BU7009 Financial Risk Management Assignment Sample

Introduction

Merck is an America based multinational company, which operates in the pharmaceutical industry. The company has its headquarters located in Kenilworth, New Jersey, United States (Merck, 2022). The company founded in the year 1891 and has been operating efficiently in the industry until now (Merck, 2022).

The company has reported to be facing a number of financial and non-financial issues recently, which has been faced by the above-mentioned organisation. This study will highlight the issues faced by the company and the measures undertaken by the organisation to reduce the impact of those issues along with the risk management assessment methods available to the concerned company.

In addition to that, the study will also include Merck’s approach to strategic planning with the consideration of stakeholders. Apart from the above-mentioned points, the current study will also emphasise on the cyber attack issue witnessed by the organisation and the initiatives taken by the company to overcome the issue.

Risk management methods available to Merck for analysing its risks

It is evident that the outbreak of covid-19 pandemic has brought different kinds of issues for Merck. However, different kinds of risk management methods are available that can be used by the organisation for analysing its risks, which are discussed below.

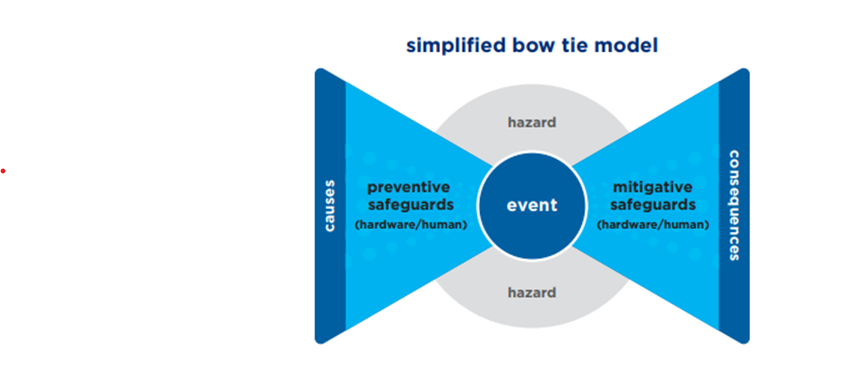

Bow tie analysis

Bow tie analysis is one of the risk management methods that can be utilise by the organisation. This analysis can be described as a risk analysis method that can be used to manage and reduce risks. This risk analysis method provides importance on the consequences and causes of risks (Sheehan et al. 2021).http://BU7009 Financial Risk Management Assignment Sample

More specifically, this process can be begun by observing potential risk and dividing them into two categories. These two categories are the causes and consequences of risk. More specifically, the first category includes all potential factors that can contribute to enhance the risk.

On the other hand, another category includes the list of all potential consequences that can be foster by risks. Hence, by utilising this risk analysis method the organisation can divide its causes of risk and their consequences. Moreover, the utilisation of this analysis method can help companies like Merck to identify potential risk and evaluate their consequences to predict that how a risk can impact the business operation.

Figure 1: Bow tie analysis model

(Source: Chevron, 2022)

In this regard, an example of Chevron, which is one of the well-known companies in Oil and Gas industry, can be illustrated. It has been found out that, the organisation has been utilising the bow tie risk analysis method. The organisation has been utilising this model to the causes of risk that have been faced by the organisation (Chevron, 2022). http://BU7009 Financial Risk Management Assignment Sample

On the other hand, this model has also been helping the organisation to evaluate the consequences of risk. This is indicating that in its control and risk management the bow tie model has been helping this organisation significantly. It has been found out that the organisation is mainly utilising this model for ensuring workplace health and safety (Chevron, 2022).http://BU7009 Financial Risk Management Assignment Sample In other words, the model has been helping the organisation to identify the race regarding workplace health and safety. This example is indicating that the bow tie risk analysis model can be helpful for Merck.

Decision tree analysis

Another option regarding the risk management that is available for Merck is the decision tree analysis. The decision tree analysis method can help organisations to ensure the best action in a specific scenario. However, for utilising this risk analysis method companies need to start analysing proposed decisions regarding risk management. After analysing a proposed decision regarding risk management, companies need to map out various potential outcomes of their decisions (Brooks, 2022).

Hence, in this risk analysis method, it is important to list out all potential outcomes. More specifically, understanding of potential outcomes can help companies to decide their best action for each issue. The knowledge of potential outcomes can also help companies to take effective actions. For instance, companies need to be focused on aspects like profitability while taking strategies for risk management. Hence, the characteristics of this risk management analysis reflect that it can be used by an organisation like Merck.

More specifically, the covid-19 pandemic has brought various different kinds of issues to the organisation; hence, the utilisation of this risk analysis method could help the organisation to challenges. The decision tree analysis may help the organisation to outline potential outcomes, consequences of decisions, and costs. More specifically, each branch of the decision tree represents potential outcomes of decisions. This method of risk analysis is useful because it is easy to understand (Brooks, 2022). As its branches reflect potential outcomes of decisions, in the utilisation of this method, it is easy to analyse risk and take risk mitigation strategies.

Structured What If Technique (SWIFT) analysis

The SWIFT analysis can also utilised by Merck to mitigate risk. This analysis includes a team-based approach to analyse risk and improve the working environment. This analysis process also involves the assessment of how a change from a newly implemented design or plan may influence business projects. By utilising “what if” questions a team can determine that how newly implemented changes can impact business operations.

This analysis is useful to identify hazards in a business organisation. More specifically, as this analysis provides importance on “what if” questions, the identification of hazards is easier in this analysis (Lyon and Popov, 2020). The SWIFT analysis is applicable for various types of risk assessment. Especially, this can be applied to identify risk in failure scenarios.

Apart from that, this technique is used to avoid lengthy discussions regarding areas of risk. Hence, it is very flexible to apply and can help organisations to identify potential risks and take challenge mitigation strategies. In this regard, the example of BAE Systems Marine Limited can be drawn. It has been found out that BAE Systems Marine Limited has used the SWIFT analysis for hazard identification (Wilde, 2022).

Main sources of financial and non-financial risk faced by Merck and the way to mitigate such risks

Risks or challenges that have been faced by Merck are discussed below.

Non-financial risks

Challenges regarding global supply chain delays

The outbreak of the covid-19 pandemic has affected the global supply chain. Most specifically the global supply chain continues to be affected by the issues relating to the pandemic (Essa, 2022). These issues mainly include disruption and delays in the supply of goods. Therefore, chief executives of international organisations have started identifying the supply chain turmoil as one of the greatest threats to their companies (Essa, 2022).

This is because this threat has started influencing organisational growth and economic stability in a negative manner. Merck group has also faced issues regarding supply chain management. More specifically, the organisation faces challenges and risks that are caused by global supply chain delays (Merck Group, 2022). The continuous pandemic has affected global health. The organisation has a lot of responsibilities during the pandemic, as it has a long legacy of research in infectious diseases. Hence, the delay and disruption in the supply chain have influenced the overall operation of the organisation in a negative manner.

Discontinuation of Covid- 19 vaccine candidates

In accordance with a news article, the pharmaceutical giant Merck has discontinued the development of its covid-19 vaccine candidates (Talmazan, 2021). Hence, the organisation was late to join the race of developing a vaccine for the virus. In other words, the covid-19 has affected human health globally and this is the reason that the demand for covid-19 vaccines has increased.

However, in the race regarding the production of vaccines, which can protect humans against the coronavirus the organisation, was a late joiner. This has undoubtedly influenced productivity and growth in a negative manner. More specifically, the sales and revenue growth of the organisation were influenced negatively.

The company struggles to win European approval for the Covid antiviral pill

In accordance with a news article, the organisation has also faced issues to win European approval for the covid antiviral pills (Financial Times, 2021). Molnupiravir was one of the antiviral pills that have caused excitement because of its primary clinical trial results.

This is because that can significantly reduce the number of hospitalisation and death from covid-19, but it struggled to receive the authorisation from the US “Food and Drug Administration” (FDA) (Kozlov, M., (2021). Ridgeback and Merck’s investigational oral antiviral Molnupiravir have reduced the health risk of hospitalised patients, who are covid-19 positive. More specifically, Molnupiravir has reduced the risk of death of patients who are covid-19 positive, by approximately 50% (Merck, 2021).

Risk of restrictive regulatory requirements, political and macroeconomic developments

It is evident that in the sector of healthcare business the restrictive requirement is increasing. More specifically, in terms of reimbursement and drug pricing restrictive requirements are increasing. The organisational website of Merck reflects that it has faced risks regarding restrictive regulatory requirements, which are mainly based on reimbursement and drug pricing (Merck Group, 2022).

This kind of risk negatively influenced the profitability of the organisation. Apart from that, the establishment of trade barriers, foreign exchange policy changes, and sanctions late the decline in sales of the organisation.

Even potential negative macroeconomic developments also impacted the business of the organisation negatively (Merck Group, 2022). More specifically, the outbreak of the coronavirus pandemic influenced these kinds of risks, which negatively impacted the growth of the organisation. Apart from that, the organisation has also faced cyber security threats that have been discussed below.

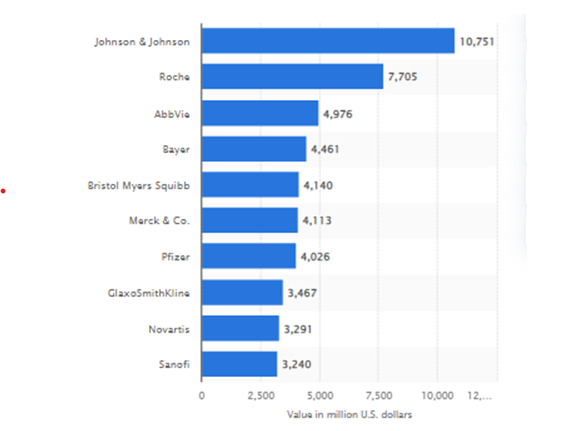

Competitive risks

The organisation has also faced risks regarding market competition during the covid-19 pandemic.

Figure 2: The brand value of the most valuable pharmaceutical companies in the world as of the year 2021

(Source: Mikulic, 2021)

The above figure is reflecting the brand value of the most valuable pharmaceutical companies as of the year 2021. According to the above graph, Merck has been facing huge competition in the market. The competitors of the organisation are Roche, Johnson & Johnson, Pfizer, and some others (Mikulic, 2021). Hence, this kind of challenge has decreased the net sales of the organisation. For instance, as per the report found on the organisational website of Merck, net sales of display Solutions have declined by approximately -6.4% (Merck Group, 2022).

The most important reason behind this decline is the competitive challenges. Apart from that, the above-mentioned discontinuation of covid-19 vaccine research has also influenced its competitive advantages in a negative manner. For instance, the demand for US regulations authorised vaccines of covid-19 from Pfizer, BioNTech, and Moderna has increased during the covid-19 pandemic (Talmazan, 2021).

This also indicates the huge competition in the market of pharmaceutical products, which has influenced the sales growth of the organisation.

Financial risks

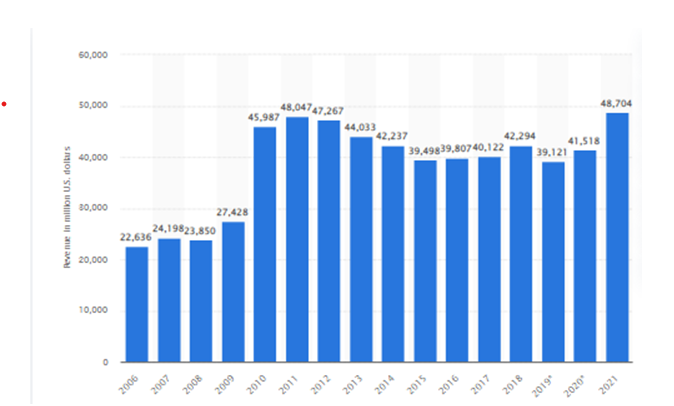

Decreased revenue

According to a news article, the outbreak of the covid-19 pandemic has influenced the revenue growth of business organisations from different sectors in a negative manner (Jones et al. 2021). However, pharmaceutical companies can be seen as winners in a comparison with companies from other sectors.

It is evident that pharmaceutical companies such as AstraZeneca, Novavax, and Moderna have faced significant growth in their share prices (Jones et al. 2021). However, many other companies like Pfizer and Merck face a decline in their revenue growth from the years 2019 to 2020.

Figure 3: Total revenue of Merck from the year 2006 to 2021

(Source: Mikulic, 2022)

The above figure is reflecting the total revenue of the organisation from the year 2006 to 2021. In accordance with the above figure, it is clear that the organisation has faced a decline in its revenue growth in the year 2019 and 2020. More specifically, during these two years, the organisation has faced the above-mentioned challenges regarding supplies and sales, which has influenced its revenue growth in a negative manner.

For evidence, the revenue of the organisation was approximately 41.5 billion US dollars in the year 2020 (Mikulic, 2022). However, in the last year, the organisation has seen a growth in its revenue. For evidence, the revenue of the organisation was increased in 2021, which was approximately 48.7 million US dollars (Mikulic, 2022).

The company’s approach to strategic planning and the consideration of stakeholders in this process

Strategic planning is an essential part for the success of any organisation. Strategic planning can be explained as the process through which the leaders of the organisation define their vision and mission and achieve their goals and objectives of growth and development (George et al. 2019).

Strategic planning of any business organisation includes the set of activities implemented by the company for allocating the resources in the proper places as per the need of the organisation, strengthening the business operations and enhancing the overall performances of the organisation.

It has been mentioned earlier in the study that Merck is a renowned company, which is operating in the pharmaceutical industry successfully. The company’s strategic planning has efficiently helped the company to achieve this goal. The company has adopted several approaches of strategic management of different aspects of the business including risk management. In this section, Merck’s strategic planning will be discussed briefly.

Sustainable strategy

As mentioned above, strategic planning helps the companies to define their vision and values, Merck’s values include achievements, responsibility, respect, courage and transparency (Merck, 2022). According to the company, it focuses greatly on maintaining sustainable business by successfully utilising science and technology in overcoming several global challenges like resource scarcity, unequal access to healthcare and other such issues.

The sustainable strategies of the company includes the goal of achieving human progress for approximately one billion people with the help of sustainable science and technology by the year 2030 (Merck, 2022).

According to the official website of the company, the organisation will meet climate neutrality by 2040 and will eventually reduce their resource consumption significantly (Merck, 2022). To achieve the three goals set by the company is focusing on seven major areas.

The first goal is dedicated to human progress and in accordance with this the company’s focus area is integrating sustainable innovations and technology for the providing the consumers efficiently (Merck, 2022). Another goal of the company is to create sustainable value chains for which the focus area is maintaining a sustainable and transparent supply chain along with securing social licence for properly operating in every region.

Lastly, the last goal is reducing ecological footprint and to achieve this goal the company will focus on climate change and greenhouse gas emission along with careful use of water and resource intensity (Merck, 2022). These strategies undertaken by the company can positively affect the stakeholders of the organisation specially consumers by improving their lifestyle as well as environmental conditions in which they are living.

Human resource management strategy

HRM of any organisation plays an important role for the proper operation of the company in the industry (Akunda et al. 2018). Merck has effectively improved their HR management strategy to boost employee’s morale and to broaden the talent of the organisation. Talent management is essential to retain deserving and skilled employees in the organisation.

To achieve this goal, the executive vice president and human resource officer of Merck, Steven Mitzell has integrated technology and innovation properly. For example, the company has achieved remarkable digital transformation of the HR of the organisation by including virtual communication and training programmes (Goldman, 2021). In addition to that, the company has also implemented digital and assessment tools in their business organisation for the proper management of human resources available to the organisation.

This strategy of Merck has significantly benefited one of the most important stakeholders of the company, which is the workforce or employees of the organisation. On the other hand, use of digital technologies for communication and training programmes can also be disadvantageous for a portion of stakeholders, as the access to internet is not equally available to everyone.

Pricing strategy

Pricing is one of the key elements of strategic planning of the business organisation. Pricing of the products hugely influences the profitability of the organisations. Merck does not follow a specific pricing strategy in all the regions in which the company is operating. Rather it designs its pricing strategy according to the economic and other conditions of the countries.

For example, in developing countries like the Philippines, the company practises a differential pricing strategy in order to provide the patients with quality products at lower prices (Merck, 2018). On the other hand, in developed countries like the USA and others the company has efficiently implemented value based pricing strategies. The company claims to provide good products at reasonable prices to ensure access to the treatment by every individual.

This strategy of the organisation is highly beneficial for the consumers. In addition to that, it is also positively influencing the profitability of the organisation remarkably. Despite that, in some instances these strategies also negatively impact the consumers. For instance, the lower income population living in developed countries suffer due to the value based pricing of the product.

Merck’s business strategy based on Ansoff matrix

As it has been discussed in the study that Merck provides drugs and healthcare products in the market it indicates that the company focuses greatly on developing and distributing products for the consumers. The company integrates several innovations and advanced technology for the development and manufacture of the medicines (Merck, 2020).

In addition to that, the company also collaborated with several experts in order to improve the quality of their products. Apart from that, Merck invests huge amounts of money for research and development (Merck, 2020). All these aspects suggest that Merck practises product development strategy. This strategy of the company is also directly influencing the consumers.

Overall, it can be stated that Merck has undertaken above discussed approaches to strategic planning and it is influencing the various stakeholders of the company both in a positive as well as negative manner.

Cyber-security threats to the company and the measures put in place to guard against such threats.

As the world is progressing towards digital advancement, it is increasing the efficiency of different business operations significantly. On the contrary, technological advancements are also increasing the chances of cyber crime (Setiawan et al. 2018). Cyber crime involves a number of misconducts including data theft and others. In recent years, a number of companies have faced cyber security attacks, which has led the companies to re-evaluate their security systems. Similarly, renowned pharmaceutical company Merck has also reported to be attacked by cyber criminals in the year 2017 (Palmer, 2018).

This cyber attack also termed as NotPetya cyber attack influenced the different operations of the company including manufacturing operations. It encrypted the data of the company and blocked the control of the data by the company. In order to regain the control of the lost data the company received random messages, which was eventually a fraud.

The company was never able to retrieve the lost data. This attack impacted the company to a great extent and the organisation is still taking necessary steps to strengthen its cyber security system effectively. Among many companies attacked by the ransomware virus, Merck was the only company to accept the facts of being attacked by cyber criminals publicly. This ransomware attack created a number of threats for the organisation and negatively impacted the bottom-line of the company remarkably.

According to the reports, the mentioned cyber attack resulted in a loss of approximately 915 million dollars (Palmer, 2018). It severely impacted the organisation’s in-house manufacturing, R&D, formulation and other operations notably. Authorities of the company stated that this cyber attack exerted an impact of 260 million dollars on sales along with an impact of 330 million dollars on marketing and other operational costs including administrative expenses (Palmer, 2018). These significant losses resulted in the failure of the company to meet consumers’ demand for certain drugs like Gardasil (Voreacos et al. 2019).

Investigation of the matter revealed that the Russian military was responsible for the attack whose target was Ukraine to be specific but the malware spread to many other systems (Voreacos et al. 2019). Therefore, this cyber attack provoked the management of Merck to carefully analyse the threats of such cyber attacks in future.

In addition to that, it has also forced the company to take necessary measures to cope up with the similar situation if experienced in future. For this purpose, Merck has hardened their cyber security system to a large extent. The company has focused extensively on improving their cyber security system with the help of several experts and software engineers.

It has eliminated the risk of experiencing any severe cyber attack by the company to some extent. In addition to that, the company has also taken legal actions in order to mitigate the loss caused by the cyber attack. Merck has reported to be winning a lawsuit and recovered a huge amount of insurance money. The company has reported to be receiving 45 million dollars as insurance payment (Sagonowsky, 2019).

Merck sued the insurers who refused to pay for NotPetya’s adverse impacts on its networks. The insurers claimed that it was an act of war, hence, the company is not eligible to receive the insurance money. Merck won the case and received a total of 1.4 billion dollars (Henriquez, 2022). This recovered money has helped the company to compensate for the huge loss witnessed by the company due to the cyber attack.

In addition to the above-mentioned steps, the company has effectively utilised different software applications to improve the cyber security system of the company. At first for several months Merck tried to manually tune the cloud applications for enhancing the security system.

After that the organisation implemented an application named Gulware for automating the network operations. It helped the company to improve the quality of service (QoS), to manage bandwidth load generated by huge network traffic (Zurier, 2019). Gulware is a software application, which automates the network operation and reduces the time required to tune cloud-based applications finely. Apart from that, this application also helps in configuration management eventually reducing the risk of cyber attacks (Zurier, 2019).

Hence, this application helped Merck to improve its cyber system to a great extent, which eventually reduced the risks of encountering cyber attacks or system malware in future. Utilisation of such applications have now become common by the different business organisations to optimise the efficiency of security systems. Such antivirus and other software applications protects the data from the attackers and reduces the threats of cyber attacks (Singh, 2022).

These attacks include data theft, malware, phishing, password attacks, and others. Hence, Merck has also effectively utilised advanced technology to avoid these cyber security attacks after experiencing the NotPetya tragedy. Overall, it can be stated that Merck has faced severe loss due to this unfortunate cyber attack and it has impacted several aspects of business. Thus, the company has taken necessary measures to avoid the chances of being exposed to any such issue in future. The company has strengthened its security system and has recovered the loss by receiving insurance money.

Conclusion

From the overall analysis, it can be concluded that the covid-19 pandemic has brought a lot of challenges to Merck. These challenges include cyber security issues, supply chain management issues, and others. However, there are various options of risk analysis methods available for the organisation. The organisation has faced issues regarding restrictive regulatory requirements.

These kinds of issues have influenced the competitive advantage of the organisation in a negative manner. However, the organisation has taken effective strategies to mitigate challenges. Most specifically, strategic planning has helped the organisation to overcome challenges during the covid-19 period. The organisation has made changes in its pricing strategy and HRM practices to deal with these issues.

Apart from that, it has also taken steps to improve cyber security to avoid risks related to that in the future. It has been found out that the organisation has been facing extensive competition in the pharmaceutical industry. However, strategies of the organisation have been helping it to overcome risk, which has been influencing its revenue growth in a positive manner.

References

Akunda, D., Chen, Z. and Gikiri, S.N., (2018). Role of HRM in talent retention with evidence. Journal of Management and Strategy, 9(2), pp.8-19.

Brooks, C., (2022). Decision trees are flowchart graphs or diagrams that explore all of the decision alternatives and their possible outcomes. [Online] Available at: <https://www.businessnewsdaily.com/6147-decision-tree.html> [Accessed 2 May 2022]

Chevron, (2022). Operational excellence management system. [Online] Available at: <https://www.chevron.com/-/media/shared-media/documents/oems_overview.pdf> [Accessed 2 May 2022]

Essa, S. A. T., (2022). 5 ways the COVID-19 pandemic has changed the supply chain. [Online] Available at: <https://www.weforum.org/agenda/2022/01/5-ways-the-covid-19-pandemic-has-changed-the-supply-chain/> [Accessed 2 May 2022]

Financial Times, (2021). Merck struggles to win European approval for Covid antiviral pill. [Online] Available at: <https://www.ft.com/content/2cf0b6cc-b07b-4ff9-a833-42eb1798a576> [Accessed 2 May 2022]

George, B., Walker, R.M. and Monster, J., (2019). Does strategic planning improve organizational performance? A meta‐analysis. Public Administration Review, 79(6), pp.810-819.

Goldman. S., (2021). Merck’s CHRO on how to ‘innovate, upgrade, and use technology’ to broaden talent and boost employee morale [Online] available at: <https://www.businessinsider.in/international/news/mercks-chro-on-how-to-innovate-upgrade-and-use-technology-to-broaden-talent-and-boost-employee-morale/articleshow/85305963.cms> [Accessed 2 May 2022]

Henriquez. M., (2022). Merck wins $1.4B lawsuit over NotPetya attack [Online] available at: <https://www.securitymagazine.com/articles/96972-merck-wins-14b-lawsuit-over-notpetya-attack> [Accessed 2 May 2022]

Jones, L., Palumbo, D., and Brown, D., (2021). Coronavirus: How the pandemic has changed the world economy. [Online] Available at: <https://www.bbc.com/news/business-51706225> [Accessed 2 May 2022]

Kozlov, M., (2021). Merck’s COVID pill loses its lustre: what that means for the pandemic. [Online] Available at: <https://www.nature.com/articles/d41586-021-03667-0> [Accessed 2 May 2022]

Lyon, B.K. and Popov, G., (2020). The power of what if: Assessing and understanding risk. Professional Safety, 65(06), pp.36-43.

Merck Group, (2022). Business-related risks and opportunities. [Online] Available at: <https://www.merckgroup.com/en/annualreport/2020/management-report/report-on-risks-and-opportunities/business-related-risks-and-opportunities.html#accordion1> [Accessed 2 May 2022]

Merck Group, (2022). Fiscal 2021: Merck Delivers Record Growth and Higher Profitability. [Online] Available at: <https://www.merckgroup.com/en/news/financial-results-2021-03-03-2022.html> [Accessed 2 May 2022]

Merck, (2021). Merck and Ridgeback’s Investigational Oral Antiviral Molnupiravir Reduced the Risk of Hospitalization or Death by Approximately 50 Percent Compared to Placebo for Patients with Mild or Moderate COVID-19 in Positive Interim Analysis of Phase 3 Study. [Online] Available at: <https://www.merck.com/news/merck-and-ridgebacks-investigational-oral-antiviral-molnupiravir-reduced-the-risk-of-hospitalization-or-death-by-approximately-50-percent-compared-to-placebo-for-patients-with-mild-or-moderat/> [Accessed 2 May 2022]

Merck, (2022). Our COVID-19 response. [Online] Available at: <https://www.merck.com/our-covid-19-response/> [Accessed 2 May 2022]

Merck., (2018). Prices of Medicines [Online] available at: <https://www.merckgroup.com/en/cr-report/2018/products/health-for-all/prices-of-medicines.html> [Accessed 2 May 2022]

Merck., (2020). Business Strategies [Online] available at: <https://www.merckgroup.com/en/annualreport/2020/management-report/fundamental-information-about-the-group/strategy/business-strategies.html> [Accessed 2 May 2022]

Merck., (2022). Merck & Co. [Online] available at: <https://www.merck.com/> [Accessed 2 May 2022]

Merck., (2022). OUR SUSTAINABILITY [Online] available at: <https://www.merckgroup.com/en/sustainability/sustainability-strategy.html> [Accessed 2 May 2022]

Mikulic, M., (2021). Brand value of the world’s most valuable pharmaceutical brands as of 2021. [Online] Available at: <https://www.statista.com/statistics/541624/brand-value-of-the-world-s-most-valuable-pharmaceutical-brands/> [Accessed 2 May 2022]

Mikulic, M., (2022). Total revenue of Merck & Co. from 2006 to 2021. [Online] Available at: <https://www.statista.com/statistics/272350/revenue-of-merck-and-co/> [Accessed 2 May 2022]

Palmer. E., (2018). Merck has hardened its defenses against cyberattacks like the one last year that cost it nearly $1B [Online] available at: <https://www.fiercepharma.com/manufacturing/merck-has-hardened-its-defenses-against-cyber-attacks-like-one-last-year-cost-it> [Accessed 2 May 2022]

Sagonowsky. E., (2019). Merck, insurers fight over $1.3B in damages from cyberattack: Bloomberg [Online] available at: <https://www.fiercepharma.com/pharma/merck-insurers-fight-over-1-3-billion-damages-from-cyberattack-bloomberg> [Accessed 2 May 2022]

Setiawan, N., Tarigan, V.C.E., Sari, P.B., Rossanty, Y., Nasution, M.D.T.P. and Siregar, I., (2018). Impact Of Cybercrime In E-Business And Trust. Int. J. Civ. Eng. Technol, 9(7), pp.652-656.

Sheehan, B., Murphy, F., Kia, A.N. and Kiely, R., (2021). A quantitative bow-tie cyber risk classification and assessment framework. Journal of Risk Research, 24(12), pp.1619-1638.

Singh, L., (2022). Cyber Crime, Cyber Resilience and Security Strategy in Post Pandemic World. Supremo Amicus, 28, p.305.

Talmazan, Y., (2021). Merck discontinues two Covid-19 vaccine candidates. [Online] Available at: <https://www.nbcnews.com/health/health-news/merck-discontinues-two-covid-19-vaccine-candidates-n1255503> [Accessed 2 May 2022]

Voreacos. D., Chiglinsky. K., and Griffin. R., (2019). Merck Cyberattack’s $1.3 Billion Question: Was It an Act of War? [Online] available at: <https://www.bloomberg.com/news/features/2019-12-03/merck-cyberattack-s-1-3-billion-question-was-it-an-act-of-war> [Accessed 2 May 2022]

Wilde, (2022). Hazard Identification using SWIFT (Structured What-IF Technique/checklisT) at a COMAH Lower Tier Site: BAE Systems, Barrow-in-Furness. [Online] Available at: <https://www.wilderisk.co.uk/company-resources/hazard-identification-swift/> [Accessed 2 May 2022]

Zurier. S., (2019). After ransomware virus, Merck’s medicine was network automation [Online] available at: <https://www.techtarget.com/searchnetworking/feature/After-ransomware-virus-Mercks-medicine-was-network-automation> [Accessed 2 May 2022]