BU7006 Strategic Financial Management Assignment Sample

Introduction

Financial management is a significant management department of any organisation. Besides, financial management plays an effective and significant role in the management of an organisation. The main objective of financial management is to ensure better performance of an organisation through developing a significant strategy and financial development plan for the organisation.

Another responsibility of financial management is to make decisions according to the financial strategy of the organisation. It helps an organisation to make more sustainability of the organisation’s financial performance. It also ensures high profitability to use different incision strategies such as considering important factors which affect the financial performance of an organisation.

One of the main objectives of any organization is high profitability for better growth of organization which is too important for any organisation to become a sustainable business organisation in a competitive market.

Organisation overview

The BOOHOO plc is a UK based retail fashion industry operating business at a global level. The organisation is a group of “BOOHOO, PRETTYLITTLETHING and NASTYGAL”. It is a high growing and successful business for the past few years. The organisation’s main seven brands which are too popular in the market are “boohoo, boohooman, prettylittlething, nasty gal miss pap, Karen Millen and coast”(boohooplc.com).

These brands of an organisation are the main source of revenue of the organisation. As the organisation operates their business at an international level so the financial management is too effective and has talent management to manage all financial activities. Every organisation’s success depends on the active customer engaged in that organisation here the active customers of boohoo plc is over 8.9 million (boohooplc.com).

The main reason for organisation high customer engagement is organisation first prior is high customer satisfaction. The organization’s main objective is to deliver high returns to shareholders by achieving the growth strategy of the organisation. Besides, the company is continuously able to increase profitability. The profitability ratio of the organisation in 2018 is 0.144 and in the year 2021 is 0.37. It indicates the organisation continuously grows their revenue as well as sales.

Ratio analysis

Ratio analysis is an effective and best method to analyze the financial performance of any organisation. The ratio analysis plays an important role for organizations as well as stakeholders of an organisation to make effective financial decisions.

As opined by Eisenberg, (2019) it helps the financial management of organisations to develop strategies and plans for making investments in the business. Some important ratios are too important for the organisation and shareholders of organisations to make financial division about future financial activities.

Profitability ratio

The profitability ratio refers to an organisation’s ability or capability to earn profit through operating activities and investment activities. There are mainly four types of profitability ratios that help to assess the financial performance of an organisation.

The four profitability ratios are gross margin ratio, return of assets, return on sales and return on equity. As argued by Drury, (2018) the gross margin ratio refers to the organization’s ability to gross income through sales besides it is the main source to pay other fixed and administrative expenses of the organisation. The gross margin of Boohoo plc is 54% which indicates that the organisation earns a high rate of gross margin.

On The other hand return on investment means, organisations generate income from an investment that was made by an organisation in the past. The organisation continuously increases investment to acquire a high rate of return in future. Out of these profitability ratios, return on sales is an important ratio for measuring the profitability of an organisation. Besides, the organisation continuously increases their revenue as well as their profit for the high profitability of the organisation.

The profitability of organisations in the year 2018 is only 14% which will increase by nearly 25% in 2019 and become 19% profitability of the organisation boohooplc.com). The organisation also performed better in 2020 as in covid pandemic in that year the profitability of organisations was nearly 30% and after that, in 2021 the rate is 38%. The organisation’s financial management is too effective towards the profitability of the organisation.

[Refer to appendix 1]

Liquidity refers to the liquid assets of one organisation to pay their debt obligations and the organisation’s daily needs. It is calculated by subtracting inventory from current assets and divided by current liability. Here inventory refers to the finished stock of an organisation that is ready to sell in the market. Besides the current assets refers to the organisation’s assets that are held and utilised for not more than three years such as prepaid expenses. Furthermore, current liability is the organisation short term liability which the organisation settle within three years such as outstanding expenses.

As opined by Fatimah and Toha, (2019) on the other hand liquid assets of an organization play an important role to settle any deficit of an organisation in any critical situation.

The liquidity ratio of the organisation is 1.59 in 2018 and after that, in 2019 the ratio is 1.41 which is continuously decreasing at a sustainable percentage. Besides, the ratio is 2021 is 1.18. As opined by Abadi and Purba, (2019) which indicated that the liquid position of the organisation is not in a good position. However, the whole world is sifted into the digital mode of payment nevertheless liquidity is a significant element for any organisation.

However, the organisation cash flow does not indicate the best utilization of liquid cash. The organisation mainly focuses on liquid assets to invest in long term assets and short term assets. The total cash investment of the organisation is 43775 in 2020 and 45559 in 2019. It indicates that organisations are more interested to convert cash and liquid assets into investment activities.

[Refer to appendix 2]

Efficiency ratio

Efficiency ratio refers to an organisation’s efficiency that how an organisation utilises resources and assets to generate profit for the organisation. As opined by Muscoloni and Cannistraci, (2019) however there are different types of efficiency ratio which helps to measure organisational ability to utilise assets and resources.

The important efficiency ratio is the “assets turnover ratio”. Besides, the other efficiency ratio is the “inventory, receivable and accounts turnover ratio” also play a significant role in analyzing an organisation’s efficiency. The organisation’s efficiency ratio is 1.77 in 2018 and 1.94 in 2019. It indicates that organisations are more efficient to utilise assets to improve their sales and revenue.

Besides the boohoo, practices are more to improve their efficiency that results in the ratio are 2020 is 2.16 and 2.24 in 2021. Here it is noticed that the best efficiency ratio is more than 2.5 nevertheless the organisation is not able to maintain the best rate of efficiency ratio.

[Refer to appendix 3]

Investor ratio

Investors ratio refers to a financial ratio that is used by a stakeholder to measure the financial performance of an organisation. Stakeholders are an important factor for any organisation to become a successful business in a competitive market. As opined by Kelly and Seow, (2018)the stakeholders notice the organisation’s investment policy while they want to invest in an organisation project and new startup.

There are different types of investors ratio out of which return on investment is an important ratio for considering by and stakeholders to invest money in the organisation. The organisation mainly focuses on making a fixed portion of liquid assets and income on investment in the long term and short term. The return on investment of the organisation is 24% and in 2019 is 23%. The organisation and whole country face a pandemic situation in 2019.

The whole organisation faces a low return from investment which they made in pre Covid due to low GDP growth rate of the whole world’s countries (boohooplc.com). As argued by Kelly and Seow, (2018) the organisation’s financial management is too effective in 2020 and 2021. As a result the organisation again was able to touch a high rate of return on investment so the organisation was able to generate a 29% return rate in 2020 and 37%.

[Refer to appendix 4]

Pestle analysis 700/1100

| Factors | Key data | Impact |

| Political | ● In the UK tax burden is too high, 64.9% and besides the fiscal is 77.3%. | High |

| Economical | ● Due to bad economic conditions, the GDP has been being $3.2 trillion in 2020 (heritage.org, 2021).

● The GDP growth rate also which is 1.4% besides the per capita income is noted at $48,710. ● Business freedom in the UK is 94.4% and the 81% rate is founded on monetary freedom. |

High |

| Social | ● The unemployment rate during 2020 is 3.9% (heritage.org, 2021).

● Sustainable environment and reduce carbon emission |

Moderate |

| Technical | ● The digital market is $ 151 billion during the year.

● The new start-up is $ 13.2 billion (great.gov.uk, 2019). ● The UK is in 4th position in innovation in the world. |

High |

TABLE 1: PEST ANALYSIS

(Source: heritage.org, 2021)

The tax policy of any country plays an important role to attract new start-ups as well as promote new business. Besides, an effective tax policy also attracts more business organisations to pay tax which is too important for the sustainable economical condition of a country.

The UK government’s tax burden is too high 64.9% (heritage.org, 2021).http://BU7006 Strategic Financial management Assignment Sample It is too much affected by new organisations and new start-up organisations. It is an external factor that affects boohoo also through reducing a large position of organisation’s income. It organisation uses to pay the tax burden of the country. Besides, it gives a high impact on the organisation as well as policy and the future project of the organisation.

The GDP rate of the UK stands at $3.2 trillion which means the economic condition of the country is not in a good condition. The GDP refers to the gross domestic product of that country. Besides, it gives a value of goods and services manufactured during a specific period.

It is too much for an organisation to grow their business and promote a new business. The country’s GDP growth rate for 2020 is 1.4% (heritage.org, 2021).http://BU7006 Strategic Financial management Assignment Sample it is too low according to the previous year’s growth rate.

According to the standard growth rate of any developed country is more than 10% must be maintained by the government to attract new business organisations and business organisations operate their business in that country. Here the boohoo is also highly affected by the GDP growth rate.

However, The organization continues to grow nevertheless if the growth rate is exist above 10% then the company is better and growing more.

The per capita income of the country for 2020 is $48,710. It is a good and high per capita income compared to other countries. As opined by Abadi and Purba, (2019) It ensures that in that country’s consumers have a high purchasing power which is very important for an organisation to increase their sales and revenue.

Besides, another benefit of high per capita income is that organisations can increase their productivity. Business freedom in the country is noted at 94% and monetary freedom is 81% which refers to high business sustainability for any business industry.

Freedom in business is too important for an organisation’s success and monetary freedom also needs for the better financial performance of the business industry. Technology is one of the most significant tools for business and organisation.

Through this, they can be able to increase productivity as well as its quality of production. As highlighted under PEST analysing it has been shown that the UK has a digital market of $ 151 billion which signifies that for the development of business this prospect is quite suitable as the above technology positively impacts business production as well as profitability.

On the other hand, $ 13.2 billion start-ups also whose titan it has a good environment for business prospects. Besides the low unemployment rate, business activities in those countries are good (heritage.org, 2021).http://BU7006 Strategic Financial management Assignment Sample The boohoo also takes advantage of high per capita and sustainable business freedom as well as monetary freedom which helps the organisation to improve its financial performance of the organisation.

Significant development of an organisation

In this segment of the study, various developments of the Boohoo industry over the period of time have been highlighted. After analyzing its two years of annual report various developments have been found in the organisation.

From the annual report of 2020 of the business it has been found that revenue growth of the business has been improved by 48% and from the annual report of the year, 2021 revenue growth has been discovered at 41% (boohooplc.com, 2021 ).http://BU7006 Strategic Financial management Assignment Sample Through this, it can be assumed that it ensures sustainable development by providing better services to the customer.

On the other hand, customer value and its retain capacity is also good enough from the past few years by which it increased its acres of operation. From the annual report of 2020, it has been found that from the years of 2019 and 2020 its customer values increase by 28% and in the years 2020, it has an active customer of 8.9 million (boohooplc.com, 2020). http://BU7006 Strategic Financial management Assignment Sample

On the other hand, in the year 2021, it has an active customer of 18 million who has shopped from this company.

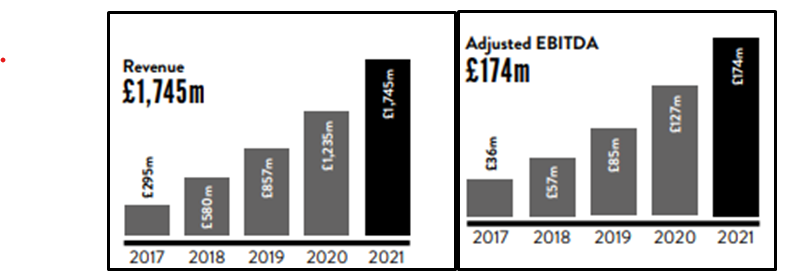

Figure 1: Development in various segments of Boohoo over the period

(Source: boohooplc.com, 2021)

From the annual report of the 2020 of the business, development in various segments of the business can be seen where it is found that in the year of 2018 total revenue is 580 million Euros. On the other hand, in the year 2021, its total revenue growth has been noticed at 1745 million Euros.

Other parts of the figure show the earnings before interest tax and depreciation of the business in which a growth of three times as compared to 2018 has been noticed.

From the ratio which has been calculated of various periods of time of the business, it has been noticed that various financial aspects like company liquidity performance, efficiency, profit-earning capacity of business has improved as compared to the previous year. On the other hand, it is also able to satisfy its different stakeholders by providing better services to them and ensures sustainable success.

SWOT analysis

| Strength | Weakness |

| ● 41% growth in the revenue of the year 2021

● 35% increase in the profitability of the business (boohooplc.com, 2021).http://BU7006 Strategic Financial management Assignment Sample ● 18 million active customers the worldwide ● 1745 million Euros revenues in the year of 2021 ● Profit before tax for the period of 2021 stood at 125 minion Euros |

● Due to adding new technological tools and techniques, organisational culture is being affected (boohooplc.com, 2020)

● Being a global company, it is sometimes unable to manage its employees throughout the world due to due to lack of effective measures in employee management ● Chances of data manipulation and data breaching is high as well as chances of cyber attack is also there. |

| Opportunity | Threats |

| ● Adding new technologies lie blockchain technologies in order to provide more security to data and information o Boohoo

● An effective step towards strengthening supply chain management in order to provide better services to its customer (Marchi and Zanoni, 2017) ● Adding effective measures in order to mitigate various compliance regarding employee engagement as well as customer engagement and build a good relationship. |

● Continuous change in preference of the customer, affects business operation and its activity.

● Due to covid-19, digitalisation of the market increased the number of competitors in the market. ● Regular investigation from regulatory bodies due to inherent complexity in the supply chain may cause reputational damage to the brand value of the company (boohooplc.com, 2021).http://BU7006 Strategic Financial management Assignment Sample |

Table 2: SWOT analysis

(Source: boohooplc.com, 2021)

Through the SWOT analysis, various threats and opportunities of the business have been highlighted. From this, it has been found that due to covid-19 various online stores and digital tools has been by the business in order to tackle the challenge by performing better in the business.

Through this, it is able to enhance customer engagement. Businesses also practice continuous audits and other corporate governance activities in order to enhance organisational culture and create a good working environment.

Challenges of Boohoo organisation

From the SWOT analysis of the business, it has been found various challenges have been faced by the business. As this business operate its activity in the broad and open market, various competitors have affected its activity as customer choices and preferences have been influenced.

Challenges regarding regulation: as it is a global company and it operates in the international market. Various rules and regulations of the local market of any country increase compliance risk and this leads to reduce the global image of the business (Chang and Andreoni, 2016).http://BU7006 Strategic Financial management Assignment Sample

Emerging regulation is another challenge due to which various compliance cost is being increased this falls negative impact in the business profitability.

Challenges while maintaining organisational ethics and cultures: Due to continuous changes in business, activity caused by external and internal reasons various new techniques and tools have been adopted by a business. In this context, the business faces a challenge as their ethics, organisational culture has been affected, and difficulties while adopting those changes (Richardson, 2018).http://BU7006 Strategic Financial management Assignment Sample

Changes while maintaining a global team one of the major challenges that has been faced by various global companies is challenges regarding managing their team. In order to perform well in the world market team spirit and good communication between the team is need.

As stated by Razafimandimby et al. (2016), various employees and workers have been engaged in the business from various countries, it is difficult for the management to manage the team properly and reduce the chances of cross-culture and conflict.

Opportunities of company

There are too many opportunities for the business by which this industry can perform better and lead the world market, As due to covid-19, the whole world adopted digital marketing stage.

As opined by Nambisan et al. (2018), digital market platforms provide a wider opportunity for the business to perform well in the market. Various technologies like the internet of things, big data analysis, and various social media platform enable the business to increase its customer engagement as well as employee engagement. On the other hand, through these technologies businesses can enhance employee skill and development and ensures a better quality of a product.

Furthermore, using bog data analysis and social medium platform businesses can get a Lagrange amount of information about various aspects like customer preferences, quality of goods and products that they want which enable amend necessary changes in the existing product and services. Apart from this, using blockchain technologies in the business provide a much opportunity to share real-time data and information in various part of the country in which they operate their business activity.

As stated by Gökalp et al. (2018) through this technology, they are able to enhance management efficiency and minimise data theft and cyber-attack. In the new era of the world sustainable fashion is emerging day by day and customer preferences have been changed and they prefer this kind of fashion more than the existing one. In this situation, Boohoo has many opportunities to adopt these new kinds of fashion products in their business productivity and provide better services to its customers.

Moreover, regular review of the competitor offering to its customer also shows many ways by which this fashion industry to use competitive advantages and provides better services to its customers. Various strategies related to market research enable a business to know the pattern of customer behaviour and changes in the market demand which not only helps to retain its customer by providing this product, which they want but also helps to lead in the existing market.

Financial and non-financial elements

In order to check the financial performance of the business named boohoo fashion industry, various ratios have been calculated by which its financial performance can be measured. Through the calculation of the liquid ratio of the various periods, it has been found that from the year, 2018 to 2021 it properly maintains its liquidity capacity.

In the year 2018, its liquidity ratio stood at 1.59 and in the year 2021, its liquidity ratios are at 1.18 that shows that it has much capacity to meet up its current liabilities. On the other hand, profitability ratios of this industry are consistently increasing over the period. Profitability ratios of the four consecutive years of the Boohoo fashion industry are 14.41%, 19.003%, 29.18% and 37.39% respectively. Through this, it can be assumed that it has much ability to earn profit through its business activity.

On the other hand, various non-financial aspects such as ethics, customer engagement, and corporate social responsibility have been properly maintained by this business. Various strategies regarding employee retention, increasing customer engagement has been consistently used by this business to perform well in the market. Continuous audit practices have been practised by this business to improve the organizational culture.

Conclusion

Boohoo is a UK based retail industry that deals in the fashion industry and it aims to provide better services to its customers and ensure sustainable success. Through analysing various aspects of this industry, it has been found that it has a good place in the world market. Various ratio analyses have been shown its financial performance in the market. In this context liquidity ratios has been taken to measure its liquidity capacity, profitability ratio has been considered to analyse its profit earning ability and assets turnover ratios has been taken to analyse its asset capability in terms of earning.

Apart from this, the current year and three consecutive previous years have also been taken to know its growth and development over the period. Through ratios analysis, it has been concluded that this industry is able to maintain a stable liquidity ratio through the four consecutive periods.

Apart from this, its liquidity capacity is also good enough to meet its current obligation and liabilities. On the other hand, profit-earning ratios of this business have sustained continuous growth and by which it increases both productivities as well as revenue of the business.

The assets turnover ratio of this industry has also increased over the period of time in which ensures proper utilisation of resources in terms of earning profit and enhancing business performance. Thus through the ratios analysis of the business, it can be concluded that it is financially performing well in the market.

After analysing various external factors of the business environment such as economic, political technologies and social factors, It has been found that the GDP of the country is high as well as per capita income of the country’s people is also at a standard level which has a false positive impact on business growth and development.

High per capita income signifies the high purchasing power of the consumer, which means that businesses can easily sell their produced goods and services through effective marketing strategies. On the other hand, the UK is the fourth most technologically developed country in innovation in the world. It provides a wider scope for the business to operate in an effective way by using various advanced technological tools.

Through various new innovative tools, businesses can reduce costs of production by using resources in an effective way and enhance the quality of produce goods. Thus through this business can be able to enhance its performance in the world market. SWOT analysis of the industry provides much information about the business performance.

Through this analysis, it has been found that companies adopt effective strategies by which they are able to increase the number of customers at an increasing rate. However, through this analysis, it has also been found that due to some inherent issues in the supply chain management it faces various problems, which reduce its brand image and its value. On the other hand, due to business changes developing and implementing new tools and techniques affect organizational ethics and culture.

Analysing the financial and non-financial aspects of the business it can be concluded that this industry effectively operates its business by maintaining both financial and nonfinancial activity like corporate governance, CSR and other activity in an effective way.

References

Books

McLaney, E. and Atrill, P., 2018. Management Accounting for Decision Makers 9th edition eBook PDF. Pearson Higher Ed.

McLaney, E. and Atrill, P., 2020. Accounting and Finance: An Introduction eBook PDF. Pearson Higher Ed.

Journals

Abadi, K., Purba, D.M. and Fauzia, Q., 2019. The Impact Of Liquidity Ratio, Leverage Ratio, Company Size And Audit Quality On-Going Concern Audit Opinion. Jurnal Akuntansi Trisakti, 6(1), pp.69-82. Available at:https://pdfs.semanticscholar.org/7fd5/f699cd0ea8e0bb756cbbb328161dd9d7cd40.pdf

Chang, H.J. and Andreoni, A., 2016. Industrial policy in a changing world: basic principles, neglected issues and new challenges. Cambridge Journal of Economics, 40. available at: https://www.academia.edu/download/59850775/Chang_Andreoni_2016_Industrial-Policy20190624-51640-e0gixn.pdf

Drury, C., 2018. Cost and management accounting. Cengage Learning. Available athttps://www.academia.edu/download/61659347/StudentManual_-Drury_Q___A_Study_book_1_20200102-115374-1jy93px.pdf

Eisenberg, P., 2019. GDF SUEZ case study-evaluation of capital structure, short-term financing and working capital. Available at:https://www.um.edu.mt/library/oar/bitstream/123456789/45996/1/53-127-1-PB.pdf

Fatimah, F., Toha, A. and Prakoso, A., 2019. The Influence of Liquidity, Leverage and Profitability Ratio on Financial Distress:(On Real Estate and Property Companies Listed in Indonesia Stock Exchange in 2015-2017). Owner: Riset dan Jurnal Akuntansi, 3(1), pp.103-115. Available athttp://owner.polgan.ac.id/index.php/owner/article/download/102/46

Gökalp, E., Gökalp, M.O., Çoban, S. and Eren, P.E., 2018, September. Analysing opportunities and challenges of integrated blockchain technologies in healthcare. In Eurosymposium on systems analysis and design (pp. 174-183). Springer, Cham. available at: https://www.researchgate.net/profile/Ebru-Goekalp/publication/327229059_Analysing_Opportunities_and_Challenges_of_Integrated_Blockchain_Technologies_in_Healthcare/links/5f256cc692851cd302ceaec0/Analysing-Opportunities-and-Challenges-of-Integrated-Blockchain-Technologies-in-Healthcare.pdf

Kelly, K. and Seow, J.L., 2018. Research note: Investor perceptions of comparable-to-industry versus higher-than-industry pay ratio disclosures. Management Accounting Research, 38, pp.51-58. Available at:https://ink.library.smu.edu.sg/cgi/viewcontent.cgi?article=2788&context=soa_research

Marchi, B. and Zanoni, S., 2017. Supply chain management for improved energy efficiency: Review and opportunities. Energies, 10(10), p.1618. available at: https://www.mdpi.com/1996-1073/10/10/1618/pdf

Muscoloni, A. and Cannistraci, C.V., 2019. Navigability evaluation of complex networks by greedy routing efficiency. Proceedings of the National Academy of Sciences, 116(5), pp.1468-1469. Available at:https://www.pnas.org/content/pnas/116/5/1468.full.pdf

Nambisan, S., Siegel, D. and Kenney, M., 2018. On open innovation, platforms, and entrepreneurship. Strategic Entrepreneurship Journal, 12(3), pp.354-368. available at: https://brie.berkeley.edu/sites/default/files/brie_wp_20185.pdf

Razafimandimby, C., Loscri, V. and Vegni, A.M., 2016, April. A neural network and IoT based scheme for performance assessment in internet of robotic things. In 2016 IEEE first international conference on internet-of-things design and implementation (IoTDI) (pp. 241-246). IEEE. available at: https://hal.inria.fr/hal-01261842/file/Cristanel-Razafimandimby-paper.pdf

Richardson, L.J., 2018. Ethical challenges in digital public archaeology. Journal of Computer Applications in Archaeology, 1(1), pp.64-73. available at: https://ueaeprints.uea.ac.uk/id/eprint/68927/1/13_158_1_PB.pdf

Websites

boohooplc.com 2021. boohoo-com-plc-annual-report-2021 available at:https://www.boohooplc.com/sites/boohoo-corp/files/all-documents/result-centre/2020/boohoo-com-plc-annual-report-2021.pdf [accessed on 18 September 2021]

boohooplc.com, 2020. boohoo-com-plc-annual-report-2020 available at: https://www.boohooplc.com/sites/boohoo-corp/files/all-documents/result-centre/2020/boohoo-com-plc-annual-report-2020-hyperlink.pdf [accessed on 22 September 2021]

boohooplc.com, 2021 boohoo-com-plc-annual-report-2021 available at: https://www.boohooplc.com/sites/boohoo-corp/files/all-documents/result-centre/2020/boohoo-com-plc-annual-report-2021.pdf [accessed on 25 September 2021]

great.gov.uk 2019 available at:https://www.great.gov.uk/international/content/about-uk/industries/technology/ [accessed on 22 September 2021]

heritage.org, 2021 United Kingdom available at:https://www.heritage.org/index/country/unitedkingdom [accessed on 22 September 2021]

wsj.com , 2021, Boohoo.Com PLC available at:https://www.wsj.com/market-data/quotes/BHHOF/financials [accessed on 20 September 2021]

www.boohooplc.com, 2021 annual report of boohoo available at:https://www.boohooplc.com/sites/boohoo-corp/files/all-documents/result-centre/2020/boohoo-com-plc-annual-report-2020-hyperlink.pdf