MBB7008M Accounting And Finance For Decision Making Assignment Sample

Module Code And Module Title : MBB7008M Accounting And Finance For Decision Making

1. Executive Summary

Introduction, In this case, study, a clear representation of Tesco Plc has been chosen in order to check their performance in the market. It is a multinational company that deals in retailing all general merchandise. The company operates their stores in various forms that are bifurcated by their ranges and sizes and have different products sold that include small, large one-stop and dotcom.

Report purpose

The main purpose of the report is to analyze the evaluation of the profitability made by the company that is related to the potential investments. Through this report, Tesco Plc’s capital budgeting of the company is estimated and its cash flows worthiness is calculated. It is the process where the company evaluated the potential of various projects and investments that the company makes.

Discussion and Analysis

The budgeting of capital creates measurability and accountability in the company and allows the company to choose the best investments that can be profitable and beneficial. A company that makes wrong investments can suffer huge risks in the future and can also bear losses in the future. Therefore it is important that the company chose various investments wisely after comparing various projects and tallying them accordingly so that there is no hurdle in managing the budgeting.

Recommendation

- It is recommended that the company should choose various projects and tally them after analyzing their profitability.

- The evaluation of the NPV and IRR depicts the positive investments as well as the makes the investment attractive.

2. Motivation of the proposed investment

Issues

Tesco Plc has faced various issues during the time of pandemic situation and the profit of the company fall rapidly by £825m. The poor performance impacted the sales of the company in several fields like the grocery wholesale business. The company faced uncertainty in the economic condition during the pandemic situation. However, after all this, the company’s sales were positively impacted as the demand for groceries rises. As the company deal in the sales of groceries online, it becomes easier for the customers to buy the products. Therefore, the sale of the company rose by 9.2% in the year 2019. The main issue that arose during the pandemic was that the company faced a shortage in hiring the staff members. The company hired around 5000 workers during covid-19 among which only 2000 permanent joined the company. Therefore, the loss of staff members affected the company drastically. The cost of the company rose rapidly during this phase which resulted in a fall in revenue in the market.

Solution

It became crucial for the company to overcome the situation and generate more revenue after facing such losses. Therefore the company took several steps in enhancing its marketing strategies.

Cause of the issue

The main issue that caused the pandemic was stockpiling which has driven the sales for various grocers. The shares of the company fell by 4.4%.In this phase, the company incurred the lowest cost in the business and also the growth as well as profit of the company rapidly fall down.

Change in the issues

The company can however recover their losses by increasing the cost of the market in order to increase the revenue and also the overall performance of the company. In order to recover the losses, the company should make changes in the grocery business and inculcate new ideas in the company.

Changing capabilities

The company should focus on fast delivery of groceries and goods so that the customers get convinced and should deliver good quality products to the customers. This helps in increasing the profit of the company and can generate fair revenue as well.

Specific deliverables

Tesco have been providing banking services to the consumers in order to develop the PCA and build healthy relations with the consumers. The company focuses on understanding the needs and wants of the consumers that help them in maintaining sustainability as well as constant growth of the company.

3. Conduct investment appraisal using both quantitative and qualitative information

Investment appraisal is an analysis that is done to evaluate the profitability of investment over the asset’s life. This depicts that the company has enough long term capabilities and potential for the shareholders to make investments and earn profits in future projects. Here, the company Tesco has been chosen and it is analyzed by comparing it with different projects to see which projects work better for the company.

Payback Analysis

It is a kind of mathematical methodology that determines the period of payback from making investments. It helps in calculating the break-even point of the company as well. The company’s cash flow depicts that the company has two projects, project A and project B that are analyzed to check the investment method for seven years. The investment in project A is 46.28% whereas project B has a negative investment that is –9.33%. This depicts that project A is the best option for making investments for the company.

Net Present Value and IRR Analysis

NPV and IRR both are used to make planning for the investments and also project the profitability of the business. Here for this company, the NPV in project A is -1082.51 and the NPV for project B is 946.77. From the calculation and evaluation, it can be concluded that project B is the best option for investment for the company.

IRR is most commonly used in the analysis of finances in order to estimate the profit incurred while making investments. The calculation of IRR is almost the same as NPV. Here, the IRR for project A is 6.76% whereas for project B it is 17.66%. This depicts that project B is more effective than project A and project B should be chosen to make an investment in order to get profits in the market.

| Table 1 | |||||||

| Tesco plc: Cash flows of proposed investment project | |||||||

| Period | Project A | Discount factor 10% | Present Value | Project B | Discount factor 10% | Present Value | |

| £000 | £000 | £000 | £000 | ||||

| 0 | -6000 | 1 | -6000 | -8000 | 1 | -8000 | |

| 1 | 500 | 0.8012 | 400.6 | 4000 | 0.8012 | 3204.8 | |

| 2 | 600 | 0.8212 | 492.72 | 1200 | 0.8212 | 985.44 | |

| 3 | 1400 | 0.7554 | 1057.56 | 1500 | 0.7554 | 1133.1 | |

| 4 | 1200 | 0.6485 | 778.2 | 1800 | 0.6485 | 1167.3 | |

| 5 | 1500 | 0.6365 | 954.75 | 1300 | 0.6365 | 827.45 | |

| 6 | 1800 | 0.4562 | 821.16 | 1400 | 0.4562 | 638.68 | |

| 7 | 1000 | 0.4125 | 412.5 | 2400 | 0.4125 | 990 | |

| NPV | -1082.51 | 946.77 | |||||

Table 1: Investment project of Tesco (Source: Self-Created)

| Tesco plc: Cash flows of proposed investment project | |||||||

| Period | Project A | Net cash flow | Project B | Net Cash flow | |||

| £000 | £000 | £000 | £000 | ||||

| 0 | -9000 | -9000 | -8000 | -8000 | |||

| 1 | 500 | -8500 | 2000 | -6000 | |||

| 2 | 400 | -8100 | 2000 | -4000 | |||

| 3 | 1500 | -6600 | 1200 | -2800 | |||

| 4 | 1200 | -5400 | 1400 | -1400 | |||

| 5 | 1400 | -4000 | 1800 | 400 | |||

| 6 | 1700 | 1000 | |||||

| 7 | 1000 | 2000 | |||||

| repaid in 4 years + 700/1600*12 | years and | 46.28571429 | months | repaid in 5 years | |||

Table 2: Cash Flow of Tesco Plc (Source: Self-Created)

The cash flow statement is made to check the cash inflows and outflows of the company and also to check the sufficient cash available in the company (Hazen and Magni, 2021). In order to run a business, it is important to have sufficient cash available so that the company can run the business more efficiently. Here, this study and the above table depict that project A has the best performance in 4 years’ time spans as compared to project B.

Pestle and SWOT Analysis

Pestle analysis

Political Factors

Tesco runs and operates in various countries therefore the company should follow the various rule and regulations in order to maintain authenticity in the business (Huang et al. 2022). This helps in maintaining political stability in the organization.

Economic factors

The company should always focus on the economic changes that happen in the business in order to maintain sustainability and this also affects various factors like sales, revenue, profits and distribution. The company should know all the guidelines and several taxation policies that are implemented by the government.

Social factors

The company Tesco should be aware of all the needs and wants of the consumers in order to build fair social relationships (Pan et al. 2022). The company recently has switched their business from food products to a whole new non-food category. The choices of the products depend on the cultural activity f the business.

Technological Factors

Tesco has implemented various strategies in their company to get the utmost profit and had used various digitalization and technologies to deliver their grocery products.

Legal Factors

In order to attain authenticity in the business the company needs to follow all the legal action implemented by the government. This creates ethnicity in the company and the customers can trust the company. This also improves the goodwill of the company.

Environmental Factors

Tesco is aiming for improving and creating sustainable growth in society. It has launched two phases reducing, removing, recycling and reusing. This helps in the development of the company and also helps in reducing waste in society.

SWOT ANALYSIS

| Strength

● The company has a strong connection with its customers as the company fulfils all the needs and wants of the consumers. ● The company has strong technological factors that enhanced the company. |

Weakness

● The company has faced various losses during the time of the pandemic and faced huge losses ● The company has low costs incurred in the business therefore the revenue generated is also low. |

| Opportunities

● Introduction of new and technological factors has affected the company and has made it more effective. ● This also helped the company in generating more profit in the business and the grocery sales also increased. |

Threats

● The company has various threats involved in the business during the pandemic and has incurred huge losses ● The overall performance of the business got declined. |

Table 3: PESTLE Tesco Plc (Source: Self-Created)

4. Critically discuss the risk and return and its potential impact on its financial performance

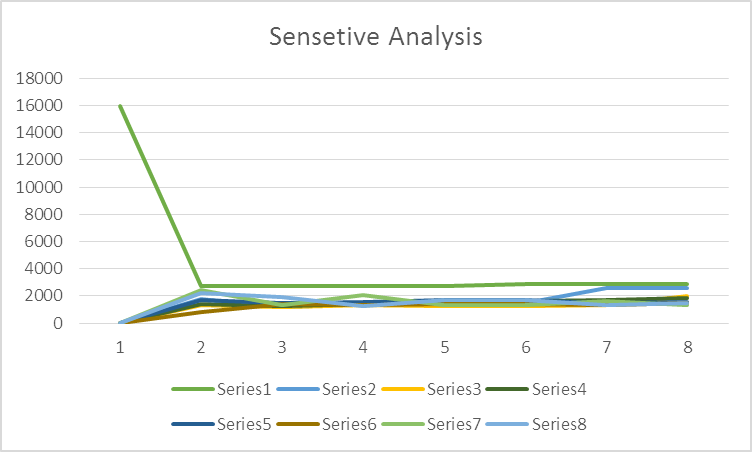

Sensitive Analysis

Tale 3: Sensitivity Analysis (Source: Self-created)

Tale 3: Sensitivity Analysis (Source: Self-created)

The analysis of the company Tesco depict the target variables of the company that are affected by the change in various variables called input variables. It predicts the future decision making of the company and their outcomes.

Cost of Capital risk

It is a kind of function that enables the market to be free from all the risks that are related to the investment (Magni and Marchioni, 2020). The investors have to be appropriate and various risk neutral estimates of the value that is expected in the cash flow statements (Wakholi et al. 2021). The company implement these risk factors to improve its functionality in the market.

Cost and Benefit risk

It offers the company a transparent and lucid way to integrate and assemble evidence in valuable decision-making and also analyzes the potential reward of the company (Marchioni and Magni, 2018). It compares the projects with different opportunities in order to estimate the best possible way to inculcate investment in the business.

Return on NPV

Difference between the present value of the inflows of cash and the outflow of cash over a given time period is the return on NPV. It estimates the potential profitability of the business or the company.

Risk and Return on Discounted Payback Period

There are comparatively ow risks involved in the business in the return of investment and different projects are compared according to the analyses. This helps the company in analyzing the performance of the company.

Potential impacts on the company’s financial performance

Tesco decided to deliver its products online and changed its packaging. The company used plastic bags in order to avoid any kind of infections in the market. The company performed similarly to the rival companies resulting in the rise in demand for various groceries and food items. This depicts that the company Tesco should implement project A in order to get better returns on the investment and to incur high profits in the business.

Reference List

Journals

Magni, C.A. and Marchioni, A., 2020. Average rates of return, working capital, and NPV-consistency in project appraisal: A sensitivity analysis approach. International Journal of Production Economics, 229, p.107769.

Marchioni, A. and Magni, C.A., 2018. Investment decisions and sensitivity analysis: NPV-consistency of rates of return. European Journal of Operational Research, 268(1), pp.361-372.

Pan, Y., Wei, K. and Zeng, X., 2022, March. Comparison of NPV and IRR and conflict resolution. In 2022 7th International Conference on Financial Innovation and Economic Development (ICFIED 2022) (pp. 1556-1560). Atlantis Press.

Wakholi, C., Nabwire, S., Kim, J., Bae, J.H., Kim, M.S., Baek, I. and Cho, B.K., 2021. Economic Analysis of an Image-Based Beef Carcass Yield Estimation System in Korea. Animals, 12(1), p.7.

Know more about UniqueSubmission’s other writing services: