FINANCE FOR INTERNATIONAL BUSINESS

INVESTMENT APPRAISAL REPORT

i) About Organic Food Industry – Intro:

Globally, We see that the people are becoming more conscious about the health and the people are moving towards Organic Food. The Global Organic Food& Beverage Industry is growing at 15.7% from 2014 to 2019. Currently, the market is expected to be around USD 211 billion. In the Global Organic Food & Beverage Industry, the Organic Fruits and Vegetables is the dominant one with around 35% of the industry size.

The awareness among the people with respect to the health benefits because of the consumption of organic food and the side effects of other items is increasing. The increasing personal disposal income is also a factor which is supporting this change. The people are now focusing more on the organic food for their daily consumption. The definition of Organic food is likely to change between countries, but however the people are moving away from the fruits and vegetables which are grown with insecticides and pesticides. They want the food items which is grown in the natural environment. The marketing efforts put by the organic company is also one of the important factor for the growth of this industry.

- ii) Objective of the Report:

- a) The major objective of the report is to find the financial feasibility to invest in Fresh Farm Foods Co and if so the valuation of the company Fresh Farm at which the Fenland Foods Plc can invest in the company

- b) The second objective is that the Fenland Foods Plc (which is about to invest) is in UK and the Farm Fresh Co is in Ireland. In case of investment, the investment company which is in UK is likely to face the foreign exchange risk. So what are all the alternative ways available to protect the Fenland Foods Plc investment from potential foreign exchange risk.

Short brief about Fenland Foods Plc:

Fenland Foods Plc was founded in the year 1970 and the company was run by the family until 1980. Post 1980, the company was restructured as a limited company and it was enjoying a rapid growth until 1991. Post that the growth stabilized and the company was on a smooth sailing. However, the directors felt that there is good scope in “Quality Organic Food” and they want to capitalize the situation and capture the same. The company to capture the growing market has updated its machinery and premises by raising money through issuing bonds in UK. The company has also raised money through both equity and preference share for its expansion and growth.

Short brief about Fresh Farm Foods Co:

Fresh Farm Foods Co is a family owned venture as of to-date and it has got a chain of retail organic outlets in Ireland. The age of Fresh Farm Foods Co is similar to that of Fenland Foods Plc. The company is one of the well-established player and known for the quality in the market. However currently, the directors feel that the company is matured in the current state. The company feels that they can expand only by establishing links with other European countries and more over the senior members also want to get retired from the business. So they are ready to sell their entire shares to another company.

Analysis:

The finance director of the Fenland’s Food Plc found that the Fresh Farm Foods Co is one of the potential company for their acquisition. Similarly, Fenland would be the right choice for Fresh Farm strategically. Thus the finance director thought that this acquisition would be a win-win situation for both the companies.

iii) P&L projection of Fresh Farm Foods Co by the Finance Director:

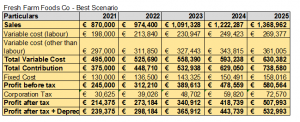

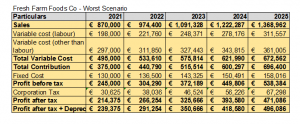

The Finance Director given his assumptions of Fresh Farm Foods Co’s P&L for five years from 2021 to 2025. We has projected the Fresh Farm Food Co’s P&L based on his assumptions. However, in his assumption he has mentioned that the labor cost is likely to grow at 8% and there is also potential for it to grow at 12%. This has made us to project the P&L financials under two scenarios and we have called it as Best Scenario (labor cost growing at 8%) and Worst Scenario (labor cost growth at 12%).

Best Scenario:

Worst Scenario:

- iv) Valuation of Fresh Farm Foods Co:

Computation of WACC:

In the first instance, if we want to work on the feasibility of any investment, we must know what the cost of capital isfor the investing company. If we know the cost of capital, then any project or investment which yields higher rate than the cost of capital can be selected for investment. If the rate of return is lower than the cost of capital then we have to reject the project or investment. In other terms, we can use this cost of capital as a discounting factor to access the viability of the project.

Weighted Average Cost of Capital = Cost of Equity * % of Equity + Cost of Preference * % of Preference + Cost of Debt * % of Debt * (1-tax rate)

Fenlands Capital Structure as of 2019:

| Particulars | Weightage |

| Equity Share Capital | 79% |

| Preference Share Capital | 6% |

| Loans | 15% |

Cost of Preference Shares – 5%

Cost of Debt – 7%

Cost of Equity is (Risk free rate of return+Premium expected for Risk)

Premium expected for Risk = Beta × (market rate of return – Risk free rate of return)

Thus, Cost of Equity =0.25%+1.7*(5.3%-0.25%) = 8.8%

Weighted Average Cost of Capital = Cost of Equity * % of Equity + Cost of Preference * % of Preference + Cost of Debt * % of Debt * (1-tax rate)

WACC = (8.8%*79%) + (5%* 6%) + (7%*15%)*(1-21%)

= 8.08%

Thus, Weighted Average Cost of Capital is 8.08%

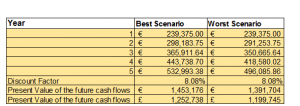

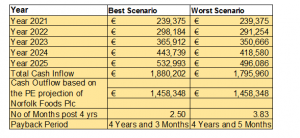

- a) Present Value:

Now, with the available Weighted Average Cost of Capital and with the projections of Fresh Farm Co Ltd, we tend to arrive at the present value of the firm by discount the future cash flows.

The present value of the firm in best case scenario is €1,453,176 and the present value of the firm in worst case scenario is €1,199,745. It means that the lowest value for the Fresh Farm based on the assumption and projection of five years P&L is €1,199,745 and the highest value that can be paid is €1,453,176.

- b) Net Present Value:

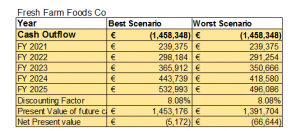

The Net Present Value is a capital budgeting method which helps us to understand as whether the sum of the cash outflow and discounts cash inflows as of today is it positive and if so then the project is viable for the investment. If not then the project is classified as not worth for investment. To perform this Net Present Value, we need cash outflow and we need cash inflows for the project. While we can take the cash inflow from the P&L projections, we compute the cash outflow based on the PE projection of Norfolk Foods Plc.

Cash Outflow: It is stated that the Norfolk Foods Plc is trading at 12 times of the Earnings per share. If we consider the same 12 times as the Price earning multiple for Fresh Farm Plc, then we have to compute the Earnings per share for Fresh Foods. The Profit after tax for Fresh Farm Foods Co. for 2019 is €114,650. Considering a 6% growth in profit after tax, we believe that the company’s 2020 earnings would be € 121,530. With €550,000 as share capital and with €1 as face value for 1 share, the number of shares is 550,000. Hence the Earnings per share is €0.22.

Thus the projected price per share in 2020 is €2.65.

Thus the value of the firm in 2020 is found to be €2.65 * 550,000 = €1,458,348.

As per the above working, the Net Present Value of the firm for the best scenario is marginally negative, which states that the value of the firm at €1,458,348 is higher than the net present value of future cash inflows. It means that the project is not viable at €1,458,348. The project has to be taken at a lower price.

Note: The scenario can also change if the number of years of projected cash inflow is extended for more than five years or if there is any positive change in the assumptions.

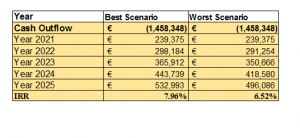

- c) Internal Rate of Return:

The Internal Rate of Return is the capital budgeting method which helps us to know the rate of return for the project. From the below table, we understand that the project is able to earn a rate of 7.96% in the best case scenario. However, the cost of capital is found to be 8.08%. Thus the project is not viable to be taken for investment.

- d) Payback Method:

The Payback method is the capital budgeting method which helps us to understand the period in which the invested money can be taken back from the project. Here, the method does not captures and gives importance for the cash flow and the period. All the cash flows are treated with equal weightage, by this we mean that the cash flow in later stages of the project is more risky than the cash flow in the initial stage.

The payback period for the Best Scenario is found to be 4 years and 3 months and the payback period for the Worst Scenario is found to be 4 years and 5 months.

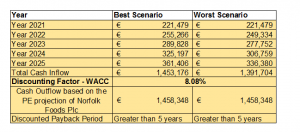

- e) Discount Payback Method:

The discount payback method is the capital budgeting method which is computed by using discounted cash inflows. From the below method, it is evident that the discounted payback period for the project is more than 5 years.

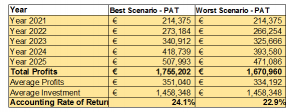

- f) Accounting Rate of Return:

The accounting rate of return is the capital budgeting method which helps us to compute the rate of return purely by using the P&L and balance sheet. This it does not considers any cash flow, discounting or the period for getting back the money.

The Accounting Rate of Return is found to be 24.1% for the project under the best scenario and it is found to be 22.9% under the worst scenario. Thus the project is considered to be a viable one for the investment.

Findings:

- After a careful consideration and working, we have found that the Weighted Average Cost of Capital for Fenland Foods Plc is found to be 8.08%. Thus if there is any project which is likely to pay a higher return can be considered. We also to bring to notice that if there is change in the capital structure, this weighted cost of capital is more likely to change.

- The present value of the Fresh Farm Foods Company Limited is found to be €1,453,176 or£1,252,738..

- The Net Present value of the project considering the cash outflow of € 1,458,348 is found to be (€5,172). It says the project is not viable at € 1,458,348

- The Internal Rate of Return for the project is found to be 7.96% slightly lower that the Weighted Cost of Capital of 8.08%.

- As per the payback period method, the payback period is found to be 4 years and 3 months. And from the discounted payback method, the payback period is found to be more than 5 years.

- From the accounting rate of return capital budgeting method, the rate of return is found to be 24.1%.

Viability of the Project:

We have done all the capital budgeting methods and consolidated view of the project is that it is worth investing at € 1,453,176 as the maximum value and the lowest value is found to be € 1,391,704. Thus the project is worth investing in the band of € 1,391,704 and € 1,453,176.

Financing Options:

Option 1: The Fenland Food Plc can invest the above said amount € 1,453,176 or £1,252,738 as a 100% equity funding

Option 2: The Fenland Food Plc can invest the above said amount € 1,453,176 or £1,252,738 in the below ratio:

50% as equity – € 726,588

And 50% as preference capital for five years – € 726,588.

This helps the company to take back half of the invested amount with dividend in four to five years without any dividend distribution tax.

Options 3: The Fenland Food Plc can invest the above said amount € 1,453,176 or £1,252,738 in the below ratio:

50% as equity – € 726,588

50% as loan for five years – € 726,588.

To infuse this fund, the company instead of bringing money form UK, it provides the security in UK worth £1.5 Million and can get the loan in Euros in Ireland to the extent of € 1,453,176. This borrowed money can be invested is Fresh Farm Foods Ltd as 50% equity and 50% as loan.

The major benefit of this option is that the company has totally hedged its forex exposure. The mother company can get the interest and dividend from Fresh Farm Foods in Euro and it can pay the same amount to the bank.. Once the company repay’s the loan, the amount can be used to close the loan taken by the mother company.

Option 4: The Fenland Food Plc can issue GDR’s in Euro currency to an extent of €1.5 Million. The raised amount can be used to purchase the Fresh Farm Foods Co and there by negating to foreign exchange risk.

Value Creation:

The acquisition between Fenland Foods Plc and Fresh Farm Foods Co is considered to be one of the Win-Win situation for both the playes. The reason being Fenland Foods Plc want to expand its presence across the borders and they want to capitalize on the growing Organic Food Market. On the other hand Fresh Farm Foods Co senior members want to retire and they also want to handover the firm to the company which is well experienced and which has got exposure in other European nations. Thus it create a good synergy and value for both the company’s.

Impact of Foreign Exchange on the Project:

Any company which is expanding its presence across the borders is more likely to face the foreign exchange impact. The mother country’s currency may appreciate or depreciate when compared to the subsidiary’s country.

In case of depreciation, the mother company is likely to receive higher amount for whatever the subsidiary sends back to the home company.

In case of appreciation, the mother company is likely to receive lesser amount for whatever the subsidiary sends back to the home company.

The above is a situation for the movement of cash flow. On the other hand, there is a higher issue in consolidation of books. However, IFRS has laid the clear guidelines in managing the same.

- J) Conclusion:

This assignment has helped as to learn in depth about capital budgeting and about Foreign exchange risk.

Recommendation:

The project is worth investing in the band of € 1,391,704 and € 1,453,176 or £1,199,745 and £1,252,738 at exchange rate of £1 = €1.16.

References

1) RA Brealey, SC Myers, AJ Marcus, 2012, Fundamentals of Corporate Finance

2) H BiermanJr, S Smidt– 2012, The capital budgeting decision: economic analysis of investment projects

3) M Rossi, 2014, Capital budgeting in Europe: confronting theory with practice

4) KA Froot, JC Stein, 2008, A new approach to capital budgeting for financial institutions

5) S Gervais, JB Heaton, T Odean, 2011, Overconfidence, compensation contracts, and capital budgeting

6) RL McDonald, 2006, The Role of Real Options in Capital Budgeting: Theory and Practice

7) K Bennouna, GG Meredith, T Marchant, 2010, Improved capital budgeting decision making: evidence from Canada

8) RA Brealey, SC Myers, AJ Marcus, 2012, Fundamentals of corporate finance

9) MR Clayman, MS Fridson, GH Troughton– 2012,Corporate finance: a practical approach

10) SA Ross – 2011, Corporate finance: Core principles and applications