M.Sc. Accounting and Finance Assignment Sample

International Corporate Reporting

Introduction

International corporate reporting is concerned with reporting the monetary performance and non-financial performance of an organization within a stated period. This portfolio of research is based on Sainsbury’s and data has been collected from annual reports and accounts of the last 5 years (2016, 2017, 2018, 2019 and 2020). Financial statements are a very important source of information for reporting and organization that outlines the financial performance of the company. Along with this annual reports and accounts also provide a very important and large amount of information about a company in terms of its strategy, practices and success. For this report, Sainsbury’s has been considered that is a UK based supermarket retailer and the 2nd largest chain of superstores in the UK. The business was started in 1869 in Holborn and is presently headquartered in London, UK.

Initial information

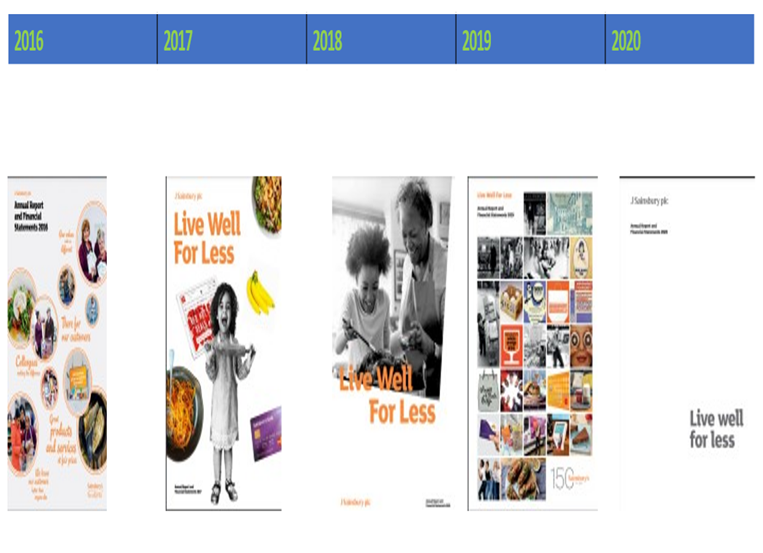

5 years Annual Reports

The above image involves covers of 5 years of Sainsbury’s annual reports and accounts. This outlines that from 2016 to 2019, covers were creative and added images from the stores. However, in the year 2020, the cover of the yearly report and books was very simple and from the year 2017, the slogan of the yearly report has remained the same that is ‘Live well for less’.

Coding

This coding is based on a thorough analysis of the annual report and chairman’s letter. In this, some key narrative elements were used and, in this report covid-19 and its impact was one of the important concerns (Annual Report and Financial Statements 2020). This outlines the impact of covid-19 and the challenges created by covid-19 for industry and the organization. The coding and content analysis mainly included narrations from the report, theme, and whether the concern is historic, ongoing and future-looking. In addition to this, the nature of the narration was also discussed in the report regarding whether it is good (positive) or bad (negative).

Based on the narratives of the report, it can be said that the company has adopted a holistic approach to dealing with the impact of the pandemic. In this holistic approach, the company have included customers, employees, communities and society in its consideration. The holistic approach of the company is very helpful in creating a positive image of the company to customers and employees. The company have also ensured the well-being of the employees and acknowledged the efforts of the employees in managing changed situations and the impact of a pandemic. In its annual report, the majority of discussion is based on the pandemic and its impact because, in the year 2020, the company, industry and the world were affected by Covid-19. Annual reports and different narratives involve the impact of covid-19, challenges created by covid-19 and the response of the company to the challenges created by covid-19.

10 KEYWORDS

The above screenshot includes 10 keywords identified from the annual report of the company. Keywords outline that customer word has been used most of the time which is around 996 times.

Customers– Customers are the most important stakeholders of the company and these are the one who buys products and services of Sainsbury’s and maintains its survival and contribute to its growth. In the annual report of Sainsbury’s customer word has been mentioned 986 times. This count of use of customer words indicates that customers are given adequate attention in Sainsbury’s. Emphasis on customers is very important for ensuring that the company is capable of attracting and retaining customers. In order to collect information about the customers, the company uses a customer relationship management system for collecting and analyzing information about client impressions.

Revenue– Revenue is the second most used word in the annual report of Sainsbury’s. Revenue is determined and computed on the basis of sales for the entire year and emphasis on revenue indicates that strategy, decisions and actions are based on the revenue of the company. earning maximum revenue is an important objective of every company and having focus on this helps in making the right strategic decisions and Sainsbury’s has a strong emphasis on revenue in the company.

Cash flow– Cash flow is the third most used word in the annual report of the company. The cash flow word has been used around 226 times and emphasis on this word indicates that the company has a strong focus on its cash flow. Cash involves cash inflow and cash outflow and organisations focus on increasing cash inflows and decreasing cash outflows. Organisations develop strategies through which they can reduce their cash outflow by reducing costs in the organisation.

Strategy– Based on the keyword analysis, strategy is the fourth most used word in the annual report of Sainsbury’s. Based on the yearly report of Sainsbury’s it can be said that the firm places a strong emphasis on strategy and implementing strategy is strongly emphasised. Emphasis on the strategy of the company outlines that strategy is a very important consideration. Strategy is concerned with an action plan that an organisation develops to achieve its goals and objectives. Appropriately developed and effectively implemented strategies play a very important role in the success of the company to achieve its goals.

Product– Based on the keywords in the report, the product is the fifth most used word in the report. Sainsbury’s is focusing on developing high-quality products along with variety and innovation while keeping the cost and price of products low. Hence, the product is also an important and strongly emphasised element of the report.

The Consolidated Balance Sheet

The consolidated balance sheet of Sainsbury’s outlines possessions and obligations held by the company. Based on the combined balance sheet non-current resources of the company have continuously increased and a very slight difference was being there in 2020. Based on this, the total current assets of the company have also increased regularly even in the year 2020. Based on the balance sheet net properties of the company have continuously increased and there was a small difference in assets in the year 2020.

Risk Judgment About the Consolidated Balance Sheet

Best of the following balance sheet it can be said that the money and money equivalents of the firm have continuously increased. Cash and cash equivalents are part of the current assets of the firm. The company also has certain current liabilities in form of loans and overdrafts and this has been fluctuating every year and highest current liabilities were in 2016 since then it has reduced and then increased in 2020 (Annual Report and Financial Statements 2019). Noncurrent assets of the company have also increased regularly and based on the complete analysis of the balance sheet and risk judgment about it the company is at low risk. The company is safe from the perspective of the debt-equity ratio and is at low risk based on gross long-term debt and net gearing.

IFRS 8, IFRS15, IAS 12, IAS35

There are multiple accounting standards that are required to be followed by the company while recording and accounting for its financial transactions. Based on the consolidated income statement different accounting standards were followed by the company. These accounting standards included IAS18, IAS1.38, IAS 33 and IAS1.85. IAS18 outlines requirements of accounting about when to recognise income from the deal of goods based on facilities and for attention and royalty (IAS 18 — Revenue, 2022).

As per this, income is the gross influx of financial benefits throughout a period based on ordinary activities of the entity. IAS1.38 require organizations to disclose comparative info in relation to the earlier per for all quantities reported in the monetary statements. IAS1.85 is about presenting additional line items in the balance sheet based on the results of the operations of the organization (IAS 1 — Presentation of Financial Statements, 2022). IAS 33 is concerning the calculation of earnings per share and diluted earnings per share. Basic salaries per share are calculated on the basis of the weighted average number of ordinary shares outstanding during the period (IAS 33 — Earnings Per Share, 2022). Diluted earnings per part include dilutive possible normal shares.

IFRS3, IFRS7, IFRS9 and IAS 1, IAS2, IAS7, IAS12, IAS16, IAS 37, IAS38

Based on the above balance sheet outlines data about Sainsbury’s in the year 2019 and 2020 based on different international financial reporting standards. Reporting standards considered in this balance sheet include IFRS 16 which requires as per IFRS 3, all identifiable resources and charges are essential to be included in consolidated statements of the financial position of the company (IFRS 3 — Business Combinations, 2022). IFRS 9 has also been considered in the following balance sheet that outlines how the organization should categorise and extent its financial assets and liabilities and some contacts for buying and selling non-financial items (IFRS 9 Financial Instruments, 2022). IFRS 15 has been considered in the following balance sheet. IFRS 15 is used for establishing principles that organizations need to apply for writing useful info to users of monetary statements. The information is about nature, amounting, timing and indecision (IFRS 15 Revenue from Contracts with Customers, 2022). Along with IFRS, some standards of IAS have also been included in the following balance sheet. IAS 2 has been considered in this balance sheet which is about the treatment of inventories in accounting (IAS 2 — Inventories, 2022). It provides leadership about shaping the cost of portfolios and considering expenses. This balance sheet has also included IAS 16 which founds principles for knowing property, plant and tools as assets. IAS 38 have also been applied to the balance sheet and this standard set out criteria for identifying and measuring intangible assets and disclosure of these assets in the statement.

Consolidated Cash Flow Statement

The following cash flow statement of Sainsbury’s is for the years 2017 and 2018 based on different international accounting standards. IAS considered and applied in this case flow statement include IAS7, IAS7.13, IAS7.16, IAS7.17, and IAS7.45. IAS 7 outlines a requirement of presenting information in a statement of cash flow regarding changes in cash and cash equivalent of a company during a period of time (IAS 7 — Statement of Cash Flows, 2022). This is a standard that requires companies to create cash flows. IAS7.13 is a standard requirement for cash inflows and outflows that are required to be presented separately as operating investing and financial activities.

Revenue

The following figure represents the revenue of Sainsbury’s in the last 5 years. Based on the revenue it can be said that the company’s revenue has been continuously increasing since the year 2016 as outlined in the consolidated revenue. However, in the year 2020, there was a slight change in revenue and it was reduced due to the impact of covid-19 (Annual Report and Financial Statements 2018). Revenue was continuously increasing but the growth was negatively affected in the year 2017 the growth was 109% which was reduced to 66.70% in 2018 to 11.02% in 2019 and in the year 2020, the growth became negative which was -0.14%. The annual growth of Sainsbury’s is 46.70% and the growth rate of Sainsbury’s can be determined as slowly growing.

Profitability

Profitability is one of the very important objectives of every organization. Profitability is concerned with additional income generated by a company after reducing the cost of the company involved in operations and administration. The income statement of a company outlines the profitability of the company based on total revenue earned by the company and costs incurred by the company. The income statement of Sainsbury’s outlines that the profit of the company is fluctuating in which profit in 2016 was 471 which was reduced to 377 in 2017 (Annual Report and Financial Statements 2017). Further in 2018, there was an additional decrease in the profit of Sainsbury’s in which the profit was 309. In the year 2019 further reduction in profitability and the profit earned by the company was 219. In the year 2020, the profit of Sainsbury’s significantly increased and the company earned 437 million.

One notable element is that there was considerable growth in the profit of the company in 2020 which was affected by Covid-19. The reason why profit was considerably lower in the year 2019 was the administrative expenses of the company. Administrative expenses were significantly high in 2019 and reduced in 2020 and this affected profit earned by the company. The operating profit of the company was also low in 2019 and this was continuously decreasing from the year 2016. As per the income statement, the operating profit of the company was 707 in 2016 and followed by this operating profit was 642, 518, 312 and 986 in 2017, 2018, 2019 and 2020 respectively. Based on the information of the income statement, it can be said that the performance of Sainsbury’s was positive and better in times of Covid as compared to previous years of operations.

Cash Flow 5 Years Summary

The cash flow statement of Sainsbury’s outlines cash inflow and outflow from the year 2016 to 2020. Based on the following cash flow statement cash flow of the company has remained the same for most of these 5 years however there is one significant change in the closing cash position in the year 2018. In addition to this, net cash flow from operating activities has significantly increased in the year 2017 as compared to the year 2016 (Annual Report and Financial Statements 2016). Since then, the cash flow has been continuously increasing in 2017 and 2018 and reduced in the year 2019 and then again increased in 2020. One important element differentiating in this cash flow statement is that in the year 2018 cash flow in the year boss positive as compared to the other 4 years outlined in the cash flow statement.

Quality of Earnings Ratio

The following information outlines that operating cash is generated by operating profit. The following information outlines that in the year 2016, cash made from processes before tax was higher than net cash from working events. Other than this, in every year followed by 2016, net cash generated from operating actions was higher than cash generated from operations before tax (Results, Reports and Presentations, 2022). Operating activities before tax because all kinds of expenses are reduced from net cash generated. Higher cash flow states the positive financial situation of the company and based on this, Sainsbury’s financial situation is positive.

References

Annual Report and Financial Statements (2016). [Online]. Available Through: https://www.about.sainsburys.co.uk/~/media/Files/S/Sainsburys/documents/reports-and-presentations/annual-reports/annual-report-2016.pdf

Annual Report and Financial Statements (2017). [Online]. Available Through: https://www.about.sainsburys.co.uk/~/media/Files/S/Sainsburys/pdf-downloads/sainsburys-ar-2017-full-report.pdf

Annual Report and Financial Statements (2018). [Online]. Available Through: https://www.about.sainsburys.co.uk/~/media/Files/S/Sainsburys/documents/reports-and-presentations/annual-reports/sainsburys-ar-2018-full-report-v2.pdf

Annual Report and Financial Statements (2019). [Online]. Available Through: https://www.about.sainsburys.co.uk/~/media/Files/S/Sainsburys/documents/reports-and-presentations/Sainsburys_AR2019.pdf

Annual Report and Financial Statements (2020). [Online]. Available Through: https://www.about.sainsburys.co.uk/~/media/Files/S/Sainsburys/documents/reports-and-presentations/annual-reports/2020/Annual_Report_and_Financial_Statements_2020.pdf

IAS 1 — Presentation of Financial Statements. (2022). [Online]. Available Through: https://www.iasplus.com/en/standards/ias/ias1

IAS 18 — Revenue. (2022). [Online]. Available Through: https://www.iasplus.com/en/standards/ias/ias18

IAS 2 — Inventories. (2022). [Online]. Available Through: https://www.iasplus.com/en/standards/ias/ias2

IAS 33 — Earnings Per Share. (2022). [Online]. Available Through: https://www.iasplus.com/en/standards/ias/ias33

IAS 7 — Statement of Cash Flows. (2022). [Online]. Available Through: https://www.iasplus.com/en/standards/ias/ias7

IFRS 15 Revenue from Contracts with Customers. (2022). [Online]. Available Through: https://www.ifrs.org/issued-standards/list-of-standards/ifrs-15-revenue-from-contracts-with-customers/

IFRS 3 — Business Combinations. (2022). [Online]. Available Through: https://www.iasplus.com/en/standards/ifrs/ifrs3#:~:text=IFRS%203%20allows%20an%20accounting,net%20assets%20of%20the%20acquiree.

IFRS 9 Financial Instruments. (2022). [Online]. Available Through: https://www.ifrs.org/issued-standards/list-of-standards/ifrs-9-financial-instruments/

Results, Reports and Presentations. (2022). [Online]. Available Through: https://www.about.sainsburys.co.uk/investors/results-reports-and-presentations#2021

………………………………………………………………………………………………………………………..

Know more about UniqueSubmission’s other writing services: