Assignment Sample on Determination of Interest Rates in an Economy

The distinction between nominal, real, and expected interest rates

The nominal interest rate can be incorporated as the percentage of increase within the money that is paid towards lenders for the utilisation of the money borrowed after a stipulated period. Furthermore, the nominal interest rate example can be portrayed with the example of a loan worth $10000 undertaken from a bank with 10% interest. Therefore, the nominal interest for the aforementioned example would be $1000 if compounded annually. Furthermore, real interest rates are associated rates after adjustments made after inflation within an economy. For example, an economy having an inflation rate of 5% and an interest rate of 5% would yield an amount of $105 at the end of a financial year. However, the amount returned to the lender would be of equivalent value as the principal amount of $100. Therefore, the inflation-adjusted return of the principal value at the year-end is zero.

The formula for nominal, real and expected inflation rate is highlighted below which is also considered as the “Fisher equation”,

i = “nominal interest rate”

r = “real interest rate”

e = “expected inflation rate”

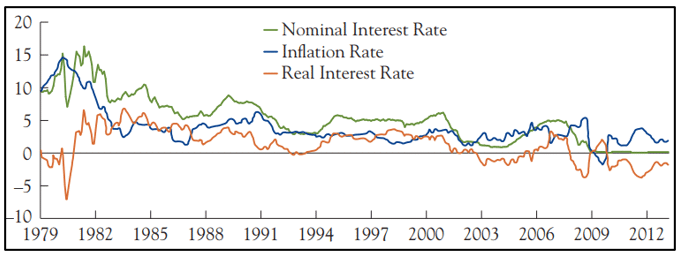

Therefore, to ascertain the expected real interest rate, we shall further subtract the “inflation rate” from “nominal interest rates”. Thus, the expected real interest rates are calculated mainly based on the expectations of inflation within a country or economy and the average nominal yields for the firms (Lundvall, 2020). Furthermore, studies have highlighted trends of higher inflation rates associated with higher nominal interest rates as described in the graph below,

Figure 1: Relationship between nominal, inflation, and real interest rates

(Source: Influenced by Cecchetti et al. 2021)

The above figure highlights the statistical data of real interest rates over the period of 1979 to 2012. Upon closer analysis, it can be seen that assumptions were made for the expected inflation rates to be equal with the actual inflation rates over a period of 3 months. However, focusing on the graph, it can be said that the higher the nominal interest and inflation rates are, the higher has been the real interest rates which can be understood while comparing periods of 1982-1988 and 2009-2012.

Furthermore, the real interest rates are mainly found to be the adjusted interest rates after adjustments have been made for inflation rates. As per the words of Carvalho et al. (2016), an increase in longevity levels or expectations can significantly put a downward thrust on the real interest rates. Thus, figure 2 has also emerged to highlight the association of higher inflation rates with higher nominal interest rates. Moreover, the majority of the countries are found to be above the 45-degree line highlighting nominal rates more than the inflation rates prevailing within the countries. Furthermore, the lower levels in 2007-2009 can be signified with the global economic crisis happening along with the financial crunch within the European countries in 2009.

Reference List

Carvalho, C., Ferrero, A., & Nechio, F. (2016). Demographics and real interest rates: Inspecting the mechanism. European Economic Review, 88, 208-226.

Cecchetti, S. G., Schoenholtz, K. L., & Fackler, J. (2021). Money, banking, and financial markets : McGraw-Hill/Irwin.

Assignment Services Unique Submission Offers: