BMG704 International Finance Assignment Sample

Module code and Title: BMG704 International Finance Assignment Sample

Introduction

This study is based on an analysis of the financial and non-financial performance of an American-based Automotive and clean energy company named Tesla Inc. This company deals with designing and manufacturing electric vehicles, better storage from home to grid scale and related products or services as well. In the past two financial years, this company has generated a profit of $721 million in the financial year 2020 and $5,519 million in the financial year 2021 (tesla.com, 2021). In this study, two recent developments by Tesla and their financial impact have been evaluated.

Section A: Two recent developments

Development 1: virtual machine mode

Tesla deals with the clean energy sector as well, thus its primary objective is to minimize carbon emissions and enhance the sustainability of the environment as well. In order to enhance its performance in terms of sustainability this company in the financial year 2020 launched virtual machine mode.

The financial impact of development

The virtual machine mode is built in a mega pack inverter which strengthens the grid performing dynamic and rejects the load. Other than this, better maintenance of the quality is possible through which this company can be able to provide 3,000 megawatt-seconds of inertia in South Australia (tesla.com, 2021). Through this, it has been observed that the company’s responses to addition and performance in terms of power supply have been increased. Other than this, it has been found that the company’s performance in terms of power supplies and control has increased through this development.

Strategy to mitigate change

The implication of this development has a significant impact on the financial and organizational structure. However, Tesla through the use of highly skilled employees and better working culture can be able to implement this change effectively.

Development two: announcement of the launching of Pi phone

Tesla has announced its entry into the telecommunication industry through the announcement of the Pi phone. This phone is going to launch at the end of the financial year 2022 (tesla.com, 2021). Entering a new industry provides a competitive advantage for the company as it increases the financial performance of the company in the market. The aim of this launch is to maintain diversity in the business portfolio. As suggested by Mehmood et al. (2019, p.5) a diversifications of product helps a company to have a positive impact on the market.

The financial impact of this development

Financial performance of this company through the announcement of the Pi phone increases. The company already builds brand value through the launch of various high-tech products in the global market. This launch attracts the potential customer of the market in an effective way. Other than this, new investment has been generated through this announcement.

Strategy to mitigate the impact of change

In order to manufacture, Pi phone this company’s need to increase their product procurement process through which they can provide this product at a great price, thus the company made certain changes in its supply chain management. Other than this, the deployment of highly skilled employees provides scope for the company to increase its performance in terms of change in its organizational culture.

Section B: Dividend policies and source of finance

It refers to the policies that are used by a company to decide its dividend payouts. In the current era of the market, competition is quite high in this situation. As per the view of Magni, (2021, p.02), there are two main types of dividend theory, one relevant theory and another irrelevant theory. Under the irrelevant dividend theory, it has been found that the dividend pattern has no impact on the share value of the company. Thus, it has been found that the payment divided has no impact on the shareholder’s wealth.

As per the view of Priya, P.V. and Mohanasundari, (2019, p.60), under the relevant theory, it has been found that the payment of the dividend has a significant impact on shareholder value and wealth. There are different types of dividend policies adopted by the company such as regular dividends, irregular dividends, stable dividends and no dividend policies. Analysis of the Tesla dividend policies has found that this company adopts non-dividend policies. The company never declare any cash dividend on its common stock. Other than this, this company has no intention to pay dividends in the foreseeable future.

It refers to the sources from which a company may be able to generate funds. Finance is the fuel to operate a business in a systematic way. Thus it is quite necessary for the company to have an effective source of finance through which it can operate in the market effectively (Alexander et al. 2009, p.26). The source of finance is majorly categorized into two groups one is internal and the other external.

Internal source of finance

Internal sources of finance are those funds which are derived within the business. The company can generate such a type of fund through the utilization of reserves and surplus. As argued by Udobi and Iyiegbuniwe (2018, p.1), another way of generating funds for the company internally is the sale of assets. Other than this, the amount of funds which is invested by the owner is also treated as the internal source of finance.

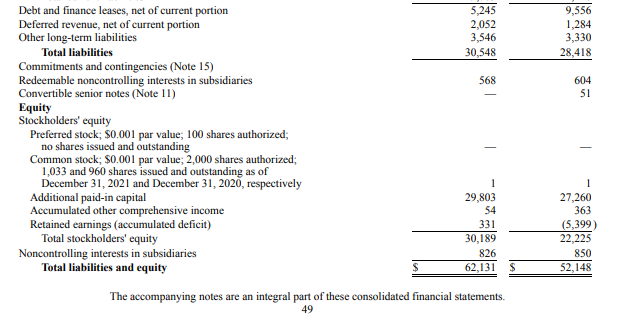

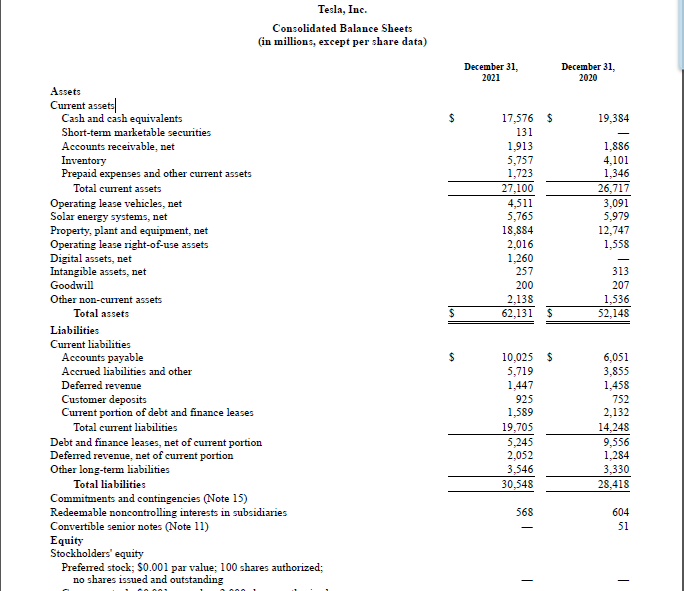

Analysis of the common stock of the company found that this value has increased from $27,260 million to $29,803 million which highlights that the company issued shares to generate funds. On the other hand, increased profit in financial years provides scope to cover the negative value of the reserve and surplus of the company from $-5,399 million to $331 million. This highlights the overall increase in the company’s shareholder equity from $ 52,148 to $ 62,131 million in the financial year 2021.

Figure 1: source of finance of Tesla (Source: tesla.com, 2021)

Figure 1: source of finance of Tesla (Source: tesla.com, 2021)

An external source of finance

An external source of finance is a source in which a company generates its funds from an external party. This source of finance includes debt, lease and preference share capital (Gherghina, 2021, p.51). Analysis of Tesla’s external source of finance has found that the company reduced its lease from $9,556 million to $5,245 million in the financial year 2021. However, the long-term debt has increased from $3,330 million to $3,546 million.

The company’s primary objective is to minimize the cost of capital by maintaining an effective capital structure. There are different theories on the capital structure which provide scope to minimize the cost of capital and maximize the chance of profit. As opined by Almabekova et al. (2018, p.116), the theory of net income theory and the traditional approach. On the other hand, under the traditional approach, it has been found that companies need to adopt an effective mix to minimize the cost of capital. In this case, Tesla uses the traditional theory and Under the net income theory, of capital structure where it maintains an optimum structure of debt and equity in its capital structure.

Section C

Profitability ratio

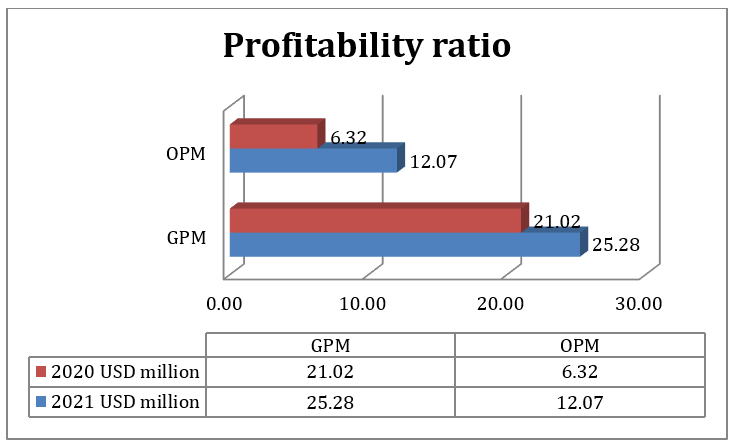

Figure 2: profitability ratio chart (Source: MS-Excel)

Figure 2: profitability ratio chart (Source: MS-Excel)

- Gross profit margin

The Gross profit margin (GPM) helps to know about the business profit that is made by the company after selling the goods and subtracting the total cost (Choiriyah et al. 2020, p.2).

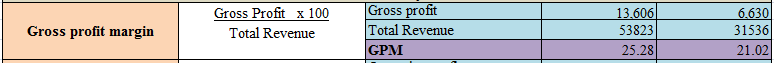

Figure 3: GPM (Source: MS-Excel)

Figure 3: GPM (Source: MS-Excel)

Significance of the ratio

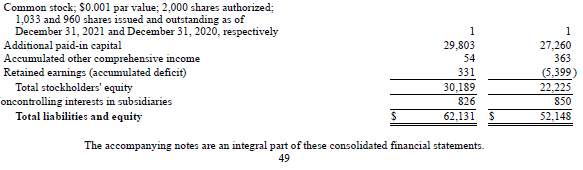

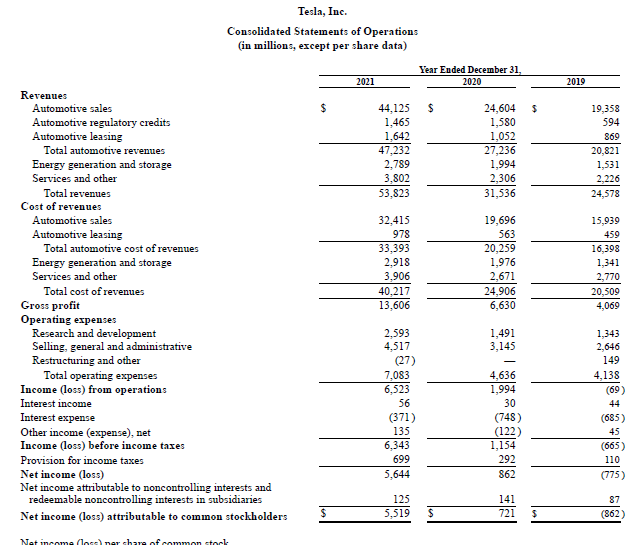

The GPM of Tesla Inc for the year 2020 was 21.02 which was in 2020 rose to 25.28 in 2021 because the gross profit that the company incurred for the year 2021 doubled in the year 2021. The Gross profit increased from 6630 million $to 13606 million $ in comparison to the revenue increased from 31536 million $ to 53823 million dollars (tesla.com, 2022).

Reason for the change

There was a rise in the gross profit margin because with the help of Virtual machine boards the company used to take less power and this helped to reduce power consumption.

- Operating profit margin

The operating profit is the profit that is earned by subtracting all the expenses from the revenue except depreciation and tax.

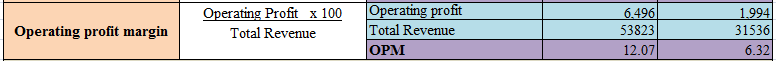

Figure 4: OPM (Source: MS-Excel)

Figure 4: OPM (Source: MS-Excel)

Significance of the ratio

There was a rise in the OPM just like the GPM as there was a rise in the Revenue and operating profit of the company. The OPM of the company in 220 was 6.32 which increased to 12.07 in 2021(ir.tesla, 2022).

Reason for the change

As the new virtual machine helped to reduce the cost of power supply which led to increases in its operating profit.

There is a rise in demand for cyber security globally with the launch of Pi phones. The company gained huge revenue as it started taking orders for those trucks, which led to the rise of the revenue of the company.

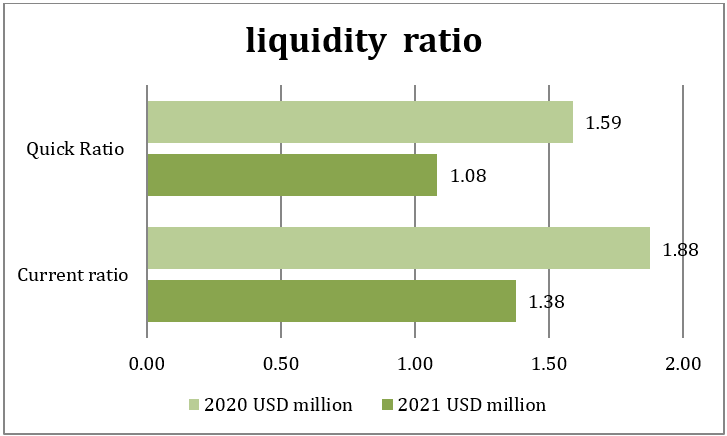

Liquidity ratio

Figure 5: liquidity Ratio chart (Source: MS-Excel)

Figure 5: liquidity Ratio chart (Source: MS-Excel)

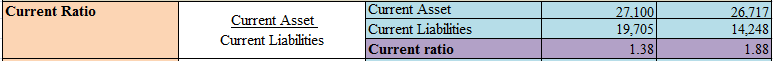

- Current Ratio

It tells the ability of the company to pay its loans and obligations through its current assets. It tells about the financial condition of the company (Nugroho and Nazar 2020, p.2).

Figure 6: Current Ratio (Source: MS-Excel)

Figure 6: Current Ratio (Source: MS-Excel)

Significance of the ratio

The current ratio of the company has reduced to 1.33 in 2021 compared to 1.88 in 2020. A decrease in the current ratio is not a good sign for a company, a current ratio lower than 1.5 is not considered good.

Reason for the change

Due to new products for the Pi phone the company has to invest a huge amount in its production so that the orders are met. Due to this the company had to invest in many new machines and various other things so the company had to take loans and obligations due to which the current ratio dropped.

- Quick Ratio (Acid)

It is the same as the current ratio but this current ratio is taken without inventories. It is also called the Acid test ratio (Supriono, 2022,P.3).

Figure 7: Quick Ratio (Source: MS-Excel)

Figure 7: Quick Ratio (Source: MS-Excel)

Significance of the ratio

Same to the current ratio there was a drop in the Quick ratio from 1.59 in 2020 to 1.08 in 2021. Again, it is not a good sign for the company if the company is unable to generate revenue in the future, then this will negatively affect the company.

Reason for the change

Just as there was a drop in the current ratio as the company increased its loans and obligations to carry out its current and its future development. So this led to falling in the Quick ratio of the company.

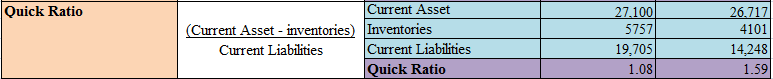

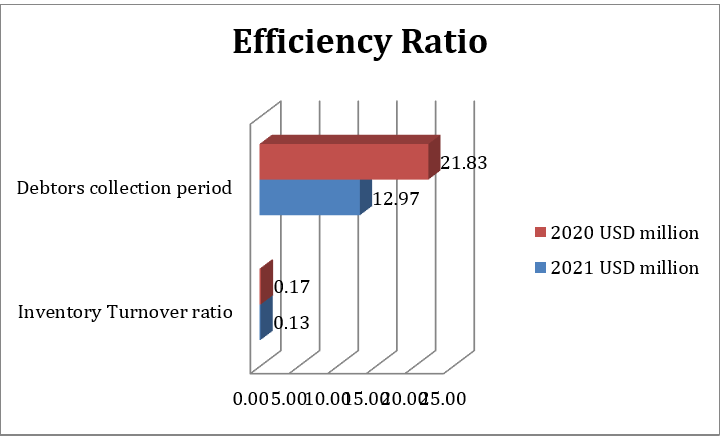

Efficiency ratio

Figure 8: Efficiency Ratio (Source: MS-Excel)

Figure 8: Efficiency Ratio (Source: MS-Excel)

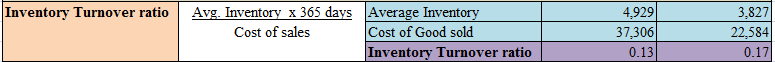

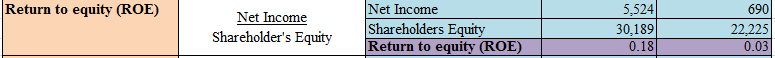

- Inventory Turnover

It is the number of times the company sells its goods and replaces them with new goods in a given period (Wafula, et al. 2019, p.5).

Figure 9: Inventory Turnover ratio (Source: MS-Excel)

Figure 9: Inventory Turnover ratio (Source: MS-Excel)

Significance of the ratio

The inventory turnover ratio for the company has reduced from 0.17 to 0.13 for the years 2021 and 2020 respectively (ir.tesla, 2022). So reducing the ratio is not a good sign for the company.

Reason for the change

As the company has started its new development like its Pi phone. So in the starting phase, the company would take time to sell its new development as the buyer would check its working.

- Debtors’ collection period

It is the time taken by the company to recover its revenue from those customers to whom the company has supplied goods on credit (Irman and Purwati 2020, p.3).

Figure 10: Debtors collection period (Source: MS-Excel)

Figure 10: Debtors collection period (Source: MS-Excel)

Significance of the ratio

The debtor’s collection time has reduced drastically from 21.83 to 12.97 from 2020 to 2021(ir.tesla, 2022).

Reason for the change

Due to the better management of power supply by installing a virtual machine board the company can develop products at a better rate and can supply goods on time which helps the company to collect money on time.

As the booking of Pi phones has been open so the order book has increased and so has their revenue due to which the debtor’s collection period has decreased.

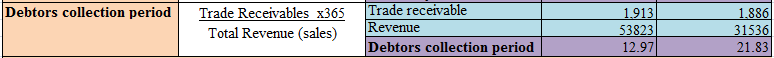

Investment ratio

Figure 11: Investment Ratio (Source: MS-Excel)

Figure 11: Investment Ratio (Source: MS-Excel)

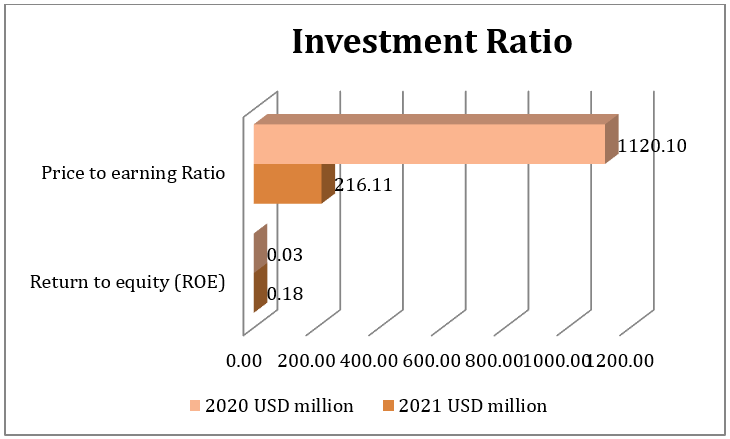

- Return on equity (ROE)

This tells the insight of the company as to how much the business makes a profit for its investors and owners (Amanda, 2019,P.1).

Figure 12: ROE (Source: MS-Excel)

Figure 12: ROE (Source: MS-Excel)

Significance of the ratio

The ROE of the company has risen from 2020 which is 0.03 to 0.18 in 2021. This will attract more investors in the future and will impact company’s reputation in a better way (ir.tesla, 2022).

Reason for the change

With the launch of a new product and also implement of a virtual board the revenue has increased and the cost of production and it is the reason rise in the ROE of the company.

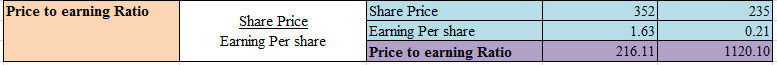

- Price-earnings

This tells the amount that an investor has to invest in a company to get a return of $ 1 from the company (Kumar, 2017,p.3).

Figure 13: P/E ratio (Source: MS-Excel)

Figure 13: P/E ratio (Source: MS-Excel)

Significance of the ratio

The P/E ratio of the company was 1120.10 in 2020 has come down drastically to 216.11. This reveals the company has shown a good EPS as it has increased drastically in comparison to its share price (ir.tesla, 2022).

Reason for the change

In 2020 as the company announced new development the investors started investing due to which the share price increased drastically compared to the EPS of the company. In 2021 the company started taking the order for the new development due to which the EPS rose and lowered its P/E ratio.

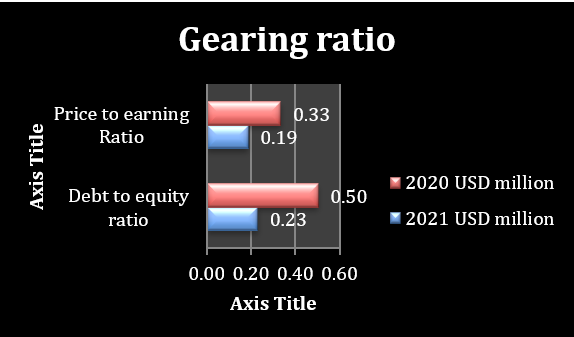

Gearing ratio

Figure 14: gearing Ratio (Source: MS-Excel)

Figure 14: gearing Ratio (Source: MS-Excel)

As stated by Rahardjo et al (2020, p.5) it is a group of financial ratios that helps to compare the shareholder’s equity with respect to the debt of the company to analyze the total amount of leverage and also its financial stability. As suggested by Cao, Y., (2021, p.3) gearing ratio can be also explained as how much money is being used by the company from the shareholder’s equity versus the debt that the company takes.

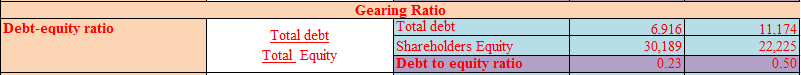

- Debt equity ratio

The mentioned ratio is helpful for measuring the total debt related with the amount of investment that is made by the owner.

Figure 15: Debt-equity ratio (Source: Excel)

Figure 15: Debt-equity ratio (Source: Excel)

Significance of the ratio

A debt-equity ratio of 2 is considered as a good value. In this matter the value of the ratio for both the years was 1. It means that the firm is generally less risky than firms whose debt-to-equity ratio is greater than 1.0. 4. If the company, for example, has a debt-to-equity ratio of. 50, it means that it uses 50 cents of debt financing for every $1 of equity financing.

Reason for the change

The reason behind the declining in debt equity ratio is that the company is using minimum amount of debt for financing. It means there are less number of debt in the balance sheet of the company.

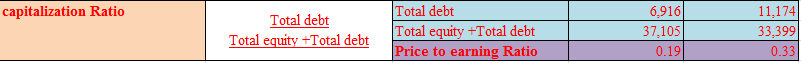

- Capitalization ratio

Capitalization ratio is a type of gearing ratio which is essential for measuring the financial leverage of a company (Bitar et al. 2018, p.3). In this matter, the total debt that has been considered for the calculations bears interest.

Figure 16: Capitalization Ratio (Source: Excel)

Figure 16: Capitalization Ratio (Source: Excel)

Significance of the ratio

A good capitalization ratio for a company is needed to be around 2-2.5. From the above calculation it has been observed that in both the years the debt to capital ratio is values under 1, and it simples that the equity of the shareholders of the company is enormous.

Reason for the change

Capital structure is considered as the key driver behind the changes in capitalization ratio. In this matter, capitalization ratio has decreased in the year 2021 and it managed to increase its revenue.

Conclusion

Based on the analysis of the impact of two recent developments it has been found that company performance has been increased through the virtual machine mode and the announcement of the cyber track. The company adopted no dividend policies which increased its earnings per share in the financial year 2021. Moreover, the company’s performance in terms of generating revenue and profitability is good. It can further be concluded through analysis of the financial performance of the company that its overall financial performance has increased in 2021 as compared to 2020.

Reference

Alexander, D., Britton, A., Jorissen, A., Hoogendoorn, M.N. and Van Mourik, C., 2009. International financial reporting and analysis.

Almabekova, O., Kuzmich, R. and Antosik, E., 2018. The income approach to business valuation: Russian perspective. Zagreb International Review of Economics & Business, 21(2), pp.115-128.

Amanda, R.I., 2019. The Impact of Cash Turnover, Receivable Turnover, Inventory Turnover, Current Ratio and Debt to Equity Ratio on Profitability. Journal of research in management, 2(2). P.1

Bitar, M., Pukthuanthong, K. and Walker, T., 2018. The effect of capital ratios on the risk, efficiency and profitability of banks: Evidence from OECD countries. Journal of international financial Markets, Institutions and Money, 53, pp.227-262.

Cao, Y., 2021, June. Internal Factors of Dividend Policy at the Firm Level: A Case Study of Lenovo Annual Report. In 2021 International Conference on Enterprise Management and Economic Development (ICEMED 2021) (pp. 363-368). Atlantis Press.

Choiriyah, C., Fatimah, F., Agustina, S. and Ulfa, U., 2020. The Effect Of Return On Assets, Return On Equity, Net Profit Margin, Earning Per Share, And Operating Profit Margin On Stock Prices Of Banking Companies In Indonesia Stock Exchange. International Journal of Finance Research, 1(2), pp.103-123.

Gherghina, Ș.C., 2021. Corporate finance. Journal of Risk and Financial Management, 14(2), p.44.

Irman, M. and Purwati, A.A., 2020. Analysis on the influence of current ratio, debt to equity ratio and total asset turnover toward return on assets on the otomotive and component company that has been registered in Indonesia Stock Exchange Within 2011-2017. International Journal of Economics Development Research (IJEDR), 1(1), pp.36-44.

Kamar, K., 2017. Analysis of the effect of return on equity (ROE) and debt to equity ratio (DER) on stock price on cement industry listed in Indonesia stock exchange (IDX) in the year of 2011-2015. IOSR Journal of Business and Management, 19(05), pp.66-76.

Magni, C.A., 2021. Relevance or irrelevance of retention for dividend policy irrelevance. International Review of Applied Financial Issues and Economics, 2(2), pp.232-247.

Mehmood, R., Hunjra, A.I. and Chani, M.I., 2019. The impact of corporate diversification and financial structure on firm performance: evidence from South Asian countries. Journal of Risk and Financial Management, 12(1), p.49.

Nugroho, A. and Nazar, R.M., 2020. The Effect Of Current Ratio, Debt To Equity Ratio, Return On Assets On Earning Per Share (Study In Company Group Of LQ45 Index Listed In Indonesia Stock Exchange 2011-2015). American Journal of Multidisciplinary Research & Development (AJMRD), 2(7), pp.76-83.

Priya, P.V. and Mohanasundari, M., 2019. Dividend policy and its impact on firm value: A review of theories and empirical evidence. Journal of Management Sciences and Technology, 3(3), pp.59-69.

Rahardjo, T.H., Bangun, N. and Amalia, T.H., 2020. Effect of Firm Size, Gearing Ratio, and Gender Diversity on Extent of Risk Disclosure. Effect of Firm Size, Gearing Ratio, and Gender Diversity on Extent of Risk Disclosure.

Supriono, S., 2022. Analysis of the Effect of Return on Equity, Debt-to-equity, Net Profit Margin on Price-to-earnings Ratio. Economic and Business Horizon, 1(1), pp.9-23.

Udobi, P.I. and Iyiegbuniwe, W.I., 2018. A Test of Miller and Modigliani Dividend Policy Irrelevance Theory in Nigerian Stock Market. American Finance & Banking Review, 2(2), pp.1-13.

Wafula, W.M., Tibbs, C.Y. and Ondiek, A.B., 2019. Average Collection Period and Financial Performance of Nzoia Water Services Company. International Journal of Multidisciplinary and Current Research. http://ijmcr. com/wp-content/uploads/2019/05/Paper5273-279. pdf.

Websites

ir.tesla, 2022, Annual report of Tesla Inc, available at:https://ir.tesla.com/#quarterly-disclosure [acessed on 20 October 2022]

tesla.com, 2021 about virtual machine mode available at: https://www.tesla.com/support/energy/tesla-software [acessed on 20 October 2022]

tesla.com, 2021 cybertruck avaibale at: https://www.tesla.com/cybertruck [acessed on 20 October 2022]

Appendix

Appendix 1: balance sheet

(Source: tesla.com, 2021)

(Source: tesla.com, 2021)

Appendix 2: income statement

(Source: tesla.com, 2021)

(Source: tesla.com, 2021)

Know more about UniqueSubmission’s other writing services: