BUS7B30 Financial Insights and Business Intelligence Assignment Sample

FINANCIAL PLANNING FOR UNILEVER

Introduction

Financial planning refers to the association of equipment, activities, materials and resources for business organisations in achieving their particular strategic goals within a given timeframe. Therefore, the current report recommends a unique project idea considering the business model of Unilever in mind and shall further focus on the different changes occurring within the financial statements of the firm in the future. Moreover, Unilever has been selected due to their extensive range of products and services along with customer oriented business models that can be further beneficial for the development of project ideas.

The proposed capital project for the firm shall be to introduce a new skincare product which shall require additional capital requirement of 8000 million to 10000 million pounds. As the business model of the firm is associated with direct customer services, it shall be easier for delivery of the products required by prospective customers. Moreover, the brand image of the firm has been at optimal levels for introduction of a new product line within the industry. In addition to that, the inclusion of new skincare products shall aid in increased profitability levels within the firm along with a rise in overall cash levels. Furthermore, the computation of projected cash flows, income statement and balance sheet for Unilever in next year shall be included within the report.

Project Idea

The current business project of introducing a new skincare product within the retail market of the UK Furthermore, the concerned skincare product has been chosen for Unilever as they are found to record over 2.6% more growth in their annual turnover in 2017 within the personal care segment. Moreover, the operating margin of the firm was also found to increase significantly from 18.1% to 19.8% in 2017 (Unilever, 2017). Therefore, it was clear that the operational strategies were evident in highlighting the higher levels of efficiency for Unilever in the personal care segment. Moreover, words of Haque et al. (2017), stated that a vacuum for premium personal care products are present for Unilever due to the increasing demand for the concerned products within emerging economies. Moreover, the study has also highlighted creation of separate brands for promotion and creation of personal care products. However, due to lack of adequate finances, recommendations have been made for inclusion of new skincare products for further increase in sales revenues.

The business model of Unilever has emerged as a “Direct-to-consumer” business model that is further dependent and operational on a Global value chain. Their primary strategy has been associated with the creation of long term sustainable value creation for their brand along with a compounding growth strategy (Akgün, 2018). Furthermore, a “direct-to-consumer” business model has been crucial for understanding the personal requirements of their existing customer base through massive marketing campaigns for the establishment of connections between the customers and its respective brands. As per the opinion of Dorman (2013), sales of products and services directly towards their respective customers are associated with the direct to consumer business model. In addition to that, sales persons are given tools for becoming individual entrepreneurs who further helps in additional employment generation in rural areas of developing economies.

Moreover, the current capital project is aimed at increasing the profitability levels of the firm through targeting the mass level customers from the developing economies across the world with the current skin care product at competitive pricing than existing market products. In addition to that, the capital project is aimed at improving the overall profitability levels of the firm through an additional increase in revenue over 40% than the previous year of 2020. In addition to that, efficiency levels can be improved through proper delegation of tasks to respective employees as well as the production line workers. Furthermore, providing the workers with additional training regarding raw materials handling and manufacturing of the product will help in increasing efficiency levels of the workers (Ndulue, 2012). Moreover, the approximate additional costs required for manufacturing the current product is estimated between £8000 million to £10,000 million annually.

Moreover, the proposal is also aimed to improve the current cash flow levels of the firm through mobilising the existing inventory levels held. In addition to that, inclusion of electronic payments from customers shall also help to attain payments upfront and reduce the additional delays in payments improving cash levels held by the organisation. According to the words of Gruca and Rego (2005), higher levels of cash flows within organisations are associated with increased customer satisfaction levels. Moreover, the benefits are found to be associated with the approach undertaken by the firms in producing their products to compete with existing firms in an industry.

Financial analysis (Income statement, balance sheet)

Financial analysis of a firm refers to the critical evaluation and analysis of the

The current section hereby highlights the financial analysis and projections made for Unilever after the incorporation and launch of the aforementioned skin care product. Moreover, the projected income statement and balance sheet proforma for 2020 and upcoming year 2021.

| Projected Income statement proforma for Unilever | ||||

| Particulars | % of sales | Amount (2020) | Projected Amount (2021) | |

| Sales/ Turnover | 40% | 50724 | 71013.6 | |

| Expenses | 20% | 41357 | 49628.4 | |

| Operating Profit | 30% | 9367 | 21385.2 | |

| Less | Taxes | 5% | 1923 | 2019.15 |

| Net Profit | 7444 | 19366.05 | ||

Table 1: Projected Income statement for Unilever after skincare product launch

(Source: Self Developed)

The table highlighted above shows the projected income statement for Unilever in 2021 and the changes occurring in the sales and profitability of the firm. Upon closer analysis, the sales revenue of Unilever is expected to increase by 40% that shows an increase in projected sales to be £71013.6 million from £50724 million in 2020. Moreover, the expenses for production and operational purposes are also found to increase by 20% that has increased the overall cost of sales amount from £41357 million in 2020 to £49628.4 million in 2021. The aforementioned expenses are considered due to the additional costs required for procurement of the raw materials, transportation costs along with factory rents and expenses for the firm. However, the operating profit shall further increase by 30% due to the full occupancy rates of the workers associated within the production of the current product as the expected demand for the product is high within the emerging markets of developing countries.

Furthermore, the operating profit for Unilever was found to be £9367 million in 2020 (Morningstar.co.uk, 2021). Upon further analysis, the expected operating profit shall increase to £21385.2 million in 2021 after the concerned product’s launch. In addition to that, an approximate estimation of 5% increase in the taxation rates has been assumed that increased annual taxes from £1923 million to £2019.15 million for the next year. However, the firm is estimated to gain a net profit increase from £7444 million in 2020 to £19366.05 million in 2021 as depicted in Table 1 highlighting an increase of over £11922.05 million in spite of the increase in annual expenses for the firm.

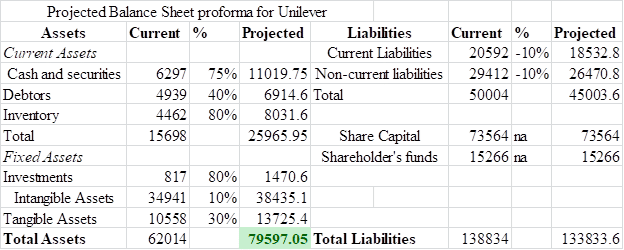

Figure 1: Projected balance sheet for Unilever in 2020-2021

(Source: Self Developed)

The aforementioned figure highlights the projected balance sheet of Unilever for 2021 focusing on the major financial changes expected within the firm after the launch of the skin care product. Upon closer analysis, the cash and securities held within the firm are expected to increase massively by 75% due to high demand of cheaper skincare products in developing markets. Moreover, Unilever is found to assign individual entrepreneurs for selling their products through a business to customer (B2C) model (Ajanee, 2008). Therefore, there are minimal chances of failure in payments and thus the expected rise in cash collections is estimated.

In addition to that, the inventory levels are estimated to increase by 80% due to full efficiency of the workers and the production working at full capacities. However, to further increase the inventory turnover ratio, high sales are expected for the current product along with proper communication channels built with the sales team and the operations and production team for the firm (Kesavan et al. 2016). Moreover, due to higher sales the inventory levels shall be replenished easily with newer stocks and higher inventory turnover ratio. Thus, an overall increase in the assets has been recorded from £62014 million in 2020 to £79597 million expected in 2021.

On the contrary, the liabilities highlight a 10% decline in both the current and non-current liabilities of the firm. Due to the exceptional profitability levels, Unilever can easily mitigate some of their existing liabilities easily to reduce their short term debts. However, a deficit has emerged to be recorded in the total liabilities column which can be considered as the owner’s equity. The excess of liabilities can be further mitigated in the upcoming years through the boost and increase in sales growth through new marketing strategies for the concerned product. Finally, the cash positions and improvements for Unilever have been further highlighted in the following section.

Financial plan (projected)

Financial planning refers to a step by step approach in the meeting of organisational goals in accordance with the control of income, expenses as well as investments. Furthermore, the different financial planning models explained during courseworks are investments in newer assets, financial degree of leverages, cash paid out to shareholders and additional liquidity requirements of firms. Moreover, focusing on the above financial analysis, the financial model of investments in fixed assets can be recommended for Unilever to further reduce the gap between the assets and liabilities occurring in 2021.

Moreover, the capital budget formulated for the firm should be essential in understanding the investments made within the company to further convert into newer assets for increasing their credibility as well as liquidity levels. Furthermore, with higher liquidity, the firm shall emerge to have better investment score for the prospective shareholders willing to purchase the company’s stock (Ibbotson et al. 2013). In addition to that, the company should also reconsider giving out additional returns to its equity shareholders from the significant profits earned after the launch of new beauty products. Therefore, it will increase the brand image along with additional investment possibilities for Unilever in the future.

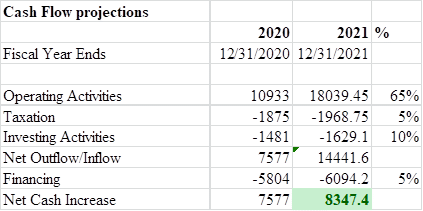

Figure 2: Cash flow projections for Unilever in 2021

(Source: Self Developed)

The cash flow projections for Unilever have been highlighted for the period of 2020-2021 in figure 2. Upon closer analysis, the operating activities cash levels are found to increase by 65% with estimations that the company shall be working at their maximum capacities. In addition to that, the firm is also recommended to focus on investing in newer assets which has increased investing activities by 10%. Furthermore, the net inflow recorded for 2021 emerged to be £14441.6 million that is estimated to increase from £7577 million in 2020.

Finally, the net cash increase for Unilever is expected to increase from £7577 million to £8347.4 million in 2020-2021 periods in spite of the increase in financing, operating as well as investing activities.

Conclusion

The current report has hereby incorporated the financial planning and analysis of Unilever in respect to the launching of a new skincare product. Furthermore, Unilever was found to have a global marketing and supply chain that has made the launch of the aforementioned product easier to target the developing economies at a competitive price level. In addition to that, the financial statements of Unilever have been critically analysed to focus on the major changes to be recorded in their profitability, liquidity and investment methods in the next year. The results highlighted an increase in net profits of the firm from £7444 million in the current year to approximately £19366.05 million in 2021. In addition to that, the cash flow projections have also highlighted an increase in the cash levels for the firm from £7577 million to £8347.4 million in the upcoming year due to a major increase in the profits as well as the operational activities of the firm.

Furthermore, recommendations of investing in newer assets have been recommended for Unilever to reduce the difference in balance sheet and furthermore improve the overall liquidity of the firm. Thus, the current report has emerged to record an increase in overall profitability and efficiency levels for Unilever through financial projections and planning.

Reference List

Ajanee, J.N., 2008. Cultural customization: An analysis of Chinese and Spanish B2C web sites. International Business & Economics Research Journal (IBER), 7(12).

Akgün, H., 2018. Mergers and Acquisitions and Open Innovation as a Business Growth Strategy. The Mega Cases of Procter & Gamble and Unilever (Doctoral dissertation, Universiteit Hasselt).

Dorman, A.J., 2013. Omni-channel retail and the new age consumer: an empirical analysis of direct-to-consumer channel interaction in the retail industry.

Gruca, T.S. and Rego, L.L., 2005. Customer satisfaction, cash flow, and shareholder value. Journal of marketing, 69(3), pp.115-130.

Haque, S.U., Jahan, Y., Siddique, R., Tasnim, T. and Roy, S., 2015. Marketing Analysis of Unilever. Total Quality Management.

Ibbotson, R.G., Chen, Z., Kim, D.Y.J. and Hu, W.Y., 2013. Liquidity as an investment style. Financial Analysts Journal, 69(3), pp.30-44.

Kesavan, S., Kushwaha, T. and Gaur, V., 2016. Do high and low inventory turnover retailers respond differently to demand shocks?. Manufacturing & Service Operations Management, 18(2), pp.198-215.

Morningstar.co.uk (2021). Unilever PLCULVR Available at: https://tools.morningstar.co.uk/uk/stockreport/default.aspx?tab=10&vw=bs&SecurityToken=0P00007P0W%5D3%5D0%5DE0WWE%24%24ALL&Id=0P00007P0W&ClientFund=0&CurrencyId=BAS [Accessed on: 12/11/2021]

Ndulue, T.I., 2012, September. Impact of traning and development on workers performance in an organisation. In Book of Proceedings, Proceedings of International Congress on Business and Economic Research (ICBER2012), International Association for Teaching and Learning, Granada (Vol. 1, pp. 135-148).

Unilever, (2017). UNILEVER ANNUAL REPORT AND ACCOUNTS 2017 Available at: https://www.unilever.com/Images/unilever-annual-report-and-accounts-2017_tcm244-516456_en.pdf [Accessed on: 12/11/2021]

Appendices

Appendix 1 : Annual Report for Unilever, 2020

Source: https://www.unilever.com/Images/annual-report-and-accounts-2020_tcm244-559824_en.pdf

………………………………………………………………………………………………………………………..

Know more about UniqueSubmission’s other writing services: