BU7006 STRATEGIC FINANCIAL MANAGEMENT ASSIGNMENT SAMPLE

1. Introduction

Strategic financial management is found to be highlighted as an efficient management process to maintain an optimal level of finances within the organizations that are further aimed at achieving company-specific strategic goals and objectives.

Moreover, the current study has focused on depicting the critical analysis of the ratio calculations undertaken for JD Group Plc with a closer understanding of the major reasons underlying the change in financial performance for the company.

Furthermore, the current report has also focused on incorporating a PEST analysis for focusing on the external developments that have happened within the organization in the past. Moreover, the report has also significantly highlighted the SWOT analysis for the current organization to focus on the innate strengths, opportunities, weaknesses and threats of the selected organisation.

The selected organisation, JD Group Plc was further found to lead in the global omnichannel fashion retailer, being the sports and outdoor brand established in 1981 in England.

Furthermore, the current company was found to currently operate with record stores of 3300 across 29 countries with a significant presence in the UK, Europe, Asia Pacific and North America. Although focusing on the mission statement laid out by the organisation, it has emerged to focus on global standards set out for the maintenance of ideal retail experiences for the consumers by providing best-in-class operations and a high level of connections between authentic product delivery and consumer experiences.

The company was also found to highlight the competitive values of responsibility and entrepreneurial spirit in their current and past improvements in financial performance.

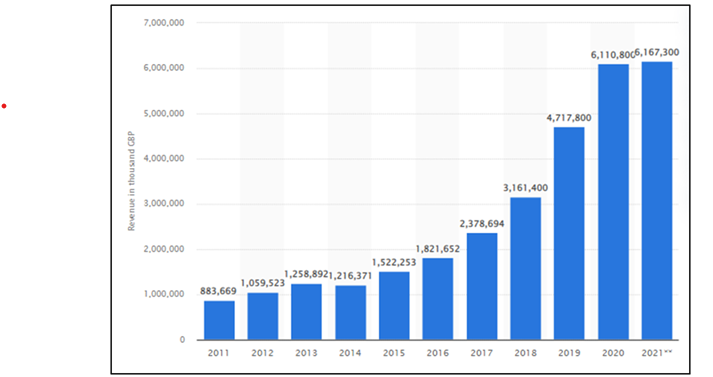

Figure 1: JD group revenue growth from 2011 to 2021

(Source: Statista, 2021)

The above figure hereby highlights the increasing revenue levels within the company for the financial period of 2011-2021. Therefore, the current report has focused on the understanding of the drastic increase in revenue and profitability generations for the company in the past decade. The figure depicted above has further highlighted the increase in the overall valuation of 6.17 billion GBP which has increased seven times more than that in 2011 (Statista, 2021). http://BU7006 STRATEGIC FINANCIAL MANAGEMENT ASSIGNMENT SAMPLE

Moreover, the executive chairman of the company was found to incorporate knowledge of the increasing revenue levels for investment valuation made during the past years helping in further improvements of multichannel propositions and development of physical and digital retail within organisations (Bbc, 2018).http://BU7006 STRATEGIC FINANCIAL MANAGEMENT ASSIGNMENT SAMPLE

2. Ratio Analysis

The current part of the report has focused on depicting the ratio analysis for JD group PLC concerning the fields of liquidity, profitability, efficiency and investment ratios.

2.1 Profitability ratios

Profitability ratios are focused on highlighting the organisation’s ability to generate income after paying off its expenditures during a financial period (Zorn et al. 2018). http://BU7006 STRATEGIC FINANCIAL MANAGEMENT ASSIGNMENT SAMPLEThe current study has heard by analysed and calculated food different profitability ratios for the company highlighted below,

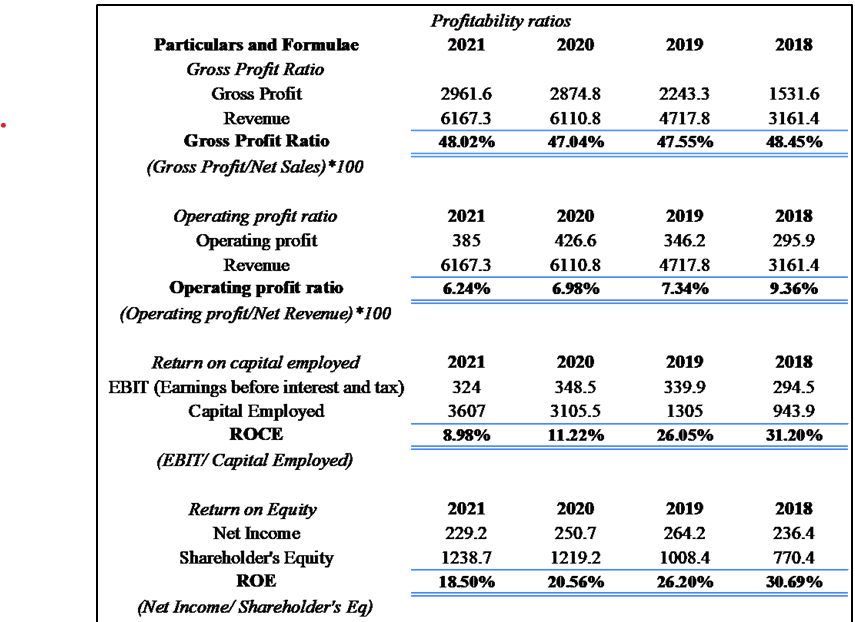

Figure 2: Profitability ratio calculations

(Source: Self Developed)

The figure depicted above highlights the calculations of the profitability ratio for JD Group PLC. Upon closer analysis, it can be stated that the gross profitability has maintained around 48% during the period 2018 to 2021 respectively.

However, the significant reason behind high levels of gross profitability for the firm has been recorded as a significant rise in investments by the company that has significantly helped in the improvement of overall profitability levels due to an increase in revenue generation over the period.

Therefore the firm has been able to maintain higher gross profit levels over the industrial level of 41%.

The operating profit ratio is also found to provide companies with the ability to finance their operation activities from the profits gained during a particular financial period. Furthermore, the calculations depicted above show a minor decline in the operating profits for the firm declared from 9% in 2018 to 7% in the subsequent year which has been reduced to 6% in 2020.

However, it has impacted the operating ratio due to lower operation and profits during 2020 and 2021 and the primary reason being fluctuations in the fair value of investment security reducing the overall profitability levels for the organisation.

Furthermore, focusing on the calculations for return on capital employed, it has been calculated by dividing earnings before interest and tax from the capital employed as depicted in the figure. Moreover, there has been a significant decline in ROCE from 31% in 2018 to 26% and 11% respectively in 2019 to 2020 (Jdplc, 2021).http://BU7006 STRATEGIC FINANCIAL MANAGEMENT ASSIGNMENT SAMPLE

Furthermore, the ROCE of the organisation reduced to 9% in 2021 which has been below the industrial average of 20% in the past 2 years respectively. Therefore, it can be linked with the reduced competitive advantage for the company as it is an important factor to ascertain the profitability levels for the form based on investment capital.

Moreover, the return on equity for the company has been calculated for understanding the financial performance after dividing the net income levels from the shareholder’s equity (Mondal and Ghosh, 2012).http://BU7006 STRATEGIC FINANCIAL MANAGEMENT ASSIGNMENT SAMPLE Furthermore, the ROE levels for the company declined significantly from 31% to 26% from 2018 to 2016 along with 21% and 19% in the period of 2020 to 2021 (Jdplc, 2021). http://BU7006 STRATEGIC FINANCIAL MANAGEMENT ASSIGNMENT SAMPLE

Furthermore, a significant reduction in return on equity levels for the company was recorded due to a significant decline in the net profitability and income levels from the equitable shareholder funds held within the company. Therefore the concerning decline in profitability levels for the organisation has resulted in a reduced return on equity levels with a significant loss of investors’ perceptions of the company.

2.2 Liquidity ratios

Liquidity ratios are mainly found to be calculated for understanding the overall conditions of organisations in paying off their short-term obligations or debt levels along with the margin of safety to maintain ready available stock or cash in hand. The calculation of liquidity ratios like during and current ratio or hereby highlighted below,

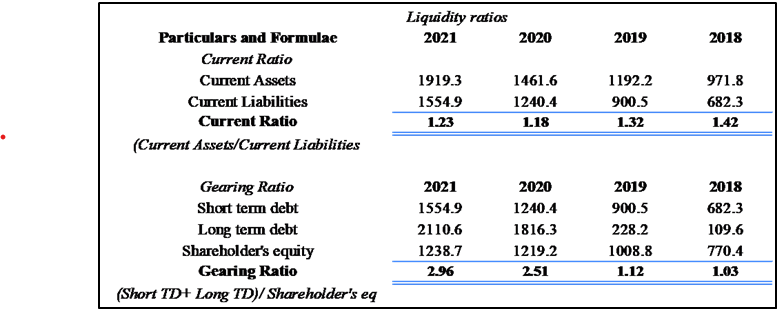

Figure 2: Liquidity ratio calculations

(Source: Self-Developed)

The above figure has significantly focused on highlighting the calculations of liquidity ratios as the current ratio formula was calculated by “dividing the current assets by the current liabilities”.

The result highlighted above states stable levels of liquidity maintained by the company having over the industrial average of 1. The gearing ratio for the company has been calculated after comparing the borrowed funds by the owners or shareholders’ capital for understanding the degree of funds being utilised to maintain liabilities held by the firm.

The gearing ratio has significantly increased for the organisation recording from 1.03 to 1.12 in the period of 2018-2019 which has emerged to again increase towards 2.51 in 2020 and 2.96 during 2021 (Jdplc, 2021).http://BU7006 STRATEGIC FINANCIAL MANAGEMENT ASSIGNMENT SAMPLE Moreover, the shareholder’s funds are also found to reduce the debt levels which can be stated as a negative aspect for the stakeholders in the future of the organisation.

2.3 Efficiency ratios

Efficiency ratios or calculated to hear by analysing the organisation’s ability to the utilisation of assets and liabilities held during a particular financial period (Osazefua Imhanzenobe, 2020). http://BU7006 STRATEGIC FINANCIAL MANAGEMENT ASSIGNMENT SAMPLE

Moreover, the current report has incorporated calculations for two efficiency ratios that are nearby highlighted below,

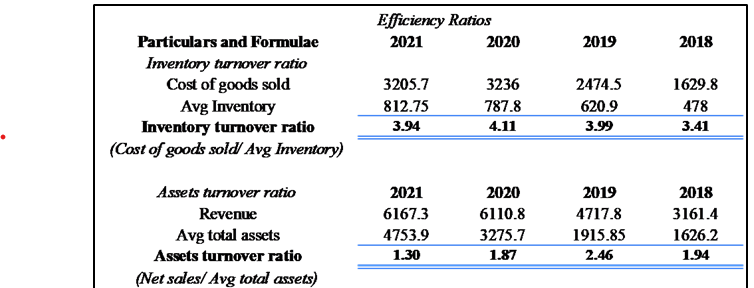

Figure 3: Efficiency ratio calculations

(Source: Self-Developed)

The figure depicted above highlights efficiency ratio calculations for GD group PLC as the inventory turnover for the company emerged to perform at an exceptional level during the period of 2018 to upon closure analysis the inventory turnover ratio for the firm has increased from 3.4 to 4.1 during 2018 to 2020 which slightly declined to 3.94 in 2021 (Jdplc, 2021). http://BU7006 STRATEGIC FINANCIAL MANAGEMENT ASSIGNMENT SAMPLE

Therefore the inventory turnover improvement has been possible due to maximized selling of goods due to a significantly higher demand for their products in the market.

Furthermore, the record inventory turnover during the period is above the industrial average. Moreover, the company was able to manage high levels of demand for particular products in channels for acquired sportswear brands and brand sportswear deliveries.

The asset turnover ratio for the current organisation has declined from 1.94 to 1.87 in a period of 2 years which declined to 1.3 in 2021 (Jdplc, 2021).http://BU7006 STRATEGIC FINANCIAL MANAGEMENT ASSIGNMENT SAMPLE

Therefore the decline in results highlights a major reduction of efficient assets used by the organisation over the concerned period which is below the industrial average of 2.5.

2.4 Investment ratios

Investment ratios are found to be calculated to focus on the relationship between the amount of money spent and subsequent prophets made by the stakeholders from a particular organisation’s stock (Shahnia et al. 2020).http://BU7006 STRATEGIC FINANCIAL MANAGEMENT ASSIGNMENT SAMPLE

Moreover, the current report has highlighted calculations of the price-earnings ratio and earnings per share for future investors and stakeholders of JD Group PLC.

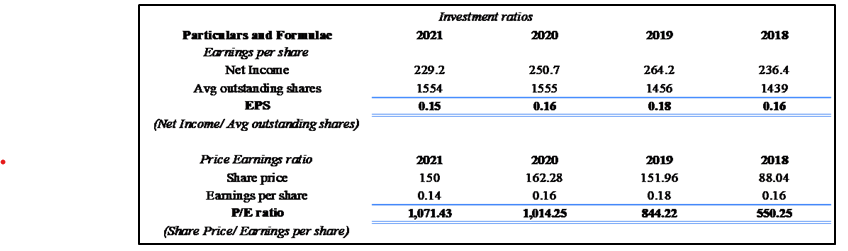

Figure 4: Investment ratio calculations

(Source: Self-Developed)

The figure depicted above focused on highlighting the calculations of investment ratios for JD Group PLC which has recorded exceptionally good performance in price-to-earnings ratio. Upon further analysis of the calculations, the PE ratio of the company has increased from 550.25 in 2018 to 1014.25 in 2020 which has further increased to 1071.43 in 2021 (Jdplc, 2021).http://BU7006 STRATEGIC FINANCIAL MANAGEMENT ASSIGNMENT SAMPLE

Moreover, the increased levels of price-to-earnings ratio mentioned by the organisation can be related to the overvaluation of stock along with the peculations of high growth rate for the company shares in the future.

However, an increase in the price-earnings ratio is found to be potential e dangerous for future investors as it is found to hold stock values and feeling to meet the actual understanding of the financial position of a company.

Moreover, the calculations for earnings per share related to JD Group PLC have been on a declining trend having recorded 0.16 during 2018 which has further reduced to 0.14 during the period of 2020 to 2021 (Jdplc, 2021).http://BU7006 STRATEGIC FINANCIAL MANAGEMENT ASSIGNMENT SAMPLE

Furthermore, the overall decline in the EPS for the organisation is found to signify a poor indication related to the financial health of the organisation through lower return generation for the investments made highlighting the negative prospect of growth.

This has been an effective measure for the organisation as it significantly fields on gaining adequate levels of earnings from the investments made by the organisation during the particular financial period.

Although it has emerged to highlight a better potential in earnings growth the ROE levels were also aligned with the same depicting better equity retention and profit levels for the company (Simplywall.st, 2022).http://BU7006 STRATEGIC FINANCIAL MANAGEMENT ASSIGNMENT SAMPLE

3. Significant developments for JD Group

3.1 Pest analysis

In this section of the study, PEST analysis has been conducted for JD Sports Plc that evaluates external factors such as political factors, economic factors, social factors and technological factors.

Political factors: The political scenario of the country has been found to be highly stable reflecting a friendly and stable business environment with anticipated market growing trends.

The concerned company has been found to be operating in several countries; however, the company is headquartered in the UK, which can be stated to possess a stable political condition. Although due to the Covid-19 effect, there have been changes in the ministry, yet the country was found to restore its political stability within a few months (Santandertrade, 2022).http://BU7006 STRATEGIC FINANCIAL MANAGEMENT ASSIGNMENT SAMPLE Moreover, the level of corruption in the country has been less which positively contributed to growth and development of businesses thereby also assisting JD Sports Plc in continuing with the operations.

In this case, despite the positive political stability, the organisation was found to face potential challenges as the JD Sports and Rangers football club were found to be charged with fixing the product prices of the Scottish football club from September 2018 to July 2019.

This, in turn, spread outrage in the external environment and the CMA (“Competition and Markets Authority”) was bound to highlight the results of the investigation thereby acknowledging the charges being true (Morningstar.co.uk, 2022).http://BU7006 STRATEGIC FINANCIAL MANAGEMENT ASSIGNMENT SAMPLE

Economic factors: The economic growth of the UK was found to be slow since 2016 due to the Brexit, however, with efficient and effective strategies, the UK government was found to restore the economic condition of the country that potentially assisted the discussed company reflecting the wider opportunities of growth.

In this respect, it has been found that the annual growth of GDP in 2020 was 7.4% reflecting a decline by 9.3% compared to 2019 (Data.worldbank.org, 2021). http://BU7006 STRATEGIC FINANCIAL MANAGEMENT ASSIGNMENT SAMPLEThe pandemic situation decreased the GDP growth of the nation thereby lowering the positive economic growth. Concerning this situation, it can be mentioned that the recovery from Brexit and Covid-19, has exceptionally provided growth opportunities for the firm with higher rates of GDP.

Moreover, it has been evident from studies that the rate of employment in the UK has been high depicting a percentage of 75.5% which also significantly contributed to the growth of the company with the increased availability of employees in the UK market (Ons.gov.uk, 2022).http://BU7006 STRATEGIC FINANCIAL MANAGEMENT ASSIGNMENT SAMPLE

On the other hand, it has been found that despite the sound condition of the UK economy, the inflation rates in the country have been significantly high. In 2022, the inflation rates reached 10.1% from 5.4% in 2020 reflecting a significant increase (Clark. D, 2022).http://BU7006 STRATEGIC FINANCIAL MANAGEMENT ASSIGNMENT SAMPLE

The prices of the gas and oil have been high in the country reflecting a higher inflation. It can be thus stated that the higher inflation situation has negatively affected the business operations of the mentioned company thereby reducing the operational efficiency.

Social factors: The demographic statistics in the UK have been found to be affecting the operations of JD Sports Plc showcasing the factors such as population age, migration trends and other socioeconomic variables.

As emerged from studies, the concerned company has been found to sign a contract and agreement with two million employees in the country for 5 years, who would be handed over from the data centres and back office towards the company’s upgrade (Itpro.co.uk, 2018).http://BU7006 STRATEGIC FINANCIAL MANAGEMENT ASSIGNMENT SAMPLE

Furthermore, it has been found that the UK holds less power distance levels reflecting the equal distribution of power amongst the employees within the UK organisations.

This reflects the maintenance of a balanced organisational structure that can exceptionally assist firms in improving their organisational performance. However, the mentioned company was also found to have a stable organisational structure that helped in retaining efficient employees and recruiting new employees.

Technological factors: The UK is considered to be the technological hub as it possesses a developed technological infrastructure. JD Sports Plc, in this respect, has been found to develop its innovative marketing strategies and policies that have helped the company in aligning with the developed information technology of the UK that has driven the customer engagement levels.

In addition to this, it has been evident that the company has been dependent on social media marketing that has significantly assisted the firm in obtaining the customer’s attention in the market through digital advertisements.

Additionally, with the incorporation of the digital technology, the company has also been found to include digital devices succubus interactive mirrors and on-screen video advertisements that have also essentially helped in grabbing the attention of the customers in the UK market (Jdplc, 2022a). http://BU7006 STRATEGIC FINANCIAL MANAGEMENT ASSIGNMENT SAMPLE

Furthermore, the company also obtained the purchasing the perceptions of the customers through the digital devices. However, the concerned firm was also noticed to incorporate 3D printing so that it can attract the customer’s attention in the local markets as well.

3.2 Evaluation of significant developments

Based on the PEST analysis of JD Sports Plc, it can be stated that the political condition of the operating market, the UK has been stable. In this case, the company has been found to develop its business opportunities.

Moreover, the economic stability and the social structure of the UK have been observed to potentially assist the company in improving its employee base reflecting a higher employment and population levels.

Furthermore, organisations within the UK have been found to follow an equal structure where employees are being treated equally. The technological development in the UK and the company has been found to be high which potentially increased the customer base. However, social media marketing and digital technologies have been observed to assist the company in developing its business opportunities in the local as well as global markets.

4. Opportunities and challenges

In this section, the opportunities and challenges faced by the mentioned company have been represented with the conduction of the SWOT analysis.

4.1 SWOT analysis

The strength, weakness, opportunities and weakness of the company have been analysed.

| Strengths

● Authentic base of supplier ● Strong distribution network (Jdplc, 2022b) ● Improved performance in new markets such as Portugal and Spain (Reuters, 2022) ● Automated operational activities ● Increased customer engagement, satisfaction ● High sales and profitability |

Opportunities

● Lower transportation and shipping costs ● High levels of free cash flow ● Advanced technological infrastructure for undertaking pricing strategies based on market analysis with technological assistance |

| Weaknesses

● Lower organisational diversity ● Inefficient management of assets and financial planning ● Inefficient inventory days compared to market competitors |

Threats

● High competition in the market ● Legal threats by CMA for price fixing and liability claims received by the company ● Increased demand for raw materials along with increase in the prices of the same. |

Table 1: SWOT analysis of JD Sports Plc

(Source: Self-developed)

Strengths

As emerged from the SWOT analysis, the discussed organisation has immense strength that can help the company in utilising the market opportunities. In this situation, it has been found that the company has been reliant on authentic suppliers in the market and thus have maintained a sound relationship with them that has strategically benefited them.

In addition to this, it can be stated that the distribution network of the organisation has been strong reflecting an effective supply chain management system. Moreover, it has been evident from the analysis that the company has integrated automation activities concerning its operations in the UK market which has potentially depicted their technological strength.

This, in turn, has positively helped the company in obtaining the attention from the customers thereby increasing the levels of customer engagement. In this context, it can be stated that the company has a strong customer base in the UK with a sound customer satisfaction level. Also, it has reflected higher sales and revenue generations depicting improved profitability. However, it can be mentioned that the performance of the organisation has been better in the new operating markets of Portugal and Spain.

Weaknesses

The company was found to face some weakness levels for reduced levels of financial planning due to inefficient planning for further utilisation of idle assets and the investments were made to record lower profitability levels making it a weaker investment prospect for future investors.

Moreover, the firm has emerged to lack in diversifying its organisational culture leading to a further requirement to reduce its inventory days. The lower diversification of products and services was found to affect the organisational portfolio making the producers face major challenges from the competitors in the market producing differentiated products.

Opportunities

The current company has emerged to highlight significantly stable free cash flow levels during the present years which have provided the organisation with an opportunity to improve its investment levels in the upcoming future.

Moreover, they should also incorporate a reduced costing strategy with their transportation and shipping costs helping them to significantly reduce the production costs for the products being manufactured.

Advancements in technology to incorporate various pricing strategies can be mainly considered by the organisation to focus on and develop a loyal customer base.

Threats

There has been a range of legal dilemmas faced by the company as mentioned by the CMA regarding price fixing for the sports goods that has emerged to significantly impact the loyalty levels of the existing customers (Morningstar.co.uk, 2022). http://BU7006 STRATEGIC FINANCIAL MANAGEMENT ASSIGNMENT SAMPLE

Moreover, there has been a rise in the overall competitor firms within the concerned market and high levels of demand for raw materials that are mainly sourced from the local distributors at higher prices increasing threats in future for the firm.

4.2 Opportunities in the future

The financial analysis of the organisation has emerged to highlight the increased levels of profitability and efficiency levels with higher levels of ROE. Furthermore, comparing the same with the current industry average, the return on equity for the company was found to record 23%.

Moreover, this has highlighted a better and more effective opportunity to grow in the future as it provides a better investment option for future stakeholders and investors.

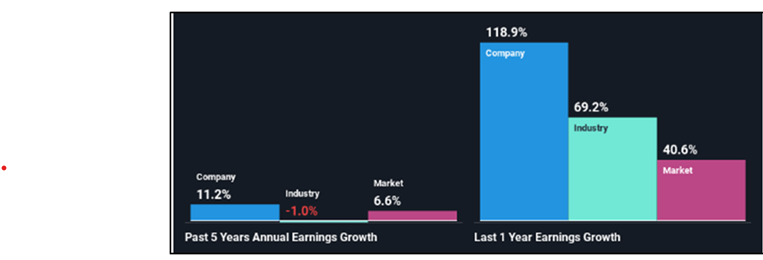

Figure 6: Past annual earnings for JD group comparisons

(Source: Simplywall.st, 2022)

The figure highlighted above states the growth in overall profits and earnings for JD Group Plc within the financial year of 2021 along with comparisons with past five-year annual growth levels.

Upon closer analysis, the growth levels in company earnings are found to record at 11.2% during the period of the past 5 years while the last year’s earnings growth for the company has emerged to increase by 118.9%.

In addition to that, JD sports fashion was found to highlight earnings growth while the payout ratio for the firm was recorded at 4.5% depicting the majority of the investments made within the firm are associated with the profits for business growth. Moreover, the company has also focused on highlighting the sharing levels of profits along with the shareholders with a regular payoff for dividends across the years.

Further focusing on the latest data collected from the annual report of the company has highlighted a future payout ratio for the organisation to increase at a rate of 6.7% in the next few years.

5. Conclusion

The current report has mainly focused on the calculations of ratio analysis to understand the overall financial performance of the organisation JD Group PLC.

Mood over the profitability ratio calculations highlighted significantly developed profitability levels for the company in the past 4 years which has available failed to meet its industrial standards declining profitability was highlighted due to a change in the fair value of investment security made by the organisation for the fluctuations.

Mud word the organisation was also found to record average liquidity levels with the further risk associated with dependency award shareholders funds to mitigate their debt levels. Moreover, this was found to highlight a negative impact on the perceptions of future shareholders.

The efficiency ratio results also highlighted the significant reduction in the usage of total assets held by the organisation in the concerned financial period while the ratios were found to decline below the industrial average. The inventory turnover ratio was found to be significantly above the industrial average due to a high demand for specific products like brand sportswear. The investment ratio on the other hand was high due to increased levels of earnings per share and price earnings ratio.

The study concluded that the performance of JD Sports Plc has been sound in the UK market due to the assistance of the external market factors. In this case, it can be concluded that the recovery of the UK economy has potentially improved the performance of the company in the market and also increased the growth opportunities.

The employment rates along with the GDP rates have essentially assisted the company in performing better. On the other hand, it can be concluded that the organisational structure and the technological assistance of the UK have also significantly helped in continuing with the company’s operations.

In this case, the study further concluded that the use of digital technologies and social media marketing has exceptionally helped the company in gaining the attention of the customers.

This has also helped the firm in increasing its sales and the overall profitability which can be stated to be one of the major strengths of the company. However, with strong network of distribution, automated services and improved customer satisfaction, the company has been found to perform well in the UK markets reflecting a positive organisational growth.

The current study has further focused on the improvement of profitability levels and future opportunities through increasing earnings to meet the industrial average. The future investors are hereby recommended to focus on the next earnings or dividend paid out to the beat the expected earnings before investing financials within the company stock.

Reference List

Bbc, (2018) How JD Sports became a £5bn company Available at: https://www.bbc.com/news/business-45482460 [Accessed on 21/09/2022]

Clark.D, (2022), Inflation rate for the Consumer Price Index (CPI) in the United Kingdom from January 1989 to August (2022), Available at https://www.statista.com/statistics/306648/inflation-rate-consumer-price-index-cpi-united-kingdom-uk/ [Accessed on 21/09/22]

Data.worldbank.org, 2021, GDP growth (annual %) – United Kingdom, Available at https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG?locations=GB [Accessed on 21/09/2022]

Itpro.co.uk, (2018). JD Sports outsources data centre Available at: https://www.itpro.co.uk/182136/jd-sports-outsources-data-centre [Accessed on: 10/06/2022]

Jdplc, (2021). ANNUAL REPORT AND ACCOUNTS 2021 Available at: https://files.jdplc.com/pdf/reports/annual-report-2021.pdf [Accessed on: 21/09/2022]

Jdplc.com, (2022a) Our Strategy Available at: https://www.jdplc.com/investor-relations/our-strategy [Accessed on 21/092022]

Morningstar.co.uk, (2022). TOP NEWS: JD Sports and Rangers Football Club guilty of price-fixing Available at: https://www.morningstar.co.uk/uk/news/AN_1654590239387689000/top-news-jd-sports-and-rangers-football-club-guilty-of-price-fixing.aspx [Accessed on 21/09/2022]

Morningstar.co.uk, (2022). TOP NEWS: JD Sports and Rangers Football Club guilty of price-fixing Available at: https://www.morningstar.co.uk/uk/news/AN_1654590239387689000/top-news-jd-sports-and-rangers-football-club-guilty-of-price-fixing.aspx [Accessed on 21/09/2022]

Osazefua Imhanzenobe, J., 2020. Managers’ financial practices and financial sustainability of Nigerian manufacturing companies: Which ratios matter most?. Cogent Economics & Finance, 8(1), p.1724241.

Reuters, (2022) BRIEF-JD Sports announces potential tie-up with Spain & Portugal’s Sport Zone Available at: https://www.reuters.com/article/brief-jd-sports-announces-potential-tie-idUSFWN1GM03U [Accessed on 21/09/2022]

Santandertrade, 2022, UNITED KINGDOM: ECONOMIC AND POLITICAL OUTLINE, Available at https://santandertrade.com/en/portal/analyse-markets/united-kingdom/economic-political-outline [Accessed on 21/09/22]

Shahnia, C., Purnamasari, E., Hakim, L. and Endri, E., 2020. Determinant of profitability: Evidence from trading, service and investment companies in Indonesia. Accounting, 6(5), pp.787-794.

Simplywall.st, (2022). Will Weakness in JD Sports Fashion plc’s (LON:JD.) Stock Prove Temporary Given Strong Fundamentals? Available at: https://simplywall.st/stocks/gb/retail/lse-jd./jd-sports-fashion-shares/news/will-weakness-in-jd-sports-fashion-plcs-lonjd-stock-prove-te [Accessed on 21/09/2022]

Statista, (2021). Revenue of JD Sports Fashion Plc worldwide from financial year 2011 to 2021 Available at: https://www.statista.com/statistics/438812/jd-sports-fashion-revenue/ [Accessed on 21/09/2022]

Zorn, A., Esteves, M., Baur, I. and Lips, M., 2018. Financial ratios as indicators of economic sustainability: A quantitative analysis for Swiss dairy farms. Sustainability, 10(8), p.2942.