COMP1611 Project Management Sample

1. Stakeholder analysis

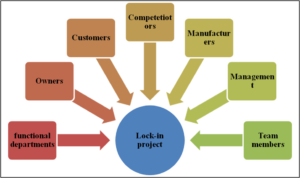

Major stockholders who are impacted by the “Lock-in project”

The selection of stakeholders is important to develop a project so that interrelationship between every element of the project can be achieved. Two main types of stakeholders exist internal stakeholder and external stakeholder and analysis of both the stakeholders are essential for better project management with the new “lock-in project. Stakeholders’ analysis is done at the very first stage of a project so that interested people with the new project can be identified (Clegg et al. 2020). The analysis of stakeholders minimizes negative impact on the project and participation of every stakeholder can be designated by this analysis. Stakeholders are the main input of managing a project as their requirements are the main factors of making an approach for the product development or making a strategy for the new project.

Figure 1: Stakeholders of this project

(Source: Self-created)

All of the selected stakeholders will be impacted by the new project as all of these have different interests in the project and changes in the policy of the Workrite components. The Workrite components work as an intermediary between customers and manufacturers and all of the selected stakeholders are essential to consider during making strategies in their new project planning. According to Pryke (2020), among all these stakeholders’ owners, management, team members, functional departments come under internal stakeholders. Customers, lock-in suppliers, manufacturer’s competitors, and government bodies come under external stakeholders who are equally important to consider in this stakeholder analysis (Abdel-Basset et al. 2019). Workrite components are one of the largest suppliers of electronic components in the UK but it is affected by different options available in the market that’s why they are making their supplier’s lock-in suppliers and thus they are making their product unique. Thus, the “lock-in project” impacts both the customers and suppliers, and manufacturers who are already dealing with the company and also affects all available competitors in the market.

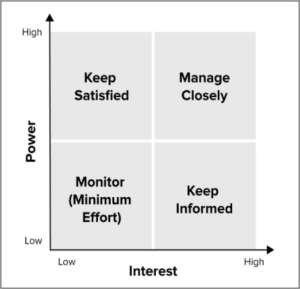

Stakeholders’ quadrant analysis

The power and interest of stakeholders should be analyzed to know their importance and real function in managing the success factors of a project. According to Schmid (2019), analysis of stakeholders’ fourth quadrant power and interest grid gives a brief illustration of their importance in the project. Workrite components are going to do a completely new work transformation with their company to increase the number of new customers instead of repeat customers. As per the report the company is expected to start a “lock-in project” project to increase more customers as the availability of their electronic components will be fixed with selected suppliers and manufacturers. Thus, new customers will be increased as per their expectations but analysis of the impact of stakeholders in this project gives a better analysis of the success factors of the project (Turner, 2020).

Figure 2: 4 quadrant analysis of stakeholder’s management

(Source: Zembri-Mary, 2019)

The position of stakeholders in this quadrant analysis decides their importance in the project and possible action required for managing those stakeholders. Such as “High power, highly interested” stakeholders require close management, and most of the effort is required to keep them satisfied such as owners, functional departments, and team members (Zembri-Mary, 2019). “High power, less interested people” need to be satisfied but does not require so much effort compared to the previous category such as governments, and other regulatory bodies. “Low power, highly interested people” should be informed adequately to remove any possible issues and they are very helpful in giving detailed information of the project such as suppliers, manufacturers, and customers (Verzuh et al. 2021). “Low power, less interested people” don’t require much effort to manage and also don’t require continuous updates about the project but minimum management is required to keep them engaged such as competitors.

Appropriate action for increasing participation of all selected stakeholders

Winning support of all stakeholders is the main functional aim of this stakeholder’s analysis and to make them engaged with a positive interest in the new “lock-in project”. Currently, customers are bypassing the components of Workrite components with other available options in the market and the company cannot attract more new customers, which is their main point of concern. Managing all these stakeholders requires some appropriate action as per their importance in the new project to increase their interest in the components of Workrite components.

“High power, high interested stakeholders”- High power of stakeholders determine the importance of their role and interest in the project management and managing of these stakeholders is the most trickiest and fruitful for the development of the project. According to Chappell (2020), these types of stakeholders are also called players as they are the decision-makers in the organization. Here, owners, team members, and functional departments are chosen as the most powerful stakeholders that require collaborative management in the project. The main two actions that can increase their interest in the “lock-in project” are to increase their involvement in product strategy making and making a roadmap for the workshop strategy making.

“High power, less interested stakeholders”- These stakeholders are called “context setters or referees” as their actions affect the project but they don’t have so much interest in the project. All opinions of these stakeholders should be heard and maintained with regular concern with them to keep them interested in the project (Abidin, 2021). Some of these stakeholders in this “lock-in project” are government and other regulatory bodies in the UK.

“Low power, highly interested stakeholders”- These types of stakeholders are called subjects as they have minimum power in decision-making but are affected by the decisions made by others in the organization. According to Ibrahim et al. (2020), actions that impact these stakeholders inform them about any change in the policy of work, and meeting their review encourages them to share feedback.

“Low power, less interested stakeholders”- The last category of stakeholders quadrant analysis has minimum interest with low power in decision making that influences project decisions. Competitors in the market are examples of these stakeholders and some action is also required to manage these stakeholders (Ludovico et al. 2020). Such actions are, to keep them informed and gain information from them to keep updates about their actions.

2. Risk analysis

Five associated risk and recommended solutions

Workrite components already faced problems with gaining new customers and irresponsible sales staff as they are busy making negotiations instead of attracting new customers. Availability of options of electronic components of the company is increasing in the market that distracts the customers (Chakrabortty et al. 2020). Hence, Robin Nightingale, the MD of Workrite components has decided to make a “lock-in project” that involves the agreement of key “refurbishment companies” to sell their product stocks only to the Workrite components. The current situation of the company enables the sales staff to negotiate with both the suppliers and customers which lags the overall processing of purchase ordering (Leknoi et al. 2020). The back office structure of the Workrite components is also inefficient to gather all information required for detailed management and Robin feels the requirement of an automated system to analyze different aspects of sales. All these factors affect the controlling system of stock of the company and cost some extra overhead in this storage by 20000 Euro per year.

Five risks in “lock-in project”

Workrite components already face lots of risk factors in their supply chain management and this project is planned to solve all those problems. Although this project also has some potential risks that have to be solved to increase its effectiveness so that the aim of making the project can be fulfilled.

- Access of suppliers

Making a polished arrangement with the project is quite difficult as there is a risk associated with the accessing of efficient suppliers as it involves repetitive processes between the chosen suppliers and the company. Although this concept is expected to reduce the cost of the company by 50000 Euro per year, attracting such suppliers is the most difficult part of this project. Accurate management information should be informed to the suppliers to make them engaged and without the use of a perfect internet-based system; it is not possible (Stocker et al. 2020).

Solution- Use of Internet-based system, Oracle database

Using an internet-based system to keep information in one place is possible and reaching appropriate information will be easier. Robin also expected to make the required change by using a new database system such as Oracle database to keep all the suppliers so that they can take part more actively with this new project.

- Tracking system of orders

The old system of the company cannot give access to the appropriate areas of accessing suppliers’ demand and information about their appropriate accessing areas. According to Firmansyah (2018), front office staff uses a computer system to load all information but it causes the risk to the new project as it should be efficient enough to keep and provide all information whenever required. Tracking of orders is affected by this process with the front office executive and there are requirements of other systems for gathering information.

Solution- Use of the automated system

Automated systems give access to information about both the suppliers and customers at a time without any interruption that is required with the “lock-in project”. According to Jones (2018), thus suppliers can get visibility of the progress of their pattern of orders and they get notification about any new orders. Hence, it will help decrease the risk with timely picking up and delivery of orders that will attract more suppliers to take part in this “lock-in project”.

iii. Sufficient suppliers

Suppliers are the main factors in this project and attracting more suppliers to add to the project is difficult as the understandability of the project is quite difficult. The interest of suppliers will increase the repetitive process of ordering and giving them assurance about timely delivery of stocks is important (Alsultan et al. 2020).

Solution- Take proper action through project management to attract suppliers

Project management policies should include supply chain management policies for efficient management of supplier demand and give proper information timely.

- Insufficient admin staff

Project managers have already shown their concern on managing the task with 34 suppliers and only 2 business analysts and there is also a lack of sufficient admin staff. Calibration of new roles becomes difficult with a limited amount of staff that should be handled.

Solution- Increase staff

Increasing the number of staff is the main solution and managing all available resources with proper allocation of roles as per their qualities and expertise.

- Losing of expertise through sales staff

Involvement of automated systems this project cancels roles of sales staff that causes risk for the company as they have enough expertise about the market and knowledge about qualitative products (AL-Obaidi et al. 2019).

Solution- Re-negotiate with them

Making re-negotiation with sales staff and making them engaged with supply chain management will be a savior of this particular risk and this will also decrease the risk of losing expertise.

3. Time management

The time scale of the project is minimized by 5 months as it requires 15 months to be completed but the allocated time for the completion is 10 months. According to Scott et al. (2020), managing the overall time for the project is necessary so that the overall work of the project work can be effectively completed. The situation is very crucial for the development of appropriate strategies for the project as time management is the most important factor in this situation. Moreover, this directly impacts the overall scope and quality of the project that also affects the cost of the project (Yu et al. 2020). Productivity of “lock-in project” will increase with proper management of time assigned for the project and the right allocation of tasks with proper time will decrease mistakes in the stages of project development. The goal of attracting more suppliers to the policy will be met with effective completion of the project with allocated time and some steps and measurements of the manager can help in that purpose.

Solution of shortage of time in this project

Pareto principle- 80/20 rule is signified in this model which includes 20% of used time should make 80% results and from the very beginning identification of tasks should be done as per their priority.

Simple model- Simplified model project development is required with a “lock-in project” of Workrite components to avoid any complicated step that involves more time but gives less efficient results.

Analyze expenses time- Regular review of allocated tasks and their required time should be observed to avoid any delay. Analyzing the expenses time in a particular task is important to minimize cost and time usage and effective use of resources and capitals (Zhou et al. 2020).

Take smaller steps- Smallest steps are more efficient, require less time compared to complicate one and the scenario requires taking the strategy as Workrite components have less time to complete the project. A complicated task increases the risk factor and involves more time which is not desirable with this minimum time allocation in the current project.

Set daily goals with a weekly and monthly one- Setting daily goals introduce urgency of work among the overall workforce and progress of the project will be faster by that process. According to Broughel (2020), with the help of weekly and monthly goal targets can be set and fulfilled to finish within the allocated time.

Work in a productive way- Task should be allocated as per its importance with time so that efficient work can be done without any delay.

Following all these steps in the time management process, Workrite components can increase their productivity and will be able to complete their project within the allocated time instead of its shortage of time.

4. Cost analysis

Cost-benefit analysis associated with this project

The “Cost-benefit analysis” of a project gives a systematic analysis of the potentiality of the overall project and shows value incurred within the project with profitability analysis. The benefits of deciding to change the working criteria are decided by this process of designing the project. According to León et al. (2020), financial metrics are measured in this analysis that involves revenue generation, savings, and profit or loss analysis with recovery time. Analysis of this particular step is important to make decisions about the planned project of Workrite components. Monetary measurement can be imposed from this analysis as it focuses on cost estimation with profitability analysis in the “lock-in project” (Zativita et al. 2019). Although the analysis has some limitations for long-term projects such as it doesn’t consider inflation, variation in cash flow, and interest rate that make it difficult for large-size projects.

Payback Calculation [Refer to Excel Spreadsheet]

“Cash Flow statement for four years”:

| Cash-Flow Statement | ||||

| Particulars | Year 1 | Year 2 | Year 3 | Year 4 |

| Amount | Amount | Amount | Amount | |

| Cash flows from operating activities: | ||||

| Net income (loss) | £ 165,000.00 | £ 173,250.00 | £ 181,912.50 | £ 191,008.13 |

| Adjustments to reconcile net income (loss) to

net cash from operating activities: |

||||

| Depreciation and amortization | £ 12,000.00 | £ 22,000.00 | £ 22,500.00 | £ 23,000.00 |

| Deferred income taxes | £ – | £ – | ||

| (Increase) decrease in inventories | £ 1,500.00 | £ 2,575.00 | £ 2,625.00 | £ 2,850.00 |

| (Increase) decrease in accounts receivable | £ 2,500.00 | £ 2,625.00 | £ 2,750.00 | £ 2,900.00 |

| (Increase) decrease in other assets | £ 2,400.00 | £ 3,000.00 | £ 3,100.00 | £ 3,150.00 |

| Increase (decrease) in accounts payable | £ 3,000.00 | £ 3,150.00 | £ 3,250.00 | £ 3,350.00 |

| Increase (decrease) in other liabilities | £ 1,200.00 | £ 1,260.00 | £ 1,350.00 | £ 1,400.00 |

| Net cash from operating activities | £ 14,200.00 | £ 25,790.00 | £ 26,375.00 | £ 27,150.00 |

| Cash flows from investing activities: | ||||

| Purchases of investments | £ 25,000.00 | £ 40,000.00 | £ 12,000.00 | £ 15,000.00 |

| Proceeds from sales of investments | £ 10,000.00 | £ – | ||

| Net cash from investing activities | -£ 15,000.00 | -£ 40,000.00 | -£ 12,000.00 | -£ 15,000.00 |

| Cash flows from financing activities: | ||||

| Issuances of common stock | £ 45,000.00 | £ 47,250.00 | £ 48,000.00 | £ 50,000.00 |

| Repurchases of common stock | £ – | £ 14,000.00 | £ 12,000.00 | £ 13,000.00 |

| Issuances of debt | £ 23,000.00 | £ 24,150.00 | £ 25,000.00 | £ 25,200.00 |

| Repayments of debt | £ 42,000.00 | £ 44,100.00 | £ 42,000.00 | £ 43,000.00 |

| Dividends paid | £ 12,000.00 | £ 25,000.00 | £ 26,000.00 | £ 27,000.00 |

| Other | £ 2,000.00 | £ 2,100.00 | £ 2,150.00 | £ 2,225.00 |

| Net cash used in financing activities | £ 12,000.00 | -£ 13,800.00 | -£ 9,150.00 | -£ 10,025.00 |

| Net increase (decrease) in cash & cash equivalents | £ 176,200.00 | £ 145,240.00 | £ 187,137.50 | £ 193,133.13 |

| Cash & cash equivalents, start of period | £ 20,000.00 | £ 196,200.00 | £ 341,440.00 | £ 528,577.50 |

| Cash & cash equivalents, end of period | £ 196,200.00 | £ 341,440.00 | £ 528,577.50 | £ 721,710.63 |

Table 1: Cash flow statement

(Source: Self-created)

Cash flow analysis is done to estimate any changes with net cash of the Workrite components in their new project that depicts all historical information about the cash flow of the company. Moreover, it determines the relationship of net cash flow and profitability of the company with the “lock-in project”.

Formula for “Payback Period calculation” is:-

= “Initial investment” / “Cash flow per year”

| Payback Period Calculation | ||

| Initial Investment | Cash-flow | |

| Initial investment Year 1 | £ 656,000.18 | 196200 |

| Initial investment Year 2 | -£ 35,000.00 | 341440 |

| Initial investment Year 3 | -£ 65,000.00 | 528578 |

| Initial investment Year 4 | £ 756,000.36 | 721711 |

| Payback for year 1: | £ 3.34 | |

| Payback for year 2: | -0.102507029 | |

| Payback for year 3: | -0.12297156 | |

| Payback for year 4: | 1.04751175 | |

Table 2: Payback period calculation

(Source: Self-created)

The payback period defines the time required for recovering the initial cost of a project that evaluates the importance of the project and the time required to recover invested capital in the project. The Workrite components of the UK faced a loss several times which is clear from its payback time calculation as the result shows two negative and two positive times in the payback period.

Return on investment [Refer to Excel Spreadsheet]

Return on investment gives information about profitability with a newly implemented project and the effectiveness of the project in the revenue generation of the company. ROI is used by investors to calculate their return and here, Workrite components calculate the value of ROI to see profitability with their new “lock-in project”.

Formula:-

[(final value of the investment-Initial value of the investment)/Cost of Investment]*100

| Return on investment (ROI) | |

| Particulars | Amount |

| Sales | € 120,000.00 |

| Less: Variable costs | € 13,000.00 |

| Less: Fixed costs | € 35,000.00 |

| Net operating income | € 65,000.00 |

| Average operating assets | € 556,000.00 |

| ROI | € 0.18 |

Table 3: Return on investment calculation

(Source: Self-created)

Reference list

Books

Chappell, J., 2020. Command and Control with Human-Machine Teams. NAVAL POSTGRADUATE SCHOOL MONTEREY CA.

Clegg, S.R., Skyttermoen, T. and Vaagaasar, A.L., 2020. Project management: a value creation approach. Sage.

Pryke, S. ed., 2020. Successful Construction supply chain management: Concepts and case studies. John Wiley & Sons.

Schmid, A.A., 2019. Benefit-cost analysis: A political economy approach. Routledge.

Turner, J., 2020. Agile Project Management: 3 Books in 1-The Ultimate Beginner’s, Intermediate & Advanced Guide to Learn Agile Project Management Step by Step. Publishing Factory.

Verzuh, E. and American Psychological Association, 2021. A Guide to the Project Management Body of Knowledge: PMBOK Guide.

Zembri-Mary, G., 2019. Project risks: Actions around uncertainty in urban planning and infrastructure Development. John Wiley & Sons.

Journals

Abdel-Basset, M., Gunasekaran, M., Mohamed, M. and Chilamkurti, N., 2019. A framework for risk assessment, management and evaluation: Economic tool for quantifying risks in supply chain. Future Generation Computer Systems, 90(1), pp.489-502.

Abidin, M., 2021. Stakeholders Evaluation on Educational Quality of Higher Education. International Journal of Instruction, 14(3), pp.287-308.

AL-Obaidi, A.Q.H. and Salman, A.M., 2019. The adoption of cost-benefit analysis as an indicator for evaluate the accounting performance of business entities (the case study for Canadian railway). Academy of Accounting and Financial Studies Journal, 23(3), pp.1-18.

Alsultan, M., Jun, J. and Lambert, J.H., 2020. Program evaluation of highway access with innovative risk-cost-benefit analysis. Reliability Engineering & System Safety, 193, p.106649.

Broughel, J., 2020. Cost-Benefit Analysis as a Failure to Learn from the Past. Broughel, James/2020.” Cost-Benefit Analysis as a Failure to Learn from the Past.” The Journal of Private Enterprise, 35(1), pp.105-113.

Chakrabortty, R.K., Sarker, R.A. and Essam, D.L., 2020. Single mode resource constrained project scheduling with unreliable resources. Operational Research, 20(3), pp.1369-1403.

Civera, C. and Freeman, R.E., 2019. Stakeholder relationships and responsibilities: A new perspective. Symphonya. Emerging Issues in Management, (1), pp.40-58.

Firmansyah, I., 2018. Efficiency and Performance of Islamic Bank: Quadrant Analysis Approach. International Journal of Islamic Business and Economics (IJIBEC), pp.15-25.

Ibrahim, I., Zukhri, N. and Rendy, R., 2020. Importance Performance Analysis (IPA) Visitors’ Satisfaction of Ecotourism in Bangka Belitung, Indonesia: Tracking the Messages to Stakeholders. In SHS Web of Conferences (Vol. 76, p. 01014). EDP Sciences.

Jones, P., 2018. Contexts of co-creation: Designing with system stakeholders. In Systemic Design (pp. 3-52). Springer, Tokyo.

Leknoi, U. and Likitlersuang, S., 2020. Good practice and lesson learned in promoting vetiver as solution for slope stabilisation and erosion control in Thailand. Land use policy, 99, p.105008.

León, M., Silva, J., Carrasco, S. and Barrientos, N., 2020. Design, cost estimation and sensitivity analysis for a production process of activated carbon from waste nutshells by physical activation. Processes, 8(8), p.945.

Ludovico, N., Dessi, F. and Bonaiuto, M., 2020. Stakeholders mapping for sustainable biofuels: an innovative procedure based on computational text analysis and social network analysis. Sustainability, 12(24), p.10317.

Scott, T.A., Ulibarri, N. and Scott, R.P., 2020. Stakeholder involvement in collaborative regulatory processes: Using automated coding to track attendance and actions. Regulation & Governance, 14(2), pp.219-237.

Stocker, F., de Arruda, M.P., de Mascena, K.M. and Boaventura, J.M., 2020. Stakeholder engagement in sustainability reporting: a classification model. Corporate Social Responsibility and Environmental Management, 27(5), pp.2071-2080.

Yu, H., Sun, X., Solvang, W.D. and Zhao, X., 2020. Reverse logistics network design for effective management of medical waste in epidemic outbreaks: Insights from the coronavirus disease 2019 (COVID-19) outbreak in Wuhan (China). International journal of environmental research and public health, 17(5), p.1770.

Zativita, F.I. and Chumaidiyah, E., 2019, May. Feasibility analysis of Rumah Tempe Zanada establishment in Bandung using net present value, internal rate of return, and payback period. In IOP Conference Series: Materials Science and Engineering (Vol. 505, No. 1, p. 012007). IOP Publishing.

Zhou, S. and Yang, P., 2020. Risk management in distributed wind energy implementing Analytic Hierarchy Process. Renewable Energy, 150, pp.616-623.

Know more about UniqueSubmission’s other writing services: