BUS7B30 Assignment Sample

Introduction

Burberry is one of the famous fashion brands in UK; this company was chosen for this study. Capital structure of this company will be evaluated in this assignment. Financial data on Burberry will be analyzed to choose the most effective budget. Efficient financial planning helps to sustain business activities without any interruption in operating activities. Profit and loss statements and balance sheets will be analyzed in this study to measure the capital structure and expected outcome of Burberry. Cash flow of Burberry will be analysed to estimate the liquidity of this company. Most effective budget will be found on Burberry to understand effective capital structure of a company in fashion industry. Success of a company depends on the effective capital structure of a company and it is necessary to attract investors to company.

Project idea

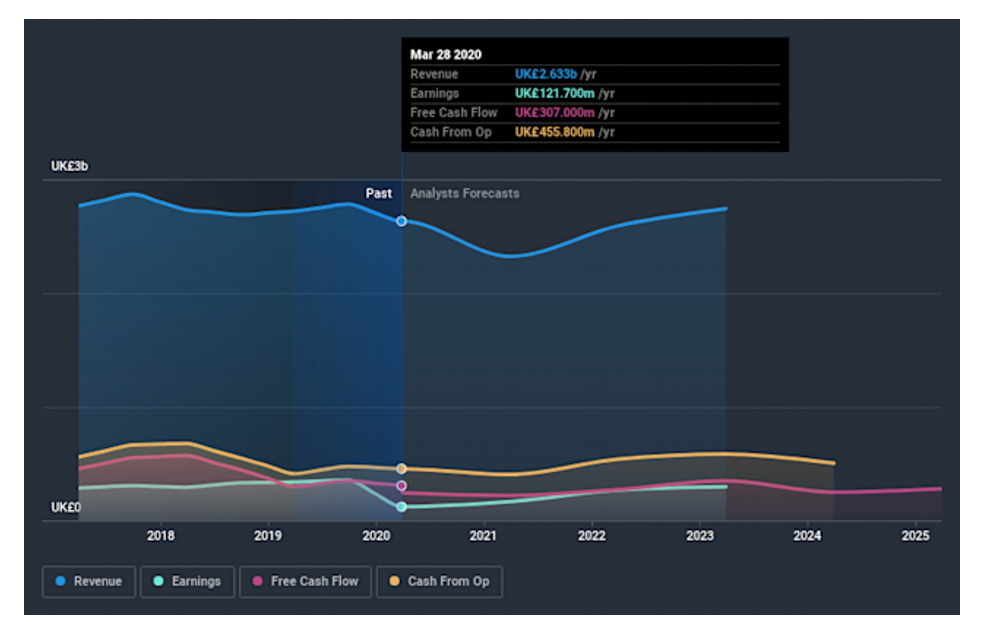

Capital project of a company plays a vital role to get investment and utilising it to earn a large amount of money. Effective capital structure is necessary for every company; Burberry’s capital project is efficient and effective to collect funds at a low cost. Total debt of Burberry is almost 54.60% of total capital; more than 50% of capital is invested from debenture holders because of the high rate of return on investment. As cited by Chen et al. (2021), three statement models will be more effective to improve financial condition of Burberry. This company has delivered a high growth rate to its investors that have increased shareholders value. Burberry earns revenue of more than 2633 million GBP per year and net cash flow is more than 66 million GBP.

This company has a well-structured capital structure and is prepared by the CFO of Burberry. Burberry has launched its online store to become a part of digital marketing and investors are motivated to invest in digital marketing companies. Quality products are prepared in Burberry that needs a large amount of money to sustain production activity. As opined by Rudolf et al. (2019), a capital project refers to the value of shareholders’ funds, debenture, and expected outstanding expenses for the company. Companies use proposed capital to purchase assets and raw materials and that helps in the betterment of the company. Available resources of funds ensure the existence of a company. Burberry produces quality goods that global consumers who can afford luxury goods prefer to choose this company.

Burberry does not invest their capital to promote goods on television but promote their products through online influencers. Consumers are so influenced by digital creators that Burberry chose a digital platform to sell products and earn a large amount of revenue from it. As cited by Darling et al. (2020), tailored expenditure of capital and plan of cost mitigation is selected to develop economic condition of this company. Sources of equity and debt are balanced in capital projects that help to develop productivity of a company. Wealth maximization is done through cost-efficient capital budgeting and brand value increases along with it. Brand value is necessary for equity investment and foreign investment is high in this company for its effective capital structure.

A solid investment grade is seen in the balance sheet of this co company that shareholders are highly motivated to invest in this company. As opined by Olteanu (2020), capital structure is planned to minimize the cost of collection and increase equity. Burberry maintains a consistent growth rate for shareholders and the dividend rate is high. This capital project is effective for Burberry because it gives liquidity freedom and company can increase productivity. More production increases profitability of the company. Almost 2685.90 million GBP is required to implement this capital project that will provide a great balance between equity and debt. Tailored expenditure of capital and plan of cost mitigation is selected to develop the economic condition of this company.

Financial analysis

Burberry has almost 66 million GBP cash inflow to continue daily activities. This company is financially strong and liquidity is high that it can easily pay all the liabilities of the organisation. COVID-19 has impacted this business that Burberry has decided to develop a recovery range of investment in current year. As cited by Casadei and Lee (2020), capital is invested in the ABC method by which capital will be invested according to the value of a project. Inventory management is tight in this organization because materials of luxury goods are expensive. It is necessary to maintain an effective budget plan for company growth. Different types of social events are hosted in this company to show corporate responsibility and increase brand value.

Figure 1: Shareholder and ownership of Burberry Group Plc

(Source: finance.yahoo.com, 2021)

Burberry always focuses on the development of liquidity and many foreign investments come for its brand value. As opined by Siregar (2021), a consistent growth rate attracts stakeholders because they get a high rate of return for investing in this company. This company donates 1% of the annual profit that is earned before deduction of tax to social development. As per the statement of loss and profits, gross profit is almost 1744 million GBP and operating profit is 433 million GBP in the year 2019-20. Earning of each share is almost 29.8 and ordinary shareholders’ weighted average number is almost 409 million. Financial fall has been seen in this company during 2019-20 for pandemics but can perform better than other competitors. [Referred to appendix 1]

Most consumers are loyal because of the great quality of goods and services that is provided by Burberry. Total debt and capital ratio is 87.50%, which shows that sources of funds are available in this company (finance.yahoo.com, 2021). Burberry has sustained its business activities during COVID-19 situation where other companies have faced a lot of complexity to survive in this uncertain time. As cited by Mrad et al. (2020), investors are highly motivated to invest in this company because of its effective financial plan and brand value. Sales revenue has been increased for taking tailored expenditure of capital and plan of cost mitigation. This company helps to improve cash flow by controlling unnecessary expenses of inventory. Many fixed assets have been depreciated because of less work during the pandemic but after implementing this capital structure productivity will increase for having good liquidity for the company. Almost 45.20% of capital is common equity of this company.

Burberry prepares goods for rich people and debts are low in this company. This company has earned a large amount of revenue in past three years for an effective budget plan. Burberry Group plc has been listed in stock exchange of London and has a membership of FTSE100 (find-and-update.company-information.service.gov.uk, 2021). Networking capital will increase because inventories are maintained tightly and current assets will be increased from debts. As opined by Elia (2019), a financial statement will be more attractive for shareholders because productivity will increase and cost will decrease in this three statement model of a financial plan that leads to exceptional growth of company. Burberry is already an established company but there are a few gaps, an effective financial plan will be helpful to increase growth rate that leads to more shareholder engagement. Equity share increase and working capital will be developing for following effective capital projects.

Financial Plan

Balance sheet, cash flow, and profit or loss account are evaluated to choose the most effective financial plan. A balance sheet helps to measure the debt and equities of a company that represents financial health of this company. As cited by Krajina et al. (2021), balance sheets are provided in the annual statement of company to show their efficiency and profit level to their shareholders. Three statement analysis helps to select the most effective way of fund collection evaluating available sources of funds. Annual sales and productivity is measured in loss and profit statement of an organisation. More profit attracts investors that are necessary for wealth maximization in an effective way. Flow of cash in the organisation represents operating, financing, and investing activities of the organisation.

Figure 2: Three statement model

(Source: Darling et al. 2020)

Evaluation of these companies cash flow helps to future decision making of a company. Three statement model helps to build control over unnecessary expenses and predict the statutory requirements of a company. This analysis model helps to improve financial condition of the company in long term. Future’s uncertain and it is hard to predict exact capital structure for a company. As opined by Ajoudani Darling et al. (2020), a sudden market collapse will affect this company for having high debt. Changes in rules and regulations of country may violate forecasted financial plan. Delay in payment of debtors can decrease cash flow of Burberry and a lot of financial crises will arrive in operational activity. Maintaining consistent liquidity is most important because stakeholders give loans by considering liquidity of organisation. Three statement analysis models is most effective process to measure a company’s strength.

Success of a company depends on a financial plan, Burberry has taken innovative ideas in its selling process and implemented most efficient capital structure for the company. Effective capital structure maintains liquidity of companies to sustain their activities. As cited by Proctor et al. (2020), expensive sources of funds are eliminated by effective capital budgeting that helps to increase leverage. Leverage on Burberry will be increased for following this financial model. Free cash flow increases and the risk of company is shared by increasing debt. Extension of debt capacity provides good cash flow in the organisation that helps increase productivity. Companies get an advantage for having good cash flow in the organisation. Management gets financial freedom to execute any project by effective capital budgeting. This model will benefit Burberry because excellent cash flow is the key to handling any uncertain situation.

Burberry is a famous fashion brand in the UK and has continued growing its brand by taking effective initiatives. More sources of funds are required to increase the workspace of this company. Three model capital structures will help Burberry to collect funds from different sources that cost as low as possible. Support service will be increased for implementing this capital structure in Burberry. As opined by Vishnevsky and Chekina (2018), cost of collection of funds will decrease in this process. Annual report of the company represents financial strength and stakeholders use this statement to invest money in this. Financial wellness promotes brand value of a company. It is necessary to evaluate different sources of funds to select the most cost-efficient and lower debt sources of funds. Liquid cash is one of the most effective factors of financial resources that help to improve cash flow of a company.

Conclusion

Financial data of Burberry Company is analyzed in this study to forecast a more effective capital budgeting plan for a company. Three model capital budget is most effective plan for a company in the personal goods industry. After evaluating different financial statements of Burberry it can be concluded that Burberry have a well-structured capital budgeting model and stakeholders invest money from foreign. Consistent growth is seen in this company, investors are highly motivated to invest in this company. Few effects have been seen in COVID-19 situation, cash flow has decreased this time. Financial managers have taken necessary initiatives to increase the financial strength Burberry. Balance sheet, loss and profit, and cash flow statement have been evaluated to understand the financial condition of Burberry. Making high-quality goods consistently in a competitive market with sudden price rises is tough without available cash flow in the organisation. Companies develop their business by improving financial conditions that help to deal with different uncertainties. After analyzing the balance sheet of Burberry it can be said that few controls over financial sources and tight inventory management give a lot of benefit to this company. It is necessary to choose an effective capital structure to get financial funds without any barriers that help this company to improve operating activities. A cash flow statement helps thunder stand the sources of cash inflow and cash outflow and CFO prepare a budget based on it. Better cash flow attracts stakeholders towards companies that will help Burberry in long run.

References

Journals

Ajoudani, A., Albrecht, P., Bianchi, M., Cherubini, A., Del Ferraro, S., Fraisse, P., Fritzsche, L., Garabini, M., Ranavolo, A., Rosen, P.H. and Sartori, M., 2020. Smart collaborative systems for enabling flexible and ergonomic work practices [industry activities]. IEEE Robotics & Automation Magazine, 27(2), pp.169-176. Available at: https://ieeexplore.ieee.org/abstract/document/9113762/

Casadei, P. and Lee, N., 2020. Global cities, creative industries and their representation on social media: A micro-data analysis of Twitter data on the fashion industry. Environment and Planning A: Economy and Space, 52(6), pp.1195-1220. Available at: https://journals.sagepub.com/doi/abs/10.1177/0308518X20901585

Chen, X., Cheng, S., Shu, R. and Yang, Y., 2021, September. Digital Marketing Transition for Luxury Industry Under the New Coronavirus Epidemic-The Case of Burberry. In 2021 International Conference on Financial Management and Economic Transition (FMET 2021) (pp. 248-254). Atlantis Press. Available at: https://www.atlantis-press.com/article/125961056.pdf

Darling, J.C., Bamidis, P.D., Burberry, J. and Rudolf, M.C., 2020. The First Thousand Days: early, integrated and evidence-based approaches to improving child health: coming to a population near you?. Archives of disease in childhood, 105(9), pp.837-841. Available at: https://adc.bmj.com/content/105/9/837.abstract

Elia, A., 2019. Fashion’s Destruction of Unsold Goods: Responsible Solutions for an Environmentally Conscious Future. Fordham Intell. Prop. Media & Ent. LJ, 30, p.539. Available at: https://heinonline.org/hol-cgi-bin/get_pdf.cgi?handle=hein.journals/frdipm30§ion=19

Krajina, A., Husić-Mehmedović, M. and Koštrebić, K., 2021. Can You See How It Smells? What Eye Tracking Can Tell Us About the Shelf Management of Luxury Perfumes. The South East European Journal of Economics and Business, 16(1), pp.93-106. Available at: http://journal.efsa.unsa.ba/index.php/see/article/view/1565

Mrad, M., Majdalani, J., Cui, C.C. and El Khansa, Z., 2020. Brand addiction in the contexts of luxury and fast-fashion brands. Journal of Retailing and Consumer Services, 55, p.102089. Available at: https://www.sciencedirect.com/science/article/pii/S0969698919315164

Olteanu, L., 2020. Rebranding strategies and their boomerang effect—The curious case of Burberry. The Journal of World Intellectual Property, 23(5-6), pp.777-797.Available at: https://onlinelibrary.wiley.com/doi/abs/10.1111/jwip.12173

Proctor, M.F., McLellan, B.N., Stenhouse, G.B., Mowat, G., Lamb, C.T. and Boyce, M.S., 2020. Effects of roads and motorized human access on grizzly bear populations in British Columbia and Alberta, Canada. Ursus, 2019(30e2), pp.16-39. Available at: https://bioone.org/journals/Ursus/volume-2019/issue-30e2/URSUS-D-18-00016.2/Effects-of-roads-and-motorized-human-access-on-grizzly-bear/10.2192/URSUS-D-18-00016.2.short

Rudolf, M., Perera, R., Swanston, D., Burberry, J., Roberts, K. and Jebb, S., 2019. Observational analysis of disparities in obesity in children in the UK: Has Leeds bucked the trend?. Pediatric obesity, 14(9), p.e12529. Available at: https://onlinelibrary.wiley.com/doi/abs/10.1111/ijpo.12529

Siregar, B.A., 2021. RELATIONSHIP OF SELF-EFFICACY TO IMPROVING EMPLOYEE PERFORMANCE: A STUDY IN MEDAN CITY. Strategic Management Business Journal, 1(1), pp.56-70. Available at: http://strategicmanagementbusinessjournal.com/index.php/SMBJ/article/view/17

Vishnevsky, V.P. and Chekina, V.D., 2018. Robot vs. tax inspector or how the fourth industrial revolution will change the tax system: a review of problems and solutions. Journal of Tax Reform, 4(1), pp.6-26. Available at: https://journals.urfu.ru/index.php/jtr/article/view/3150

Website

finance.yahoo.com, 2021, Here’s What Burberry Group plc’s (LON:BRBY) Shareholder Ownership Structure Looks Like. Available at: https://finance.yahoo.com/news/heres-burberry-group-plcs-lon-062856321.html [Accessed on: 24th October, 2021]

find-and-update.company-information.service.gov.uk, 2021, Current features. Available at: https://find-and-update.company-information.service.gov.uk/ [Accessed on: 24th October, 2021]

Appendices

Appendix 1: Revenue of Burberry

(Source: https://www.statista.com/statistics/263885/burberrys-worldwide-revenue/)

………………………………………………………………………………………………………………………..

Know more about Unique Submission’s other writing services:

Wow, this blogger is seriously impressive!

I appreciate your creativity and the effort you put into every post. Keep up the great work!