nature of that law or act where the illegal acts are going on. The situation which can occur, and information to judge the effect on accounting and financial laws.

In doing the process of auditing, an auditor can inquire about the management if required. If the management is not providing the appropriate information about the illegal acts then the auditor should have to consult the “Client’s legal counsel”, or some other one who has relevant information about the laws (Hashim et al. 2019). When the auditor have evidence about illegal act. Then auditor can consider the effect on the accounting and financials. The auditor mainly examines the effect of the illegal act on the basics of financial statements that including the fines, damages, and penalties.

Answer 2

The audit expectations gap

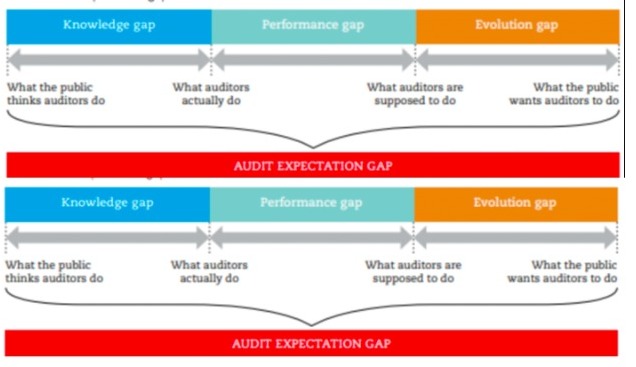

2) The audit expectation gap is commonly defined as “the difference between that public think about auditor and what the public would like auditor to do”. There are so many definitions for the expectation gap in the audition. Firstly the expectation gap audit comes in 1974, this was proposed by Carl Loggia in an academic paper. Recently audits gain too much attention from the public (Sule et al. 2019).

The expectation is now a threat in the profession of auditing. There are so many factors or attributes by which the expectation lag is happening in the audit. The time gap is the main or biggest reason for the exception gap in audits. The auditing profession is all about identifying and responding. The reason for the expectation gap is following:-

1) There is a performance gap in which there are different types of tasks and the public is expecting the auditor that they perform at a standard level. But It will happen on the auditor side. Mainly the performance happens because of a lack of focus on audit quality. In this part auditor has monitored the file again and again with focus.

2) There is a knowledge gap. This happens when the audited is not able to understand what happened to the auditor there is some unawareness about the policies. This, it concluded that the public misunderstands audit sometime.

Figure 1: The audit expectation gap

(Source: https://fbj.springeropen.in)

3)There is a liability gap. Basically, it describes the misunderstanding regarding the auditor’s legal liability. The public use to misunderstand about the legal liability of the auditor. This will create a problem for the auditor as well as the company.

4) There is an evolution gap. It exists in that area where evolution is needed. The technology and public demand are helps to make the audit process more complex. And it helps to create the evolution gap (Sinaga et al. 201). After knowing the performance and knowledge gap it is so important to avoid this gap in the audit.

The knowledge and performance gap is the main component of the expectation gap in auditing. These three are the evidence that various parties are involved in financial reporting.

The expectation gap in auditing always gives a negative impact on the auditing profession. In short, the expectation gap is not good for the auditing profession. Reducing knowledge is so difficult and it is also so important. Reducing the knowledge will help to reduce public negative thinking about the audit. In the UK it was found that most people don’t want to listen to an auditor’s points, even if they don’t read the auditor’s opinion on company accounting (Rustiarini et al. 2020).

Reducing the knowledge gap can regulate and set the standard for the audit process. To reduce the knowledge gap auditor have to collect sufficient knowledge about the statement and the public have to give them a chance or time to understand things.

People also have to listen to their points and go through their opinion about the company’s financial statement. The point is that auditing is very important for corporate reporting. For the performance gap, it is very important to set the standard as per public opinion. And the public should also have to understand that they do not set any assuming standards that will so difficult for the auditor to achieve.

Mainly performance happens in that area where the auditor does not focus. Because of this, the quality of auditing is also decreased and able to achieve the standard that is set by the public for the audit. After reducing the performance gap and knowledge it is for the public to focus that how they want to see the auditor. By understanding this factor by the public the evolution gap will happen. (Tapang, and Ihendinihu, 2020).

There is a link between the knowledge gap and the evolution gap. Policy-makers create a link between the knowledge gap and the evolution gap. In the audit profession, if the information is inaccurate or there is any fault in data this can damage the public perfection of the audit profession. While it is already discussed that public understanding can reduce the knowledge gap. Even it can also reducer the evaluation gap. In the UK the performance gap is the biggest reason for the exception gap in audits.

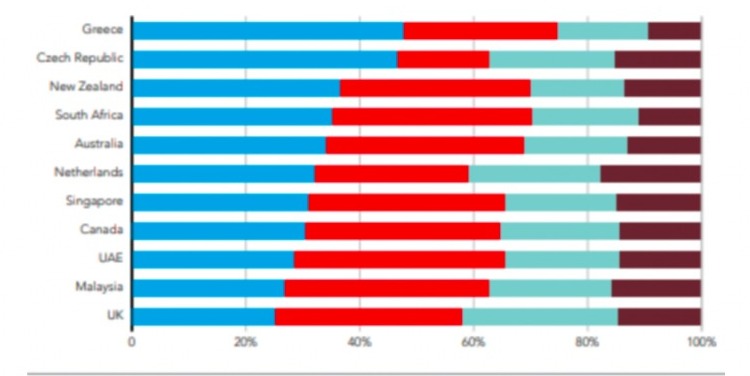

Figure 2: Expectation gap in the countries

(Source: https://fbj.springeropen.in)

In figure 2 there is a graph on the expectation gap in audits in different countries. Here, the blue color indicates the auditor gives an opinion on the financial statement of a company, whether there is a mistake or any chance of error or fraud. The color Red indicates that the accuracy of the financial statement for a company is given by the auditor.

Sky blue color indicated that there is no mistake in the company financial statement due to fraud or error. m And this report are provided by the auditor (Sridharan, and Hadley, 2018). At last, the brown color indicates the auditor is verified that there is no mistake in the company’s financial report.

It is not so easy to reduce the expectation gap in audits. This approach definitely works but it is not too easy on this approach. These approaches do not fully reduce the exception gap but yes if they follow step by step there is a chance that the expectation gap will not occur in audits (Ariail, and Crumbley, 2019).

Reducing the expectation in audits will make the financial statement more correct, there are no mistakes due to error or fraud. Reducing the expectation in audits will also help the auditor to work efficiently.

Reference list

Journals

Alawi, S.A.A., Wadi, R.M.A. and Kukreja, G., 2018. the determinants of audit expectation gap: An empirical study from Kingdom of Bahrain. Accounting and Finance Research, 7(3), pp.54-66.

Al-Mamun, A., Rashid, M., Roudaki, H. and Yasser, Q.R., 2022. An overview of Corporate Fraud and its Prevention Approach. Australasian Accounting, Business and Finance Journal, 16(1), p.6.

Ariail, D.L. and Crumbley, D.L., 2019. PwC and the Colonial Bank fraud: A perfect storm. Journal of Forensic and Investigative Accounting, 11(3), pp.440-458.

Blythe, S., 2021. Auditors’ Duty to Detect Illegal Acts Having a Material Effect on the Financial Statements: A Case Study of Miller Investment Trust v. KPMG. 5: 7. International Journal of Economics, Business and Management Research, pp.81-90.

Habbe, A.H., Rasyid, S., Arif, H. and Muda, I., 2019. Measuring internal auditor’s intention to blow the whistle (a Quasi-experiment of internal auditors in the local government). Business: Theory and Practice, 20, pp.224-233.

Handoyo, B.R.M. and Bayunitri, B.I., 2021. The influence of internal audit and internal control toward fraud prevention. International Journal of Financial, Accounting, and Management, 3(1), pp.45-64.

Hashim, H.A., Salleh, Z., Mohamad, N.R., Anuar, F.S. and Ali, M.M., 2019. Auditors’ perceptions towards their role in assessing, preventing and detecting business fraud. International Journal of Innovation, Creativity and Change, 5(2), pp.847-862.

Rustiarini, N.W., Yuesti, A. and Gama, A.W.S., 2020. Public accounting profession and fraud detection responsibility. Journal of Financial Crime.

Sinaga, H.D.P., Samekto, F.A. and Emirzon, J., 2019. Ideal corporate criminal liability for the performance and accreditation of public accountant audit report in Indonesia. International Journal of Economics and Business Administration, 7(4), pp.451-63.

Sridharan, U.V. and Hadley, L.U., 2018. Internal audit, fraud and risk management at Wells Fargo. International Journal of the Academic Business World, 12(1), pp.49-53.

Sule, S., Yusof, N.Z.M. and Bahador, K.M.K., 2019. Users’ perceptions on auditors’ responsibilities for fraud prevention, detection and audit expectation GAP in Nigeria. auditing, 5, p.2.

Tapang, A.T. and Ihendinihu, J.U., 2020. Effect of forensic accounting services on unethical practices in Nigerian banking industry. The Journal of Accounting and Management, 10(1).

Know more about UniqueSubmission’s other writing services: