Business Strategy and Finance Sample

Introduction

The report is on the basis of the financial and business strategy of the entity IHG hotels, situated in the UK. The company mainly focuses on the process of “franchise and manage hotels”, which allows for increasing the fee margins, and fee revenue, with the limited requirements of the capital. IHG continues in the operation with a “premium listing” on the “LSE” and another on the “NYSE”. The company applies the principle of the UK “Corporate Governance”, under the NYSE listing rules of the foreign private insurer. The company is emerging with total revenue of $2907 million, and an operating profit with $494 million, for the year 2020. Hence, the report constructs the eternal and external analysis of the business and financial analysis as well. Furthermore, the discussion based on the strategic internal position of the company will be done. The researcher may understand the strategic position of the company by using the ESG factor. Moreover, the recommendation on investment criteria of the business by using the models and required strategies will be provided in this aspect.

Main body

External analysis

PESTEL Analysis

| Political factors | Political factors exert a strong influence on the sustainability of long-term and profitability of IHG plc. “Bureaucracy and corruption” influence the business environment, by operating high corruption and weak law enforcement that make the business environment increasingly unpredictable. The stability in the context of the government of the UK has highly influenced the success of IHG plc. Even the group gets success mostly in the USA, where the government of the USA has influenced the success of the organization. Furthermore, industrial safety regulation in the “consumer services sector” creates a quiet impact on the political factor of the company. |

| Economic factors | The “microenvironment” such as the saving rate, inflation rate, interest rate, and “foreign exchange rate” aggregate the demand and investment in the performance of an economy. IHG plc, affected the economic growth rate, economic “inflation & industry” such as “Travel & Leisure industry growth rate”, and “consumer spending” (Fernfortuniversity, 2022). Hence, the economic condition of the UK has influenced the organization to reach a strategic position that may affect the future. |

| Social factors | The social culture and its impact on the way of shared beliefs and attitudes of the population in the environment of an organization play a vital role.

● Skill and demographic level of the population ● Education level as well as ‘technology standard” in the IHG plc industry ● Leisure interest (PEYKANI, NAMAZI and MOHAMMADI, 2022, p.2) ● “Entrepreneurial spirit” and “broader nature of the society” are the societies encourages entrepreneurship Furthermore, the “socio-cultural events” may be highly encouraged not only to the young people but also to the new aged. Partially entertainment besides daily engagement with “luxurious “and “fashionable” setup. |

| Technological factors | IHG incorporated online activities in its operation, hence, the company engaged highly in technology integral success. The company also realizes that the development of ICT asa most of the operations rely on the activity and the usability of the information technology. Therefore, the technology is so relatable to the vital part of the operation of the business for the integral part of the business. All the aspects of the organization that include repurchase, sales, marketing, management, and operation depend on the development of the technology. The application of the Artificial Intelligence in the business may become helpful to the hen face the performance of the business. |

| Environmental factors | The business environment of the company in the context of making the micro and macro factor better for the business profitability. Hence, the business environment consists of the organizational; structure, suppliers, competitors, intermeterters, and competitors of the company such as “Unviable-Roams-Westfield”, and “Marcus & Mill chap”. The consolation of making macro impact may consider as the largely affected factor to the business in the process of making decisions internationally.

|

| Legal factors | IHG PLC, refers under the “ Companies Act”, during the year 2020,

The company engaged with the different laws and regulations that follow to better influence the management and working structure of the business. The application of “SFDSS’ ‘, and “legal action” that from organizations affected by the “Incidents of Security”. Furthermore, “Labor regulation and the negotiation”, are the new adopted by the company for the existing worker to lead to higher benefit cost and wages. These are becoming a changing environment in the process of working rules that may raise operating expenses and legal costs as well.

|

Table 1: PESTLE

(Source: Self-made)

Internal analysis

SWOT Analysis

| Strengths

● Highly skilled working performance through successful learning programs and training (RIVERA et al. 2021 p.2) ● Automation of activities that brought consistency of quality ● Highly successful at “Go To Market Strategies” for its product |

Weakness

● Need more investment in new technologies ● The net contribution % and profitability ratio of the company are below the average of industry ● The company have not very good product demand at the stage of leading forecasting maximum rate of the missed opportunities |

| Opportunity

● The application of new technology in the business provides to IHG PLC, to practices differentiated pricing strategy in the new market ● Opening up of a new market due to government agreement for the adaptation of standard technology ● New trends in the behavior of the consumers that can provide (BUHALIS and MOLDAVSKA, 2022)opportunity to built new revenue stream |

Threat

● There may be risk in the rising raw material that can pose a threat to profitability of IHG PLC ● Demand of highly profitability products with seasonal nature and any unlikely event during peak season may impact to profitability for short to medium term ● “Rising pay level” specially moments such as $15 an hour |

Table 2: SWOT

(Source: Self-made)

Financial analysis

The performance ratio of the company represents the class of the “financial matrix”, which helps analyze the ability of businesses to assess and generate earnings. Based on the annual report of the company for the years 2020 and 2021, the performance ratio predicts the financial ability of the company.

Profitability ratio

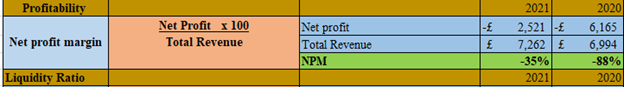

Figure 1: Profitability

(Source: Self-made)

The profitability ratio of IHG plc indicates that the company has negative values on the performance of the business. As per the analysis of the annual report for the year 2020, and 2021, the “net profit margin” ratio occurs at -8%, and -35%, where the company has decreased profitability. On the other hand, the above figure shows that the company is in the way of improving its performance (BADMINTON, and KAINDE, 2022, p.3). The ratio of the company is showing a negative percentage, which means the company’s ability in creating earnings, was very weak, as they have failed in obtaining a positive income in business. This will create financial difficulties for the company, as they have been unable to process earnings in business. The investors of the company will also amaze doubt on the ability of the company as they failed in providing them a positive return.

Liquidity Ratio

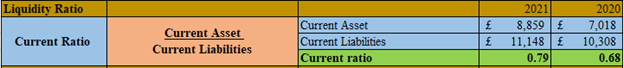

Figure 2: Liquidity

(Source: Self-made)

The liquidity ratio of the company is showing the deflation performance in the upcoming year 2022. Hence, the ability of the company is not well to pay off its current liabilities as well as current assets. As the “current ratio” of the company occurs at 0.79 and 0.68 for the years 2021 and 2020 respectively. The aforementioned figures have shown an enhancement of the liquidity position of the company due to having higher current assets in business. Moreover, this will attract more investors in business as they will provide a high rate of return to the company.

Efficiency Ratio

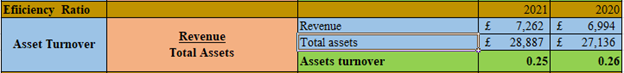

Figure 3: Efficiency

(Source: Self-made)

According to the efficiency ratio analysis of the business, the company revenue of the business decreased as compared to the previous year compared to the current year 2021. Hence, the occurrence of the “asset turnover ratio”, for the years 2021, and 2020, at 0.25, and 0.26 respectively. This showed a significant reduction in the ratios, which is a negative indication for the companyThis, is because the reduction in the ratios depicts that the company has the weak ability to generate earnings for the use of assets of the business (SRISATHAN et al. 2020, p.2). Due to this reason, it can be said that the company needs to focus on the earnings of business, which will surely increase the assets usage of the company.

Solvency Ratio

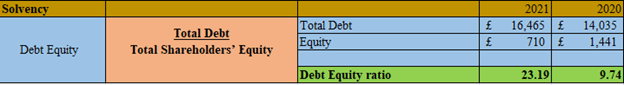

Figure 4: Solvency

(Source: Self-made)

As per the analysis of the annual report, the solvency ratio comes top unfavorable condition, indicating the company will default on its debt obligations (OLLIVIER DE and ROS-TONEN, 2022, p.3). Hence, the company refers to bankruptcy in the future of the bad occurrence of debt equity, which is 23.19, and 9.74 for the year 2021, and 23020 respectively. The solvency ratio of the company has increased massively in 2021 in comparison to 2020, which depicts that the risk position in the company was very low. This will attract higher investors in business for making investment as the company was highly solvent.

Stock performance

Figure 5: Stock performance

(Source: Yahoo, 2022)

The company is engaged with the “FTSE 100 index”, with a secondary listing on the “NYSE”. The share has been awarded outstanding at the year-end of 2020, with the “weighted average” life of 0.5 for the year 2020, 1.0 year for the “annual report performance plan” (HUSSEIN-ELHAKIM, 2021).The performance-related awards 1.2 years and 1.2 years for restricted stock units. The ordinary shares are also listed on the NYSE, therefore, the annual performance of the company has changed trading in the form of ADSs evidenced by ADRs. Furthermore, each one ordinary share has been represented by ADS.

Summary of strategic position (ESG factor)

The committee of IHG plc, incurred with the “holistic approach” to measure and implements a new target of salaries. It may ensure that the company has continued to work with the “RBC”, and “CMT”, to represent ESG metrics for good decision-making to the Executive director’s remuneration and well-maintained performance of the company (Annualreport, 2021, p.108). The company drives compatibility and transparency in the performance of the business across the UK by using the “Global Reporting Initiative”, “Stakeholder Capitalism Metrics (SCM)”, and “Sustainability Accounting Standards Board (SASB)”.

Environmental factor

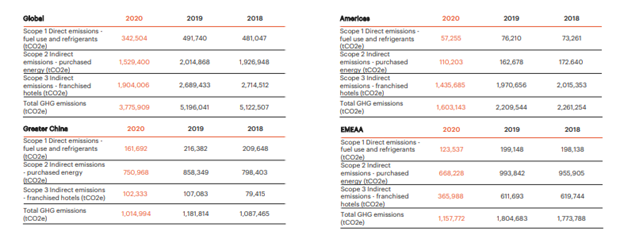

Figure 6: Environment factors

(Source: Self-made)

The company works with external constraints to provide an up to date carbon footprint of IHG. assess performance of the business engaged in the emission of GHG protocol, “Reporting Standard methodology”, and “Corporate Accounting”, that refer to existing and emerging explanations of the business (ŠEBESTOVÁ, KREJČÍ, and RYLKOVÁ, 2022, p.2). The committee executed that assessment of the board benefiting with the additional expertise in the engagement of the technology, and in the sector of traveling by focusing the ESG responsibility. The company has the better investment in the performance of consultant use of utility consumption of data as reported by hotel in IHG engagement. According to data of 2020, the environmental sampling covered “311 (88%), of 354 UK hotels and 4,649 (79%) of 5,922 global hotels with the high occupancy of the customers during the reporting period 2017-2020 (Ihgplc, 2021)”.

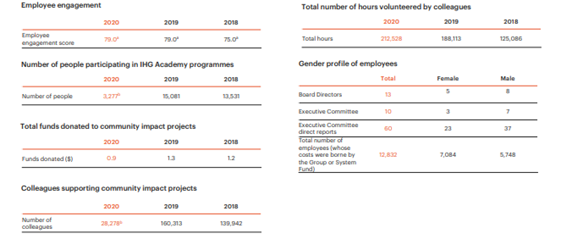

Social Factor

Figure 7: Social factors

(Source: Self-made)

SASB regulations are the minimum number of sectors with ESG standards. Therefore, the shareholders may get a higher impact on the profitability and operating health of an entity. Hence, it is important to the management of the company to maintain the sustainability of the hotels of a better rate of return in the way of highly performance that mayu feel an “exclusive and safe environment” to the public. The company is also engaging in the development of innovative offering support and guidance that may engage in ensuring authentic tools and resources. It becomes necessary to develop and grow the business that may create the career of the IHG plc (Ihgplc, 2021, p. 33). Further, the availability of online performing tools pay a highlighted point to the public that creates attraction towards companies. An online “learning suite”, that may include “Harvard Manage Mentorand virtual classes”, and My Learning, in 2020 are the most impressive things toward high sociality.

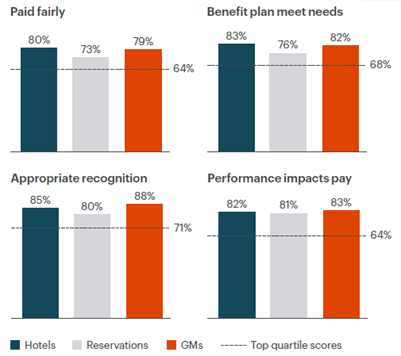

Governance factor

Figure 8: Governance factors

(Source: Self-made)

According to (Ihgplc, 2021), the base salary for the year 2021, reviews the process of continuing the building simple operational management in the process to include manager presentation. Particularly in the context of paying action towards the responses the effect of covid-19 on the business, this may allow the business in the way of making a merit budget to be targeted on the area of the most impacted. For the year 2021, the level of engagement for the purpose of “healthcare” covers offered context across the UK and all corporate employees (DUTTA, KULKARNI and LAI, 2022, p5). Therefore, the company adopted the continued “roll out wellness” that offered to support the team employees in the way of “health and well-being” for the changing and flexible working environment (Ihgplc, 2021, p. 112). These may also include the enhanced “parental leave policy” in the cooperative employees in the UK. the governing factor in the way of covering the match number of IHG to purchase shares on a “1-for-1” basis. Therefore, the Participation enhanced from “49% in 2020” to “50% in 2021” and to “53% in 2022” further, “shares matching” from the 2020 plan conducted in January 2022.

Investment Recommendation

According to the analysis of the financial performance on the basis of the annual report 2021. It represents the company falling toward loss or bankruptcy in business management. The report concluded that the company has been facing a higher risk of return as shown by analyzing the solvency ratio. One possible approach would be helpful to the company in the context of the betterment of the business (HSIAO and CHEN, 2022). The projection of “total cash flow” at the time of investment, and insurance with reinvestment of the net negative cash flows during the period of projection and borrowing. Furthermore, “selling assets” to cover “net negatives” such as the profitability ratio that represents the above figures for the year 2021, -35%.

Conclusion

The financial analysis often assesses the liquidity of the organization, solvency, profitability, efficiency, and financial stability in the long and short term. The ratio analysis of the company provides relative measures of the performance of the company, which is not better. Hence, it is concluded that investments in these types of businesses are not profitable to the investors, and a loss in the rate of return. Furthermore, the financial stability ratio in the vein of the “debt to the net worth ratio” represents the company providing a lower degree of protection to the credit. The decision-making on the implementation of the changes that pay unlimited determination by the hotel situated owner, in the context of their commercial position of business. Further, across the equity’s wider portfolio, introduce that the company is not able to compete in the UK market as the low performance of the liquidity. However, all the roles of entire hotels have been paid above the high wages of living and zero hours of contracts are not utilized in the UK at the renter estate. Moreover, according to the ESG analysis of the company, it has good management towards attracting customers.

Reference list

BADMINTON, J.R. and KAINDE, Q.C., 2022. UNDERSTANDING SMART CITY STRATEGY IN DEVELOPING COUNTRIES’ CITIES. Theoretical and Empirical Researches in Urban Management, 17(3), pp. 71-88. Available at: <https://www.proquest.com/scholarly-journals/understanding-smart-city-strategy-developing/docview/2701147870/se-2> [accessed on: 18.10.2022]

BAK, I., ZIOLO, M., CHEBA, K. and SPOZ, A., 2022. Environmental, social and governance factors in companies’ business models and the motives of incorporating them in the core business. Journal of Business Economics and Management, 23(4), pp. 837-855. Available at: < https://doi.org/10.3846/jbem.2022.16207> [accessed on: 18.10.2022]

BUHALIS, D. and MOLDAVSKA, I., 2022. Voice assistants in hospitality: using artificial intelligence for customer service. Journal of Hospitality and Tourism Technology, 13(3), pp. 386-403. Available at: <https://doi.org/10.1007/s12525-020-00439-y> [accessed on: 18.10.2022]

DUTTA, A.S., KULKARNI, K.G. and LAI, K.P., 2022. Effects of Covid-19 on Business and Financial Strategy of a Firm: Survey of Indian MSMEs. IUP Journal of Business Strategy, 19(2), pp. 7-22. Available at: < https://www.proquest.com/scholarly-journals/effects-covid-19-on-business-financial-strategy/docview/2711035543/se-2> [accessed on: 18.10.2022]

Fernfortuniversity, 2022, Intercontinental Hotels Group Plc PESTEL & Environment Analysis, 2022, (online), Available at <http://fernfortuniversity.com/term-papers/pestel/nyse4/6804-intercontinental-hotels-group-plc.php> [accessed on: 18.10.2022]

HSIAO, C. and CHEN, J., 2022. The effect of board characteristics and strategic model on financial performance and firm value-Taking the digital industry of Chinese listed companies as a sample. Journal of Accounting, Finance & Management Strategy, 17(1), pp. 125-167. Available at: <https://www.proquest.com/scholarly-journals/effect-board-characteristics-strategic-model-on/docview/2681088862/se-2> [accessed on: 18.10.2022]

HUSSEIN-ELHAKIM, A.I., 2021. The impact of improvisation and financial bootstrapping strategies on business performance. EuroMed Journal of Business, 16(2), pp. 171-194. Available at: < https://doi.org/10.1108/EMJB-03-2020-0022 > [accessed on: 18.10.2022]

Ihgplc, 2021, IHG HOTEL AND RESORT, 2021, (online), available at: <https://www.ihgplc.com/en/-/media/ihg/annualreports/2020report/pdf/additional/esg-databook.pdf> [accessed on: 18.10.2022]

OLLIVIER DE LETH, D. and ROS-TONEN, M., 2022. Creating Shared Value Through an Inclusive Development Lens: A Case Study of a CSV Strategy in Ghana’s Cocoa Sector: JBE. Journal of Business Ethics, 178(2), pp. 399-354 Available at: < https://doi.org/10.1371/journal.pone.0265025> [accessed on: 18.10.2022]

PEYKANI, P., NAMAZI, M. and MOHAMMADI, E., 2022. Bridging the knowledge gap between technology and business: An innovation strategy perspective. PLoS One, 17(4),. Available at: <https://www.ihgplc.com/en/-/media/ihg/annualreports/2020report/pdf/additional/esg-databook.pdf> [accessed on: 18.10.2022]

PRATIWI, L.F.L., MILLATY, M. and DEWI, M.P., 2022. Development Strategy for Palm Sugar Product Attribute: a Competitive Product to Achieving Sustainable Development Goals (SDGs). IOP Conference Series.Earth and Environmental Science, 1018(1), pp. 012001. Available at: <https://www.ihgplc.com/en/-/media/ihg/annualreports/2020report/pdf/additional/esg-databook.pdf> [accessed on: 18.10.2022]

RIVERA AGUILAR, J.E., ZANG, L. and FUSHIMI, S., 2022. Towards sustainability in hospitality operations: how is quality of life and work–life balance related? Worldwide Hospitality and Tourism Themes, 14(3), pp. 274-285. Available at: < https://doi.org/10.25145/j.pasos.2022.20.058> [accessed on: 18.10.2022]

ŠEBESTOVÁ, J.D., KREJČÍ, P. and RYLKOVÁ, Ž., 2022. What Situations Cause Crucial Financial Decisions within Social Businesses? Central European Business Review, 11(3), pp. 39-54. Available at: < https://doi.org/10.18267/j.cebr.294> [accessed on: 18.10.2022]

SRISATHAN, W.A., KETKAEW, C., JITJAK, W., NGIWPHROM, S. and NARUETHARADHOL, P., 2022. Open innovation as a strategy for collaboration-based business model innovation: The moderating effect among multigenerational entrepreneurs. PLoS One, 17(6),. Available at: <https://doi.org/10.1371/journal.pone.0265025> [accessed on: 18.10.2022]

WANG, C., BRABENEC, T., GAO, P. and TANG, Z., 2021. The Business Strategy, Competitive Advantage and Financial Strategy: A Perspective from Corporate Maturity Mismatched Investment. Journal of Competitiveness, 13(1), pp. 164-164–181. Available at: < https://doi.org/10.7441/joc.2021.01.10> [accessed on: 18.10.2022]

Yahoo, 2022, yahoo finance, 2022, (online) Available at: <https://consent.yahoo.com/v2/collectConsent?sessionId=4_cc-session_5bf33f69-f31e-4ec6-8b9a-ae28bd5a88d8 > [accessed on: 18.10.2022]

ZHONG, X., REN, L. and SONG, T., 2022. Beyond Market Strategies: How Multiple Decision-Maker Groups Jointly Influence Underperforming Firms’ Corporate Social (Ir)responsibility: JBE. Journal of Business Ethics, 178(2), pp. 481-499. Available at: < https://doi.org/10.1007/s10551-021-04796-2 > [accessed on: 18.10.2022]

Know more about UniqueSubmission’s other writing services: