BE951 Research Methods in Accounting

Module Code And Title : BE951 Research Methods in Accounting

1 Introduction

1.1 Background of research

This research attempts to explore the relationship between the usage of financial services, access to the bank and scope for microfinance in Middlesbrough, England. Financial inclusion or broad access to finance refers to the timely delivery of financial services to disadvantaged sections of society. This study is an attempt to arrive at a deeper understanding of the process of financial inclusion, the difference between access to financial services and usage, the significance of inclusion to households as well as scope for micro finance in Middles Brough, England.

In the last 10 years Microfinance became one of the world’s most high-profile and generously funded development interventions. There is no regulatory framework for microfinance in the UK since microfinance is not listed as a specific sector: most microfinance institutions are not banks and they cannot take a deposit. As regards credits for enterprises, self-employed persons and persons outside the banking system, the activity of the CDFIs (Community Development Finance Institutions) that have developed sincethe1990s, has become essential.(1)

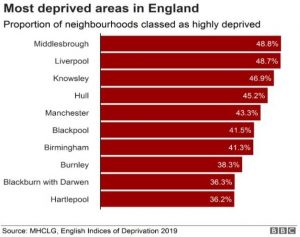

Figure 1:Most deprived areas in England (Source:Bbc.com, 2021)

Figure 1:Most deprived areas in England (Source:Bbc.com, 2021)

Based on the data published by the BBC on most deprived areas in England, this Middles Brough area is elected for the study.

As microfinance is an emerging factor through which a better future can be ensured. In this situation, it is quite necessary to connect various parts of society to this financial inclusion which ensures better mobilisation of funds and money. In the recent trend of the market, connecting various segments of society to financial inclusion benefited in the development of society and standard of living. However, some areas remain untouched in respect of this which may create barriers to attain overall development. This research is based on deprived areas where a detailed analysis of better financial inclusion and scope for microfinance will be analysed.

Different barriers and constraint hurdles effective expansion of financial inclusion and connecting people through financial institutions. In the recent trend of markets where financial institutions and banking services provide a wider range of scopes through which an individual can be able to access their bank account and manage funds without any issues. As opined by Akilenget al. (2018) Use of modern tools and technology such as mobile phones, internet access and designated apps provided by these institutions enables them to effectively connect with financial services. However, use of such an effective strategy doesn’t positively impact some aspects of society. Deprived areas of any country and those areas which are not good in terms of technology are not able to avail such kinds of service. This leads to inequality in society. High numbers of cybercrime and a cyber-attack on digital financial services lead to effective implications of financial inclusion (Kim et al. 2018). This leads to the principal and core values of financial inclusion.

Due to the lack of technological advancement, some parts of society remain untouched from these financial services and benefits, which affects the effective implications of financial inclusion in the country. On the other hand, lack of knowledge about this framework is another major issue that creates constraints on proper implementation of financial inclusion. The target of financial inclusion is to connect more people with banking and financial services. However, those areas where the number of financial institutions and banks is not Available remain untouched. As opined by David et al. (2018), this leads to a gap between individuals and financial services. Moreover, trust of individuals toward these services cannot be created in an effective way. In this situation, it is quite essential to get connected with those areas through various strategies such as campaigning which creates awareness about the benefits of this service. Based on the use of such a strategy, the gap between customers and financial institutions can be mitigated. On the other hand, this leads to creating trust between customers and financial institutions which is beneficial for effective implementation of financial inclusion.

On the other hand, connecting deprived areas with financial Inclusion and digital financial solutions provide a wider range of opportunities to develop infrastructure such as education, health system, and the emergence of new business as well. Moreover, an increase in the use of banking services and financial services allow household members as well for microfinance in different sectors. As argued by Demirgüç-Kuntet al. (2020), these institutions collect small savings from household members and encourage microfinance which leads to an increase in small and medium-size industries in the country. On the other hand, this strategy reduces inequality in society and eradicates poverty. Furthermore, financial inclusion focuses more on the principal nod universal access to financial services which allows people to manage their funds in a better way. Moreover, this Inclusion enables deprived areas people to get more scope and development through facilitating consumption and engaging in effective and product activities.

1.2 Literature Review: –

Cnaan, R. A., Moodithaya, M.S., & Handy, F. (2012) “Financial inclusion: Lesson from rural south India. ”They found that majority of household have access to bank and only 23% reported that no one in the household has a bank account. It also found that socio demographic variables provide insight into who is financially excluded or included.

Kumar,L., Balasubramanian,G. and Subramanian, R(2012)“Technology, Financial Inclusion and Securities Markets.” The study found that in several under developed African countries, changes in regulation and the permeation of the mobile has aided the substantial growth of financial inclusion.

1.3 Research Questions: –

- What is the extent of financial inclusion among household of Middles brough, England in terms of access and usage of bank account?

- What is the level of awareness about financial inclusion for ces among household of Middleborough, England?

- Do demographic factors influence the household of Middles borough, England in terms of access and usage of bank account?

1.4 Research Objectives: –

- To examine the extent of financial inclusion among household of Middlesbrough, England in terms of access and usage of bank account.

- To examine the level of awareness about financial inclusion forces among household of Middlesbrough, England.

- To study the influence of demographic factors on access & usage of bank account of the household of Middlesbrough, England.

1.5 Significance of research

Financial inclusion is aimed at providing banking and financial services to all people in a fair, transparent and equitable manner at affordable cost. The main reason of financially exclusion is that household with low in come often lack access to bank account and has to spend time and money for multiple visits to avail the banking services, be it opening a saving bank account or availing a loan, these families find it more difficult to save and to plan financially for the future. So here it is need to identifies possible ways through which bank can increase the customer base from these group.

On the other hand, an increase in the number of customers and people connecting to banking services and other financial services assists in sustainable growth of the country and overall development. Apart from this, connecting people with financial services and banking services increased the mobilization of funds and scope for better funds management. This leads to an increase in the financial position of customers as well. Focusing on the scope for improving microfinance through connecting household members of Middlesbrough, England allows analysing barriers that create constraints to connect people with financial services. On the other hand, this research connects each part of society to banking and financial services which enhances awareness of each sector of society on the proper use of funds. As cited by Hussaini and Chibuzo (2018), in the recent scenario financial inclusion proves a wider range of scope for better funds management and generating income through financing money. Analysis of this research provides a scope through which household members with lower income ability manage timer funds in a better way.

Financial inclusion provides scope to avail equal opportunity to access financial services. It is the process through which an individual and business can be able to access affordable and timely financial products and services. Financial services include banking services, loans, insurance and equity. As cited by Ozili (2018), the prime objective of financial inclusion is to bring digital and modern financial solutions for the underprivileged people of any country. In the current scenario where Middlesbrough, England is deprived and underprivileged areas in terms of financial inclusion banking services. In this situation, the chance of inequality, poverty is high in those areas which lead to the overall growth of the nation. Based on the analysis of the advantages of financial inclusion it has been noted that financial inclusion enables individuals to get connected to digital financial solutions and services. This leads to reducing poverty and increasing the standard of living. Apart from this, it also provides scope to minimise inequality in the society which promotes harmony in the society. An individual is able to get more scope through which better management of funds is possible. On the other hand, banks and other financial institutions are able to increase their customer base. Moreover, people can be able to save their deposits and funds in these financial institutions in a better way and connects to the rest of the world through investing funds in different areas.

In order to connect a large number of customers with financial institutions and banking services, it is quite necessary to analyse major factors which influence expansion of financial inclusion. As stated by Lashitewet al. (2019), analysis of these factors provides necessary guidance through which people get more engaged in financial and banking services. In an analysis of determinants of financial inclusion, it has been noticed that technology is a major factor that plays a pivotal role in connecting individuals to banking and financial institutions. In the last two decades, it has been noticed that technology is a leading factor and the use of digital tools and technology enables users to manage financial operations in an effective way (Kabakova and Plaksenkov, 2018). As in the current era where a person can be able to invest funds in any part of the world which emphasises that technology has a significant role in financial inclusion. In this situation, it is quite necessary for institutions to be more focused on technological advancement of those areas which are backward in respect of the use of digital financial solutions.

On the other hand, per capita income is another factor that directly influences financial and banking services. Higher per capita income areas have more users of banking services. In this situation, it has been noticed that income has an influence on financial inclusion. On the other hand, education is another factor that has influenced the proper implementation of banking and financial services. There is a correlational relationship between education and financial inclusion (Oecd.org, 2021). This reflects that the use of financial education programs seems effective through which encouraging people to take financial services can be ensured. Moreover, banking institutions are more capable of expressing different scopes for development and better management of funds which increases the effectiveness of financial inclusion.

3. Methodology

3.1 Research method

In this research paper, positivism research philosophy will be used as principles of this research philosophy allow to analyse the social world in an objective way. On the other hand, this research philosophy allows researchers to follow a well-defined structure through which the whole research will be cited in a smooth manner (Ryan, 2019). Furthermore, using this philosophy in the research will assist the researcher to find relationships between variables and factors affecting financial inclusion and microfinance. Through this will be able to analyse various aspects in a better way.

A deductive approach will be chosen for better research results. Based on this researcher approach, researchers are able to explain causal relationships among various concepts and variables of research topics. As opined by Bergdahl et al. (2019), this allows researchers to undertake actual relationships between various aspects and this leads to increased teacher effectiveness.

In this research paper, a descriptive research design will be chosen. Adopting this research design allows a researcher to obtain various data and information in a systematic way which increases researcher quality and its effectiveness. Apart from this, using a descriptive research design enables researchers to cover various aspects of financial inclusion in an effective manner. As cited by Atmowardoyo (2018), this leads to an increase in the quality of research as well as its validity. In order to ensure better research result is quite necessary for a researcher to adopt an effective research design that boosts research quality and its effectiveness.

Figure 2: Research method (Source: Atmowardoyo 2018)

Figure 2: Research method (Source: Atmowardoyo 2018)

Moreover, this research design answers various questions of research in a systematic way. On the other hand, descriptive research design allows researchers to analyse non-quantified topics such as financial inclusion benefits and their impact on microfinance (Umanailoet al. 2019). In this situation using descriptive research design allows integration of both quantitative and qualitative methods of data collection. This leads to providing better scope to prude logical conclusions on the whole research topic.

3.2 Research sampling

Random sampling method will be applied in this research as this research will include human participations while conducting the survey using a set of questionnaires. According to the view of Bergdahl et al. (2019),random sampling research method helps to collect data in a neutral way by not affecting any community. Besides, it will help to collect data from both male and female along with various professional background which will be beneficial to reduce the scope of any biases in the research population.

3.3 Data collection method

The data collection method is an integral part of the research process on which researcher quality and its validity vary. In this situation, it is important for the researcher to adopt data collection methods on the research topic which enhances vitality of the research paper. Researchers will collect various data and information for the research by means of questionnaires. Target population of this data collection are household members of Middlesbrough, England. On the other hand, a researcher will collect further data and resources for this research by means of journals, articles and official websites through which depth knowledge about the research topic can gather by using secondary data collection process. As stated by Umanailoet al. (2019), using “primary data collection methods” will enable researchers to implement better control and increase accuracy of information. On the other hand, through adopting primary data collection researchers will be able to provide up to dated and actual phenomena of financial inclusion and scope for microfinance in Middlesbrough, England. Moreover, this research approach will assist researchers to measure concerts quantitatively leads to enhanced overall quality of research results.

3.4 Data analysis

Data analysis is the process of evaluating, interpreting and finding relationships between concepts and variables which allow researchers to find the most appropriate answer to a research question. As in the current scenario where research is to be induced on the financial inclusion and scope for development of microfinance researchers need to adopt an effective data analysis tool through which collected data on this researcher topic can be based in the proper way (Kuz’minaet al. 2020). In this research paper, quantitative data analysis is used. Using this data analysis method will allow a researcher to evaluate various aspects of financial inclusion and provide, a logical conclusion on the whole research topic.

4. Ethical issues

Compliance with ethics is quite necessary for the research which guides researchers to choose appropriate manner to conduct the research. As this research is based on the primary data collection researcher more focused on effective data management of information which has been gathered through the question to participants. In this research researcher uses interview methods of data collection in which 40 participants will be selected in which household member of Middlesbrough, England is forced. Every participant of interviews has signed a consent form which reflects that this interview process properly complied with ethics. On the other hand, it also ensures that information in this interview cannot be used without prior consent of participants. Based on this, researcher is able to comply with ethics in an effective manner. on the other hand, researcher focus on sues of those tools and techniques which is harmless in nature towards any individual and person which enables to properly complied with effective research ethics.

5. Time table

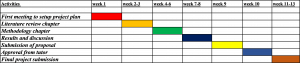

Figure 3: Time table (Source MS excel)

Figure 3: Time table (Source MS excel)

References

Journals

Akileng, G., Lawino, G.M. and Nzibonera, E., 2018. Evaluation of determinants of financial inclusion in Uganda. Journal of Applied Finance and Banking, 8(4), pp.47-66. Available at:http://www.scienpress.com/Upload/JAFB/Vol%208_4_4.pdf

Atmowardoyo, H., 2018. Research methods in TEFL studies: Descriptive research, case study, error analysis, and R & D. Journal of Language Teaching and Research, 9(1), pp.197-204. Available at:http://academypublication.com/issues2/jltr/vol09/01/25.pdf

Bergdahl, E., Ternestedt, B.M., Berterö, C. and Andershed, B., 2019. The theory of a co‐creative process in advanced palliative home care nursing encounters: A qualitative deductive approach over time. Nursing open, 6(1), pp.175-188. Available at:https://onlinelibrary.wiley.com/doi/pdfdirect/10.1002/nop2.203

Cnaan, R. A.,Moodithaya, M.S., & Handy, F. 2012 “Financial Inclusion: Lesson fromrural south India” has been Retrieved from journal of social policy, Vol.41 (1), Pg. 183-205,Dated:7th March, 2016.

David, O.O., Oluseyi, A.S. and Emmanuel, A., 2018. Empirical analysis of the determinants of financial inclusion in Nigeria: 1990-2016. Journal of Finance and Economics, 6(1), pp.19-25. Available at:https://www.researchgate.net/profile/Sesan-Adeniji/publication/328409800_Empirical_Analysis_of_the_Determinants_of_Financial_Inclusion_in_Nigeria_1990_-_2016/links/5bcb6059299bf17a1c62e852/Empirical-Analysis-of-the-Determinants-of-Financial-Inclusion-in-Nigeria-1990-2016.pdf

Demirgüç-Kunt, A., Klapper, L., Singer, D., Ansar, S. and Hess, J., 2020. The Global Findex Database 2017: Measuring financial inclusion and opportunities to expand access to and use of financial services. The World Bank Economic Review, 34(Supplement_1), pp.S2-S8. Available at:https://academic.oup.com/wber/article/34/Supplement_1/S2/5700461

Hussaini, U. and Chibuzo, I.C., 2018. The effects of financial inclusion on poverty reduction: The moderating effects of microfinance. International Journal of Multidisciplinary Research and Development, 5(12), pp.188-198. Available at:https://www.academia.edu/download/58585508/The_effects_of_financial_inclusion_on_poverty_reduction-The_moderating_effects_of_microfinance.pdf

Kabakova, O. and Plaksenkov, E., 2018. Analysis of factors affecting financial inclusion: Ecosystem view. Journal of business Research, 89, pp.198-205. Available at:https://finance.skolkovo.ru/downloads/documents/FinChair/Research_Reports/SKOLKOVO_Ecosystem_View_2018-02_en.pdf

Kim, M., Zoo, H., Lee, H. and Kang, J., 2018. Mobile financial services, financial inclusion, and development: A systematic review of academic literature. The Electronic Journal of Information Systems in Developing Countries, 84(5), p.e12044. Available at:https://onlinelibrary.wiley.com/doi/pdfdirect/10.1002/isd2.12044

Kumar, N, 2009 “Financial inclusion and its determinants: Evidence from state levelempiricalanalysisin India”

Kuz’mina, E.V., P’yankova, N.G., Tret’yakova, N.Y.V. and Botsoeva, A.V., 2020. Using Data Analysis Methodology to Foster Professional Competencies in Business Informaticians. European Journal of Contemporary Education, 9(1), pp.54-66. Available at:https://files.eric.ed.gov/fulltext/EJ1249383.pdf

Lashitew, A.A., van Tulder, R. and Liasse, Y., 2019. Mobile phones for financial inclusion: What explains the diffusion of mobile money innovations?.Research Policy, 48(5), pp.1201-1215. Available at:https://www.researchgate.net/profile/Addisu-Lashitew-2/publication/330716526_Mobile_Phones_for_Financial_Inclusion_What_Explains_the_Diffusion_of_Mobile_Money_Innovations/links/5c50bf1a92851c22a398d279/Mobile-Phones-for-Financial-Inclusion-What-Explains-the-Diffusion-of-Mobile-Money-Innovations.pdf

Ozili, P.K., 2018. Impact of digital finance on financial inclusion and stability. Borsa Istanbul Review, 18(4), pp.329-340. Available at:https://www.sciencedirect.com/science/article/pii/S2214845017301503

Ryan, G.S., 2019. Postpositivist, critical realism: philosophy, methodology and method for nursing research. Nurse researcher, 27(3), pp.20-26. Available at:http://oro.open.ac.uk/57453/1/Ryan%20%26%20Rutty%202018%20PPCR.pdf

Umanailo, M.C., Hamid, I., Hamiru, H., Assagaf, S.S.F., Bula, M., Nawawi, M., Pulhehe, S., Yusuf, S. and Bon, A.T., 2019. Utilization of Qualitative Methods in Research Universities. Education science, 20. Available at:http://www.ieomsociety.org/pilsen2019/papers/571.pdf

VITTORIO E. AGOSTINELLI.“MICROCREDIT IN UNITED KINGDOM” has beenretrievedformhttps://rivista.microcredito.gov.it/world-news/archivio-world-news/455-microcredit-in-united-kingdom.html

Websites

Bbc.com, 2021, most deprived areas of UK,Available at:https://www.bbc.com/news/uk-england-49812519[Accessed on 7 February 2022]

Oecd.org, 2021, financial education on financial inclusion Available at: https://www.oecd.org/financial/education/oecd-international-network-on-financial-education.htm [Accessed on 7 February 2022]

Know more about UniqueSubmission’s other writing services: