BU7006 Strategic Financial management sample

1. Introduction

Financial management involves handling business financial resources in such a way that organizations remain profitable and at the same time comply with rules and regulations accordingly and it also helps businesses to do financial planning. Financial management is significant for businesses as it helps them to attract investment and earns shareholders’ financial gains ensuring optimal use of funds and also providing new opportunities for development. Boohoo was founded in 2006 in Manchester in the UK by Mahmud Kamani and Carol Kane in the historical textile district and promoted innovative fast fashion to young consumers. This study focuses on financial and non-financial development over the years of Boohoo which is a retail fashion business in the UK popular among consumers for fast fashion and online presence. Boohoo mainly targets 16 to 30 years age bracket of consumers and it has over 3600 products unique in the sense that Boohoo only sells its own products and also has stores overseas.

2. Ratios for financial years 2018-2021

Investors’ Ratios

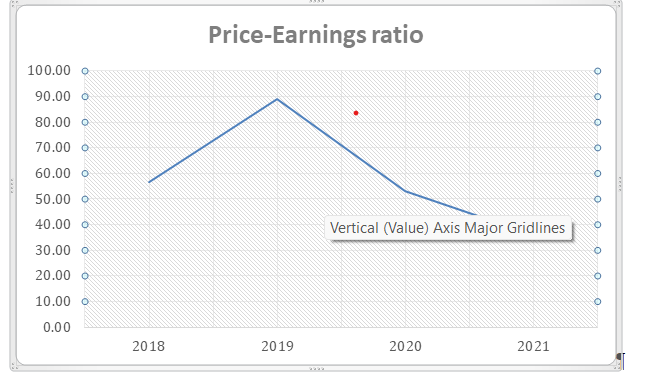

| Specifications | 2018 | 2019 | 2020 | 2021 |

| Company’s share price in market/Earnings per share | £157.6/£2.78 | £290.6/£3.27 | £290.4/£5.48 | £265.95/£7.43 |

| Price-Earnings ratio | 56.69 | 88.87 | 52.99 | 35.79 |

The price-Earnings ratio of Boohoo is 35.79 which means shares of Boohoo are trading on 34.79times higher than the current EPS. However, the shares of Boohoo were trading on 52.99times higher than the EPS of 2020. http://Best BU7006 Strategic Financial management The share value of Boohoo was the highest in 2019 in the last 4 years. As per these results, undervaluation of Boohoo Plc’s shares has been found.

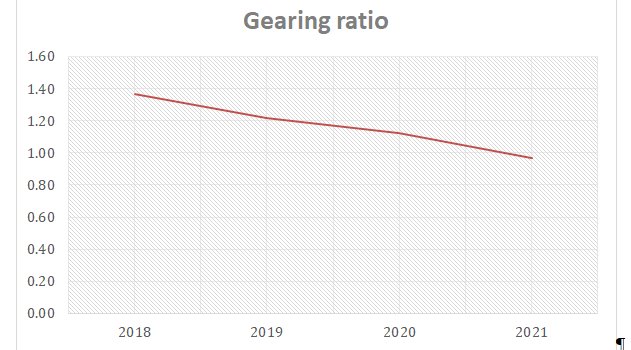

| Specifications | 2018 | 2019 | 2020 | 2021 |

| Liabilities or Debts/Shareholders funds | £114108m/£212779m | £169374m/£270402m | £241556m/£327935m | £303400m/£472500m |

| Gearing ratio | 1.37 | 1.22 | 1.13 | 0.97 |

The gearing ratio compares the form of owner’s equity with borrowed funds of the company. So, if the borrowed fund of the venture exceeds equity, a high leverage risk can be found in the company (Nuryani and Sunarsi, 2020).http://Best BU7006 Strategic Financial management Boohoo Plc has adequate maintenance of capital structure as a gradual reduction in borrowed capital has been found since 2019. The company has the highest gearing ratio in 2018 which is 1.37 which has been reduced to 0.97 in 2021.http://Best BU7006 Strategic Financial management

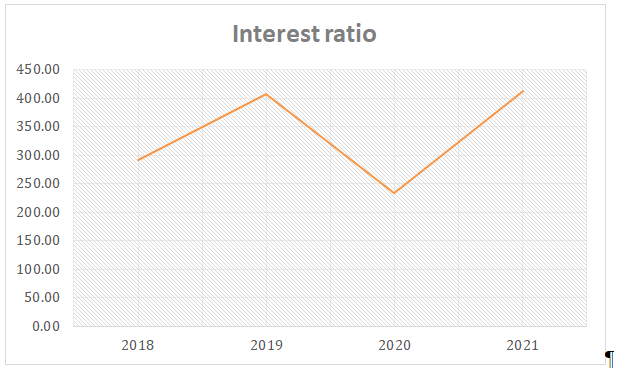

| Specifications | 2018 | 2019 | 2020 | 2021 |

| EBIT/Interest | £42685m/£146m | £58680m/£144m | £90896m/£390m | £124100m/£300m |

| Interest ratio | 292.36 | 407.50 | 233.07 | 413.67 |

The interest ratio defines the period over which a company pays interest on outstanding debts. Boohoo Plc’s interest ratio has doubled in 2021 as compared to 2020.http://Best BU7006 Strategic Financial management Besides, a gradual improvement in interest ratio has been found in the last 4 years. It means Boohoo Plc’s performance is well in paying interest on outstanding dues.

Liquidity Ratios

| Specifications | 2018 | 2019 | 2020 | 2021 |

| Absolute cash equivalent/Liability(Current) | £142575m/£104394m | £197872m/£162093m | £245400m/£217906m | £276000m/£285700m |

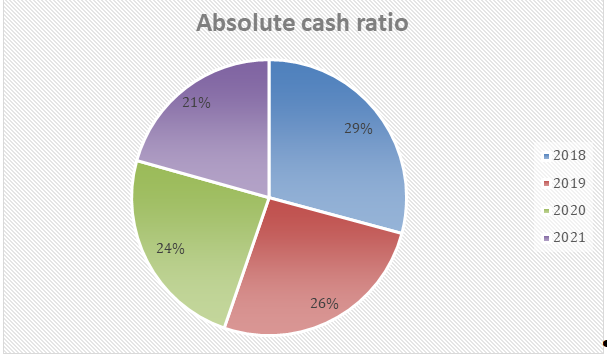

| Absolute cash ratio | 1.37 | 1.22 | 1.13 | 0.97 |

The absolute cash ratio takes into account liquid assets like cash at the bank, cash in hand, and other marketable securities for determining the liquidity position of the business. According to Alali et al. (2021), effective use of liquid assets helps a business in paying off short-term liabilities. Boohoo Plc’s absolute cash ratio is declining since 2019. It means the company is not maintaining enough cash for paying off current liabilities.

| Specifications | 2018 | 2019 | 2020 | 2021 |

| Asset(Current)/Liability(Current) | £215092m/£104394m | £296323m/£162093m | £382982m/£217906m | £483000m/£285700m |

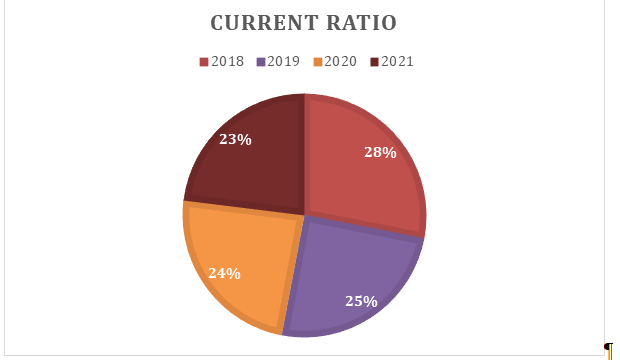

| Current ratio | 2.06 | 1.83 | 1.76 | 1.69 |

The current ratio is used for understanding the working capital position of the business. Boohoo Plc has a 1.69times current ratio in 2021 which was higher in the last 3 years. The company has the highest current ratio in 2018 which means the working capital position of Boohoo Plc has declined.

| Specifications | 2018 | 2019 | 2020 | 2021 |

| Asset(Current)/Inventories(Closing)/ Liability (Current) | £215092m-£48248m/£104394m | £296323m-£66806m/£162093m | £382982m-£99107m/£217906m | £483000m-£14490m/£285700m |

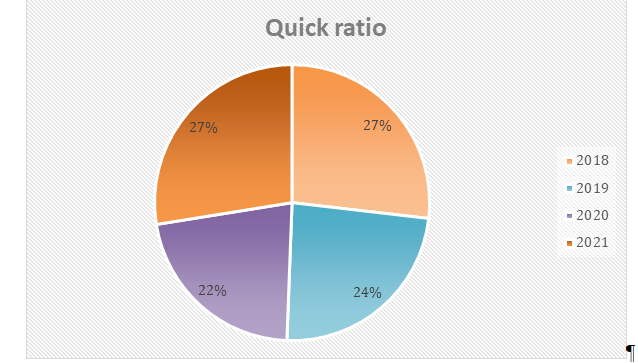

| Quick ratio | 1.60 | 1.42 | 1.30 | 1.64 |

Quick ratio defines whether the company is able to retire its current liabilities with quick assets or not. This ratio neglects closing inventories from current assets for calculating quick assets (Shehata and Rashed, 2021). http://Best BU7006 Strategic Financial management This ratio defines the good liquidity of Boohoo Plc as it neglects closing stock. Boohoo has the lowest closing stock in 2021 which has boosted its liquidity position.

Efficiency Ratios

| Specifications | 2018 | 2019 | 2020 | 2021 |

| Receivables*365(Total operating days)/Revenue from sales | £17499m*365/£579800m | £22576m*365/£856920m | £31828m*365/£1234876m | £40600m*365/£1745300m |

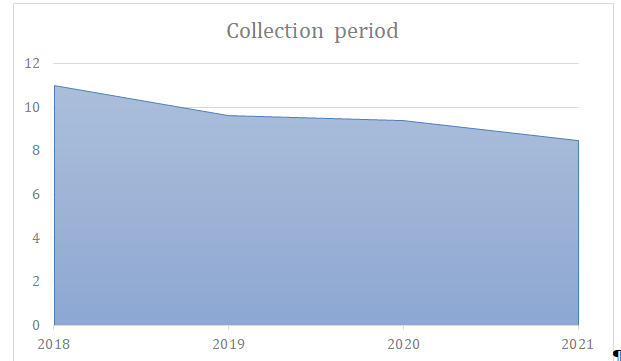

| Collection period | 11 | 10 | 9 | 8 |

The collection period shows the amount of time it takes for an organization to receive payment owed by clients. Boohoo Plc has received payment from clients in less time in 2021. Comparing the last 4 years’ performance, improvement in performance has been found along with a gradual reduction in the collection period.

| Specifications | 2018 | 2019 | 2020 | 2021 |

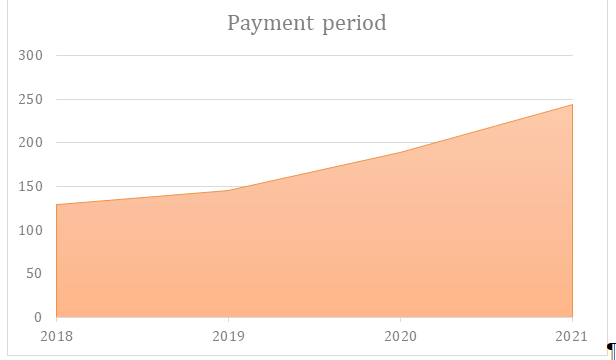

| Payables*365(Total operating days)/Sales cost | £96670m*365/£273445m | £154351m*365/£387926m | £293000m*365/£568640m | £535000m*365/£800100m |

| Payment period | 129 | 145 | 188 | 244 |

The payment period shows the amount of time it takes for an organization to make payments owed to suppliers (Atidhira and Yustina, 2017). Boohoo Plc has made payments to suppliers in 244days in 2021. Comparing the last 4 years’ performance, a reduction in performance has been found along with swift improvement in a payment period.

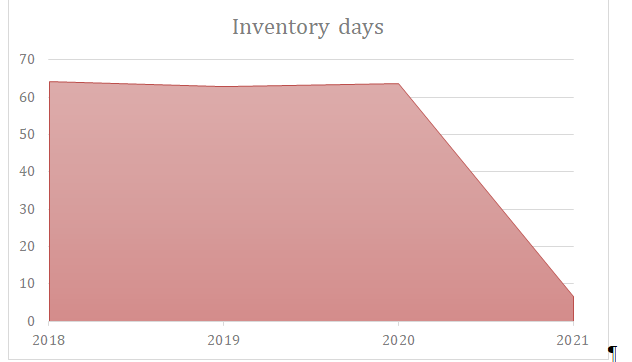

| Specifications | 2018 | 2019 | 2020 | 2021 |

| Inventories*365(Total operating days)/Sales cost | £48248m*365/£273445m | £66806m*365/£387926m | £99107m*365/£568640m | £14490m*365/£800100m |

| Inventory days | 64 | 63 | 64 | 7 |

The inventory period is an efficiency ratio that measures the average number of days an organization holds its inventory before selling it. The inventory period of Boohoo Plc is 7 days in 2021 which defines the good performance of the company. In the last 3 years, a higher inventory period has been found due to higher closing stocks.

Profitability Ratios

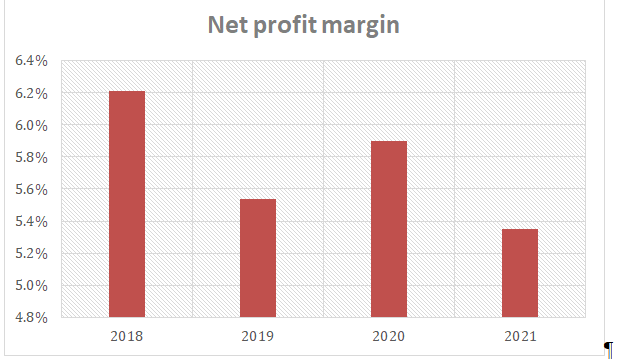

| Specifications | 2018 | 2019 | 2020 | 2021 |

| Profit(Net)/revenue*100 | £36000m/£579800m | £47459m/£856920m | £72883m/£1234876m | £93400m/£1745300m |

| Net profit margin | 6.2% | 6% | 5.9% | 5.4% |

Net profit margin defines profit generated from revenue. If a company generates a higher net income, it is performing well in the market (Atrill and McLaney, 2019).http://Best BU7006 Strategic Financial management The net profit margin of Boohoo is 5.4% in 2021 which is 0.5% lower than in 2020 and 0.6% lower than in 2019. The company has the highest net profit margin in 2018 which defines the declining profitability of Boohoo.

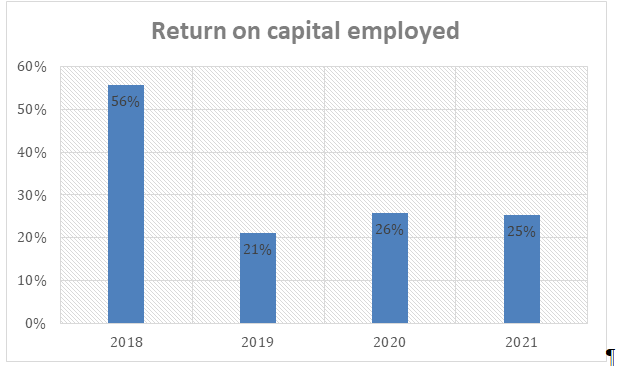

| Specifications | 2018 | 2019 | 2020 | 2021 |

| EBIT/Capital employed*100, Capital employed: Asset-Current liability | £124100m/(£326887m-£104394m) | £58680m/(£439776m-£162093m) | £90896m/(£569491m-£217906m) | £124100m/(£775000m-£285700m) |

| Return on capital employed | 56% | 21% | 26% | 25% |

Return on capital employed is used by companies for analyzing how well capital employed is used in management. Boohoo Plc’s return on capital employed is 25% in 2021 which indicates a 1% reduction from last year. Besides, a reducing position of return on capital employed has been found from 2019. http://Best BU7006 Strategic Financial management

| Specifications | 2018 | 2019 | 2020 | 2021 |

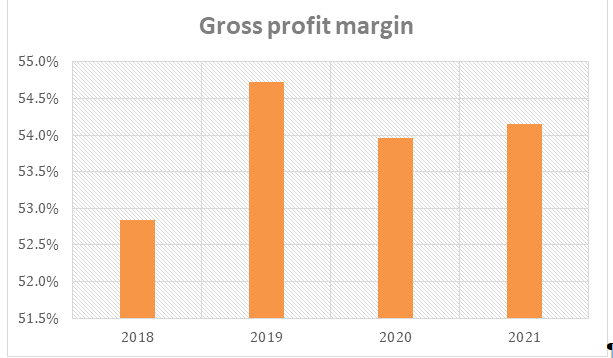

| Profit(Gross)/revenue*100 | £306355m/£579800m | £468994m/£856920m | £666300m/£1234876m | £945200m/£1745300m |

| Gross profit margin | 52.8% | 54.7% | 54.0% | 54.2% |

Gross profit margin is an analytical matrix to determine the gross income of a company. As per Drury (2018),http://Best BU7006 Strategic Financial management gross profit defines how efficiently a company is making a profit from its product and service. Boohoo Plc’s gross profit margin is 54.2% in 2021 which indicates good performance. The gross margin of Boohoo shows sound performance in the last 3 years.

Underlying reasons for financial performance

Boohoo is one of the leading names in the global fashion industry. It delivers more focused on customers, suppliers, people, and stakeholders (Boohooplc, 2021).http://Best BU7006 Strategic Financial management Platform, people, planet, performance, and products are the key focus of Boohoo Plc. It was established in 2006 and faced stagnant growth since 2014. Since its IPO in 2014, Boohoo Plc has delivered strong profitable performance and growth in the global fashion industry (Boohooplc, 2021).http://Best BU7006 Strategic Financial management From a small fashion retailer, it became a medium-sized e-retail in the global fashion industry. The company experienced sound growth from 2014 to 2017. In 2017, the strategic development of Boohoo took place as the company emphasizes on strategic acquisition (Investegate.co.uk, 2021).http://Best BU7006 Strategic Financial management In early 2017, it purchased free-thinking brands Nasty Gal and PrettyLittleThing. This has boosted the group revenue of Boohoo by 47% in 2018 (Boohooplc, 2021). In 2019 the company acquired Karen Millen, Dorothy Perkins, Wallis, MissPap, and Coast brands.

This has helped the company in increasing revenue by 83%. Profit before tax of Boohoo increased by 51% and earnings per share increased by 43% (Boohooplc, 2021).http://Best BU7006 Strategic Financial management In mid of 2020 Boohoo acquired Oasis and Warehouse for selling great quality fashion products at affordable prices. Such strategic decisions have made development in market growth and revenue of the company. During the Covid-19 pandemic, the company made an EBIT of $241.4m net revenue which shows a jump of 32% in the 1st quarter of 2020 (Bbc.co.uk, 2021).http://Best BU7006 Strategic Financial management Acquisition of these brands has made the company a multi-brand platform that is united by a shared customer value proposition. In 2020 the company has 17m active customers from the age group 16-40-year-old individuals. At the start of 2020, the intellectual property rights of Debenhams were acquired by Boohoo which has helped in developing a highly successful direct-to-consumer multi-brand platform (Boohooplc, 2021).http://Best BU7006 Strategic Financial management These actions can be assessed as the underlying reason for the financial growth of Boohoo.

3. PESTLE Analysis

PESTLE analysis of Boohoo

PESTLE analysis stands for Political, Social, Technological, Legal, and Environmental factors affecting the macro environment of the retail sector. It also presents a wider understanding of the challenges Boohoo would face while operating in the competitive retail sector in the UK. This would help Boohoo maximize profits and minimize challenges and helps the company to go through changes easily.

| Factors | Impact |

| Political | ● Brexit created a negative impact on retail sector businesses that are operating online and businesses such as Boohoo suffered due to these political decisions in the UK.

● Other events such as differences between USA and China regarding trade have also impacted UK’s retail business as customer confidence declines worldwide (Martinez et al. 2018).http://Best BU7006 Strategic Financial management ● Since political factors have the potential to disrupt business boohoo plc. Need to consider these factors while preparing a strategy for its business. Political stability is good for business whereas chaos in the political arena leads to distrust among stakeholders as businesses such as Boohoo plc suffer economically as their performances decline. |

| Economic | ● Currency is different in most countries and the exchange rate of the currencies impacts businesses.

● In the views of Garcia et al. (2019) since economic development depends on business performance, growing economies are providing new opportunities for businesses. ● Core infrastructure of countries where Boohoo plc is operating is also responsible for its performance. ● GDP growth is vital for businesses such as Boohoo plc. UK’s GDP has shown a 0.1% increase in 2021 as the nation is still recovering from the impact of Covid -19 which has led to many businesses closing temporarily or permanently as they suffered significant financial damage. |

| Social | ● Social factors have significant effects on success and understanding of the retail sector and its target demographic is key to better performances.

● Boohoo, which operates in the UK and in the international market, needs to be aware of income inequality and adjust its business management model according to these changes. ● Boohoo plc needs to build local teams and partnerships to get a better idea about social norms and adjust its marketing strategies accordingly. ● At the same time focussing on online shopping and recent changes in consumer behavior patterns to remain profitable in UK retail market. |

| Technological | ● Technological advancements are affecting business and understanding these changes is key to the decision-making process for businesses such as Boohoo Plc.

● Marketing on social media platforms such as Facebook and Instagram is part of marketing campaigns for businesses. Boohoo is expected to profit from social media marketing if it found creative ways to promote business. ● Boohoo Plc needs to understand new technologies such as 5G and its effects on consumer experience and it needs to make strategies to invest in research and development. |

| Legal | ● Boohoo Plc needs to understand laws that are there to protect employees’ interests and ensure their safety.

● It needs to become an equal opportunity employer which would protect organizations from potential lawsuits in the future. |

| Environmental | ● Boohoo needs to have proper waste management practices and adopt renewable technology to stop climate change.

● Boohoo needs to manufacture eco-friendly products and market its products to customers and avoid resource depletion by following guidelines. |

Significant development within Boohoo and the retail sector

Significant development within Boohoo

Boohoo fashion retailer from the UK has seen a lot of changes over the years in 2018 its business expanded as consumers preferred online shopping over visiting stores. Its revenue increased 44% and reached £328.2 million in the last 4 months of 2018 (Bbc.com, 2021). http://Best BU7006 Strategic Financial management t sells clothes, shoes, and accessories to a younger demographic and it is revealed to have more than 5 million customers. It faced competition from a rival brand called ASOS during pre-Christmas sales as consumers were selecting brands baked on price and it implemented a competitive pricing strategy to keep profits. From 2018 to 2019 Boohoo further strengthened its position in the UK’s retail market as a trend of online shopping kept going and footfalls in the high street declined. Online retailers such as Boohoo need to be innovative and resilient to operate in a highly competitive fashion market. In view of Chapman et al. (2021) as the brands continue to see profit during 2018 and 2019 it has been warned by experts about slowing down in sales as the brand becomes mature and advised to make an investment in infrastructure and operation. According to analyst Sophie Lund-Yates financial management is key to future success for brands such as Boohoo. In 2021 Boohoo is adopting more sustainable approaches as retailers have made promises to repair its supply chain. In 2020 37% increase in profit has been observed despite Covid-19 as the trend of digital shopping continues among consumers and criticism regarding its supply chain and it is expected to grow 25% in revenues in 2021-2022 (Reuters.com, 2021).http://Best BU7006 Strategic Financial management After an independent review revealed low pay in factories in Leicester and bad working conditions Boohoo adopted the “Agenda for Change” program in 2021. It remained operational during the Covid-19 pandemic driving its revenues to £ 1.75 billion pounds as lockdown forced other businesses to stop operations.

A significant development in the Retail Sector

Many brands in the UK in recent years have adopted fast fashion and made products such as dresses, tops, and skirts in the UK and stopped outsourcing business to Asia. It is helping businesses as it reduces the cost of manufacturing and is able to meet the demands of a new generation of customers as online shopping increases. As stated by Heninger et al. (2020) online shopping saved time in production. Distribution and delivery and made products are available to customers readily. In 2018 Boohoo earned £ 856 million through increased production costs a bit but high demand and sales ensured profit for the business and it helped the business to charge more as clothes were made in the UK (Statista.com, 2021). The retail sector in the UK has other brands that are competing for customers’ attention such as Marks and Spencer (M&S), Next, and ASOS. As stated by Naidoo and Gasparatos, (2018) after the lockdowns were called off by authorities and the success of vaccination drives, businesses and customers are becoming optimistic about the future prospects. High street reopens which would boost retail sector sales and consumer-led recovery is expected in 2021. Still, it is likely to take more time for the situation to become normal as shopping in stores is restarting (Deloitte.com, 2021).http://Best BU7006 Strategic Financial management The trend of shopping online is here to stay as consumers are used to shopping online and sales figures for non-essential items are increasing it is expected to transform the retail sector by attracting more investment.

4. SWOT Analysis

SWOT analysis of Boohoo

Boohoo, which mainly operates in the UK, follows an online business model to run business. It has 3500 products and the SWOT analysis would help them to look forward to trends in fashion and analyzing factors that have a significant impact on its business would result in a profitable enterprise with solid future prospects.

| Factors | Boohoo |

| Strength | ● Boohoo’s product portfolio makes it more attractive to customers and the brand is able to provide options for different segments of consumers with varied tastes.

● Its competitive strategy also helps earn more profit as it provides all options for customers under one palace. ● In view of Sminia, (2021) it has expanded into different regions and its international identity helped to create a loyal customer base business. ● Boohoo Plc has maintained a leadership position by focusing on innovation. ● It has focused on customer satisfaction and practices a sustainable approach for business. |

| Weakness | ● Boohoo Plc is facing a decreased amount of liquidity and this shortage of cash flow is gaming its daily task and business operation.

● It is expecting an inability to expand to new markets due to cash shortage and this situation is preventing long-term financial investment of Boohoo Plc. ● As stated by Cheng, (2021) brands suffered from insufficient research in financial investment which is key to development. The number of resources dedicated to making investment plans was not enough to successfully guide its business and the lack of structures to protect its interest affected Boohoo Plc negatively in the retail market in the UK. |

| Opportunity | ● There are opportunities as population growth is expected to extend customer segments for businesses such as Boohoo Plc.

● It needs to act according to customers’ preferences and cater to them using market knowledge. ● In view of Watanabe et al. 2021 customers are expected to have disposable income. This is an opportunity for businesses such as Boohoo Plc to present high-end products to customers. ● In the views of Oztek and Yerden, (2021) e-commerce is expected to play a vital; role in providing opportunities for Boohoo as a social media platform and providing new ways to reach customers through digital marketing strategies. ● It would support businesses to create niche market segments and help them to break down boundaries as the digital economy allows businesses such as Boohoo Plc to target geographically separated customer bases. |

| Threats | ● Boohoo plc is expected to face challenges due to changing regulations.

● Emphasizing on the view of Kolte et al. 2021 brands need to adhere to compliance rules as legal standards change which is a threat to the business’s future. ● It needs to comply with these rules to avoid legal actions. ● Boohoo Plc has competitors such as Trenyol, H&M, Topshop, and ASOS which threatens its customer base. ● If the economic situation deteriorates it would affect the profits of Boohoo Plc as consumers’ purchasing capacity would be affected due to these changes. ● Lack of cultural intelligence has the potential to harm business as globalization is forcing brands to cross national boundaries. Boohoo Plc. need to include cultural diversity in its business operation to protect its image in the public eye. |

Financial and Non-Financial challenges

Financial challenges for Boohoo Plc would be the maintenance of strong revenue growth in the foreseeable future. Since the Covid-19 pandemic restrictions on physical operation and the brick & mortar market have been found. In such a situation companies were bound to use digital platforms for surviving in the market. As Boohoo was a player in online fashion retailing it gained significant revenue in 2020. However, other retailers including Next, H&M, M&S, and Asos incurred losses in operations. So, if competitors of Boohoo, which are leading players in the physical retail industry, develop a strong strategy for increasing sales, the threat of financial losses could be incurred by Boohoo. As Boohoo only operates in the online fashion industry and its competitors have a presence in both the online and physical fashion markets, they could bring ample threat to the financial growth of Boohoo. Thus, the future prosperity and growth of Boohoo lie in its ability to gain a competitive edge over competitors. Development in competitors like H&M and Asos could bring financial challenges for Boohoo Plc.

Boohoo Plc operates in the fast fashion industry which is alleged to have an adverse impact on the environment. Thus, challenges associated with sustainability could be expected in foreseeable future. During 2020-21, the company had an allegation of violating workers’ rights by not providing proper working conditions to employees in an England factory. Besides, PwC the statutory auditor of Boohoo has highlighted growing sustainability issues in the company (Accountingweb.co.uk, 2021).http://Best BU7006 Strategic Financial management The independent review of Sir Brian Leveson from advisory firm KPMG shows the extremely serious condition of the company. Due to the severe condition of Boohoo, a forensic supply chain initiative called Fast Forward would be used by Boohoo in the coming years. However, as the condition of a company is too serious, the negative impact of sustainability issues could be found in the foreseeable future.

Opportunities in the foreseeable future

Financial opportunities of Boohoo

Boohoo Plc wants to provide outstanding service to customers and at the same time keep its prices reasonable. It wants to make investments in infrastructure and technology to make the online shopping experience better for customers. It is expecting its growth from new acquisitions and it is expected to be 25% at the group level from 2021 to 2022 first two months. Its current acquisition has created more than 1000 jobs and it has 18 million consumers actively shopping from the brand (Boohooplc.com, 2021).http://Best BU7006 Strategic Financial management It merged with Dorothy Perkins as well as Wallis and Burton which pushed the diversity of Boohoo Plc. Economic uncertainty poses a threat to the brand’s success as the cost of business increases as the impact of disruption created by Covid-19 in the previous year (Weinberg et al. 2020).http://Best BU7006 Strategic Financial management It has strong revenue forecasted in UK and revenue in the international market is currently 46% of its total revenue. Boohoo Plc has shown net earnings of £ 276.0 million pounds in 2021 which is more compared to £ 240.6 million earned in 2020. Boohoo is one of the leading brands in eCommerce platforms to provide the latest in fashion to customers 24*7.

Non-financial opportunities of Boohoo

In 2020 July brand faced allegations of malpractices in one of its supply and manufacturer centers in Leicester and business declared to take immediate action to mitigate this issue instead of denying them and it declared its commitment towards rebuilding the garment sector in the UK (Boohooplc.com, 2021).http://Best BU7006 Strategic Financial management As this sector wants to contribute a lot of employment and make financial profits which is beneficial to the local and national economy of the UK. In 2021 Boohoo Plc adopted Agenda for change as an independent review revealed improper working conditions and low payment of staff which resulted in this response. It reinforces its commitment to UK’s manufacturing sector to make decisions accordingly. In view of Naidoo and Gasparatos, (2018) brands need to empower their corporate governance and promised ethical compliance rules and adopted a sustainable approach and pledge to obtain resources responsibly. It has also evaluated its supply chain and made integrating new technologies a priority to its business and made adequate investments to build funds to provide support to its workforce. It has an approved group of suppliers who are able to support its objectives. Boohoo Plc is expecting these changes to result in a sustainable business model which is able to bring positive change within the organization.

Covid-19 response of Boohoo

Boohoo Plc was ready to embrace government strategies and it followed the guidance provided by authorities to keep workplaces safe. It took necessary action to make it facilitates and office safe for employees in the UK and international outlets. As it allowed its employees to work from home during pandemics and made shifts rotational and during a critical periods, only essential workers were asked to be at facilities. It followed social distancing rules and provided large working spaces in warehouses to maintain these rules and avoid contact. It also carried out sanitization procedures and implemented deep cleaning to make the workplace safer from infection (Brydges et al. 2020).http://Best BU7006 Strategic Financial management It installed thermal imaging scanners in distribution centres and its main office at Manchester to screen individuals. Boohoo Plc updated its safety procedures and informed it simultaneously to its staff and it allowed a Rapid lateral flow testing program in its facilities which were monitored by the British Army later in 2021 testing was also stated in other facilities of Boohoo Plc.

5. Conclusion

Boohoo has gone through a lot of challenges since it started its journey in 2006 and made its place in UK retail sector as one of the leading brands in online shopping. The pandemic has impacted its development in 2020 but it has increased its product specification and it is offering activewear, and loungewear as it responded form changing demand of customers in the UK. It remained open during lockdowns and profited financially as an increasing number of customers and a pragmatic strategy to reduce the cost of marketing assisted Boohoo Plc to remain financially profitable. As customers are able to use different methods of payment it also earned businesses such as Boohoo Plc more profits. It is taking steps to develop its supply chains and at the same time taking decisions such as Agenda for Change to support its employees. It has promised to make several changes to its governance and appointed independent bodies for Audit and Risk management and it would publish its sustainability report to promote transparency. As online fashion is expected to grow as internet use is increasing worldwide it ambles businesses such as Boohoo Plc have new opportunities for growth. Boohoo plc provides good quality products which cost less compared to High Street therefore it is always in demand among customers.

Reference

Accountingweb.co.uk (2021). About Boohoo Plc. Available at https://www.accountingweb.co.uk/business/financial-reporting/boohoos-sustainability-questioned-as-pwc-quits-as-auditor[Accessed on 12th September 2021]

Alali, E., Alhammadi, N., Almarar, M.S., Almheiri, S., Almarar, F., Almarar, M., Alremaithi, L.K. and Nobanee, H., (2021). Financial Analysis and Performance Evaluation of Moderna, 3(2), pp.55-59.

Atidhira, A.T. and Yustina, A.I., (2017). The influence of return on asset, debt to equity ratio, earnings per share, and company size on share return in property and real estate companies. JAAF (Journal of Applied Accounting and Finance), 1(2), pp.128-146.

Atrill, P. and McLaney, E. (2019). Accounting and Finance for non-specialists, 11th Ed., Pearson.

Bbc.co.uk (2021). About Boohoo Plc’s financial performance. Available at: https://www.bbc.co.uk/news/business-57481508[Accessed on 10th September 2021]

Bbc. com,(2021) About Boohoo Remain In Fashion Available at: https://www.bbc.com/news/business-46874367 [Accessed on 15th September 2021]

Boohooplc (2021). About Boohoo Plc. Available at: https://www.boohooplc.com/group/our-vision-and-strategy [Accessed on 5th September 2021]

Boohooplc (2021). About Boohoo Plc’s financial performance. Available at: https://www.boohooplc.com/sites/boohoo-corp/files/all-documents/result-centre/2018/4042-boohoo-randa-hyperlink.pdf [Accessed on 6th September 2021]

Boohooplc (2021). About Boohoo Plc’s financial performance. Available at: https://www.boohooplc.com/sites/boohoo-corp/files/all-documents/4412-boohoo-ar-2019.pdf[Accessed on 7th September 2021]

Boohooplc (2021). About Boohoo Plc’s financial performance. Available at: https://www.boohooplc.com/investors/results-centre/year/2020[Accessed on 8th September 2021]

Boohooplc (2021). About Boohoo Plc’s financial performance. Available at: https://www.boohooplc.com/investors [Accessed on 9th September 2021]

Boohooplc.com,(2021) About Boohoo Plc Group Available at: https://www.boohooplc.com/sites/boohoo-corp/files/all-documents/result-centre/2021/boohoo-group-prelim-fy21.pdf [Accessed on 19th September 2021]

Boohooplc.com,(2021) About Sustainability In Boohoo Plc Available at:https://www.boohooplc.com/sustainability/agenda-for-change [Accessed on 22nd September 2021]

Brydges, T., Retamal, M. and Hanlon, M., 2020. Will COVID-19 support the transition to a more sustainable fashion industry?. Sustainability: Science, Practice and Policy, 16(1), pp.298-308.

Deloitte.com,(2021) About Retail Trends Available at: https://www2.deloitte.com/uk/en/pages/consumer-business/articles/retail-trends.html [Accessed on 18th September 2021]

Drury, C. (2018). Management and Cost Accounting, 10th Ed., Cengage learning.

García-Medina, I., Pereira Correia, P.A. and Alberola Amores, L., 2019. How the digital age has changed the corporate communication world: the case of Digital Marketing in the Fashion Business. IROCAMM: International Review of Communication and Marketing Mix, 2 (1), 87-94.

García-Medina, I., Pereira Correia, P.A. and Alberola Amores, L., 2019. How the digital age has changed the corporate communication world: the case of Digital Marketing in the Fashion Business. IROCAMM: International Review of Communication and Marketing Mix, 2 (1), 87-94.

Henninger, C.E., Cano, M.B., Boardman, R., Jones, C., Mccormick, H. and Sahab, S., 2020. Cradle-to-Cradle Versus Consumer Preferences in the Fashion Industry. Encyclopedia of renewable and sustainable materials, 5, pp.353-357.

https://www.statista.com/statistics/794862/boohoo-plc-group-revenue-worldwide/ [ Accessed on 26th September 2021]

Investegate.co.uk (2021). About Boohoo Plc. Available at https://www.investegate.co.uk/boohoo-group-plc–boo-/rns/strategic-acquisition/202101250700076824M/[Accessed on 11th September 2021]

Martinez Dy, A., Martin, L. and Marlow, S., 2018. Emancipation through digital entrepreneurship? A critical realist analysis. Organization, 25(5), pp.585-608.

Naidoo, M. and Gasparatos, A., 2018. Corporate environmental sustainability in the retail sector: Drivers, strategies and performance measurement. Journal of Cleaner Production, 203, pp.125-142

Nuryani, Y. and Sunarsi, D., (2020). The Effect of Current Ratio and Debt to Equity Ratio on dividend Growth, 4(2), pp.304-312.

Reuters.com,(2021) About Boohoo Earnings Available at:https://www.reuters.com/world/uk/boohoo-earnings-up-37-pandemic-drives-business-online-2021-05-05/[Accessed on 16th September 2021]

Shehata, W. and Rashed, A., (2021). Accounting Conservatism, Information Asymmetry, and Cash Holdings. Journal of Accounting, Business, and Management (JABM), 28(1), pp.63-72.

Statista.com, (2021) About Revenue of Boohoo Available at:

Watanabe, C., Akhtar, W., Tou, Y. and Neittaanmäki, P., 2021. Amazon’s New Supra-Omnichannel: Realizing Growing Seamless Switching for Apparel During COVID-19. Technology in Society, 66, p.101645.

Watanabe, C., Akhtar, W., Tou, Y. and Neittaanmäki, P., 2021. Amazon’s New Supra-Omnichannel: Realizing Growing Seamless Switching for Apparel During COVID-19. Technology in Society, 66, p.101645.

Weinberg, N., Bora, A., Sassetti, F., Bryant, K., Rootalu, E., Bikziantieieva, K., van Breen, L., Carrier, P., Lannquist, Y. and Miailhe10, N., 2020. AI against Modern Slavery: Digital Insights into Modern Slavery Reporting-Challenges and Opportunities.