BMG880 Data Analytics Assignment Sample

BMG880 Data Analytics Assignment Sample

1.0 Introduction to the Problematic Situation/Opportunity

Shell Plc an international energy giant, faced a difficult “financial situation” due to different factors affecting the energy enterprise in the year 2021. Despite being one of the biggest and most significant players in the gas and oil sector, the company faced substantial headwinds that create a hazard to its long-term viability and financial stability.

This report analyses the problematic situation Shell Plc experienced in the year 2021, scouring into the key elements that impacted its financial performance. Also, it recognizes an opportunity for the company to change itself amidst the developing global energy geography.

Problematic Situation:

- Decline in Oil Demand: The COVID-19 pandemic directed general lockdowns and limitations, causing an influential decline in transnational oil demand. With global travel arriving to a comparative standstill and industrial movement slowing down, Shell faced decreased demand for its substance products, resulting in descending revenues and profits.

- Volatile Oil Prices: The pandemic also initiated oil price fluctuations, creating it difficult for Shell to signify market conditions accurately. This unsteady added further sophistication to the company’s financial planning and put anxiety on its margins.

- Increasing Competition: Shell encountered inflexible competition from both definitive gas and oil companies and appearing renewable energy participants. The growing understanding of climate change and the transition towards cleaner energy authorities provoked customers and investors to investigate alternative energy choices, which impacted Shell’s revenue brooks and market share.

- Environmental Concerns and ESG Factors: The Company’s sober reliance on fossil fuels removed surveys from institutional investors and environmental activists concentrated on Environmental, Social, and Governance aspects. This showed reputational threats and raised pressure on Shell to establish a transparent adherence to sustainability and decrease its carbon footprint.

Opportunity for Transformation:

- Energy Transition: Shell could capitalize on the international transition towards renewable energy sources by financing clean technologies like solar, hydrogen, and wind. By accommodating its energy portfolio, the company could demonstrate itself as a manager in energy growth, demanding environmentally aware customers and investors.

- Embracing Digitalization: Combining advanced data analytics and digital technologies into its processes could improve efficiency, optimize exploration actions, and facilitate supply chain management. By adopting digitalization, Shell could decrease operating costs and achieve a competitive advantage in the energy market.

- Corporate Social Responsibility (CSR): Establishing a strong adherence to CSR initiatives, like community development, environmental conservation, and education, could help reconstruct Shell’s reputation and enhance its reputation among stakeholders.

- Mergers and Acquisitions: Strategic acquisitions in the “renewable energy sector” could promote Shell to develop its green energy delivery rapidly and cultivate the expertise required to steer the growing market dynamics effectively.

2.0 Theoretical Frameworks to Link Problem/Opportunity

To interpret the problem and opportunity encountered by Shell Plc in the year 2021, here will utilize the McKinsey 7S Framework. Created by “Tom Peters and Robert Waterman”, this theoretical model analyses 7 key interrelated factors within an institution to comprehend how they interact and affect each other. By using this framework, here can determine the areas where Shell encountered challenges and find the possibility for transformation.

Strategy: The drop in oil demand and rising competition necessitates strategic growth for Shell. The possibility lies in redefining its approach to adopt the energy change (Al-Khowarizmi, et al., 2020). This affects diversifying its portfolio to contain renewable energy sources and financing clean technologies, arranging Shell as a manager in the “emerging green energy” market.

Structure: Shell’s standard hierarchical structure may restrict skillfulness in responding to market changes. A possibility exists in embracing a more adaptable organizational structure that encourages innovation and collaboration, allowing the company to pivot fast towards endurable energy ventures.

Systems: Shell must update its operational systems to accommodate the changes in its strategy. This affects comprising advanced data analytics and digital technologies to optimize investigation efforts, and supply chain management, and observe the effect of renewable energy investments.

Skills: As Shell experiences the renewable energy sector, developing the necessary expertise becomes necessary. The company can finance upskilling its workforce or desire partnerships and assets to achieve the needed skills for successful modification.

Shared Values: To manage environmental problems and enhance its reputation, Shell must develop its shared values, highlighting sustainability and reliable corporate practices. Merging its importance with societal expectations will create trust and support its brand image.

Style: The leadership type at Shell needs to grow to foster a culture of innovation, sustainability, and adaptability (Amer, et al., 2023). Leaders must drive the energy transition schedule and inspire employees to adopt the transformative voyage.

Staff: Shell must evaluate its workforce’s enthusiasm for the changing energy geography. Determining gaps in talent and providing respectable people in the right positions will be required for successful change.

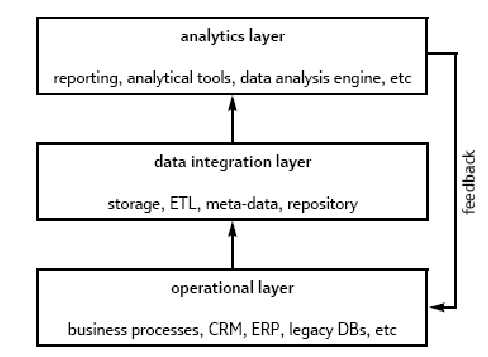

2.1 Business Intelligence System Layer

(Source: www.researchgate.net)

(Source: www.researchgate.net)

The 1st layer of Shell Plc’s “Business Intelligence System” is the Analytical Layer. This layer concentrates on decision-making and data analysis abilities. It contains reporting tools, a data analysis engine, and analytical tools. Reporting tools permit users to develop and consider standardized information, delivering insights into different parts of the business, like operational efficiency, financial performance, and production metrics (Boruki, et al., 2020).

Analytical tools encourage predictive analytics, advanced data exploration, and data mining to discover patterns and movements in extensive datasets. The data analysis tool confirms the efficient processing of difficult queries and analyses, enabling real-time and desired data analysis for “informed decision-making” by the management.

The Data Integration Layer is the 2nd layer of Shell Plc’s “Business Intelligence System”. This layer is liable for managing metadata management, data integration, ETL processes, data storage, and holding centralized data storage. It incorporates data from different internal and external sources, like financial records, market data, production systems, and supply chain databases.

The ETL operations extract, convert, and load the data into the devolve repository, confirming data quality and consistency. “Metadata management” confirms data definitions and connections are well-defined and available, enhancing data governance and obliging the result of meaningful analytical standards.

The 3rd layer of the “Business Intelligence System” is the Operational Layer. It concentrates on the operational elements of Shell Plc’s business strategies. This layer contains BPM tools to model, streamline operations across various departments, automate, and optimize business workflows (Bramantyo, et al., 2022). CRM tools allow effective consumer engagement, permitting to drive sales, marketing, and consumer support actions.

Enterprise Resource Planning techniques consolidate and incorporate substance business processes like inventory, procurement, and finance management. Also, the Operational Layer has legacy databases that keep historical data and sustain operational applications that might not be completely incorporated into the newer BI system.

Together, these 3 layers of the “Business Intelligence System” at Shell Plc deliver a wide and integrated method for operational efficiency, decision-making, and data analysis. The Analytical Layer designates stakeholders with useful understandings, while the Data Integration Layer confirms data quality and availability. Eventually, the Operational Layer optimizes business operations and consumer interactions, improving Shell’s competitiveness and capability to adjust to the dynamic energy industry geography.

2.1.1 Credit Management

Shell Plc’s credit management involves the company’s rules and guidelines connected to extending credit to consumers and operating its own credit responsibilities. As an international energy company with various procedures, Shell employs stringent credit assessment methods to undervalue credit risk and confirm timely collections from consumers (Hosseini, et al., 2022).

Also, the company concentrates on enhancing its “working capital” and preserving strong connections with “financial institutions” to address its credit exposure virtually. A strong credit management method authorizes Shell to safeguard its financial strength and hold a profitable credit profile in the market.

2.1.2 Unbilled Management

Unbilled management at Shell Plc directs the method of driving revenue recognition and invoicing for assistance or products that have been produced but not previously billed to consumers. It affects tracking and organizing accounts receivable before the proper billing process happens. Shell executes effective unbilled management techniques and methods to provide accurate revenue credit, undervalue delays in billing, and enhance cash flow (IBEZIM, 2021). This authorizes the company to strengthen financial efficiency and clearness while delivering a clear view of its revenue brook from services or interests supplied but not yet invoiced.

2.1.3 Dispute Management

Dispute management at Shell Plc affects the frequent handling of consumer complaints, disputes, and debates related to its products, billing, or services. The company executes a structured approach to address and determine disputes promptly and reasonably, seeking to maintain healthy consumer relationships and secure its reputation.

Shell’s conflict management method includes detailed investigation, open communication with consumers, and discovering mutually satisfactory solutions. By efficiently handling disputes, Shell can minimize possible financial defeats, improve customer satisfaction, and display its commitment to delivering dependable and reliable benefits in the energy sector.

2.1.4 Covid-19 and Decrease in Oil Prices

The outbreak of COVID-19 in 2020 had a substantial effect on international oil demand, conducting to a strong decrease in oil prices of Shell Plc. The pandemic resulted in general travel restrictions, decreased economic activity, and lockdowns, generating a substantial reduction in the utilization of oil (Li, et al., 2021).

As an interpretation, Shell encountered challenging market requirements with descending oil prices, affecting its revenues and profitability. The company had to steer through this exceptional situation, changing its operations and executing cost-cutting efforts to mitigate the outcomes of decreased oil demand and expenses during the pandemic.

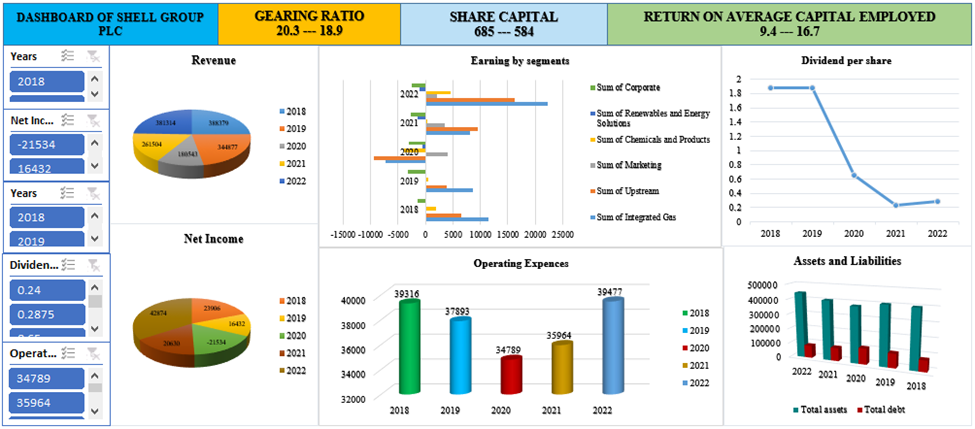

2.2 Evidence of global trade Business (Shell Group Plc)

(Source: MS Excel)

(Source: MS Excel)

2.2.1 The process of dashboard creation

The need for a consolidated and easily available platform for tracking and assessing key performance indicators (KPIs) connected to energy trade serves as a rationale for the design of a dashboard for international energy trade analysis. The dashboard offers a graphical representation of data obtained from several reliable websites.

It makes it possible for decision-makers, analysts, and researchers to keep track of trends, spot trends, and get new viewpoints on the world of energy trading. The dashboard enables well-informed choices, policy development, and planning for strategy in the energy industry by combining data on issues such as the production of energy, consumption, imports, exports, costs, and market trends.

2.2.2 Buildings and Planning of Model

After downloading the dataset of KPIs, different kinds of charts like line charts, Bar charts, and Pie charts are created using a pivot table (Mägar, 2019). The pivot table has been created based on different variables of each KPI. And through using advanced formulas of Excel the charts are created.

2.2.3 Dashboard Justification

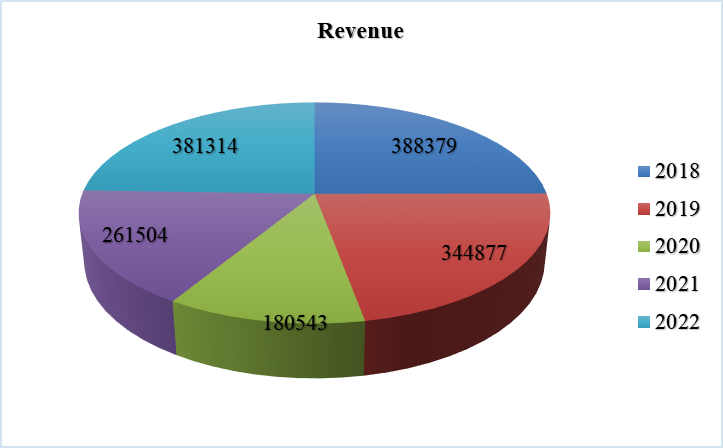

Chart 1: Revenue of the company (Source: MS Excel)

Chart 1: Revenue of the company (Source: MS Excel)

Chart 1 shows the KPI Revenue, which is necessary for the company because it directly shows financial success and health. It measures generated total income from sales, showing the company’s capability to attract customers and generate income. Observing revenue enable the companies to assess their performance on sales, trend identification, and make the decision wisely, also their strategy’s effectiveness, finally assuring sustainability and driving growth.

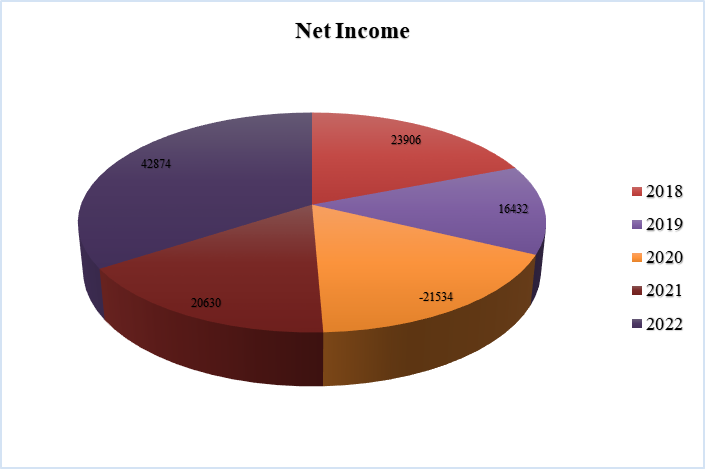

Chart 2: Net Income of the company (Source: MS Excel)

Chart 2: Net Income of the company (Source: MS Excel)

Chart 2 shows net income, it is an important key performance indicator (KPI) since it offers an accurate picture of profitability. After all costs, particularly taxes, and interest, have been deducted, it indicates the company’s capacity to produce revenue (Patel, 2022). Making educated company decisions necessitates using net income as a helpful metric for assessing operational efficiency and assessing financial stability. Stakeholders may employ it to evaluate a business’s overall success as well as its prospects for development and stability.

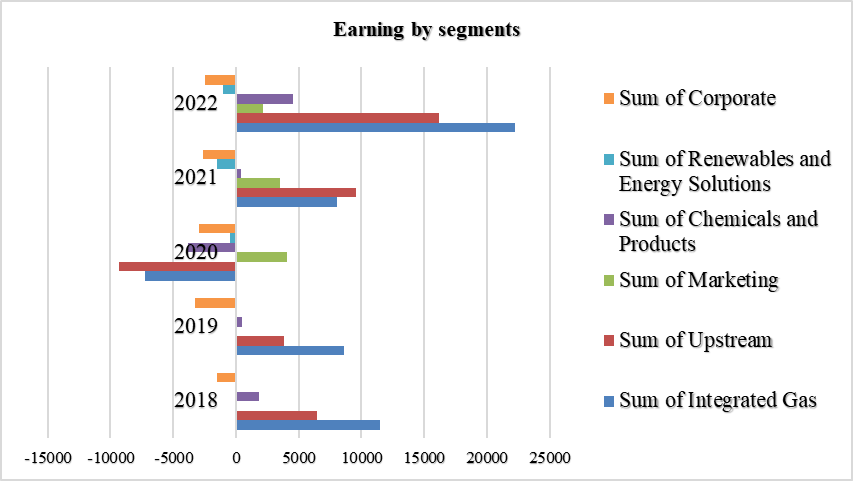

Chart 3: Earnings by segments of the company (Source: MS Excel)

Chart 3: Earnings by segments of the company (Source: MS Excel)

Earnings by segments (KPI) offer a useful statistic to companies operating in the global trade in energy. An in-depth understanding of income development across multiple energy sectors, particularly oil, gas, and renewables, is rendered possible by this research (Rane, et al., 2020). It gives companies the ability to determine profitable markets, evaluate the efficacy of each company unit, decide on investment wisely, and allocate funds wisely, resulting in increased financial results and improved efficiency.

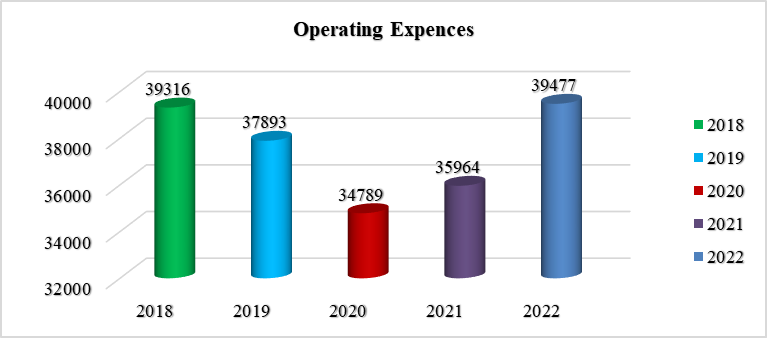

Chart 4: Earnings by segments of the company (Source: MS Excel)

Chart 4: Earnings by segments of the company (Source: MS Excel)

Operating expenses (KPI) are essential for a business as they paint an exact representation of its efficiency and financial health. Companies could identify saving money opportunities, enhance the allocation of resources, and boost profitability by tracking and assessing operational expenditures. In an increasingly intense global energy market, this KPI justifies its value by allowing sound choices, improving efficiency in operations, and assuring sustainable growth.

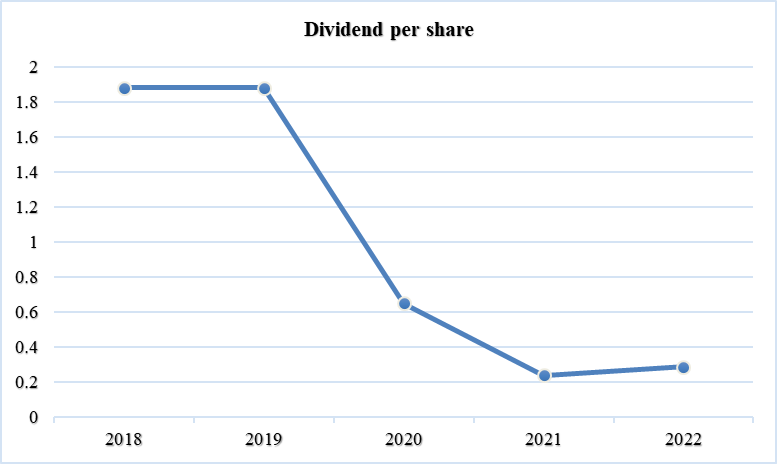

Chart 5: Earnings by segments of the company (Source: MS Excel)

Chart 5: Earnings by segments of the company (Source: MS Excel)

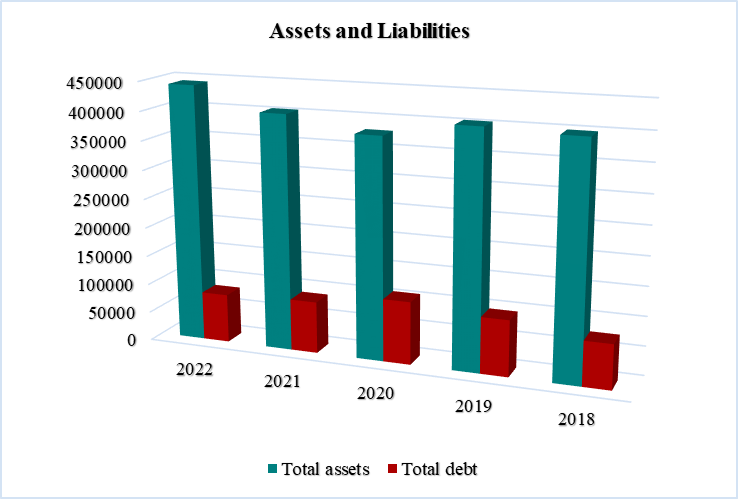

Chart 6: Earnings by segments of the company (Source: MS Excel)

Chart 6: Earnings by segments of the company (Source: MS Excel)

Total debt and total assets is a KPIs that are important for knowing a company’s financial health. Total debt provides the ability to measure a company’s leverage and solvency since it indicates the quantity it has borrowed. Total assets, on the other hand, indicate the company’s whole worth and the possibility of expansion (Sayah, et al., 2020). Evaluating exposure to risks, figuring out reliability, and making sound decisions about allocations of capital and investment approaches are all made easy by keeping a focus on these KPIs.

3.0 Dashboard Critical Analysis and Limitations

3.1 Enhanced Data Visualization and Insights:

A pleasing and designed dashboard can deliver real-time and mutual data visualization, permitting Shell’s management to achieve a rapid understanding of KPIs related to revenue, sustainability, renewable energy investments, and costs metrics. Visualizing data via charts, maps, and graphs creates it more straightforward to determine trends, potential areas, and patterns for improvement (Sølvsberg, et al., 2020). This authorizes decision-makers with actionable knowledge to supervise the company in the proper direction.

3.2 Improved Decision-Making:

The availability of convenient and appropriate data on a dashboard allows “data-driven decision-making” at all groups of the organization (Woolfson, et al., 2019). Managers can quickly evaluate the effect of market changes, environmental concerns, and oil prices on Shell’s financial performance. Operational managers can distribute efficiency, and observe project progress, and energy production. In favor, this enables a culture of “informed decision-making”, conducting risk management and resource allocation.

Transparency and Accountability:

A dashboard solution enables accountability and transparency within the community. Access to “performance metrics” and “real-time data” promotes a sense of privilege among employees, encouraging them to donate to Shell’s transformation actions (Sousa, 2020). Similarly, transparency helps shareholders, including customers and investors, measure the company’s commitment to bearable practices and follow its progress.

Scalability and Adaptability:

Shell Plc’s global presence and various operations in a dashboard solution can be adjusted to adapt to different energy segments, regions, and business units (Todorovic, et al., 2021). The scalability and flexibility of the dashboard encourage it to adjust to changing business requirements and developing industry dynamics, confirming its usability and long-term relevance.

4.0 Conclusion and Recommendation

The implementation of a “Business Intelligence Analytics” system in Shell Plc, concentrating on the challenges of reducing oil demand and rising competition while assuming the possibility for transformation, is important for the company’s endurable success and growth. The offered system’s 3-layer architecture, enclosing an “Analytical Layer” with analytical and reporting tools delivers an integrated and holistic solution to manage the determined problematic situation and grasp the transformation possibility.

The dashboard solution within the “Business Intelligence Analytics” system appears as a key element, delivering improved data visualization, “data-driven decision-making”, and real-time wisdom. By harnessing the strength of data, Shell’s management can steer through the challenges presented by market dynamics, intense competition, and environmental concerns.

To assure a successful performance of the “Business Intelligence Analytics” system, the following recommendations are offered:

- Stakeholder Collaboration: Employ stakeholders across all groups of the society, from top managers to operational groups, in the innovation and performance process. Collaboratively determine KPIs, user needs, and data requirements to secure the system aligns with business purposes.

- Data Quality and Governance: Prioritize data governance, accuracy, and quality throughout the system’s performance. Establish strong data security protocols, metadata documentation, and data management practices to assure the integrity and dependability of the insights developed.

- Change Management: Highlight employee training and change management to promote adoption and overvalue the advantages of the “Business Intelligence Analytics system”. Deliver wide training on utilizing the analytical tools and dashboard to cultivate a data-driven culture and designate employees to assemble informed decisions.

- Continuous Improvement: Treat the performance as an “iterative process” and continuously assess the system’s performance against the selected business purposes. Survey feedback from consumers to refine and improve the system’s abilities over the period.

By observing these recommendations, Shell Plc can place itself as a “data-driven” and “agile energy leader”, adopting the opportunities, navigating challenges, and creating well-informed decisions delivered by the growing energy geography. The “Business Intelligence Analytics” system will operate as a motivation for transformation, confirming Shell’s long-term sustainability and competitiveness in the engaged global energy sector.

Reference List

Journals

Boruki, M.I., Fransius, F., Octaviany, T.E. and Nengkoda, A., 2020. SWOT and Impact Analysis for Indonesia Upstream Oil and Gas Industry to Survive from COVID-19 Pandemic and New Normal Forecast. Journal IATMI.

Bramantyo, H.A., Utomo, B.S. and Khusna, E.M., 2022. Data Processing for IoT in Oil and Gas Refineries. Journal of Telecommunication Network (Jurnal Jaringan Telekomunikasi), 12(1), pp.48-54.

Hosseini, A.M., Sauter, T. and Kastner, W., 2022, April. A safety and security reference architecture for asset administration shell design. In 2022 IEEE 18th International Conference on Factory Communication Systems (WFCS) (pp. 1-8). IEEE.

IBEZIM, R.A., 2021. GLOBAL MEMORANDUM OF UNDERSTANDING INITIATIVES OF SHELL PETROLEUM DEVELOPMENT COMPANY AND CONFLICT MITIGATION IN THE NIGER DELTA AREA OF NIGERIA.

Li, H., Yu, H., Cao, N., Tian, H. and Cheng, S., 2021. Applications of artificial intelligence in oil and gas development. Archives of Computational Methods in Engineering, 28, pp.937-949.

Mägar, R. and Faustino, A., STRATEGIC PLAN FOR ROYAL DUTCH SHELL PLC.

Patel, S., 2022. Monitoring Operational Efficiency in Oil and Gas Industry through Dashboards, KPIs and Metrices (Doctoral dissertation, School of Petroleum Management).

Rane, S.B., Narvel, Y.A.M. and Bhandarkar, B.M., 2020. Developing strategies to improve agility in the project procurement management (PPM) process: Perspective of business intelligence (BI). Business Process Management Journal, 26(1), pp.257-286.

Sayah, K.D.B., Seghier, F.Z.B. and Elhouda, N., 2020. Analysis of the Financial Strategy of SHELL Petroleum Company. Journal of Studies in Economics and Management Volume, 3(06), p.278.

Sølvsberg, E., Øien, C.D., Dransfeld, S., Eleftheriadis, R.J. and Myklebust, O., 2020. Analysis-oriented structure for runtime data in Industry 4.0 asset administration shells. Procedia Manufacturing, 51, pp.1106-1110.

Sousa, S., 2020. Equity Research-Royal Dutch Shell, PLC (Doctoral dissertation, Universidade de Lisboa (Portugal)).

Todorovic, V., Dakic, P. and Aleksie, M., 2021. Company management using managerial dashboards and analytical software. Economic and Social Development: Book of Proceedings, pp.166-173.

Woolfson, C. and Beck, M., 2019. Corporate social responsibility in the international oil industry. In Corporate social responsibility failures in the oil industry (pp. 1-14). Routledge.

Know more about UniqueSubmission’s other writing services: