Financial Insights and Business Intelligence Assignment Sample

Introduction

This assignment is based on suggestions to Rio Tinto to solve their financial, investment as well as operations that may arise due to renovation of the whole industry. Rio Tinto has developed a business development plan for implementing new technology as well as expanding business in more locations. The company is proposing a capital for renovation of an organisation of $100 million and using their capital from different financial resources such as bank loans. Further organisation is required to acquire capital in different business development processes. Thus this assignment assists organisations to develop a strategy for investment as well as operating activities after the renovation process. This study paper is suggestion and conclusion based that is given an overview of different steps before implementation in organisation.

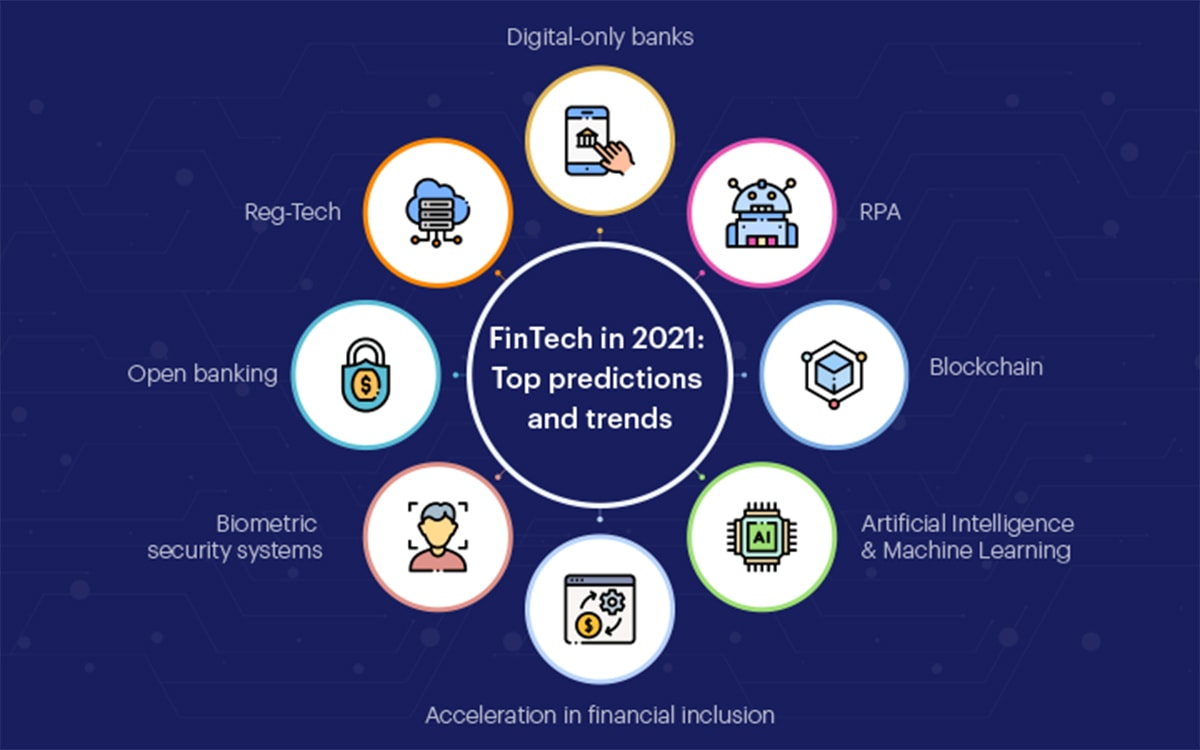

FinTech solutions for organisation’s financing

Any organisation wants to improve financial performance and growth continuously. Nevertheless, organisations are required to develop strategic financial plans that assist businesses to meet their financial needs. In this context, Rio Tinto is the 2nd largest mining industry and operates business in 35 countries. Now the organisation is deciding to improve business more through proposed capital of $100 million (Riotinto.com, 2020). As copied by Jamil and Seman (2019), this is the main problem of the organisation to acquire this proposed capital and collection process of financial support. Thus the organisation should consider these suggestions below and develop a plan for acquiring proposed capital without any critical problem.

Digital wallet and payment process: digital wallet is a digital financial account that is not linked with any bank and operates with the support of digital gadgets without taking approval of banking organisations. As argued by Kandpal and Mehrotra (2019), this payment process is too effective and a time saver for business organisations and stakeholders of business organisations as operating from anywhere weighs in little time. Thus Rio Tinto should consider this payment process in business for developing a better “digital credit score” and take assistance from different financial institutes as well as stakeholders. As a result, any shareholder who is willing to invest in a business can easily invest in a business through digital payment.

Figure 1: FinTech solutions

Peer to peer: this concept is to assist business organisations to allocate share and organisation bonds in digital mode in different share markets as well as to financial institutes to acquire massive capital. Rio Tinto required 100 million of capital for renovation of different product plans as well as milling plants. As opined by Saba and Kouser (2019), this organisation is required to implement digital culture in business and perform financial activities with support of digital wallets for better performance. This process is to make an easy investment process of Rio Tinto that is needed for better actual operation in the organisation. Thus an effective fintech solution that is considered by different business organisations for satisfying financial requirements. Shareholders are the main financial resource and businesses may have low risks and financial costs while acquiring capital from equity shares. Shareholders and different stakeholders are focused on analysing the organisation’s profitability before purchasing the equity share of that organisation. Here organisations have better financial performance and efficiency. That supports Rio Tinto to attract shareholders to make investments in business organisations.

Use credit score: credit score refers to the faith of different financial institutes and stakeholders in a business organisation. Besides, credit scores also indicate an organisation’s financial stability and performance. Rio Tinto has a credit score of A in “long term rating” and A-1 in short term rating. Thus the organisation should focus on implementing a digital payment process to develop this credit score more. As opined by Mehrban et al. (2020), further, Rio Tinto may use that credit score to take loans from different financial institutes such as investment banks. Now in the current situation in business may be improved credit scores through performing large numbers of digital transactions.

Small ticket loans: small-ticket loans refer to those business loans that are taken for a short term financial problem. Here Rio Tinto is required to focus on raising business capital considering small loans from different pivotal financial investors. As stated by Ali and Abdullah (2019), as a result, there are low risks in const in business organisations and salted loans in different small instalments. Different financial institutes identify financial requirements of any business through implementing the “BNPL offerings method”.

There are main fintech solutions that should be considered to fulfil the needs of 100 million capital. Rio Tinto has several benefits while implementing these strategies in business/ the first benefit is that companies can save their management time and implement that time in other financial processes of the organisation. Besides, the organisation’s debt-equity and profitability ratio are better and the company may make payment loans.

FinTech solutions for investing decisions

Investment is a significant factor in the business development practice of a business organisation. Rio Tinto has a proposed capital of 100 million to acquire new technology plans for performing operating as well as other business activities without facing critical problems. As argued by Lee and Shin (2018), Rio Tinto should be considered a fintech investment solution for developing a better organisation infrastructure that assists businesses to meet their investment goal and better “return on investment”. Sufficient return is an important factor while a business and stakeholder is going to invest.

Investment opportunities: Rio Tinto wants to invest nearly 100 million in the purchase of new machinery as well as renovation of old plants and machinery. Rio Tinto should be considered a better investment opportunity for raising capital as well as investment. As argued by Mention, (2019), here investment opportunity refers to Rio Tinto must be invested in the right business location as well as in the required financial ratio. As the company is mining, thus the organisation requires massive manpower as well as natural resources. Thus Rio Tinto should be an identity and a new mining location with high natural resources for the milking process. As an organisation, it fails to perform other business practices without having sufficient iron and other mining resources.

Best resource: There are different types of financial resources that support businesses to meet financial needs. Nevertheless, Rio Tinto needs to select low risks and cost financial resources. As argued by DANG and VU (2020), equity share is a better financial resource as compared with other financial resources such as dividend bonds. Rio Tinto is the 2nd largest mining and metal production industry in the world. Thus the company must select share capital first instead of other financial resources. These steps should be considered by Rio Tinto to collect capital from different financial resources. Besides, organisations may select other financial resources while failing to meet financial needs from the share market. Nevertheless, the priority must be shared capital.

Digital machine learning: digital organisation culture is too much implemented by different business industries to perform operating and other business activities. As opined by Todd and Seay, (2020), digital culture refers to putting detailed technology in the operating process of an organisation with manpower. Rio Tinto has spent nearly $50 million on the renovation of the organisation and $10 million on the research and development processes in the organisation. Thus Rio Tinto should invest that amount for the acquisition of the latest technology as well as the digital production line. Further, companies should consider robots and artificial intelligence to implement in business and make an investment for this purpose also.

Big data: big data is an investment technique that consists of the analysis of different past investment activities of an organisation. Rio Tinto has a better financial infrastructure and growth rate. Thus organisations need to consider investment decisions and return on that investment for developing investment decisions and making investments. As stated by Moccia and García (2021), the organisation’s ROI ratio is 0.455539671 that indicates that organisations have an effective investment return. On the other hand, Rio Tinto must be considered the NPV and the payback period of proposed capital for developing an investment strategy. As a result, the organisation may successfully implement an investment policy in the organisation.

FinTech solutions for operating decisions

Fintech solution is the best strategy for any business while taking division for business improvement and investment. Any business operates with the support of different stakeholders such as employees and suppliers. Rio Tinto operates business throughout the whole world thus business organisations need to have an effective operating system having digital operating culture as well as efficient employees. As stated by Lee and Shin (2018), operating costs affect the profitability of the organisation and the price of the final product. Rio Tinto should be considered with the latest technology and an effective production line so that the operating process is performed effectively at a low operating cost. That is to assist Rio Tinto to develop a competitive advantage in the global mining business. The company should consider the below fintech solutions to improve the efficiency of operating systems.

Assets management: assets management refers to managing purchase and depreciation process of an organisation. Assets are mainly plants and machinery of any business organisation that assist manufacturing and other operating processes of the organisation. Rio Tinto is expressly willing to invest 40 million for purchase of the latest machinery and technology. As opined by Mărăcine and Voican (2020), thus organisations need to be considered well-managed assets management in organisations that have properly observed operating functions of assets. As a result, Rio Tinto may be able to improve the efficiency of machinery as well as production quality. Besides, management must be considered a suitable depreciation rate thus the organisation improves profitability as well as reduces the operating cost of the organisation.

Figure 2: Fintech solution

Training and development: Training and development is also a prime solution of fintech strategy. Rio Tinto has the latest machinery and technology thus it is important for organisations to make available training on the latest technology to improve the efficiency of employees as well as to manage the operating process of the organisation. As opined by Moccia and García (2021), it is most important for an organisation to provide training to employees for improving performance and efficiency. On the other hand, a development programme assists employees to improve their working efficiency and perform work smartly. As the organisation is acquire latest technology thus development program must be provided by Rio Tinto so that they understand smart work practice as well as handle machines efficiently and take more care of machine. As a result, the performance of machines and employees are automatically improved, which is required for a better digital operating system of a company.

Digital supply chain: supply chain exists in any business and without its performance of business does not exist. Nevertheless, the performance of an organisation is related to the performance of the supply chain of the organisation. Rio Tinto is a mining organisation and acquires natural resources from different countries for the production of iron as well as other metals for sale in the global metal market. As argued by Mărăcine and Voican (2020), it is required to implement digital assistance and gadgets in the supply chain in order to make a “digital supply chain”. As a result, Rio Tinto performed their supply of manufactured metal to different markets and consumers. On the other hand, the latest supply chain may also assist businesses to purchase raw materials from anywhere where organisations get them at low rates.

Conclusion

Throughout the preparation of this assignment and previous assignment on this topic, Rio Tinto had a business exploration plan and for this organisation proposed capital for $100 milking and invested it for three projects such as acquisition of new plans and machinery as well as renovation and research and development process. Thus Rio Tinto has different types of financial and investment problems. This study paper assists companies to develop solutions to those problems as well as improving operating performance. Rio Tinto should be considered the prescribed strategy for sole their future problem while organisation have investment as well as aeries financial support from a different resource.

Reference

Journals

Ali, H., Abdullah, R. and Zaini, M.Z., 2019. Fintech and its potential impact on Islamic banking and finance industry: A case study of Brunei Darussalam and Malaysia. International Journal of Islamic Economics and Finance (IJIEF), 2(1), pp.73-108. Available at: http://journal.umy.ac.id/index.php/ijief/article/download/6364/4433

DANG, T.T. and VU, H.Q., 2020. Fintech in Microfinance: a new direction for Microfinance institutions in Vietnam. The Journal of Business Economics and Environmental Studies, 10(3), pp.13-22. Available at: https://www.koreascience.or.kr/article/JAKO202021961381654.pdf

Jamil, N.N. and Seman, J.A., 2019. The impact of fintech on the sustainability of Islamic accounting and finance education in Malaysia. Journal of Islamic, Social, Economics and Development (JISED), 4(17), pp.74-88. Available at: https://www.researchgate.net/profile/Nurul-Jamil-6/publication/332440091_The_Impact_of_Fintech_On_The_Sustainability_Of_Islamic_Accounting_And_Finance_Education_In_Malaysia/links/5cb56778299bf12097684d48/The-Impact-of-Fintech-On-The-Sustainability-Of-Islamic-Accounting-And-Finance-Education-In-Malaysia.pdf

Kandpal, V. and Mehrotra, R., 2019. Financial inclusion: The role of Fintech and digital financial services in India. Indian Journal of Economics & Business, 19(1), pp.85-93. Available at: https://www.researchgate.net/profile/Dr-Vinay-Kandpal/publication/337168283_FINANCIAL_INCLUSION_THE_ROLE_OF_FINTECH_AND_DIGITAL_FINANCIAL_SERVICES_IN_INDIA/links/5dc98805299bf1a47b2f9788/FINANCIAL-INCLUSION-THE-ROLE-OF-FINTECH-AND-DIGITAL-FINANCIAL-SERVICES-IN-INDIA.pdf

Lee, I. and Shin, Y.J., 2018. Fintech: Ecosystem, business models, investment decisions, and challenges. Business horizons, 61(1), pp.35-46. Available at: https://www.academia.edu/download/60183957/BH865-PDF-ENG__Fintech__Ecosystem__business_models_20190801-95998-19ksrtq.pdf

Lee, I. and Shin, Y.J., 2018. Fintech: Ecosystem, business models, investment decisions, and challenges. Business horizons, 61(1), pp.35-46. Available at: https://www.academia.edu/download/60183957/BH865-PDF-ENG__Fintech__Ecosystem__business_models_20190801-95998-19ksrtq.pdf

Mărăcine, V., Voican, O. and Scarlat, E., 2020. The digital transformation and disruption in business models of the banks under the impact of FinTech and BigTech. In Proceedings of the International Conference on Business Excellence (Vol. 14, No. 1, pp. 294-305). Available at: https://sciendo.com/pdf/10.2478/picbe-2020-0028

Mehrban, S., Nadeem, M.W., Hussain, M., Ahmed, M.M., Hakeem, O., Saqib, S., Kiah, M.M., Abbas, F., Hassan, M. and Khan, M.A., 2020. Towards secure FinTech: A survey, taxonomy, and open research challenges. IEEE Access, 8, pp.23391-23406. Available at: https://ieeexplore.ieee.org/iel7/6287639/8948470/08976098.pdf

Mention, A.L., 2019. The future of fintech. Research-Technology Management, 62(4), pp.59-63. Available at: https://www.tandfonline.com/doi/pdf/10.1080/08956308.2019.1613123

Moccia, S., García, M.R. and Tomic, I., 2021. Fintech strategy: e-reputation. International Journal of Intellectual Property Management, 11(1), pp.38-53. Available at: https://roderic.uv.es/bitstream/handle/10550/79424/145681.pdf?sequence=1

Saba, I., Kouser, R. and Chaudhry, I.S., 2019. FinTech and Islamic Finance-Challenges and Opportunities. Review of Economics and Development Studies, 5(4), pp.581-890. Available at: http://reads.spcrd.org/index.php/reads/article/download/148/141

Todd, T.M. and Seay, M.C., 2020. Financial attributes, financial behaviors, financial‐advisor‐use beliefs, and investing characteristics associated with having used a robo‐advisor. Financial Planning Review, 3(3), p.e1104. Available at: https://onlinelibrary.wiley.com/doi/pdf/10.1002/cfp2.1104

Websites

Riotinto.com, 2020 annual report Available at: https://www.riotinto.com/-/media/Content/Documents/Invest/Reports/Annual-reports/RT-Annual-report-2020.pdf?rev=6df52113b92840648d05a4ac9e4cc1d8 [Accessed on 11november 2021]

………………………………………………………………………………………………………………………..

Know more about UniqueSubmission’s other writing services: