Impact of BREXIT at London housing market

Brexit (Bretain and Exit) is a common term which is used for the United Kingdom’s withdrawal from the European Union (EU). BREXIT has taken place in the year of 2016 with the majority consensus through the vote regarding leaving the European Union (Ambrose, Eichholtz, & Lindenthal, 2013).

The decision of exit of UK from the European Union has highly impacted the London housing market. BREXIT has highly affected the market as it has created the situation of uncertainty.

Due to this uncertainty the investment on housing market from the local consumers have decreased as housing needs huge investment as well as due to uncertainty risk found in the market so people prefer to save the money instead of investing the money.

Simultaneously, due to BREXIT, there is risk found by the foreign investors in the London housing market which has decreased the chances of foreign investment too and directly impacted the London market. BREXIT has created the scenario of uncertainty in this market.

From the survey, it is identified that due to this

referendum, there is huge fall taken place in investing trend of the Londoners in housing market.

There is huge fall has taken place regarding the number of people who have shown interest in this sector. In this context, Ritchie, et al. (2014) identified that according to the figures of HM Revenue & Customs, the London housing transactions has decreased by 9% in the second half of 2016.

At the same time, Beatty, & Fothergill (2014) depicted that the uncertainty in the London market has decreased the trust of the people from the London market which has inversely impacted the foreign trade

Changes in Demand

(Source: Soderbery, 2015)

From the above diagram, it can identified that in the year 2014, the housing demand of London market was extended from D to D1, however, after the BREXIT in the year 2016, London is facing the issue of decrease market demand in housing market which can be seen through D2 (Soderbery, 2015).

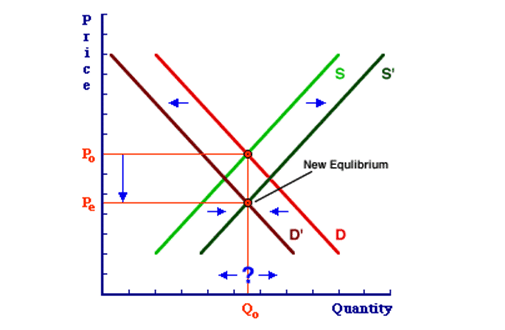

Demand Supply Curve of London Housing Market after BREXIT

(Source: Lloret, et al., 2015)

From the above graph, it can be identified that the demand of the London housing market has decreased D to D’ (Lloret, et al., 2015). Due to this decreased demand, price of the housing was decreased from P0 to Pe. On the other hand supply of the housing has increased from s to S’.

In this context, Ahlfeldt, & Kavetsos (2014) depicted that it is identified that in the year 2014, London housing market was at boom and the pricing analysts have analyzed that at that time there was the high pricing strategy used by the housing firms and the country experiencing a housing price boom.

However in the contrary, BREXIT has created uncertainty in the market due to which the housing price is driving down and showing negative growth. At present, London housing market is facing the issue of low pricing which was faced by the country in the year of 2013 due to recession.

Zhao, et al. (2013) stated that buyers have perceptions that the price will decrease more in the upcoming year due to which they are keeping hold on the purchase of housing and in the year 2016, firm growth remained at 5.6 per cent.

In the views of Jadidzadeh, & Serletis (2017), due to decrease in pricing, in the upcoming year the investment in housing will increase as the people who are living at a rented home will prefer to buy home on loan so that they can pay the amount of house through easy installment rather than giving the rental.

However, due to uncertainty in the market, it is assumed that after the year 2017 slowly and gradually London housing market will start growing. Moreover, it is assumed that this growth will not so high. According the assumptions of the marketers, it is identified that this hike will be approx, 9.8%.

Figure 2: Average London house price – annual % change

(Source: Kachmazov, G. (2017)

From the above table, it can be identified that in the year 2014, the housing price of London housing was on hike, however after that it has shown decline. Moreover, from the year 2016, it has shown huge decline and the housing market has shown drastically change.

At the same time, it is expected that in the year 2019, the housing market will increase to grow again (Kachmazov, 2017). However, the graph is not showing adequate hike in the London housing market as foreign investors not become able to trust on the London market due to which majorly domestic sales will take place in the market. The major reason found behind it is the UK’s decision to exit the European Union on the London housing market.

Due to this decreased price, London people will become able to purchase their own home due to which most of the population of Londoners have their own home. In like manner, Cashin, et al. (2014) determined that due to this devaluation of the London housing market, Londoners will start buying home more than their need which will decrease the chances of foreign investment and it will directly impact the GDP of the London as real estate industry plays vital role in country economy.

However, there is a need of upward pressure on house prices over the year 2017 and 2018 to make the country come up from the weaker economic growth and the situation of greater pressure on household finances.

References

Ahlfeldt, G. M., & Kavetsos, G. (2014). Form or function?: the effect of new sports stadia on property prices in London. Journal of the Royal Statistical Society: series A (statistics in society), 177(1), 169-190.

Ahlfeldt, G. M., & Kavetsos, G. (2014). Form or function?: the effect of new sports stadia on property prices in London. Journal of the Royal Statistical Society: series A (statistics in society), 177(1), 169-190.

Ambrose, B. W., Eichholtz, P., & Lindenthal, T. (2013). House prices and fundamentals: 355 years of evidence. Journal of Money, Credit and Banking, 45(2‐3), 477-491.

Beatty, C., & Fothergill, S. (2014). The local and regional impact of the UK’s welfare reforms. Cambridge Journal of Regions, Economy and Society, 7(1), 63-79.

Cashin, P., Mohaddes, K., Raissi, M., & Raissi, M. (2014). The differential effects of oil demand and supply shocks on the global economy. Energy Economics, 44, 113-134.

Jadidzadeh, A., & Serletis, A. (2017). How does the US natural gas market react to demand and supply shocks in the crude oil market?. Energy Economics, 63, 66-74.

Kachmazov, G. (2017). How will Brexit really affect Britain’s property market? SARAH DAVIDSON crunches the numbers behind house prices and forecasts. [Online] available at: http://www.thisismoney.co.uk/money/mortgageshome/article-4360258/How-Brexit-really-affect-Britain-s-housing-market.html (Accessed at: 25 May 2017).

Lloret, E. J. A. V., Abarle, R. B., Pantaleon, R. P., Valdez, E. M., & Vinluan, A. A. (2015). Development of Computer based Law of Supply and Demand Simulator. Development, 3(3).

Ratcliffe, A., & von Hinke Kessler Scholder, S. (2015). The london bombings and racial prejudice: Evidence from the housing and labor market. Economic Inquiry, 53(1), 276-293.

Ritchie, B. W., Crotts, J. C., Zehrer, A., & Volsky, G. T. (2014). Understanding the effects of a tourism crisis: the impact of the BP oil spill on regional lodging demand. Journal of Travel Research, 53(1), 12-25.

Soderbery, A. (2015). Estimating import supply and demand elasticities: Analysis and implications. Journal of International Economics, 96(1), 1-17.

Zhao, C., Wang, J., Watson, J. P., & Guan, Y. (2013). Multi-stage robust unit commitment considering wind and demand response uncertainties. IEEE Transactions on Power Systems, 28(3), 2708-2717.