HI5020 Corporate Accounting Assignment Sample

Here’s the best sample of HI5020 Corporate Accounting Assignment, written by the expert.

Executive summary

This report is prepared on “Century 21” one of the reputed medium sized companies operating in Australia. The report examines the accounting standards and processes followed in a real estate business house. Relevant business related information about the “Century 21” is being collected through the annual report presented by the company. The company was formed in the year 1994, and since then has taken up new projects for the benefit of the community members and the commercial property seekers. “Century 21” increased the equity value in the year 2015 to undertake new projects and to accomplish the requirements of the new works. However, the exact value of the equity and the way or process that it was raised was not communicated to the AIMS security funds. The other problem was with the recording and reporting of the cash flow for the “Century 21” that was not reported by the company to the AIMS security fund from 2014.Taxable amount that were paid by the company was not regulated, which affected the reliability of the real estate firm.

Introduction

A reliable, transparent, and feasible accounting standards and practices had to be followed by the companies to communicate the financial performances to the external and internal stakeholders. Corporate accounting standards needs the companies to strictly follow the practices and accounting policies included in the AS process. This report examines the financial information and the accounting practices followed in “Century 21.” The company’s driven by “customer service culture” that enabled the managers to adopt evolutionary processes to conduct the business activities.

Customer expectations and orientation programs are concentrated by the management in order to sustain the competition. “Century 21” is a real estate development and investment company that develops own properties, buys and sells the property, and offer other types of customer services. Data centres of the company handles high volume of the business and customer information to introduce a re-developmental program needed for the company (Seidman and Stomberg, 2011).

Funds raised by the companies are used to improve the developmental programs and strategies to handle the commercial and the non-commercial customers. The business agenda is to provide positive returns to the investors that also analyse the cash flow distribution process to increase the capital growth. Investments are made on the assets, and funds raised are used to handle the customer requirements. Regular information on the competitors offer and services are collected so as to make the relevant changes in the operational works.

Century 21 offers mortgage, property buying and selling services and property developmental services to the clients. Capital growth recorded was around 18% for the year 2017-18. The capital investment recorded for the first quarter of 2018 for “Century 21” was $51,486,916. It has been listed in the ASX market in Australia. This report analyse the calculations and the treatment followed for the income taxation process.

Owners’ equity

Equity and changes in the equity value

Equity for a company reflects the ability of the management to make the useful business decisions and introduce plans to undertake new projects. Century 21 raises funds through direct share issues to the stakeholders and general public.

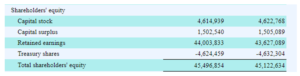

The details of the equity value for Century 21 is presented below –

The equity values for the company are being presented for the year 2016-17.

The table above reflects the change in the equity rates for the company. Capital stock and retained earnings for Century 21 increased from $45,122,634 to $45,496,854 in the year 2016-17. It can be stated that the equity rate for the company had increased, due to the increase in the retained earnings. The growth was estimated to be around 15% of the total value. With an increase in the capital funds, the company could plan to increase the value of the operational works and implement the changes in the operational tasks to provide the better services to the customers. With additional funds, the management planned to explore different investment options that would improve the business activities (Robinson et al., 2012).

In the AIMS property securities fund, the company had failed to report about the changes in the financial statements and the equity values. The asset value for the company was attributed to the unit-holders that were recognised under the mobility included in the session of AASB132. This law defines the details about the financial instruments that were used to examine the requirements to change the operational works.

Comparative evaluation of debt and equity positions

A comparison of the deb equity position for the companies are presented in the table below –

| Century 21 | AIMS property | |

| Debt ratio | 43435770 | Not available |

| Equity | 47,848,454 | Not given |

| Debt/equity | 0.09 |

The table details above states that the Century 21 utilises more equity funds to improve its capital structure like the debt increase and improve the creditworthiness to handle the future challenges. Based on the information a proper contingency plan is prepared to deal with the operational challenges and in increasing the business conduct. The managers also process low debt-equity ratio is used to analyse the risks. It was found that the risks for the external investors were high. The company had adopted a better investment options to analyse the shareholders equity needed to conduct the business activities. AIMS do have detailed lists on the non-current liability held by the company. It also doesn’t mention the details, about the equity changes in the accounting statements (Zehi, Khani, 2010).

Cash flow details

Details included in the cash flow statements

The annual report of Century 21 and AIMS company, the below mentioned points can be associated with the cash-flow statements

- Distributions – The distribution aspects are checked to understand the allocating of the capital gains, losses, and income generated by the company in the previous financial year.

- Interest – The total amount of the interest value earned by the company during the financial year but not recorded in the books are included in this aspect.

- Net cash-inflows arising from the operational activities – The cash in-flow statement analyse the operational activities that balances between the cash in-flow and the out-flow statements. The key operational activities associated with the product buying and selling of the goods and services are examined.

- Net cash-flows from investing activities – The balance of the cash in-flows and out-flows from the investments made are examined.

- Distributions paid – The distribution process for the interest paid and dividend incurred by the company are examined from the stakeholder’s point of view on a regular basis.

- Net cash-flows – A proper balance of the total cash in-flows and out-flows are analysed from the type of the financial decisions made by the company.

- Net increase or decrease in the cash equivalents – any increase or decrease in the cash equivalents from the beginning of the financial year (Richardson et al., 2014).

An increase in the cash flow and equivalent was recorded to be around $15, 45,380 in the year 2017. The annual report of Century 21 the overall increase in the cash flow was examined from the operational activities, which increased due to the receipts made by the company. Payments made to the employees and suppliers after considering the GST increased and this reduced the net cash in-flows from the operational activities. There were no major cash flows made due to the investing activities as the company didn’t make any investment decisions. The cash flow also increased due to an improvement in the distributor’s payment. There was an increase in the cash equivalent to $45,496,854.

Cash flows recorded for AIMS security had drastically reduced for the year 2015-16. The company had introduced a change in the operational works, investment strategies, and in the financial activities including the cash-flow. There was a reduction in the net cash-flow that was recorded for the operational activities. The expenses paid along with the management charges had increased. The net cash flow incurred by the company from various investing activities had dropped by 10% in the year 2017. There was a growth in the investment activities as well for the company. The company also witnessed a decrease in the cash equivalent process that affected the business activities.

Analysis of the broad categories of the cash-flows

The details, about the broad categories for both the companies are included in the table below –

| Century 21 | Amount in $000 | ||

| 2017 | 2016 | 2015 | |

| Operational works | 14500 | 13500 | 11500 |

| investing activities | |||

| Financial activities conducted by the company | (13040) | (12150) | (10,250) |

| AIMS security | Amount in $000 | ||

| Operational works | 2500 | 3500 | 3400 |

| investing activities | (11750) | 13440 | (19,083) |

| Financial activities conducted by the company | (3,748) | (2,588) | (3500) |

Analysis of the companies

From the table above, the increase in the cash flow and the operational expenses in Century 21has been examined at the same time. It can be seen that the security value of the Century 21 had drastically affected the investment strategies and policies that were developed for the company. There has been a change or fluctuations in the investment amount and this was due to the change in the cash flow that occurred from the financial activities that increased in the year 2016. In AIMS the financial activities for the company had also increased for the previous financial year (Price et al., 2011).

Comprehensive analysis of the income statement

Items reported

The annual report for both the companies was examined to understand the income and the expense statements. Other details that were collected from the accounting statements were about the capital losses, GAAP, IFRS and others. Additional funds were raised from the sales of the securities, foreign exchange transactions, and others. The company can invest in the share values and bonds, where the bond value change is analysed through the change in the income statement (Hanlon, Heitzman, 2010).

The income raised through the unrealised holdings of the funds, foreign currency transactions, implementation of the pension plan, and others are included in the income statement for the company. Some of the financial details included in the Century 21 company were –

- Asset re-valuation value and reserve value

- Cash flow hedge-reserves

- Analysing the undistributed income

Analysis of these items for not being recorded in the income statement

The items that have been not reported in the financial profit and loss statement for the financial year were analysed. It was found that the income, expenses, losses and gains that were not realised by the company for the financial year was not included in the report. There was no direct impact for not including these details in the books of account for the existing financial year.

Profit attributed due to the inclusion of these items in the income statement

In case these items are included in the profit and loss statement of the company, then the statement would have slight variations. However, it would not have any major impact in the profit attributed to the stakeholders of the firm. The overall comprehensive value of the profit and loss statement is not included in the profit collection for the attributable to the shareholders (Huseynov, Klamm, 2012).

Does the company need a comprehensive income to be included in the performance evaluation process?

The company could use the comprehensive income statement to examine the manager’s performance in the organisation. With the comprehensive income and sales statement the relevant details about the company performances are shared with the clients and the stakeholders. Such processes affect the decisions made by the investors of the accounting process. Investors are interested in analysing the income statement and other comprehensive statements that provides detailed information about the performances (Lanis, Richardson, 2011).

Corporate income tax

Taxes are paid by the companies deduced from the total profit that is being earned after paying the tax amount. The tax value is applicable to the companies in accordance to the corporate law and policies. A flat tax rate of 30% is applicable to the companies operating in Australia. Century 21 has paid a total tax of $ 1,121,951for the financial year 2017. There was no tax income that was earned by the company for the previous accounting year.

The tax amount is calculated through the group allocation process, where the deals of the amount are clearly mentioned. There were no specific tax expenses that were paid by the company for the financial year by Century 21.

Company tax rates

The “Century 21” is one of the better service providers in Australia and listed with the stock exchange. The company paid the stated tax rate, and declares the income and the expenses in the stated manner. A flat 30% of the tax amount is paid by the company for the income earned during the previous financial year. For the AIMS the tax rates cannot be determined by the company as it is no liable to pay any tax rates on the once earned during the previous financial year. The taxable income and gains are distributed among the unit-holders (Mehrani, Seyyedi, 2014).

Deferred tax rates included in the balance sheet

In the deferred tax calculation process the company has to maintain a proper book-keeping process to record the business information. Deferred tax values is occurred by the company, where the management has paid advance tax. The deferred tax values or the assets are the tax value that has been overpaid by the company. Process followed to record the information is quite similar to the deferred tax asset valuation process. In case of the deferred tax liability the liabilities are properly recorded in the balance sheet. The income tax calculated on the profit and loss earned for the previous year is associated with the differences between the tax paid of the assets and liabilities incurred by the company.

In case of the deferred tax asset value, the future taxable amount is compared against the usage of the total assets. Deferred assets and business liabilities are recorded in the books of accounts and it is valued at the stated tax rates. The amount calculated for this is $14, 000 for the previous year. Balance sheet of APSF had equal rights as compared to the ordinary in its recorded by the company. There are no proper processes followed to analyse the participation of the company in vaulting the deferred payment and the distribution units (Pourheydari, Amininia, 2014).

Deferred tax asset values for the companies

The financial statement for both the companies was examined to evaluate the performances and localities of the company. There was no increase or decrease in deferred tax asset and liability valuation process. The company also experienced no change in the different units for the AIMS security process.

Valuation of the cast tax values for the companies

Taxable value for the Century 21 stated that details of the profit and loss statement incurred for the previous financial year. The taxable amount as $451457 for the previous financial year which was calculated after deducting 30% tax amount. Financial reports for the company were stored in the funds or reserves and there were no cash tax values. The changes in the deferred tax values and the liability were determined at the time of calculating the tax amount. For this, it was relevant for the company to include the relevant information in the books of accounts.

Valuation of the cash tax rate

The calculation process of the cash tax value for the company, the company considers two different types of approaches. Simplified and advanced approach is the methods adopted by the companies to analyse the tax values. In simplified process, the actual tax values and expenses are valued at the book value by the company. Advance approach needs the company to make the relevant adjustments, above paying the tax amount. The amount to be recorded in the books of accounts is directly taken from the income statement, and the changes recorded in the deferred taxes are valued by the companies. The net cash and income are included in the calculation process (Armstrong, et al., 2015).

The income tax is calculated in accordance to the values that are included in the books of accounts for the financial year. AIMS had a higher profit rate, as there was no tax paid by the company.

Differences in the cash tax rates and book-value rates

Cash as rate and the book tax rate are different from each other, as it is recorded in the accurate manner. The information recorded at the book value and it includes the income earned by the company for the previous financial year. The cash tax rates are included in the taxation income value. In the book value tax calculate process, the total tax amount and the cash tax value includes the valuation of the calculation of the total tax rates (Chen et al., 2010)

Conclusion

The discussion conducted above analyses the equity amount for the Century 21 company. It was realised that the amount increased in the previous financial year. AIMS had not fund reported for the equity value and it is recorded and included in the books of account. There was an increase in the cash in-flow for the Century 21 however; there was a decline in the cash flow for the company. The inferred value is included in the tax treatment process which is conducted to find the value as per different situations. Tax treatment processes for both the companies differed from each other, and it was accurately presented in the books of account. The discussion also states that the income tax to be paid by the company is a liability. Tax treatment process includes analysing the asset and the liability values that would be included in the valuation process. The tax rate value is examined, and the right process is followed to record the information in the books of accounts.

References

Armstrong, C.S., Blouin, J.L., Jagolinzer, A.D., Larcker, D.F. (2015), Corporate governance, incentives, and tax avoidance. Journal of Accounting and Economics, 60(1), 1-17

Chen, S., Chen, X., Cheng, Q., Shevlin, T. (2010), Are family firms more tax aggressive than non-family firms? Journal of Financial Economics, 95(1), 41-61

Hanlon, M., Heitzman, S. (2010), A review of tax research. Journal of Accounting and Economics, 50(2), 127-178.

Huseynov, F., Klamm, B.K. (2012), Tax avoidance, tax management and corporate social responsibility. Journal of Corporate Finance, 18(4), 804-827

Lanis, R., Richardson, G. (2011), The effect of board of director composition on corporate tax aggressiveness. Journal of Accounting and Public Policy, 30(1), 50-70.

Mehrani, S., Seyyedi, S.J. (2014), Investigating the relationship between tax avoidance and tax differences in companies listed on the Tehran stock exchange. Accounting and Auditing Research, 6, 50-75.

Pourheydari, A., Amininia, M. (2014), Investigating the effect of tax avoidance on the cost of share capital, by taking growth opportunities and institutional ownership into account. Journal of Scientific Studies, 3, 173-195.

Price, R., F. J. Román, and B. Rountree.(2011). The impact of governance reform on performance and transparency. Journal of Financial Economics 99 (1), 76-96.

Richardson, G., Lanis, R., Leung, S.C.M. (2014), Corporate tax aggressiveness, outside directors, and debt policy: An empirical analysis. Journal of Corporate Finance, 25, 107-121.

Robinson, J.R., Y. Xue, and M.H. Zhang. (2012). Tax planning and financial expertise in the audit committee. Unpublished working paper.Zehi, T., Khani, M. (2010), Investigating factors affecting tax evasion (A case study of East Azerbaijan province). Tax Bulletin, 9, 25-60

Know more about UniqueSubmission’s other writing services:

Its like you read my mind You appear to know a lot about this like you wrote the book in it or something I think that you could do with some pics to drive the message home a little bit but instead of that this is fantastic blog An excellent read I will certainly be back