Objectives Of The Company Are To Deliver Their Products And Services

Introduction

The business objectives of the company are to deliver their products and services to the consumers at competitive price points so that consumers get attracted to their products and prefer them rather than other competitors. The automotive market in Europe is advantageous to deliver various direct and indirect jobs, where more than 6.1% of employees are involved in the automobile industry. Therefore, providing significant job options and effective products to the consumers is the main objective here.

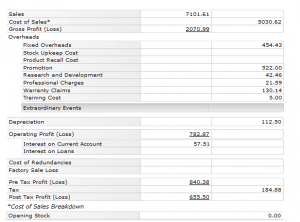

The performance of the company is quite nice here where the profitability shows the outcomes of the business. Although there are various expenditures applied to the company, the company is able to get remarkable profitability and growth in their business. The number of sales is quite huge here, but the competitive market can affect the sales in future where the company needs some changes to be implemented in their workplaces according to the consumers’ preferences.

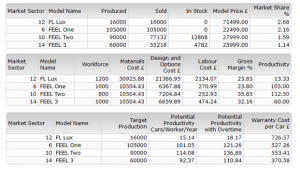

Figure 1: Production report

(Source:https://executive.trainingsimulations.co.uk/WhatIf/index.php? Action=show&ID=87293&)

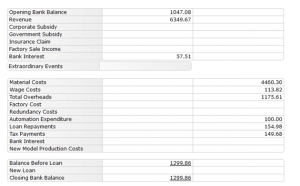

Figure 2: Cash Flow of the company

(Source:https://executive.trainingsimulations.co.uk/WhatIf/index.php?Action=show&ID=87293&)

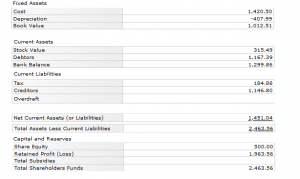

Figure 3: Balance sheet

(Source:https://executive.trainingsimulations.co.uk/WhatIf/index.php?Action=show&ID=87293&)

Figure 4: profit and loss Account

(Source:https://executive.trainingsimulations.co.uk/WhatIf/index.php? Action=show&ID=87293&)

Company Performance

The performance of the company is now elaborate in this section where the entire five rounds are taken into consideration for analyzing the results and finding whether any types of innovations and growth are acquired by the company or not.

Round 1

According to round 1, significant market research was conducted, which was responsible for predicting some results in the car markets. It had predicted that the sales would be the same for 15.6cm cars. Though it was a product care market, it is predicted that the market of small cars will grow up to 1% compared to last year. The medium to be changed very little than in the previous years (Doubravský and Doskočil 2016). Moreover, the large car market is assumed to be decreased by 1% and the car market in luxury segments will be shrunk by 3%. The rate of inflation was approx. 2.16%, which is predicted to be over 4% in the next year.

Figure 5: Production report, Round 1

(Source:https://executive.trainingsimulations.co.uk/Whatif/index.php?Action=previous results in &ID=87293&)

From the above figure, it is quite obvious to see that the sales of small cars are growing and most of the cars lie in this category which leads to positive prediction results. The FL Coupe is produced and sold most where there are no remaining cars, in stock for the FL Coupe now. Whereas, the model FEEL One also sold higher and also produced more significantly based on the prediction about the boost sales of small and compact cars this year (Shockley, 2016). As more FEEL One models were produced, the workforces engaged with this model are higher than the FL Coupe one. As the material costs and the other optional costs are less for the market sector 14, the potential productivity rate is also very high here. Moreover, the gross margin is also slightly higher to get better profitability. The total market share of the four categories is divided like 6.18, 5.49, 3.09 and 0.80 (all are in m) for the small, medium, large and luxury segments respectively.

Figure 6: Prices in Round 1

(Source: Provided)

Figure 7: Prices in Round 2

(Source: Provided)

Table: Forecast table in Round 1

(Source: Self-created)

It is seen that the forecast done in the initial stage was mostly meet the outcomes which were predicted in the forecast. Though some changes are seen in the warrant costs per car in FL Coupe and FEEL ONE model. The operating profits are also changed with the changes of post-tax profits. Compared to other rounds, this was the most stable for Felidae.

Round 2

It is seen that the company here plays a crucial role in terms of increasing their sales and productions where they went for strategic movements, they minimized or reduced the prices of the cars so that more number of sales could be generated and affect the revenues of sales of the company. From the above figures, the price list should be focused where it is significantly seen that the price of FL Coupe had reduced from $72999 to $69999 which is quite a good marketing strategy for the company (Kumar et al. 2018). Moreover, the FEEL One model was also taken into consideration the prices have decreased from $22999 to $21999.

Figure 8: Production report of Round 2

(Source:https://executive.trainingsimulations.co.uk/Whatif/index.php?Action=previous results &ID=87293&)

From the above figure, it is also seen that in round 2, the model added to their sales is FEEL Two, which is slightly premium. The main structure and design of the model are equal to the FEEL One model, only some additional features are added here. Additionally, it is also seen that the material cost is exactly the same, i.e. $9782.54 for both the FEEL One and FEEL Two models. The only difference is seen in the designs and options, where the buyers of the FEEL Two will get the premium features (Najafabadiet al. 2019). The difference between the labour costs is also very marginal where only in some areas the labours have to do more work to fit additional features. As the new features are introduced in their small category car, the productivity would be higher for the consumers who are anxious to use those new features in the same models. Therefore, it helps to enhance the performance of the company in various sectors where the consumers are getting special features in their popular FEEL model. In business, it is very crucial to have these types of modifications to understand the needs and requirements of the costumes. As technologies are evolving every day, the implementation of those technologies is very much essential nowadays for the consumers so that digitalization can be achieved by the consumers effectively (Vanaukenet al. 2017). Therefore, the organizations got feedback from customers and added those features in the FEEL Two model so that they can have an option to choose between premium features or regular features. It directly affects the brand image as well as the brand value of the organizations where it shows that the company is interested in those consumers to meet their requirements effectively. Therefore, the number of production of the new generation FEEL model is introduced.

Table: Forecast table in Round 2

(Source: Self-created)

In round 2, the profits were expected to be achieved in the forecast where it is seen that productivities of the models are gone beyond the predictions. A huge success was achieved in this round. Moreover, the decision taken by the company to introduce new models was a great achievement for the company.

Round 3

Compared to round 1, it is also seen that in round 2, the sales margin of the small cars has increased from 6.18 to 6.27. The sales of medium segment cars also increased from 5.49 to 5.51. Whereas, the broader category faced a bit decreased in their sales from 3.09 to 3.03. The sales of luxury cars are minimized a little bit from 0.8 to 0.77, which is very marginal.

Figure 9: Production report, Round 3

(Source:https://executive.trainingsimulations.co.uk/Whatif/index.php?Action=previous results &ID=87293&)

In round three, the performance of the company is affected drastically. A new model has been introduced named Flux which replaced the segment of medium car and the FL Coupe model was replaced by it. But the thing is, consumers were not accepting these types of frequency changes, tho0ugh the new model was attractive for the consumers. The market had faced serious drawbacks and losses in this round where every segment faced minimization of the sales of cars (Xabaet al. 2018). Therefore, though the new model achieved a good percentage of market share, the overall profitability has gone down, and sales were reduced. Compared to last year, it is also seen that in round 3, the sales margin of the small cars has decreased from 6.27 to 5.78. The sales of medium segment cars also reduced from 5.51 to 5.20. Whereas, the broader category faced a bit decreased in their sales from 3.03 to 2.83. The sales of luxury cars are minimized a little bit from 0.8 to 0.67, which was very marginal.

Figure 10: Product life cycle in Round 2

(Source:https://executive.trainingsimulations.co.uk/Whatif/index.php?Action=previous results &ID=87293&)

Table: Forecast table in Round 3

(Source: Self-created)

Though round 2 was a huge success for the company, round 3 maintained the growth and productivity where this time also the production goes beyond the forecast. Moreover, the warranty per cost is achieved more than it was expected where the life cycle of the cars was enhanced.

Round 4

In round 4, it is seen that no investments were made in new models, but the advanced model of the FEEL lineup was introduced named FEEL 3. Besides that, the old models are carried on by the company as the sales were quite good, and they were improving the performance and features of those models by adding new features and options. The consumers are attracted to those features, and the most crucial decision was taken by the company is for lowering the pricing of their two models so that consumers could provide more interest in their products. As the workers are already much trained, the investments in skill and management training were decreased up to twenty million and thirty million for those ratings respectively (Agiomirgianakiset al. 2012). But in automation, the investment is going huge for dealing with the demands of their cars among consumers.

Figure 11: Production report, Round 4

(Source:https://executive.trainingsimulations.co.uk/Whatif/index.php?Action=previous results &ID=87293&)

Here it was seen that the age group was changed for the vehicles where the price of FL Lux model had decreased up to 71499, which was much attractive and played a crucial role in boosting the sales. Though it is to be noted that more consumers are attracted to small and company cars. Therefore, they decided to minimize the price of the FEEL One model which increased up to 22499 USD as its high demands. Moreover, the FEEL Two model also acquired an increase in cost up to 27999 USD. According to round 4, it was seen that the small category vehicles are sold mostly. Though, in parallel, the medium category sales are also incensed hugely and competing for the small categories. The team performance was improved by the last mistakes done by the company about the bad product life cycles.

Trend Analysis

The product life cycle of the cars manufactured by the company was perfect for one year. According to the graph, the market share is also growing for the enhanced life cycle of products. Consumers are accepting and getting various benefits from their products so that consumers are providing more interest in their products (Emmanuel, 2016). Though it was the first year, it wasn’t predicted how many years the products would run like this. Compared to the 1st year, the sustainability rate of the cars goes down where the product life cycle was decreasing from the past years. Comparatively, the premium model FL Lux couldn’t face the problem where the other budget models faced the problem. The second year determines that the life cycle was increasing but after that, it was started decreasing and in the 3rd year it was seen that huge impact on the product life cycle facing the decrease for the FEEL TWO model most. Compared to the FEEL TWO model, the other models have not faced the issue in a huge margin. But the starting life cycle was creating huge hype, and all are being attracted to their products and the features provided by the company with a better life cycle. After-sales services are the segments where consumers are very much concerned. It directly creates trust in the brand, and here the life cycle also proved that the company was doing enough hard work for the consumers.

Figure 11: Product life cycle in Round 3

(Source:https://executive.trainingsimulations.co.uk/Whatif/index.php?Action=previous results &ID=87293&)

As it was discussed earlier that in round 3, the production and the sales of the cars had decreased. One of the crucial reasons behind this was the decrease in the life cycle of their products. In Round 2, the consumers are getting various services where they already have gained trust for the company in the first year, where they got a better product life cycle. But after that, the crucial time was started where consumers are facing lots of issues that directly affect the sales of the products. Therefore, though a new model was introduced, the sales were decreased (Schneckenberget al. 2017). From the above figure, it is evident that the graph was increasing marginally well, but after the first year, the decrease in product life cycles are seen mostly in smaller and cheaper cars. As the sales of these smaller cars were higher, a more number of people were affected by this type of life cycle where condoms were losing their trust in the company. Moreover, though the graph was decreasing for the smaller cars, the premium and larger cars life cycle was still increasing. It directs that the company was using their premium materials as well as a robust raw material in their premium cars where though the number of consumers is small, the increased life cycle has been determined correctly.

Figure 12: Turnover and profit of teams in round 1

(Source:https://executive.trainingsimulations.co.uk/Whatif/index.php?Action=previous results &ID=87293&)

From the above figure, it is understood clearly that the initial year was awful for Felidae where all the other companies are growing very aggressively. Though It was a little start for the company, Felidae gained the trust of the consumers from the second year. Therefore, in round 1, the company was running in negative profitability, and the total revenues were minimal. The post-tax profit went into loss shown in the figure with the green bar (Cubas‐Díaz and Martinez Sedano, 2018). Hence, it was evident that the start of the company was not tremendous here. Here, the VUC company shined where it gained the most revenues and profits which was providing competitive advantages. But the thing is, not only the initial sales, the after-sales and the quality of the products will be responsible in future where the consumer will be able to get the actual service and product qualities.

Figure 13: Turnover and profit of teams in round 2

(Source:https://executive.trainingsimulations.co.uk/Whatif/index.php?Action=previous results &ID=87293&)

The above figure consists of the profit graph, which was acquired by the company in the next year in round 2. This was the best year for Felidae where it directly jumped from zero to the top and provided competition to the VUC company which was securing first place last year in terms of revenue (Karlsson and Nowell, 2017). It has been seen that the consumers are getting trust from the company, and this year, the sales jumped every high, which leads to huge revenues and successful performance of the company in this sector. Though the probability was not much than the VUC company, the revenue was precisely the same, which was an excellent achievement for the company.

Figure 14: Turnover and profit of teams in round 3

(Source:https://executive.trainingsimulations.co.uk/Whatif/index.php?Action=previous results &ID=87293&)

The above figure consists of the graph abiotic the round 3 profitability, where team Falidae again faced some difficulties about the life cycles of the products which directly affect the profitability and revenue of the company. Here all the other companies had done a perfect job getting average revenues and profits. This is the main reason for the minimization of sales, where the consumers are trying new products from several brands. But people also buy small and medium cars from the team Felidae as they are focusing on various types of innovations and implementing those in their cars (Rahman and Khan, 2017). Hence, here the competition are getting higher which is responsible for minimizing the sales of the company directly, though it is providing considerable investments in their R&D teams for more innovations to offer more comfort to their cars. Whenever the competitors are growing, companies are needed to build products that are unique and meet the requirements of consumers more effectively (tandfonline.com, 2017).

Learning

Organizational decisions play a crucial role in terms of controlling the flow of a particular company. All the fundamental factors in any organization like, financial, human resource, operations and marketing are taken into consideration for making any significant decision so that the outcome could be assumed or predicted. Here in the automotive sector, these decisions contain improvements in cars, enhance the implementation of new technologies and pricing strategies so that more people could provide internet in a particular company (Tomsiket al. 2016). As technologies are helping, consumers always need transformations in their products and need more innovative features in cars. Therefore, to make possible these types of requirements, several significant decisions are required in order to be acquired knowing the effective outcomes. All the decisions taken by the company are to be discussed here where the investments in R&D teams, in new segments all are to be taken into consideration. In order to improve the skill related to decision making and communication, self-improvement is essential. Candace thinks that communication skill is crucial for dealing with various kinds of customers, and therefore it is considered as one of the most effective strategies. This skill is not only vital for dealing with customers but also for overcoming internal conflict within an organization (Bashir et al. 2019).

Decision making

In order to achieve growth in the business, it is essential to increase employee engagement. Taking the initiative which will help in reducing conflict leads to an increase in employee engagement. The more number of the workforce will be assigned in the innovations, or manufacturing process, the more significant new ideas will be produced. Here the leadership style of the leaders also plays an essential role where they communicate with the workers and try to know the problems faced in their workplaces. Therefore, it would be more useful to solve those problems which can indirectly enhance the productivity rate of their products too. It is required to take various kinds of strategies. Therefore, critical thinking gets the most priority here where unique decisions are to be made. Ethical considerations in business decision making are one of the crucial areas that determine the sustainability of a business.

Figure 15: Decision making in Round 1

(Source:https://executive.trainingsimulations.co.uk/Whatif/index.php?Action=previous results &ID=87293&)

The above figure is responsible for showing the decisions taken by the team here. It is evident that the new models always create hype among the consumers. Therefore, the crucial decision is made here for introducing the latest models in the market. The market research was conducted to understand the requirements of the consumers so that those features could be implemented in the new model (Gong et al. 2018). Over thirty-six million dollars are invested in the latest models and created a suitable plan having the data on competitions of new models in the market. The FL Coupe and the FEEL One models are created by the investments and enter the market with their offerings. It is seen that the company here plays a crucial role in terms of increasing their sales and productions where they went for strategic movements, they minimized or reduced the prices of the cars so that more number of sales could be generated and affect the revenues of sales of the company. From the above figures, the price list should be focused where it is significantly seen that the price of FL Coupe had reduced from $72999 to $69999 which is quite a good marketing strategy for the company. Moreover, the FEEL One model was also taken into consideration the prices have decreased from $22999 to $21999. The FL Coupe is produced and sold most where there are no remaining cars, in stock for the FL Coupe now. Whereas, the model FEEL One also sold higher and also produced more significant based on the prediction about the boost sales of small and compact cars this year.

Marketing

As more FEEL One models were built, the workforces engaged with this model are higher than the FL Coupe one. As the material costs and the other optional costs are less for the market sector 14, the potential productivity rate is also very high here. The training is also provided to the workers for better manufacturing processes (theaspd.com, 2018).

Moreover, various investments are made to provide exceptional training and management training, too, where the human resource department also could serve the employees effectively. In automation, fifty million was invested, whereas eighty million was in skill training and sixty-four million in management training (Grinols and Mustard, 2001). The age group was also divided where FL Coupe was directly manufactured for the age group 2 having the size 4. The deciding factor of the price here is 72999 dollars which are quite high rather to other small vehicles. As it is medium size and comes in a slight premium segment, the pricing is entirely justified. Additionally, the FEEL One model was decided to be in a more compact size, particularly for the age group 4. The size of the cars here is smaller, and the age group is higher, having fewer premium features, mostly for the regular middle-class usage. The pricing strategy here is very aggressive when it costs only 22999 Dollars, which is much cheaper than the other model (Jablinskiet al. 2016). Therefore, this decision was very crucial here, having an effective pricing strategy. The gross margin is also slightly higher to get better profitability (eprints. white rose.ac. the UK, 2020).

Figure 16: Decision making in Round 2

(Source:https://executive.trainingsimulations.co.uk/Whatif/index.php?Action=previous results &ID=87293&)

In round 2, it is seen that no investments were made in new models and the old models are carried on by the company as the sales were quite good and they were improving the performance and features of those models adding new features and options. The consumers are attracted to those features, and the most crucial decision was taken by the company is for lowering the pricing of their two models so that consumers could provide more interest in their products. As the workers are already much trained, the investments in skill and management training were decreased up to 40 million and thirty million for those ratings respectively. But in automation, the investment is going huge for dealing with the demands of their cars among consumers (Popovaet al. 2017). Here it was seen that the age group was changed for the vehicles where the price of the FL Coupe model had decreased up to 69999, which was much attractive and played a crucial role in boosting the sales. Though it is to be noted that more consumers are attracted to small and company cars. Therefore, they decided to minimize the price of the FEEL One model which increased up to 21999 USD. Thus, consumers were getting many benefits from the pricing segments as well as getting more features. It is crucially seen here that the investment is made in the previous round, as an outcome, a new model was introduced, which was a premium version of the FEEL One model, named FEEL Two (Akkaya and Ceren, 2013). The premium features are added here in this model to provide more comfort to the consumers investing a little bit more in the same sized model. The pricing had been decided as 26999 USD, which was also competitive for the consumers.

Figure 17: Decision making in Round 3

(Source:https://executive.trainingsimulations.co.uk/Whatif/index.php?Action=previous results &ID=87293&)

In round 3, it was very crucial for the company as the consumers were listing their trust in the company for their inadequate services and product life cycle. Although the vehicles were performing well for the first year, after two years, the life cycle of the products went very bad where it was seen more consumers were complaining about their products. Therefore, the company needed to announce something different to deal with the consumers. The decisions were taken effectively in round 3 where it handles the problems faced in round 2 and it affects directly the revenue and performance of the company effectively.

Marketing

The competition were increased in the market where the companies were providing competitive products with very strategic pricing points. At this point, the Felidae team was responsible for investing more in another new model (Jordan, 2010). The skill training and management training was contributed by sixty million and forty million USD. Additionally, 200 million USD was invested in automation. The investment in the new model was about 500 million USD which was huge. The market research was also conducted for evaluating the outcome of the new model and expect a more significant outcome from it. The new model was introduced, whose name was Flux having the size four and age group 3. The pricing was a little bit higher than the FL Coupe model, and all the changes were done in the looks though both models were for the premium segments with a variety of features and stability. Furthermore, it was noticed that the product life cycle of the premium cars was much stable, and the consumers of these models were not complaining as much as the FEEL One and Two models.

Figure 18: Decision making in Round 4

(Source:https://executive.trainingsimulations.co.uk/Whatif/index.php?Action=previous results &ID=87293&)

In round 4, it is seen that no investments were made in new models, but the advanced model of the FEEL lineup was introduced named FEEL 3. Besides that, the old models are carried on by the company as the sales were quite good, and they were improving the performance and features of those models by adding new features and options. The consumers are attracted to those features, and the most crucial decision was taken by the company is for lowering the pricing of their two models so that consumers could provide more interest in their products. As the workers are already much trained, the investments in skill and management training were decreased up to twenty million and thirty million for those ratings respectively (Agiomirgianakiset al. 2012). But in automation, the investment is going huge for dealing with the demands of their cars among consumers. Here it was seen that the age group was changed for the vehicles where the price of FL Lux model had decreased up to 71499, which was much attractive and played a crucial role in boosting the sales. Though it is to be noted that more consumers are attracted to small and company cars. Therefore, they decided to minimize the price of the FEEL One model which increased up to 22499 USD as its high demands. Moreover, the FEEL Two model also acquired an increase in cost up to 27999 USD. Therefore, consumers were getting many benefits from the pricing segments as well as getting more features. It is crucially seen here that the investment is made in the previous round, as an outcome, a new model was introduced, which was a premium version of the FEEL Two model, named FEEL 3. More premium features are added here in this model to provide more comfort to the consumers investing a little bit more in the same sized model (Chan and Yazdanifard, 2014). The pricing had been decided as 25999 USD, which was very much competitive for the consumers conducting serious competition with its predecessors. Here, it was noticed that the pricing strategy was very aggressive, which outperformed the aggressive pricing of the other FEEL lineups.

Table: Forecast table in Round 4

(Source: Self-created)

The round 4 forecast was decent where the forecasts of the productivities are accurately matched, while market share is seen to be increased and operating profits were gained more than the forecasted one.

Operations

It is quite obvious that the decision-making strategies are very significant for the companies to get competitive advantages from the other competitors. The starting model had done very well in these segments where it was noticed that in the starting points, the company was providing the products and consumers were attracted much for their pricing of the compact models (Cardos and Pete, 2011). Here all the other companies had done a perfect job getting average revenues and profits. This is the main reason for the minimization of sales, where the consumers are trying new products from several brands. But people also buy small and medium cars from the team Felidae as they are focusing on various types of innovations and implementing those in their cars. Hence, here the competition are getting higher which is responsible for minimizing the sales of the company directly, though it is providing considerable investments in their R&D teams for more innovations to offer more comfort to their cars. Moreover, launching the FEEL 3 model was very crucial for the company providing the same competitive pricing so that consumers could get those products more effectively with less pricing. Though the age group of FEEL was the same, the size was reduced and became smaller to provide the perfect compact experience to the consumers. The reduction of pricing might be because of the less size too, where the spaces inside the cars were also decreased, which leads to fewer comforts.

Conclusion

The main objectives of the company were to provide the best products within a compact competitive price point so that consumers will get more price to performance ratio. In the starting points, it is evident that the company was not popular and not gaining much profitability first. but after the launch of their two models, the company was surprised by getting a huge response and provided huge competition to the market leaders. Therefore, consumers are also getting interested in investing in their models. Here the objectives of the company were going to be met. But the next year, the product life cycle became a huge issue where the budget and compact models were facing sustainability issues. These issues are coming on the company models like FEEL One and FEEL Two, not in the premium segments. Though the situation was handled by the company providing the new models in the premiums as well as in budget segments where the FEEL 3 was praised much for its compactness and the most aggressive pricing. Therefore, it can be seen that the objectives were partially met by the company here.

Team Performance

The performance of the teams is quite aggressive, where all the members in the teams played a crucial role in investing more in the new innovation. The R&D teams played the most significant role here for getting more opportunities and several new innovations to be implemented in their new models so that consumers could get hands-on of the new technologies in their cars effectively.

Figure 19: Round 4 production report

(Source:https://executive.trainingsimulations.co.uk/Whatif/index.php?Action=previous results &ID=87293&)

Performance of the team

The performance of the team directly could be seen by the profitability and sales units of the models. According to round 4, it was seen that the small category vehicles are sold mostly. Though, in parallel, the medium category sales are also incensed hugely and competing for the small categories. The team performance was improved by the last mistakes done by the company about the bad product life cycles. Therefore, they didn’t want the same types of wrong things again. Moreover, 2260 new jobs are provided by the company which is very competitive to the VUC company, and these recruitments might help in the team performance effectively. The R&D teams are taken very seriously by the company wherein new innovations; the investments are done hugely. Over 28 million USD is announced to be invested in the R&D teams so that more people could get new products. The effective decisions taken by the teams of the company is quite beneficial where the pricing strategy of the company is taken in such a way that the other companies could not provide such pricing. Moreover, various investments are made in skill training, management training and automation so that the workers could gain knowledge about the new technologies and their implementation. It also provides a huge motivation to the teams for implementing the innovations perfectly and introducing them in their cars. Therefore, the leadership is very effective here for investing more in these segments and thinking about the skills of the employees, which directs effective human resources management as well as better team management in the workplace.

Figure 20: Key perception factor

(Source:https://executive.trainingsimulations.co.uk/WhatIf/index.php?Action=show&ID=87293&)

Personal reflection

The above figure is responsible for providing the determination about the design of the models where it is seen that most of the features are included in the premium model so that consumers will get more comfortable here. Therefore, the teams are very efficient for segmenting the cars based on the features, and the pricing capabilities are justified here. The R&D teams are taken very seriously by the company wherein new innovations, and investments are made hugely. Over 28 million USD is announced to be invested in the R&D teams so that more people could get new products. The effective decisions taken by the teams of the company is quite beneficial where the pricing strategy of the company is taken in such a way that the other companies could not provide such pricing. Hence, it can assure the direct engagement of the teams in the development of new innovations effectively.

Reference list

Book

Magee, J.F., 1964. Decision trees for decision making (pp. 35-48). Harvard Business Review.

Lanning, M.J., 1998. Delivering profitable value. Cambridge: Perseus Books Group.

Journal

Agiomirgianakis, G.M., Magoutas, A.I. and Sfakianakis, G., 2012. Determinants of profitability and the decision-making process of firms in the tourism sector: the case of Greece. International Journal of Decision Sciences, Risk and Management, 4(3-4), pp.294-299.

Akkaya, G.C. and Ceren, U.Z.A.R., 2013. The usage of multiple-criteria decision-making techniques on profitability and efficiency: an application of PROMETHEE. International journal of economics and finance studies, 5(1), pp.149-156.

Bashir, T., Mehmood, F. and Khan, A., 2019. Comforting Investments are Rarely Profitable: Impediments in Investor Decision Making. Global Social Sciences Review, 4(2), pp.71-82.

Cardos, I.R. and Pete, S., 2011. activity-based costing (ABC) and activity-based management (ABM) implementation–is this the solution for organizations to gain profitability. Romanian Journal of Economics, 32(1), pp.151-168.

Chan, J.M. and Yazdanifard, R., 2014. How social media marketing can influence the profitability of an online company from a consumer point of view. Journal of Research in Marketing, 2(2), pp.157-160.

Cubas‐Díaz, M. and Martinez Sedano, M.A., 2018. Measures for sustainable investment decisions and business strategy–a triple bottom line approach. Business strategy and the environment, 27(1), pp.16-38.

Doubravský, K. and Doskočil, R., 2016. Determination of client profitability under uncertainty based on a decision tree. Journal of Eastern Europe Research in Business & Economics, pp.1-8.

Emmanuel, K.Y., 2016. Financial management practices and profitability of business enterprises in Obuasi (Doctoral dissertation).

Gong, M., Simpson, A., Koh, L. and Tan, K.H., 2018. Inside out: The interrelationships of sustainable performance metrics and its effect on business decision making: Theory and practice. Resources, Conservation and Recycling, 128, pp.155-166.

Grinols, E.L. and Mustard, D.B., 2001. Business profitability versus social profitability: Evaluating industries with externalities, the case of casinos. Managerial and Decision Economics, 22(1‐3), pp.143-162.

Jablinski, J., Popova, O. and Kuznetsov, V., 2016. Sustainability as the modern base of profitable business activity. European Cooperation, 8(15), pp.48-55.

Jordan, J.M., 2010. Salary and decision making: Relationship between pay and focus on financial profitability and prosociality in an organizational context. Journal of Applied Social Psychology, 40(2), pp.402-420.

Karlsson, T. and Nowell, P., 2017. ENTREPRENEURIAL TEAM PROFITABILITY AND STRATEGIC DECISION MAKING QUALITY: DIVERGENT EFFECTS OF HOMOGENEITY. Frontiers of Entrepreneurship Research, 37(8), p.3.

Kumar, V., Lahiri, A. and Dogan, O.B., 2018. A strategic framework for a profitable business model in the sharing economy. Industrial Marketing Management, 69, pp.147-160.

Najafabadi, Z.M., Khashei, M. and Bijari, M., 2019. Evaluating Markowitz-based risk measurement approaches for making profitable investment decisions. Business Administration and Management (TRANSFERRED), 1(1).

Popova, O., Tomashevska, O. and Popova, S., 2017. Decision making based on the principles of sustainability for providing profitable business activity. Economic transformation in Ukraine: comparative analysis and European experience, pp.41-149.

Rahman, A. and Khan, M.N.A., 2017. An assessment of data mining based CRM techniques for enhancing profitability. International Journal of Education and Management Engineering, 7(2), p.30.

Schneckenberg, D., Velamuri, V.K., Comberg, C. and Spieth, P., 2017. Business model innovation and decision making: uncovering mechanisms for coping with uncertainty. R&D Management, 47(3), pp.404-419.

Shockley, J., 2016. Precision agriculture economics and decision making—beyond profitability. Crops and Soils, 49(6), pp.16-19.

Tomsik, P., Stojanova, H., Sedlo, J. and Vajcnerova, I., 2016. Factors of profitability of the grapes production. Agricultural Economics, 62(6), pp.292-297.

Vanauken, H.E., Ascigil, S. and Carraher, S., 2017. Turkish SMEs’ use of financial statements for decision making. The Journal of Entrepreneurial Finance (JEF), 19(1).

Xaba, T., Marwa, N. and Mathur-Helm, B., 2018. Efficiency and profitability analysis of agricultural cooperatives in Mpumalanga, South Africa.

Online article

eprints.white rose.ac.UK, 2020, How does sustainable development of supply chains, available at: http://eprints.whiterose.ac.uk/121992/3/Wong%202017%20BSE%20Sustainable%20SC%20development%20lean%20greeen%20profitable%20AAM.pdf [Accessed on 4.5. 2020]

Website

tandfonline.com, 2017, Technology, Innovation, Entrepreneurship and The Small Business—Technology and Innovation in Small Business, Available at: https://www.tandfonline.com/doi/pdf/10.1111/jsbm.12311?needAccess=true [Accessed on: 02.05.2020]

theaspd.com, 2018, DIGITIZATION AS A CATALYST FOR BUSINESS MODEL INNOVATION A THREE-STEP APPROACH TO FACILITATING ECONOMIC SUCCESS, Available at: http://www.theaspd.com/resources/jbm%20vol.%204-2-1.pdf [Accessed on: 02.05.2020]