BUSI1715 Organisational Assignment Sample

Module code and Title: BUSI1715 Organisational Assignment Sample

Introduction

The financial performance of any business is a core pillar of any organisation’s report as financial performance has indicated current as well as past performance levels. This report is prepared to analyse the financial performance of Amazon which is a UK-based and global online retail leading industry. On the other hand, for competitive analysis, Walmart has selected. Walmart is a core competitor of Amazon as well as affects the business performance of Amazon.

Therefore, to conduct a financial performance of Amazon ratio analysis has been selected. Apart from this, an overview of the non-financial performance of Amazon‘s annual report and the CSR report Amazon have been selected. The aim of this report is to overview and highlights the financial and non-financial performance of Amazon.

Overview of Amazon

Amazon is an online retail and supply chain retail industry that performs business at a global level. Amazon was established in 1994 in Washington, United States. The actual revenue of Amazon exists at £ 4.85 billion which will increase by nearly 64% in 2020 compared with 2019. This indicates that Amazon is able to enhance its business performance as well as consumer engagement.

Amazon has improved its revenue in the Covid-19 pandemic situation when different business organisations have suffered from massive losses and low consumer engagement. Besides that, net income for the year 2022 exists at £ 119 million. It has increased from 24%. This increment rate indicates that Amazon is able to sustain its consumers’ engagement as well as reduce operating and administrative costs.

Non-financial performance of any business is mainly evaluated with the support of CSR and strategy and regulation to manage its non-financial resources such as employees and strategic resources which do not exist to other competitors easily. Besides, Amazon has performed different types of CSR activities during the Covid-19 pandemic and at other times at different locations. There are nearly 33,675 employees engaged in Amazon in 20220 which will increase from last year’s engagement of 25,498 employees.

Besides that, Amazon has set aims to operate the whole business process with Renewable Energy till 2025. Besides that, Amazon has operated business through nearly 56000 shipments organisation at the global level. The organisation has also focused on net-zero carbon by 2030 which has indicated that Amazon has been more aggressive for the environment as well as the positive impact of different elements and areas of the environment.

Financial Performance

The financial performance of any Amazon has to execute with profitability as well as liquidity as these two factors are more significant for different types of stakeholders. Thus, here mainly four types of financial ratios are selected as follows: “profitability, liquidity, efficiency and financial leverage”. These four ratios indicated an overview of business at a glance as well as different types of stakeholders are also considered in this ratio before engaging in the organisation and role.

Profitability

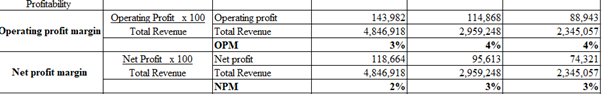

Figure 1: Profitability (Source: Q4cdn.com, 2022)

Figure 1: Profitability (Source: Q4cdn.com, 2022)

The profitability of Amazon is reduced in 2020 which will exist at 3% and in 2018 & 2019 this value will exist at 4%. Amazon has improved its revenue in 2020 as compared with last year’s value of 4,846,918 by 64% compared to 2019’s revenue. Nevertheless, Amazon has suffered from high operating costs at a value of 4,702,936 in 2020 and it will exist at the value of 2,844,380 in 2019 (Q4cdn.com, 2022).

As opined by Correa et al. (2019), it has indicated that Amazon has incurred more operating costs in 2020 due to the effective supply chain process in Covid-19. On the other hand, the net margin of Amazon will exist at 3% in 2018 and 2019 nevertheless Amazon has suffered from a low net margin of 2%.

Liquidity

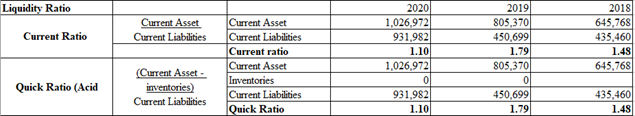

Figure 2: Liquidity (Source: Q4cdn.com, 2022)

Figure 2: Liquidity (Source: Q4cdn.com, 2022)

The liquidity of Amazon exists at 1.10, 1.79 and 1.48 from 2020 to 2018. It has indicated that the liquidity of Amazon has also reduced in 2020 due to Covid-19 and increasing competition in the global digital retail market rapidly (Q4cdn.com, 2022). Besides that, the quick ratio of Amazon has existed at 1.10, 1.79 and 1.48 for the last three consecutive years.

Efficiency

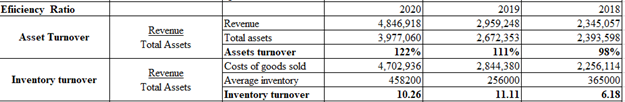

Figure 3: Efficiency (Source: Q4cdn.com, 2022)

Figure 3: Efficiency (Source: Q4cdn.com, 2022)

The asset turnover ratio of Amazon will exist at 122% in 2020, 111%, and 98% in 2018. It has indicated that Amazon has suffered from low efficiency at the current time. Compared with last year’s efficiency level (Mahmud, 2021). On the other hand, inventory turnover exists at 10.26, 11.11 and 6.18 has indicated that the organisation has suffered from high inventory days which is increasing working capital. As a result, Amazon needs more capital to operate its business.

Financial leverage

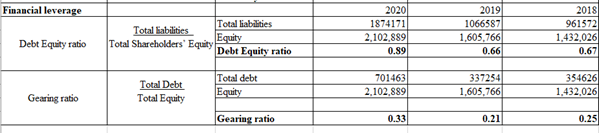

Figure 4: Financial leverage (Source: Q4cdn.com, 2022)

Figure 4: Financial leverage (Source: Q4cdn.com, 2022)

The debt-equity ratio of Amazon has existed for the past three consecutive years at 0.89, 0.66 and 0.67 (Q4cdn.com, 2022). The debt-equity has indicated that Amazon has failed to improve financial stability through an increased total liability compared with debt. Besides that, the gearing ratio of Amazon exists at 0.33, 0.21 and 0.25. This indicates that Amazon has also failed to increase equity proportionate debt.

The financial performance of Amazon is not in a better place which is evaluated through profitability as well as liquidity. Here Amazon has to improve its profitability to sustain its business operation in the global market as well as compare its competitors such as Walmart. On the other hand, Amazon has also been able to enhance its business revenue as well as reduce operating costs through implementing the latest technology as well as improving the productivity of employees by providing training and skills on the latest technology and tools.

Competitive analysis

| Ratio Name | Amazon | Walmart Plc | ||||

| 2020 £ | 2019 £ | 2018 £ | 2020 £ | 2019 £ | 2018 £ | |

| Profitability | ||||||

| Operating profit margin | 143,982 | 114,868 | 88,943 | 21,468 | 21,957 | 21,203 |

| 4,846,918 | 2,959,248 | 2,345,057 | 523,964 | 514,405 | 499,909 | |

| 3% | 4% | 4% | 4.10% | 4.27% | 4.24% | |

| Net profit margin | 118,664 | 95,613 | 74,321 | 14,881 | 6,670 | 9,862 |

| 4,846,918 | 2,959,248 | 2,345,057 | 523,964 | 514,405 | 499,909 | |

| 2% | 3% | 3% | 3% | 1% | 2% | |

Table 1: Competitive profitability analysis (Source: Self-made)

Analysis

In this analysis, it can be4 seen that Walmart had performed better in terms of profitability. In 2018 the company had generated 4.24% of OPM whereas Amazon had generated 4% of OPM. It means that the revenue model of Walmart is comparatively better than Amazon‘s. As opined by Kalyani, (2019), in the case of NPM it can be seen Amazon had managed to maintain 3% of profit but Walmart had generated 2% in 2018. In 2020 Amazon had generated 2% and Walmart had reached 3 %. As a result, in terms of profitability, it can be seen that Walmart is standing in a better position where the profitability rate is more.

| Liquidity ratio | Amazon | Walmart Plc | ||||

| 2020 £ | 2019 £ | 2018 £ | 2020 £ | 2019 £ | 2018 £ | |

| Current Ratio | 1,026,972 | 805,370 | 645,768 | 61,806 | 61,897 | 59,664 |

| 931,982 | 450,699 | 435,460 | 77,790 | 77,477 | 78,521 | |

| 1.10 | 1.79 | 1.48 | 0.79 | 0.80 | 0.76 | |

| Quick Ratio (Acid) | 1,026,972 | 805,370 | 645,768 | 61,806 | 61,897 | 59,664 |

| 0 | 0 | 36,273 | 31,181 | 18,242 | ||

| 931,982 | 450,699 | 435,460 | 77,790 | 77,477 | 78,521 | |

| 1.10 | 1.78 | 1.48 | 0.33 | 0.40 | 0.53 | |

Table 2: Evaluation of competitive liquidity ratio (Source: Self-made)

Analysis

In the case of the current ratio, the balance between asset and liability is better in Amazon as the ratio is more than 1 in 2020 the ratio is 1.10 whereas in Walmart the ratio is 0.79. It is because the asset is £ 61806 and the liability is £ 77790. As opined by Erickson and Rothberg (2019), this may create a negative impact on the flexibility of the company to pay off its debts.

In the case of the quick ratio, the value is also stable for Amazon and less for Walmart. It is because the inventory is considerably zero which resulted in a ratio of 1.79 in 2019. On the other side, for Walmart it is only 0.40 as a result Amazonhas better logistic management.

| Efficiency Performance | Amazon | Walmart Plc | ||||

| 2020 £ | 2019 £ | 2018 £ | 2020 £ | 2019 £ | 2018 £ | |

| Inventory Turnover days | 4,846,918 | 2,959,248 | 2,345,057 | 36,273 | 31,181 | 18,242 |

| 3,977,060 | 2,672,353 | 2,393,598 | 394,605 | 385,301 | 373,396 | |

| 1.21 | 1.10 | 0.97 | 33.55 | 29.54 | 17.83 | |

| 2020 £ | 2019 £ | 2018 £ | 2020 £ | 2019 £ | 2018 £ | |

| Asset turnover | 4,702,936 | 2,844,380 | 2,256,114 | 236,495 | 219,295 | 204,522 |

| 458200 | 256000 | 365000 | 523,964 | 514,405 | 499,909 | |

| 10.26 | 11.11 | 6.18 | 164.75 | 155.60 | 149.33 | |

Table 3: Calculation for competitive efficiency (Source: Self-made)

Analysis

In the case of Amazon, the inventory recovery rate is better as it takes 1.22 days to recover it on the other side Walmart takes 33.55 days to recover the inventory. As stated by Chiet al. (2022), in the case of asset turnover, it can be seen that the asset turnover is 10.26 for Amazon whereas for Walmart it is 164.75. It is because the revenue generated by Walmart is £ 523964 and for Amazon, it is £ 458200. As a result, Walmart is able to generate more revenue than Amazon.

| Financial Leverage ratios | Amazon | Walmart Plc | ||||

| 2020 £ | 2019 £ | 2018 £ | 2020 £ | 2019 £ | 2018 £ | |

| Gearing ratio | Total liabilities | 1874171 | 1066587 | 961572 | 170,700 | 49,900 |

| Equity | 2,102,889 | 1,605,766 | 1,432,026 | 501,400 | 704,300 | |

| 0.671 | 0.340 | 0.071 | ||||

| 0.89 | 0.66 | 0.67 | 0.671 | 0.340 | 0.071 | |

| Debt Ratio | 701463 | 337254 | 354626 | 2,368 | 5,225 | 5,257 |

| 2,102,889 | 1,605,766 | 1,432,026 | 236,495 | 219,295 | 204,522 | |

| 0.33 | 0.21 | 0.24 | 0.01 | 0.02 | 0.03 | |

Table 4: Evaluation of Competitive financial leverage ratio (Source: Self-made)

Analysis

In the case of Amazon, the Gearing ratio is performing better as it is 0.89 and for Walmart, it is 0.67 for 2020. This means the stakeholder’s interest is more in the case of Amazon. The debt is more for Amazon which is compared to Walmart which is 0.01 which means the company needs to manage its liability more effectively.

Non-financial performance

Non-financial performance of Amazon is observed with different factors and areas of Amazon such as employee and consumer engagement. Apart from this Amazon has also increased its consumer engagement which is evaluated to increase the revenue by 64% compared with last year’s revenue. As opined by Liu et al. (2022), Amazon has also increased its employee engagement from 25,498 to 33,675 in 2020 (Sustainability.aboutAmazon.com, 2022).

All these aspects indicate that Amazon has developed vector relationships with internal as well as external stakeholders which support Amazon to improve its non-financial performance and growth at a global level. Besides that, the brand value of Amazon has also increased at the current time compared with its last year’s brand value of 350.27$ billion by nearly 23.4%. Any organisation’s brand value and consumer loyalty are based on services and products which is provided by Amazon to the end-users and consumers.

As opined by Nguyen et al. (2020), here Amazon has engaged in online retail service as well as supply chain management with different entertainment content through single subscription and ID (Thuy et al. 2021). Besides that, consumers of Amazon are also taking advantage of prime membership of Amazon for watching different latest movies as well as shopping for different latest brands and products at a desirable speed of delivery compared with other industries’ delivery process and time.

On the other hand, Amazon has focused on reducing carbon emissions itself as well as different supply chain partners and industries that are supporting Amazon to perform its supply chain process at the global level (Eneizanet al. 2018). As Amazon has set aims to net carbon emission by 2013 different partners and segment organisations provide the latest tools and technology as well as resources.

Further Amazon has also engaged in the implementation of the latest technology which has increased the features and facilities of Amazon to its consumers and different stakeholders such as suppliers and investors which is increasing the brand value and performance of Amazon.

Social objectives

In the year 1997, Amazon went public and instantly it has been criticized for lacking commitments regarding corporate as well as social responsibilities. In order to overcome this barrier, the company has decided to adopt some activities. The managerial team of the company has been quite assured that these activities will be helpful for maintaining the growth of the company. Amazon had globally helped many of its users to get access to day-to-day commodities during the pandemic.

The company has managed its warehousing facilities in a better way so that the delivery of the order can be done within a very short period of time. Providing faster delivery and better customer personalisation has helped to improve the customer experience. As argued by Liu et al. (2022), It can also be seen that the company had always maintained social terms and contributed a positive impact on the economy of the UK.

It had helped to create more Employment and had not reduced its workforce during the global pandemic. It has successfully provided a positive work environment for its employees where job satisfaction is considered a primary objective of organizational growth.

- The concerned organization has developed a relief fund by investing USD25 million as an initial contribution. The company has been focusing on supporting the services partners, responsible for doing independent delivery. Also, it supports the stakeholders in order to manage the negative impact of the coronavirus.

- Amazon has conducted a programme regarding the donation of electronic devices as well as gift cards to school children. As opined by Correa et al. (2019), In this matter, they have considered those schools which are located near the “Amazon fulfilment centres”.

- The company has managed to organize an event named “Girls who code” In order to help more girls willing to learn to code.

- The concerned organization has also helped local as well as national non-profit organizations by providing them with cash and donations.

- In the year 2021, the company invested an amount of USD300 in order to bring out safety projects.

Conclusion

It can be concluded that the role of different types of business activities is covered in this project. In order to provide the financial health of Amazon, ratio analysis is done with the help of four different types of ratios that are profitability, liquidity, efficiency, and financial leverage ratio. This will help to provide an overall in-depth view of different parts of the organization. To understand the position of this online retail company a competitor is also considered named Walmart.

The financial data of this company is evaluated side by side so that it could be identified which portions of Amazon are needed to be imported. Such as the Operating profit margin of the company needs to be improved. Moreover, in the analysis of the financial performance of both Walmart and Amazon, it has been found that the performance of Amazon is comparatively better than Walmart which provides competitive advantages to the company to perform well in the market.

As in the current era of the market organizational competitiveness is the core activity through which it can be able to increase its customer base and profitability.

Analysis of the comparative performance of Walmart and Amazon in the context of profitability has found that the overall performance of Amazon is better than Walmart. However, Amazon is struggling with the procurement of funds as it has a high debt-equity ratio. On the other side, Amazon had better manage its logistics and the balance of current assets over liability.

In terms of the debt ratio, it is more for Amazon which highlights that the company needs to look after its liability management. If this type of issue can be resolved then the sustainability of the company can be maintained for a longer period of time.

Reference

Journals

Eneizan, B., Abdulrahman, S.A. and Alabboodi, A.S., 2018. The influence of environmental marketing mixes on the non-financial performance of solar energy firms: The mediating role of corporate image. Ajar, 4(7), pp.190-196.

Erickson, S. and Rothberg, H.N., 2019. Toward a deeper understanding of competitive knowledge assets. Electronic Journal of Knowledge Management, 17(1), pp.pp79-88.

Kalyani, P., 2019. FDI directive 2019 and impact on eCommerce market a case study with special reference to Amazon, Walmart-Flipkart and others with new entry reliance into the market. Information Technology and Management. https://doi. org/10.5281/zenodo, 2579850.

Liu, Y., Kim, C.Y., Lee, E.H. and Yoo, J.W., 2022. Relationship between sustainable management activities and financial performance: Mediating effects of non-financial performance and moderating effects of the institutional environment. Sustainability, 14(3), p.1168.

Mahmud, M., 2021. Case Comparison of Major Digital Business Platforms: Amazon, AliExpress and eBay. Turkish Journal of Computer and Mathematics Education (TURCOMAT), 12(3), pp.5801-5808.

Nguyen, T., Pham, T., Phan, T. and Then, T., 2020. Impact of green supply chain practices on financial and non-financial performance of Vietnam’s tourism enterprises. Uncertain Supply Chain Management, 8(3), pp.481-494.

Thuy, C.T.M., Khuong, N.V., Canh, N.T. and Liem, N.T., 2021. Corporate social responsibility disclosure and financial performance: The mediating role of financial statement comparability. Sustainability, 13(18), p.10077.

Websites

Q4cdn.com, 2022; Annual report of Amazon 2020. Available at: https://s2.q4cdn.com/299287126/files/doc_financials/2022/ar/Amazon-2021-Annual-Report.pdf [Accessed on 15 June 2022]

Sustainability.aboutAmazon.com, 2022;Amazon Sustainability 2020 Report Available at: https://sustainability.aboutAmazon.com/pdfBuilderDownload?name=Amazon-sustainability-2020-report [Accessed on 22 June 2022]

Walmart.com, 2022; Annual report of Walmart 2020Available at: https://corporate.Walmart.com/media-library/document/2020-Walmart-annual-report/_proxyDocument?id=00000171-a3ea-dfc0-af71-b3fea8490000 [Accessed on 19 June 2022]

Appendix

Appendix 1: Calculation of financial ratios of Amazon

| Calculation of financial ratio of Amazon | ||||||

| Ratio Name | Formula | Variable | Year | |||

| 2020 | 2019 | 2018 | ||||

| Profitability | ||||||

| Operating profit margin | Operating Profit x 100 Total Revenue |

Operating profit | 143,982 | 114,868 | 88,943 | |

| Total Revenue | 4,846,918 | 2,959,248 | 2,345,057 | |||

| OPM | 3% | 4% | 4% | |||

| Net profit margin | Net Profit x 100 Total Revenue |

Net profit | 118,664 | 95,613 | 74,321 | |

| Total Revenue | 4,846,918 | 2,959,248 | 2,345,057 | |||

| NPM | 2% | 3% | 3% | |||

| Liquidity Ratio | 2020 | 2019 | 2018 | |||

| Current Ratio | Current Asset Current Liabilities |

Current Asset | 1,026,972 | 805,370 | 645,768 | |

| Current Liabilities | 931,982 | 450,699 | 435,460 | |||

| Current ratio | 1.10 | 1.79 | 1.48 | |||

| Quick Ratio (Acid | (Current Asset – inventories) Current Liabilities |

Current Asset | 1,026,972 | 805,370 | 645,768 | |

| Inventories | 0 | 0 | ||||

| Current Liabilities | 931,982 | 450,699 | 435,460 | |||

| Quick Ratio | 1.10 | 1.79 | 1.48 | |||

| Efiiciency Ratio | 2020 | 2019 | 2018 | |||

| Asset Turnover | Revenue Total Assets |

Revenue | 4,846,918 | 2,959,248 | 2,345,057 | |

| Total assets | 3,977,060 | 2,672,353 | 2,393,598 | |||

| Assets turnover | 122% | 111% | 98% | |||

| Inventory turnover | Revenue Total Assets |

Costs of goods sold | 4,702,936 | 2,844,380 | 2,256,114 | |

| Average inventory | 458200 | 256000 | 365000 | |||

| Inventory turnover | 10.26 | 11.11 | 6.18 | |||

| Financial leverage | 2020 | 2019 | 2018 | |||

| Debt Equity ratio | Total liabilities Total Shareholders’ Equity |

Total liabilities | 1874171 | 1066587 | 961572 | |

| Equity | 2,102,889 | 1,605,766 | 1,432,026 | |||

| Debt Equity ratio | 0.89 | 0.66 | 0.67 | |||

| Gearing ratio | Total Debt Total Equity |

Total debt | 701463 | 337254 | 354626 | |

| Equity | 2,102,889 | 1,605,766 | 1,432,026 | |||

| Gearing ratio | 0.33 | 0.21 | 0.25 | |||

Know more about UniqueSubmission’s other writing services: