BMG705 Individual Written report Assignment Sample

Introduction

International business expansion is the process of expanding the business operations from local markets to foreign markets (Suzuki and Okamuro, 2017). This process of internationalisation can be undertaken by various channels like mergers and acquisitions, Foreign Direct Investments and many more.

Thus, the current report is based on the internationalisation of small and medium enterprises. It focuses on an SME that carry out moderate operations and require exposure to achieve better customer segments.

The case study of Milton Sandford Wines has been considered for the FDI initiative in France. France has been selected as a country for the FDI as the cultural and economic aspects of the business will support the business of antique wines. The report also sheds light on the FDI attractiveness of France as to be accounted for by the management of the organisation. The pros and cons of the FDI have been emphasised to make the right choice from the alternatives of the firm’s international expansion.

Organisational Overview

Milton Sandford Wines is an organisation that deals in manufacturing boutique wines. The customer groups for this organisation are not individual only but hotels, restaurants, and gastropubs also. The firm has been working in Consumer Staple Products and was incorporated in the year 2006 (Milton Sandford Wines, 2020). The wines from chalks in Berkshire are transferred to the customers like Sticks n Sushi, The George at Backwell, Vintage Inns, The White Spoons and many more.

Figure 1: Logo of Milton Sandford Wines

(Source: Milton Sandford Wines, 2020)

The firm conducts food and wine trips for educational purposes, and it is a career development opportunity for the firm’s employees. The firm has initiated a novel concept of underground dining, which has received a positive response from the public. The cave dinners with the fine wine served to bring a seamless experience for the customers. The firm has been planning to implement the seamless experience in other counties like France through FDI mode.

Foreign Direct Investment

Foreign Direct Investment is the investment in foreign lands by grasping the ownership rights in a particular firm. FDI is a crucial aspect of international economic integration because it creates long-term business bonds among countries (Jones and Wren, 2016).

The controlling ownership makes this form of acquisition more prevalent for various small and medium-sized firms. Milton Sandford Wines (MSW) is also an SME that has been planning FDI in certain countries to expand operations and raise the growth perspective. FDI is not merely the transfer of money but also the exchange of technology, management and human resources among the organisations. Therefore, FDI is considered a vehicle of economic development.

Need for FDI

FDI is quite important for the developing economies and emerging firms who need funding as well as expertise in the new lands. The investor portfolio for any firm is diversified in the case of FDI used as a channel. It is a source that is long term in nature and a stable source in a foreign land.

The entry of technical know-how and the developed machine would allow the betterment inefficiency of the processes indulged in the firm. This would bring speed, accuracy and less effort taking work in the future (FDI India, 2020). Thus, FDI is considered essential by a recently opened fine wine dealer like MSW. The standard of living in the country rises when FDI brings in better employment opportunities and high income for the locals.

FDI consideration for any geographical location depends on various factors such as open or closed economy, skilled or unskilled workforce or the level of growth opportunities offered in the market. The current pandemic in the year 2020 has crashed the FDI status for all the countries.

A sudden breakdown of all the activities and mobility restrictions has posed a complete stop for the firms to enter into the new markets. Yet, the conditions have been increasingly changing, and continuous operations for FDI have been noticed in the upcoming years. There are various advantages and disadvantages of FDI to be used as a channel of investment:

Advantages of FDI:

FDI is responsible for creating a more dynamic and conducive environment for the locals as well as the investors. Hence it helps in the process of Economic Development Stimulation. International trade in SMEs is not very common due to the import tariffs and duties.

SME may overcome this fear by acquiring a direct interest that is employing FDI in the desired country. In some relevant countries, MSW falling under the small and medium-sized enterprise category may show its international presence with the FDI (Alfaro, 2017). FDI mode also generates employment opportunities for the locals. This raises the level of personal income. The firms can also take benefits for the tax benefits in the countries.

Disadvantages of FDI:

FDI comes with numerous benefits and brings in some threats for the local players. Political instability in the country may affect the investors. FDI is not a low-cost aspect that all SMEs may undertake. Sometimes, importing is relatively cheaper than foreign direct investment. This is probable that the foreign direct investments may turn out to be risky or economically non-viable.

Country for FDI

Various countries support the FDI in terms of resources and cost. The evaluation of the FDI attractiveness in different countries has revealed numerous countries such as Singapore, Netherlands, France, Indian and Hong Kong. The country selected for international expansion by MSW is France. The macroeconomic conditions of France can be well understood by a strategic framework defining strengths, weaknesses, opportunities, and threats, which is referred to as SWOT analysis (Sarsby, 2016).

| Strengths

The economic condition of France is supported by tourism, agriculture and telecommunication. The export of cheese and wine items are famous here (Cró and Martins, 2020). This country welcomes business innovation. It is also a supportive country for start-ups as tax management is simple in the countries. |

Weaknesses

The most crucial barrier in France is the language barrier. Another issue concerned is the high cost of living in France. The “Customer is always right” policy, like the western culture, does not prevail in the France territory (Simonova-Khitrova, 2015). |

| Opportunities

The growth sectors for France are Education, Tourism. Therefore, a room for tourism would allow MSW to carry out its operations with a more extensive customer base from different locations around the globe.

|

Threats

Terrorism is the act of spreading fear through violent activities. France is also a victim of several acts of terrorism. There is an issue of high volume vehicle break-ins which is a threat to the safety and security of the management. The valuables are not safe, which poses questionability to maintain the antique wines stock at such place. |

France is ranked as one of the top ten emerging economic powers globally, becoming the central attraction point. The asset holding of the country is relatively high, which makes it popular among foreign investors. The primary sector as well the emerging tertiary industry, makes it a strong economy.

There is the availability of good infrastructural facilities along with high-quality public services. The investment-friendly environment in business has been a critical point for investors. There is a range of players in the market large multinationals to high-tech start-ups.

The weaknesses in FDI which act as main obstacles in the French economy have been given as:

- The corporate taxes in the world have been high in France.

- The labour cost of the French economy has been increased.

- High taxes and work regime with inequalities.

- The low level of Small and medium enterprises who have been operating for exports.

- The French economy is stuck under increased public spending, which causes public debts.

France Economy

There are government policies that revitalise the economy, and there are administrative formalities that reduce the burden the foreign companies who have been planning to invest in the country. The labour market is flexible as the new labour legislation has been employed to reinforce vocational training in the French economy. The market-oriented economy in France is diversified in its actions. The dominant sector in French Economy has been the service sector.

The country will be the largest recipient of the Foreign Direct Investment in Europe in the year 2020. The innovation index in the country has been high in France. The government has been highly involved in the spending in the Research and development sector, which would further promote innovation and bring betterment in the skills and competence of the employees. France is one of the most visited destinations in the world, which makes the chances of MSW stronger to operate in the French conditions and adapt to the culture.

Paris, which is the capital of France, is a global city that is a hub of business (Economics, 2016). It is also ranked as one of the most attractive cities in the world. The reformation in the labour laws would allow the investors to save their costs and will enable them to earn higher profits.

The high-income economy has a GDP of $ 3.1 trillion, making it rank 7th in the world in terms of GDP. The country has GDP per capita has amounted to $ 44,995 in France. The Human Development Index has been very high for the country, which describes the significance of the human resources in the country. The main import partners have been Germany, Belgium, Netherland and many more countries. Thus, the partners are well coordinated with the government.

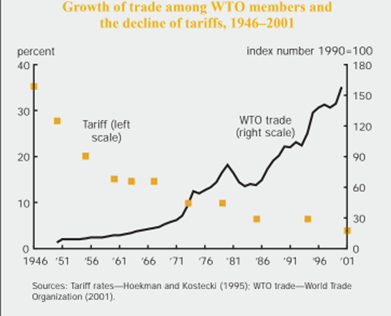

FDI Attractiveness in France

There are specific facts and figures which reveal the condition of FDI in France after the traumatic pandemic in the region. The FDI percentage has seen a drastic fall of 47 per cent from the year 2019 to 2020. The valuation of FDI recorded in the year 2019 was USD 34 billion, which fell to nearly USD 21 billion (World Investment Report, 2021). The stock of FDI lying within the countries is about $968 billion.

As per the reports, France ranks 8th largest recipient of FDI in the world. France is already a recipient of FD I from the UK in many other sectors like health care and renewable energy. More than 50 per cent of the FDI Stocks lying within the France Economy are from the Netherlands, the United Kingdom and Switzerland (Seid, 2018). France authorities have been planning to attract the firms which have been based in London and convert France into a hub for the multinational development of the firms.

The Ease of Doing Business Index is released to identify the condition favouring business in any geographical region. France has secured an adorable position in the index that is 32nd out of 190 countries for the year 2020 (Nasir et. al. 2020). The attractiveness of FDI in France exists due to various factors enlisted below:

- Skilled and qualified workforce

- The vast and advanced industrial base

- Abundant agricultural resources available

- Cultural firmness and reputation all over the globe

- Central location in the European continent

The data for relevant investment in the furnace has been given in the following figure:

Figure 2: FDI in France

(Source: UNCTAD, 2020)

Conclusion

France is a country with various strengths and weaknesses for being selected as a destination for FDI. The place is renowned for its fine cuisine and extraordinary landmarks, which can be combined with the experience of the fine wine supplied by MSW. The FDI by MSW would allow the firm to benefit from factors like cultural fondness, easy availability of labour, and fine cuisine habits. More economic factors contribute to the economic situation of France and make it a place favourable for FDI.

The strong economic situation of France will make the FDI decision of the management in MSW effective. There are high chances that the social trends in France will support the fine wine with cuisine and give a positive response to the activities like underground dining prevalent in MSW. The report effectively emphasises the pros and cons of investing in France with a basic understanding of the current FDI situations and the French Economy.

References

Alfaro, L., (2017). Gains from foreign direct investment: Macro and micro approaches. The World Bank Economic Review, 30(Supplement_1), pp.S2-S15.

Cró, S. and Martins, A.M., (2020). Foreign Direct Investment in the tourism sector: The case of France. Tourism Management Perspectives, 33, p.100614.

Economics, C., (2016). Towards a Foreign Direct Investment (FDI) attractiveness scoreboard. Directorate General for Internal Market, Industry, Entrepreneurship and SMEs Unit, 1.

FDI India, (2020). WHY IS FDI SO IMPORTANT? [Online]. Accessed Through < https://www.fdi.finance/blog/why-is-fdi-so-important> Accessed on 1st December, 2021.

Jones, J. and Wren, C., (2016). Foreign direct investment and the regional economy. Routledge.

Milton Stanford Wines, (2020). [Online]. Accessed Through: <https://www.winecellarclub.co.uk/events/underground-2020>. Accessed on 1st December, 2021.

Nasir, M.A., Shahbaz, M., Mateev, M., Abosedra, S. and Jiao, Z., (2020). Determinants of FDI in France: role of transport infrastructure, education, financial development and energy consumption. International Journal of Finance and Economics.

Sarsby, A., (2016). SWOT analysis. Lulu. com.

Seid, S., (2018). Global regulation of foreign direct investment. Routledge.

Simonova-Khitrova, M.Y., (2015). SWOT-analysis of wine producing companies’ marketing in France. Annals of marketing-mba, 4.

Suzuki, S. and Okamuro, H., (2017). Determinants of academic startups’ orientation toward international business expansion. Administrative Sciences, 7(1), p.1.

World Investment Report, (2021). UNCTAD. FRANCE: FOREIGN INVESTMENT. [Online]. Accessed Through: <https://santandertrade.com/en/portal/establish-overseas/france/foreign-investment>. Accessed on: 1st December, 2021.

Know more about UniqueSubmission’s other writing services: