CRN 17420 202010 Assignment Sample – Risk Management 2022

Introduction

Operational Management refers to the business practice performed by organisations for increasing performance generating higher rate of profitability. The primary aim of this report is to provide a risk management report for the chosen UK based company Carlsberg. The first section of this report comprises an overview of the company stating its functions and operations related to operational management.

It is followed by the identification of key risk factors arising due to COVID19 and Brexit. Internal and external risk factors involving financial and business-related risks are being addressed under the first section. The second section of this report identifies the impact of risks associated with Carlsberg, UK. It is presented in the form of risk management framework, impact in work culture and consumer behaviour interlinked with Carlsberg, UK.

This report is further presented under the third section which provides a proposal and risk management strategies for Carlsberg, UK. Risk management strategies are provided through Board responsibilities, risk avoidance and overview of current risk practice.

It is further supported by recommendations for the future in performing effective operational and risk management. Recommendations are divided into predicting and anticipating risk along with future development in risk management.

Company Background

Carlsberg Group in UK is a brewing company involved in manufacturing of wines, beers and varieties of liquor items. Carlsberg Group had collaborated with Marston PLC to expand their operations in the liquor market across the brewery industries of UK (CARLSBERG, 2021).

This company owns a brewery and distribution network across major regions of UK such as Northampton, Oxfordshire, Bedford, Wolverhampton and other eleven centres. Carlsberg Group possesses an annual turnover of £50 million and has an employee range of nearly 250 to 300 (CARLSBERG, 2021). This company continues to operate with internal control and risk management as an effective business management strategy to address global crises.

In the current COVID 19 and Brexit situation in UK, Carlsberg had decided to set up an executive committee with responsibility for risk and operational management. The Audit Committee of Carlsberg, UK prepares the internal controls associated with risk management (CARLSBERG, 2021).

This company segregates its risk management procedures through three main divisions such as “overall control environment”, “risk assessment” and “control activities”. Carlsberg continues to promote their sustainability approach in coping up with the economic crisis arising due to pandemic and Brexit (CARLSBERG, 2021). This strategy had helped the company to understand the internal and external risks associated with the brewery industry which was affected due to COVID19 pandemic and Brexit.

Identification of key risk factors of due to Covid 19 and Brexit

Internal Risks associated with COVID19 and Brexit

COVID 19 and Brexit were considered as the two major challenges for UK based companies that were affected due to the changes in the economic structure. As per the views of Mitchell et al. (2020) independent UK based breweries have dipped from 1823 to 1816 during the pandemic in 2020. This data implies that during the lockdown situations arising into the pandemic, retail outlets of breweries were forced to shut down due to low customer turnover.

The new trade deal involving Brexit had negatively affected the wine and beer suppliers across UK due to change in trade regulations (THE GUARDIAN, 2020). Brexit had impacted the transport costs of export and import of liquor items across UK which had created a negative impact on independent breweries. For instance, liquor company Carlsberg Group has faced a fall in the profit margin in an approximate rate of 10% to 15% during 2020 due to the lockdown regulations in pandemic (THE GUARDIAN, 2020).

Sales of this company have remained suspended from April of 2020 during the lockdown which had resulted in the closure of some franchise outlets across UK. COVID 19 had negatively impacted the internal financial structure of Carlsberg Group resulting in a decrease in sales rate.

Occurrence of Brexit in UK had created internal problems in reinforcing laws of communication and increasing modes of paperwork. As observed by Rawson et al. (2020) the Brexit deal in 2020 had proven to be a short-lived factor for the brewing industry in UK. New trade rules incorporated under the Brexit deals have increased shipments rates and created disruption in supply chain and deliveries.

In this context brewery company Carlsberg Group had faced cancellation of orders from customers due to delay in deliveries and increase in shipment costs This had affected the internal functions of this company where officials were unable to meet their required sales demand during 2020 resulting in occurrence of loss.

As asserted by Strong (2020) Brexit deal had increased the amount of taxes associated with the wine and brewery industry of UK increase in taxes had decreased the volumes of liquor purchase. Customers purchasing liquor items on a frequent basis were unwilling to pay a sudden increase in tax rates thereby resulting in a drop in profitability of brewery companies.

Carlsberg Group had seen a sales slump of about 82% leading to closure of some retail stores during 2020 (THE GUARDIAN, 2020). This company has been suffering from a disruption caused in the supply chains and manufacturing units which had resulted in damaging their global domain in the international brewery industry. Breweries across UK were unable to access “business grants” and holidays during COVID19 pandemic which had obstructed them from receiving Government support.

Carlsberg Group had decided to sustain the ongoing economic crisis by application of “operational management” to address its internal risks.

External Risks associated with COVID19 and Brexit

External risks such as supply chain disruption associated with COVID 19 and Brexit had decreased the profitability of UK based brewery companies. According to Hope (2019) governments across the world had imposed lockdown restrictions and sanitation protocols in response to the COVID19 pandemic.

This had impacted the transport and logistics industries across the world where international supply chains were disrupted. For instance, UK based Brewery Company Carlsberg Group had faced mass cancellations of customer orders due to delay in deliveries (BBC, 2020).

This company had faced disruption in its supply and manufacturing chains across the UK as lockdown restrictions from April 2020 had obstructed it from performing activities. As per the views of Leruth (2021) external impact of Brexit can be highlighted by the description in import and export of trade items in and across UK. Brexit had exerted pressure on the activities of UK breweries by imposing additional costs on the import of liquor items from other parts of EU.

The revision of trade policies under the Brexit deal had impacted the transport facilities of brewery company Carlsberg Groups (BBC, 2020). Carlsberg Groups had earlier assured deliveries of items across EU through DHL and DPD in transporting wholesale orders across Europe.

Occurrence of Brexit had hampered the shipping and transporting functions due to incorporation of new international trade laws. In context to this issue, Carlsberg Group has organised a “sustainability approach” under their “operational management” team (CARLSBERG, 2021). Under the sustainability approach this company had started to introduce sustainable products and promote positive drinking to increase the local consumer demand within regions of UK.

Coronavirus pandemic has introduced new restrictions in the manufacturing process of brewery industries across UK. Stephens et al. (2020) explained that manufacturing units of brewery companies had faced disruption due to closure of factories in lockdown and disruption in supply chains.

Breweries across UK had started to offer their consumers with liquor items at lower rates along with complimentary services to sustain in the recession market. Shift in demand for liquor items towards “off-premises” and “certain packaging types” had decreased the profit margin of brewery companies functioning across UK. For example, Carlsberg Group had been forced to sell its expensive beer items at 7% less profit margin in the second quarter of 2020 to sustain in the pandemic situation (ESMMAGAZINE, 2020).

This company had transformed a part of its beer manufacturing department into production of alcohol-based sanitizers as a risk management procedure developed under “operational management”. Carlsberg, UK had donated equipment and alcohol-free beverages to health workers during the pandemic (CARLSBERG, 2021). This operational management strategy had helped this company to increase their brand awareness during the pandemic crisis with an ethical approach.

Effective operational management had assisted Carlsberg to identify the external risks associated with supply chain disruption during Brexit and change in consumer demand during COVID 19.

Financial risks

Financial sector of UK has suffered from profound structural effects due to the occurrence of COVID 19 pandemic and Brexit. As per the views of Kumar et al. (2021) manufacturing industries across UK had suffered a setback due to lockdown restrictions during COVID 19 and incorporation of Brexit deal had worsened the situation. Economic impacts arising due to COVID19 and Brexit had also increased regional disparities among different manufacturing sectors in UK.

In January 2021 the economy of UK contracted to a rate of 2.9% after the incorporation of Brexit in December 2020 (STATISTA, 2021). Brexit had resulted in the fall of imported goods within UK at a rate of 5.6 million British pounds and exported goods at a rate of 6.6 million British pounds during 2020. This data indicates that Brexit trade deals had threatened the export and import structure of the UK economy where high tax rates and increase in paperwork have been major factors behind the financial crisis.

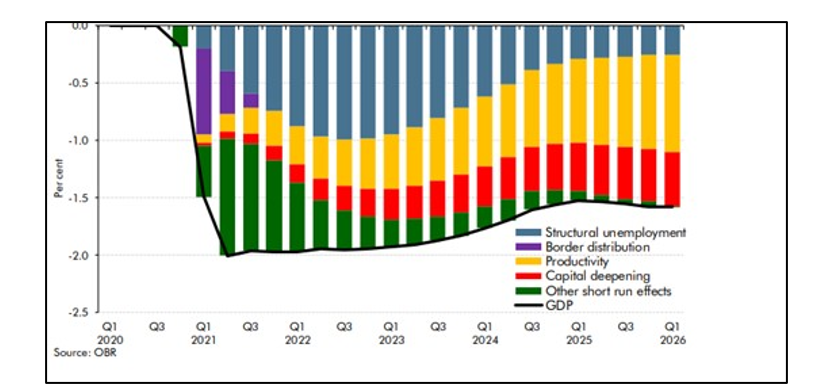

Figure 2: OBR Economic and Fiscal Outlook

(Source: Inspired by Haroon et al. 2021)

The manufacturing sector across UK has been exposed to tariff and non-tariff trade barriers after the emergence of Brexit in December 2020. As per the views of Haroon et al. (2021) OBR relative intensity have stated that change in tariff rates would result in the drop in of exchange rate which would likely to increase the inflation rate by 1.5 %.

This statistical data indicates that new trade losses incorporated in UK during Brexit would gradually decrease the profit margin of manufacturing industries thereby decreasing the export rate of the country. In context to this issue, Carlsberg Group in UK has suffered from an annual decline of 8, 4% in their revenue during the first and second quarters of 2020 (STATISTA, 2021).

This brewery company had faced challenges in reaching their annual sales target during the pandemic situation in 2020 which had decreased their profitability.

Brexit trade deals had increased the import and export rates of alcohol and beverages by reducing the demand of international consumers due to increase of shipping costs. As per views of Dao et al. (2019), consumers across UK had to deal with 13% CPI in basket goods which are directly imported from EU and 7% on indirectly imported goods.

Increases in the cost of goods have obstructed alcohol and beverages services falling under non-essential items suffer a gradual decrease. For instance, annual operating profit of Carlsberg Group has shown a decline of 3.1% in 2020 (YAHOOFINANCE, 2021). This company had to cut travelling and marketing costs under their “operational management” programme to sustain their losses incurred during the pandemic situation.

Risks related to business expansion

| Identified Risk | Impact | Likelihood | Mitigation Strategy |

| Disruption in Supply Chains | High | High | Carlsberg UK had decided to collaborate with e-commerce companies JD.com to expand their online beverage portal. |

| Financial Risks | High | High | Carlsberg Group had lowered their marketing and packaging costs to sustain the losses incurred during 2020. |

| Trade Barriers | Medium | Medium | This company had started to snake virtual promotion of their brand in Malaysia to capture the Asian liquor market. |

| Manufacturing Risks | Medium | Medium | In response to this risk, Carlsberg UK had opted for “sustainable approach” to manufacture liquor in an environment friendly manner. |

Table 1: Risk Matrix Table for Carlsberg Groups, UK

(Source: Created by Author)

Analysis

Risks identified from the risk matrix table proposed for Carlsberg Groups, UK can be segregated under risk related to finance, supply chains, trading and manufacturing. According to Menoni (2020) COVID 19 and Brexit had caused a decline in the operating profit of manufacturing industries across UK. Carlsberg Group has suffered from a decline of 11.6% in their organic revenue during 2020.

In response to the financial crisis, this company had decided to cut down their marketing and promotional costs to sustain in the recession market. This risk management strategy had helped this organisation to focus on improving their sales targets in the last quarters of the 2020 financial year. Livingstone et al. (2020) noted that brewery companies across the UK have faced financial risks due to low consumer turnout in their retail outlets.

In context to this risk, Carlsberg Group in UK had collaborated with e-commerce company JD.com for further developing their online portal for expanding in the e-commerce market.

Trade barriers were identified as another major risk arising due to Brexit in UK. As per the views of Madhavi (2018) new trade laws and increase in trade tariffs have hindered the trading activities of UK based companies. Carlsberg Group has opted to promote their brand in the Malaysian liquor market for expanding the business in the Asian countries instead of focusing on the European regions.

Supply chains across the world have faced disruption due to lockdown restrictions occurring during COVID 19 situation. Carlsberg Groups had opted for the “Fund the Journey” strategy to attract potential investors from the Asian regions especially Malaysia for expanding their liquor market in the eastern region.

In addressing the manufacturing risk associated with COVID 19 and Brexit, Carlsberg Groups have opted for a “sustainability approach” in their manufacturing process. This internal operational management strategy had assisted this company to target the health-conscious consumers in the liquor market and lower their manufacturing costs through cost effective strategies.

Impact of the risks on Carlsberg, UK

Internal Risk Framework

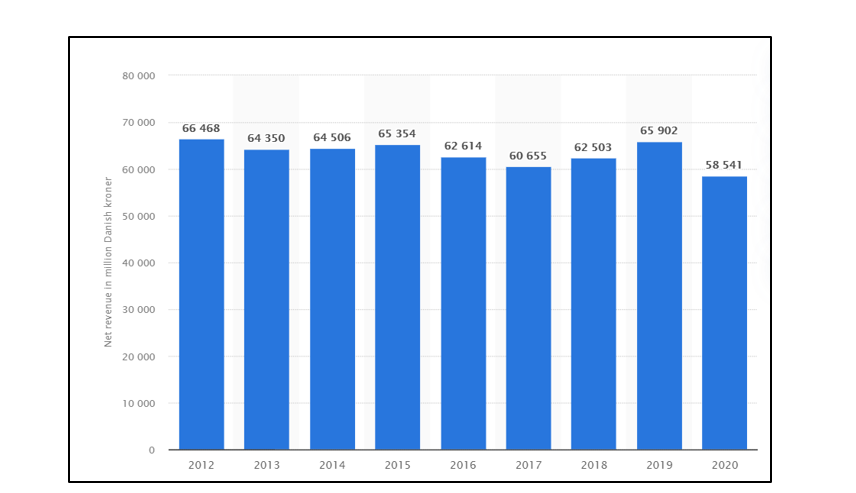

Figure 3: Net Revenue of Carlsberg Groups (2012-2020)

(Source: STATISTA, 2021)

Carlsberg Group in UK had suffered from a financial crisis during the COVID 19 pandemic situation in 2020. As per the statistical report presented by Statista, it can be identified that in a period of twelve years from 2012 to 200 the annual revenue of Carlsberg has decreased by 7927 million.

This data signifies that due to the emergence of COVID 19 pandemic in 2020 there has been a rapid downfall in the liquor demand thereby resulting in a rapid decrease of annual revenue for the company. As per the views of Shen (2021), COVID 19 had resulted in the rapid change in consumer behaviour under the liquor market in UK.

This market phenomenon had impacted the sales of brewery companies based in UK where trade activities were reduced during 2020. For instance, Carlsberg Group suffered a decrease in their organic annual revenue by 8.4% in the first quarter of 2020 and volumes had shed by 3.8% (STATISTA, 2021). Decrease in the annual organic revenue during 2020 had affected the internal management of this company.

Carlsberg has forced to shut down their retail franchise in the regional sectors of UK to sustain the economic crisis.

Internal risks such as barriers in communications and increase in modes of paperwork during Brexit had negatively impacted the sales of Carlsberg Groups. The “on trade” activities of the brewery company including sales through import and export have dropped by 20% in 2020 (YAHOOFINANCE, 2021).

Brexit had obstructed the import of liquor items from countries in the EU due to increase in costs of trade tariffs and taxes on liquor items. Freund et al. (2017) noted that increase in the taxes upon liquor goods have impacted the consumer market where frequent purchasers have denied paying high liquor rates.

Companies like Carlsberg Group in UK have suffered from the change in consumer demand after the imposition of additional taxes on liquor items (THEGUARDIAN, 2021). The spectre of inflation occurring in UK during Brexit has put pressure on brewer companies like Carlsberg who have been struggling to increase their profit margin despite the decrease in purchasing rate.

External Risk Framework

Supply Chain disruptions falling under the external risks arising during COVID 19 and Brexit had negatively impacted the operations of Carlsberg Group. As observed by Fairlie (2021) more than half of manufacturing companies based in UK have suffered contraction in their supply chain during 2020 due to the COVID 19 pandemic.

In context to this issue, Carlsberg Groups have faced a decline of 85% in logistics and transport during 2020 (ESMMAGAZINE, 2020). The brewery company had previously operated with suppliers in China and Western Europe which was disrupted during lockdowns imposed in China and UK. Freund et al. (2017) explained that lockdown restrictions across the world have decreased the international trading rates between the western and eastern regions of the world.

Imposition of travel restrictions across borders has hindered the logistics and transport of international companies. For instance, UK based brewing companies like Carlsberg have suffered a decline of 10% to 15% in its organic revenue in the supply chains managed in the liquor market of China and Western Europe (ESMMAGAZINE, 2020).

Carlsberg Group has opted for operational management programmes in collaborating with e-commerce companies like JD.com to expand their online platforms in eastern liquor markets of Malaysia.

Manufacturing problems under external risk factors occurring due to Brexit have impacted the manufacturing units of beer industries in UK. As per the views of Yueh (2017) beer industry in UK had been predominantly dependent on the domestic raw materials imported from across regions of Europe. Brexit trade deals incorporated in December 2020 have imposed trade barriers between UK based companies and EU.

For instance, UK based company Carlsberg Groups have earlier imported their raw materials from regional sectors of France and Italy with minimum efforts in transport and logistics (CARLSBERG, 2020). Revised trade laws imposed during Brexit have increased the cost of raw materials, packaging and transport costs resulting in shifts from international partners towards domestic manufacturing.

In response to this situation, Carlsberg has adopted a sustainable manufacturing policy under their operational management segment (CARLSBERG, 2020). This strategy had helped this company to organise for a cost-effective manufacturing process to meet the challenges of increasing cost of international raw materials.

Changes in the work culture

The emergence of the Covid 19 in the business arena has not only caused massive financial distress for the companies but also incurred long-lasting transformations in the organizational framework.

As per the view of Hartmann and Lussier, (2020), the organizational framework of the leading companies have altered completely and put immense pressure on both the administration and the employees. The adoption of the digital mode is not something new in the business lexicon and Covid 19 has played the role of catalyst in this paradigm shift.

The data has revealed that Carlsberg, UK has formed a partnership with JD.com, an e-commerce giant in the aftermath of Covid 19 (STANDARD, 2020). It is to be mentioned that the digital business model of Carlsberg has impacted the traditional organizational framework and shaped it in a new way.

Wang et al. (2021) pointed out that remote working has altered the work culture and mostly it is lacking a harmonious and collaborative ambience. Being a part of the brewery sector, it was quite difficult for the operational management of Carlsberg to maintain collaboration and to enable the employees to coordinate with each other during remote working (INVESTORSCHRONICLE, 2021).

On the other hand, the lockdown brought new challenges for the continuation of the business operation in the brewery sector as it was difficult to manufacture the beer and wine from outside of the factories. Many leading businesses of UK, like Heineken and Carlsberg, had reported immense difficulty in the supply chains to maintain the social distancing and to continue the business operation.

Resultantly, the storming success of Carlsberg in UK, as well as the global domain, was damaged immensely and the company is still striving to fill this gap.

Changes in the consumer behaviour

In 2020, the global brewery sector witnessed the changing dynamics due to the Covid 19 lockdown and governmental restrictions on the business. According to Michieet al. (2020), Covid 19 has weighed heavily on the behavioural pattern of consumers and the drinking habits of the individuals have encountered a huge jolt. The definitions of convenience and comfort have completely altered under the impact of the governmental regulations, associated with Covid 19.

In countries like the UK, US and Australia, drinking has a close association with socializing. The sudden declaration of the nationwide lockdown forced the Pubs and hospitality organizations to shut their door overnight. This factor disrupted the social life of the individuals and their habit of alcohol consumption.

Schmits and Glowacz, (2021) asserted many people gave up their drinking habits during the lockdown and the rest of the people preferred to get their favourite drink on their doorstep. Though the operational management of Carlsberg managed to connect some of their target customers, the giving up of the drinking habits has significantly minimised the rate of profitability.

Many surveys are conducted in the aftermath of the Covid 19 lockdown to assess the impact of Covid on the brewery sector (Pitts and Witrick, 2021). The surveys have revealed that frequency, quantity and the place of drinking of the individuals have changed. It is to be found that it is conducive for the financial distress of the leading breweries like Carlsberg and Heineken, while small breweries found to have encountered bankruptcy.

Remote working has effectively reduced the leisure time of the people and they are getting less time to binge on drinking. As per data of 2020, during the lockdown, the tax on alcohol in the UK was 2.8%, but the salary cut and lay off of the employees had significantly reduced the consumers of the brewery companies (BBC, 2020).

Hence, there are several reasons behind the behavioural change of the consumers and the brewery companies, like Carlsberg, need to come up with a resilient strategy to mitigate the challenges.

Proposal for the mitigation strategies for Carlsberg, UK

Board responsibilities on risk

Being a UK based organization; Carlsberg has become prey to the dual threats, Brexit and Covid 19. The operational management of Carlsberg has strived to tackle these threat factors at the same time. The in-depth analysis of Carlsberg has depicted that this company has an inclination from the beginning to deal with the challenges with a resilient approach and deft strategies (CARLSBERG GROUP, 2020).

Therefore, in the aftermath of Covid 19, the operational management of Carlsberg would have to empower the employees for a smooth business operation and gradual increase of the profitability rate. In the annual report of 2020, the operational management of Carlsberg made it clear that the efficiency and effectiveness of the strategies would be their weapon to make recovery from the uncharted waters of pandemic (CARLSBERG GROUP, 2020).

Besides alcoholic beverages, non-alcoholic drinks would be introduced and prioritized by the operational authority to manage the risk of low demand in the brewery sector.

The Brexit impact is still persistent in all the sectors of UK and the brewery sector is no exception. Opatrny, (2021) observed that Brexit has inflicted financial agony on the leading as well as the small businesses and made them susceptible to long term financial loss.

The increased taxes on wine and beer products have intensified the financial risk for Carlsberg. Opatrny, (2021) further added that while the organizations of UK are attempting to recover from the Brexit hangover, Covid 19 pandemic has posed unavoidable threats on both financial and non-financial terms.

Therefore, the operational management of Carlsberg is responsible for making consolidated risk management strategies to ensure the further progress and excellence of Carlsberg in the long run.

Risk Control Strategies

Covid 19 pandemic and Brexit have made the organizations of UK realise the importance of risk management in the post-Covid and post Brexit era. McCabe, (2020) stated that both the Covid 19 and Brexit have brought about uncertainty for the commercial sector and UK is the hapless victim of these threat factors. Amidst such risk, the operational management of Carlsberg has come forward with skilful strategies to address the pertinent risks (INSIDERMEDIA, (2020).

The online delivery of premium beer to the doorstep of consumers is found to be effective in averting the risk of virus contamination. On the other hand, the digital delivery model aids to maintain utmost compliance with the social distancing regulations.

In terms of recovering from the financial decline, Carlsberg has switched the social media marketing strategies and the online trade channels to focus on the convenience of the consumers. It is advised that launching the new variants of beer through the virtual platforms would enable Carlsberg to achieve a competitive edge over the other breweries of UK.

As per the view of Zéman and Lentner (2018), the cost-efficient strategy is found to be one of the effective strategies to deal with the financial decline and low demand. Therefore, maintaining affordable pricing in the existing products and combo offers would assist Carlsberg to make a quick recovery and to restore its storming successful position in the global brewery market.

The latest data has revealed the fact that the leading breweries of UK are offering the best deal in the best pricing to make a superior consumer experience (BBC, 2020). Simultaneously, it intends to provide the consumers with an opportunity for online clubbing.

The virtual promotion of the new beer variants of Carlsberg in Malaysia is found to have garnered huge positive responses from global consumers. In the annual report of 2020, the operational management of Carlsberg made an announcement that the organization would come up with the cost optimization strategies and would embark on a new journey, named ‘Fund the Journey’ (CARLSBERG GROUP, 2020).

The ‘Fund the Journey’ strategy is a reaction against the Covid 19 and Brexit induced risk factors. This particular strategy would also be applied in both the on and offline trade with the aim of recovering from the profit margin loss. Apart from that, UK governmental aid and support are highly required for increasing the efficiency of risk management strategies.

The governmental approval for the renewal of the liquor license and a new license for the retail liquor shops in UK domain would help Carlsberg in their hassle-free business operation. On the other hand, the digital business model would eliminate the trade barriers in the business expansion of Carlsberg in the other EU countries.

Risk Management in practice

Role and importance of risk management

The business arena abounds with numerous unforeseen risk factors and it impels the existing businesses to mitigate the risks and to attain agility in this process. Hopkin, (2018) suggested that risk management is mandatory for the organizations as without it the firms would lose their vitality and productive spirit in the competitive juncture.

The purpose of incorporating risk management in the business operation of the firms is not merely to remove the risk factors, but to reduce the adverse impact of the risks. Hopkin (2018) opined that in order to mitigate the risk factors, organizations need to identify and prioritize the underlying risks. Risks are found to be the preliminary source of uncertainty within the organization.

Lesser and Berghult, (2018) revealed that risk factors might stem from both the internal and external factors and ultimately lead the firms in the wrong direction. Thus, the risk management strategies are required to enhance the operational efficiency of Carlsberg, UK and to mend their ways in future.

The risk factors are found to be allied with the financial standing of a company. The wake of the Covid 19 pandemic and Brexit ultimately ravaged Carlsberg’s financial performance.

The strategic risk management in Carlsberg includes five steps, “risk avoidance”, “acceptance”, “mitigation”, “reduction” and ” transferral”. These five strategies of risk management would be discussed in the latter part of the report to suggest the recommendations accordingly.

Risk avoidance

In the business domain, it is completely impossible for organizations to uproot the risk factors. The risk avoidance strategies are there to deviate from the pertinent risk factors. Hu et al. (2017) explained that risk avoidance strategy is an escape route for the firms for a specific period of time. The risk avoidance step of risk management aims to circumnavigate the negotiation for the sustenance of the organization in the competitive market.

In the context of Brexit and Covid-19, it is to be stated that the digital business model would act as a risk avoidance strategy for Carlsberg. Hu et al. (2017) pointed out that risk avoidance is applicable for those risks which have not yet emerged, likely appearing from the various sources.

The proper maintenance of the social distancing in the manufacturing and warehouse activities of Carlsberg would assist it to avoid the risks of contamination. Besides that, the use of innovative technical support would make the process of packaging easier and convenient.

Risk acceptance

Risk acceptance refers to a state of inaction, only accepting the risks and their probable consequences of the business operation of the firms. As stated by Hilorme et al. (2019), risk acceptance is a vital part of risk mitigation that is deemed to be a conscious step of risk management.

It is quite difficult for organizations to combat every time with legal constraints and financial crisis and risk acceptance, in this case, enables them to accept the risks. Diamantidis et al. (2018) considered risk acceptance strategy as self-insurance and prioritized it for developing awareness about the risk factors.

The economic recession induced by Brexit and Covid 19 was unpredictable and unavoidable for the organizations and it left no room to accept the ensuing financial and business-related constraints. The effective cost management and the optimal performance of the digital business model would prove advantageous for Carlsberg.

Risk mitigation

Risk mitigation is marked as the most effective part of risk management in business organizations. Karneyeva and Wüstenhagen, (2017) elucidated that risk mitigation provides insight about the possible resolutions and at the same time aims to make further improvements for the prevention of future risks.

In the context of Carlsberg and its current challenges, it can be stated that the operational management needs to adopt in detail market research. The analysis of the changing market environment after Covid 19 and Brexit and forecasting of the consumer demand is recommended for the operational management of Carlsberg. The changing behaviour would be beneficial in deriving long term value and in eliminating the risks of low demand and low sales.

Risk reduction

Risk reduction is a progressive response towards adverse consequences. Cheung et al. (2018) mentioned that instead of testing the risk tolerance of an organization, the authority should adopt the risk reduction strategy as it helps to minimize the severity of the adverse consequences.

The inclusion of the cultural changes by the operational management of Carlsberg would reduce the risk of cultural discriminations due to remote working. Besides that, the productivity of the workers would be increased in this process. The adoption of incentive schemes and employee benefit programmes would reduce the future risk of employee shortage.

The process and production would enable the operational management of Carlsberg to leverage its strengths as well as to secure the consumer base. The low demand risks however would be reduced to some extent. The adoption of AI technology in warehouse operations and in the manufacturing process would enhance efficiency as well as would reduce the risks borne out of human touch.

Risk Transferral

“Risk Transferral” strategy is an important part of risk mitigation that indulges an organization to transfer the risk factors to the other party. As per the view of Ashu and Van Niekerk, (2019), risk transferral strategy is used prevalently in the domain of financial investment, where the risk factors transferred from the policyholder to the insurance company.

This particular strategy is found to be useful in shielding the business organizations from the severity of the risk factors and their long term consequences. Adoption of this strategy would permit Carlsberg to transfer all their risk factors to the other parties and to save their reputational grandeur in the global domain.

Making several financial insurances would be beneficial for Carlsberg as they would be able to avoid bankruptcy in this process. On the other hand, the financial debt would be easily cleared off with the employment of this strategy. The risk transferral strategy would be a defensive move for Carlsberg in the domain of UK.

Recommendations

The detailing of the current challenges of Carlsberg has enunciated various perspectives to make improvement in the domain of the global brewery sector. The prolonged lockdown and the altering drinking patterns of the consumers have incurred major damages on the profitability rate of the brewery organizations, especially which are only dependent on the offline trade model.

The unprecedented slowdown of the financial performance is a huge jolt to the operational management of Carlsberg as over the years they remained in the forefront of the global brewery domain.

Recommendations for the development of the global brewery industry

Carlsberg, UK is an inextricable part of the global brewery industry. Consequently, the financial recession in the global domain has left an indelible imprint on the business of Carlsberg. The adoption of the digital business models by all the breweries would bring out a positive outcome for the global economy. It is recommended that collaboration with the food delivery apps would help the global brewery sector to earn massive financial benefit.

This particular strategy would facilitate market expansion and targeting the consumers would be easy for breweries like Carlsberg. Sustainability is a topmost priority to the consumers in the Post Covid and Brexit tine. Therefore, sustainable practices in the manufacturing process and warehouse activities of the breweries are mandatory for securing the dominant position in the market.

The societal commitment would add a new dimension to the business of the brewery organizations. In this context, it is worth mentioning that besides profit-making, the global brewery sector would have to create value for the employees and stakeholders as a part of future risk management.

Future Development in risk management

The financial decline and operational inefficiency of Carlsberg in the post-Brexit and Covid era have enunciated the importance of the incorporation of resilient risk management practices within the organization. Risk management is of paramount importance for Carlsberg to prevent the emergence of future risks.

It is recommended that besides the virtual promotion, the online presence of the organization needs to be increased. The relentless focus on the relationship with the stakeholders and early intervention on the risk factors would help to detect the real extent of the risk factors.

The inclusion of employee benefits programmes and incentive schemes shall enhance employee engagement and organizational commitment. It would reduce the risk of employee dissatisfaction and labour strikes. Therefore, it can be stated that adoption risk reduction and risk transferral would be more beneficial for Carlsberg.

The development of the optimized Customer Relationship Management services would derive immense support and positive reviews from the consumers during the turbulent touch point. The low sales and low demand issues would be eradicated in this process.

The use of customer relationship management software like “Zoho” and “Salesforce” would help in the rejuvenation of the financial growth.

Conclusion

Operational management is found to be one of the most important departments of every organisation that determines the course of action of the business. This report is composed from the perspective of operational management. The case study of Carlsberg, UK has been presented to analyse the importance of risk management within the organizational framework. This study has attempted to underline the potential internal as well as external risk factors that are causing huge damage in the business of Carlsberg.

Currently, this company is in combat with the dual-threat, Brexit and Covid 19. Thus, the reputation of Carlsberg is at stake due to the lack of prevalent risk management practices. This study has also depicted the impact of the risk factors on the business operation of Carlsberg. The major drop in consumer demand and the alteration in the work culture are marked as the greatest issues to deal with.

It has allowed this study to make significant recommendations to make a quick recovery from the fallen state. The optimization in the digital business model and use of AI technology would assist Carlsberg in maintaining its operational excellence, while financial insurance would save it from bankruptcy.

This study has also suggested developing a consolidated relationship with the stakeholders. In nutshell, this report aimed to point out the flaws in the risk management practices of Carlsberg and the recommendations that have been given to accelerate the process of recovery.

References

Ashu, R.E. and Van Niekerk, D., (2019). Building national and local capacity for disaster risk management in Cameroon. Disaster Prevention and Management: An International Journal.

Available at:https://www.bbc.com/news/science-environment-55207597[Accessed on 11June 2021]

BBC (2020).Beer and crisps used to help tackle climate change

BBC (2020).Budget 2020: Beer, wine and cider duties frozen. Available at: https://www.bbc.com/news/business-51833138 [Accessed on 10 June 2021]

BBC, (2021). Official Website. Available at : https://www.bbc.co.uk/news/business-52770262 [Accessed on : 10th June 2021]

Carlsberg Group (2020). Annual Report.Available at:https://www.carlsberggroup.com/media/42542/carlsberg-group-annual-report-2020_final.pdf [Accessed on 11 June 2021]

Carlsberg Group, (2021). Official Website. Available at : https://www.carlsberggroup.com/who-we-are/corporate-governance/internal-control-risk-management/ [Accessed on : 9th June 2021]

Cheung, W.W., Jones, M.C., Reygondeau, G. and Frölicher, T.L., (2018). Opportunities for climate‐risk reduction through effective fisheries management.Global change biology, 24(11), pp.5149-5163.

Dao, T.M., McGroarty, F. and Urquhart, A., (2019). The Brexit vote and currency markets. Journal of International Financial Markets, Institutions and Money, 59, pp.153-164.

Diamantidis, D., Sýkora, M. and Bertacca, E., (2018), October. Obsolescence rate: Framework, analysis and influence on risk acceptance criteria. In Life Cycle Analysis and Assessment in Civil Engineering: Towards an Integrated Vision: Proceedings of the Sixth International Symposium on Life-Cycle Civil Engineering (IALCCE 2018), 28-31 October 2018, Ghent, Belgium (Vol. 5, p. 379). CRC Press.

Es Magazine, (2021). Carlsberg Expects Profits Fall. Available at : https://www.esmmagazine.com/coronavirus/carlsberg-expects-profit-fall-10-15-lockdowns-impact-sales-106111[Accessed on : 11th June 2021]

Fairlie, R. and Fossen, F.M., (2021). The early impacts of the COVID-19 pandemic on business sales. Small Business Economics, pp.1-12.

Freund, F., Pelikan, J., Salamon, P., Offermann, F. and Banse, M., (2017). The UK after the Referendum: Renegotiating Tariffs and Beyond.

Haroon, O., Ali, M., Khan, A., Khattak, M.A. and Rizvi, S.A.R., (2021). Financial Market Risks during the COVID-19 Pandemic. Emerging Markets Finance and Trade, 57(8), pp.2407-2414.

Hartmann, N.N. and Lussier, B., (2020). Managing the sales force through the unexpected exogenous COVID-19 crisis. Industrial Marketing Management, 88, pp.101-111.

Hilorme, T., Zamazii, O., Judina, O., Korolenko, R. and Melnikova, Y., (2019).Formation of risk mitigating strategies for the implementation of projects of energy saving technologies.Academy of Strategic Management Journal, 18(3), pp.1-6.

Hope, M., (2019). The economic impact of Brexit on London. London: Greater London Authority.

Hopkin, P., (2018). Fundamentals of risk management: understanding, evaluating and implementing effective risk management. Kogan Page Publishers.

Hu, M., Liao, Y., Wang, W., Li, G., Cheng, B. and Chen, F., (2017). Decision tree-based maneuver prediction for driver rear-end risk-avoidance behaviors in cut-in scenarios. Journal of advanced transportation, 2017.

Insidermedia (2020).Carlsberg Reveals Sustainability Improvements. Available at:https://www.insidermedia.com/news/midlands/tag/Carlsberg+UK [Accessed on 12June 2021]

Investorschronicle (2021).Has Covid-19 changed the brewery sector forever?.Available at: https://www.investorschronicle.co.uk/news/2021/04/27/has-covid-19-changed-the-brewery-sector-forever/ [Accessed on 9 June 2021]

Karneyeva, Y. and Wüstenhagen, R., (2017). Solar feed-in tariffs in a post-grid parity world: The role of risk, investor diversity and business models. Energy Policy, 106, pp.445-456.

Kumar, A., Mangla, S.K., Kumar, P. and Song, M., (2021). Mitigate risks in perishable food supply chains: Learning from COVID-19. Technological Forecasting and Social Change, 166, p.120643.

Leruth, B. and Taylor-Gooby, P., (2021). The United Kingdom before and after Brexit. In Handbook on Austerity, Populism and the Welfare State. Edward Elgar Publishing.

Lesser, A. and Berghult, J., (2018). The challenges of Strategic Risk Management.

Livingston, E., Desai, A. and Berkwits, M., (2020). Sourcing personal protective equipment during the COVID-19 pandemic. Jama, 323(19), pp.1912-1914.

Madhavi, E. and Reddy, N.R., (2018). The Effect of Brexit on Indian Stock Market: An Empirical Study. IUP Journal of Financial Risk Management, 15(3).

McCabe, S., (2020).From the ‘Rocks’ of Brexit to the Economic Devastation of COVID-19.

Menoni, S. and Schwarze, R., (2020). Recovery during a crisis: Facing the challenges of risk assessment and resilience management of COVID-19. Environment Systems and Decisions, 40, pp.189-198.

Michie, S., West, R., Amlôt, R. and Rubin, J., (2020).Slowing down the covid-19 outbreak: changing behaviour by understanding it.BMJ.

Mitchell, R., Maull, R., Pearson, S., Brewer, S. and Collison, M., (2020). The impact of COVID-19 on the UK fresh food supply chain. arXiv preprint arXiv:2006.00279.

Opatrny, M., (2021). The impact of the Brexit vote on UK financial markets: a synthetic control method approach. Empirica, 48(2), pp.559-587.

Pitts, E.R. and Witrick, K., (2021). Brewery Packaging in a Post-COVID Economy within the United States.Beverages 2021, 7, 14.

Rawson, T., Brewer, T., Veltcheva, D., Huntingford, C. and Bonsall, M.B., (2020). How and when to end the COVID-19 lockdown: an optimization approach. Frontiers in public health, 8, p.262.

Schmits, E. and Glowacz, F., (2021). Changes in alcohol use during the COVID-19 pandemic: Impact of the lockdown conditions and mental health factors. International journal of mental health and addiction, pp.1-12.

Shen, J., (2021). Alcohols, COVID-19 Pandemic, and Coronavirus Infection.

Standard (2020).Marston’s and Carlsberg UK form brewing joint venture partnership. Available at: https://www.standard.co.uk/business/marston-s-and-carlsberg-uk-form-brewing-joint-venture-partnership-a4448691.html [Accessed on 11 June 2021]

Statista, (2021). Carlsberg Net Revenue 2020. Available at : https://www.statista.com/statistics/741358/carlsberg-net-revenue-worldwide/[Accessed on : 11th June 2021]

Stephens, M., Cross, S. and Luckwell, G., (2020). Coronavirus and the impact on output in the UK economy: June 2020. Office for National Statistics, 12.

Strong, H. and Wells, R., (2020). Brexit-related food issues in the UK print media: setting the agenda for post-Brexit food policy. British Food Journal.

The Guardian, (2021). Beer Prices Rise in Brexit Inflation. Available at : https://www.theguardian.com/business/2020/jan/24/beer-prices-rise-brexit-inflation-heineken-carlsberg-carling-budweiser [Accessed on : 9th June 2021]

Wang, B., Liu, Y., Qian, J. and Parker, S.K., (2021). Achieving effective remote working during the COVID‐19 pandemic: A work design perspective.Applied Psychology, 70(1), pp.16-59.

Yahoo Finance, (2021). Carlsberg Eyes Earnings Growth 2021. Available at :https://in.finance.yahoo.com/news/carlsberg-eyes-earnings-growth-2021-063317400.html[Accessed on : 10th June 2021]

Yueh, L., (2017). Britain’s Economic Outlook after Brexit. Global Policy, 8, pp.54-61.

Zéman, Z. and Lentner, C., (2018). The changing role of going concern assumption supporting management decisions after financial crisis.Polish Journal of Management Studies, 18.

Know more about UniqueSubmission’s other writing services: