BU7006 Strategic Financial management

1. Introduction (BU7006 Strategic Financial management)

Different types of financial ratios will be evaluated in this study to understand the performance of Next PLC and make effective strategies for the upcoming future. Profitability ratio will be analyzed to find its position in the market in this study. Efficiency ratio will be evaluated in this study to analyze the financial decision making power of the management team of Next PLC. PEST of Next PLC will be discussed in this study to understand the different environment that has been faced by this company to operate its retail business. An opportunity of upcoming near future for Next PLC has been evaluated to make strategic financial management planning. Challenges of Next PLC to operate a business during pandemic and Brexit will be evaluated in this study. SWOT of Next PLC will be discussed to make the most effective future plan to sustain the existence of business for a long period.

2.1 Ratio analysis

Profitability ratio of Next PLC for four years

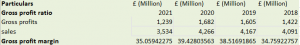

Gross profit ratio

Ratio of gross profit has been calculated in this study to analyze profitability of Next PLC for over four years. Gross profit ratio represents profitability of a company before deduction of indirect expenses[1]. Around 35% in 2021 and more than 39% gross profit has been earned in this company. Main focus of this company is to provide best service quality with reasonable prices that it has earned almost 38.5% in 2019 and around 34.75% in 2018 gross profit[2]. A large number of investors are highly motivated by this company for its high rate of return on investment.

Figure 1: Gross profit ratio (Source: Next Plc, 2021)

Figure 1: Gross profit ratio (Source: Next Plc, 2021)

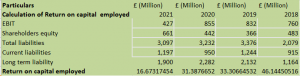

Return on capital employed

Company’s profitability is evaluated based on the invested capital through return on capital employed. Return on capital employed is almost 16.67 % in 2021 and 31.38% in 2020 in Next PLC[3]. Almost 33% in 2019 and approximately 46% in 2018 are the return on capital employed of Next PLC. It has been found from above ratio analysis of Next PLC that profitability has decreased due to a lack of efficient management and effective supply chain during a pandemic.

Figure 2: Calculation of Return on capital employed (Source: Next Plc, 2021)

Figure 2: Calculation of Return on capital employed (Source: Next Plc, 2021)

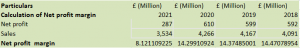

Net profit ratio

Net profit ratioof Next PLC has been calculated over four years to understand its actual profitability. The Ratio of net profit is almost 8% in 2021 and more than 14% in 2020 in Next PLC. Monster of the companies of the retail industry has suffered to maintain extra burden of Covid 19 protocols that profitability is low in 2021. Almost 14% in 2019 and more than 14.47% net margin has been earned by Next PLC. Next PLC has executed consistent profitability in this organization and a large number of investors invest in this company[4]. Consumer engagement rate is high and most of them are loyal to companies that have made net profit consistently.

Figure 3: Calculation of Net profit margin (Source: Next Plc, 2021)

Figure 3: Calculation of Net profit margin (Source: Next Plc, 2021)

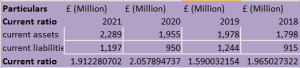

Liquidity ratio of Next PLC from 2018 to 2021

Current ratio

Current ratio of Next PLC is almost 2.05 in 2020 that has been reduced to 1.91 in 2021 in Next PLC due to unexpected losses in the pandemic. Current ratio helps to understand the ability of a company to pay its current liabilities by selling its current assets. Current ratio of Next PLC is almost 1.59 in 2019 and more than 1.96 in 2018[5]. Liquidity of this company is good as compared to the other companies in the retail industry in the UK[6]. Next PLC never faces complications for having good liquidity in this company. More than 700 retail stores of Next PLC are there in the UK to serve high-quality products to middle-class people.

Figure 4: Current ratio (Source: Next Plc, 2021)

Figure 4: Current ratio (Source: Next Plc, 2021)

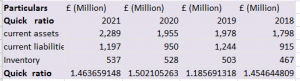

Quick ratio

Quick ratio is used to Measure Company’s ability to pay its current liabilities without selling inventories. Next PLC has maintained a quick ratio of 1.46 in 2021 and more than 1.5 in 2020 that is necessary to operate daily activities. The Quick ratio of Next PLC is around 1.18 in 2019 and more than 1.46 in 2018. Next PLC has managed its financial activities effectively and managed to maintain an excellent net profit ratio over four years.

Figure 5: Quick ratio (Source: Next Plc, 2021)

Figure 5: Quick ratio (Source: Next Plc, 2021)

Investor ratio of Next PLC for four years

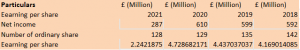

Earnings per share

Earnings per share are almost 2.24 in 2021 and more than 4.72 in 2020 in next plc. Per-share earnings are almost 4.43 in 2019 and approximately 4.16 in 2018 in Next PLC. Investors invest their funds by evaluating EPS of a company because it represents direct earnings from investment[7]. Next PLC has managed to provide a consistent EPS over four years but it has decreased to 2.24 in 2021 due to change in consumer behaviour in the retail industry.

Figure 6: Earnings per share (Source: Next Plc, 2021)

Figure 6: Earnings per share (Source: Next Plc, 2021)

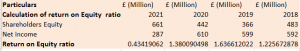

Return on equity

Return on equity is calculated to evaluate managing power of available equities to improve performance of a company. Management of Next PLC generated income growth by 1.22 in 2018 that has increased to almost 1.63 in 2019. More than 1.38 in 2020n and around 0.43 in 2021 return on equity is executed in Next PLC. Investors make their most profiFigure decisions through return on equity ratio and management always try to improve it to enhance performance by attracting more investors.

Figure 7: Calculation of return on Equity ratio (Source: Next Plc, 2021)

Figure 7: Calculation of return on Equity ratio (Source: Next Plc, 2021)

Efficiency ratio for four years of Next PLC

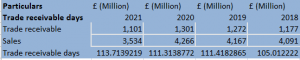

Trade receivable days

Trade receivable days are the amount of time that debtors if a company take to pay their dues to the organization. Low receivable day’s helps to manage good liquidity of a company that provides stability in regular business operations. Trade receivable days are more than 105 days in 2018 that will increase to 112 days in 2019. Next PLC allows its consumers to pay their dues by taking almost 111 days that represents financial solvency. Payable days of trade were almost 111 days in 2020 that has increased to 113 days in 2021. Next PLC has to make innovative ideas to influence its consumers to pay their dues as soon as possible. In this way, Next PLC will be able to utilize its resources efficiently and effectively for years.

Figure 8: Trade receivable days (Source: Next Plc, 2021)

Figure 8: Trade receivable days (Source: Next Plc, 2021)

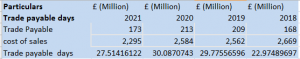

Trade payable days

Payable days of trade represent a particular amount of time that a company usually takes to pay its creditors. High trade payable days represent inefficiency of a company but improve liquidity of a company[8]. Trade payable days are almost 23 days in 2018 that has increased to 30 days in 2019 in Next PLC. Almost 30 days in 2020 and more than 27 days are taken by Next PLC to pay its creditors. Next PLC has paid its trade dues within a short period that represents efficiency of its top management financial resources.

Figure 9: Trade payable days (Source: Next Plc, 2021)

Figure 9: Trade payable days (Source: Next Plc, 2021)

2.2 Evaluation of performance of Next PLC based on financial ratio

Financial ratio helps to understand performance of a company statistically that different ratios for the last four years have been calculated for next plc to evaluate performance. Annual sales of Next PLC were almost 4091 million GBP in 2018 and it has maintained till 2020 but it has decreased to 3534 million GBP in 2021 due pandemic situation. Fall in annual sales has affected profitability of a company and per-unit fixed cost increases for a decrease of annual sales. Next PLC had the lowest net profit in 2021 that is almost 8% and it is clear that it has suffered a lot to manage its regular operations during the pandemic.

The price of products has increased which affects middle-class people in the market in 2021. Next PLC is efficient enough to pay its trade payables within a short period and allow a longer period for its debtors. The brand value of Next PLC is high and its targeted market is middle-class people that have executed a consistent EPS over four years[9]. Current ratio is high in Next PLC and it has never faced liquidity issues during short term decision making in operating activity. Return on equity is low in this organization by 2021 but investors are highly motivated to invest in this company because of its brand value and the previous year performance.

Next PLC attracts consumers who belong to the age group of 25 to 46 years old because these people are highly motivated to consume high-quality goods. A lot of investors are there in the market to finance Next PLC but liquidity is higher than standard so that there is an opportunity to utilize available resources to generate more profit.

3.1 PEST analysis of Next PLC

| Factors | Analysis | Impact |

| Political | NEXT Plc operates most of its business in the UK. Thus all income of the organisation is taxable as per UK tax policy. Corporate tax in the UK is 17% that is reduced from 19% in April 2020[10]. This action of the government is taken in order to attract different types of business in the country. The UK government is a sFigure government that is evaluated through a political sFigure index of the country[11]. That is noticed at 0.47 points. The USTR of the country has argued that there are no types of barriers and restrictions for investing in any business as well as transfer profit of business the UK government has declared minimum wages for workers is “£8.72 per hour” and 48 hours in week for working as per labour law of government. There are “Competition Act 1998” and “Enterprise Act 2002” to formulate for a secure business organisation from competitors unethical activities in the country. These are main political factors of a country that an organisation must consider for better performance as well as business expansion in the country. | Medium |

| Economical | An organisation may be considered as an economical factor for taking any business activities in the country. The current GDP growth rate of the country is 6.76%. This means businesses can easily grow their business in the country. There are normally countries that develop ‘62 months’ for business cycles and 28-month switch standard errors. The unemployment rate and employment rate of the country is 3.9% and 75.3%[12]. | High |

| Social | Social factors affect an organisation’s growth as well as the process of business. The UK’s population has improved at a rate of 0.47% and the social mobility of the country is 42%. These indicate that NEXT Plc may be improving its business through utilising this social mobility. The total income of the county is distributed on an average of £12,798 to the top 20% of the country. Further people believe in working hard and improving their lifestyle. “Per capita income” of the country is 29,147. Industries of the UK mainly use high technology for producing goods that give minimum impact on the environment. | Medium |

| Technology | Technology is one that is the best pillar for supporting business in any difficult problem. The UK government is formulating a policy for technology imported from developed countries and new technology acquired by the government in order to boost corporate activities in the country. The obsolescence rate of the country is low, which indicates that organisations must update their technology, plant and machinery. | High |

Table 1: PEST analysis (Source:Next Plc, 2021)

These are the main factors that affected an organisation’s process of generating income as well as improving its business expansion. Among them, political factors are the main factor as it assists any new business start-up as well as attract business. The UK government is focused on reducing the burden of business and in this process; the tax authority of the country is taking the decision to reduce corporate tax to 17% from 19%. Further, the government is declared a standard wage rate that is good for businesses as well as employees[13]. Because this is not a massive rate and assists a business to motivate employees to perform well in an organisation. The government is making some acts and regulations to secure businesses from competitors’ unethical operations that are common in different countries to reduce competitors’ performance. The second one is that the economical factor of a country is a supportive element for any business. The GDP is positive in currency pandemic situations as well as organisation is improving their performance after relief by the government in pandemic rules and regulation.

The Population is not improving at a massive rate, which is not good news for the organisation. Nevertheless, it is better for the government to focus on improving the corporate sector of the country. Social mobility rst6e of the country is good news for business organisations because 42% mobility rate indicate people of the county is focused to work more and improve lifestyle more. Further technology used in the country is already updated and advanced. People and employees are too Trans to use technology in an organisation’s business process. Further, the company is considering this factor to take improvement action of business. Finally, it is evaluated that all factors of the country are supporting[14]. NEXT Plc to improve their performance in their tax rate and social mobility is more supportive.

3.2 Critical evaluation on the development of NEXT Plc in the retail sector

NEXT Plc is a retail business and the improvement of retail business is dependent on the practices of competitors as well as employee satisfaction. NEXT Plc has established business since 1864. The company is the oldest business entity in the UK and global markets. The company is operating a business in more than 70 countries. Organisation is facing low revenue as well as sales in last year of £3.6 billion that is reduced by 16.9%[15]. The company is facing this problem due to the Covid pandemic and not using the latest technology in pandemic situations. The organisation faces supply issues while the organisation is performing business in pandemic situations. The supply chain of the country is affected by different types of problems that are raised in pandemic situations. The company is expected to have a 4% low sale in 2020 due to labour shortage as well as other business factors for not performing well in that period and coordination between different departments is proper. As a result the organisation only generated £800m. Further organisations do not hire too many employees for performing the organisation’s business operations. Therefore NEXT Plc must be considered as an effective development in organisation for better performance in the global market.

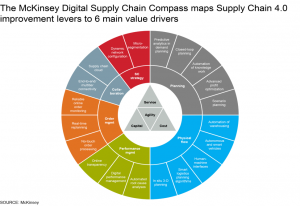

Digital supply chain (DSC): DSC is one of the best polishes to improve the efficiency of an organisation as well as provide better and good experimentation to customers. Thus a company must be considered to acquire the latest technology as well as provide advanced training on technology and advanced gadgets that the organisation uses in performing production processes and other business processes. NEXT Plc is facing 16.9% low sales in 2020 due to not upgrading the technology and tools that they use to perform different types of business operations in a pandemic situation.

Figure 10: DSC (Source: Next Plc, 2021)

Figure 10: DSC (Source: Next Plc, 2021)

Employee retention: employee ratio motivates employees to perform well organisation operation as well as survive customers with more care and attractiveness. Thus it is important for NEXT Plc to retain employees in the organisation by providing extra facilities and benefits for performing well for the organisation[16]. This step of the organisation is to assist organisations to improve their sales[17]. Employees are more motivated through the activities of the company. The company may be able to achieve its predetermined sales target.

Training and development: NEXT Plc must provide “training and development” programs to their employees to make them more efficient and effective for performing sales and other business operations. Employees, as well as the whole organisation, get several benefits. Employees are performing well through use of the latest technology that is implemented by organisations in the supply chain[18]. The company is facing their problem due to not properly improved DSC in an organisation that is too much used by retail business and sector in Covid pandemic.

These are the main areas where NEXT Plc needs to improve for better performance in the global retail sector as well as the UK retail sector. The company may get several benefits such as reduced supply cost of goods as well as costumes of the organisation feel better than the previous service process of the organisation.

4.1 SWOT analysis of Next PLC

| Strengths | Weakness |

| ● Profitability 8% (nextplc.co.UK ,2021)

● Operate a business in more than 70 countries |

● Low numbers of employees

● Performed business as per the traditional method |

| Opportunities | Threats |

| ● Adopt DSC (digital supply chain)

● Utilise social mobility of country ● Provide training and development to employee |

● New entries in retail sector

● Increasing Competition ● Continuously fallen in sales |

Table 2: SWOT analysis (Source: Next Plc, 2021)

NEXT Plc must utilise opportunities that are a result to attract their existing customers. Organisation is facing low sales due to this reason and continually fallen in their sale as well as supply chain of the organisation is not effective[19]. Thus the company must adopt DSC in their supply process for better performance in pandemic situations as well as compete with their competitors. The company must consider these opportunities for performing well by providing new experiences to costumes[20]. This activity of the organisation attracts old customers as well as other organisation customers. Besides, the company has some treats such as a new entity’s entry in the global market as well as a country’s market. Nowadays competition is increasing in any market either the retail sector or other sectors. It is biog threats for organisation as organisation sale performance is not better in 2020.

Strength

Next plc has excellent liquidity that it can make any operational decision without any complication. Effective decisions are enhanced by its loyal consumers because the buying behaviour of regular consumers reduces risk of a company[21]. It has its individual style of clothes that consumers easily recognise its brand that gives a competitive advantage in the retail market. Consumers are influenced by its high-quality products with affordable budgets and it attracts mid and high earning segment consumers to sell in its products.

Weaknesses

Main limitation of Next PLC is to manage finance because financial resources are not maintained strategically. Next PLC is not an efficient use of cash resources and prefers debt financing instead of equity financing. Traditional methods are used in this company in that productivity is comparatively lower than market competitors[22]. Efficient utilization of technological resources will reduce cost of production that will allow more consumers to access products of Next PLC.

Opportunities

A large amount of profit has been lost during Covid 19 pandemic and people have not visited the stores but it was expected that demand for retail goods will increase in the post-pandemic period. Next PLC can utilize this opportunity to generate more profit with effective decisions. Consumers are influenced by social media creators that promote brands through social media creators that will increase profitability.

Threats

Threats of Next PLC are to manage financial activities because competitors have made innovative ideas to reduce production costs[23]. Implementation of substitute goods in the market may affect consumer behaviour and it is necessary to observe consumers preferences and make products according to their demand. Newmarket entrants have used technologies to sustain their business activities during uncertainty and reduced human resources to increase efficiency that may affect products pricing of Next PLC.

4.2 Critical evaluations of opportunities of next plc for foreseeable future

Next PLC follows individual trend creation for its potential consumers that it is easily identified in a competitive market. Making products based on upcoming trends will ensure profitability and reduce risk[24]. Demand of consumers will increase in a post-pandemic situation and managing online and offline business efficiently is necessary to sustain its business activities[25]. Implementation of new technology for production will increase efficiency of Next PLC and will get a sustainable source of energy. Technological use in the retail industry will increase affordability so that Next PLC can expand its business in different countries.

Digital marketing is one of the most effective and efficient marketing in the current situation and Next PLC has an opportunity to participate in international marketing and earn a large amount of revenue through business expansion. Supply chain has been impacted most by a pandemic that competitors will face a lot of complications to develop a sustainable supply chain but Next PLC can easily develop a digital supply chain and incorporate transportation services to deliver products on time. Using big data analytics will improve understanding consumer behaviour that will help to make products according to the demand of customers and risk of production reduces.

Next PLC can make products in different price segments by effective utilization of substitute goods that are easily available in the market. A large number of people are willing to buy high-quality products at a low price. Using substitute raw materials to produce clothes will reduce prices and attract those consumers to purchase these products. In this way, Next PLC will be able to improve its performance and generate more profits than previous. Consumers have invested a large amount of money in purchasing goods and services through online platforms that investing in digital marketing plans can help m Next PLC to generate more profit in a competitive market.

4.3 Critical evaluation of challenges of next plc for foreseeable future

Preliminary expenses of implementing new technology in business are expensive and Next PLC has suffered to manage operating activities during pandemic situations. Earnings per share and profitability of the company have decreased and it is hard to predict the upcoming demand of consumers. Management team of Next PLC will face a lot of complications in making long term strategies during uncertainties. Brexit has seen during the pandemic that there is a shortage of financial resources and investing in new technology will be risky[26]. Consumers’ behaviour has changed to purchasing daily foods that increase the immunity of the human body. There is the least chance of expected demand in the retail sector.

Pay level of workers and price of raw materials has increased but affordability has decreased due to the Cover-19 pandemic situation where companies may not be able to achieve their predetermined goals. Consumers are highly influenced by online shopping and engagement of consumers in the retail market has decreased from last year due to fear of infection[27]. Next PLC has more than 700 retail stores but maintaining these stores will be a big challenge for this company.

Currency imbalance is a major issue in the current period and a lot of well-established companies have shut down due to currency crises in different countries. Financial management challenge is one of the major challenges of Next PLC[28]. Targeted consumer segment is middle-class people in Next PLC but it is difficult to maintain affordable prices during the recession[29]. Receivable days are high in Next PLC must be adjusted with trade payable days to ensure effective operating decisions for the company. Managing the ever-changing behaviour of consumers is not possible and implementation of sustainable sources is not affordable in the current situation of Next PLC.

5. Conclusion

Based on this study it can be concluded that Next PLC has executed a consistent profit over four years but a pandemic has affected the profitability of this company. Efficiency of managing financial resources is so low in Next PLC that this company is unable to utilize its financial resources for the development of performance. Next PLC has good financial-based and implementation technologies and efficient strategies that will expand market value of this company. A lot of challenges have arisen with Covid-19 and it is necessary to make changes in strategies to sustain a business for a long period.

From the above ratio analysis of Next PLC, it can be said that it helps to identify performance of a company to make strategic decisions. Accurate analysis of financial ratios helps to improve financial performance of a company. Next PLC will be able to make required changes in its financial budget in future decision making. Financial performance analysis is necessary to attract investors and maximize the profit of an organization. Supply chains of the retail industry have collapsed during pandemics that must be improved to stay in a competitive market for a long period.

References

Journals

Biancone, P., Secinaro, S., Brescia, V. and Calandra, D., 2019. Management of open innovation in healthcare for cost accounting using EHR. Journal of Open Innovation: Technology, Market, and Complexity, 5(4), p.99.Available at: https://www.mdpi.com/591970

Callahan, M., Perlade, A. and Schmitt, J.H., 2019. Interactions of negative strain rate sensitivity, martensite transformation, and dynamic strain aging in 3rd generation advanced high-strength steels. Materials Science and Engineering: A, 754, pp.140-151.Available at: https://www.sciencedirect.com/science/article/pii/S0921509319303338

Campbell, M.R., Mann, K.D., Moffatt, S., Dave, M. and Pearce, M.S., 2018. Social determinants of emotional well-being in new refugees in the UK. Public Health, 164, pp.72-81. Available at: https://core.ac.uk/download/pdf/327365302.pdf

Chowdhury, M.S.A., Khan, M.F., Alam, M.M., Sadi, A.S. and Alauddin, M., 2019. Users’ Perceptions on the Usage of M-commerce in Bangladesh: A SWOT Analysis. American Journal of Operations Management and Information Systems, 4(3), pp.87-91. Available at: https://www.researchgate.net/profile/Md-Chowdhury-18/publication/335925003_Users’_Perceptions_on_the_Usage_of_M-commerce_in_Bangladesh_A_SWOT_Analysis/links/5d83e56692851ceb791b05af/Users-Perceptions-on-the-Usage-of-M-commerce-in-Bangladesh-A-SWOT-Analysis.pdf

Connon, I., 2017. Transcending the triad: Political distrust, local cultural norms and reconceptualising the drivers of domestic energy poverty in the UK. In Energy Poverty and Vulnerability: A Global Perspective (pp. 46-60). Routledge. Available at: https://discovery.dundee.ac.uk/ws/files/18353549/Irena_Connon_revised_chapter_March_2017_NSedits.pdf

Cowell, F., Karagiannaki, E. and McKnight, A., 2019. The changing distribution of wealth in the pre-crisis US and UK: the role of socio-economic factors. Oxford Economic Papers, 71(1), pp.1-24. Available at: http://eprints.lse.ac.uk/89833/1/Cowell_The-changing-distribution-of-wealth_Accepted.pdf

Kapoor, G.T., E-RETAILING BUSINESS IN INDIA: A SWOT ANALYSIS. NEWMAN, p.35. Available at: http://newmanpublication.com/dash/issueworkfiles/27.pdf#page=35

Keay, A. and Iqbal, T., 2018. Sustainability in large UK listed retail companies: A sectoral analysis. Deakin Law Review, 23, pp.209-244.Available at: https://search.informit.org/doi/abs/10.3316/informit.159392140959229

Kozłowska, A., Grzegorczyk, B., Morawiec, M. and Grajcar, A., 2019. Explanation of the PLC effect in advanced high-strength medium-mn steels. a review. Materials, 12(24), p.4175.Available at: https://www.mdpi.com/594192

McLaney, E. and Atrill, P., 2018. Management Accounting for Decision Makers 9th edition eBook PDF. Pearson Higher Ed.Available at: https://scholar.google.com/scholar?hl=en&as_sdt=0%2C5&as_ylo=2017&q=Atrill%2C+P.+and+McLaney%2C+E.+%282018%29+Management+Accounting+for+decision+makers%2C+9th+Ed.%2C+Pearson.&btnG=

McLaney, E. and Atrill, P., 2020. Accounting and Finance: An Introduction eBook PDF. Pearson Higher Ed.Available at: https://scholar.google.com/scholar?hl=en&as_sdt=0%2C5&as_ylo=2017&q=Atrill%2C+P.+and+McLaney%2C+E.+%282020%29+Accounting+and+Finance%3A+An+introduction%2C+10th+Ed.%2C+Pearson.&btnG=

Merritt, K. and Zhao, S., 2020. An Investigation of What Factors Determine the Way in Which Customer Satisfaction Is Increased through Omni-Channel Marketing in Retail. Administrative Sciences, 10(4), p.85.Available at: https://www.mdpi.com/874754

Mi, X., Tang, M., Liao, H., Shen, W. and Lev, B., 2019. The state-of-the-art survey on integrations and applications of the best worst method in decision making: Why, what, what for and what’s next?. Omega, 87, pp.205-225.Available at: https://www.sciencedirect.com/science/article/pii/S0305048318309575

Mittal, S., Khan, M.A., Romero, D. and Wuest, T., 2018. A critical review of smart manufacturing & Industry 4.0 maturity models: Implications for small and medium-sized enterprises (SMEs). Journal of manufacturing systems, 49, pp.194-214. Available at: https://www.researchgate.net/profile/David-Romero-32/publication/328726147_A_Critical_Review_of_Smart_Manufacturing_Industry_40_Maturity_Models_Implications_for_Small_and_Medium-sized_Enterprises_SMEs/links/5be0577a4585150b2ba092ef/A-Critical-Review-of-Smart-Manufacturing-Industry-40-Maturity-Models-Implications-for-Small-and-Medium-sized-Enterprises-SMEs.pdf

Moagar-Poladian, S., Dumitrescu, G.C. and Tanase, I.A., 2017. Retail e-Commerce (E-tail)-evolution, characteristics and perspectives in China, the USA and Europe. Global Economic Observer, 5(1), p.167.Available at: http://www.globeco.ro/wp-content/uploads/vol/split/vol_5_no_1/geo_2017_vol5_no1_art_020.pdf

Mousavi, M.M. and Lin, J., 2020. The application of PROMETHEE multi-criteria decision aid in financial decision making: Case of distress prediction models evaluation. Expert Systems with Applications, 159, p.113438.Available at: https://www.sciencedirect.com/science/article/pii/S0957417420302621

Nandi, A. and Platt, L., 2020. The relationship between political and ethnic identity among UK ethnic minority and majority populations. Journal of Ethnic and Migration Studies, 46(5), pp.957-979. Available at: https://www.tandfonline.com/doi/pdf/10.1080/1369183X.2018.1539286

Perszyk, R.E., Kristensen, A.S., Lyuboslavsky, P. and Traynelis, S.F., 2021. Three-dimensional missense tolerance ratio analysis. Genome Research, 31(8), pp.1447-1461.Available at: https://genome.cshlp.org/content/31/8/1447.short

Preast, J.L. and Burns, M.K., 2019. Effects of consultation on professional learning communities. Journal of Educational and Psychological Consultation, 29(2), pp.206-236.Available at: https://www.tandfonline.com/doi/abs/10.1080/10474412.2018.1495084

Radzi, A.I.N., Drahman, D.N.A., Joseph, C., Rahmat, M. and Suria, K., 2020. Competition-based learning strategy of the online Introductory Accounting quiz for non-accounting majors. International Business Education Journal, 13(1), pp.83-94.Available at: http://ojs.upsi.edu.my/index.php/IBEJ/article/view/3460

Uday, S. and Högler, W., 2018. Prevention of rickets and osteomalacia in the UK: political action overdue. Archives of disease in childhood, 103(9), pp.901-906. Available at: https://adc.bmj.com/content/archdischild/103/9/901.full.pdf

Wiedemann, S.G., Biggs, L., Nebel, B., Bauch, K., Laitala, K., Klepp, I.G., Swan, P.G. and Watson, K., 2020. Environmental impacts associated with the production, use, and end-of-life of a woollen garment. The International Journal of Life Cycle Assessment, 25, pp.1486-1499.Available at: https://link.springer.com/content/pdf/10.1007/s11367-020-01766-0.pdf

Wynn, M.G., 2018. Technology transfer projects in the UK: An analysis of university-Industry collaboration. International Journal of Knowledge Management (IJKM), 14(2), pp.52-72. Available at: http://eprints.glos.ac.uk/5522/10/Publisher%27s%20version%20Technology%20Transfer%20Projects%20in%20the%20UK.pdf

Yagi, M. and Kokubu, K., 2018. Corporate material flow management in Thailand: The way to material flow cost accounting. Journal of Cleaner Production, 198, pp.763-775.Available at: https://www.sciencedirect.com/science/article/pii/S0959652618319747

Zhang, L., Wu, L., Huang, L. and Zhang, Y., 2021. Wield the Power of Omni-channel Retailing Strategy: a Capability and Supply Chain Resilience Perspective. Journal of Strategic Marketing, pp.1-25.Available at: https://www.tandfonline.com/doi/abs/10.1080/0965254X.2021.1972440

Website

nextplc.co.uk , (2021), Annual report. Available at: https://www.nextplc.co.uk/ [Accessed on 5th December 2021]

nextplc.co.uk ,2021; annual report of Next plc Available at: https://www.nextplc.co.uk/~/media/Files/N/Next-PLC-V2/documents/2021/annual-report-and-accounts-jan21.pdf [accessed on 10 December 2021]

[1] Mousavi, M.M. and Lin, J., 2020. The application of PROMETHEE multi-criteria decision aid in financial decision making: Case of distress prediction models evaluation. Expert Systems with Applications, 159, p.113438.Available at: https://www.sciencedirect.com/science/article/pii/S0957417420302621

[2] nextplc.co.uk , (2021), Annual report. Available at: https://www.nextplc.co.uk/ [Accessed on 5th December 2021]

[3] Mi, X., Tang, M., Liao, H., Shen, W. and Lev, B., 2019. The state-of-the-art survey on integrations and applications of the best worst method in decision making: Why, what, what for and what’s next?. Omega, 87, pp.205-225.Available at: https://www.sciencedirect.com/science/article/pii/S0305048318309575

[4] Biancone, P., Secinaro, S., Brescia, V. and Calandra, D., 2019. Management of open innovation in healthcare for cost accounting using EHR. Journal of Open Innovation: Technology, Market, and Complexity, 5(4), p.99.Available at: https://www.mdpi.com/591970

[5] nextplc.co.uk , (2021), Annual report. Available at: https://www.nextplc.co.uk/ [Accessed on 5th December 2021]

[6] Merritt, K. and Zhao, S., 2020. An Investigation of What Factors Determine the Way in Which Customer Satisfaction Is Increased through Omni-Channel Marketing in Retail. Administrative Sciences, 10(4), p.85.Available at: https://www.mdpi.com/874754

[7]Moagar-Poladian, S., Dumitrescu, G.C. and Tanase, I.A., 2017. Retail e-Commerce (E-tail)-evolution, characteristics and perspectives in China, the USA and Europe. Global Economic Observer, 5(1), p.167.Available at: http://www.globeco.ro/wp-content/uploads/vol/split/vol_5_no_1/geo_2017_vol5_no1_art_020.pdf

[8] Keay, A. and Iqbal, T., 2018. Sustainability in large UK listed retail companies: A sectoral analysis. Deakin Law Review, 23, pp.209-244.Available at: https://search.informit.org/doi/abs/10.3316/informit.159392140959229

[9][9] McLaney, E. and Atrill, P., 2018. Management Accounting for Decision Makers 9th edition eBook PDF. Pearson Higher Ed.Available at: https://scholar.google.com/scholar?hl=en&as_sdt=0%2C5&as_ylo=2017&q=Atrill%2C+P.+and+McLaney%2C+E.+%282018%29+Management+Accounting+for+decision+makers%2C+9th+Ed.%2C+Pearson.&btnG=

[10]nextplc.co.uk ,2021; annual report of Next plc Available at: https://www.nextplc.co.uk/~/media/Files/N/Next-PLC-V2/documents/2021/annual-report-and-accounts-jan21.pdf [accessed on 10 December 2021]

[11] Uday, S. and Högler, W., 2018. Prevention of rickets and osteomalacia in the UK: political action overdue. Archives of disease in childhood, 103(9), pp.901-906. Available at: https://adc.bmj.com/content/archdischild/103/9/901.full.pdf

[12] nextplc.co.uk ,2021; annual report of Next plc available at: https://www.nextplc.co.uk/~/media/Files/N/Next-PLC-V2/documents/2021/annual-report-and-accounts-jan21.pdf [accessed on 10 December 2021]

[13] Connon, I., 2017. Transcending the triad: Political distrust, local cultural norms and reconceptualising the drivers of domestic energy poverty in the UK. In Energy Poverty and Vulnerability: A Global Perspective (pp. 46-60). Routledge. Available at: https://discovery.dundee.ac.uk/ws/files/18353549/Irena_Connon_revised_chapter_March_2017_NSedits.pdf

[14] Cowell, F., Karagiannaki, E. and McKnight, A., 2019. The changing distribution of wealth in the pre-crisis US and UK: the role of socio-economic factors. Oxford Economic Papers, 71(1), pp.1-24. Available at: http://eprints.lse.ac.uk/89833/1/Cowell_The-changing-distribution-of-wealth_Accepted.pdf

[15] nextplc.co.uk ,2021; annual report of Next plc Available at: https://www.nextplc.co.uk/~/media/Files/N/Next-PLC-V2/documents/2021/annual-report-and-accounts-jan21.pdf [accessed on 10 December 2021]

[16] Chowdhury, M.S.A., Khan, M.F., Alam, M.M., Sadi, A.S. and Alauddin, M., 2019. Users’ Perceptions on the Usage of M-commerce in Bangladesh: A SWOT Analysis. American Journal of Operations Management and Information Systems, 4(3), pp.87-91. Available at: https://www.researchgate.net/profile/Md-Chowdhury-18/publication/335925003_Users’_Perceptions_on_the_Usage_of_M-commerce_in_Bangladesh_A_SWOT_Analysis/links/5d83e56692851ceb791b05af/Users-Perceptions-on-the-Usage-of-M-commerce-in-Bangladesh-A-SWOT-Analysis.pdf

[17] Mittal, S., Khan, M.A., Romero, D. and Wuest, T., 2018. A critical review of smart manufacturing & Industry 4.0 maturity models: Implications for small and medium-sized enterprises (SMEs). Journal of manufacturing systems, 49, pp.194-214. Available at: https://www.researchgate.net/profile/David-Romero-32/publication/328726147_A_Critical_Review_of_Smart_Manufacturing_Industry_40_Maturity_Models_Implications_for_Small_and_Medium-sized_Enterprises_SMEs/links/5be0577a4585150b2ba092ef/A-Critical-Review-of-Smart-Manufacturing-Industry-40-Maturity-Models-Implications-for-Small-and-Medium-sized-Enterprises-SMEs.pdf

[18] Campbell, M.R., Mann, K.D., Moffatt, S., Dave, M. and Pearce, M.S., 2018. Social determinants of emotional well-being in new refugees in the UK. Public Health, 164, pp.72-81. Available at: https://core.ac.uk/download/pdf/327365302.pdf

[19] Kapoor, G.T., E-RETAILING BUSINESS IN INDIA: A SWOT ANALYSIS. NEWMAN, p.35. Available at: http://newmanpublication.com/dash/issueworkfiles/27.pdf#page=35

[20] Wynn, M.G., 2018. Technology transfer projects in the UK: An analysis of university-Industry collaboration. International Journal of Knowledge Management (IJKM), 14(2), pp.52-72. Available at: http://eprints.glos.ac.uk/5522/10/Publisher%27s%20version%20Technology%20Transfer%20Projects%20in%20the%20UK.pdf

[21] McLaney, E. and Atrill, P., 2020. Accounting and Finance: An Introduction eBook PDF. Pearson Higher Ed.Available at: https://scholar.google.com/scholar?hl=en&as_sdt=0%2C5&as_ylo=2017&q=Atrill%2C+P.+and+McLaney%2C+E.+%282020%29+Accounting+and+Finance%3A+An+introduction%2C+10th+Ed.%2C+Pearson.&btnG=

[22] Wiedemann, S.G., Biggs, L., Nebel, B., Bauch, K., Laitala, K., Klepp, I.G., Swan, P.G. and Watson, K., 2020. Environmental impacts associated with the production, use, and end-of-life of a woollen garment. The International Journal of Life Cycle Assessment, 25, pp.1486-1499.Available at: https://link.springer.com/content/pdf/10.1007/s11367-020-01766-0.pdf

[23] Callahan, M., Perlade, A. and Schmitt, J.H., 2019. Interactions of negative strain rate sensitivity, martensite transformation, and dynamic strain aging in 3rd generation advanced high-strength steels. Materials Science and Engineering: A, 754, pp.140-151.Available at:https://www.sciencedirect.com/science/article/pii/S0921509319303338

[24] Preast, J.L. and Burns, M.K., 2019. Effects of consultation on professional learning communities. Journal of Educational and Psychological Consultation, 29(2), pp.206-236.Available at: https://www.tandfonline.com/doi/abs/10.1080/10474412.2018.1495084

[25] Zhang, L., Wu, L., Huang, L. and Zhang, Y., 2021. Wield the Power of Omni-channel Retailing Strategy: a Capability and Supply Chain Resilience Perspective. Journal of Strategic Marketing, pp.1-25.Available at: https://www.tandfonline.com/doi/abs/10.1080/0965254X.2021.1972440

[26] Perszyk, R.E., Kristensen, A.S., Lyuboslavsky, P. and Traynelis, S.F., 2021. Three-dimensional missense tolerance ratio analysis. Genome Research, 31(8), pp.1447-1461.Available at: https://genome.cshlp.org/content/31/8/1447.short

[27] Radzi, A.I.N., Drahman, D.N.A., Joseph, C., Rahmat, M. and Suria, K., 2020. Competition-based learning strategy of the online Introductory Accounting quiz for non-accounting majors. International Business Education Journal, 13(1), pp.83-94.Available at: http://ojs.upsi.edu.my/index.php/IBEJ/article/view/3460

[28] Yagi, M. and Kokubu, K., 2018. Corporate material flow management in Thailand: The way to material flow cost accounting. Journal of Cleaner Production, 198, pp.763-775.Available at: https://www.sciencedirect.com/science/article/pii/S0959652618319747

[29] Kozłowska, A., Grzegorczyk, B., Morawiec, M. and Grajcar, A., 2019. Explanation of the PLC effect in advanced high-strength medium-mn steels. a review. Materials, 12(24), p.4175.Available at: https://www.mdpi.com/594192

Know more about UniqueSubmission’s other writing services: