Essay On Operational Risk Management Assignment Sample

Essay On Operational Risk Management Of Hsbc Bank

Introduction

Operational risk in banking sectors may hamper the internal process and sustainable development of the organization. Different operational risks such as employee error, cyber security risk, and technological risk negatively affect the financial operation in banking industries. Financial regulation, innovative technologies helps to reshape the banking industry and plays a significant role to minimize operational cost. Failure of internal operational processes may cause financial loss or information loss in the banking industry. Operational risk management is an important factor for HSBC banks to enhance their financial performance and reduce financial risk. Issues of cyber security, data theft, and internal security threats are the main reasons for operational risk. Decisions regarding financial investment during the Covid-19 pandemic also may create operational risk in banking sectors. This study is mainly focused on operational risk management operation of HSBC bank and legal impact, technological impact in operational risk management will also be discussed.

Discussion and critical evaluation

Operational risk at HSBC Bank

The major operational risk appears for HSBC bank during money lending and financial investment. Most of the time people fail to repay money that people borrow and financial investment of this bank converts into non-profit assets (Hsbc.com, 2021). It is difficult for the management of HSBC to comply with all organization regulations that create legal risk and financial losses due to poor strategies. Technical error is also an important risk because due to poor computer system management of this bank faces financial loss, information loss. Cyber security issues also raise operational risk for different banking sectors in this advanced technology era (Leo et al. 2019). Cyber security is a common risk for HSBC due to poor technical control and software management.

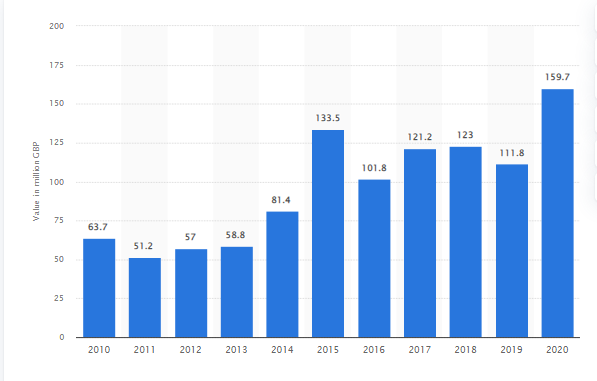

Demand for online banking has also increased gradually nowadays, creating a major online fraud threat. Online fraud threat in the UK causes financial losses of approximately 159.7 million British pounds in 2020 (Statista.com, 2021). This data indicates that cyber threat and online fraud is important operational risk for banking sectors. Hence management of HSBC bank is required to secure all of their software as well as transaction process. Poor data privacy is also a vital operational risk that may decrease customer service quality, financial performance as well as reduce customer’s loyalty (Prochazkova et al. 2020). Poor management of customer information, transaction data increase the chance of data theft and it is also a major reason for financial losses. An error of employees is also the main reason for internal operational risk and it happens due to poor training of employees. [Refer to Appendix 1]

Poor cyber security strategies of HSBC bank create opportunities for online fraud to penetrate financial as well as customer data efficiently. Approximately 226,000 employees of HSBC are located in the UK; hence it is difficult to provide training and education for all employees that create internal errors (Statista.com, 2021). The control of third parties is increasing in banking sectors, which also creates a throat for financial institutions to control the activity of third parties. Approximately 24% of people reported fraud cases in the financial payment system and another 47% are expected to increase fraud cases in banking sectors during the Covid-19 pandemic situation (Statista.com, 2021). It indicates that online payment increased during the Pandemic situation that created a major challenge for HSBC to ensure a safe payment process for potential consumers.

Poor policies in financial organizations also raise the risk of financial losses and hamper financial performance for organizations. Due to the Covid-19 pandemic situation, the economic growth of different countries has fallen and it negatively impacts financial performance of banking sectors (Elamer et al. 2020). Wrong decisions of financial investments during the pandemic situation may cause financial loss for HSBC bank. Management of HSBC bank is required to make decisions regarding financial investments by pepper market analysis to minimize operational risk. Many times most of the banking sectors are to maintain rules and regulations regarding financial services because they conduct all financial operations as per their own rules. It can cause financial losses, data theft, and other operational risks that negatively impact customer services (Fajembola et al. 2018). The use of innovative technologies and software is important for HSBC to minimize operational risk in their business.

Process to recover operational risk of HSBC Bank

Operational risk may hamper financial performance and create challenges for HSBC bank to develop their business in a safe environment. Most of the risks appear while making decisions regarding financial investments because most of the time customers are unable to repay borrowed money. Hence management of HSBC banks makes operational risk control frameworks to minimize operational risk through cost-effective strategies. They build a group executive committee to target potential risks in their organization and set strategies to minimize the risk (Erin et al. 2018). The management of HSBC communicates with their customers to collect their information and detect all types of financial risk to prevent data crime.

HSBC bank enhances its monitoring system and enhances its control on digital payment options for minimizing online fraud risk effectively. Management of this banking industry also enhances their control on different third-party service providers to enhance the quality of their business in the financial market. Due to cyber threats, many financial organizations face huge financial losses and data theft. HSBC is the largest banking sector in the UK and they used an effective cyber security framework to minimize cyber threats in financial services (Hsbc.com, 2021). The security monitoring system of HSBC monitors all transactions 24 hours to detect threats and to provide technical support for customers.

All cyber security processes and monitoring systems of HSBC are monitored under the security operation system (SOC) (Hsbc.com, 2021). Continuous testing of online threat vulnerability scanning helps HSBC to minimize the operation risk in an efficient manner. Poor data privacy also raises the operational risk in banking sectors and that also affects customer service negatively (Hassani et al. 2018). High-level commitment of HSBC and use of a global approach helps management of HSBC to handle all personal data of their potential consumers. They follow global standard mechanisms to protect all financial information as well as customer data accurately.

Good transparency, fair and lawful usage of data helps HSBC to enhance their data protection strategies in business. HSBC is a leading banking industry in the UK, using block chain technology in their business to store financial information, customer information accurately (Hsbc.com, 2021). Management follows all rules and regulations of the Government while transferring customers’ data to another entity, thyroid party service providers for protecting data effectively. Banking industry is also required to give proper training for their employees to minimize internal risks that may occur due to employee errors.

Most of the operational risks arise due to use of poor computer systems, poor software management (Hsbc.com, 2021). Management of financial institutions is required to implement good technology, software, and computer systems to prevent data breaches and cyber threats. It is noticed that internal people are engaged with data theft and other unethical practices in financial organizations that arise operational risk (Hussaini et al. 2018). Management is required to enhance their monitoring process to reduce unlawful practices as well as data management in the financial sector. The management of HSBC has a great responsibility to protect data and the financial system from financial crime by using proper strategies. HSBC makes strict standards and rules that are required to be maintained by each customer for protecting financial data from different fraud activities.

HSBC management wants to become one of the global leaders in managing financial risk by preventing financial crime. Hence management of HSBC did not allow high risk customers and management stopped their business with those customers immediately. Technology plays a significant role in fighting financial crime (Aloqab et al. 2018). Management of this bank positively upgraded its system and IT infrastructure to prevent several types of financial crime. The management of HSBC screens more than 689 million transactions across 236 million accounts each month to detect unlawful transactions and financial crime (Hsbc.com, 2021).

Conclusion

Operational risks have a major impact on banking industries to maintain their financial performance, services. Technology plays a vital role to detect online fraud, financial crime effectively in HSBC. Management uses several strategies to reduce unlawful financial activities in business. HSBC uses an effective cyber security framework and maintains global standards to protect financial information as well as customer data. Most organizations are not maintaining government rules and regulations that create vulnerable situations within the organization.

Proper software management and technical support help to detect data theft, cyber threats, hacker activity to minimize operational risk. HSBC uses a strong monitoring system and monitors all financial activities 24 hours to detect financial crime effectively. The use of innovative technologies such as block chain technology helps to store financial data and give better protection from cyber threats. Banking industries are required to control third party service providers to reduce data theft and operational risk in organizations. HSBC developed its IT infrastructure and technologies to become one of the important leaders in managing financial crime.

References

Aloqab, A., Alobaidi, F. and Raweh, B., 2018. Operational risk management in financial institutions: An overview. Business and economic research, 8(2), pp.10-32.

Elamer, A.A., Ntim, C.G. and Abdou, H.A., 2020. Islamic governance, national governance, and bank risk management and disclosure in MENA countries. Business & Society, 59(5), pp.914-955.

Erin, O., Asiriuwa, O., Olojede, P., Ajetunmobi, O. and Usman, T., 2018. Does risk governance impact bank performance? Evidence from the Nigerian banking sector. Academy of Accounting and Financial Studies Journal, 22(4), pp.1-14.

Fajembola, O.D., Rahman, N.A.A. and Md-Rus, R., 2018. The risk management committee and bank stability: a proposed framework. Journal of Advanced Research in Business and Management Studies, 12(1), pp.13-24.

Hassani, H., Huang, X. and Silva, E., 2018. Digitalisation and big data mining in banking. Big Data and Cognitive Computing, 2(3), p.18.

Hsbc.com, 2021, Managing risk operational risk, Available at: https://www.hsbc.com/who-we-are/esg-and-responsible-business/managing-risk/operational-risk [Accessed on: 3rd December, 2021]

Hsbc.com, 2021, The benefit of block chain technology, Available at: https://www.hsbc.com/news-and-media/hsbc-news/harnessing-the-benefits-of-blockchain#:~:text=HSBC’s%20Digital%20Vault%20is%20a,search%20of%20paper%2Dbased%20records. [Accessed on: 3rd December, 2021]

Hussaini, U., Bakar, A.A. and Yusuf, M.B.O., 2018. The Effect of Fraud Risk Management, Risk Culture, on the Performance of Nigerian Banking Sector: Preliminary Analysis. International Journal of Academic Research in Accounting, Finance and Management Sciences, 8(3), pp.224-237.

Leo, M., Sharma, S. and Maddulety, K., 2019. Machine learning in banking risk management: A literature review. Risks, 7(1), p.29.

Prochazkova, D. and Prochazka, J., 2020. Tools for Risk Management of Technical Facilities Operation. European Journal of Engineering and Technology Research, 5(4), pp.494-500.

Statista.com, 2021, Increase payment fraud corona virus outbreak, Available at: https://www.statista.com/statistics/1175651/increase-payment-fraud-coronavirus-outbreak/ [Accessed on: 3rd December, 2021]

Statista.com, 2021, Total workforce at hsbc, Available at: https://www.statista.com/statistics/258419/total-workforce-at-hsbc-from-2010/ [Accessed on: 3rd December, 2021]

Statista.com, 2021, United Kingdome online banking losses, Available at: https://www.statista.com/statistics/326169/united-kingdom-uk-online-banking-losses/ [Accessed on: 3rd December, 2021]

Appendices

Appendix 1: Financial losses of the UK

(Source: Statista.com, 2021)