FIN9014-M Managerial Finance Assignment Sample

Here’s the best sample of FIN9014-M Managerial Finance Assignment.

Executive summary

The financial management report is included with the knowledge of the firm’s non-current liability, loan interest and sources of capital to enhance the understanding about the firm. In this report, there is in-depth information of the firm’s balance sheet with presence of distinct explanation. A brief explanation of the time value of money has been properly explained in this report and the relevance of using the time value of money has been specifically discussed in this section. Expected sources of capital of LVMH have been discussed with the help of profitability, liquidity, and financial structure analysis of the company. The present report has been concluded with a proper recommendation of whether Lincoln international bank lent a loan of €5 billion to Louis Vuitton (LVMH) or not.

Introduction

The annual report of Louis Vuitton (LVMH) is going to be analyzed in this report as it will help in disclosing the sales volume and sources of income of LVMH plc. Cash flows of LVMH plc tend to be analyzed as it is facilitated in identifying various lending opportunities within the selected organization. The present report is explained further with the concept of the time value of money and the measures that can be applied by Lincoln international bank plc to examine the internal capability of LVMH plc. Other sources of capital of LVMH plc are going to be disclosed in this report and with the help of ratio analysis, the financial performance of LVMH plc in the last two years has been included in this report. The present report concludes whether Lincoln International bank can lend a €5 billion loan to LVMH plc or not.

Evaluation of ultimate sources of funds and sales volume of LVMH plc

In the net financial debt section of LVMH plc, the long-term and short-term borrowings of LVMH have been clearly explained. The long-term borrowings of the retail organization are medium-term notes, dominated commercial papers, other credit facilities, bank overdrafts, and accrued interest to the organization. As opined by Chua and Tam (2020), the main focus of a business is interconnected with incrementing the overall economic growth of the company. In this regard, the management of LVMH plc increases loans from Bonds medium-term notes to €3072 in the assessment year 2021 which was valued as €1094 in the operational year 2020 (LVMH Annual report, 2021).

The amount of bank overdraft, bank borrowings, and current bank borrowings have been increased in this period. The gross browning of LVMH plc is reduced to €20241 in the year 2021 which was €24703 in the year 2020 (LVMH Annual report, 2021). Hence, it can be viewed that LVMH plc is concentrated on gathering the required funds of its business from long-term borrowings in the assessment year 2020 and 2021 respectively.

Estimation of the potential risks related to the income with the help of CVP analysis

The potential risks of a business can be measured with the help of considering all types of financial risks and loans to repay in a certain period. An increase in the total volume of loans within the organization is considered as one of the main reasons for increasing the risks of the organization is related to increasing the volume of liability of the company. As stated by Arbidane and Tarasova (2018), the breakdown of the gross borrowings helped in giving proper access to the total liabilities of the organization in respect to certain currencies. Total non-current provisions of LVMH plc are increased to €3980 which was valued as €3322 in the year 2020. An increase in the volume of provision can help in all types of financial risks within the organization.

| Cost volume profit analysis | ||||

| Louis Vuitton (LVMH) | ||||

| Particulars | 2021 | 2020 | ||

| Per unit | Total | Per unit | Total | |

| Price per unit | € 113.76 | € 8,24,73,325.00 | € 123.15 | € 10,52,71,854.00 |

| Varibale cost per unit | € 51.19 | € 3,71,12,996.25 | € 59.11 | € 5,05,30,489.92 |

| Contribution Margin per unit | € 62.57 | € 4,53,60,328.75 | € 64.04 | € 5,47,41,364.08 |

| Fixed costs | € 3,24,58,754.00 | € 87,54,865.00 | ||

| Net income | € 1,29,01,574.75 | € 4,59,86,499.08 | ||

| BE points in units | € 0.72 | € 0.16 | ||

| BE points in sales | € 5,18,792.46 | € 1,36,717.39 | ||

Based on the CVP analysis of LVMH plc, it can be viewed that the price per unit of LVMH’s products has been increased in the assessment year 2021 and it is valuated as €113.76 in the year 2021. The main reason behind increasing the total price of the products of LVMH plc is to collect the amounts which will be paid as interests to the external lenders within the company. As believed by Ciriello (2021), the focus of a business should be connected with an increasing total volume of operational activities of the business as it helped in maintaining strategical growth and financial development with the organization.

One of the important aspects of CVP analysis is to know about the contribution margin per unit of the organization. The contribution margin of LVMH plc is increased to €62.57 and it is determined as €64.04 in the financial year 2020. Hence, it can be concluded that an increase in the price of the products of LVMH plc cannot be able to incur all types of variable and fixed costs of the business as it makes a negative impact on the total contribution margin of the organization. As believed by Pisár et al. (2021), one of the important aspects of a business is to increase the net income of the business in any circumstances of its business position. In this case, the business cannot be able to increase the total profit of the organization, it should need to main a fixed percentage of profit in respect to the previous years’ profit.

Business group, currency, and geographical evaluation of LVMH plc

The net income of LVMH plc for the last two years is €12901574.75 and €8754.8655 as it can be viewed that the overall net profit of the organization is decreased by more than 60% in the year 2020. As narrated by Kaur and Chaudhary (2021), information from the various business group can be able to identify the total revenue and total assets of the organization. In the total revenue of the LVMH plc, the portion of fashion and leather goods was maximum as the total revenue and income from leather goods are €64215 and €30896 respectively (LVMH Annaul report, 2021). Thus, it can be viewed that leather goods, watches, and jewellery are two effective profitable segments of the selected organization.

Evaluation of the risks of LVMH plc

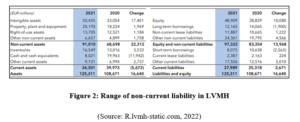

The main reason behind increasing the risks of the organization is the total liabilities of the business have been uplifted in this period. The non-current lease liabilities of LVMH plc are increased to €11,887 in the operational year 2021 and other noncurrent liabilities of the organization are incremented in this period. As stated by Grira and Labidi (2021), changes in the financial policies and impact on the financial policies have to be measured properly that can be effective in evaluating the sustainable financial opportunities and strategic development of the business. The main strategical activities of the organization have to be maintained in such a manner as it can be adequate in narrating the financial techniques of the business. However, an increase in the overall long-term liabilities is considered as one of the financial deficits within the business activities.

Evaluation of the present cash flows of LVMH plc

The cash flows of an organization are associated with three different interfaces such as operating, investing, and financial activities. An increase in the operating activities is directly connected with incrementing the total income and net operations activities of the business. As narrated by Abubakari et al. (2022), investing activities of the organization helped in introspecting lending and financial activities of the business. Total cash flow operational activities of LVMH plc for the assessment year 2020 and 2021 were €13997 and €22621 respectively as it seems the financial and marketing activities of the company have increased in this period. In the year 2021, LVMH plc is concentrating on incurring investing activities within the business as it helps in maintaining strategic activities of the business. Focus on the financial activities and maintaining operational tactics can be able to make a sustainable impact in the growth of the financial strategies of the company.

Impact of cash flows interconnected with the Lincoln international bank plc

Cash flow analysis of LVMH plc is important for Lincoln International bank because it helps in understanding the impact of various schemes and present financial status can be explored with the help of cash flow analysis. As narrated by Riyaldi and Fuadi (2019), utilization of the financial activities and proper evaluation of the marketing activities facilitated the overall interim growth of the business. The financial activities of the LVMH plc have decreased to -€15979 which was valued at -€2939 in the operational year 2020. Based on the financial cash flow analysis, it can be viewed that LVMH plc cannot be able to maintain financial growth in the last two to three years. However, it seems that the retail organization is associated with making repayments of the long-term borrowings of the organization.

Discussion on the time value of money

The time value of money is associated with evaluating the total amount of money that is required to be explored within a stipulated period of time. Estimation of the time value of money is interconnected with annual interest rates and future values of the organization. As narrated by Abdurrachman et al. (2021), one of the important perspectives of using the time value of money is to analyze the role of the inventors within the business. The perspective of using the time value of money is narrated with the adequate implementation of the financial measurement and operational progression within the business. The main focus of using the time value of money by Lincoln International Bank is directly associated with measuring financial strategies and managerial activities within the business. The financial performance of LVMH plc can be measured to discuss managerial issues and financial development.

Identification of the relevancy of time value of money with Lincoln international bank

Usage of the time value of money is considered as one of the tools for Lincoln international bank as with the help of these reports, it can be able to identify various important aspects of performance analysis. With the help of time value analysis, the future growth and financial strategies can be properly analyzed in this report as it helped in measuring the financial outcome and operational development within a stipulated period of time. As opined by Kurniawan (2021), the time value of money is directly interconnected with the financial activities and evaluation of the financial objectives in the organization. The overall opportunity costs and financial growth analysis can be maintained to utilize operational activities and financial strategic growth of the business. The main perspective of the business is interconnected with measuring the strategic activities and financial operations of the business.

Identification of expected sources of capital

Other sources of capital

Sources of capital play an important role in a firm’s financial activities while it is responsible for the representation of a firm’s economic stability. As per the views of Maksymchuk (2019), the capacity of the economy in a business firm indicates stability in its sources of capital. The sources of a firm’s capital are also used to maintain the balance between the firm’s capital and liability to ensure suitable economic growth. In the firm named Louis Vuitton (LVMH), the source of capital is an influential factor in the concern of its loan-making capacity.

Connection with other sources of capital to borrowed capital

Borrowed capital can be mentioned as one of the important aspects of a firm’s source of capital while the firm borrows assets for its capital increment. The capital increment is necessary for a firm as it helps the firm’s economic stability to maintain a required balance between capital and liabilities. According to the explanation of Salihi (2021), borrowed capital is used to increase the profitability of the business firm during its financial investment. In this case, it is important to say that there is a limit to increasing the firm’s capital by considering the availability of liabilities in the firm. The economical profitability of LVMH depends on its source of the capital where borrowed capital is important in case there is a lack of capital. Hence, it can be said that there is a strong relationship between the source of capital and borrowed capital in a firm’s economic stability.

non-current liabilities

The non-current liability mainly indicates the long-term liabilities of the business firm that refers to some financial obligations in the balance sheet. Hence, it can be said that the stability in the firm’s financial condition is quietly related to the range of non-current liabilities.

According to the annual report of LVMH, it is necessary to identify the actual presence of non-current liability before any kind of financial activity such as taking a loan or investing in a loan. The non-current liability in 2021 has increased from 68,698 in 2020 to 91,010 which indicates high concern of financial stability in the firm (R.lvmh-static.com, 2022). Since, the lack of proper non-current liability in the firm’s balance sheet is capable of increasing the possibility of financial instability.

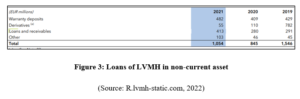

Interest in loan

Loan interest indicates the paid amount that is made by the firm for its borrowed capital and required to pay the interest amount to the lenders according to the agreement. As per the views of Kartikasari et al. (2019), the leverage, dividend and value of a business firm sometimes rely on the range of loan interest of the firm as it influences its economic stability accordingly.

According to the annual report of LVMH, the range of its loans and receivables was 280 in 2020 which has been increased in 2021 while the range has become 413 (R.lvmh-static.com, 2022). This indicates the increment of loan interest that refers not to taking any loan as it is involved with a high possibility of economic instability in the firm.

Leverage including competition

| Discount Rates | |||||

| Year | 10% | ||||

| 0 | 1.00 | ||||

| 1 | 0.91 | ||||

| 2 | 0.83 | ||||

| 3 | 0.75 | ||||

| 4 | 0.68 | ||||

| 5 | 0.62 | ||||

| Particulars | Sales revenue | ||||

| Year 0 | -5 | ||||

| Year 1 | 1.5 | ||||

| Year 2 | 2 | ||||

| Year 3 | 1 | ||||

| Year 4 | 2 | ||||

| Year 5 | 4 | ||||

| Requiremnt of more capital in LVMH plc | |||||

| Cash flows (£ms) | Cash Flows | CCF | DCF @10% | PV (@10%) | |

| Year 0 | -5 | -5.00 | 1.00 | -5 | |

| Year 1 | 1.5 | -3.50 | 0.91 | -3.18181818 | |

| Year 2 | 2 | 3.50 | 0.83 | 2.89256198 | |

| Year 3 | 1 | 3.00 | 0.75 | 2.2539444 | |

| Year 4 | 2 | 3.00 | 0.68 | 2.04904037 | |

| Year 5 | 4 | 6.00 | 0.62 | 3.72552794 | |

| NPV = | 7.74 | ||||

| Net present value = (Summation of the total present value of a machine’s whole life) | |||||

The main context of leverage analysis is to evaluate strategic business options to explore the performance of the firm for a certain period of time. One of the focuses of the leverage strategic analysis is to enhance the overall financial analysis of the business. As stated by Devi and Asthma (2020), proper analysis of the financial strategies and effective evaluation of the marginal techniques is associated with exploring the marginal activities and optimistic approach of the business. Effective evaluation of the financial techniques and adequate measurement of the business strategies can be able to evaluate changes in the promotional strategies of the organization. Basic weightage on the average number of shares of LVMH plc has been increased to €120 in the year 2021, previously which was €109 per annum. However, the total net income of the business has been valued as €1245758 in the year 2021, and that in the year 2020 was €8789585 in that year.

Risk measurement with borrowed capital

| Payback period of LVMH plc | |||

| Year | Cash flows (£`Million) | Balance | Payback period (Years) |

| Year 0 | -1.5 | -1.5 | 1 |

| Year 1 | 1.5 | 0 | |

| Year 2 | 2 | 3.5 | |

| Year 3 | 1 | 3 | |

| Year 4 | 2 | 3 | |

| Year 5 | 4 | 6 | |

| Payback period = (Initial investment / Cash flows per year) | |||

Risk assessment of the organization is directly interconnected with identifying the upcoming threats and opportunities of the business. Based on the borrowed capital analysis of LVMH plc, it can be viewed that long-term borrowing of LVMH plc is reduced to €12165 in 2021 as the retail organization has played certain measures that need to be explored with the business. Change in the marketing strategies and proper protectional activities can be able to make an evaluation of the financial activities and business strategies. Risk assessment of LVMH plc can be maintained with the help of proper promotional activities with the organization.

Investment financial analysis of LVMH plc

Profitability analysis

| Louis Vuitton (LVMH) | ||

| Profitability Ratio | 2021 | 2020 |

| Operating profit/(Loss) | 17,155.00 | 7,972.00 |

| Revenue | 64,215.00 | 44,651.00 |

| Operating profit margin (%) | 26.71% | 17.85% |

| Profitability Ratios | 2020 | 2019 |

| Net Profit/(Loss) | 12,036.00 | 4,702.00 |

| Revenue | 64,215.00 | 44,651.00 |

| Net margin (%) | 18.74% | 10.53% |

The main prospect of profitability analysis is to evaluate the overall income opportunities of the business is to ascertain proper financial activities and marketing development of the organization. Both increases in the operating profit and financial revenue can help in the promotional growth of the business. As believed by Avazov and Maxmudov (2020), a reduction in the total operating profits is considered as one of the main reasons behind the operational growth analysis of the retail organization. The net margin and operating profit of the organization are valued at €`12036 and €17155 for the operational year 2020. However, the increased overall productional growth can be effective in uplifting the promotional objectives of the company.

Liquidity analysis

| Liquidity Ratios | 2021 | 2020 |

| Current Assets | 34,301 | 39,973 |

| Current Liabilities | 27,989 | 25,318 |

| Current Ratio | 1.23 | 1.58 |

| Liquidity Ratios | 2021 | 2020 |

| Current Assets | 34,301.00 | 39,973.00 |

| Inventories | 16549.00 | 13016.00 |

| Current Assets – Inventories | 17,752.00 | 26,957.00 |

| Current Liabilities | 27,989.00 | 25,318.00 |

| Quick Ratio | 0.63 | 1.06 |

Current liabilities of LVMH plc seem to be increased and current assets of the company have been reduced. The total current liabilities of LVMH plc are evaluated as €27989 in the year 2021 and the value of the current liabilities in the year 2020 was €25318. An increase in the total current liabilities of the organization is associated with visualizing its negative impact on current ratio analysis. As believed by Rizki (2019), proper projection of the financial performances is considered as one of the important aspects in determining the marginal activities and evaluating the working capital requirements. Based on the liquidity analysis, it can be viewed that LVMH plc can be able to maintain an adequate capital structure in the last two years.

Gearing and financial structure analysis

| Gearing | 2021 | 2020 |

| Total Debt | 28,832.00 | 25,548.00 |

| Total Equity | 227.00 | 237.00 |

| Debt to Equity Ratio | 127.01 | 107.80 |

| Gearing | 2021 | 2020 |

| Total Debt | 28,832.00 | 25,548.00 |

| Total Assets | 1,25,311 | 1,08,671 |

| Debt Ratio | 0.23 | 0.24 |

| Financial structure | 2021 | 2020 |

| Net income | 12,45,758.00 | 87,89,585.00 |

| Basic weighted average number of shares | 120.00 | 109.00 |

| Earnings per share (£p) | 10,381.32 | 80,638.39 |

| Financial structure | 2021 | 2020 |

| Dividend paid | 47.00 | 60.00 |

| Basic weighted average number of shares | 120.00 | 109.00 |

| Dividend per share (£p) | 0.39 | 0.55 |

According to the financial structure and gearing analysis of LVMH plc, it can be obtained that the debt ratio of the company has been reduced in this period. An increase in the total debt in the last two years is a symbol of increased liabilities of the organization. As narrated by Draženović et al. (2019), expansion of sustainable growth is one of the vital aspects of an organization and it helped in making changes in the business. The total dividend yield has been reduced to €47 billion and which was valued at €60 billion in the previous year. Hence, it can be viewed that the financial leverage of LVMH was not profitable in the last few years.

Conclusion

Based on the cash flow and investment analysis, it can be viewed that the operational profitability of the retail organization seems the be reduced in the last two or three years. Interpretation of the results of liquidity analysis, it can be viewed that the promotional activities and overall marketing approach were not good enough in the last two years of operation. Proper financial structure and gearing analysis it can be pointed out the business organization cannot be able to maintain an adequate debt-equity ratio throughout the years 2020 and 2021 respectively.

Recommendation

- The marketing activities of LVMH plc can be explored in the upcoming years as it can help in the proper usage of €5 billion in its business activities (LVMH Annual report, 2021).

- The adequate working capital structure should need to be maintained in the upcoming years and for this reason, the overall current assets are required to be increased (LVMH Annual report, 2021).

- Overall improvement in the debt structure can be considered as one of the effective solutions for LVMH plc for the upcoming years and the strategies. Thus, it is recommended not to lend a loan of €5 billion to Louis Vuitton as its overall profitability decreased in the last two years (LVMH Annual report, 2021).

Reference list

Abdurrachman, W.A., Arohman, A. and Ruliza, M., 2021. How to Source and Use of Maju Jaya Building Store Funds. Enrichment: Journal of Management, 12(1), pp.639-646.

Abubakari, A.R., Abdulai, M.S. and Adam, A.R., 2022. The Influence of funds on the Organizational Performance of SMEs in the Tamale Metropolis of Ghana. Journal of Entrepreneurship, Business and Economics, 10(1), pp.109-140.

Arbidane, I. and Tarasova, M., 2018, May. ASSESSMENT OF THE IMPACT OF THE EU STRUCTURAL FUNDS ON BUSINESS IN LATVIA. In SOCIETY. INTEGRATION. EDUCATION. Proceedings of the International Scientific Conference (Vol. 6, pp. 15-29).

Avazov, N. and Maxmudov, N., 2020. Investment as a source of financing. Архив научных исследований, (24).

Burkhanov, A., 2020. Econometric Analysis of World Investment Funds Net Assets. Архив научных исследований, (22).

Chua, A.K.P. and Tam, O.K., 2020. The shrouded business of style drift in active mutual funds. Journal of Corporate Finance, 64, p.101667.

Ciriello, R.F., 2021. Tokenized index funds: A blockchain-based concept and a multidisciplinary research framework. International Journal of Information Management, 61, p.102400.

Devi, L.K. and Athma, P., 2020. PERFORMANCE OF EQUITY MUTUAL FUNDS IN INDIA: AN ANALYSIS OF SELECT ASSET MANAGEMENT COMPANIES. International Journal of Management (IJM), 11(12).

Draženović, B.O., Hodžić, S. and Maradin, D., 2019. The Efficiency of Mandatory Pension Funds: Case of Croatia. The South East European Journal of Economics and Business, 14(2), pp.82-94.

Fabregat-Aibar, L., Barberà-Mariné, M.G., Terceño, A. and Pié, L., 2019. A bibliometric and visualization analysis of socially responsible funds. Sustainability, 11(9), p.2526.

Grira, J. and Labidi, C., 2021. Banks, Funds, and risks in islamic finance: Literature & future research avenues. Finance Research Letters, 41, p.101815.

Hidayat, S. and Irwansyah, R., 2021, May. Islamic Banking Third-party Funds Grouping uses the Data Mining Clustering. In Journal of Physics: Conference Series (Vol. 1899, No. 1, p. 012095). IOP Publishing.

Kartikasari, E.D., Hermantono, A. and Mahmudah, A., 2019. Good Corporate Governance, Devidend, Leverage, and Firm Value. International Research Journal of Business Studies, 12(3), pp.301-311.

Kaur, J. and Chaudhary, R., 2021. A Performance Evaluation of Ethical Mutual Funds: Evidence from India. Colombo Business Journal, 12(2).

Kurniawan, G.P., 2021. The Effect of Acceptance and Management of Political Party Funds on the Future of Political in Indonesia. International Journal on Advanced Science, Education, and Religion, 4(2), pp.110-116.

LVMH Annual report, 2020, Annual report and accounts 2020, Available at: https://r.lvmh-static.com/uploads/2021/01/documents-financiers-2020_va_v2.pdf, [Accessed on: 25/01/2022]

LVMH Annual report, 2021, Annual report and accounts 2021, Available at: https://r.lvmh-static.com/uploads/2022/01/financial-documents-december-31-2021.pdf, [Accessed on: 25/01/2022]

Maksymchuk, O., 2019. Local borrowing as a source of capital expenditures of local budgets. World of finance, (2 (59)), pp.98-108.

Neto, A.F.D.C., Klötzle, M.C. and Pinto, A.C.F., 2021. Do Market Conditions Affect the Tracking Efficiency of Exchange-traded Funds? Evidence from Developed and Emerging Markets. Global Business Review, p.09721509211036798.

Nikolaos, K.A., Alexandros, K., Stephanos, P. and Christina, B., 2020. SELECTIVITY AND MARKET TIMING SKILLS IN EMERGING GREEK EQUITY MUTUAL FUNDS DURING THE SOVEREIGN DEBT CRISIS. Studies in Business & Economics, 15(2).

Pisár, P., Ďurčeková, I. and Křápek, M., 2021. Effectiveness of Public Support for Business Innovation from EU Funds: Case Study in Slovakia. Network of Institutes and Schools of Public Administration in Central and Eastern Europe. The NISPAcee Journal of Public Administration and Policy, 14(1), pp.261-283.

Puie, F.R., 2020. The role of European funds in developing and sustaining rural entrepreneurship in Romania. In Proceedings of the International Conference on Business Excellence (Vol. 14, No. 1, pp. 134-148).

R.lvmh-static.com, 2022, financial-documents-december-31-2021, Available at: https://r.lvmh-static.com/uploads/2022/01/financial-documents-december-31-2021.pdf [Accessed 1 February 2022]

Riyaldi, M.H. and Fuadi, T.Z., 2019, November. The The Effectiveness of Zakat Funds towards Mustahik’s Business Development in Banda Aceh (A Study on Baitul Mal Kota Banda Aceh). In International Conference of Zakat (pp. 168-178).

Rizki, D., 2019, November. A Peer-to-Peer Lending Methods in Management of Zakat Funds through Sharia Financial Institutions. In International Conference of Zakat (pp. 25-40).

Roy, S., 2019. Does air quality matter for mutual funds’ tracking errors?: a thesis presented in partial fulfilment of the requirements for the degree of Master of Business Studies in Finance at Massey University, Auckland, New Zealand (Doctoral dissertation, Massey University).

Salihi, S., 2021. THE IMPACT OF BORROWED CAPITAL ON ENTERPRISE PROFIT-THE CASE OF SMALL AND MEDIUM ENTERPRISES IN THE POLOG REGION. International Scientific Journal in Economics, Finance, Business, Marketing, Management and Tourism, 8(15-16), pp.204-214.

Satone, V., Desai, D. and Mehta, D., 2021. Fund2Vec: Mutual Funds Similarity using Graph Learning. arXiv preprint arXiv:2106.12987.

Shukla, N. and Shukla, S., 2021. Comparartive Performance Apraisal of Selected Mutual Funds. ADHYAYAN: A JOURNAL OF MANAGEMENT SCIENCES, 11(01), pp.24-28.

________________________________________________________________________________

Know more about UniqueSubmission’s other writing services: