LD0474 Module Title: Strategic Management for Competitive Advantage

I. Introduction

Statement of business objectives

- Implementation of constant innovation and developments in its financial practices is a vital aspect to maintain sustainability in Lion car company.

- Lion car company use productive resources, the application of which enables increased productivity in the supply chain network of Lion car company

Summary of company’s performances

In round 1 of Lion car company, two cars named as wheelie and rush have been produced by the company. Two different workforces have been applied by Lion car company to visualize the primary objectives of its business. The market shares of the two cars are 1.87 and 2.23% in the financial year of its operational practices. On the other hand, it can be viewed that worth £27000 million and £36,500 million cars have been supplied by Lion car company. The introduction of Kita, Splendop, and Myni increased the overall business performance level of the car company.

II. Company performance

The assignment is based on the European Car industry and four functional areas such as finance, marketing area, operational area and human resource management. As cited by Hart et al. (2017), an organization deals with their shareholders to maximize their value in a market.

Therefore, the team has to maximize their productivity to achieve shareholders’ value of a company. The decision is based on four rounds to make a proper decision for the game. On the other hand, from round 1 to round 4 the team has decided to produce 25-40 cars on wheelie and 41-55 cars on rush (Case study).

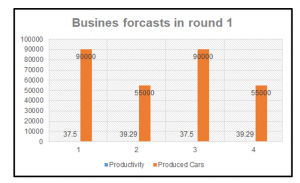

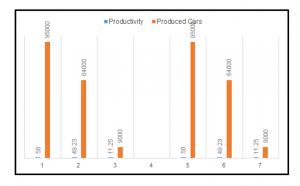

Therefore, in round 1, productivity for producing cars was 37.5 in wheelie and 39.29 cars in Rush. The company has produced 90,000 cars of wheelie and 55,000 cars of rush in round 1. The unsold stock was 0 for both rounds 1 and 2 and the productivity was exactly same for both rounds 1 and 2. Whereas in round 3 and round 4 the productivity has been increasing and the target for producing cars has been changed in both rounds (Case study).

A. Round 1

Decision

The company has taken decision of $37.5 and 39.29 in productivity of two car which allowed the company to increase the production of the cars. They were able to produce 55 000 and 90000 car models. The operating profit of the company was $571.30m which shows the impact of the decisions made by the company.

Figure 3: Business forecasts in round 1

(Source: MS Excel)

Automation expenses in the pound have been classified under two different circumstances as productivity in a wheeler car is £37.5 whereas productivity in a rush car is 39.29. In round 1, it was estimated to produce 90,000 units of wheeler cars and 55,000 units of rush cars in its operating practices. As argued by Miroshnychenko et al. (2021), growth in the marketing practices and development of the business objectives have to be adequate as it helps in maintaining operational viability in the business.

Adequate growth into the production of cars for enhancing strategic performances can help in maintaining strategic and operational growth into the business prospects. Market shares have been increased from 1.87 to 2.23 as there are strategic changes and its marketing requirement.

Results

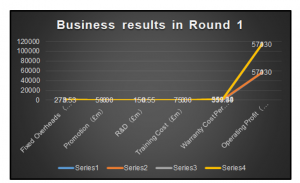

Figure 4: Business results in round 1

(Source: MS Excel)

Interpretation of the results can be used to understand the performance of round 1 as well as changes into the operational structure can be used to maintain organization structures. Operating profit was £571.30 million as it was equivalent to its operational profits. Discussion on the findings and strategic prospects have been applied to its operational factors as fluctuations in the business techniques have been furnished into the 1st round of its business activities.

Classification into the marketing factors along with deterministic approaches into the business techniques should need to be developed to increase relative practices into the business. As discussed by Yang and Meyer (2019), implementation of certain retail techniques such as big data analysis and production of strategic techniques into business need to be maintained xin this regard, it can be stated the total post-tax profit is derived as £55231 million that is well justified based on the performances forecasted in round 1.

B. Round 2

Decision

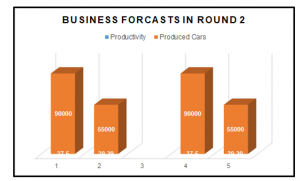

The decisions made by the organization helped the company to increase their production rate and they were able to produce 145000 car models in the 2nd round. They were able to maintain their fixed overheads and they achieved $273.53m in fixed overheads.

The relative issue in maintaining sustainable performances into the bushes has been observed into round two of its business activities for valuation of the business strategies can be maintained to increase overall sustainable factors into the business. Vast areas for making necessary developments have been spotted into round two based on which the necessary developments should need to be maintained.

Total weekly wages have been determined as £620 million as a result it is required to reduce the total wages of its business operations. As criticized by Lukeš et al. (2019), application of the innovative approaches and determination of certain rates should need to be maintained to increase specific developments in marketing techniques. In addition, it can be viewed that improvisation into the operational factors and maintenance of strategic changes can facilitate in enhancing business developments. Hence it is required to maintain adequate innovation for the growth of the Lion car company in upcoming rounds.

Forecast

Figure 5: Business forecasts in round 2

(Source: MS Excel)

According to round 2, a specific target zone has been followed by Lion car company as it was concentrated on making developments in its business. Production of 25 to 40 cars has been maintained into the 2nd round of its business strategies as fulfilling the business requirement the adequate growth in its business structure can be achieved. Net cash position for the Wheelie car put £21813 million into the business. On the other hand, promotion changes in operational techniques can be used to visualize specific business approaches in its marketing techniques.

Implementation of the technical growth and justification of the business techniques need to be visualized as it can help in evaluating the training and marketing costs of the company. In addition, it can maintain operational growth and decrease the number of total loans that can be used to maintain strategic changes in business mobilization.

Results

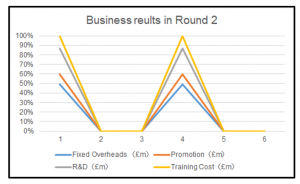

Figure 6: Business forecasts in round 2

(Source: MS Excel)

There is no unsold stock remaining in its stores as an implementation of selling strategies has helped in maintaining strategic performances in the business. A creative discussion on the performance measurements in the 2nd round can be used to evaluate strategic requirements for the business.

Total production volume appeared in the 2nd round as 1,45,000 units, which is appropriate to the total production estimated in round 1. As opined by Asamoah et al. (2020), the effect of transfer money and estimation of the monetary policies can be placed as adequate to increase specific benefits into the business’s activities.

Fixed overheads in this period have resulted in £273.53 million as there is a specific change in the strategic techniques of the Lion car company. Optimization of the relatable factors such as fact sheets can be used to maintain specific business projection and operational sustainability in Lion car company.

C. Round 3

Decision

The company has decided to introduce a new car model which allowed them to increase the sales of their cars. They allocated 800 work force to launch the new car model whoch is proven a good decision form their part. The selling price of new car model was $86000m which is quite profitable for the organization.

Forecast

Figure 7: Business forecasts in round 3

(Source: MS Excel)

It was forecasted in the meeting of round 3 to include a luxurious brand called Kita in its operational techniques, as a result, the consumers would feel attracted to make a purchase of its products. On the other hand, the specific implementation of the marketing objectives and fulfilling the requirement of the business can help in increasing operational viability into the business. Kita has been forecasted to launch at a workforce of 800.

As narrated by Snieska et al. (2019), evaluation of the economic performances along with implementing marketing strategies can help in developing the overall financial issues of a company. Weekly market share performances of the three cars such as wheelie, rush, and Kita are 1.96%, 2.52%, and 1.56% respectively. Total three strike days have been considered in the entire round as it can help in maintaining strategic performances at its business level.

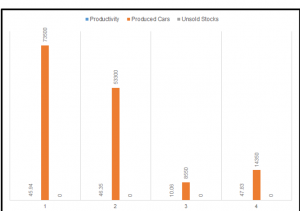

Results

Figure 8: Business forecasts in round 3

(Source: MS Excel)

Three different modules of cars have been produced in the third round of Lion car company’s operational strategies as maintenance of surgical techniques and estimation of the business can facilitate the growth of its operational services. The selling price of the Wheelie Car has been predicted as £28000 million, the selling price of the Rush car is £38000 million and the selling price of the luxurious Kita car is £86000 million which can be adequate to maintain operational projection and profitable measures into the business.

As opined by Popkova et al. (2017), improvisation into the marketing strategies and projection of the strategic undertakings can be adequate to improve operational viability into the business. Total training costs have been reflected into the third round in its business as 75 million. Based on which post it and operational values have been estimated as £668.03 million.

D. Round 4

Decision

The organization have allocated 1600, 1150, 850, 300 and 100 work force for the different car models. This decision allowed them to increase their production rate and enhance the sales of the car models. They were able to achieve the market share of 1.31, 1.82, 1.14, 0.49 and 0.1 for the various car models.

Forecast

Figure 9: Business forecasts in round 4

(Source: MS Excel)

The administration of the Lion car company has decided to launch two new cars at round four of its operational activities. Based on which specific tools and techniques have been implemented to maintain sustainability into the marketing factors of its business techniques. Adaptation of the deterministic approaches as well as sustainable factors needs to be maintained to increase positive techniques and strategic objectives in the business.

As opined by Yun et al. (2019), adequate fluctuation into the business model and estimation into the marketing techniques are considered as two specific approaches through which adequateness between the demand and marketing policies have been determined. The total gross margin has been estimated as £1238.71 million, on the other hand, the total net cash position has been calculated as £2259.26 million in its operational activities. Total post-tax credit for its company has been estimated as £502.11 million at the fourth round of its operational practices.

Results

Figure 10: Business forecasts in round 4

(Source: MS Excel)

Five different car models of Lion car company have been introduced into round 4 of its business operation as it can help in maintaining strategic factors into the business. The applied workforces of Wheelie, Rush, Kita, Splendop, and Myni are 1600, 1150, 850, 300, and 100 respectively. Furthermore, it can be viewed that during the 4th round of Lion car company’s business operation five cars have presented five different productivity levels.

The productivity of Wheelie, Rush, Kita, Splendop, and Myni are £45.94, £46.35, £10.06, £47.83, and £66 individually. As opined by Sheikh et al. (2017), measurements of the business performances and estimations of the strategic factors can be implemented to increase overall sustainable techniques in a business’s operational activities. Market values of the shares of Wheelie, Rush, Kita, Splendop, and Myni are 1.31, 1.82., 1.14, 0.49, and 0.1 as it visualizes the discrepancies in the marketing prospects of its business.

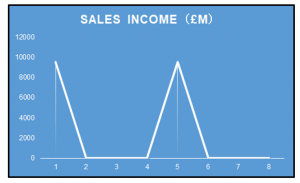

III. Trends analysis

Total sales income has been estimated as £9564.26 million based on which the operational expenses of its business have been incurred. Maintenance of the strategic techniques can be used to maintain operational growth in the business. Net cash position in round 3 has been identified as £139734 million as total business techniques and marketing troops have been narrated based on its marketing strategies.

As narrated by Snieska et al. (2019), growth in the operational prospects can make necessary improvements to the financial viability of business strategies. On the other hand, training costs in the third round have beesn determined as £149.64 million and operating profit have been forecasted as £861.33 million both of which can be maintained to improvise the operational stability and operational movements. The total loan amount has been calculated as £668.03 million as there are operational prospects in its marketing approaches.

- Comparison of Lion car company with its competitors

The weekly range for round 1 is £620 as strategic performances have been observed in meeting the necessary requirements. Fixed overhead expenses are £273.53 million as the total operational expenses increase financial structures in the business. A decrease in the total sales can be able to maintain operational strategies and be able to maintain strategic requirements in the business.

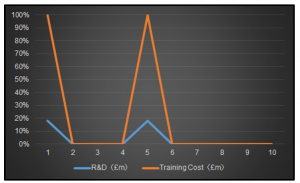

At round 1of the Lion car company, total research and development expenses have been estimated as £150.55 million as there are certain techniques that have been followed to present operational objectives into the business. As criticized by Peters et al. (2019), entrepreneurial values have to be met to increase the productivity of its business techniques. On the other hand, the warranty cost per car is £359.39 for a Wheeler car and £519.44 for a rush car.

- Comparison with round 3 to round 4:

The productivity for round 3 the team has analyzed that 50% of wheelie and for rush the productivity was 49.23. On the other hand, the company has expanded their production where the productivity was 11.2 of Kita. However, the productivity in round has comparatively greater as the production is increasing.

The market shares for round 3 the organization has faced 1.96 for Wheelie and 2.52 for Rush. As cited by Greenacre (2018), market share helps to identify the value of an organization in the competitive market. On the other hand, for Kita the market share was 1.56. Although in round 4 the market share has been distributed with four products such as wheelie, rush, Kita and SPLENDOP and Myni which was 1.14 and 0.49 of market share (Case study).

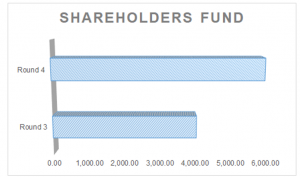

Figure 1: Shareholders fund

(Source: MS Excel)

On the other hand, weekly wages can be differentiated between round 3 and round 4 where in round 3 the weekly wages for manufacturing the car were 650. Whereas, in round 4 670 has been analyzed on weekly wages in an organization. The total sale for LION was estimated in this assignment and distributed in different production for manufacturing the cars in this business. The total unsold stock was zero for both rounds and shareholders’ funds have been estimated which was around £4024.48 million in round 3 and £5898.44 million in round 4. It can be stated that round 5 has greater market share and shareholders fund as compared to round 3 (Case study). The total sales were £9554.26 million in round 3 and in round 4 it was estimated to be £10422.65 million which was greater as compared to round 3 due to increase in production.

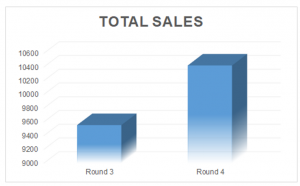

Figure 2: Total sales

(Source: MS Excel)

The assignment has also analyzed their cash position in the market where in round 3 the team has faced £2808.84 million in round 3 and £4750.31 million in round 4 which was greater as compared to round 3. On the other hand, the gross profit margin was 35.10% in round 3 and in round 4 the gross profit margin was 34.06% which was lower than in round 3. Whereas the return on investment was 42.79% in round 3 and in round 4 the rate of return on investment was 31.77% which was lower as compared to round 3 (Case study). It can be stated that in round 4 due increase in production the productivity and wages has been distributed in those products and the huge amount of profitability in an organization.

IV. Learning

Critical reflection on the decisions affecting the stakeholder groups is conducted in the learning section of this report. The learnings in the four financial areas such as marketing, finance, human resource, and operations management are discussed in the critical reflection section. The decisions made based on these financial areas and how the decisions on these areas affected the stakeholder group are discussed in this section.

The performance of the organization is critically evaluated to identify the effects of decisions and the influence of financial, marketing, operations and human resource management on the stakeholder’s groups. The improvement of organizations performance and the growth in sales revenue and total sales are analysed in this section. The critical reflection can develop the changes in the next level of simulation game.

Reflection on financial decisions

The organization produced 90000 and 55000 cards respectively and the selling price was $27000m and $36500m. The market share of the organization was 1.87 and 2.23 in the first two years. The warranty costs per car were 359.39 and 519.44 respectively and this financial decision by the team has affected the sales of the cars considerably. As per the view of Alshehhi et al. (2018), financial decisions play a significant role in developing organizations’ business performance.

The organization spent $620 on the weekly wage of the employees and the fixed overhead was $273.53m. The cash flow is a clear evidence pf the fact to create an effective on an organisation. The wage decision of the team has positively impacted the profit margin of the company and the gross margin was 12830%. The weekly wage was reduced by the financial team from $620 to $650 and it helped to increase the production rate of the company.

In the third round, the organization produced 95000, 64000, and 9000 medium, large and luxury cars respectively. Based on these data it can be stated that the increase in employee wages has helped the organization to enhance its production rate. The fixed overheads have increased from 273.53 to 353.95 in round three which shows the impact of financial decisions made by the team. As per the view of Paniagua et al. (2018), effective financial decisions are crucial to achieving long-term growth and effects in the organization.

The financial team has set up the selling price of the cards based on the nature of the cars. The selling prices of medium, large and luxury cars in the third year were 28000, 38000 and $86000 respectively. The decision to set different prices for various types of cars has helped to increase the stakeholder’s funds from $2302.48 to $4024.48m.

The significant of money has been invested that can include new factories and get the positive result for an organisation Based on the above data it can be stated that the financial decision in terms of the selling price of the different types of cats has positively impacted stakeholders’ funds. The company introduced small cars in the fourth year and increased the weekly wage of the employees from $650 to $670m.

The organization has produced 73500,53300,8500 and 6600 medium, large, luxury, and small cars respectively. As per the view of Galant and Cadez (2017), large amounts of funds are involved in financial decisions. The decisions made by the financial team are crucial to control and manage a large number of funds. The net cash position in the fourth year was $2259.26m and the fixed overheads were $333.13m. The financial decisions made in the fourth year helped to increase the stakeholder’s funds from $4024.48 to 5898.44m.

Reflection on marketing decisions

Marketing decisions play a significant role to influence the sales and the business performance of the organizations. The marketing teams of the organization have made several decisions regarding marketing activities which helped them to enhance stakeholders groups. In the first year, the organization spent $59.00n in promotional activities which helped them to achieve $5096.31m of total sales.

As per the view of Yasa et al. (2020), marketing decisions play a crucial role in developing the business performance of organizations. The total sales of the organization in the first year was 4437.50 whereas the sales revenue was $4011.99m. Based on the data it can be stated that the marketing decisions made by the team helped the organization to achieve its marketing goals.

The market share of the organization was 4.05 which is considered good for the organization and the effectiveness of the marketing decisions can be raised for this data. The marketing team spent the same amount of capital in the 2nd year, however, the total sales of the organization have increased significantly from $5096.31 to $6713.21m.

The total sales of the company have also increased in the 2nd year, the total sales was 5866.00, this data shows that the marketing decisions made by the team have helped the company to increase the sales of the cars. The sales revenue of the organization has increased from $4011.99 to $5729.02m. As per the view of Lessmann et al. (2019), the pricing and promotion decisions are crucial to improve the sales of products and services. The market share of the company has increased from 4.05 to 6.85 which is a significant improvement for the organization.

The marketing decisions regarding the promotional costs and prices has helped the company to enhance their market share. The marketing team decided to spend $63m on the promotional activities which helped them to increase the total sales from $6713.21 to $9554.28m.

The marketing decisions have proven instrumental in improving the total sales of the organization. As per the view of Kauffmann et al. (2019), marketing decisions allow organizations to define the scopes of the marketing activities. The sales revenue of the organization has reduced slightly in the third year, the sales revenue reduced from %5729.02 to $5497.78m. The decision of increasing the promotional cost might have influenced the sales revenue of the company.

However, the market share of the organization has increased from 6.85 to 8.59 in the third year which shows a significant improvement in the market share.

The net cash position of LION has increased from $829.65m to $2808.84m in the third year whereas it further increased to $4750.31m in the fourth year. The organization spent $68m in the fourth year which is slightly higher than the previous years.

As per the view of Syaekhoni et al. (2017), strategic and tactical decisions are essential to enhance the marketing performance of the organizations. The total sales of LION have increased from $99554.26 to $10422.65m in the fourth year, showing a significant improvement in the marketing performance. However, the total sales of the organization have reduced from 5542.71 to 5152.95.

This result shows that there are some improvements in marketing decisions that need to be done in order to increase the total sales. The sales revenue of the organization has reduced from $5497.78 to $5336.84m, (Yoon, 2019). However, the market share of LION has increased from 8.59 to 8.62. The net cash position of the organization has increased from $2808.84 to $4750.31m which shows the positive impact of the marketing decisions.

Reflection on human resource management decisions

Human resource management is an important part of the organization and the overall performance of business operations depends on it. As per the view of Oppel et al. (2017), decisions regarding human resource management can impact the stakeholder’s performance inside the organization. There were 3 strike days in the first year which shows an effective performance by the human resource management team.

The team spent $75m on the training cost of the employees in the first year. The research and development cost was $150.55m in the first year. The workforce assigned for manufacturing medium and large cars were 2400 and 1400 respectively. The productivity in the case of medium and large cars was 37.5 and 39.29 which shows the impact of decision-making regarding HRM. There were three strike days in the second year and the workforce for the cars remained the same.

The organization spent the same amount of capital in training, R&D and the productivity of the employees was similar to year one in year two. As per the view of Newman et al. (2020), decisions regarding training costs are essential to enhance the overall productivity of the employees. The company allocated 1900,1300 and 800 workers for the manufacturing of medium, large and luxury cars respectively.

The capital spent on training and R&D was the same in the third year however, the productivity has increased considerably in the fourth year. The productivity of employees in terms of medium, large and luxury cars was 50, 49.23, and 11.25 respectively. These stats show that the HRM decision made by the teams has helped the company to increase the productivity of the employees and maintain the training costs.

The workforce allocated for the medium, large, luxury, and small cars was 1600,1150,850 and 100 respectively. The training costs remained the same in the fourth team and the R&D costs were reduced significantly. The productivity of employees in medium, large, luxury, and small cars was 45.94, 46.35, 10.06, and 66 respectively.

Based on these data it can be stated that the human resource management decisions have helped the organization to manage the training of the employees and enhance their productivity. The company was able to diversify its car models and introduce new models due to effective human resource management decisions.

Reflection on Operational management

There is major essential art for all among the areas the team has learned that a set of goals and objectives for an organization. The operating management can be crucial for analyzing the business performances (Ruparathna et al. 2017). The team has analyzed the productivity of a company to produce effective cars and the team has conducted four rounds to understand the concept of company’s performance and compare them to their competitors in a competitive market to gain a huge amount of profitability in a market.

The team has learned that by using these areas to make effective decisions for shareholders to make investment in a market. The team has learned from the business finance to construct risk factors for the business and how the company can overcome risk factors.

The team has used several lectures and assignments for conducting a business simulation for manufacturing cars with the help of human resource management. As cited by Tiainen (2018), the operational management is valuable for an organization on their different stages. Therefore, with the help of operational management the team has learned that a company can achieve a set of goals and it helps to make an organization successful in a market. LION can use their material for Business finance, marketing and operational area, human resources to show managerial risks and return for manufacturing cars.

The team has made decisions for operational management to show a company’s vision, mission and their financial reports to show their performance to achieve their set of goals and objectives. In this assignment there are four rounds of games to produce effective cars and show the company’s performance with production, gross profit margin and comparison with their competitors in the market.

It has shown that the company has decided to look after a company’s financial report which they have learned from their semesters to achieve operational strategies for an organization. On the other hand, the team could have made better decisions by looking after the company’s value and ethics, and corporate responsibility to get a better operational management in their organization. As cited by Hajnić et al. (2020), research about the company’s corporate responsibility and responsibility for a community where the team can decide for their company’s ability to achieve operational strategies in a specific year.

In this assignment the team has shown LION’s vision and mission and analyzed their performance during the rounds. As cited by Chistnikova et al. (2020), operational strategies the company can make proper strategy for their upcoming financial year to recover their cost and risk factor and build a new vision and mission for a specific year.

On the other hand, with the help of semester and lectures the team can also look after the company’s community and corporate responsibilities and the other segments where the company can set up their value on ethics. These factors are important for a market to set up goals and objectives where teams can decide to use effective strategies to make a proper plan for their organization to compete with the other company’s and make a huge profit.

V. Conclusion

In this assignment there were two objectives which the team of an organization can achieve: manufacturing cars and making huge progress in the upcoming year. An organization should achieve Productive resources to utilize their resources for production of cars. On the other hand, an organization should implement creativity in their production to achieve growth in future.

The assignment has shown four rounds of manufacturing cars to develop nature for an organization. In round 1 and round 2, there were two car productions and it has been increased due to increased productivity and achieving the objectives effectively. Therefore, it can be stated that with the help of innovative technology and utilized effective resources an organization has built four different production of care effectively. LION has achieved all the goals and objectives they have made earlier with a new product in a market and maximize their utility for improving profitability in a market.

VI. Team performance

Performance of team

In business management it is essential to work as a team and team performances are crucial for an organization to make a proper decision about strategies. The team performance can evaluate a strength and weakness for each employee who contributes effectively in an organization. As cited by Murray et al. (2019), it can help to be productive in a working environment and contribute to effective work in the business.

Therefore, team performance is an essential key for developing an organization in a competitive market. It can help to identify the role of each employee which can fit their skills and knowledge. In this assignment there are covering few theories and model for understanding the team performance for an organization which are as follows:

- Tuckman Team model

The major team development theory is Tuckman Team model which refers to evaluating team development for an organization. It was established by psychologist Bruce Tuckman in 1965 where he stated that team development is important for an organization. As cited by Kii (2018), there are four stages of team development in a business such as storming, performing, forming, norming and adjourning.

The stages can move from the first stage to the last which depends on the business event for an organization. The forming stage derives when every employee should communicate with each other and share thoughts to an organization.

Figure 11: Tuckman Team model

(Source: Kii, 2018)

On the other hand, the storming stage can define ideas that can be made by individuals for an organization. As cited by Jones (2019), the norming stage refers to the flexibility of each employee in a business where they can distribute their work and understand their role to contribute in an organization. Performing stage can refer to work as a team where everyone can build a strategy by sharing and communicating with each other effectively. Adjourning is to go separate ways for each employee in the business.

- DISC model

DISC theory was established by Dr. William Moulton Marston who predicts the behavior of an employee by using four elements of individuals. The four traits are dominance, inducement, supportive and compliance. As cited by Guo et al. (2019), dominance is the traits characteristic of an individual who has the ability to take risks and problem solving power.

On the other hand, with dominance they have capability to solve problems and create new things to the organization. Inducement is referring to employees who are trustworthy whereas supportive refers to having the ability to work as a team and good listener from other employees. The employees who are loyal to their organization and supportive for a planning process that can be developed by the team.

Figure 12: DISC model

(Source: Guo et al. 2019)

On the other hand, compliance refers to an employee who has the ability to handle the high standard of an organization. As cited by Diaz et al. (2019), the employees who are realistic and also tempered in an organization to tackle the management power in an organization. They can gather various information from a market which can be used in an organization effectively.

- GRIP model

There are four elements of the GRIP model which was established by Richard Beckhard in 1972. Goals, roles, interpersonal and process are four elements of the GRIP model where an individual can adapt such a model and develop their performances in an organization. As cited by Li et al. (2019), goals can refer to where the team can make a goal for an organization and Roles can be distributed to individuals to contribute effectively in an organization. Interpersonal can refer to an individual to communicate with each other and process refers to making a proper decision for an organization.

Figure 13: GRIP model

(Source: Li et al. 2019)

In this assignment, a team can adapt such a model to contribute to their organization to make a proper decision to solve their problems in a business. Tuckman Team model can be adopted by the team which can be beneficial for an organization to develop team management.

Personal role

I have learned from different models of team development which can be used in an organization to develop a team for a business. I have learned from Tuckman Team model to work in a process which can help an organization effectively.

VII. Reference list

Alshehhi, A., Nobanee, H. and Khare, N., 2018. The impact of sustainability practices on corporate financial performance: Literature trends and future research potential. Sustainability, 10(2), p.494. available at https://www.mdpi.com/2071-1050/10/2/494/pdf

Asamoah, D., Takieddine, S. and Amedofu, M., 2020. Examining the effect of mobile money transfer (MMT) capabilities on business growth and development impact. Information Technology for Development, 26(1), pp.146-161.

Chistnikova, I., Mochalova, Y., Ivashchenko, S., Tahira, K. and Farid, D., 2020. APPLICATION OF SQDCME OPERATIONAL MANAGEMENT SYSTEM IN EDUCATIONAL ORGANIZATIONS. Economic and Social Development: Book of Proceedings, pp.354-360.

Diaz, G.P.N., Saulo, A.C. and Otero, A.D., 2019, July. Comparative study on the wake description using actuator disc model with increasing level of complexity. In Journal of Physics: Conference Series (Vol. 1256, No. 1, p. 012017). IOP Publishing.

Galant, A. and Cadez, S., 2017. Corporate social responsibility and financial performance relationship: a review of measurement approaches. Economic research-Ekonomska istraživanja, 30(1), pp.676-693. Available at https://hrcak.srce.hr/file/269178

Gielnik, M.M., Zacher, H. and Schmitt, A., 2017. How small business managers’ age and focus on opportunities affect business growth: a mediated moderation growth model. Journal of Small Business Management, 55(3), pp.460-483.

Greenacre, M., 2018. Compositional data analysis in practice. CRC Press.

Guo, J., Sun, M., Gu, W.M. and Yi, T., 2019. Thick-disc model to explain the spectral state transition in NGC 247. Monthly Notices of the Royal Astronomical Society, 485(2), pp.2558-2561.

Hajnić, M. and Mileva Boshkoska, B., 2020. A decision support model for the operational management of employee redeployment in large governmental organisations. Journal of Decision Systems, pp.1-9.

Hart, O. and Zingales, L., 2017. Companies should maximize shareholder welfare not market value. ECGI-Finance Working Paper, (521).

Jones, D., 2019. The Tuckman’s Model Implementation, Effect, and Analysis & the New Development of Jones LSI Model on a Small Group. Journal of Management, 6(4).

Kauffmann, E., Peral, J., Gil, D., Ferrández, A., Sellers, R. and Mora, H., 2019. Managing marketing decision-making with sentiment analysis: An evaluation of the main product features using text data mining. Sustainability, 11(15), p.4235. available at https://www.mdpi.com/2071-1050/11/15/4235/pdf

Kii, W.Y., 2018. Tuckman And Tom Edison Model Of Team Developments Applied By Stkip Weetebula Team For Implementation Of SPS (Seminar-Practice-School).

Lessmann, S., Haupt, J., Coussement, K. and De Bock, K.W., 2019. Targeting customers for profit: An ensemble learning framework to support marketing decision-making. Information Sciences. Available at https://www.econstor.eu/bitstream/10419/230723/1/irtg1792dp2018-012.pdf

Li, X., Ying, X. and Chuah, M.C., 2019, October. Grip: Graph-based interaction-aware trajectory prediction. In 2019 IEEE Intelligent Transportation Systems Conference (ITSC) (pp. 3960-3966). IEEE.

Lukeš, M., Longo, M.C. and Zouhar, J., 2019. Do business incubators really enhance entrepreneurial growth? Evidence from a large sample of innovative Italian start-ups. Technovation, 82, pp.25-34.

Miroshnychenko, I., De Massis, A., Miller, D. and Barontini, R., 2021. Family business growth around the world. Entrepreneurship Theory and Practice, 45(4), pp.682-708.

Murray, R.M., Coffee, P., Eklund, R.C. and Arthur, C.A., 2019. Attributional consensus: The importance of agreement over causes for team performance to interpersonal outcomes and performance. Psychology of Sport and Exercise, 43, pp.219-225.

Newman, D.T., Fast, N.J. and Harmon, D.J., 2020. When eliminating bias isn’t fair: Algorithmic reductionism and procedural justice in human resource decisions. Organizational Behavior and Human Decision Processes, 160, pp.149-167. Available at https://www.sciencedirect.com/science/article/am/pii/S0749597818303595

Oppel, E.M., Winter, V. and Schreyögg, J., 2017. Evaluating the link between human resource management decisions and patient satisfaction with quality of care. Health care management review, 42(1), pp.53-64. Available at https://www.researchgate.net/profile/Eva-Maria-Wild-Nee-Oppel-2/publication/281337428_Evaluating_the_link_between_human_resource_management_decisions_and_patient_satisfaction_with_quality_of_care/links/5971c6d04585153016392f1e/Evaluating-the-link-between-human-resource-management-decisions-and-patient-satisfaction-with-quality-of-care.pdf

Paniagua, J., Rivelles, R. and Sapena, J., 2018. Corporate governance and financial performance: The role of ownership and board structure. Journal of Business Research, 89, pp.229-234. Available at https://www.uv.es/jorpaso2/papers/Corporate%20governance%20and%20financial%20performance.pdf

Papa, A., Dezi, L., Gregori, G.L., Mueller, J. and Miglietta, N., 2018. Improving innovation performance through knowledge acquisition: the moderating role of employee retention and human resource management practices. Journal of Knowledge Management. Available at https://iris.unito.it/bitstream/2318/1662413/2/PDF_Proof_JKM.pdf

Peters, M., Kallmuenzer, A. and Buhalis, D., 2019. Hospitality entrepreneurs managing quality of life and business growth. Current Issues in Tourism, 22(16), pp.2014-2033.

Popkova, E.G., Tyurina, Y.G., Sozinova, A.A., Bychkova, L.V., Zemskova, O.M., Serebryakova, M.F. and Lazareva, N.V., 2017. Clustering as a growth point of modern Russian business. In Integration and Clustering for Sustainable Economic Growth (pp. 55-63). Springer, Cham.

Ruparathna, R., Hewage, K. and Sadiq, R., 2017. Developing a level of service (LOS) index for operational management of public buildings. Sustainable cities and society, 34, pp.159-173.

Sheikh, A.A., Shahzad, A. and Ishaq, A.K., 2017. The growth of e-marketing in business-to-business industry and its effect on the performance of businesses in Pakistan: Marketing success. International and Multidisciplinary Journal of Social Sciences, 6(2), pp.178-214.

Snieska, V., Zykiene, I. and Burksaitiene, D., 2019. Evaluation of location’s attractiveness for business growth in smart development. Economic research-Ekonomska istraživanja, 32(1), pp.925-946.

Snieska, V., Zykiene, I. and Burksaitiene, D., 2019. Evaluation of location’s attractiveness for business growth in smart development. Economic research-Ekonomska istraživanja, 32(1), pp.925-946.

Syaekhoni, M.A., Alfian, G. and Kwon, Y.S., 2017. Customer purchasing behavior analysis as alternatives for supporting in-store green marketing decision-making. Sustainability, 9(11), p.2008. available at https://www.mdpi.com/2071-1050/9/11/2008/pdf

Tiainen, T., 2018. Operational management model for strategic supplier.

Yang, W. and Meyer, K.E., 2019. How does ownership influence business growth? A competitive dynamics perspective. International Business Review, 28(5), p.101482.

Yasa, N., Giantari, I.G.A.K., Setini, M. and Rahmayanti, P.J.M.S.L., 2020. The role of competitive advantage in mediating the effect of promotional strategy on marketing performance. Management Science Letters, 10(12), pp.2845-2848. Available at http://m.growingscience.com/msl/Vol10/msl_2020_120.pdf

Yoon, H., 2019. Effects of particulate matter (PM10) on tourism sales revenue: A generalized additive modeling approach. Tourism Management, 74, pp.358-369. Available at http://pdf.xuebalib.com:1262/6ryluyeh1Vq8.pdf

Yun, J.J., Won, D., Park, K., Jeong, E. and Zhao, X., 2019. The role of a business model in market growth: The difference between the converted industry and the emerging industry. Technological Forecasting and Social Change, 146, pp.534-562.

Know more about UniqueSubmission’s other writing services: