MAR023-1 International Business Assignment Sample : Foreign Direct Investment

Here’s the best sample of MAR023-1 International Business Assignment on Foreign Direct Investment, written by the expert.

Executive Summary

The present report has shed light on the FDI strategies and challenges for business development of Tesco. The concept of FDI has been demonstrated in the study with help of Internationalization Model, Capital Movement Theory, and Eclectic Paradigm Model. Apart from this, the strategies and challenges of FDI has been analysed in the study in the context of Tesco. Moreover, the study has consisted of critical analysis of internationalization strategies used by Tesco.

Introduction

The present report is going to analyse the relevant issues and key assumptions of foreign direct investment. The study will be developed based on the context of FDI strategies of Tesco in the UK. In order to understand the concept of FDI, theories such as capital movement theory, internationalisation model is going to be discussed in the report. Apart from this, the literature analysis on FDI is going to be developed based on key issues and international firm strategies of Tesco. Moreover, the study will consist of critical analysis of the FDI of Tesco.

Clear understanding on FDI

Capital Movement Theory

The capital movement theory suggests that capital is the essential aspect for enhancing the product procedure of a business. Internal capital transfer refers to the movement of any kind of capital between two or more countries. According to Tvaronavičienė (2019), the capital movement of the countries is dependent upon financial capital or physical capital. The concept of FDI comes from the idea of capital movement, where a company invests in a different country which supports the overall economic development of the host country. The foreign direct investment is extremely important for under developed or developing countries where economic requirements can be met by enhancing the employment rate. On the other hand, investors get benefited by increasing market share and profit.

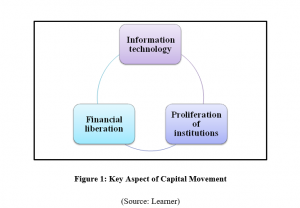

As an example, Tesco is looking forward to investing in Indian market, which will be helpful for India to improve its economic position. Besides, Tesco will be benefited through market expansion and revenue margin. The theory suggests that the international capital movement develops a relationship of borrowing and lending among the countries around the world. As cited by Tvaronavičienė (2019), in the capital account of balance of payment, the movement of capital is recorded. Since the 1990s, the surge in capital flow has been seen in the global marketplace, which has eventually brought the concept of foreign direct investment. The flow of international capital is emanated from three aspects namely information technology, financial liberation and proliferation of institutions.

Internationalization Theory

The main focus of the internationalization theory is on the impact of transaction cost on the formation of an organization. The development of the model is done based on the idea of occurrence of business transactions in the international market. As opined by Conconi et al. (2016), the idea of internationalization is developed by explaining FDI and international production. The operations of a large firm like Tesco is not only focused on development of goods and services but on certain activities such as hiring, training, marketing and R&D (Research and Development). All of these activities of the firms are interrelated by the intermediation of products and services.

As per the internationalization theory the essential intermediate that develops connections between key activities are Knowledge and Expertise (Casson, 2018). Knowledge is considered as an essential part of internationalization theory of FDI that takes a significant amount of time to generate. As an example, research and development is a key activity that helps to generate knowledge that can be used for enhancing the operational and marketing strategy. Besides, expertise of the employees is crucial for the success and growth of a business.

Expertise can help an organization to develop effective connection between each of the departments of an organization. Knowledge and expertise can easily be transmitted from one country to another country with the help of FDI. It is essential for Tesco to develop internal markets in the markets of foreign countries. It can be understood from the internationalization theory that FDI is essential for a multinational company to improve its knowledge and expertise with the help of foreign direct investment, which can lead to business growth.

Eclectic Paradigm (Framework) for FDI

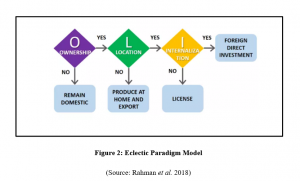

The model of electric paradigms is extremely important to understand the internationalization of business through foreign direct investment. There are several motivations that play a crucial role in influencing the decision of multinational companies to invest in a foreign country. The first thing is human and physical resources that are attractive in a foreign country than home country. The second focus point of companies is needs and demands of the customers of the foreign market (Pathan, 2017). Based on the analysis of these two aspects, the decision of investing on a new market is taken by a company.

There are multiple strategies of accessing a new market such as exporting, franchising, licensing, developing strategic alliances and acquiring and creating joint ventures and they are considered by multinational companies like Tesco. As opined by Sharmiladevi (2017), the strategies for instance, Strategic Alliance, Joint Venture and Acquiring require a large amount of equity; hence, the concept of FDI comes in place. In the Eclectic Paradigm model, three essential elements for engaging successful foreign direct investment have been identified such as Ownership, Location and Internalization (Rahman et al. 2018). Based on the advantages of these three aspects in the foreign market, Tesco can easily develop an effective strategy of international business in a foreign marketplace. The eclectic paradigm model is mainly focused on the entry in the foreign market and engaging FDI with business development.

Choice of relevant literature and integration (Key Assumptions)

Key issues of FDI

FDI refers to business process of investing or purchasing capital in a foreign country for business development. As an example, Tesco is going to invest a significant amount of money in the Indian market which is considered as FDI for India (Malviya, 2015). However, investing in a foreign country is not an easy task for Tesco as it may have to face certain challenges in the process. There are three major aspects that significantly affect the FDI of multinational companies (Nielsen et al. 2017). They are as follows:

Skill & wage cost of workers

Wage rate and skills are considered as two major factors that attract investors to invest in developing countries (Bickenbach and Liu, 2018). The cost of labour is significantly low in the Indian subcontinent, hence it has attracted Tesco. However, the lack of skilled employees in the country can be a significant challenge for business development in Tesco.

Communication & transportation links

In order to develop business in a foreign market, it is important for a company to pay attention to communication and transportation is extremely important. Communication and transportation is an essential aspect that creates a link between two countries (Guimón and Filippov, 2017). However, high transportation costs in certain countries are a major drawback internationalization of the business of Tesco.

Infrastructure & access to raw materials

It is crucial to have a strong infrastructure in a country where the business is going to be expanded. As per Szent-Iványi (2017), lack of proper infrastructure can affect the resource allocation of the business process. It can be extremely challenging for Tesco to expand business in foreign countries where proper infrastructure and access to resources are not available.

The above mentioned aspects are detrimental to the business growth and market expansion for Tesco. These issues have the potential to prevent FDI direct investment in a foreign market. Hence, it is important for Tesco to develop internal firm strategies to deal with potential challenges.

Internal Firm Strategy

The expansion of business in the international business is the main driver for the success of Tesco. The company is aimed to move into high margin merchandise of non food items based on the strong business core in the domestic market of the UK. As suggested by Wood et al. (2017), the success of Tesco in the domestic market of the United Kingdom is built on cultivation of customer loyalty, reasonable price and expansion of retail services. The basics of the business strategy of Tesco include core business, internationalization, community plan and retailing services. Focusing on such aspects, Tesco is developing its business in the international market using foreign direct investment strategy.

The rationale for the business development strategy through FDI of Tesco is to create a business scope that will be helpful for enabling the company to deliver sustainable long term growth in the international market (Wood et al. 2016). In order to expand business in the Indian marketplace, Tesco has partnered with Tata group for multi-brand retailing. Tata is an established company of India which understands the patterns of business development in the country. Based on the joint venture strategy of FDI, Tesco is looking forward to potential challenges such as infrastructure, skills and transportation. The joint venturing will be helpful for the company to expand its business in India without facing much trouble.

Critical Evaluation

It can be understood from the above discussion that Tesco is using a joint venture strategy to access the market of India. There are many benefits of FDI that can be acquired by Tesco with the help of joint ventures. As cited by Dheensa et al. (2017), joint ventures are extremely important for a company to get access to the human and physical resource without getting directly involved in activities such as hiring and resourcing. In the case of Tesco, it can use the already hired employees of Tata group for executing the different activities of the business process. As argued by Romeli et al. (2016), the joint ventures can allow companies to share the risk of uncertainties in the foreign market.

In the context of Tesco, the joint venture strategy has helped the company to pressure business opportunities provided by high population and market demand in India. However, the volatility of the Indian economy and the spending of customers can affect the business development process of Tesco. There are certain limitations for multinational companies such as Tesco for using joint venture for FDI in the foreign country. As critiqued by Dheensa et al. (2017), the level of success of joint ventures is dependent upon the effectiveness of the tactics of alliance companies. The occurrence of any kind of misunderstanding or conflict between Tata and Tesco lead to failure of the venture.

Besides India, Tesco has followed the acquisition strategy of FDI to expand business in France. Tesco has bought 85% of equity in Catteau supermarkets in the past which used to be operated by a local company of France named Cedico (Wood et al. 2016). There are certain negative consequences of acquisition which may affect the business of the company. As argued by Safa et al. (2017), it is extremely challenging for multinational companies to integrate acquired business with the domestic office. Acquiring business does not signify acceptance of assets and opportunities but also the risks and liabilities. However, in order to enhance the overall business development through foreign direct investment, Tesco is required to go through appropriate market analysis and develop effective business strategies.

Conclusion

Based on the above analysis, it can be concluded that FDI is an effective strategy for business development for Tesco. However, the company is needed to focus on the challenges and risks associated with this strategy. In the present report, the clear understanding regarding FDI has been gained with the help of models and theories such as Capital Movement Theory, Eclectic Paradigm Model and Internationalization Theory. The analysis has suggested certain challenges of FDI in the new market such as skill of workers, infrastructure and transportation related issues. However, the success of business development of Tesco international market is ensured by its core business and diversification strategy. Moreover, the report has shed light on certain challenges associated with FDI strategies such as acquire and joint venture.

References

Bickenbach, F. and Liu, W.H., 2018. Chinese direct investment in Europe–Challenges for EU FDI policy. In CESifo Forum (Vol. 19, No. 4, pp. 15-22). München: ifo Institut–Leibniz-Institut für Wirtschaftsforschung an der Universität München.

Casson, M., 2018. Coase and International Business: Rethinking the Connection. The Multinational Enterprise: Theory and History, Cheltenham, UK and Northampton, MA, USA: Edward Elgar Publishing, pp.209-29.

Conconi, P., Sapir, A. and Zanardi, M., 2016. The internationalization process of firms: From exports to FDI. Journal of International Economics, 99, pp.16-30.

Dheensa, S., Carrieri, D., Kelly, S., Clarke, A., Doheny, S., Turnpenny, P. and Lucassen, A., 2017. A’joint venture’model of recontacting in clinical genomics: challenges for responsible implementation. European journal of medical genetics, 60(7), pp.403-409.

Guimón, J. and Filippov, S., 2017. Competing for high-quality FDI: Management challenges for investment promotion agencies. Institutions and Economies, pp.25-44.

Malviya, S., 2015. FDI in multi-brand retail: Tata-Tesco JV plans Rs 250 crore investment to open more stores, The Economic Times. Available at: https://economictimes.indiatimes.com/industry/services/retail/fdi-in-multi-brand-retail-tata-tesco-jv-plans-rs-250-crore-investment-to-open-more-stores/articleshow/45984724.cms?from=mdr [Accessed on 6th July 2020]

Nielsen, B.B., Asmussen, C.G. and Weatherall, C.D., 2017. The location choice of foreign direct investments: Empirical evidence and methodological challenges. Journal of World Business, 52(1), pp.62-82.

Pathan, S.K., 2017. An empirical analysis of the impact of three important aspects of Eclectic Paradigm on Foreign Direct Investment (FDI). International Research Journal of Arts & Humanities (IRJAH), 45(45).

Rahman, A., Bridge, A., Rowlinson, S., Hubbard, B. and Xia, B., 2018. Multinational contracting and the eclectic paradigm of internationalization. Engineering, Construction and Architectural Management, 25(11), pp.1418-1435.

Romeli, N., Halil, F.M., Ismail, F. and Shukor, A.S.A., 2016. Economic Challenges in Joint Venture Infrastructure Projects: Towards Contractor’s Quality of Life. Procedia-Social and Behavioral Sciences, 234, pp.19-27.

Safa, M., Weeks, K., Stromberg, R. and Al Azam, A., 2017, July. Strategic Port Human Resource Talent Acquisition and Training: Challenges and Opportunities. In International Conference on Applied Human Factors and Ergonomics (pp. 205-215). Springer, Cham.

Szent-Iványi, B., 2017. Investment promotion in the Visegrad four countries: post-FDI challenges. Condemned to be left behind, pp.171-187.

Tvaronavičienė, M. (2019, May). Emerging economic leadership: insights into recent trends of capital movement. In 3rd International Conference on Social, Economic, and Academic Leadership (ICSEAL 2019). Atlantis Press.

Tvaronavičienė, M., 2019. Insights into global trends of capital flows’ peculiarities: emerging leadership of China. Administration & Public Management Review, (32).

Wood, S., Coe, N.M. and Wrigley, N., 2016. Multi-scalar localization and capability transference: exploring embeddedness in the Asian retail expansion of Tesco. Regional Studies, 50(3), pp.475-495.

Wood, S., Wrigley, N. and Coe, N.M., 2017. Capital discipline and financial market relations in retail globalization: insights from the case of Tesco plc. Journal of Economic Geography, 17(1), pp.31-57.

________________________________________________________________________________

Know more about UniqueSubmission’s other writing services: