BU7006 Strategic Financial Management Assignment Sample

Introduction

Boohoo Group Plc is a leading and well-established online fashion retailer, based in the United Kingdom (Nguyen, 2017). http://BU7006 Strategic Financial Management Assignment SampleThe firm emphasizes on the concept of fast-fashion, which offers the customers with trending, fashionable, and the latest clothing products. The fashion retailer observed a sales boom in the previous year.

This is primarily because customers moved to the online platforms for purchasing products, due to temporary shutdown of stores and markets as an outcome of the COVID-19 pandemic outbreak.

Furthermore, the company’s sales are continuously growing stronger this year, immensely supported by the establishment of Boohoo’s new Debenhams digital departmental store (Bick et. al. 2018).http://BU7006 Strategic Financial Management Assignment Sample The product lines offered by the newly established store include fashion, beauty, as well as homewares.

Hence, the present report is vital in shedding light on the financial as well as non-financial position of the concerned organization, Boohoo Group Plc. For this purpose, the report evaluates and analyses the financial health and position of the firm by calculating ratios.

In addition to this, the report also highlights the non-financial health of the firm. The models of SWOT and PEST analysis are applied for analysing the current industrial position of the firm as well as to identify potential opportunities and threats. Lastly, the report proposes certain recommendations and suggestions for the firm concerning its improvement and growth.

Ratio Analysis

Financial performance of Boohoo Group Plc for the past four years (2018-2021) is as follows:

| Ratios | 2018 | 2019 | 2020 | 2021 | Ratio analysis |

| Performance ratios | |||||

| Net asset turnover ratio = sales/ total asset | 579.80/ 327

=1.77 |

856.90/ 439.78

=1.94 |

1234.90/

569.5 =2.17 |

1745.30/

775.9 =2.25 |

Boohoo Plc’s efficiency is increasing year by year which means organisation using its asset properly to generate income |

| Fixed asset turnover ratio= sales/fixed asset | 579.80/ 111.8

= 5.19 |

856.90/ 143.45

= 5.97 |

1234.90/ 186.60

=6.62 |

1745.30/ 292.90

= 5.96 |

Boohoo Plc’s efficiency is increasing from year 2018 to 2020 but in 2021 efficiency is decreases which means in 2021 fixed assets are not properly utilised by organisation to generate sales. |

| Stock turnover ratio = sales/average inventory | 579.80/

41.21 =14.06 |

856.90/

57.53 =14.89 |

1234.90/

82.96 =14.89 |

1745.30/

122 = 14.30 |

Lower the ratio means inventory is not sold during the year. Boohoo Plc’s Performance is good from 2018 to 2020 but in 2021 it does not use its inventory properly. |

| Debtor turnover ratio= sales/ average debtors | 579.80/

14.72 = 39.39 |

856.90/

21.63 = 39.61 |

1234.90/

28.78 = 42.90 |

1745.30/

36.2 =48.21 |

This shows Boohoo Plc is rapidly collecting its receivables which are good for the organisation. |

| Liquidity ratios | |||||

| Current ratio=

Current asset/ Current liability |

215.09/

104.22 = 2.06 |

296.32/

162.10 = 1.82 |

382.9/

217.90 = 1.76 |

483/

285.7 = 1.69 |

Ideal ratio is 2:1. Boohoo Plc’s current ratio is drastically decreasing which means organisation have some issues to meet its short-term obligations (Utami, 2017). |

| Quick ratio=

Quick asset/ current liability |

166.84/

104.22 = 1.6 |

229.51/

162.10 = 1.4

|

283.8/

217.90 = 1.3 |

338.1/

285.7 = 1.2 |

Ideal quick ratio is 1:1. Boohoo Plc’s quick ratio is more than one which means organisation has proper liquid assets to meet its short-term obligations. |

| Cash ratio= (cash+ bank + marketable security)/ current liability | 142.57/

104.22 = 1.36 |

197.87/

162.10 = 1.22 |

245.40/

217.9 =1.13 |

276/

285.7 =.96 |

Boohoo Plc’s cash ratio is decreasing continuously which is not good for Boohoo Plc. organisation will not have absolute liquidity in future. |

| Net working capital = CA- CL (excluding short term borrowing) | 114.09 | 138.02 | 181.5 | 204 | Boohoo Plc’s net working capital ratio is increasing which is good for organisation as loans are tied with the minimum working capital requirements. |

| Leverage ratios | |||||

| Equity ratio =

Shareholder equity/ Net asset |

204.02/

212.11 = .97 |

270.40/

270.40 = 1 |

310.60/

327.90 = .95 |

472.50/

472.50 = 1 |

Boohoo Plc’s equity ratio is fluctuating in all the years which show proportion of owners fund to total fund invested in the business. |

| Debt ratio =

Debt / net asset |

10.83/

212.11 = .05

|

8.98/

270.40 = .03 |

36.6/

327.90 = .11 |

20.2/

472.50 =.04 |

This ratio shows the long term solvency of organisation. Ratio more than 1 shows that larger proportion of company’s assets is funded by debt which is risky for organisation. Boohoo Plc ratio is less than 1 which is good as company has no risk or lower risk. |

| Debt equity ratio= debt/ equity | 9.71/

204.02 = .047 |

7.28/

270.40 = .026 |

23.70/

310.60 = .076 |

17.70/

472.50= .03 |

This ratio shows proportion of debt fund in relation to equity (Nuryani and Sunarsi, 2020). Boohoo Plc ratio is fluctuating but it is good for organisation as debt is less as compare to equity means there is no risk in the Boohoo Plc. |

| Proprietary ratio = propriety fund / total asset | 204.02/

327 = .62 |

270.40/

439.78 = .61 |

310.60/

569.5 = .54 |

472.50/

775.9 = .61 |

Boohoo Plc proprietary ratio is less than 1. It shows the proportion of total asset financed by proprietor’s fund. Higher the ratio means less risk. Here Boohoo Plc has some risk element as proprietor’s fund is less than total assets. |

| Coverage ratios | |||||

| Interest coverage ratio= EBIT/interest | 42.69/

.63 = 67.76 |

58.68/

1.18 = 49.73 |

90.90/

1.30 = 69.92 |

124.10/

.60 = 206.83 |

It indicates firm ability to meet interest obligations (Manik, 2016). Boohoo Plc’s interest coverage ratio is good as organisation easily pay its interest debt. |

| Profitability ratios based on sales | |||||

| Net profit ratio

=net profit/ sales*100 |

(36/

579.80) *100 = 6.2% |

(47.46/

856.90) *100 = 5.5% |

(72.90/

1234.90) *100 = 5.9% |

(93.40/

1745.30) *100 = 5.3% |

Net profit ratio of

Boohoo Plc is fluctuating. It is not good for organisation. Higher net profit ratio shows positive returns from the business (Nariswari and Nugraha, 2020). |

| Operating profit ratio=

(Operating profit/ sales) * 100 |

(42.69/

579.80) *100= 7.36% |

58.68/

856.90) *100 = 6.85% |

90.90/

1234.90) *100 = 7.36% |

124.10/

1745.30) *100 = 7.11% |

Operating profit ratio of Boohoo Plc is fluctuating. It is not good for organisation. |

| Profitability related to overall return | |||||

| Return on asset = net profit after tax/ total asset | 36/

327 = .11

|

47.46/ 439.78

= .11

|

72.90/

569.5 = .13 |

93.40/

775.9 = .12 |

This ratio measures the net profit earn by company with using amount of capital employed. Boohoo Plc ratio is fluctuating but it is fine for the organisation not such bad. |

| Return on equity= (net profit – preference dividend/net worth) *100 | (36/ 212.11) *100

= 16.97%

|

(47.46/

270.40) *100 = 17.55% |

(72.90/

327.90) *100 = 22.23% |

(93.40/

472.50) *100

= 19.76% |

It shows the profits earn from the equity invested in the organisation (Szydlowska, 2018). Boohoo Plc maintained its ratio from 2018 to 2020 but in 2021 return on equity is decreases which are not favourable for the organisation. |

| Profitability ratios required for analysis from owners’ point of view | |||||

| Earnings per share | 3.00P | 3.78P | 5.48P | 7.43P | Boohoo Plc earning per share is increases day by day which is favourable for the organisation as well as equity shareholders of the Boohoo Plc. |

| Diluted earnings per share | 2.71P | 3.71P | 5.35P | 7.25P | Diluted earnings per share show the earning received by shareholder in worst-to-worst situation in the organisation. Boohoo Plc is good it means there is not so much risk in the business. |

Hence, it can be analysed and assessed that Boohoo Plc is maintaining and retaining its position in the market as it highlights performance growth and enhancement from year 2018 to 2020.

But in 2021 Boohoo Plc not perform well as compare to past years (SUTHAR, 2018).http://BU7006 Strategic Financial Management Assignment Sample There can be many reasons of not maintaining same performance. One of the main reasons can be COVID-19 due to which business suffers result in decreasing performance like fixed assets an inventory are not properly utilised in year 2021. But overall organisation financial performance is good.

PEST Analysis

Boohoo Group Plc holds the position of an established and developed online fashion retailer, based in the United Kingdom (Wang et. al. 2020). http://BU7006 Strategic Financial Management Assignment SampleThe company highlighted significant financial growth and excellent performance during the period when entire fashion retail industry was facing downfalls due to the COVID-19 pandemic outbreak.

However, the firm is exposed to several aspects and dimensions within the external corporate environment. For an instance, the unexpected and sudden outbreak of the COVID-19 pandemic as well as its impacts on the entire corporate scenario highlights the significance of frequently assessing the external corporate scenario.

For this purpose, the PEST model is observed to be highly suitable and appropriate as it reflects the key domains or dimensions within the external business environment. The domains include Political, Economic, Social, and Technological aspects. A slight or minute change within any of these domains may directly or indirectly affect the business operations and activities of Boohoo Group Plc (Camargo et. al. 2020). http://BU7006 Strategic Financial Management Assignment SampleThese domains are explained below.

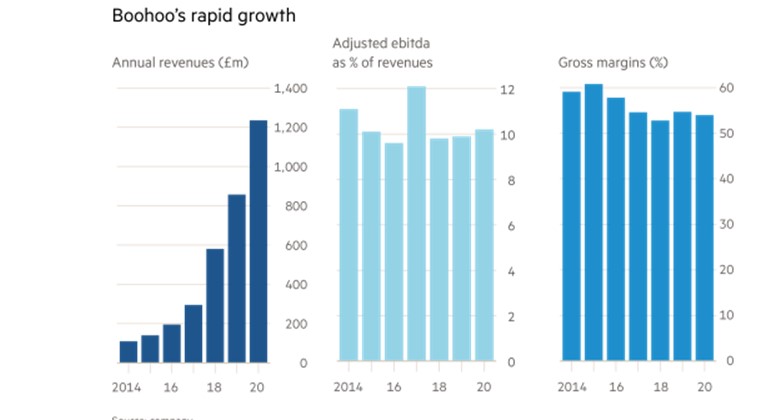

Figure 1 Rapid growth of Boohoo Group Plc

(Source: Eley et. al. 2020)

Political factors: Boohoo Group Plc is an online fashion retailer, based in the United Kingdom. The entire fashion retail industry of UK maintains a global image and reputation.

Although, the recent conditions of temporary shut downs and restrictions on movement of people and goods have severely hit the industry (Arrigo, 2018). http://BU7006 Strategic Financial Management Assignment SampleYet, Boohoo Group Plc remained undisturbed due to the negative political and economic challenges, and highlighted significant financial growth. Furthermore, political stability and consistency within the nation positively affects the industry as well as the concerned firm.

However, Brexit has been observed to directly affect the business operations and activities of the firm. This is because a major portion of the firm’s revenue is generated from outside of the UK.

Brexit has now highlighted uncertainties to the future of Boohoo’s international trading. On the contrary, the firm’s investors tend to prefer stability and certainty, which is not offered by Boohoo as it is based in UK and exports to U.S. and EU. Eventually, this may result in intensifying the turmoil around Brexit, thereby, decreasing the share price of UK fashion retailers (Boohoo Group), hence negatively affecting its equity value.

In addition to this, the US/China Trade War may also indirectly affect the firm’s operations and activities. This is because the added tax on Chinese products by the U.S. institutions forces Chinese retailers to increase prices of locally manufactured equipment, thereby, increasing the product cost and technologies for online retailers like the Boohoo Group Plc (Zhang et. al. 2021).http://BU7006 Strategic Financial Management Assignment Sample

Hence, an increase in product and technology costs for the firm will impose a knock-on impact to its profits. Similar to Brexit, this trade war is significantly contributing in increasing uncertainties into the markets, thereby, also affecting the profitability and growth of Boohoo Group Plc.

Economic factors: The entire world economy has been negatively hit by the outbreak of the COVID-19 pandemic (Camargo et. al. 2020).http://BU7006 Strategic Financial Management Assignment Sample The fashion retailers also experienced significant downfalls in their revenue as well as profitability. However, unlike other retailers, Boohoo Group Plc experienced a hike in its sales and profitability.

This is because the firm is an online fashion retailer and the customers shifted to the online platforms for purchasing products and apparel amidst the pandemic shut down and restrictions.

The company highlighted significant results for the financial year ended 29 February 2020 with a 44% increment in revenue generation amounting to £1.234 billion, over the whole Boohoo Group. It highlights the positive impacts of the economic uncertainties upon the concerned firm (Arrigo, 2018).http://BU7006 Strategic Financial Management Assignment Sample

In addition to this, it has been observed that the UK government does not impose any rigid policies and regulations to fashion retailers as well as corporations operating in other industries. Government policies, laws, and regulations largely support the firm’s business operations and activities over the online platform. Moreover, Brexit has resulted in hiking up the prices of products within the industry, therefore, putting the nation into inflationary conditions.

The pressure of increasing minimum wage of workers on fashion manufacturers is resulting in increasing product costs, thereby, resulting in increment of selling costs to the customers. However, spending disposable income on trending and fashionable apparel is still popular and considered by the consumers (Zhang et. al. 2021).http://BU7006 Strategic Financial Management Assignment Sample Therefore, the economic aspects highlight a moderate level of impact on Boohoo Group Plc.

Social factors: Boohoo Group Plc primarily targets men and women ranging within the age group of 16-30 years, based in the United Kingdom (Binet et. al. 2019).http://BU7006 Strategic Financial Management Assignment Sample The target consumer group highlights the attributes and personality characteristics of fast-changing demands, trending and fashionable clothes, and frequent purchasing habits.

A recent report or survey stated that over 80% buyers purchase clothes which they never wear. This is a good or positive aspect for the fashion retailers as it directly affects their sales and profitability. However, this is against the environment.

In addition to this, it has been observed that modern customers prefer brands which are endorsed and marketed by popular faces and social media influencers. This further highlights an opportunity for Boohoo Group Plc to gear up its sales as well as enhance its profitability.

Furthermore, an increase in sales of the firm amidst pandemic situations and lockdowns also reflect the drastic shift of customers from offline or physical shopping experience to the online platforms (Cao, 2018).http://BU7006 Strategic Financial Management Assignment Sample Lastly, the fashion customers acquire high switching power, which implies that customers move to fashion brands offering excellent discounts and offers as well as low prices.

Technological factors: Implementation and integration of modernised and the latest technologies has been identified as major weakness for Boohoo Group Plc. The firm must realise and observe the significance as well as excellent benefits offered by the latest technologies, like Machine Learning, Cloud Computing, and Artificial Intelligence (Manik, 2016).http://BU7006 Strategic Financial Management Assignment Sample

However, the firm recently invested a significant amount in enhancing and improving its mobile website of Boohoo.com. This has resulted in accelerating the firm’s revenue, of which a major portion is credited to online selling. Hence, the firm’s official website enables customers to choose and order their favourite products online.

Therefore, it can be assessed and analysed that the external environment conditions concerning UK-based fashion retail industry highlight growth trends and opportunities for Boohoo Group Plc.

Supportive and stable political conditions, positive effects of economic fluctuations, fast-changing customer preferences and trends, and lastly, emerging technologies support the development of the firm.

SWOT Analysis

Boohoo Group Plc holds a renowned name and reputation as an excellent online fashion retailer, engaged in providing quirky and trendy apparel to its target customers (Binet et. al. 2019). http://BU7006 Strategic Financial Management Assignment SampleThe firm is engaged in the provision of its products over the international platform, catering to customers’ needs from almost every nation across the globe.

The firm owns prestigious brands like Nast Gal, PrettyLittleThing, Karen Milan, Coast Brands, and MissPap. These brands are similarly engaged in designing, manufacturing, retailing, as well as selling apparel and other accessories to the target customers. Furthermore, the USP or Unique Selling Proposition of Boohoo Group Plc lies in being a dominating and leading online fashion retailer, specialising in own-brand trendy and fashion clothing (Shen et. al. 2017). http://BU7006 Strategic Financial Management Assignment Sample

The mission statement of the firm is to lead the e-commerce fashion market across the global platform, in a way that it delivers for its people, customers, stakeholders, and suppliers.

Whereas, the firm’s vision is to lead the e-commerce fashion market concerning 16–30-year-old customers, which the firm will drive through its strategic priorities; Innovation, Insights, Integration, and Investment. Hence, to further analyse the firm’s strengths and shortcomings, the SWOT model is applied below.

| SWOT Analysis of Boohoo Group Plc | |

| Strengths | Weaknesses |

| · Excellent financial growth

· Effective and automated centres of distribution · Successful implementation of “fashion-for-all” approach · Diverse brand portfolio with strong international presence |

· Surrounding controversies tarnishing brand image and reputation

· Body-positivity movement highlighting lack of diversity

|

| Opportunities | Threats |

| · Product diversification into kid’s apparel

· Collaboration with renowned personalities like Jon Jones and Quavo for enhancing brand visibility · International expansion |

· Fast-changing customer preferences and fashion trends

· Controversies concerning supplier’s factory conditions · Aggressive and intensive rivalry |

Strengths: Boohoo Group Plc enjoys a reputed, well-established, and prospering brand name within the online fashion retailing market, based in the United Kingdom (Todeschini et. al. 2017). http://BU7006 Strategic Financial Management Assignment SampleThe major strength of the company is its robust and excellent financial growth, which can also be observed by the above undertaken ratio assessment and analysis.

The entire retail and fashion industry sales was severely hit by the pandemic outbreak, however, Boohoo remained unperturbed and highlighted significant financial outcomes with FY2020. The firm performed outstandingly highlighting a revenue hike by 44%, amounting to approximately £1.234 billion, across the entire group.

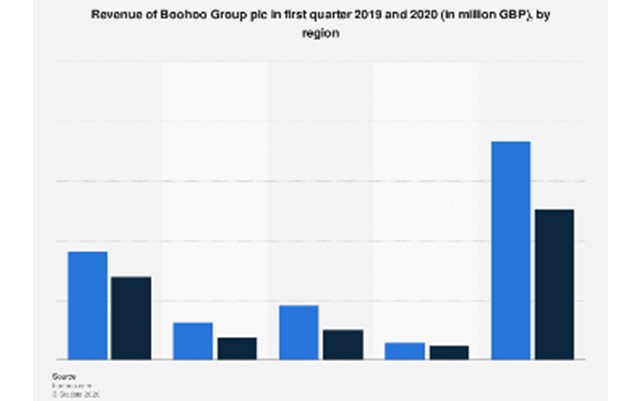

Therefore, it showcases exceptional growth and development across all operating geographies, including 39% increment within the UK and 51% increment in international turnover (Yoo et. al. 2018). http://BU7006 Strategic Financial Management Assignment SampleFurthermore, considering the terms of the firm’s performance of its allied brands, Boohoo Group Plc’s revenue showcased an increment of 38% amounting £516 million as well as down 30bps, enlightening 52.6% gross profit margin.

Figure 2 Revenue generated by Boohoo Group Plc during COVID-19 crisis

(Source: Statista Research Department, 2020)

Other than financial strength, the company also integrates and maintains automated and highly effective distribution centres, which also act as a strong foundation for accelerating firm’s growth and development (Cao, 2018).http://BU7006 Strategic Financial Management Assignment Sample

The company recently spent a significant amount for developing efficient distribution system, thereby, highlighting its goal of building a £3 billion net sales generating distribution system. Boohoo also offers bus services for all the surrounding towns and cities to distribution centres and new welfare programs or facilities to the Burnley personnel.

Additionally, the firm also enhanced its revenue-generating capability, underpinned the firm’s infrastructural requirements as well as added to operational flexibility of the whole Group, by integrating Sheffield facility. Lastly, the firm recently expanded its product portfolio by applying the “fashion-for-all” approach. Hence, Boohoo is now embracing and offering plus-sized models. It has also initiated the sales of 26-sized, miniskirts, latest bodycon dresses, and swimsuits (Yang et. al. 2017).http://BU7006 Strategic Financial Management Assignment Sample This initiative of the firm resulted in gearing up its sales and profits.

Weaknesses: In contrary to the weaknesses, Boohoo Group Plc also highlights certain weaknesses or shortcomings. The major weaknesses of the firm include lack of innovation and technological advancements (Arrigo, 2020).http://BU7006 Strategic Financial Management Assignment Sample The company recently reflected its objectives and plans concerning the expansion of its business operations and activities across the international platform.

For this purpose, it is crucial for the firm to invest significant amount into technology upgradation and modernisation so as to manage its operations and ensure accomplishment of its objectives. In addition to this, it has been observed that although the Boohoo Group keeps up with the latest fashion trends, yet the company’s apparel developments are largely a response to the rival players in the industry.

The company designs and develops its clothing or apparel as a response to the strategies and techniques of its rival firms within the fashion retailing industry. Boohoo Group Plc also faced certain controversies and criticism concerned with violation of e-commerce laws and regulations.

For an instance, Boohoo Group must be aware and acquire adequate knowledge associated with the introduction of GDPR regulations and policies in the last year (Parker and Henninger, 2018).http://BU7006 Strategic Financial Management Assignment Sample Other than this, Boohoo Group Plc also faces certain issues and challenges in developing and maintaining an inclusive workplace environment for its diverse employees and staff members working at different levels within the firm.

Opportunities: The external corporate environment of the fashion retail industry has been assessed and analysed considering the emerging growth-oriented opportunities for Boohoo Group Plc.

International expansion of the firm into new markets through acquisitions highlights key opportunities to penetrate into nations pertaining different fashion styles and trends, thereby, highlighting an opportunity of product diversification (Bertola and Teunissen, 2018). http://BU7006 Strategic Financial Management Assignment Sample

Moreover, the firm experienced a hike in its revenue and sales during the last year as the customers switched to the online platforms for making purchases. Boohoo Group Plc highlighted a significant growth in its financial health and position, in which a major portion is credited to online sales. However, it has been assessed that the firm must enhance its online visibility and product availability.

This is because the industrial scenario highlights a significant potential concerning an increment in the usage of mobile sites of Boohoo.com as well as PrettyLittleThing.com.

The continuous expansion or increment in smartphone ownership within the global markets, highlights more probabilities of customers using their smart mobile phones for making online purchases (Kautish et. al. 2021).http://BU7006 Strategic Financial Management Assignment Sample Hence, it reflects an excellent and growth-oriented opportunity for Boohoo Group to further boosts its online sales.

In addition to this, product diversification and the establishment of a new product line is also observed to be effective opportunity, highlighting the growth-oriented potential for the firm. The company currently offers apparel and beauty care products for men and women. I

t encounters an opportunity for entering the kid’s line (Sun and Zhao,). The firm must design and develop clothing for kids, combined with men and women. This will significantly contribute in boosting its sales and profitability. Also, it would be easier for the firm to capture a significant customer base as it already holds an effective brand name and reputation across the global market.

Furthermore, the integration of the latest technological advancements including Machine Learning, 3D Printing, and Artificial Intelligence offer excellent potential to Boohoo Group Plc for ensuring cost-effectiveness as well as to enhance efficiencies in undertaking its business operations (Papanotas, 2020).http://BU7006 Strategic Financial Management Assignment Sample Lastly, integration with renowned personalities like Jon Jones and Quavo for promoting the apparel is also observed to be a highly growth-oriented opportunity for Boohoo Group Plc.

Threats: Although, Boohoo Group Plc enjoys a dominating and leading position within the online fashion retail industry, based in the UK, the company faces certain serious challenges and threats in the corporate scenario (Kalbaska et. al. 2019).http://BU7006 Strategic Financial Management Assignment Sample News headlines and certain reports highlighted that the company’s suppliers provide unethical and inappropriate workplace conditions to the employees and workers. The workers in a factory of Boohoo’s supplier based in Leicester were being paid as little as $4.40 or £3.50 for an hour.

Furthermore, the reports also reflected that the workers were not provided with the proper equipment and other key requirements for ensuring their protection against the deadly Corona Virus. However, the executives at Boohoo then states that it would terminate its corporate relations with any such supplier.

Moreover, the company also initiated an independent review and assessment of its British supply chain by investing $12.5 million in eradicating unethical norms and malpractices in any supplier factories. Yet, the criticism and controversy resulted in the deteriorating brand image of the firm.

Several faces promoting the brand as well as its customers posted negative comments over the social media platforms against the Boohoo Group Plc (Sumarliah et. al. 2021). http://BU7006 Strategic Financial Management Assignment SampleTherefore, this incident largely affected the firm as well as its brand reputation and image within the UK fashion retail industry.

Other than this, Boohoo Group Plc faces serious challenges and issues from its well-established competitors and rival brands. The major rivalries comprise of H&M, ZARA, Trendyol, ASOS, Matches Fashion, Topshop Topman, and Missguided (Nguyen, 2017).http://BU7006 Strategic Financial Management Assignment Sample

These organisations tend to adopt and implement excellent strategies and techniques in order to attract or capture customers towards their products. Furthermore, fast-changing fashion trends, preferences, and demands of the consumers also offer a great threat to the firm in undertaking its business operations and activities.

Therefore¸ it can be analysed and observed that Boohoo Group Plc holds an influencing and strong position within the online fashion retain industry within the UK market.

The internal factors offer great and excellent strengths to the firm, as well as the external environment offers growth-potential opportunities (Bick et. al. 2018).http://BU7006 Strategic Financial Management Assignment Sample However, the firm also reflects certain shortcomings as well as is exposed to serious threats emerging within its external environment. Hence, the firm must frequently assess and analyse its internal as well as external strategic factors.

Conclusion

Hence, the above report presented an evaluation and analysis of a leading online fashion retailer, Boohoo Group Plc, based in the United Kingdom. The report highlighted the financial health and position of the firm by calculating different ratios.

In addition to this, the non-financial health and status of the firm has been analysed and studied by applying the models of SWOT and PEST analysis. The SWOT model highlighted the acquired strengths and weaknesses of the firm as well as the opportunities and threats observed in the corporate environment.

Whereas, the PEST model reflected the key domains affecting the firm’s operations and activities, which are political, economic, social, and technological. Therefore, the report is vital in enlightening the firm’s overall position within the industry as well as the industry’s favourability towards the firm.

References

Arrigo, E., (2018). Customer relationships and supply chain management in the fast fashion industry. In Diverse methods in customer relationship marketing and management (pp. 1-16). IGI Global.

Arrigo, E., (2020). Global sourcing in fast fashion retailers: sourcing locations and sustainability considerations. Sustainability, 12(2), p.508.

Bertola, P. and Teunissen, J., (2018). Fashion 4.0. Innovating fashion industry through digital transformation. Research Journal of Textile and Apparel.

Bick, R., Halsey, E. and Ekenga, C.C., (2018). The global environmental injustice of fast fashion. Environmental Health, 17(1), pp.1-4.

Binet, F., Coste-Manière, I., Decombes, C., Grasselli, Y., Ouedermi, D. and Ramchandani, M., (2019). Fast fashion and sustainable consumption. In Fast fashion, fashion brands and sustainable consumption (pp. 19-35). Springer, Singapore.

Camargo, L.R., Pereira, S.C.F. and Scarpin, M.R.S., (2020). Fast and ultra-fast fashion supply chain management: an exploratory research. International Journal of Retail & Distribution Management.

Cao, H., (2018). The growth of e-commerce and its impact on the fast fashion retailers.

Kalbaska, N., Sádaba, T., Cominelli, F. and Cantoni, L., (2019). Fashion communication in the digital age. Cham, Switzerland: Springer.

Kautish, P., Guru, S. and Sinha, A., (2021). Values, satisfaction and intentions: online innovation perspective for fashion apparels. International Journal of Innovation Science.

Manik, A.B., (2016). The impact of debt to equity ratio, debt to assets ratio, tangibility, interest coverage ratio and financial leverage multiplier on price to book value (Empirical Study of the Manufacturing Companies that Listed on Indonesia Stock Exchange (IDX) during the Period 2010-2015) (Doctoral dissertation, UAJY).

Nariswari, T.N. and Nugraha, N.M., (2020). Profit Growth: Impact of Net Profit Margin, Gross Profit Margin and Total Assests Turnover. International Journal of Finance & Banking Studies (2147-4486), 9(4), pp.87-96.

Nguyen, T.H.N., (2017). Integration of multi-channel distribution and its impact on profit of fast fashion companies.

Nuryani, Y. and Sunarsi, D., (2020). The Effect of Current Ratio and Debt to Equity Ratio on Deviding Growth. JASa (Jurnal Akuntansi, Audit dan Sistem Informasi Akuntansi), 4(2), pp.304-312.

Papanotas, N., (2020). Design research and applications of contemporary digital technologies in the fashion industry.

Parker, C.J. and Henninger, C.E., (2018). Focus on the fast fashion industry. Eco-Friendly and Fair: Fast Fashion and Consumer Behaviour.

Shen, B., Choi, T.M. and Chow, P.S., (2017). Brand loyalties in designer luxury and fast fashion co-branding alliances. Journal of Business Research, 81, pp.173-180.

Sumarliah, E., Usmanova, K., Mousa, K. and Indriya, I., (2021). E-commerce in the fashion business: the roles of the COVID-19 situational factors, hedonic and utilitarian motives on consumers’ intention to purchase online. International Journal of Fashion Design, Technology and Education, pp.1-11.

Sun, L. and Zhao, L., (2018). Technology disruptions: Exploring the changing roles of designers, makers, and users in the fashion industry. International Journal of Fashion Design, Technology and Education, 11(3), pp.362-374.

SUTHAR, K., (2018). Financial Ratio Analysis: A Theoretical Study. International Journal of Research in all Subjects in Multi Languages, Gujarat, India.

Szydlowska, K. (2018). Ratio Analysis. Financial Position of a Company. Germany: GRIN Verlag.

Todeschini, B.V., Cortimiglia, M.N., Callegaro-de-Menezes, D. and Ghezzi, A., (2017). Innovative and sustainable business models in the fashion industry: Entrepreneurial drivers, opportunities, and challenges. Business Horizons, 60(6), pp.759-770.

Utami, W.B., (2017). Analysis of Current Ratio Changes Effect, Asset Ratio Debt, Total Asset Turnover, Return On Asset, And Price Earning Ratio In Predictinggrowth Income By Considering Corporate Size In The Company Joined In Lq45 Index Year 2013-2016. International Journal of Economics, Business and Accounting Research (IJEBAR), 1(01).

Wang, B., Luo, W., Zhang, A., Tian, Z. and Li, Z., (2020). Blockchain-enabled circular supply chain management: A system architecture for fast fashion. Computers in Industry, 123, p.103324.

Yang, S., Song, Y. and Tong, S., (2017). Sustainable retailing in the fashion industry: A systematic literature review. Sustainability, 9(7), p.1266.

Yoo, J.J., Divita, L. and Kim, H.Y., (2018). Predicting consumer intention to purchase clothing products made from sustainable fabrics: Implications for the fast-fashion industry. Clothing Cultures, 5(1), pp.47-60.

Zhang, B., Zhang, Y. and Zhou, P., (2021). Consumer attitude towards sustainability of fast fashion products in the UK. Sustainability, 13(4), p.1646.

Online

Hargreaves Lansdown, 2021. Financial performance of Boohoo Plc.(online) [Accessed Through]. <https://www.hl.co.uk/shares/shares-search-results/b/boohoo-group-ordinary-1p/financial-statements-and-reports>

Statista Research Department, 2020. Boohoo plc revenue comparison Q1 2019 and Q2 2020, by region. [Online:]. [Accessed through]: <https://www.statista.com/statistics/1136536/boohoo-revenue-during-coronavirus/ >

Eley et. al. 2020. Boohoo comes out fighting after market tears it to shreds. [Online:]. [Accessed through]: <https://www.ft.com/content/6e4b36b5-2174-4410-ab6d-5eb492792d6d>