BSS054-6 Risk and Procurement Management Assignment Sample

Executive Summary

The main aim of the report is to understand the risk and quality standard mitigation strategies for an effective risk management plan. The BAA T5 project is analysed in this report to identify the risk and the impact of each risk on the management. The mitigation strategy and KPI for bespoke risk management plan efficiency are shown in this report. This report will help to identify the importance of risk management plans and techniques for identifying risk for effective project execution on time.

Introduction

BAA’s terminal programme at Heathrow airport is one of Europe’s largest projects in terms of construction. When the project will be completed it will approximately cater to almost 30 million passengers in a year with additional aircraft parking capacity. The project has a huge investment and the risk to complete the project is very high (Eriksson et. al. 2019). Therefore, in this report, the risk and procurement strategy will be planned with the new project of BAA Heathrow terminal 5. To achieve an audacious target in terms of finances and programme the BAA Terminal 5 has to consider a new contracting and procurement strategy (Hong, Z., Lee, C.K. and Zhang, L., (2018). Therefore, the risk involvement and mitigation of the risk will be determined for overall mitigation of the project risk for successful procurement and completion of the construction respectively. The various mitigation strategy for dealing with the procurement and contracting risk will be shown in this report.

Develop a Bespoke risk management Plan for the case study

The risk management plan is projected as a document that will help to identify the risk and mitigate the risk with an estimated management strategy. BAA Heathrow case study has shown that the risk is mostly associated with the finance, price, performance management risk, insurance risk, resources risk, and inherent financial risk (Nojavan et. al. 2019). The risk for non-performance and finance is high with a dynamic impact on the management of the project. Therefore, the Bespoke risk management plan will be initiated to develop the project.

Bespoke Risk management strategy

| Risk | Performance | Management | Finance | Resources |

| Management plan | Increasing the potentiality in performing as a team. | HR management | Internal accounts management in terms of pricing, cost-effectiveness. | Better management procuring the resources. |

| Effectiveness | Highly effective | Moderately effective | Highly effective | Highly effective |

| Indicators | Develop a better performance plan | Sustainable and optimal resource utilisation alongside technology for better HR management and performance management. | Evaluating the trend of the price risk and analysing the financial sector. | Proper allocation of the resources and optimal utilisation of the resources. |

The above Bespoke risk management plan is showing the risk and its effectiveness with the help of the KPI alongside the indicators for analysing the mitigation of the risk with the risk management strategy.

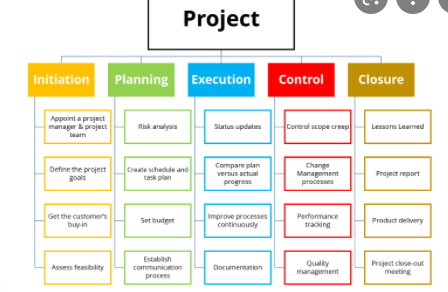

Work break down structure

Figure 1 WBS

(Source: Self made)

KPI to rate the effectiveness

The KPI will help to show the effectiveness of the developed strategy for the identified risk. The seven steps will show the risk management eligibility. They are:

Identifying the risk:

The case study has shown that the identified risk of the BAA Terminal 5 project is financial, price, non-performance, insurance, resource, and internal inherent risk.

Actual Risk:

The non-performance risk and the financial risk are the actual risk with more impact on the dealings with suppliers and indicating problems among monitoring the performances (Eriksson, 2017). The transparency, controls, and procedure for the performance of the supply chain is a huge risk associated with the cost of finance where the overhead cost is considered by the BAA when things go wrong.

Unidentified risk:

Climate change, natural disasters are risks associated with the project (Peng et. al. 2020). The construction is related to the airport so the license to issue the project risk, actual parking capacity plan has the risk which can diminish the project effectiveness.

Risk frequency:

The frequency of risk has a plan for practicing the risk management plan for preventing the risk occurrence (Volker et. al. 2018). The multi-risk management plan for minimising the financial risk with financial record software will help construct a terminal which is a preventing idea for the project construction.

Risk severity:

The actual and the unidentified risk is very severe due to the lack of the potentiality associated with the surrounding (Deng et. al. 2020). The lack of supply management team, finance department, HR resources are increasing the risk.

The cost incurred due to the risk:

The total investment is Euro 4.2 billion and it at least requires 35% of the cost to mitigate the risk with effective strategies and equipment.

Effectiveness and speed of the solution:

From the risk management plan the risk can be mitigated in terms of insurance, price, resources.

Identify the risk with probability impact model and risk register

Risk Register

| Risk | Probability | Impact | Risk rating | Action or risk description | Responsibility | Status review |

| Risk related to non-performance areas | 5 | 6 | 30 | Lack of potentialities among the supply chain and the surrounding risk associated with the lack of potentiality during the performance management. | HR assistant and HR head for managing and allocating the roles with performance management control solution. | Done |

| The risk from the financial area | 3 | 5 | 15 | The poor use of the optimal resources to identify the appropriate financial solution is a huge risk (Al-Balushi and Durugbo, 2020). As the project re-testing for delays, extra protection, and financial support to the contractor’s risk, employees have increased the financial burden. | Financial team | Done |

| Resource risk | 2 | 6 | 12 | The supplier’s interference and multiple impacts of the lack of monitoring of the performances have increased the procurement risk of the resources. | Supply management team | Done |

| Inherent risk | 2 | 5 | 10 | The accounting problems and the records, change in contracts, incentives paid off to the supplier (Habibi, Kermanshachi et. al. 2019). This document’s financial records are a challenge with dynamic changes in the contracts of commercial policy. | Accounting team | Done |

| Insurance risk | 3 | 2 | 6 | The insurance cost with site vulnerabilities and causes through various uncertain risks. | Finance and insurance department | Done |

| Risk in price | 2 | 2 | 4 | The changing price risk with change in market increasing volatility and shortage of finance. | The finance team and insurance department | Done |

| Risk in the management | 1 | 2 | 2 | The forecasting of the change in the climate, the unforeseen disaster, emergency in the planned communication, lack of quality standard, lack of transparency increases the management team coordination risk. | Team management | Done |

Developing a mitigation plan in the risk register

Risk mitigation strategy

| Risk factor | Non-performance risk | Financial risk | Inherent risk | Insurance risk | Price risk | Management risk | Resources risk |

| Risk mitigation strategies | The proper acquisition of the talents and monitoring the performance (Mello et. al. 2017). While aiming to use the human resource strategy for higher performance results. | The financial resources optimal usage with proper technology for recording the data during changing commercial contracts for effective financial risk assessment. | The past records are the key to retaining the information for current inherent financial records identification (Challender, 2019). The well-documented records for collecting past and present records will help to mitigate the risk. | The vulnerabilities of the site identification and the potential damage determination for better insurance risk mitigation (Sönnichsen and Clement, 2020). The strategy is to allow a team that can analyse the vulnerabilities associated with the sites for mitigating the insurance risk. | The price allocation and the market volatility, dynamic market while allocating the price analysis will help mitigate the risk. | The task and team involvement require effective coordination (Jensen, 2017). So, the task is to set up management teams for effective coordination and collaboration for the management of the resources. | The resources procurement and the record of the profit of the supplier, the resource cost record will help to identify the effectiveness of the resource obtained for effective mitigation of the risk. |

Risk contingency plan for high impact factors

Non-performance risk:

The impact of the risk is moderate and if not utilised properly will not hamper the project execution. The HR team must analyse the role and allot tasks for effective performance.

Financial risk:

The high risk is involved that can slow the process of the project. The change in financial planning with more technology to retain data for effective financial management.

Insurance risk:

The risk is moderate and it requires consideration of the vulnerability and uncertainties for minimising the risk.

Price risk:

It can have a huge impact as the market fluctuation can impact the flow of money. A significant strategy to identify the data required for pricing and analysing the dynamic situation will help mitigate the risk.

Monte Carlo Simulation

It is a process used to predict the project result during the process of managing the project which cannot be mostly determined due to interferences of the random variables. The risk of uncertainty and impact of risk can be identified easily in the forecasting model. It is used as multiple simulation processes where a wide range of problems related to finance, supply chain management, science can be managed (Loosemore and Reid, 2019). In the case of the BAA Terminal 5 project, these methods are best suited as it has a wide range of aspects that required to be managed in terms of operation, supply chain, finance. The impact and the probability of the overhead cost in the T5 project can be easily identified with this method.

The results can be used in making decisions about the fixed price and cost-plus contracts as it will consider the uncertain variables with assigning of the random value and run the model consistently assigning the variables with values (Babich and Kouvelis, 2018). Moreover, once the process is completed, the outcomes are averaged to provide an estimated result. The method with constant comparison allows for exploring the possible outcomes while assessing the impact of the risk. The fixed price and cost-plus are actual risks of finance and Monte-Carlo with the continuous process will identify the risk. Also, the impact of the risk to make decisions regarding the uncertain situation related to cost.

Conclusion

From the above discussion and strategy, it is clear that the BAA T5 project has various risks due to delays in handling the project. The largest project and parking capability construction have enhanced the risk with change in commerce policy, the incentive to supplier, team management non-competencies while performing. Thus, the above project identifying risk register, mitigation strategy, risk management bespoke plan will help to overcome the risk for effective project construction. The Monte-Carlo simulation will help make decisions regarding the fixed and cost-plus prices with identification of the impact of risk.

Recommendations

There can be a proper budget prepared to avoid financial risk. For that expert help can be taken. It will enable in effective allocation of resources.

There must be proper monitoring of resources done to ensure that they are effectively utilized. This will be useful in reducing wastage of resources.

There should ne certain criteria identified of evaluating performance. So, on basis of that non performing areas are determined. Then, measures are taken to improve those areas.

A personal reflection on individual learning

I have contributed in assessing the risk among the project WBS and the skill of risk register, mitigation strategy, risk management plan with the development of Monte-Carlo simulation for making a decision with more specific quantitative analysis. The hard skills of managing the project with risk identification, and allocation of work, monitoring performances for project completion on time are some learning I acquired during the task. The group working skills also enhanced which will be helpful as a project manager to lead teams, manage the problems with various HR strategies.

References

Al-Balushi, Z. and Durugbo, C.M., (2020). Management strategies for supply risk dependencies: empirical evidence from the gulf region. International Journal of Physical Distribution & Logistics Management.

Babich, V. and Kouvelis, P., (2018). Introduction to the special issue on research at the interface of finance, operations, and risk management (iFORM): Recent contributions and future directions.

Challender, J., (2019). Building Collaborative Trust in Construction Procurement Strategies. John Wiley & Sons.

Deng, T., Yan, W., Nojavan, S. and Jermsittiparsert, K., (2020). Risk evaluation and retail electricity pricing using downside risk constraints method. Energy, 192, p.116672.

Eriksson, P.E., (2017). Procurement strategies for enhancing exploration and exploitation in construction projects. Journal of Financial Management of Property and Construction.

Eriksson, P.E., Volker, L., Kadefors, A., Lingegård, S., Larsson, J. and Rosander, L., (2019). Collaborative procurement strategies for infrastructure projects: a multiple-case study. Proceedings of the Institution of Civil Engineers-Management, Procurement and Law, 172(5), pp.197-205.

Habibi, M., Kermanshachi, S. and Rouhanizadeh, B., (2019). Identifying and measuring engineering, procurement, and construction (EPC) key performance indicators and management strategies. Infrastructures, 4(2), p.14.

Hong, Z., Lee, C.K. and Zhang, L., (2018). Procurement risk management under uncertainty: a review. Industrial Management & Data Systems.

Jensen, P.A., (2017). Strategic sourcing and procurement of facilities management services. Journal of Global Operations and Strategic Sourcing.

Loosemore, M. and Reid, S., (2019). The social procurement practices of tier-one construction contractors in Australia. Construction management and economics, 37(4), pp.183-200.

Mello, T.M.D., Eckhardt, D. and Leiras, A., (2017). Sustainable procurement portfolio management: a case study in a mining company. Production, 27.

Nojavan, S., Nourollahi, R., Pashaei-Didani, H. and Zare, K., (2019). Uncertainty-based electricity procurement by retailer using robust optimization approach in the presence of demand response exchange. International Journal of Electrical Power & Energy Systems, 105, pp.237-248.

Peng, Q., Wang, C. and Xu, L., (2020). Emission abatement and procurement strategies in a low-carbon supply chain with option contracts under stochastic demand. Computers & Industrial Engineering, 144, p.106502.

Sönnichsen, S.D. and Clement, J., (2020). Review of green and sustainable public procurement: Towards circular public procurement. Journal of Cleaner Production, 245, p.118901.

Volker, L., Eriksson, P.E., Kadefors, A. and Larsson, J., (2018), January. A case based comparison of the efficiency and innovation potential of integrative and collaborative procurement strategies. In 34th Annual Association of Researchers in Construction Management Conference, ARCOM (pp. 515-24).

………………………………………………………………………………………………………………………..

Know more about UniqueSubmission’s other writing services:

Assignment Writing Help

Essay Writing Help

Dissertation Writing Help

Case Studies Writing Help

MYOB Perdisco Assignment Help

Presentation Assignment Help

Proofreading & Editing Help