Curiosity, Creativity and Research MBA_7_CCR

Introduction

The financial market is place where there many buyers and sellers engage in the trading of properties such as equity, bond, currency and other derivatives of money. The features of financial markets are open pricing, simple regulations on trading and basic policies on cost and the forces that set the cost of trades. Presently, the trade markets are present in most of the countries with different amount of transactions.

The trade markets in some countries are at the initial stage of development whereas in countries like US the trading is done in trillion dollars by the Forex and New York Stock Exchange. The trade markets use the price and money value for financial transactions. In a country, if the economy is good and if there is high demand, the prices will tend to increase to higher rates and the profit will be more.

But there some highly influencing factors like varying tax rates, economic disasters in productivity, and the unemployment problems will affect the prices in trade markets and this will in turn affect the trader’s profit.

Background and Context

The most important research issue in trade market economy is to determine the impact of the financial market on the entire economy of a country. The issue has been come into due to the financial fluctuations in many countries. Many researches have been done on how the unfavorable choice or other dangerous problems impact the financial markets by restricting the businesses and industries to increase their revenues.

This impact leads to restrictions in investors and these problems in financial markets affect the real economy of the country. The financial markets in real are affected by the secondary markets where the traders have security of invested money. In stock market which is one of the type of financial market,

the increase or decrease in stocks affect the business organizations only when the share is involved. The trading is done only with the investors without affecting the businesses. These derivatives markets there are many activities are performed but it does not affect the economy of the country directly. But it affects the financial markets which in turn affect the nation’s economy.

Problem Statement

The objective of this proposal is to analyze the current financial markets and how they affecting a country’s economy around the world and use the findings of the research to the business organizations. If all the businesses will not operate on the market, the impact of trading alone can be observed by the people in a nation’s economy.

In this paper, we are going to do literature survey on some of the existing papers which deals with how financial markets affect the economy of a country. Here, we are going to propose various factors which affect the economy of a country. This research will be helpful to find useful knowledge for countries and organizational structures to plan its business objectives and policies.

Research Questions

Some of the research questions to be answered are; why the financial markets are so important for country’s economy? ; How government money investment policies affect the economy? How the foreign capital investments affect the economy? How unemployment rate increases in a country? Why economy is important for a country? How banking systems are important for a country? These questions need to be answered to know the effects of financial markets on country’s economy.

Relevance and Importance of the Research

The businesses which operate on financial markets will impact the society and economy of the nation. The business and trading in the financial markets can influence the money supply and the nature of people and businesses which in turn impact the society and economy of the country.

This issue has been come into due to the financial fluctuations in many countries. Many researches have been done on how the unfavorable choice or other dangerous problems impact the financial markets by restricting the businesses and industries to increase their revenues. This impact leads to restrictions in investors and these problems in financial markets affect the real economy of the country.

Literature Review

Here we are going to discuss about various research studies about the impact and role of financial markets on the economic growth of a country.

(Demirguc-Kunt, Feyen, & Levine, 2011) examines the increasing significance of financial markets and banking systems for the economic development process and the relationship between the banks and financial markets and how they involve in the process of economic development. Here the role of banks and financial markets in the country’s economic development has been evaluated by quantile regression method.

The connection between the banks and the financial markets with the economy is proved using the Ordinary Least Squares (OLS) method. (EKMEKCIOGLU, 2013) discusses about the role of financial markets in the uncertainty of the global economy.

The role of the financial markets can be classified based on the function as intermediate, economic and financial. This paper discusses about the economic crisis in various countries. In Europe, the economy stagnation occurred due to the balance payments in financial factors. The issues in the fiscal cliff of US influenced negative impacts on the economy of the nation.

In other developing countries like China also the economy has been affected though they have a tremendous economic growth in the past. (Gadanecz & Mehrotra, 2014) deals with the connection among the increasing stock exchanges and the growth of the economy. It also investigates how the flexible stock exchange market influences the financial market.

The research shows that there is no connection between the flexible stock exchange rate and the growth of economy in long run. (Shin, 2013) dicusses about whether the financial markets influence the ecomomy development of the growth.

The previous researches evaluated the financial development of a the nation based on the credit levels of the banking sectors and stock markets .

The research revealed that the financial market does not impact the economic development of a country. (Popov & Smets, 2011) discusses about the role of financial markets in the world economy with the trade off between the growth and risk related to the financial markets.

The set of regulations and the business policies should reduce the risks involved in the financial markets without affecting the economic growth. (Bond, Edmans, & Goldstein, 2011) discusses about the real effects of the financial market that occurred mainly due to the market prices.

The author argues that the power of decisions in trade market requires the new description of the pricing which reflects the information useful for trading decisions. Here the author proved the real effects of second level financial markets. The second level financial markets influence the primary financial markets to some extent of levels.

Key Concepts and Theories

The neo-Classical theory states that the saving is the important factor which determines the economy. The capital investment and rate of interest is the fundamental factor influencing supply and demand for capital flows.

Modigliani-Miller theorems also approved the neo- Classical theory and stated that the financial markets influence the economic growth on a microeconomic level, which concludes that the organization’s investment policies are not dependent on the financial systems.

Gurley and Shaw (1955, 1960) concluded that financial development is a continuous process which influences and being influenced by the growth of the real sector.

The individual works of McKinnon (1973) and Shaw (1973) followed the neo-Classical framework. Stiglitz and Weiss (1981) argued that there are problems in credit management due to the improper communication between the suppliers and credit users.

Key Debates and Controversies

There are many debates are occurred between the researchers on significance of the financial markets for country’s economy.

Some of the researchers argue that the significant development of financial markets based on mobilized savings, capital allocation, industry control and managing risks. Robinson (1952) stressed that the financial markets does not influence economic growth; but basically they are affected by the improvements in the actual industry sector.

Lucas (1988) too pointed out that the role of financial markets in economy growth is often amplified by economy researchers.

The researches of economists like Goldsmith (1969), Schumpeter (1934) and McKinnon (1973) argued the significance of financial markets is the main reason for development of country’s economy and proved that financial markets positively indulged in the economic growth.

Gaps in Existing Knowledge

Some of the researchers argued that the secondary markets play an important role in the development of financial markets. The cost pricing and pricing decisions on the financial markets also affect the financial markets. The foreign money investments not only affected by the government money policies sometimes it is also affected by the environmental conditions of the country and risks involved in the infrastructure of the country.

Research Design and Methods

For evaluating the impact of financial markets that affect the Country’s economy, some factors have to be selected. The factors chosen for investigation are based on the historical evidences of economy of the country and the economic alterations that enables to predict the future economy.

For the research purpose, the examples are taken from developed and developing countries economy. These countries are classified into three pools. The first pool with countries of powerful financial markets and which has traditional financial structure.

The second pool consists of countries with high financial activity and which follows Islamic financial structure. The third pool consists of developing countries with growing financial markets.

Based on the previous researches, it is proven that the powerful financial markets of the world are in the highly developed countries. The research also shown that the countries with moving financial market and following traditional finance systems have high volume of direct foreign investments.

In contrary, the countries with developing financial markets the foreign investments are increasing. In case of countries with new financial markets, both the internal and external direct investments are low.

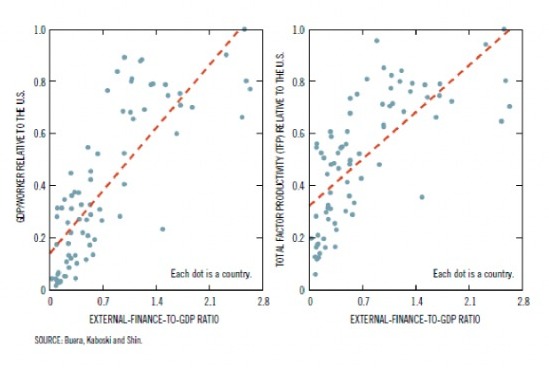

Fig1. Relationship between Financial market development and Economic Growth

The above diagram shows the connection between the development of financial markets and the economic growth of the countries. Here, each point is a country and the line indicates the relationship between two variables.

The line shows the ratio of GDP to the economic development which is evaluated by the output per worker. The diagram also reveals that the countries with good economy have highly developed financial markets (Shin & Yongseok, 2013).

Capital Investments

The financial markets are directly proportional to the growth of country’s economy. The financial markets support the flow of money from investors who are economically strong to the people who need money to start or enhance the business activities.

This flow of money can takes place either directly or indirectly. This type of money investments will help the businesses to improve the production which in turn improve the profit of private companies and governmental agencies. The financial improvement in businesses will increase the taxes that should be paid to the government. This activities lead to the growth of nation’s economy.

Unemployment rate

Next we are going to analyze how the capital investments will help to reduce the unemployment rate. As already said, the flow of capital money from the investors to business people will be helpful for the financial development.

In this case both the parties are benefitting. These investments lead to growth of production which in turn raises the number of jobs hence the unemployment rate will be reduced.

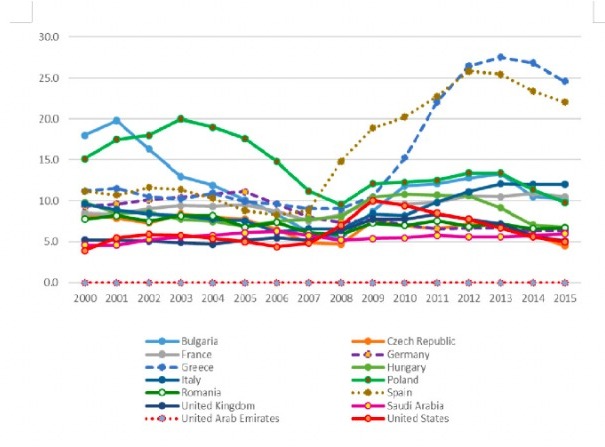

Fig.2 Unemployment, % of labour force. Source: based on BMI Research data base, on 30th of June 2016.

The above diagram shows the unemployment rate of various countries. From the results, it is evident that the countries with highly developed financial markets and high foreign investments have low unemployment percentage.

There are some countries with stable political environment but not highly developed financial market also have low unemployment rate.

Investment Risk

When the economic development of a country is related with the financial risks, the countries with highly influenced financial markets will have low investments risk.

The stability in financial markets and good political surrounding will improve the trust of the investors and they believe there is a low risk in investing these countries.

In the countries with unstable tax regulations and unfavorable political situations will lead to high risk for investors to invest in those countries. The foreign investments will be low in these countries that have high risks for investors which in turn affect the financial markets. Thereby affects the growth of the economy of the country.

Monetary Policy and Payment Balance

There is a correlation between the stable monetary policies and the operation of financial markets. The countries with stable and fixed monetary policies, foreign investments, internal capital investments, loan options have developed financial markets.

Based on the previous researches, it is evident that the countries with stable currencies have a highly developed financial market. In contrary, the countries with unbalanced currency values there is a under developed financial market.

The payment balance of a country shows its money transactions with the other countries. The payment balance represents the country’s international debts and international transactions.

This shows the growth of economy of a country. Based on the previous researches, the countries with higher rate of changes in investment have developed financial markets and have a good record of payment balances.

These countries have lesser risk for investments. The countries with lower rate of changes in the capital investment have under developed financial markets.

Social Stability

If the investors do not have trust in investing in a country, there is no possibility of development of financial markets. The investors will have confident to invest only when there are stable monetary policies and thereby improve the economic and social balance.

If there is a balance in economic policies and investments, there will be development in financial markets and decrease the unemployment rate. Based on the previous researches, the countries with high risk in stability of social policies, there is under developed financial markets and also low economic growth.

The countries with low risk of social stability, there is strong financial markets and good economy (Mosteanu, 2017).

Aims and Objective

The main objective of this proposal is to determine the development of the current financial markets and how they are affecting a country’s economy around the world and use the findings of the research to the business organizations.

If all the businesses will not operate on the market, the impact of trading alone can be observed by the people in a nation’s economy.

Potential Obstacles

The possible issues which act as obstacles in determining the effects of financial markets on country’s economy are changing developments in technology, cultural diversities, climatic variations, influences of terrorism and issues to wars. These also affect the economy of the country.

So it is difficult to determine how actually the financial markets play key role in the economic development of the country.

Implications and contribution to knowledge

Practical Implications

Based on the previous evidences and discussions, it is evident that the various factors of the financial markets affect the economy of the country. The investor’s decisions affect the growth of financial markets and thereby affect the economy of the country.

The business organizations can use these factors to improve their processes in order increase the revenue of the nation. It is the responsibility of the country also to attract foreign investors by setting stable, fiscal and monetary policies and loan options.

Thus the analysis has been made how the financial markets influence the economy of a country. The various factors of the financial markets affect the economy of the country. The investor’s decisions affect the growth of financial markets and thereby affect the economy of the country.

The business organizations can use these factors to improve their processes in order increase the revenue of the nation.

Theoretical Implications

It is the responsibility of the country also to attract foreign investors by setting stable, fiscal and monetary policies and loan options. Thus the countries with stable policies for money value, high foreign investments, and lower risk for investors will have highly developed financial markets, low employment rate which in turn improves the economy growth of a country.

The developed countries based on the good economy have highly developed financial markets and the countries with low economy have underdeveloped financial markets as well.

References

Bond, P., Edmans, A., & Goldstein, I. ,2011. THE REAL EFFECTS OF FINANCIAL MARKETS. NATIONAL BUREAU OF ECONOMIC RESEARCH , 1-36.

Demirguc-Kunt, A., Feyen, E., & Levine, R. ,2011. Optimal Financial Structures and Development:The evolving importance of banks and markets. https://www.researchgate.net/profile/Ross_Levine/publication/265202090_Optimal_Financial_Structures_and_Development_The_evolving_importance_of_banks_and_markets/links/5523c95b0cf2b351d9c336aa/Optimal-Financial-Structures-and-Development-The-evolving-impor , 1-35.

EKMEKCIOGLU, E. ,2013. Role of Financial Markets in a Global Economy and the Concept of Uncertainty. International Journal of Academic Research in Economics and Management Sciences , 199-206.

Gadanecz, B., & Mehrotra, A. N. ,2014. The Exchange Rate, Real Economy and Financial Markets. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2497130 , 11-23.

Mosteanu, N. R. ,2017. The Influence of Financial Markets on Countries’ Economic Life. Economics World , 268-280.

Popov, A., & Smets, F. ,2011. On the trade-off between growth and stability: The role of financial markets. https://www.dnb.nl/en/binaries/Vox%20EU%20piece%20final%20AP%20FS_tcm47-280395.pdf , 1-6.

Shin, & Yongseok. ,2013. Financial Markets An Engine for Economic Growth. https://www.stlouisfed.org/~/media/files/pdfs/publications/pub_assets/pdf/re/2013/c/financial_markets.pdf , 1-9.