Corporate Governances and Social Responsibility

The aim of this paper is to critically discuss the function of governance with special focus on board’s professional values using an ethical framework. In regards to this, the role of board for managing risk and control the internal operations are analysed.

The reason behind is to select this subject matter because of scandal which occurred in USA FIFA 2015. Since, FIFA is always come into the bribery controversy from 2010 and it still goes onwards. Such practice directly affects the goodwill of FIFA association.

So these study could help to discuss the problems and implement right corporate governances by revamping FIFA governance’s structure. At the same time, ethical framework is used to discuss the function of governance by focus on board professional values (Bayle, 2015).

Besides that, the role of board in risk management is also figure out with the objective to analyse the FIFA 2015 case study. thus, this study provide detail understanding about the FIFA allegation 2015 and role of ineffective corporate governances in regards to poor implementation of functions and events (Bean, 2015). That’s why ethical framework proves to be useful for guiding towards developing right governances.

It is found that in Zurich, the Swiss plainclothes police arrested FIFA bigwigs, sports marketing executives and owner of broadcasting corporation in charge of racketeering, wire fraud and money laundering to corrupt issue of media and marketing rights for FIFA games in USA approx. $150 million.

Along this, $110 million bribes related to Copa America Centenario are also occurred (Bayle and Rayner, 2018). In addition to this study, the US District court in Brooklyn alleges that bribery is used with a purpose to influences the clothing sponsorship contracts and selection process for FIFA 2010 and 2011 (Mcfarland, 2015).

Besides that, sports equipments firm like Nike is also alleged for paying $40 million in bribes to become a sole provider of uniforms, footwear, accessories and equipments to the Brazil national team.

The increasing corruption in FIFA directly influences the two generation of soccer officials as alleged they have abused the position of trust to acquire million of dollars in bribes and kickbacks. Other than that, it is also identified that in 2010, the FIFA already awarded for 2022 world cup in Qatar and this led to vote buying and similarly, this happened in FIFA 2015

USA case where alleged fraud is found between North and South America. In this, most of the defendants are from CONCACAF and CONMEBOL and these are organisation that runs North and South American soccer respectively (Boudreaux et al., 2016).

In addition to this study, there is also found an involvement of internal allegation as four individuals are guilty in which two corporate defendants including former FIFA executives Charles Blazer and Jose Hawilla, the owner and founder of Brazilian sports marketing conglomerate.

In respect to such case, Joseph Sepp Blatter who is FIFA president since 1998 stated that FIFA has raised the football craze among the global popularity and this result in making financially successfully (Pielke, 2013).

Similarly, FIFA is meant to be humble sport which include humanitarian work to bring sport to the world but the increasing frauds and bribes process influences the image of FIFA which is not good for the football fans as there trust over the FIFA slowly get demolished. Thus, there is need to address such issue by identifying the root cause of such corruption.

Moreover, it is found that FIFA election system could be the main cause of increasing corruption. Likewise, the FIFA board is organised the event based on votes of different registered nations. So this enhances the action of fraud and biasness in regards to gain award to conduct the FIFA in particular country (Wintoki et al., 2012). It influences the governances of FIFA so there is high need to review the corporate government for supporting ethical actions.

Critically discuss function of governances with focus on board professional values using an ethical framework

The corporate governances are considered as rules, practice and processes within which firm is directed and controlled. It mainly indulge in making balance to protect the interest of corporate stakeholders like employees, customers and society, shareholders, suppliers, financier and government (Claessens and Yurtoglu, 2013).

However, corporate governances lie in what way business is functioned and board action defines ethic of business. Thus, the board behaviour and nature is accountable for corporate governances. Likewise, it all depends how board delegates authority to manage business throughout the organisation.

The authority deliveries allow the management to carry out the task as per the specified budgets and timings, purposes, vision and strategy. This helps to properly performances of work on a timely manner. Moreover, the extent of business decision of board clearly reflects the ethical values and principle of business to a long-term success.

Basically, the business ethics refers to the way board conduct itself and chooses the individual to behave in carrying out the given role. In regards to this, high skill and competencies are required of board with director properly exercising proper care in their duties and upholding high standards of integrity and acting fairly.

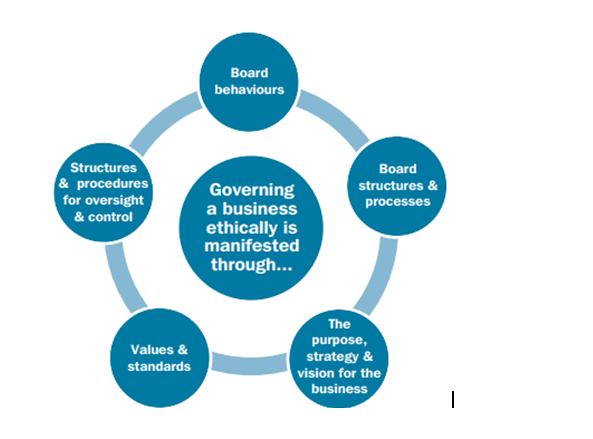

In respect to understand the governances by focus on the board professional value, ethical aspects of corporate governances is undertakes. In this ethical framework, there are different aspects are mentioned for the board to practice for maintaining the ethicality.

Ethical aspects of corporate governances

(Sources: Casson, 2013)

In this framework, each aspect has present different ethic values that board need to perform for maintaining the governances in their business. All the above mention elements need to be place in order for board commitment to ethics to be put fully in practice.

Board Behaviours: The board member behaviour is found to be ethical when it actions reflect ethical values in the form of integrity, respect, fairness and honesty etc. In regards to this, the boards need to have positive attitude towards each areas like customer service, employee satisfaction and support the equality among different stakeholders. These areas reflect the board ethical behaviour.

Board Structures & Processes: this aspect include board ethical behaviour by avoiding of unethical ones such as fraud practices, conflict between the parties etc, board with right governances structure also ensured the proper accountability, committees and decision-making procedures (Muchlinski, 2012). Thus, the transparency in organisation structure also contributes towards framing right governances.

The purposes, Strategy & vision for the business: the board defines the purpose of business in order to reflect what the strategy which they need to follow is. Thus, board vision needs to be clear and valuable then further business internal operations could be performed ethically (Khan et al., 2013). Thus, the business purpose and vision should be correct and free from false practice.

Values & Standards: The board clear their values and standard to business members and ensure the implementation of such standard of behaviours it expects for business practice. The way business will be done and its role in society also define the values and standards in ethical framework (Pande and Ansari, 2014). The business values and standards are defined through ethics programmes and CSR initiatives.

Structures & Procedures for Oversight & Control: Mechanism of delegation and control are helpful to ethical business practice.

In respect to the corporate governances and social responsibility, the boards of companies are expected to take the lead in cultural shift through conduct training and perform operations in an ethical manner. This way firm able to address the changes in current business environment.

Other than that, the application of right legislation, compliances over the business could also support the ethic and values. Likewise, WHS act, gender equality, fair pay compensation etc. are the laws that are current requirement for the business to perform transparent operations.

Thus, these areas prove to be useful for developing appropriate corporate governances. In context to FIFA, Jafar (2015) stated that the board is failing to address the ethics and corporate governances as in the FIFA 2015 controversy, there are various members are involved in the fraud, and money laundering. This is possible due to unethical behaviour of board.

For instance, if board of FIFA set the standard in proper manner and support the transparent operations and performances then such condition are not takes place. Thus, the board behaviour of FIFA is considered as an improper.

In support to this study, Ntim and Soobaroyen (2013) defined that FIFA board structure limitation is the major cause of major faults as FIFA select the nation based on election so the chances of fraud or bribery get more. Thus, this affects the FIFA ethical behaviour.

However, the football governing body established more than 110 years and after that also it serious mistakes it committed and due to this, there is no doubt that FIFA corporate government is transparent. The FIFA board is lost faith and trust of various football fans.

According to Erkens et al. (2012), there are four major failures that present the poor corporate governances of FIFA. First, the good corporate governances is affected when senior executives of organisation are personally implicated or involved in the corruption like take bribes from advertisement agency for covering the sports event.

Other than that, clothing line like Nike is also affected with the bad corporate governances in the form of provide bribe for becoming an exclusive partner of FIFA 2015.

Secondly, the limitation of transparency is another unethical practice as it restricts to defend itself against allegation of corruption and maintain the trustworthy between its key stakeholders.

Thirdly, the defendant’s use of American banking system in the United States plans their alleged activities. In this, the US department of justice it needed to make arrests in Switzerland (Filatotchev et al., 2013).

Fourth one failure in corporate governance’s at institution level as FIFA consist of far reaching stakeholders so the allegation put pressure on large sponsors like VISA, Adidas and Coca-Cola and McDonalds and Hyundai etc to take action in regards to such concern areas. in this, Interpol has developed an distanced itself from the troubled football body and it influences the FIFA 2011 and 2015 adversely.

Therefore, these areas clearly demonstrated that poor corporate governances of FIFA in respect to its action and principles. It is found that none of business able to make people follows the rule but they must put mechanism in place to make an investigate indication of corruptions and frauds.

Therefore, these areas do not support the ethicality and transparency in business. But in case of sports event like FIFA, the trust of people is the biggest governance’s practice which only achieved with the right act and value process in activities (Aebi et al., 2012).

Therefore, these controversies are the biggest limitation within which the problem of corporate governance is identified and analysed. That’s why scandal surrounding to football is considered as a prime example of poor corporate governances and requirement to bring ethical framework in its business activities for revamping the position and goodwill in global market.

Critically evaluate the role of board in risk management, internal control and mitigating risk

According to Teen (2016) board has an important role to play in managing risk by implementing internal control. This is done through perform various responsibilities. Likewise, the board controls a code of business conduct for members of BOD and business employees.

In this, it determines the behaviour of directors and employees and describes the conflict of interest and main situation that constitute conflict of interest. Besides that, describe the procedure to director regards to follow legislation in resolve possible conflict of interest.

This helps to mitigate the risk related to internal operations like employee conflict and disagreement of individual from the management. At the same time, Aebi et al. (2012) stated that role of board is also crucial in regards to approve the finances and investment policy for shareholder welfare.

So this decision is taken by the board in regards to invest appropriate and reduce risk of low cash inflows. In accordance’s to such role, FIFA board fails to implement responsibilities as Board has not taken any strict and immediate action in-spite of increasing cases like bribery, wire fraud etc. these problem is also occurred due to board played inappropriate role as they do not mention that what behaviour they need to follow and violation of rule must be punishable.

Thus, absences of such policy result in poor governances in FIFA. Furthermore, FIFA board also use false practice to generate the finances like take bribery from the firm to become an exclusive partner of events. Besides that, take money at the time of election in order to award the country for conducting the event at their place.

Thus, such unethical action proves to be ineffective for the FIFA reputation in term to devaluate the trust of individuals. It could result an adverse impact on FIFA business in future scenario. Thus, there is huge requirement for board to perform internal control for reducing the risk.

In addition to this study, Berger et al. (2014) defined that board also have a role to maintain the audit and financial risk committee for making internal control. The audit committee is responsible for the following duties.

Likewise, audit committee to monitor the reporting process of financial statements, supervise the financial reporting process, and examine the efficiency of firm internal control. Thus, such actions allow the board to take right decision and implement it successfully.

This role is also important for FIFA as its board audit committee fails to control the false practice at internal level as there are four individuals are found guilty which belong to FIFA associations including former FIFA executives Charles Blazer. Therefore, these areas clearly showed lack of internal control by Board side.

Hines et al. (2015) found that Board has not very direct role to manage risk but its actions support the management to control the internal risk. Likewise, they develop policy and procedures to mitigate the risk related to flow of cash and human resource turnover rate and limitation of trust and faith by the side of stakeholders.

Such risk is handled by the board by its policy. Likewise, board develop a WHS policy in order to protect the interest of stakeholders. The right audit committee is also important to bring transparency so Board need to develop audit team by including both external and internal human resources then the monitoring process can be done ethically. So this practice can also benefit to FIFA organisation to bring ethics and values in their operations. However, the right monitoring also support the board to play role with governances.

Thus, it is quite important for organisation or board to have transparent monitoring process for mitigate the current and future risk to a larger extent. In regards to this, Elzahar and Hussainey (2012) stated that for sports event, the trust and faith is quite important to earn as the success of association is largely depend on such areas.

Similarly, FIFA organisation should now focus on the internal control and try to revamp its goodwill so that people lost trust can be achieved and able to established as transparent football association.

For this, Boards need to take various actions by incorporating the role of supervisory and it is done through define the rules and laws and prohibition of any law would be liable to take strict actions. Moreover, there is also requiring to holding major authorities by the board in regards to bring proper flow of legislation in all hierarchy. Thus, this area could assist in regards to mitigate the risk and assist the FIFA to achieve the proper governances in each function.

In favour to the study of ethics, Calomiris and Carlson (2016) mentioned that cognitivism and non-cognitivism theories. As per this theory, cognitivism entails that there is two aspect of truth that statement can be true or false.

While, non-cognitivism argues that it is not possible to assess objective of moral belief as it also define that ethical sentences can be either true or false but they do not express the feeling of people. In relation to FIFA case, the allegation have made that the senior officials bribed ISL so this statement can be true or false. However, these are not feeling of people but proposition.

However, FIFA is also get an allegation for involving in claim of bribery from commercial deals with Latin America and US tournaments. In regards to this, the truth is revealed through based on evidences which present that firm like Nike give bribes to FIFA official for becoming an exclusive partner.

Such area presents the truth with justification. So this is proved to be true because of availability of evidences by showing payment of €106m to South America marketing executives (Jizi et al. 2014). However, the decision to hold world cup is also considered as a influenced of bribes. Thus, such unethical area can only be sorted by the positive and effective role of board members and their decisions.

This can be done through develop right level of communication between different functions in the form of conduct meeting and identify the root cause and accordingly take decision to deal with such problem and risk. Hence, such actions could allow FIFA to mitigate the risk which is occurring due to poor governances.

From the above analysis, it is concluded that ethical corporate governances should be adapted in every organisation be it profit making or non-profit making. But it is important to creating good business goodwill as this influence in maintaining trust with management.

But absences of corporate governances in FIFA organisation result in major scandals so it is recommended to FIFA board to maintain ethical guidelines for ensuring the transparency and accountability in their governances. However, it is worth noting that board has major role to bring ethics and governances in the functions and right value process always support towards mitigating the risk to a larger extent.

Aebi, V., Sabato, G. and Schmid, M., 2012. Risk management, corporate governance, and bank performance in the financial crisis. Journal of Banking & Finance, 36(12), pp.3213-3226.

Bayle, E. and Rayner, H., 2018. Sociology of a scandal: the emergence of ‘FIFAgate’. Soccer & Society, 19(4), pp.593-611.

Bayle, E., 2015. “FIFA-gate”: an opportunity to clean up international sports governance. Soccer & Society, pp.1-2.

Bean, B.W., 2015. An Interim Essay on FIFA’s World Cup of Corruption: The Desperate Need for International Corporate Governance Standards at FIFA. ILSA J. Int’l & Comp. L., 22, p.367.

Berger, A.N., Kick, T. and Schaeck, K., 2014. Executive board composition and bank risk taking. Journal of Corporate Finance, 28, pp.48-65.

Boudreaux, C.J., Karahan, G. and Coats, M., 2016. Bend it like FIFA: corruption on and off the pitch. Managerial Finance, 42(9), pp.866-878.

Calomiris, C.W. and Carlson, M., 2016. Corporate governance and risk management at unprotected banks: National banks in the 1890s. Journal of Financial Economics, 119(3), pp.512-532.

Casson. J., 2013. A review of the ethical aspects of corporate Governances regulation and guidance in the EU. [Online] Available at: https://www.ibe.org.uk/userassets/publicationdownloads/ibe_report_a_review_of_the_ethical_aspects_of_corporate_governance_regulation_and_guidance_in_the_eu.pdf (Accessed on: 15-02-2019)

Claessens, S. and Yurtoglu, B.B., 2013. Corporate governance in emerging markets: A survey. Emerging markets review, 15, pp.1-33.

Elzahar, H. and Hussainey, K., 2012. Determinants of narrative risk disclosures in UK interim reports. The Journal of Risk Finance, 13(2), pp.133-147.

Erkens, D.H., Hung, M. and Matos, P., 2012. Corporate governance in the 2007–2008 financial crisis: Evidence from financial institutions worldwide. Journal of Corporate Finance, 18(2), pp.389-411.

Filatotchev, I., Jackson, G. and Nakajima, C., 2013. Corporate governance and national institutions: A review and emerging research agenda. Asia Pacific Journal of Management, 30(4), pp.965-986.

Hines, C.S., Masli, A., Mauldin, E.G. and Peters, G.F., 2015. Board risk committees and audit pricing. Auditing: A Journal of Practice & Theory, 34(4), pp.59-84.

Jafar. B., 2015. Fifa arrests provide object lesson for corporate governance. [Online] Available at: https://www.thenational.ae/business/fifa-arrests-provide-object-lesson-for-corporate-governance-1.38847 (Accessed on: 15-02-2019)

Jizi, M.I., Salama, A., Dixon, R. and Stratling, R., 2014. Corporate governance and corporate social responsibility disclosure: Evidence from the US banking sector. Journal of Business Ethics, 125(4), pp.601-615.

Khan, A., Muttakin, M.B. and Siddiqui, J., 2013. Corporate governance and corporate social responsibility disclosures: Evidence from an emerging economy. Journal of business ethics, 114(2), pp.207-223.

Mcfarland. K., 2015. EVERYTHING YOU NEED TO KNOW ABOUT FIFA’S CORRUPTION SCANDAL. [Online] Available at: https://www.wired.com/2015/05/fifa-scandal-explained/ (Accessed on: 15-02-2019)

Muchlinski, P., 2012. Implementing the new UN corporate human rights framework: Implications for corporate law, governance, and regulation. Business Ethics Quarterly, 22(1), pp.145-177.

Ntim, C.G. and Soobaroyen, T., 2013. Corporate governance and performance in socially responsible corporations: New empirical insights from a Neo‐Institutional framework. Corporate Governance: An International Review, 21(5), pp.468-494.

Pande, S. and Ansari, V.A., 2014. A theoretical framework for corporate governance. Indian Journal of Corporate Governance, 7(1), pp.56-72.

Pielke Jr, R., 2013. How can FIFA be held accountable?. Sport management review, 16(3), pp.255-267.

Teen, M.Y. ed., 2016. Corporate governance case studies, volume 5. CPA Australia Ltd: VIVA LA FIFA, pp. 163-173. [Online ]Available at: http://governanceforstakeholders.com/wp-content/uploads/2013/03/cg-vol-5.pdf (Accessed on: 16-02-2019)

Wintoki, M.B., Linck, J.S. and Netter, J.M., 2012. Endogeneity and the dynamics of internal corporate governance. Journal of Financial Economics, 105(3), pp.581-606.