BUS7B30 Financial Insights and Business Intelligence Assignment Sample

Executive Summary

The report presents the existing business financial aspects of Tesco Plc. which is a giant in the UK dealing in all the retail sectors. Financial analysis is the process of digging into the financial statements and the reports which have to reflect the actual market position of the entity. The identification of current resources, assets, and liability allows the management to form relevant strategies and enhance growth and development.

Introduction

Capital projects are the ones that aim to add up the assets in a firm and may include maintenance activities. Such projects are giant and are for a long-term purpose (Yun et. al. 2016). In other words, a long duration or long planned project that are planned in accordance to construct or formulate, to improvise, to maintain the improvisation, or to develop an asset that is capital asset are referred as capital project. The current report is based on the understanding of the financial functions in the business and using the financial trends in the ascertainment of further investment in any long-term projects. The report is based on introducing the capital project in Tesco Plc. which is a retail firm and is initiating a segment that will form customised products for the customers.

This will require the establishment of a new unit apart from the retail stores successfully operating in the market. Hence, the report has depicted the business insights on the Tesco plc financial factors and enhanced the financial model that would direct the management to make a sound choice in different available alternatives. The report is a blend of theoretical and practical instances of current situations in the firm presented by the financial statements extracted from the annual reports. The report is also inclusive of the projected behaviour of the financial statement.

Project Description

Tesco Plc. is a multinational grocery and merchandise retailer. It is the third-largest retailer in the UK in terms of revenues earned by the firm. The firm has retail stores in almost five countries. The firm needs to undertake a capital project which is associated with the installation of a manufacturing firm. The trend in the UK has shifted now, and people tend to prefer bulk shopping which their attitude and beliefs may influence. TESCO has adopted a tendency to provide discounts on non-food items that will expand markets and help to work following social customs (Haddock-Millar and Rigby, 2015).

The idea of the project is to form a manufacturing unit that would design customized general merchandise that would be mostly used for personalization or gifting purpose. The personalization of products would include printing designs, names, or colours as desired by the customers. Such customization would be effective enough for price-insensitive customers. The idea would involve huge capital investment and inculcate skilled labour who is well experienced in the customisation process. Thus, the cost estimation for the same project has been enlisted as follows:

| Estimated project Cost | Cost ($) |

| Capital to be raised in Tesla Plc. | |

| Customisation printers | $12,000 |

| Permits | $150 |

| Domain names | $200 |

| Trademarks/designs/patents | $600 |

| Rental lease cost (Advance rent to be paid ) | $1,500 |

| Electricity and Water Bills | $1,000 |

| Phone connection and Internet Charges | $300 |

| Internet connection | $180 |

| Training and development cost | $450 |

| Insurance Cost | |

| Printing, Stationery & office supplies | $150 |

| Marketing & advertising | $400 |

| Estimated project Cost | $16,930 |

There are economic barriers in the UK markets which may hinder the development of the project. Economic factors also include the cost of production, which can affect the pricing strategy and thus affect profits adversely. In UK markets, labour costs are highly influential. Changes in the policies for minimum wage rates have raised the overall cost of production. Thus, economic factors and their volatility is essential to be given back (Adamyk, 2019). The setting up of the manufacturing plant for customized goods by Tesco will enhance the strategy of differentiation in competitive advantage. Differentiation is a strategy of getting unique features in products or services that prospective competitors cannot imitate.

Evaluation of the firm

Financial analysis is performed to analyze that the firm is stable in terms of profitability, liquidity, or solvency (Wang and vom Hofe, 2020). Financial analysis helps to understand the trends in the economy and formulate the financial policies for the future. The management will effectively carry out the investment purpose with higher returns.

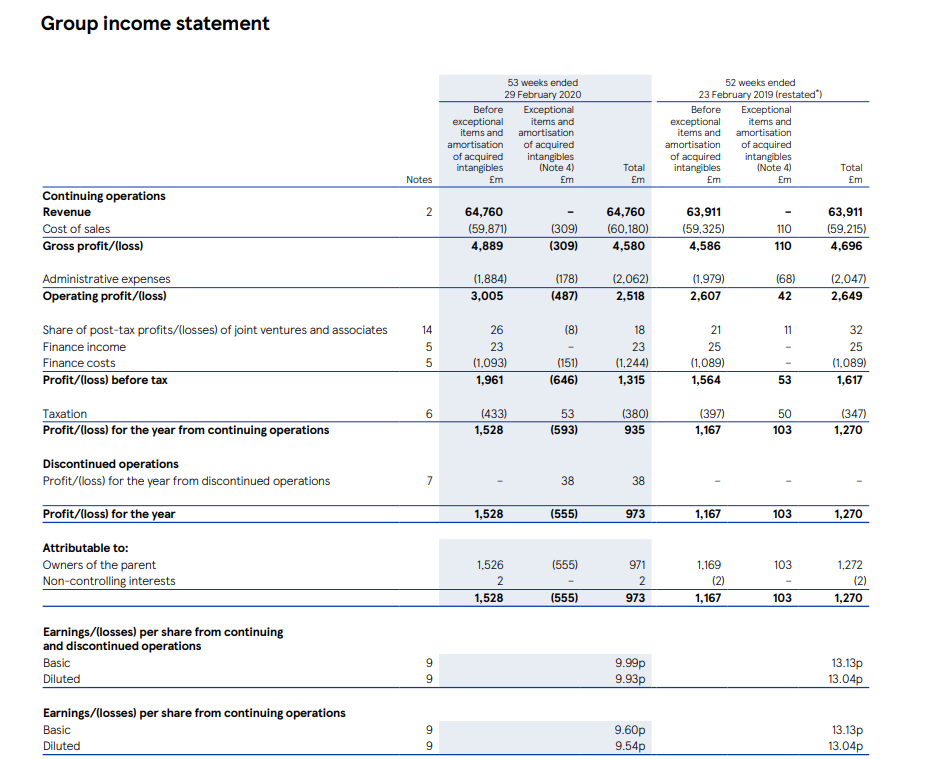

Tesco has been experiencing a fall in revenue generation after the Covid Pandemic, which may be due to high mobility restrictions implied in different geographical locations. Gross revenue has fallen from a value of approx 7000 Million. As a result of the decline in the revenues, there is decreasing gross profit. There are various evaluations of Tesco based on the existing conditions of the market:

· Tesco excels in its retail customer services and hence has brilliant reviews for the shopping experience by the customers.

|

|

The revenue for the firm on different dates in the last three years has been presented as:

Figure 1: Income Statement of TESCO Plc.

(Source: Annual Report Tesco, 2020)

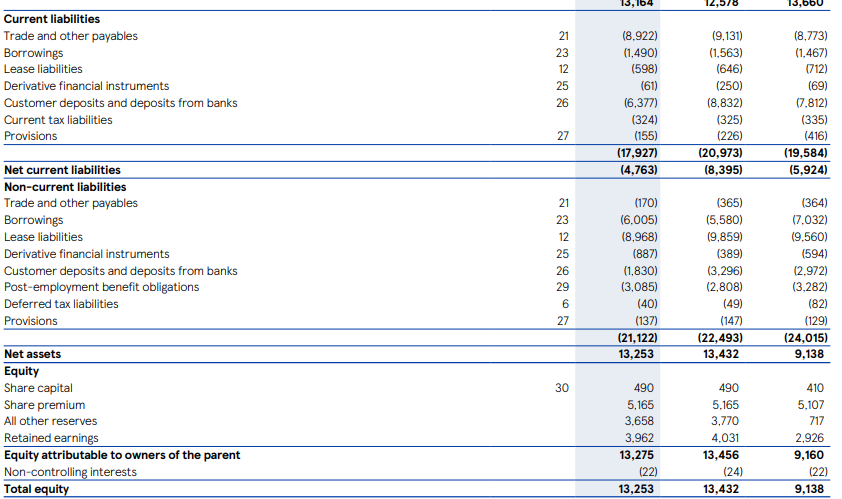

The capital structure of a firm is also to be evaluated before making such a huge investment to choose the firm’s capital structure (Yapa Abeywardhana, 2017). It is observed that the equity proportion in the firm is way less than the debt raised. The debts have been high with a value of £ m 21,122 and an interest cost of approx £ m 1093. Therefore, it is appropriate to undertake the financing method to be more of equity and the retained earnings to bear less interest cost for the firm.

Figure 2: Liability Part of Balance Sheet Tesco

(Source: Annual Report Tesco, 2020)

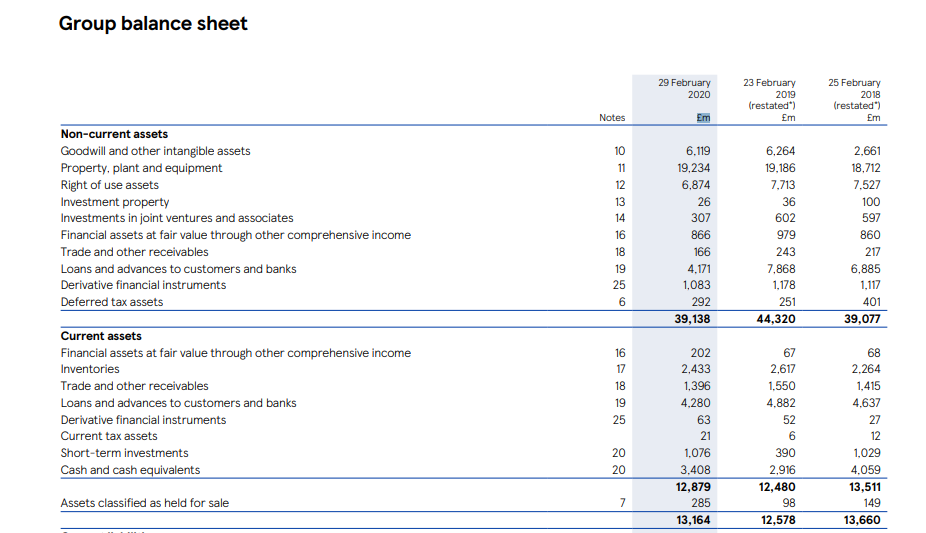

The cash balance with the firm has been maintained. The implementation of the unit will involve returns in the form of new customers, which will raise the level of revenue in the firm. The year 2019 has been drastically poor for the financial performance of the firm. The assets like cash balance, short-term investments, and many more have been falling rigorously. Therefore, the decision to expand in another sector would work out to foster frequent cash flow in the firm. The trade receivables have fallen from a value of £ 1550 m to £ 1396 m. This can be referred to as the probable cause of the increase in the cash and not merely revenue increment. The tangible assets, which are in the form of Property, plants, and types of equipment, have not been changing in high proportion from the year 2018 to 2020, which means that the firm does not intend to invest in additional assets. This manufacturing establishment will prove to be an effective source in the market where customization is trendy. Tesco will gain a competitive advantage in the form of differentiation. Competitive advantage is a trait that beats the completion in the market (Kumar and Pansari, 2016).

Figure 3: Assets Part of Balance Sheet Tesco

(Source: Annual report Tesco, 2020)

The firm has reduced its investments from joint ventures and associates. The initiation of a new unit can take the entrance into the market through such ways. The joint venture investments have been brought down to a value of £ 307 m from £ 602m (Muli, 2019). The short-term investments made through different channels would have been yielding interest benefits. Hence, the other income earned will benefit the firm. The low-value investments in the year 2019 have experienced a high positive inclination in the year 2020.

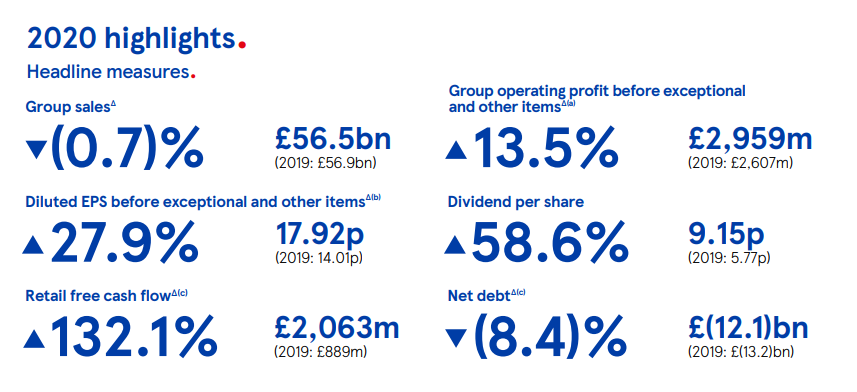

Figure 4: Financial Highlights for Tesco 2020

(Source: Annual Report Tesco, 2020)

Financial Planning for the firm

Financial planning is the process of estimating the funds required in any project. The financial policies are to be formulated to allocate the funds appropriately to the operations (Alexander, 2018). Planning in any firm is done through the application of different kinds of models in the firm. The financial Planning model adopted contain certain common ingredients such as:

- Sales Forecast that depicts the cash flows based on sales.

- It projected financial statements that ascertain consistency and foster better and appropriate interpretation.

- The details of additional assets that need to be engaged to attract customers to meet sales demands.

- Capital is needed for the initiation and smooth running of the capital project.

- Type of capital alternative chosen by the management to raise funds.

The model selected for the financial planning is the Percentage of Sales Approach – I, which enhances the only few financial items that vary directly with sales. The profit and loss statement has depreciation, interest, and insurance expenses which are not affected by the revenue generation capability of the firm. There is another element, dividend, which is the residual of the profits paid to the shareholders. Dividend payment is also considered a managerial decision and hence does not vary directly with revenue generated from sales.

Another model, Percentage of Sales Approach – II, is based on the assumption that all the assets procured by the organization change with the change in the sales figures. As a result of a change in sales, accounts receivables are also dependent variables. At the same time, the liability elements like long-term debt and equity depend on the capital structure decisions made by the senior management and not on sales. Any firm would require external financing when there is a difference in the forecasted values of the assets and equity and liabilities. It is necessary to balance the basic accounting equation.

| Tesco Plc. (Projected ) | |||

| Statement of profit and loss | 2,021 | 2022 | 2023 |

| Revenue from Sales | $ 25,000.00 | $27,500 | $30,250 |

| Cost of sales | $ 16,950.00 | $18,645 | $20,510 |

| Gross profit/net sales | $ 8,050.00 | $ 8,855.00 | $ 9,740.00 |

| Expenses | |||

| Depreciation Expenses | $ 2,550.00 | $2,550 | $2,550 |

| Marketing Expenses | $ 400.00 | $450 | $650 |

| Interest | $ 550.00 | $550 | $550 |

| Insurance | $ 800.00 | $ 800.00 | $ 800.00 |

| Total expenses | $ 4,300.00 | $ 4,350.00 | $ 4,550.00 |

| NET PROFIT | $ 3,750.00 | $4,505 | $5,190 |

The change in the sales level has been assumed as 10 percent. The changes in the balance sheet items will be made in terms of the capital; raised from different sources. The balance sheet will present the changes in different financial elements.

| For Tesco Plc. (customisation segment extracts ) | |||

| BALANCE SHEET FORECAST | 2021 | 2022 | 2023 |

| Current assets | |||

| Cash | $5,000 | $4,000 | $6,000 |

| Inventory | $14,000 | $18,000 | $16,000 |

| – | |||

| Trade Receivables | $6,000 | $6,600 | $7,260 |

| Fixed assets | |||

| Furniture & fittings | $1,200 | $1,800 | $3,000 |

| Vehicles | $4,000 | $4,000 | $4,000 |

| Machine | $13,950 | $13,950 | $13,950 |

| ` | |||

| Total assets | $44,150 | $48,350 | $50,210 |

| Current/short-term liabilities | |||

| Accounts payable | $400 | $650 | $1,020 |

| Long-term liabilities | |||

| Loans | $2,000 | $3,000 | $3,000 |

| Total liabilities | $2,400 | $3,650 | $4,020 |

| Equity (Balance) | $41,750 | $44,700 | $46,190 |

The retained earnings with the have been well enough, but the year has seen a drastic rise in the dividend payment. The rise in the dividend payments to 58% has reduced the part of retained earnings in the balance sheet. There are other highlights which have been expressing the factors like the Retail free cash flow and the Group sales. These figures have depicted the operating profit as declining in the period to a valuation of £2,518m from the amount of £2,649 m. The firm capital project initiated should opt for the capital structure that minimizes cost and maximizes the returns (Oral and CenkAkkaya, 2015).

Conclusion

The report has been concluded with an effective model for Tesco that would provide different aspects of the financial reflections for the firm. The introduction of a new manufacturing unit in the organisation would help in the higher revenue generation and better market capturing of the firm. Tesco has been drastically affected by the Covid pandemic. The capital project is established as a new manufacturing unit that would serve to retain the old customers and attract different customer segments to make a repetitive purchase. The strategy of differentiation would raise revenues and help build brand image in the market. The first-mover advantage of the firm will bring a rarity for Tesco. Financial Evaluation of the current position and the financial planning will be helpful to get an appropriate way through the establishment, execution, and implementation process.

References

Adamyk, K., (2019). PESTLE Analysis on Tesco PLC. Sage.

Alexander, J., (2018). Financial planning & analysis and performance management. John Wiley & Sons.

Annual Report Tesco, (2020) [Online]. Accessed through < https://www.annualreports.com/Company/tesco-pl >. Accessed on: 26th October, 2020.

Haddock-Millar, J. and Rigby, C., (2015). Business Strategy and the Environment: Tesco PLC’s Declining Financial Performance and Underlying Issues. Review of Business & Finance Studies, 6(3), pp.91-103.

Kumar, V. and Pansari, A., (2016). Competitive advantage through engagement. Journal of marketing research, 53(4), pp.497-514.

Muli, A.N., (2019). STRATEGIC FINANCIAL EVALUATION AND ANALYSIS OF TESCO AND BENEDICT CO.

Oral, C. and CenkAkkaya, G., (2015). Cash flow at risk: A tool for financial planning. Procedia economics and finance, 23, pp.262-266.

Wang, X. and vom Hofe, R., (2020). Financial analysis. In Selected Methods of Planning Analysis (pp. 173-223). Springer, Singapore.

Yapa Abeywardhana, D., (2017). Capital structure theory: An overview. Accounting and finance research, 6(1).

Yun, S., Choi, J., Oliveira, D.P., Mulva, S.P. and Kang, Y., (2016). Measuring project management inputs throughout capital project delivery. International Journal of Project Management, 34(7), pp.1167-1182.

Know more about UniqueSubmission’s other writing services: