LLM Programme Coursework Assessment Sample

CONSIDER HOW THE CONCEPTS OF CORPORATE CITIZENSHIP AND CORPORATE SOCIAL RESPONSIBILITY MAY BE USED TO PREVENT AGGRESSIVE TAX PLANNING OR TAX AVOIDANCE

1.0 Introduction

“Corporate Social Responsibility” has been one of the most integral parts of any organization which has been doing business for quite some time. In the most traditional part “Corporate Social Responsibility” has been classified into three categories namely economical, social and environmental. The people expect any organization to work on these categories for people of the organization and society. Every organization has a duty towards the society and towards the environment. This is the reason why the concept of “Corporate Social Responsibility” has come in the first place. The process of “Aggressive tax planning” is defined by a scheme of tax which brings down the tax rate for a particular category of income for an organization or human being. The researchers have argued for a long time that the concept of “Corporate Citizenship” and “Corporate Social Responsibility” in an organization can prevent “Aggressive tax planning”. The recognition of the citizenship of the corporate has helped the organizations to understand the responsibility of them towards the society. The responsibilities include social responsibility, economic responsibility and environmental responsibility. In this essay the discussion of how “Corporate Social Responsibility” and the citizenship of the corporate can change the scene regarding tax avoidance and “aggressive tax planning” will be made to help the readers get an in depth idea about all the terminology of the discussion. This essay will also discuss each of the corporate terminology separately and how all of the connected with each other will be discussed for a better understanding.

2.0 Discussion

One of the most important parts of “Corporate Social Responsibility” and the citizenship of corporations is the legal responsibility that an organization has outside of the other responsibilities. The concept of citizenship of the corporations comes from the ethical point of view where every organization has a duty towards the society[1]. The duties can be categorized into various parts namely the social responsibility, ethical responsibility, legal responsibility, environmental responsibility, economic responsibility etc. the responsibilities are not only towards the society but also towards the stakeholders and the employees of the organization. This is the reason why the impact of “Corporate Social Responsibility” towards an organization has come out to be so profitable from a moral, legal, economic point of view[2]. One of the most important parts of the “Corporate Social Responsibility” has been the legal part of the organization.

CSR and Legal Responsibility of an Organization

The concept of tax avoidance and aggressive tax planning come from the idea that an organization has no legal rights towards the society and the government. There are various taxes that an organization’s need to pay. The various taxes include the taxes the organization needs to pay for every manufacturing product and even for every employee. The concept of “aggressive tax planning” comes from this kind of ethical point of view where the organization’s head thinks it is unethical for them to pay so many taxes to the government. This is where they either plan for an aggressive planning of taxes to reduce the amount of taxes using the gray areas of the law or they completely avoid the taxing[3]. The concept of “Corporate Social Responsibility” has been a very popular and important practice for every organization for a long time. One of the most important parts of the practice of “Corporate Social Responsibility ” is the legal responsibility that an organization needs to maintain according to the practice. The concept of the legal responsibility tells that an organization not only has the social responsibility towards the society but they have also a business responsibility towards the society[4]. As the organization being a business entity they need to follow the rules and regulations according to the laws.

Figure 1: Legal Responsibility of an Organization

(Source: https://www.illeslex.net/)

One of the main parts of the rules and regulations has been the taxes the organization needs to pay to the government[5]. The organizational tax has been paid to the government which in turn helps the society to grow for the next step. If any organization does not pay their taxes properly it means they are indirectly reducing the growth of the society. This concept completely goes against the practice of the “Corporate Social Responsibility” of an organization. Even from a business point of view the organization primarily uses “Corporate Social Responsibility” practice to improve the brand image. If the organization goes for tax avoidance or aggressive planning to reduce the taxes there is always a chance that an organization may get caught due to tax fraud and their brand image gets reduced due to these aggressive planning. This is the legal bounds an organization has while practicing the “Corporate Social Responsibility” inside the organization. This in turn even forcefully helps the organization to pay the bright amount of taxes on time[6]. The legal responsibility of the organization also improves them morally to pay the taxes not only use the force. The “Corporate Social Responsibility” is not any legal practice, rather every organization uses this concept by their choice. So it is their choice also to maintain the legal responsibility to the society and the government. Rather force the organization by choice to maintain the legal responsibilities. This includes the concept of paying taxes on time and paying the right amount of taxes. The various researchers have understood in the past about the concept of legal responsibility of an organization and how it reduces the planning of aggressive taxes. One of the most important parts of the “Corporate Social Responsibility” practice is that it helps the hierarchy of an organization to understand the legal part more clearly[7]. This means for “Corporate Social Responsibility” practices the organization needs to organize many programs for the general public to improve their brand image. These programs help the hierarchy of an organization to meet with the general public more and help them interact with them more closely. This way the management and hierarchy of an organization understand in which places the money of their taxes are used. It improves the organization’s legal point of views and sees their responsibilities clearly. Without the campaigns due to “Corporate Social Responsibility”, the organizations do not understand their legal responsibility completely and how their money is helping the society to improve. The lifestyle of the general public is improving due to the huge tax money the organization is paying. The understanding influences them to pay the taxes on time.

CSR and Improvement of Brand Image

Not every organization introduces “Corporate Social Responsibility” practices for societal gain. There are various other organizations that introduce “Corporate Social Responsibility” to improve their own gain. One of the most famous strategies of the concept of “Corporate Social Responsibility” helps an organization to improve the brand image and popularity. The organizations campaign their work more of an advertisement to improve their popularity and show off their societal work with the part of advertising campaign. Legally the organization has every right to use their “Corporate Social Responsibility” campaign for the improvement of their brand but morally it is different. The organizations look for aggressive tax planning and tax avoidance for saving money to improve the financial value[8]. However there are always the chances that an organization may get caught for tax fraud. One allegation of a tax fraud case can hamper the reputation or brand image of an organization so much. The customers can even go for the rivals if any smaller allegations come towards the organization[9]. This is the reason for fear that the reputation that has been built due to the “Corporate Social Responsibility” practices can be tarnished to the ground due to one allegation or caught.

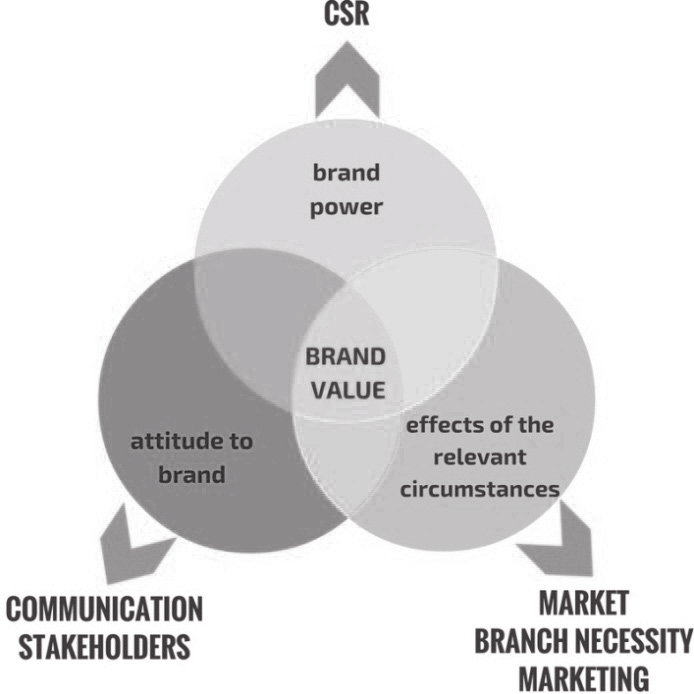

Figure 2: Brand Value improvement Due to CSR

(Source: https://www.revistaespacios.net/)

This is how the “Corporate Social Responsibility” practices can improve the brand image and reputation of an organization so much that they cannot risk their reputation for aggressive tax planning and tax avoidance[10]. The management of an organization also understands from the “Corporate Social Responsibility” practices that it is very tough to build a reputed company but one allegation of tax fraud can tarnish the whole reputation. This way the organizations go for the legal steps and do not risk their reputation for tax fraud.

CSR and Ethical responsibility of an organization

One of the most important parts of an organization’s “Corporate Social Responsibility” is the ethical responsibility of the organization. In this part an organization understands the ethical responsibility towards the society and the stakeholders. The ethical responsibility involves how they can help their society in different ways. It also involves understanding how they are helping the society to grow. The tax an organization is paying helps the society to grow. The organization also helps the society by giving them job opportunities for responsible candidates. In this way the practice of “Corporate Social Responsibility” helps the organization to understand their impact towards the society and how important they are to the society. This goes both ways as the customers are the part of the society so by buying the product they are also returning their help to the organization[11]. The ethical responsibility of the “Corporate Social Responsibility” practices help the hierarchy of an organization, how they are helping the society to grow and how their money helps the society to grow more.

Figure 3: Ethical responsibility of an Organization

(Source: https://pressbooks.senecacollege.ca/)

The organization grows that ethical sense about what to do and what not to do. These involve paying the taxes on time as the money of the taxes are directly helping the society to grow[12]. This ethical sense of understanding helps the organization reduce tax abduction and aggressive tax planning[13]. They are clearly seeing where their tax money is utilized. There is a major difference between the legal and ethical side of the responsibility of “Corporate Social Responsibility ” as in the legal side the rules are bound in law and on the ethical side it is completely the understanding of the organization from the moral and ethical point of view.

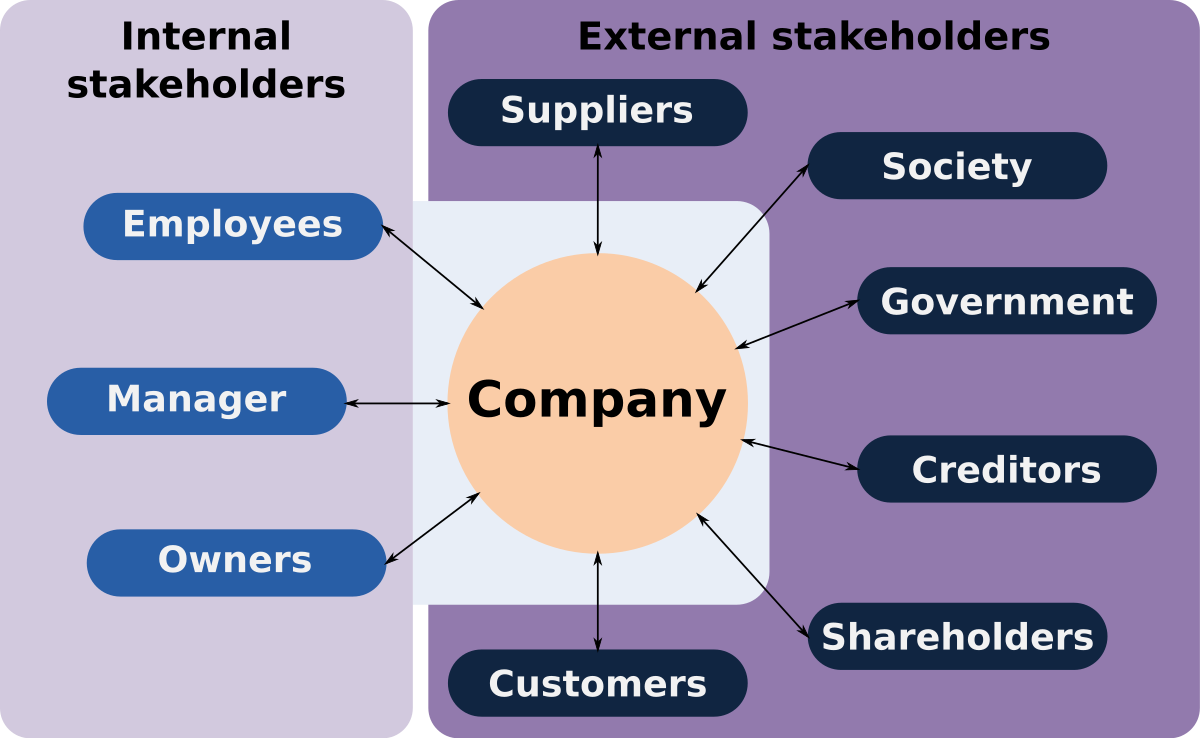

CSR and the Responsibility towards the Internal Stakeholders

One of the most important parts of the “Corporate Social Responsibility” practices is the responsibility of the organization towards their stakeholders[14]. The stakeholders are the part of an organization that is directly responsible about the policy of the organization. The employees, management, shareholders all of them are part of the stakeholders. The interesting study of the “Corporate Social Responsibility ” states that the organization has the duty towards their own organization[15]. Most parts of an organization do not directly take the decision for the organization, most of the employees or stakeholders just get the effects of every decision. The very few people who are sitting at the top like the board of directors or CEO take the major decisions. For an organization that is trying to take aggressive tax policies and even trying to go for tax avoidance the decisions are made by the board of directors but the effect of that would be gotten by all the employees. There is a significant probability if the organization is caught for tax fraud and tax avoidance. The legal reputation of the organization will not only be reduced but the reputation of the stakeholders will also be reduced to the society and their family and friends. The concept of “Corporate Social Responsibility” states that the organization has the duty towards the stakeholders and they have the responsibility to bring in a healthy work culture for the employees. The reputation of the organization must be preserved by the organization[16]. This is the reason why “Corporate Social Responsibility” helps the organization understand their responsibility towards their stakeholders.

Figure 4: Stakeholders of an Organization

(Source: https://en.wikipedia.org/)

The strategies include the improvement of the work culture and preserving their reputation. This includes the organizations must pay their taxes on time and the right amount also should be paid for the sake of their stakeholders reputation. This is the reason why various organizations start to pay their taxes after their “Corporate Social Responsibility” strategy[17]. The tax fraud allegation of an organization can hamper the reputation of the employees and shareholders in the organization to the society and the family. The work culture environment also can be ruined due to one allegation towards the environment. The “Corporate Social Responsibility” practice has the duty to preserve the stakeholder reputation and work culture. This is how from the point of view of the stakeholders the “Corporate Social Responsibility” strategies may reduce the planning of aggressive taxation and tax avoidance.

CSR and Social Responsibility of an Organization

Various scientists have researched the topic of the impact of “Corporate Social Responsibility” and the aggressive plannings of tax and tax avoidance. Most of the scientists have concluded that the organizations that are socially irresponsible have the high probability of tax avoidance and aggressive planning of taxes. The organizations who have a social responsibility strategy have the lesser probability and even 0 probability of any tax avoidance and fraud. The reason behind these results is the concept of “Corporate Social Responsibility”[18]. The basic concept of the “Corporate Social Responsibility” helps the firms to understand their social, moral, ethical, environmental and legal responsibility towards the society and the stakeholders. The management understands the social responsibilities of an organization by visiting in the various campaigns and also understands the business related responsibility to the locality. To continue a business in a society an organization must follow some steps. The social responsibility of an organization is the part of those steps. The various researchers have concluded that organizations with “Corporate Social Responsibility” strategies are fully disclosed has the greater chances of tax avoidance than the organization with open “Corporate Social Responsibility” strategies.

Figure 5: Social Responsibility of an Organization

(Source: https://givingcompass.org/)

The social responsibilities of the “Corporate Social Responsibility” strategies help the organization to understand their duties[19]. These include the negative side of tax avoidance and aggressive tax planning towards the society. The society grows by the money of the taxes of the organizations it helps the society to grow for a better future. Understanding is very much important for the hierarchy of the organization. The “Corporate Social Responsibility” strategies help the organization to understand that. This is the reason why the organizations with proper social responsibility strategies have the lesser chance of tax avoidance, while for the organization without any “Corporate Social Responsibility” strategies have the greater chance of tax avoidance.

CSR and Customer Responsibility

The “Corporate Social Responsibility” strategies also include the duty of an organization towards their customers. The customers are part of the society however the organizations have some specific duty towards their customers. The customers and organizations both look for a long time relationship with each other. The trust towards the brand grows due to the popularity and customer satisfaction. There is an increasing amount of chance while using aggressive tax policy or tax avoidance an organization can get caught of tax fraud. The allegation of tax fraud can result in customer mistrust. The customer has trusted the organization for their products and one allegation can shatter the understanding of trust in a matter of moment. The “Corporate Social Responsibility “strategies of an organization state the duty of an organization towards their customer and how to make the customer trust the brand. One allegation of tax fraud can change the whole scenario completely[20]. The “Corporate Social Responsibility” approach helps the organization to understand about the duties more efficiently which in turn helps the organization to understand about how aggressive tax planning can be good earning for a short time. But for a long term purpose they can lose the customers which in turn destabilize the financial reputation of an organization. The taxpayer department of an organization may defend their activity and tax avoidance part but that single allegation can turn the customers from the organization. The customers may feel betrayed by the organization for their activities. The practice of “Corporate Social Responsibility” states the opposite. The approach always states the responsibilities of the organization towards the customers and how they should provide the customers with greater accuracy. The behavioral and environmental responsibilities of an organization towards the customers are also discussed in the “Corporate Social Responsibility” approaches. The tax avoidance or aggressive tax planning strategies completely go against these strategies. This is how the customer responsibility part of the “Corporate Social Responsibility” may reduce the tax avoidance and aggressive strategies of tax.

CSR and Economic Responsibility

One of the most significant practices of “Corporate Social Responsibility” is the economic responsibility of an organization. The organization has an economic responsibility towards the society and their stakeholders. The economic responsibility of “Corporate Social Responsibility” states the organization should look for sustainable development to improve the economy of the organization. For example an organization can produce the product with the help of the recycling process which in turn helps the organization to reduce the manufacturing cost. The thinking behind aggressive tax strategies and tax avoidance for an organization is that the added money would improve the financial and economical condition of an organization. The economic part of the “Corporate Social Responsibility” looks after improving the economic conduction of the organization for the foreseeable future. This in turn helps the organization for sustainable development economically. As the economic condition is improving through the economical responsibility part, the organization may not look for tax fraud. The organization is gaining money from their “Corporate Social Responsibility” approaches so they do not look for aggressive tax planning and tax avoidance.

3.0 Conclusion

“Corporate Social Responsibility” has been one of the most popular practices in any organization. The researchers have researched various impacts of “Corporate Social Responsibility” in an organization. One of the most important applications of the “Corporate Social Responsibility” approach has been the decrease of tax avoidance and aggressive tax planning in the organization. The “Corporate Social Responsibility” and the reason behind the tax avoidance have been discussed in the essay. The economic responsibility, social responsibility, ethical responsibility of the “Corporate Social Responsibility” has been discussed and how these approaches help the organization to reduce the aggressiveness of the tax planning and tax avoidance. This essay will help the readers to understand in depth about the various parts of “Corporate Social Responsibility” and citizenship of the corporate and their impact on paying taxes. The legal responsibility of an organization and their impact on the aggressive planning of the tax and tax avoidance has also been discussed. How the customer and employee responsibility improve with the approach of “Corporate Social Responsibility” has also been discussed in depth and how these approaches of “Corporate Social Responsibility” help the organization to reduce the tax avoidance and help the organization to take less aggressive approaches have also been discussed in this essay.

Reference List

Journals

Goerke L, ‘Corporate Social Responsibility And Tax Avoidance’ [2018] SSRN Electronic Journal

Brune A, Thomsen M, and Watrin C, ‘Family Firm Heterogeneity And Tax Avoidance: The Role

Of The Founder’ (2019) 32 Family Business Review

Cooper M, and Nguyen Q, ‘Understanding The Interaction Of Motivation And Opportunity For

Tax Planning Inside US Multinationals: A Qualitative Study’ (2019) 54 Journal of World Business

Muhmad S, ‘The Effects Of Financial Motives Towards Corporate Tax Avoidance: Evidence From Public Listed Companies In Malaysia’ (2020) 12 Journal of Advanced Research in Dynamical and Control Systems

Gribnau H, and Jallai A, ‘Sustainable Tax Governance And Transparency’ [2018] SSRN Electronic Journal

Gulzar M and others, ‘Does Corporate Social Responsibility Influence Corporate Tax Avoidance Of Chinese Listed Companies?’ (2018) 10 Sustainability

Karavitis P, Kazakis P, and Xu T, ‘Overconfident Ceos, Corporate Social Responsibility &Amp; Tax Avoidance: Evidence From China’ [2021] SSRN Electronic Journal

Hasian Purba, ‘THE EFFECT OF GOOD CORPORATE GOVERNANCE MECHANISM AND CORPORATE SOCIAL RESPONSIBILITY DISCLOSURE ON TAX AVOIDANCE WITH COMPANY SIZE AS MODERATING VARIABLES’ [2021] EPRA International Journal of Multidisciplinary Research (IJMR)

Handayani R, ‘Analysis Of Corporate Social Responsibility And Good Corporate Governance To Tax Aggressiveness’ (2019) 9 International Journal of Academic Research in Accounting, Finance and Management Sciences

Hardeck I, Harden J, and Upton D, ‘Consumer Reactions To Tax Avoidance: Evidence From The United States And Germany’ (2019) 170 Journal of Business Ethics

Jallai A, and Gribnau H, ‘Aggressive Tax Planning And Corporate Social Irresponsibility: Managerial Discretion In The Light Of Corporate Governance’ [2018] SSRN Electronic Journal

Jallai A, ‘Good Tax Governance: International Corporate Tax Planning And Corporate Social Responsibility – Does One Exclude The Other?’ [2020] SSRN Electronic Journal

Liao L, Chen G, and Zheng D, ‘Corporate Social Responsibility And Financial Fraud: Evidence From China’ (2019) 59 Accounting & Finance

Ortas E, and Gallego-Álvarez I, ‘Bridging The Gap Between Corporate Social Responsibility Performance And Tax Aggressiveness’ (2020) 33 Accounting, Auditing & Accountability Journal

Rudyanto A, and Pirzada K, ‘The Role Of Sustainability Reporting In Shareholder Perception Of Tax Avoidance’ (2020) ahead-of-print Social Responsibility Journal

Toder-Alon A, Rosenstreich E, and Te’eni Harari T, ‘Give Or Take? Consumers’ Ambivalent Perspectives On The Relationship Between A Firm’s Corporate Social Responsibility Engagement And Its Responsible Tax Payments’ (2019) 26 Corporate Social Responsibility and Environmental Management

‘Corporate Social Responsibility And Tax Avoidance In Nigeria’ [2021] Research Journal of Finance and Accounting

Akın E, ‘Aggressive Tax Policy Versus Aggressive Tax Planning’ [2020] SSRN Electronic Journal

Wang F and others, ‘CORPORATE TAX AVOIDANCE: A LITERATURE REVIEW AND RESEARCH AGENDA’ (2019) 34 Journal of Economic Surveys

Wen W, Cui H, and Ke Y, ‘Directors With Foreign Experience And Corporate Tax Avoidance’ (2020) 62 Journal of Corporate Finance

[1] Laszlo Goerke, ‘Corporate Social Responsibility And Tax Avoidance’ [2018] SSRN Electronic Journal.

[2] Alexander Brune, Martin Thomsen and Christoph Watrin, ‘Family Firm Heterogeneity And Tax Avoidance: The Role Of The Founder’ (2019) 32 Family Business Review.

[3] Maggie Cooper and Quyen T.K. Nguyen, ‘Understanding The Interaction Of Motivation And Opportunity For Tax Planning Inside US Multinationals: A Qualitative Study’ (2019) 54 Journal of World Business.

[4] Siti Nasuha Muhmad, ‘The Effects Of Financial Motives Towards Corporate Tax Avoidance: Evidence From Public Listed Companies In Malaysia’ (2020) 12 Journal of Advanced Research in Dynamical and Control Systems.

[5] Hans Gribnau and Ave-Geidi Jallai, ‘Sustainable Tax Governance And Transparency’ [2018] SSRN Electronic Journal.

[6] Muhmad S, ‘The Effects Of Financial Motives Towards Corporate Tax Avoidance: Evidence From Public Listed Companies In Malaysia’ (2020) 12 Journal of Advanced Research in Dynamical and Control Systems

[7] : M.A. Gulzar and others, ‘Does Corporate Social Responsibility Influence Corporate Tax Avoidance Of Chinese Listed Companies?’ (2018) 10 Sustainability.

[8] Panagiotis Karavitis, Pantelis Kazakis and Tianyue Xu, ‘Overconfident Ceos, Corporate Social Responsibility &Amp; Tax Avoidance: Evidence From China’ [2021] SSRN Electronic Journal.

[9] Hasian Purba, ‘THE EFFECT OF GOOD CORPORATE GOVERNANCE MECHANISM AND CORPORATE SOCIAL RESPONSIBILITY DISCLOSURE ON TAX AVOIDANCE WITH COMPANY SIZE AS MODERATING VARIABLES’ [2021] EPRA International Journal of Multidisciplinary Research (IJMR).

[10] Riaty Handayani, ‘Analysis Of Corporate Social Responsibility And Good Corporate Governance To Tax Aggressiveness’ (2019) 9 International Journal of Academic Research in Accounting, Finance and Management Sciences.

[11] : Inga Hardeck, J. William Harden and David R. Upton, ‘Consumer Reactions To Tax Avoidance: Evidence From The United States And Germany’ (2019) 170 Journal of Business Ethics.

[12] Ave-Geidi Jallai and Hans Gribnau, ‘Aggressive Tax Planning And Corporate Social Irresponsibility: Managerial Discretion In The Light Of Corporate Governance’ [2018] SSRN Electronic Journal.

[13] Ave-Geidi Jallai, ‘Good Tax Governance: International Corporate Tax Planning And Corporate Social Responsibility – Does One Exclude The Other?’ [2020] SSRN Electronic Journal.

[14] Lin Liao, Guanting Chen and Dengjin Zheng, ‘Corporate Social Responsibility And Financial Fraud: Evidence From China’ (2019) 59 Accounting & Finance.

[15] Eduardo Ortas and Isabel Gallego-Álvarez, ‘Bridging The Gap Between Corporate Social Responsibility Performance And Tax Aggressiveness’ (2020) 33 Accounting, Auditing & Accountability Journal.

[16] Astrid Rudyanto and Kashan Pirzada, ‘The Role Of Sustainability Reporting In Shareholder Perception Of Tax Avoidance’ (2020) ahead-of-print Social Responsibility Journal.

[17] Anat Toder-Alon, Eyal Rosenstreich and Tali Te’eni Harari, ‘Give Or Take? Consumers’ Ambivalent Perspectives On The Relationship Between A Firm’s Corporate Social Responsibility Engagement And Its Responsible Tax Payments’ (2019) 26 Corporate Social Responsibility and Environmental Management.

[18] ‘Corporate Social Responsibility And Tax Avoidance In Nigeria’ [2021] Research Journal of Finance and Accounting

[19] Emre Akın, ‘Aggressive Tax Policy Versus Aggressive Tax Planning’ [2020] SSRN Electronic Journal.

[20] Wen Wen, Huijie Cui and Yun Ke, ‘Directors With Foreign Experience And Corporate Tax Avoidance’ (2020) 62 Journal of Corporate Finance.

………………………………………………………………………………………………………………………..

Know more about UniqueSubmission’s other writing services: