Creativity, Enterprise and Innovation MBA_7_CEI_1

Introduction (Creativity, Enterprise and Innovation MBA_7_CEI_1)

The purpose of this assignment is to emphasis upon the importance of innovation and development in an organisational setup. In this assignment, the case scenario of Wagestream.co.uk has been taken into consideration. It is a technology company, which has started its business from 2018. The main purpose of this organisation is to offer a platform to the workers, by using which they can store their financial information and data in secure way and can keep track on their daily wages rate and revenues.

Wagestream.co.uk is basically a financial institute which offers its services to the customers through online. Being a manager of Wagestream.co.uk, the purpose of this assignment is to identify the risks that Wagestream.co.uk can experiences for being an internet business along with the best suited technology and innovation by using which organisation can offer quality and error free services to its client.

Question 1: what digital and data skill one already have what skill need to be developed and how would use these skills as a business manager of wagestream.co.uk?

When it comes to digital and data skill, as per my opinion I have posses a good level of proficiency in the field and if I were a business manager at wagestream.com I would use my digital and data skills to improve the overall efficiency of the organisation in the field of using digital platform.

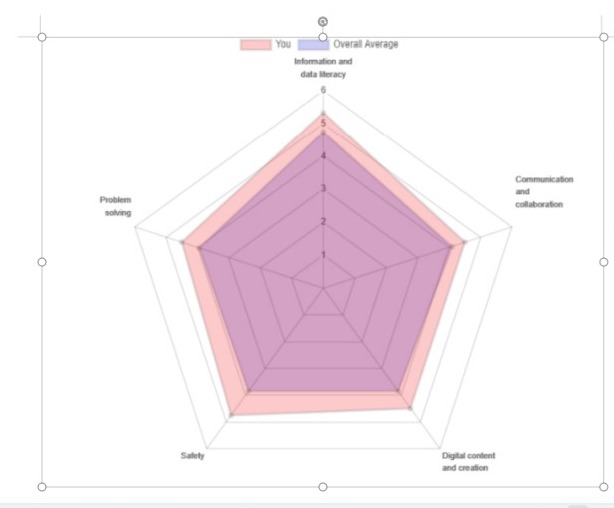

I have completed the “Digital Competency: Online Self-Assessment Tool” and the radar chart is attach below

Figure: Radar chart for self-assessment on digital and data skill

Source: (Radar, 2020)

-

Information and data literacy

In this competency I scored 5.33, where the overall average is 4.73. wagestream.com provides online financial services, so in the field of information and data literacy posses huge importance for the business. Being a manager of the organisation I use this skill for efficiently articulate the information needs such as the new guidelines issued by the government in the financial sector, the changing needs of the market, the data of the financial sectors and so on (Radar, 2020) .

Besides that this skill is also useful for locate and retrieve digital data. For a financial service providing organisation gathering the reverent data is necessary and the skill make me quite efficient in judging the relevance of the data sources by using which I can help the organisation to avoid the threat of data inaccuracy. Moreover, by using the ability to efficiently store, organise and manage the required digital data, contents and information I will try to ensure the overall efficiency in the field.

-

Communication and collaboration

In this competency I scored 4.5, which is slightly higher than the overall average 4.1. So there is a scope to improve this competency more. Being an online service provider, wagestream.com have to deal with its customers by using the online mode of communication, so efficiency in the mode is very necessary, If I were the manager of the organisation,

I try to improve the communication aspect of the organisation by managing the use of the latest and effective technologies which is efficient for dealing with customers for different background and need. As per my opinion, for an online service provider, the communication and collaboration aspect should be efficient as well as easy to understand which is wagestream.com already following.

-

Digital Content and creation

At this skill I scored 4.5, where the average is 3.84. So still there is scope of improvement for becoming more efficient in the field. If I was a business manager in wagestream.com it used this skill for ensuring that quality contents are published in the website of the organisation and when needed I also used my skill to modify the contents and besides that I also use my skill to guide others in the right way.

while it comes to digital contents copyright and licensing is very crucial so I tried to provide a proper guideline to my subordinate for efficiently create the contents so the organisation do not have to face any difficulty regarding copyright and licensing issue.

-

Safety

At this skill I scored 4.75, where the average is 3.84, so here is also a significant room for improvement. If I was the manager of wagestream.com I ensure the safety and security measures are properly being taken for protecting the devices efficiently.

It is one of the ethical responsibility of the organisation to protect the personal data of the stakeholders otherwise it have to face legal consequences under the Data Protection Act 2018 so as a manager I make sure the right approach was being taken for protecting the data and in case of complex situation when my knowledge is not sufficient I took expert help (Kässi and Lehdonvirta., 2019).

- Problem solving

At this skill I scored 4.5, where the average is 3.95, so here is also a significant room for improvement as the level of proficiency is not enough for solving complex situation. As a business manager of wagestream.com I will use my knowledge to keep the process up-to-date as per the digital evolution.

Question 2: How advances in technology can be applied to wagestream.co.uk and how they can support effective management?

Being an online financial service provider organisation, investment in the right advancement in technologies can enhance its performance in the next level. One of the most effective advance in technology for wagestream.com will be Artificial Intelligence (AI). Al can be described as the simulation of human intelligence in machines which are effectively programmed to think like humans and also mimic the human actions.

in the present time the AI is transforming the financial service industry. The AI technologies like Databorot, Underwriter.ai can be introduced in Wagestrem.com for enhancing its efficiency in providing services and also boosting the efficiency in management.

The AI like Data robot give machine learning software for business analysis, software engineering and data science. The AI effectively build accurate predictive models which enhance the decision making process for the issues associated with digital wealth management, marketing, investment and so on(AI and the bottom line: 15 examples of artificial intelligence in finance, 2020). In short it makes the decision making process more efficient for an organisation which in turn enhances its overall performance.

In modern times the AI increasingly allowing the robotic process to perform the task presently performed by the people. The application of AI robots in the fields of management can increases the managerial efficiency of the overall organisation.

In the initial period the technology only can be used as an assistant which ensure every management related tasks are being performed efficiently within the organisation (Belanche et al., 2019). Besides that, the AI services like Datsarobot can be used for making the problem solving approach of the organisation more efficient.

Financial service market is at a unique place and time, which needs innovation and evaluation in technology. Like many financial institutions, AI can be considered as one of the innovative technology or tool for Wagestream.co.uk to offer the desirable and error free services to its users.

The benefits of machine learning tool like AI for Wagestream is that it can help the organisation to detect the AI fraud on time and can help firm to reimage its operation.

Starting from accelerate the initiatives to leveraging the financial data and to deliver a bottom-line output to clients, AI can be considered as one of the most essential machine learning tool for Wagestream.co.uk (SAS Institute Inc. (2019).

The benefits of using AI in Wagestream:

- Client experience:

- To know the clients

- Deepen the relation between clients and organisation

- Precisely target the offers (PwC, 2017)

- Ensure that client can get support on time

- Lending:

- Actively manage clients’ portfolio

- Budget forecast report

- determine the best risk-adjustment return

Artificial Intelligence in Finance can transform the way we interact with the money. It can help any financial institutes like Wagestream.co.uk to streamline and to optimise the entire process starting from credential decision making to quantitative trading and managing financial risk.

Data Robot is a machine learning software for the data scientists, software engineers, IT professionals. Data Robot can help financial institutes like Wagestream.co.uk and its business to quickly develop an accurate predictive model to enhance effective management process and decision making regarding issues like fraudulent, transaction, digital wealth management, block chain and so on.

by using Data Robot, Wagestream can make more precise decision by determining which worker or service users has the higher scale of likelihood of default. This is how the technology can endorse and enhance the effective management system of the organisation.

Question 3: Where the innovation is necessary to benefit the business and customer at wagestream,co.uk?

Innovation can be defined as the new ideas and creative thought, new imagination by using which an organisation can increase the productive and quality of service provision being delivered to the clients. Wagestream is a technology company which offer services to the clients to ensure their financial benefits and wellness. Wagestream is an online platform, where the workers can check or keep track on financial performance.

In such scenario, the organisation can implement innovation in technology and service provision.

For example: the organisation can use hybrid cloud- a cloud computing system to deal with huge number of financial data and information of the clients (Sundarakani et al., 2019). By using hybrid cloud, Wagestream can offer multiples of benefit to the clients by addressing data security, compliances and governance. More specifically, hybrid cloud can keep data and information of the clients secure.

The Security threads are changing constantly and this technological innovation can provide the Wagestream an easy access to the tools like AI which is used mostly to address cyber threats.

Moreover, by using hybrid cloud, Wagestream can scale their data and information needs in real-time by avoiding excessive expenditure for proposition to maintain the unused digital capacity (Deloitte Israel & Co. (2019). It can also enable Wagestream to use the digital resources on the basis of needs, by enabling the organisation to respond to the shifting necessity of the customers.

Robotic Process automation or RPA can be considered as another technological innovation, which can be used by Wagestream to ensure benefits of customer and organisation. RPA is such a technological innovation in financial service background, by using which a financial institute like Wagestream can accelerate the growth by executing pre-programed policies across a range of unstructured and structured information and financial data.

This intelligent automation services process is considered to be beneficial for Wagestream while it comes to take prior decision regarding to store and assess the financial data and information of clients.

It can also help the organisation to determine the data patterns and make decision accordingly by reducing the administrative cost (Procter & Gamble (2019). By using RPA, Wagestream can regulate the flow of information by increasing the quality and speed of service by 50%. By using this robotic process, Wagestream can minimize the human error in financial calculation process and can simplify the compliances by customers regarding the delivered services by keeping track on automated process.

To increase the privacy of data and minimize the risk of data loss, the organisation can up-dated their software system at regular basis and by using antivirus security process.

Block chain is another technological innovation that can be used by Wagestream.co.uk to offer suitable, fast and error free services to the clients on the basis of their needs. Block chain has the transformational impact on financial institute, by using this technology, Wagestream can improve performance efficacy and productivity of the website (Boston Consulting Group, 2019).

To process the daily wages rate and income of workers, to know the clients, to reduce fraudulence on webpage- Wagestream can focus on using Block Chain.

So, as a whole it can be said that being a financial institute, it should be important for Wagestream to implement innovation in service provision. The main function of Wagestream is to offer a platform to the clients where they can keep track on their regular financial performance, monthly revenues and wages rates.

So, it should be essential for Wagestream to secure the webpages of the organisation and networking services, so that every worker can store their financial data and information at Wagestream with proper secrecy.

To ensure confidentiality of the service, the organisation has the necessity to use different tools and technologies, specifically when it comes ensure privacy and confidentiality of data. Innovation can also be implemented to provide error free services and financial advices to the clients on time and in prompt way (Willcocks et al., 2017).

Question 4: Identify the risks that wagestream.co.uk might face and how those can be managed?

Wagestream is a technology company which offers financial benefits and wellness to the clients. In clear terms, Wagestream offers scope to its workers to access their income at any time during monthly pay cycle. The software application which is being used in Wagestream can make it easy for its users to keep a track on their earnings and daily wages rate in real time.

The organisational activities is solely based on the technology and Internet services, which underpins the organisational innovation in every possible forms (Deborah Perry Piscione, 2017). In such cases, some common risks might be experienced by Wagestream while offering services to its clients.

The most common risks that Wagestream can experience while implementing new technologies like: Big Data, AI and IoT are:

- Privacy threats and cyber security- with the implementation of new technology in service, the chance of data loss prevention will increase simultaneously. Internet fraud is another risk that Wagestream may face while handling data and information along with the financial statement of the clients at online platform. Almost 75% risk due to cyber security and privacy threats have been increased in Wagestream (Deloitte United States. 2020).

- Privacy law- internet business needs to manage privacy of the customer sensitive information. The main function of Wagestream.co.uk is to provide a platform to the workers, by using which they can access their revenue and wages rate through internet. While it comes to provide internet service to the clients and deal with their financial information, privacy and secrecy of the data and information should be kept in utmost important for the organisation.

- Advertising and Marketing- while it comes to set up campaign for the internet business, the organisation must not violate the FTC advertising rules and regulation (Price waterhouse Coopers Slovensko, 2018).

Risk related with the innovation and implementation of technology in organisational setup can be categorized into three categories:

- Cyber security and privacy threats

- Technology risk

- Operational risk

To mitigate the potential risk within organisation and to provide a safe and secure services to the clients, it should be important for Wagestream to follow risk management plan.

| Type of risks | Outcome | priorities | Action plan |

| Cyber security | Negative impact on performance and efficacy of the organisation,

Intrude of anonymous person to misuse the financial information and data |

5 | Use of Cross-site scripting, an up-to-date antivirus software can help to restrict the intrude of anonymous person and track the information illegitimately |

| Privacy law | Steal of information and financial data, copyright violation, policy violation | 5 | Use of different IM portals, restriction in using unlicensed software, use of proper copyright policy can help |

| Advertising and marketing | Loss of productivities, data loss, inappropriate content | 4 | Use of patent of software system, use of proper marketing policy, use of DLP solution for e-commerce and e-marketing,

Use of P2P or peer-to-peer software to share entire hard drives, use of privacy for online storage of data and information |

Conclusion

In conclusion, it can be stated that, in this assignment, focus has been given upon the case scenario of Wagestream.co.uk. in this report, different innovation and risk management techniques have been discussed in precise way, that Wagestream.co.uk can experience while offering financial benefits and supports to its users through webpages.

References

Belanche, D., Casaló, L.V. and Flavián, C., 2019. Artificial Intelligence in FinTech: understanding robo-advisors adoption among customers. Industrial Management & Data Systems.

Boston Consulting Group (2019) Innovation in 2019:The Most Innovative Companies 2019. Available from: https://www.bcg.com/publications/2019/most-innovative-companiesinnovation.aspx [Accessed 18 October 2019]

Built In. 2020. AI And The Bottom Line: 15 Examples Of Artificial Intelligence In Finance. [online] Available at: <https://builtin.com/artificial-intelligence/ai-finance-banking-applications-companies> [Accessed 22 July 2020].

Choi, D. and Lee, K., 2018. An artificial intelligence approach to financial fraud detection under IoT environment: A survey and implementation. Security and Communication Networks, 2018.

Deborah Perry Piscione (2017) Innovation and Risk Available from: https://www.youtube.com/watch?v=U923bTKBLMQ [Accessed 25 October 2019]

Deloitte Israel & Co. (2019) Data Driven Innovation. Available from:https://www2.deloitte.com/il/en/pages/strategy/articles/-data-driveninnovation.html [Accessed 18 October 2019]

Deloitte United States. 2020. Cyber Risk In An Internet Of Things World | Deloitte US. [online] Available at: <https://www2.deloitte.com/us/en/pages/technology-media-and-telecommunications/articles/cyber-risk-in-an-internet-of-things-world-emerging-trends.html> [Accessed 22 July 2020].

Digital skills Accelerator. 2020. Radar. [online] Available at: <https://www.digitalskillsaccelerator.eu/radar/#gf_2> [Accessed 22 July 2020].

Gutierrez-Estevez, D.M., Gramaglia, M., De Domenico, A., Dandachi, G., Khatibi, S., Tsolkas, D., Balan, I., Garcia-Saavedra, A., Elzur, U. and Wang, Y., 2019. Artificial intelligence for elastic management and orchestration of 5G networks. IEEE Wireless Communications, 26(5), pp.134-141.

https://www.pgcareers.com/aboutus/?utm_source=google&utm_medium=ppc&utm_campaign=ukinnovationpassive&gclid=EAIaIQobChMIn_iyh7-q5QIVx8jeCh0XPgw0EAMYASAAEgKLevD_BwE [Accessed 18 October 2019]

Kässi, O. and Lehdonvirta, V., 2019. Do digital skill certificates help new workers enter the market? Evidence from an online labour platform.

matters? Available from: https://www.sas.com/en_gb/insights/data-management/digital-transformation.html [Accessed 5 November, 2019]

Price waterhouse Coopers Slovensko (2018) Managing risks and enabling growth in the age of innovation. Available from: https://www.pwc.com/sk/en/risk-in-reviewstudy.html [Accessed 25 October 2019]

Procter & Gamble (2019) About us build brands that are more than just brands. Available from:

PwC ( 2017) The Essential Eight:Your guide to the emerging technologies revolutionizing business now. Available from: https://www.pwc.com/gx/en/issues/technology/essential-eight-technologies.html#cta-1 [Accessed 5 November, 2019]

SAS Institute Inc. (2019) Digital Transformation: What it is and why it

Sundarakani, B., Kamran, R., Maheshwari, P. and Jain, V., 2019. Designing a hybrid cloud for a supply chain network of Industry 4.0: a theoretical framework. Benchmarking: An International Journal.

Willcocks, L., Lacity, M. and Craig, A., 2017. Robotic process automation: strategic transformation lever for global business services?. Journal of Information Technology Teaching Cases, 7(1), pp.17-28.