BMG704 International Finance Assignment Sample

Module Code And Title : BMG704 International Finance Assignment Sample

Introduction

Cineworld Group Plc is a UK based cinema company that has 9500 screens across 790 sites in 10 countries. It is world’s second largest cinema chain listed in LSE as CINE (Cineworld Plc, 2022). The company operates in UK, US, Romania, Slovakia, Czech Republic, Ireland, Hungary, Poland, Israel, and Ireland. The company made revenue US$436937m in 2019, and US$852.3m in 2020 (Statista, 2022).

Besides, net income of company is US$180.3m in 2019, and -US$2651.5m in 2020. Current report analyses financial performance of Cineworld. Moreover, recent development in internal business environment affecting performance of Cineworld has been highlighted along with its dividend policy, and source of finance.

a. Recent development

Two recent developments in internal business environment that affected Cineworld are Brexit, and Covid-19 pandemic situation. These developments have appeared to have negative outcomes for Cineworld. Impact of these developments and strategies implicated by Cineworld has been discussed as under:

Brexit

One event that impacted performance of Cineworld is Brexit. This development was withdrawal of UK from EU on 2020.01.31 at 23:00 GMT. After being part for 47 year, it was the only sovereign country which left EU (Bbc, 2022).

Brexit deal will impact the UK’s cinema industry. It is worth £3bn and employs 100000 individuals. Three quarters of film industry is based in London, it is crucial for ensuring capital recovery and remaining competitive in market. Due to trade deals with EU, changing licence rules due to Brexit lead to damage to broadcasters along with skills shortage (London.gov.uk, 2022). Occurrence of Brexit created currency shift in UK; as a result, Cineworld’s profit fell by 35%.

Effect of Brexit deal on Cineworld was intense. It is second largest exhibitor of Europe which reported a 34.6% drop in pre-tax profitability after Brexit referendum. Such reduction largely took place due to currency movement. Before this event, company had £356.7m revenue which was 8.4% up from last year. But, currency movement cost Cineworld £6.1m in last 6months. Almost 20% of its debt was from Europe, and currency movement tends to increase cost of these debts (Screendaily, 2022). According to CEO of Cineworld, Brexit has a significant negative impact of performance of this company but profit shifted due to currency translation losses.

UK’s cinema market was one of industries that miserably impacted by Brexit deal, a number of strategies developed by Cineworld for dealing with issues. UK and Ireland were major markets for this company; company provided higher emphasis on market to deal with losses. It acquired five sites of Empire Cinema including its premium Leicester square locations that helped in boosting its performance. In addition, it boosted revenue by performance of advertising company Digital Cinema Media that saw 12.5% raise in trading. Further, Cineworld slightly increased investment in its subsidiary Picturehouse for boosting performance.

Covid-19

Another recent development that impacted performance of Cineworld was Covid-19 pandemic. Covid-19 pandemic created social and economic disruption all over the world. 10m of individuals are at risk of falling into extreme poverty and 690m people are found to be undernourished (Who.int, 2022). Besides, situation has negative impact on both lives of individuals and business environment. Cineworld incurred huge losses after occurrence of Covid-19 pandemic.

By second quarter of 2020, company faced losses of $1.6bn. Cineworld reopened 561 sites out of 778 after lockdown restrictions eased. Due to lockdown closure, revenue of Cineworld sank by $712.4m compared to $2.15bn revenue a year earlier (Bbc, 2022). The company also had a huge fall in pre-tax profit which is $139.7m in first six month of 2020.

Due to reduction in demand for cinemas during Covid-19 pandemic, CEO of company also raised doubts on its survival during second lockdown. The company has to shift its operations temporarily in UK and US market leaving 45000 employees unemployed. This helped company in stabilising its performance during corona virus related collapse in cinema going and film release. During second phase of lockdown, company had to close 90 percent of its screens and its debts rose to $8.2bn.

Covid-19 pandemic had significantly impacted on overalls cinema industry and financial results of Cineworld in 2020-2021. To deal with such a situation, company closed all its sites until 2021 April 2nd. Higher emphasis was provided by management of costs reduction, cash preservation, and safety of customers & employees.

The company operated under minimum liquidity in 2020-2021, and obtained group leverage covenant waivers until June 2020 (Cineworldplc, 2022). As company has a significant amount of debt and incurred losses during pandemic situation of 2020, additional liquidity of $810.8m was raised for meeting debt obligations. Due to significant demand for cinema during 2020, company was able to improve its financial position in global cinema industry.

b. Finance and risk management

International finance and risk management strategy for Cineworld can be discussed by analysing its source of finance and dividend policy. It is helpful for analysing impact of these elements on financial position of Cineworld.

Source of finance

Sources of finance can be assessed as places from where a company raises funds. A company can rise funding from internal and external sources (Atrill and Mc Laney, 2017). Besides, debt and equity are major sources of finance. Such sources of finance are used by Cineworld for financing its operations.

Cineworld has equity $2,937.7m in 2019 and $226.3m in 2020. Long-term debt capital of company is $8,022.4m in 2019 and $8,735.1m in 2020 (Annualreports.co.uk, 2022). Besides, short-term debt of company is $1,490.4m in 2019 and $1,663.8m in 2020.

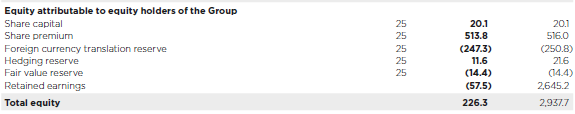

Breakdown of equity capital shows share capital $20.1m in 2019 and 2020. Share premium of company is $513.8m in 2020 and $516m in 2019. Foreign currency translation reserve of Cineworld is -$247.3m in 2020 and -$250.8m in 2019. Besides, hedging reserves were $11.6m in 2020 and $21.6m in 2019. Fair value reserve of this company is -$14.4m in 2019 and 2020. Further, retained earnings were -$57.5m in 2020 and $2645.2m in 2019 (Annualreports.co.uk, 2022).

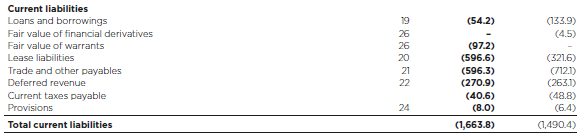

In short-term debts, Cineworld has loans and borrowings $54.2m in 2020 and $133.9m in 2019. Fair value of financial derivatives was $4.5m in 2019. Provisions were $8m and $6.4m in 2020 and 2019 respectively. Current tax payables were $40.6m in 2020 and $48.8m in 2019. Deferred revenue was $270.9m in 2020 and $263.1m in 2019. Fair value of warrants were $97.2m in 2020, lease liabilities were $596.6m in 2020 and $321.6m in 2019. Further, trade and other payables were $270.9m and $263.1m in 2020 and 2019 respectively.

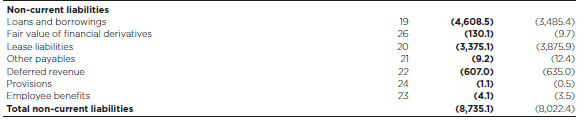

In long-term debts, Cineworld has loans and borrowings $4,608.5m in 2020 and $3,485.4m in 2019. Fair value of financial derivatives was $130.1m in 2020 and $9.7m in 2020. Provisions were $1.1m and $0.5m in 2020 and 2019 respectively. Employee benefits were $4.1m in 2020 and $3.5m in 2019. Deferred revenue was $607m in 2020 and $635m in 2019. Other payables were $9.2m in 2020 and $12.4m in 2019, lease liabilities were $3,375.1m in 2020 and $3,875.9m in 2019.

This means proportion of debt capital is higher in capital structure of Cineworld. Calculation of gearing ratio can be made for examining capital structure of Cineworld. Calculation of gearing ratio has been made for determining financial risk of company. Cineworld has gearing ratio 60.43% in 2018, 80.34% in 2019, and 97.79% in 2020. This means debt capital of Cineworld has increased gradually in past three years.

A high level of debt capital in financial position statement indicates relevance of net income theory of capital structure. The theory states that with increase in debt capital, WACC of company declines resulting in increased firm value (Abdullah and Tursoy, 2021). However, capital structure of Cineworld is optimal due to increase in debt capital as compared to equity capital.

Cineworld has outstanding operational cash flow of $227.6m in 2020 and $1293.7m in 2019. Besides, total debt was increased by $886.1m in 2020. This means with increase in debt capital, operating cash flow of Cineworld has declined. Due to Covid-19 pandemic, Cineworld’s cash flow position worsened. Due to higher dependence on debt capital, issues in cash management and liquidity position have taken place in 2020. The company is currently focusing on preserving cash and raising more liquidity for improving leverage.

Dividend policy

Dividend policy is financial policy used by ventures for structuring dividend payouts to shareholders. As opined by Alexander and Nobes (2016), dividend policy is important for company as it helps in maintaining satisfied shareholders. Cineworld pays quarterly dividends.

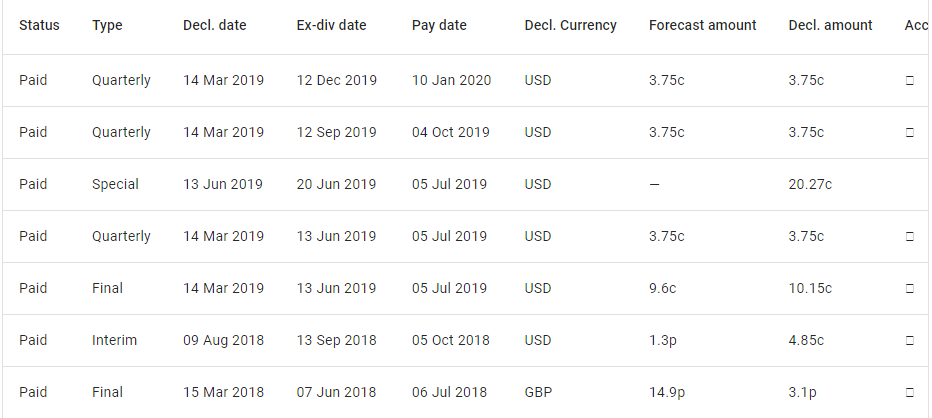

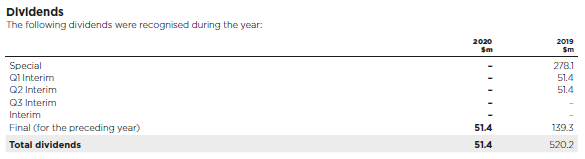

In 2018, Cineworld paid interim dividend 4.85p and final dividend 10.15p. In 2019, company paid final dividend of 10.15c and quarterly dividend of 3.75c. In 2020 company paid 20.27c special dividend, and a 3.75c quarterly dividend (Dividendmax, 2022). Total dividends paid by Cineworld were $122.9m in 2018, $520.2m in 2019, and $51.4m in 2020. This indicates reduction in dividend payment during pandemic situation of 2020.

As per last 3 years dividend payout of Cineworld, it can be said that dividend growth policy in 2019 was efficient but reduction in dividend payout has taken place due reduction in financial position during pandemic situation of 2020. Dividend payout of Cineworld is 43.23% in 2018, 288.52% in 2019, and -1.94% in 2020 this indicates that company has sound dividend history since 2019 but reduction in performance took place due to potential losses took place in 2020. Besides, dividend paid by company in 2020 was for 2019. Dividend per share in 2019 was 0.3277.

Prior to Covid-19 pandemic situation, Cineworld was consistently paying dividends to investors. A consistent increment in dividend was censured by management of Cineworld for attracting more investors to invest in operations. Along with increment in cash flow and profitability, dividends were increased in past years. Besides, buybacks of shares were also made by company to promote shareholders interest (Dailybusinessgroup.co.uk, 2022). With increase in dividend payment, significant increase in share price has been found in past year. The company had share price £270 in 2018, and £222.40 in 2019 (Finance.yahoo, 2022).

Analysis of Cineworld’s dividend policy shows application of dividend relevance theory. Relevance theory of dividend payment indicates that shareholders prefer dividend payment as capital gain (Nambukara-Gamage and Peries, 2020). As shareholders of Cineworld had a higher appetite for dividends, reduction in dividend payment led to decline in share price of this company. In pandemic situation of 2020, the company was unable to pay sound amount of dividend to shareholders. Moreover, no dividends were declared by company for 2020. Further, it can be said that dividend policy of Cineworld for 2020 was irrelevant.

c. Financial performance

Profitability

ROCE

Return on capital employed is financial ratio that sheds light on profitability position of company. ROCE is “operating profit/total assets-current liabilities*100”. A high ROCE means the company is making effective use of capital employed to make profit (Atrill and Mc Laney 2017). ROCE of Cineworld is 5.20% in 2019 and -18.37% in 2020. This indicates reduction in profitability of company due to ineffective use of capital employed. During 2020, the company incurred operational loss of -$2258m as demand of cinema declined during Covid-19 pandemic. This means, Cineworld has to ensure effective use of capital employed to improve ROCE.

Operating profit margin

Operating profit margin is financial ratio that sheds light on profitability position of company. Operating profit margin is “operating profit/total revenue*100”. A high operating profit margin means the company has lower operating expenses (Alexander and Nobes, 2016). Operating profit margin of Cineworld is 16.58% in 2019 and -264.89% in 2020. This indicates reduction in operating profitability of company due to operating losses in 2020. This means, Cineworld has higher operating expenses and lower total revenue; as a result, operating profit margin has negative balance.

Efficiency

Inventory turnover days

This ratio identifies efficiency of company to convert inventories into sales. Taking lower time to cover inventories and obtain cash signifies higher efficiency of a company (Garba et al. 2020). Inventory turnover days is “average inventory*365 days/costs of sales”. Cineworld has taken 5days in 2020 and 4days in 2019 to convert inventories into sales. This means efficiency of Cineworld declined by 1day. This reduction in efficiency position has been taken place due to reduction in demand of cinema in 2020. Besides, average inventory of this company was also lower in 2020 than in 2019.

Receivables turnover days

This ratio identifies efficiency of company to collect dues from customers. Taking lower time to collect dues from customers indicates higher efficiency of a company (Purwanti, 2019). Receivable turnover days is “average receivables*365 days/total revenue”. Cineworld has taken 23days in 2020 and 22days in 2019 to collect dues from customers. This means efficiency of Cineworld declined by 1day. This reduction in efficiency position has been taken place due to reduction in demand of cinema in 2020. Besides, revenue of this company was also lower in 2020 than in 2019.

Liquidity

Current ratio

Current ratio is financial ratio that sheds light on liquidity position of company (Watson and Head, 2016). Current ratio is “current assets/current liabilities”. Current ratio of Cineworld is 0.30times in 2019 and 0.37times in 2020. Cineworld has higher current liabilities than current assets in both 2019 & 2020; as a result the company has a miserable liquidity position. The company has to decline proportion of current liabilities to boost liquidity position.

Quick ratio

Quick ratio is financial ratio that sheds light on liquidity position of company without considering inventory balance (Wijaya and Sedana, 2020). Quick ratio is “current assets-inventories/current liabilities”. Quick ratio of Cineworld is 0.28times in 2019 and -0.36times in 2020. Cineworld has higher current liabilities than current assets in both 2019 & 2020. Inventories in 2020 were $20m lower than 2019; as a result the company has a miserable liquidity position. The company has to decline proportion of current liabilities to boost liquidity position.

Investment

Gearing ratio

Gearing ratio is financial ratio which signifies leverage position of company. Besides, it signifies that the company has a solvent business position and is efficient for making investment (Kariyawasam, 2019). Cineworld has gearing ratio 80.34% in 2019, and 97.79% in 2020. This mean presence of debt capital in capital structure has been improved, as result the company does not have a sound investment position. Thus, reduction of debt capital can be helpful to improve gearing position of Cineworld.

Price-earnings ratio

This ratio compares market price of shares with earnings per share. A high price-earnings ratio means shares of company are overvalued and investing in this would not bring significant returns (Fadjar et al. 2021). Price-earnings ratio is “market price per share/earnings per share”. Price-earnings ratio of Cineworld was 16.99 in 2019 and -0.34 in 2020. This means shares of Cineworld declined in market during pandemic situation of 2020. Performance of the company can be improved by increase in demand of cinema in post-pandemic situation.

Conclusion

Cineworld is the world’s second largest cinema chain, listed on LSE as CINE. In 2019, the company made US$436937m in revenue, and in 2020, it made US$852.3m revenue. Brexit and the Covid-19 pandemic scenario are two recent upheavals in the internal business climate that have impacted Cineworld. Cineworld appears to have suffered as a result of these occurrences.

The organisation used successful tactics to cope with the challenges that arose as a result of these recent events. In addition, debt and equity are important sources of capital. Cineworld relies on such sources of funding to run its business. Furthermore, Cineworld has been discovered to pay quarterly dividends. According to ratio analysis, Cineworld’s financial performance in 2020 was lower than 2019.

References

Abdullah, H. and Tursoy, T., (2021). Capital structure and firm performance: evidence of Germany under IFRS adoption. Review of Managerial Science, 15(2), pp.379-398.

Alexander, D., and Nobes, C. (2016). Financial accounting –an international introduction. 6th edition. Harlow: Pearson Education.

Annualreports.co.uk (2022). About Cineworld Plc annual report. Available at: https://www.annualreports.co.uk/Company/Cineworl3[Accessed on 19th February 2022]

Atrill, P., and Mc Laney E. (2017). Accounting and finance for non-specialists. 10th Edition.

Bbc (2022). About Brexit. Available at: https://www.bbc.com/news/uk-politics-32810887[Accessed on 12th February 2022]

Bbc (2022). About Cineworld Plc issues in pandemic. Available at: https://www.bbc.com/news/business-54277278[Accessed on 17th February 2022]

Cineworldplc (2022). About Cineworld Plc annual report. Available at: https://www.cineworldplc.com/sites/cineworld-plc/files/reports-presentation/(2021)/2503(2021)-preliminary-results-(2020).pdf[Accessed on 18th February 2022]

Cineworldplc (2022). About Cineworld Plc. Available at: https://www.cineworldplc.com/en/home-page[Accessed on 10th February 2022]

Dailybusinessgroup.co.uk (2022). About Cineworld Plc. Available at: https://dailybusinessgroup.co.uk/(2021)/11/blockbusters-boost-cineworld-cairn-begins-buyback/[Accessed on 21th February 2022]

Dividendmax (2022). About Cineworld Plc. Available at: https://www.dividendmax.com/united-kingdom/london-stock-exchange/travel-and-leisure/cineworld-group/dividends[Accessed on 20th February 2022]

Fadjar, A., Jumana, Y.L. and Gunawan, B., (2021). The Effect Of Current Ratio, Net Profit Margin, Debt To Equity Ratio Firm Size And Return On Equity On Price Earning Ratio Empirical Studies On Consumer Goods Industry Companies Listed On Idx (Years 2018-(2020). Review of International Geographical Education Online, 11(6), pp.714-727.

Finance.yahoo (2022). About Cineworld Plc. Available at: https://finance.yahoo.com/quote/CINE.L/[Accessed on 22th February 2022]

Garba, S., Mourad, B. and Chamo, M.A., (2020). The effect of inventory turnover period on the profitability of listed nigerian conglomerate companies. International Journal of Financial Research, 11(2), pp.287-292.

Kariyawasam, H.N., (2019). Analysing the impact of financial ratios on a company’s financial performance. International Journal of Management Excellence, 13(1), pp.1898-1903.

London.gov.uk (2022). About Cinema industry issues during Covid-19 pandemic. Available at: https://www.london.gov.uk/questions/(2021)/0806[Accessed on 13th February 2022]

Nambukara-Gamage, B. and Peries, S.T., (2020). The Impact of Dividend Policy on Shareholder Wealth: A Study on the Retailing Industry of Australia. Review of Integrative Business and Economics Research, 9(1), pp.38-50.

Purwanti, T., (2019). An analysis of cash and receivables turnover effect towards company profitability. International Journal of Seocology, pp.037-044.

Screendaily (2022). About Cineworld Plc fall in revenue. Available at: https://www.screendaily.com/news/cineworld-sees-profits-fall-35-due-to-currency-shifts/5107395.article[Accessed on 14th February 2022]

Standard.co.uk (2022). About Cineworld Plc issues in Brexit. Available at: https://www.standard.co.uk/business/box-office-will-benefit-from-brexit-blues-says-cineworld-a3317451.html[Accessed on 15th February 2022]

Statista (2022). About Cineworld Plc revenue. Available at: https://www.statista.com/statistics/1082295/cineworld-income-worldwide/[Accessed on 11th February 2022]

Watson, D. and Head, A. (2016). Corporate finance 7th ed. New York: Pearson.

Who.int (2022). About Covid-19 pandemic. Available at: https://www.who.int/news/item/13-10-(2020)-impact-of-covid-19-on-people’s-livelihoods-their-health-and-our-food-systems#:~:text=The%20economic%20and%20social%20disruption,the%20end%20of%20the%20year. [Accessed on 16th February 2022]

Wijaya, D.P. and Sedana, I.B.P., (2020). Effects of quick ratio, return on assets and exchange rates on stock returns. Am. J. Humanities Soc. Sci. Res, 4, pp.323-329

Know more about UniqueSubmission’s other writing services:

The point of view of your article has taught me a lot, and I already know how to improve the paper on gate.oi, thank you. https://www.gate.io/de/signup/XwNAU