BUS7B30 Financial Insights and Business Intelligence Assignment Sample

Executive Summary

The report has presented business Insights of Unilever Plc. which is a British multinational firm dealing in a variety of fast-moving consumer products. There is a description of a financial plan that would guide the installation of the machine for packaging. The firm’s financial analysis has been done to check the feasibility and profitability of the project for the long term.

Introduction

The report has been prepared with a view to ascertaining the introduction of a diversified business line. Diversification or product development will enhance the market share of the firm (David et. al. 2017). Unilever is a firm based in the UK and dealing in multipurpose items. The report includes the presentation of the financial analysis of Unilever, which is an FMCG giant. Unilever can expand itself in the form organic food industry, which is quite popular after the pandemic. The pandemic has shifted the focus of the masses from packaged food to healthy food. The inclusion of this product line in the business would enable the increment in the firm’s revenue. The changes that occur in the financial planning will be highlighted in the firm.

Unilever Plc. is a British firm that is a public limited company. The firm has been selected for initiation of a capital project which may involve high investment and long-term efforts from the management. Unilever is already a diversified firm and has a variety of product lines in fast-moving consumer goods (Nazarova, 2015). The implementation of novel ideas would be helpful to recover the adverse impacts of the pandemic.

Project idea

Unilever is a firm that has been effectively dealing in food, condiments, minerals and supplements, tea, beauty products, and personal care. The firm can diversify its operations in the segment of organic foods, which will enhance the health and well-being of the community (Hoffman and Gold, 2016).

A firm’s finance function is associated with raising funds for performing specific functions and allocating the resources judicially without wasting resources. The Financial managers play a pivotal role in the implementation of the machine for the unique packaging of organic foods and drinks. The financial managers will perform the following functions:

- Design the capital structure of the firm

- Ascertain the capital alternatives.

- Allocate the resources to appropriate operations.

The organic food product packaging can be initiated with a developed machine that undertakes the entire manufacturing of the solid organic material. An additional chamber is to be separately installed for the safe packaging of the drinks and beverages in the organic foods. Since the organisation is dealing well with the brands like Rexona, Lifebuoy, Hellmann’s and Heart brand there is a scope left for the section of healthy food and supplements. Product development is the process of introducing a new product in the existing market, which would attract new customers and retain the existing customers.

A capital project is a long-term investment that improves the capital assets or makes an addition in the same. Such projects are highly capital intensive in nature. The capital projects in the corporation may exist in the form of developing the manufacturing plant or business place. This investment is associated with the application of depreciation on the product or the asset developed.

The introduction and instalment of organic food and beverage production packaging will involve different costs such as installation cost, freight charges, and maintenance of the machine. There are various hidden costs associated with the machine instalment, such as training and development for the proper usage of the machine to the existing employees, preparation of a shed that would provide a cold environment for the drinks chamber. The cost estimates for the given project can be given in the following manner:

| Business: Unilever Plc., London | |

| Capital Project Cost Estimates | |

| Packaging Machine Installation Cost | AMOUNT |

| Cost of registration with authorities | |

| Packaging Machine Cost | $ 5800.00 |

| Permits | $ 400.00 |

| Trademarks/designs/patents | $ 500.00 |

| Advance Deposits | $ 500.00 |

| Direct and Indirect Cost | |

| Utility connections & bonds (Electricity, gas, water) | $ 800.00 |

| Transportation Cost | $ 600.00 |

| Insurance Cost | $ 400.00 |

| Marketing & advertising | $ 300.00 |

| EQUIPMENT/CAPITAL COSTS | |

| Infrastructural Maintenance | $ 1,200.00 |

| Security system | $ 1,000.00 |

| Total Cost | $ 11,500.00 |

(Source: Self Made, 2021)

The cost of the additional chamber of drinks and beverage packaging has been given as:

| Packaging Chamber Installation Cost | AMOUNT |

| Cost of the additional chamber (inclusive of installation cost and freight charges ) | $ 2000.00 |

(Source: Self Made, 2021)

Financial analysis

The latest financial analysis for the entrustment of the new machines for the production of organic food will enhance the cash flow, revenue generation and improve the firm’s market value in case of effective and positive response. Current financial statements have been evaluated to understand the expenditure better to be made in the project. The cash flow statement for the last five years reflects that Unilever has been effectively doing capital expenditure. This is the reason for the negative cash from investing activities in the last years.

Figure 1: Unilever Cash Flow Extracts

(Source: Annual Report, 2020)

The financing activities include the issuance of the redemption of capital or the activities associated with the dividends. The dividend payment is a regular activity in the firm which is done from the retained earnings. It is observed that retained earnings are the cheapest and reliable form of investment (Kilroy and Schneider, 2017). Therefore, the firm will try to lower the dividend and invest the profits in the newer projects after convincing the shareholders and the board members.

Figure 2: Five years cash Flow extracts

(Source: Annual Report, 2020)

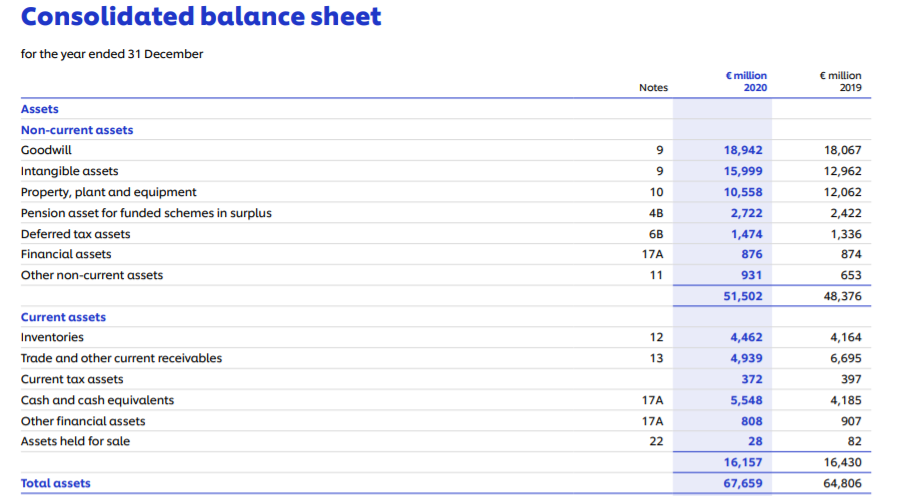

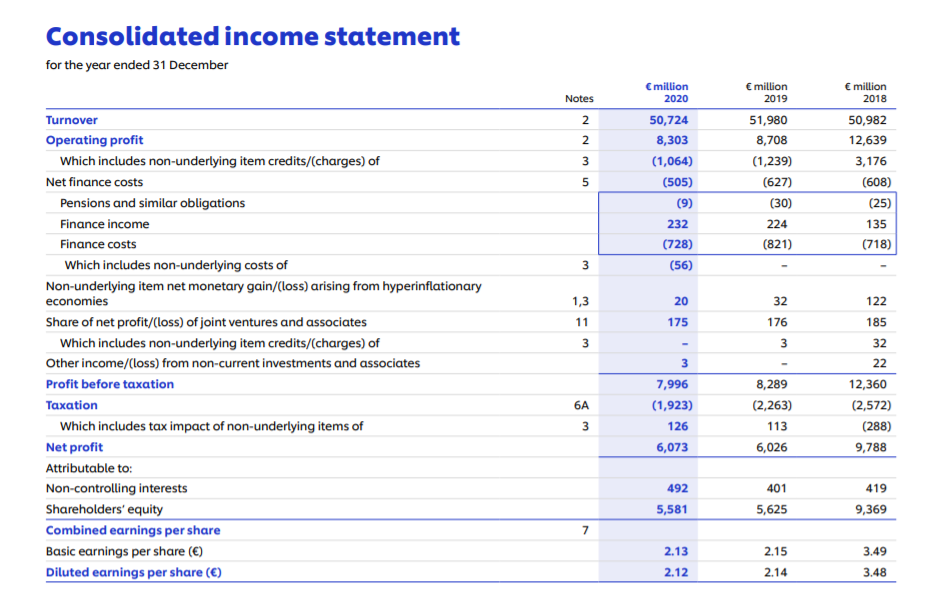

The revenue in the firm seems to be declining in the year 2020 as compared to 2019. The revenue increment is fostered by innovative marketing or the introduction of some new products. The firm has decided to enter the novel range of organic foods and has decided to attract customers with its effective and innovative marketing ideas. The revenue increment will directly contribute to higher gross profit for the firm, which will effectively cover the firm’s costs.

The Assets have been valued at the amount of 67,659 € million in 2020, which will be increasing in the upcoming years. The ratios associated with the asset valuation and the revenue will be reflecting better figures. The machine is a depreciable asset, and it needs to be appropriately depreciated from correct tax ascertainment. The depreciation is the wear and tear of the machine with time (Palepu et. al. 2020). It is the allocation of the cost of the machine acquiring to the useful life of the machine.

Figure 3: Balance Sheet Unilever Plc.

(Source: Annual Report, 2020)

The capital structure refers to the balance of the equity and debt in the employed capital of the firm. Unilever has a higher proportion of debt in the firm represented by the Statement of Financial Position of the firm. The retained earnings partially fund the funds required for the new project, and the rest focus should be laid on the equity financing more (AREAS, 2018).

The asset proportion of the firm is more inclined to the intangible assets as the valuation of the same is € 15,999 million for the current year and has risen to around € 3000 million. Intangible assets are those which cannot be seen or touched, such as the intellectual rights or the trademarks or the patents, whereas tangible assets are those which can be seen and touched. The installation of machinery would enhance the valuation of tangible assets.

In case the debt is issued for the procurement of the machinery, then there may be an incurrence of the interest cost in the firm. There are several other investment alternatives in venture financing or crowd funding, but the firm is sound enough to raise the sources that support independence.

Figure 3: Income Statement Unilever Plc.

(Source: Annual Report, 2020)

Financial Plan

Financial modelling is the combination of the accounting, finance, and business functions in a metrics form such that an abstract model of the current financial situation is presented (Chang and Ramachandran, 2017). Different kinds of financial models can be employed in the business.

The future Financial Planning of the firm is affected in various ways. There may be changes in the capital structure or the application of the funds in different products or services. There are various models for the financial planning of the capital projects to be undertaken in the firm. Various elements are to be considered while financial planning, such as the liquidity requirement or the investment needs that are governed by the networking capital decisions or capital budgeting decisions (Botha et. al. 2018). The current case in Unilever is more inclined to invest in the new asset for better packaging.

Importance of Financial Planning

Financial Planning in Unilever is a high investment and will be affecting the in-hand returns of the shareholders. Therefore, it is essential to present the benefits of financial planning, which will yield long-term advantages. Financial Planning in Unilever would allow management a systematic framework for exploring its opportunities (Blanchett, 2015). This expands the chances of feasibility checking of different alternatives.

Use of Financial model

Financial plan models include various components such as the sales forecast, projected financial statements, capital requirements for the project, additional assets to be employed that will enhance the capacity to meet the sales projections, etc. There may be some assumptions made about the upcoming economic events, which are highly uncertain yet can affect the investment decisions. The addition of a packaging machine for organic food in Unilever will expect the following revenue from the product line:

| Sales Forecast | Year 1 | Year 2 | Year 3 |

| Sales (Inclusive of miscellaneous Income ) | $ 18,000 | $21,000 | $23,500 |

The projected financial statements consist of a statement of financial position, income statement, and cash flow statement, which depict the estimated financial position of the enterprise. The projected statements allow the management to form relevant strategies and bifurcate expenses in relevant fields. The income statement is the description of expenditure and income that a firm incurs in a given financial year (Fraser et. al. 2016).

| Unilever Plc. (Organic Food ) | |||

| Projected Income Statement | Year 1 | Year 2 | Year 3 |

| Sales (Inclusive of miscellaneous Income ) | $ 18,000.00 | $21,000 | $23,500 |

| less cost of goods sold | $ 11,500.00 | $13,600 | $15,500 |

| Gross profit/net sales | $ 6,500.00 | $ 7,400.00 | $ 8,000.00 |

| Expenses | |||

| Advertising & marketing | $ 400.00 | $600 | $700 |

| Interest | $ 600.00 | $750 | $850 |

| Insurance | $ 1,200.00 | $ 1,200.00 | $ 1,200.00 |

| Total expenses | $ 2,200.00 | $2,550 | $2,750 |

| NET PROFIT | $ 4,300.00 | $4,850 | $5,250 |

The following table gives the additional Asset valuation that is to be implied in the organisation with the amount of depreciation charged at the rate of 10 percent on both machines.

The additional asset of packaging costing 5800 Dollars will be required. The cost of installation and the rights would be added to the machinery cost while providing depreciation. Additional Chamber costing 2000 Dollars has also been installed, directing effective packaging for the beverage section.

| Unilever Plc. | |

| Additional Machines Required for Capital Project | AMOUNT |

| Packaging Machine Cost | $5,800.00 |

| Permits | $400.00 |

| Trademarks/designs/patents | $500.00 |

| Advance Deposits | $500.00 |

| Direct and Indirect Cost | |

| Transportation Cost | $600.00 |

| EQUIPMENT/CAPITAL COSTS | |

| Infrastructural Maintenance | $1,200.00 |

| Additional Chamber | $2,000.00 |

| Total Cost | $11,000.00 |

Limitation of capital project

The capital project, which is to be implied in Unilever, has limitations in terms of pricing that would charge from the customers. The packaging machine for the organic food will incur some extra charges per unit costing of the product. This may lead to an increase in the product’s pricing, and the product line will attract only the price-insensitive customers. The market segment with low prices and better quality customers will be left aloof. The beverage packaging may also require freezing instruments with the wholesalers and buyers, which will limit its expansion in the market. Thus, there may be a limitation in terms of the market share increasing easily and the issue of cost burden being laid on the customers. Low affordability may become one of the causes of the low revenue generation for Unilever.

Conclusion

The report has been presenting an effective idea for the firm to grow in a different market sector and allow the organisation to manage its operations in different channels. The packaging is a crucial source for the attraction of the customers. The capital project on installing a machine would give higher returns to the firm. The financial managers will undertake the investment appraisal techniques that will reveal the utility and the return proportion of different options undertaken for the capital project. The project has been responsible for the dividend reduction, which may be a cause of the dissatisfaction of the shareholders. The managers need to have a report on the benefits that the implementation of such a project can reap. It has been concluded that the finance team is crucially important during the capital projects for evaluation of the systems and returns.

References

AREAS, B., (2018). Financial analysis. growth, 30, p.10.

Blanchett, D., (2015). The value of goals-based financial planning. Journal of financial Planning, 28(6), pp.42-50.

David, F.R., David, F.R. and David, M.E., (2017). Strategic management: concepts and cases: A competitive advantage approach. Pearson.

Botha, M., Du Preez, L., Geach, W.D. and Rabenowitz, P., (2018). Fundamentals of financial planning (2018). Cape Town: LexisNexis.

Chang, V. and Ramachandran, M., (2017). Financial modeling and prediction as a service. Journal of Grid Computing, 15(2), pp.177-195.

Fraser, L.M., Ormiston, A. and Fraser, L.M., (2016). Understanding financial statements. New York: Pearson.

Hoffman, A.N. and Gold, N., (2016). Unilever: Making Sustainable Living Commonplace. Rotterdam School of Management, Erasmus University.

Kilroy, D. and Schneider, M., (2017). Valuing the Current Strategy. In Customer Value, Shareholder Wealth, Community Wellbeing (pp. 109-141). Palgrave Macmillan, Cham.

Nazarova, V., (2015). Corporate diversification effect on firm value (Unilever group case study). Annals of economics and finance, 16(1), pp.173-198.

Palepu, K.G., Healy, P.M., Wright, S., Bradbury, M. and Coulton, J., (2020). Business analysis and valuation: Using financial statements. Cengage AU.

Unilever official Website. (2021). [Online]. Accessed through < https://www.unilever.com > Accessed on 26th October, (2021).

Know more about UniqueSubmission’s other writing services: