CORPORATE ACCOUNTING

Abstract

The report has provided the detailed description about the annual report of both the companies Commonwealth Bank and the Westpac Bank. It has mainly represented the annual report of the last three years that includes all the assets, liabilities of the company.

This has made it possible to understand the financial condition of both the companies. It has also described about all the funds that has been generated in both internal and external way in the case for both the companies. Along with this, the report has critical examine the entire measurements based on the assets of the companies with the help of the AASB guidelines.

Thus the report has provided the brief idea about the annual report and the profits that both the companies have achieved during the business year

Good corporate governance underpins the performance of the banks in the country. In addition, successful governance of the corporate structure improves public accountability and also minimizes the risk. Apart from this, it can be stated that this also enhances the efficiency of the banks.

This study will give an idea about the sources of funds of the banks and in this case, it will also give an idea about the assets and liabilities of the company. The main aim of the study is to find out the source of funds of the banks and assets and liabilities of both of the banks. In addition, it can be stated that this will also present an analysis of the annual report.

2. Identification of the different source of funds

According to the annual report of the Commonwealth Bank, it has been observed that the bank invests a lot of money in generating funds for the bank. In addition they also invest the earning of the previous years with equity to invest the capital for the finance.

The Westpac bank invests a large amount of money from its previous year’s earning. Apart from this they also invest a high amount of funds in order to maintain the business of the bank.

3. Evolution of the sources of fund

According to the annual report of 2016, 2017 and 2018 it can be depicted that the debt issue of the bank is increasing than the previous years. Further analysis of the annual report of the bank can be depicted that the debt issues of the bank have increased by 3% in the year 2017 (commbank.com.au, 2017).

In addition, it can be stated that in case the debt issues of the bank are increasing this situation also represents that the risk of the bank is also enhancing rapidly. In addition, it can be seen that the debt of the bank has also increased further by 2.8% it has reached 168,034 $M to 172,673 $M. This signifies that the debt of the bank has increased by 2.8% than the previous year (commbank.com.au, 2017).

In addition, it can be commented that the debt of the company is increasing this situation is also enhancing the profitability of the company, this situation also enhances the growth of the bank. Another source of the bank is the equity capital of the bank. In this case, it can be seen that the equity capital of the bank has also increased by a huge amount. In case the equity of the bank is increasing this situation denotes that the operation of the company is also increasing significantly.

According to the annual report of the bank, it can be seen that the debt of the company is decreasing. In case the debt of the bank is decreasing then it can be augmented that the risk is decreasing for this bank (westpac.com.au, 2017).

In addition, it can be stated that in case the debt of the bank is decreasing they are trying to enhance the earning of the bank. In case the earnings of the bank are increasing then it can be stated that this situation of the bank will also enhance the earnings of the banks. This, in turn, will also have an impact on eth profitability of the bank.

4. Percentage of the funds that are generated internally and externally

| DEBT TO EQUITY RATIO (Commonwealth Bank) | ||||

| Year | Formula | Total liabilities | Shareholders’ equity | Result |

| 2016 | Total liability/shareholder’s equity | 872,437 | 60,564 | 144.05% |

| 2017 | Total liability/shareholder’s equity | 912,658 | 63,716 | 143.2% |

| 2018 | Total liability/shareholder’s equity | 907,305 | 67,860 | 133.70% |

From the above table it can be depicted that the liabilities of the bank has increased in the year 2017 compared to 2016. Apart from this, it can be stated that in the next year the equity of the bank has decreased by a significant amount. In addition, it can be augmented that the shareholder’s equity of the bank has increased every year.

In the year 2016 shareholder’s equity was equal to 60,564 and in the next year the equity has increased to 63,716 and in the year 2018 shareholders’ equity of the bank has increased further 67,860 (commbank.com.au, 2018). Apart from this in case of debt-equity ratio it can be seen that ratio is decreasing over the year, this situation has also enhanced the profitability of the bank.

| DEBT TO EQUITY RATIO (Westpac Bank) | ||||

| Year | Formula | Total liabilities | Shareholders’ equity | Result |

| 2017 | Total liability/shareholder’s equity | 815,019 | 64,573 | 126.2% |

| 2018 | Total liability/shareholder’s equity | 790,533 | 61,342 | 128.8% |

| 2019 | Total liability/shareholder’s equity | 781,021 | 58,181 | 134.2% |

From the above table, it is seen that the total liabilities of the bank is decreasing over the year. In addition, it can be stated that the shareholder’s equity of the bank is also decreasing over the year. As a result of that the debt to equity ratio of the bank is also increasing.

In this case it can be seen that in the year 2016 the number of total liabilities of the bank was 815,019 (westpac.com.au, 2016). In the next year, the amount has decreased to 790,533 apart from this in the next year the total liability of the company has also decreased by a significant amount.

The amount has reached to 781,021 in addition the debt to equity ratio has also decreased by a significant amount. This will also present the equity of the company that is it has presented a clear situation of the bank. In addition, it can be augmented that the shareholder’s equity of the bank has increased every year.

5. Relative merits and shortcomings of the different sources of fund

Banks loans

Merits

- The rate of interest is low and favorable for business.

- The monthly payments are fixed, and stable.

- The business credit can be formed using the application of bank loans.

Shortcomings

- The paperwork is a very time worthy process, and also very lengthy

- The time of waiting is very long.

Equity capital

Merits

- This is an internal source of the fund that enhances the efficiency of the bank.

- This situation decreases the risk of the bank.

Shortcomings

- In gaining equity they have sacrifice the amount of share of the bank.

6. Examine different types of liabilities shown in the balance sheet

According to the annual report of the bank, it can be seen that the liabilities of the bank can be specified into three parts current liabilities, noncurrent liabilities, and contingent liabilities.

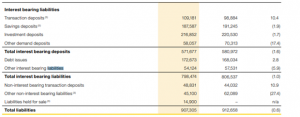

In addition, it can be stated that liabilities can be specified into two parts interest-bearing liabilities and non-interest bearing liabilities. In addition, it can be stated that the interest-bearing liabilities are the debt of the bank.

Figure 1: liabilities

(Source: commbank.com.au, 2018),

From the above figure, it can be depicted that the interest-bearing liabilities of the bank are the transaction deposits, savings deposits, and investment deposits. However, non-current liabilities include tax liabilities, provisions, and interest-bearing liabilities.

In the case of Westpac Bank, it can be seen that the liabilities of the bank have increased over the year. In the year 2016, the liability of the bank was 781,021 in the next year the liability of the bank has increased by a significant amount and it has reached 790,533.

Therefore, it can be stated that in this case, the interest-bearing liabilities are the deposits of the bank. In addition, it can be augmented that the liabilities of the bank have increased by a significant amount.

![]()

Figure 2: Liabilities

(Source: westpac.com.au, 2016)

From the above figure, it can be seen that for the Westpac bank this also includes loan capital in the interest-bearing liabilities.

7. Examine the key provisions under AASB 137 ‘Provisions, Contingent Liabilities and Contingent Assets

The AASB 137 includes such key provisions

In case there is an obligation in the current than that needs resource outflows

- The provision can be identified under the condition which can be an obligation for the banks due to the previous activities. In addition, it can be stated that a reliable estimate can be done.

- The disclosures should be made:

- The amount that is carrying at the start of the provision.

- Extra provisions are made.

- The amount that is used for the same provision (Aasb.gov.au, 2019)

- The remaining amount that is unused

- An increment in the amount that is discounted.

- A detailed description of the obligation.

- The assumptions that are made for future implementation.

- The reimbursement amount.

In case there is a current obligation which probably not gives rise to current obligation

- The liability that is contingent does not need to be identified by the AASB

- The following disclosures need to be done for the contingent liability

- The estimation of the financial can have an impact on the operation of the business of the bank.

There is a remoteness in the outflow of the resources due to a possible obligation or a present obligation

- The provision is not required which is a contingent liability in nature (Aasb.gov.au, 2019)

- There is no need to disclose any information about the same

Note 1: Measurement (Best estimate)

The amount that will be recognized with respect to the provision will be considered as the best estimate of the expenses that will be required. The ends will be required in order to settle the current obligation at the end of the reporting period (Aasb.gov.au, 2019).

Note 2: Expected disposal of assets

The gain that has been made from the expected disposal of assets will not be considered in case of measuring a provision. The expected disposal is closely related to the event, which gave rise to the provision. However, it will not be recognized and instead the gain during the time the disposal of assets was made (Aasb.gov.au, 2019).

Companies referred to the AASB 137

From the annual report, it can be seen that the bank is like to meet the AASB 137 standards.

![]()

Figure 3: Provisions

(Source: commbank.com.au, 2017)

From the figure, it can be depicted that commonwealth bank has published the provision statement of the bank. This situation signifies that the bank has followed the standards of AASB 137. The Westpac bank has not published the provision statement of the bank, thus it can be stated that the banks have not followed the AASB standards of the bank.

This will also present the equity of the company that is it has presented a clear situation of the bank. In addition, it can be augmented that the shareholder’s equity of the bank has increased every year. In the year 2016 shareholder’s equity was equal to 60,564.

In the next year, the equity has increased to 63,716 and in the year 2018 shareholders’ equity of the bank has increased further 67, 860. Apart from this in case of debt-equity ratio, it can be seen that ratio is decreasing over the year. This situation has also enhanced the profitability of the bank.

In addition to the Westpac Bank In the year 2016 the liability of the bank was 781,021 in the next year the liability of the bank has increased by a significant amount and it has reached 790,533.

Therefore, it can be stated that in this case, the interest-bearing liabilities are the deposits of the bank. In addition, it can be augmented that the liabilities of the bank have increased by a significant amount.

Therefore it can be stated that this has presented the data of the company accurately but they also need to present the data more accurately. In addition, it can be stated that in case the debt of the bank is decreasing they are trying to enhance the earning of the bank.

In case the earnings of the bank are increasing then it can be stated that this situation of the bank will also enhance the earnings of the banks. This, in turn, will also have an impact on eth profitability of the bank.

8. Identify all different categories

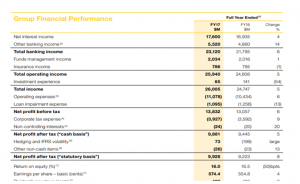

In the annual report of the Commonwealth bank, the different liabilities have clearly mentioned. It has mentioned the interest-earning assets along with the interest-bearing liabilities for the years 2016, 2017 and 2018. This provides an understanding of the company’s financial debts that have been generated during the course period of the business work.

As per Tiwari and Vidyarthi, (2018), it can be observed that the company has also mentioned the net profit before the tax and also after the tax which has helped to gain an idea about the company’s entire profit in the fixed year.

Figure 4: Annual report of the Commonwealth Bank of the year 2017

(Source: commbank.com.au, 2018)

It has clearly shown all the return on equity and the earnings per share to represent the company’s profit in the business year. This return on equity mainly represents the profit of the company that has been generated from the investment of the shareholders to the fund of the company.

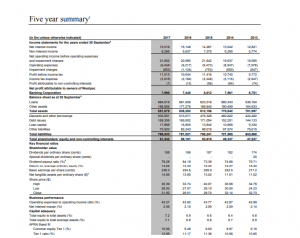

Figure 5: Summary of five years of Westpack Bank

(Source: westpac.com.au, 2017)

As per the summary of the last five years of the company’s annual report, it can be observed that total liabilities, total assets, net interest income, profit before income tax as well as profit after income tax have been mentioned (westpac.com.au, 2017).

It can be observed that the total assets have been increased with the year that has shown the monetary value of the company. It has clearly mentioned that the company has gained a profit with the year.

9. Critically examine the measurement basis used by the company for each class of assets

It can be observed that the company has analyzed the current business position and has presented a position in the annual report. As the opinion of Gray and Nowland, (2017), it can be observed that there are two main important parts, namely, time value and the money which has helped to gain knowledge about the acquisition of the company.

The calculations have been done with the help of AASB 137 guidelines that have helped to produce the estimates in the right format. Along with this, it can be observed that the report has presented several future tangible factors, pre-tax rate and also the risk liabilities in order to provide a proper annual report for the company’s three years performance.

In order to prepare the annual report for the Westpac bank, AASB 137 guidelines have been used to prepare the annual report. In the annual report, all the different liabilities have been clearly presented which has helped to understand the profit and the cash flow of the company.

Based on the above study it can be depicted that shareholders’ equity of the Commonwealth Bank and the Westpac bank is increasing over the year. This in turn also has an impact on the debt-equity ratio of the bank.

In addition, it can be stated that Commonwealth bank is following the AASB standard in Australia whereas the Westpac bank is not following the AASB standard in Australia.

In addition, it can be commented that the debt of the company is increasing this situation is also enhancing the profitability of the company, this situation also enhances the growth of the bank, another source of the bank is the equity capital of the bank.

In addition, it can be stated that in case the debt of the bank is decreasing they are trying to enhance the earning of the bank. In case the earnings of the bank are increasing then it can be stated that this situation of the bank will also enhance the earnings of the banks.

Aasb.gov.au 2019, Provisions, Contingent Liabilities and Contingent Assets, Available at: https://www.aasb.gov.au/admin/file/content105/c9/AASB137_08-15.pdf [Accessed on: 11.01.2020]

Adams, C., 2017. Conceptualising the contemporary corporate value creation processes. Accounting, auditing and accountability journal., 30(4), pp.906-931.

Bhattacharjee, S., Chakraborty, S. and Bhattacharjee, S., 2017. Impact of corporate governance attributes on intellectual capital disclosure: evidence from listed banking companies in Bangladesh. Prestige International Journal of Management & IT-Sanchayan, 6(1), pp.20-42.

commbank.com.au (2016) commbank.com.au ANNUAL REPORT 2016 Available at: https://www.commbank.com.au/content/dam/commbank/about-us/shareholders/pdfs/annual-reports/2016_Annual_Report_to_Shareholders_15_August_2016.pdf [Accessed on: 11.01.2020]

commbank.com.au (2017) Annual Report 2017 Available at: https://www.commbank.com.au/content/dam/commbank/about-us/shareholders/pdfs/annual-reports/annual_report_2017_14_aug_2017.pdf [Accessed on: 11.01.2020]

commbank.com.au (2018), Annual Report 2018 Available at: https://www.commbank.com.au/content/dam/commbank/about-us/shareholders/pdfs/results/fy18/cba-annual-report-2018.pdf [Accessed on: 11.01.2020]

Gray, S. and Nowland, J., 2017. The diversity of expertise on corporate boards in Australia. Accounting & Finance, 57(2), pp.429-463.

Gray, S., Harymawan, I. and Nowland, J., 2016. Political and government connections on corporate boards in Australia: Good for business?. Australian Journal of Management, 41(1), pp.3-26.

McLaren, J., Kendall, W. and Rook, L., 2019. Would the Singaporean approach to whistleblower protection laws work in Australia?. Australasian Accounting, Business and Finance Journal, 13(1), pp.90-108.

Salim, R., Arjomandi, A. and Seufert, J.H., 2016. Does corporate governance affect Australian banks’ performance?. Journal of International Financial Markets, Institutions and Money, 43, pp.113-125.

Tiwari, R. and Vidyarthi, H., 2018. Intellectual capital and corporate performance: a case of Indian banks. Journal of Accounting in Emerging Economies.

westpac.com.au (2016) Full Year 2016 Financial Results Available at: https://www.westpac.com.au/content/dam/public/wbc/documents/pdf/aw/ic/financial-information/FY16_ASX_Profit_Announcement.pdf [Accessed on: 11.01.2020]

westpac.com.au (2017),Annual Report 2017 Available at: https://www.westpac.com.au/content/dam/public/wbc/documents/pdf/aw/ic/2017_Westpac_Annual_Report_Web_ready_&_Bookmarked.pdf [Accessed on: 11.01.2020]

westpac.com.au (2018), Annual Report 2018 Available at: https://www.westpac.com.au/content/dam/public/wbc/documents/pdf/aw/ic/2018_Westpac_Annual_Report.pdf [Accessed on: 11.01.2020]