MKT744 – Assignment Sample Global Marketing

Module Code And Title : MKT744 – Assignment Sample Global Marketing

Introduction

International trade is important because it helps to enhance business in the global market. Thus, it contributes to the economy and involves detailed market research and development in the international market. The application of trade law helps the business to upgrade its profit margin. The economy of the UK depends on foreign trade.

The major trade partner of the UK is the EU. The EU partners include France and Germany and it accounts for 12% of exports business. As per the economic theory, the total spending of a country affects employment, outputs and inflation. Emerging market refers to the developing market which fulfills the standards of a country’s trades and business.

It is important for a country’s economy as it develops the market strategy. The pre-industrial state moves towards modernisation which experiences an economic shift. This economy has potential which gives good profit to the foreign countries and helps in progression. This report critically analyzes the current situation of the UK’s international trade due to Brexit and the recent consequences of COVID 19.

Recent developments in UK in terms of international trade (Brexit and Covid19)

Pre and post Brexit situation on international trade of UK

The political and economic situation of the UK due to Brexit is still unfolding. The market is still struggling and is facing severe consequences. The UK and EU both have faced significant losses. The withdrawal of 2020 has affected international trade. In 2015, the share of UK with EU exports fell from 7.1% to 6.2% (Flach, 2022).

On the other hand, in 2019 after Brexit, the import has fallen from 4.4% to 3.8% (Flach, 2022). It is indicating that the post Brexit situation is more challenging as it is affecting the economy of the country. “Additional trade division” has been observed in the UK after Brexit. In the pre-Brexit time, there were some limitations in the “International Trade Law ”. On the other hand, after Brexit, the deals have been changed. For instance, UK has agreed to the terms of free trade with New Zealand. It encourages employment and the economy of both countries (ONS, 2022).

The free trade deals are making the price cheaper and encouraging business entrepreneurs. It has been achieved with the elimination and reduction of tariffs. It also aims to remove quotas which refer to the limitation of the amount of goods that will be traded. In the changing market scenario, it has become difficult for the UK market to focus on the domestic market management as per the international requirements which can be seen as one of the most significant drawbacks in that aspect.

Brexit will take place in 2020. After negotiation, the UK-EU trade law will come into force in 2021. The deals are preventing quotas and tariffs which are making the trade more expensive. The UK does not have to follow the product standards of the EU because new checks were introduced. Before Brexit the UK was part of EU trade deals automatically. After Brexit, the UK has left and 40 EU countries have made deals with 70 countries. Brexit and Covid-19 have affected the business and both are influencing each other.

The seismic events are working as a twinning pressure on the trade business of UK and EU. 2021 was the transition period of Brexit, where UK exports have faced 45% business failure in the international business (Politico, 2022). On the other hand, imports have decreased to 33% (Edgington, 2021). It is reflecting that the business failures and decreasing imports are affecting the economical situation. Supply chain management is the major area that has been affected in the international trade platform.

There is a lack of a market for UK companies. After Brexit, the “Trade Agreement map” has changed. The UK government has changed the roll-over to hold the commonwealth countries. The trend of trades has been changed to visualization after Brexit.

Pre and post Covid-19 situation on international trade of UK

The effect of the pandemic has coincided with Brexit simultaneously. The pandemic has affected the trade flow in the UK and EU. The percentage of GDP has become low which is reflecting the economic situation of the country.

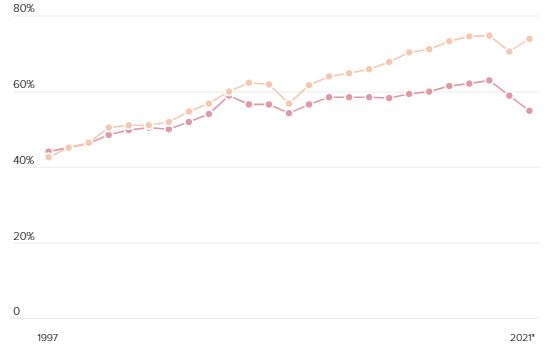

Figure 1: UK trade balance till 2021 (Source: Flach, 2022)

Figure 1: UK trade balance till 2021 (Source: Flach, 2022)

As per figure 1, the UK Balance is poorer which is affecting the economy of the country. It was seasonally adjusted during Covid-19. After Covid-19 most of the UK trade has done international business with non-EU countries.

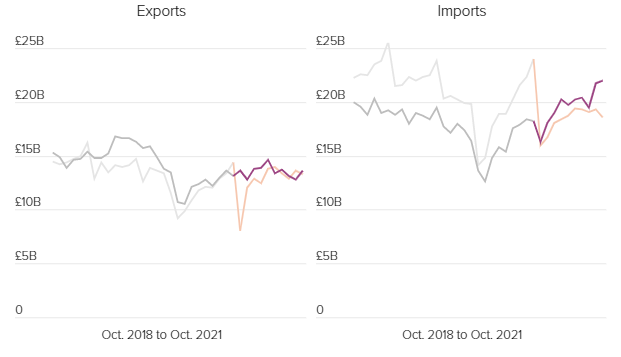

Figure 2: Change in UK exports and imports (Source: Trade economics, 2021)

Figure 2: Change in UK exports and imports (Source: Trade economics, 2021)

As per figure 2, the economic shift has been noticed after Covid-19. The UK has faced difficulties to make trade business with the EU. After Covid, the UK wants to enhance their business in the global platform to contribute to their economic development. Major disruptions have been noticed in 2021 due to Covid-19. The UK has signed “free trade agreements” with New Zealand and Australia.

Trade deals have been generated which is compensating the economic loss of the UK. Imports have increased from China to the UK in the timespan of 2019. The tariff has been applied for the partner countries by UK countries. Covid-19 has affected the global and domestic supply chain. As per the recent data, 16% of the supply chain had been distorted in the UK. It is reflecting that the consumer is not getting real-time delivery. Consumers started to rely more on domestic companies. It is affecting the global business and the customer demand is changing.

After Covid-19 evidence is suggesting that the warehousing problem is most severe which is lowering the productivity and profit margin of the companies. The UK has to generate a lockdown during Covid-19. On the other hand, they have to follow the global supply chain index to mitigate organizational issues. It is indicating that the supply chain was under pressure (Wiedmann and Lenzen, 2018). The disruption of business management is affecting the potentiality of companies.

“Economic cooperation and development” has focused on mitigating the challenge. “Trade in value Added” or TIVA has shown the role of suppliers. They have a major role in mitigating the Covid-19 issues. After Covid-19, a high degree of integration has been noticed to solve the economic challenges that occurred due to Brexit (Hiscox, 2020). There is a lack of production inputs which is contributing to the business disruption. The sales have experienced a 30% decrease after Covid-19 (Xu et al. 2020). Covid-19 has affected the business, employment, work hours and investment of shareholders in UK businesses.

Effects of Covid-19 on general UK business

Covid-19 has a severe effect on the business and economic scale of the UK. It has lowered the productivity and profit margin. As per the view of Niepmann and Schmidt (2017), international trade and emerging markets are required for a business. It helps to revive the business and helps in business enhancement in the global platform. Covid-19 has been identified as a VUCA challenge that has created a vulnerable situation in the UK.

It has been noticed that 16% of the businesses which have continued their trade even during Cloud-19 have faced severe challenges in supply chain management (Atkin and Khandelwal, 2020). Employment has been reduced due to Corvid-19. Supply chain issues have been noticed in the onset of Omicron variants.

As per the business entrepreneurs, the lack of availability of products has created severe problems for the business. Lack of product and shortage of raw materials has become a major problem for the health sector. On the other hand, the hospitality industry has suffered the most. The lockdown has restricted travelling which has lowered the profit margin of the business (Bankofengland, 2020). The customer preferences are changing and the business is facing challenges to maintain the customer demands.

The manufacturing business and retail industry have faced a major problem maintaining international trade. 84% of the wholesale and retail business has lower sales performance (Edgington, 2021). Food service and accommodation businesses have faced 81% business loss in the global platform. The construction business has also been on the list which has experienced 71% business loss (Edgington, 2021). Transportation, logistics are the major backbone of the business enhancement which has affected during and after Covid-19. Communication and information technology is not affected severely. Real estate services have been affected due to Covid-19.

Water supply and mining platforms have been suffered in the domestic area of the UK. As per the current business report, 25% of the business has expired trade falls due to Covid-19. In the EU transition period supply chain is the major problem in the global platform and in the domestic market of the UK. 58% of the businesses have faced supplier problems. Re-orientation should be reported in the country to bring changes in organizational performances. The companies are using more UK suppliers and EU suppliers. Collaboration with stakeholders is mitigating the changes in the company that have occurred during Covid-19.

Importance of Emerging Markets for UK to boost up foreign trade

Emerging markets are important to enhance the business in the global platform. As per the business report, the fastest-growing export market for UK is in Asia. After Brexit, the UK has faced changes in an international trade agreement. They have to follow the EU rules to trade their goods (Heinberg et al. 2017). On the other hand, Covid-19 has also affected the business severely which has lowered the economy. Emerging markets are helpful for the UK to enhance their business in the global market. The economic and political status of the country or region is very important for emerging markets.

The business should access the credit of foreign countries to enhance their profit margin. “Emerging market investment” reflects that the country is experiencing economic growth in the business sector. The GDP of the country reflects the economic condition and how they are gaining profit due to emerging markets (Hernandez and Guillén, 2018). For instance, the developing BRIC (“Brazil, Russia, India and China”) countries have several market opportunities and they fall under the category of emerging market development.

The emerging market of the UK is developing a strong economy that can create a stable environment. As for the view of Morton et al. (2017), the advantages and importance of emerging markets are related to diversification and growth. Diversification refers to the business enhancement in the multi-cultural platform. It reflects international business on a global platform (Hernandez and Guillén, 2018). The process increases the number of business entrepreneurs, foreign trade activity, profit margin and productivity.

The emerging market needs collaboration and cooperation with foreign companies. Emerging market refers to the potentiality of cones and the companies experience high growth. Political risk and economic risk are there to invest in the emerging market. The current UK political background is facing a lack of stability. It is identified as a risk of investing in the emerging market. Economic risk includes business failure, lack of skilled labor and high deflation and inflation in the market. There are some unsound monetary policies that can affect the operation management of a business.

The export department of the UK is working with SMEs and micros. Business entrepreneurs have a major role to enhance business in the emerging market. The importance of emerging markets is to give opportunities to the development of the domestic market. The emerging markets help in the foreign trades. For instance, Asia has an excellent opportunity for British exporters. Capitalization and effort from trade councils are required to make the opportunities feasible. From the micro-economic point of view there the emerging market has promising, scientific and cultural developmental opportunities.

It has been observed that emerging markets are contributing to 40% of the GDP worldwide (Tashman et al. 2019). It reflects emerging markets that contribute to business development. It has increased the market value in the global platform. Covid-19 and Brexit have affected the business environment of global business and domestic business of the UK as well. Investment in emerging markets will help the business to increase its profit margin. The project contribution will influence the purchasing power of business entrepreneurs and the customers as well.

The citizens of emerging markets can experience reaped benefits and rapid development in the market. It contributes to the economy of the country. It may increase the GDP of the country. For instance, the retail industry has faced severe losses from 2019 to 2020 due to Covid-19 (Heinberg et al. 2017). The supply chain management had been severely affected.

The swift market change in the emerging market has developed economic inflation and deflation. In UK retailing sector is contributing majorly to the emerging market. Microieconmic evidence has suggested that the business persons are experiencing notable acceleration due to the merging market in the global platform. It will impact the economic outlook and help the companies to meet their long-term organizational goals.

An emerging market is important for economical rebalancing. Constant cooperation from the business entrepreneurs helps in balancing. It is required to stretch the economic performance in an appropriate way (AEB, 2021). Emerging market helps to modernize the market segment. The business person applies several technologies to achieve a competitive advantage in the merging global and domestic market. Hence, the process influences the business entrepreneurs to develop their technological skills.

It helps to give chances to skilled employees. Participation in the market girth of the emerging market helps in business enhancement in the global platform. Emerging market has economic, cultural and scientific importance. It helps to mitigate the risk of the financial crisis and increases the diversity level of the international community. Hence, by participating in the business managers of the emerging markets the UK entrepreneur can mitigate their economic challenges due to Brexit and Covid-19.

Challenges for the UK to engage with Emerging Markets

It seems that emerging markets face several challenges in most of the global and developed countries, thus the UK is no exception. These kinds of significant challenges have led the UK business markets into volatile business challenges as the data of market research has been constantly changing and rapid change in the technological divergence.

However, it seems that almost 80% of the worldwide GDP has been coming from the emerging markets development (Ahuja et al. 2020). Thus, it becomes necessary to maintain the supply chain of emerging markets. Thus challenges many have faced by the UK to engage in the emerging markets are

Brexit effects: it seems that Brexit has been bringing so much uncertainty in the business market development of the UK. However, the UK is always ready to compete without having the support of the EU (Dermody et al. 2018).

Although, it’s becoming challenging for the country to compete with the global market level with such uncertainties. In addition to this, the Covid 19 pandemic is also left huge negative impact in the grow of the emerging market development of UK business industry

Financial infrastructure: it seems that the emerging markets have been underdeveloped in the case of the financial infrastructure. The rapid changes in the financial structure may have impacted the organization structure of banks, share markets, stock markets and other financial institutions (Paul, 2019).

The impact of the emerging markets also left huge impact on the purchase decision of the consumer behaviors therefore, it seems that it’s become challenging for the financial institution to adapt such rapid changes

Political instability

The UK can be recognized as one of the politically stable countries; however the emerging markets developed can be the reason for the political instability of the country. It seems that most of their business organizations in the UK, who use emerging market development, have been facing several uneasiness and political instability (Tang, 2018).

On the other hand, this becomes also challenging for the retailers as well as a manufacturer to deal with these kinds of emerging markets. It become also challenging for the consumers too

Issues in domestic infrastructure

The infrastructure of emerging market development is not always able to adapt by every business organization. This rapid change in the technology mat has faced several challenges as it impacts the overall organizational structure (De Corato et al. 2018). Also it becomes hectic for the employees to adapt to such rapid technological changes. Therefore, it is challenging for the global country UK, to ads such changes to become successful

Supply chain disruption

The emerging markets of the business development has been used a lo resources and additional data in order to become successful however, in most of the case due to huge amount of the data and additional resources, the3 issues such as la of visibility has been shown on the other hand, most of the global companies also faced collaboration issue among the suppliers and manufacturers. A as result, the companies may have face supply chain disruption

Rapid change and region entrance

De Corato et al. (2018) states that, The continuous changes has been seems the emerging markets mainly, the changes has been seems in the economic growth development in the emerging markets several business organization has been seen their up and down and it’s become challenging to gather every data on the other hand, when an organization had been enter into an emerging or new markets, the market itself collect all the data of the company, there are no such privacy factor

Opportunities for the UK in emerging markets

It seems that the emerging markets have provided huge opportunities to most of the global market business industry. One of the main advantages of implementing the emerging market is to get access to most of the new and advanced technology. It seems that the emerging technologies have been using technological aspects such as artificial intelligence, big data analytics and many more in order to increase the productivity of the emerging markets.

On the other hand, De Corato et al. (2018) states that, it seems that the UK investors are not increasing their interest in the emerging market development in order to enhance their business entity. On the other hand, due to several uncertainties in the business development growth in UK, most of the investors are now wants to invest in the new emerging markets in order to get success.

As per the research, almost 33% of the UK investors show they are receiving twice what they are actually investing in the emerging markets (Aguilera et al. 2019). Thus, the expectations for the higher developed growth are influencing the other investors to invest in the emerging market development. It seems that almost 32% of investors state that the emerging markets have provided rapid growth within the business organization.

On the other hand, almost 36% of the business investors state that the emerging markets only provide uncertainties within the business organization. Vidya and Prabheesh (2020), states that several business investors are four times more likes the emerging market development. Within the past 12 months the emerging market has been developed almost 12% in UK market development. The overall market development of the emerging market is also help in changes the policy business policies of most of the company.

Opportunity of emerging market development in post Brexit

Implementing the emerging market development is become beneficial for the growth development of the country. It seems that, in the year of 2016 to2019 export and trade business developed almost 19% after implements in the emerging market (Pham et al. 2019). In addition to this , the emerging markets also brings some significance changes at the workplace of the company which he the company to change its organizational structure after the post Brexit situation also , the UK economical growth development has faced challenges due to brexit.

Thus, it seems that almost 34% of the business investors thought the investing in the emerging markets will be beneficial for the business organizations as well as help them to coping up with the post brexit deal.

Conclusion Recommendations

It has been concluded from the above that Brexit has a severe effect on the business of the EU and UK as well. There are specific trade laws of EU which is difficult for UK to maintain. Hence, they are trying to collaborate with other foreign countries to mitigate the challenges. The major challenges due to Brexit are related to the trade agreement and business enhancement. On the other hand, Covid-19 pandemic is also an issue for UK domestic market and the global market as well. An emerging market is giving the opportunity to the UK business for enhancing their business.

It is helping them to mitigate the business challenges in the global market. The supply chain management has been affected severely due to Brexit and Covid-19. Collaboration and multi-cultural diversity will help the business entrepreneurs to mitigate the risk. It will also help them to participate in the global emerging market.

- It has been recommended that the trade agreements of EU and UK should be revised and it should allow free agreements to support the business entrepreneurs.

- It has been recommended that the business enterprise should do detailed market research and development. It will help them to understand the market risk. After the analyzing, technological development is required to improve organizational efficiency. The UK government should help the business and SMEs to invest in the emerging market.

References

Ahuja, R., Sawhney, A., Jain, M., Arif, M. and Rakshit, S., 2020. Factors influencing BIM adoption in emerging markets–the case of India. International Journal of Construction Management, 20(1), pp.65-76.

Dermody, J., Koenig-Lewis, N., Zhao, A.L. and Hanmer-Lloyd, S., 2018. Appraising the influence of pro-environmental self-identity on sustainable consumption buying and curtailment in emerging markets: Evidence from China and Poland. Journal of Business Research, 86, pp.333-343.

Paul, J., 2019. Marketing in emerging markets: a review, theoretical synthesis and extension. International Journal of Emerging Markets.

Tang, C.S., 2018. Socially responsible supply chains in emerging markets: Some research opportunities. Journal of Operations Management, 57, pp.1-10.

De Corato, U., De Bari, I., Viola, E. and Pugliese, M., 2018. Assessing the main opportunities of integrated biorefining from agro-bioenergy co/by-products and agroindustrial residues into high-value added products associated to some emerging markets: A review. Renewable and Sustainable Energy Reviews, 88, pp.326-346.

Aguilera, R.V., Marano, V. and Haxhi, I., 2019. International corporate governance: A review and opportunities for future research. Journal of International Business Studies, 50(4), pp.457-498.

Vidya, C.T. and Prabheesh, K.P., 2020. Implications of COVID-19 pandemic on the global trade networks. Emerging Markets Finance and Trade, 56(10), pp.2408-2421.

Pham, T.H., Nguyen, T.N., Phan, T.T.H. and Nguyen, N.T., 2019. Evaluating the purchase behaviour of organic food by young consumers in an emerging market economy. Journal of Strategic Marketing, 27(6), pp.540-556.

Wiedmann, T. and Lenzen, M., 2018. Environmental and social footprints of international trade. Nature Geoscience, 11(5), pp.314-321.

Hiscox, M.J., 2020. International trade and political conflict. Princeton University Press.

Carr, I. and Stone, P., 2017. International trade law. Routledge.

Xu, Z., Li, Y., Chau, S.N., Dietz, T., Li, C., Wan, L., Zhang, J., Zhang, L., Li, Y., Chung, M.G. and Liu, J., 2020. Impacts of international trade on global sustainable development. Nature Sustainability, 3(11), pp.964-971.

Niepmann, F. and Schmidt-Eisenlohr, T., 2017. International trade, risk and the role of banks. Journal of International Economics, 107, pp.111-126.

Atkin, D. and Khandelwal, A.K., 2020. How distortions alter the impacts of international trade in developing countries. Annual Review of Economics, 12, pp.213-238.

Morton, C., Anable, J. and Nelson, J.D., 2017. Consumer structure in the emerging market for electric vehicles: Identifying market segments using cluster analysis. International Journal of Sustainable Transportation, 11(6), pp.443-459.

Tashman, P., Marano, V. and Kostova, T., 2019. Walking the walk or talking the talk? Corporate social responsibility decoupling in emerging market multinationals. Journal of International Business Studies, 50(2), pp.153-171.

Hernandez, E. and Guillén, M.F., 2018. What’s theoretically novel about emerging-market multinationals?. Journal of International Business Studies, 49(1), pp.24-33.

Heinberg, M., Ozkaya, H.E. and Taube, M., 2017. The influence of global and local iconic brand positioning on advertising persuasion in an emerging market setting. Journal of International Business Studies, 48(8), pp.1009-1022.

Tom Edgington, 2021. Brexit: What trade deals has the UK done so far? BBC [online]. Available at: https://www.bbc.com/news/uk-47213842

Politico, 2022. How Brexit and the pandemic changed UK trade in 4 charts. Politico [online]. Available at: https://www.politico.eu/article/how-brexit-and-the-pandemic-changed-uk-trade/

Lisandra Flach, 2022. Brexit’s effects on UK trade are dramatic – but we feel them in the EU too. The Guardian [online]. Available at: https://www.theguardian.com/commentisfree/2022/feb/02/brexits-effects-on-uk-trade-are-dramatic-but-we-feel-them-in-the-eu-too

Trade economics, 2021. UK Trade Agreements After Brexit. Trade economics [online]. Available at: https://www.tradeeconomics.com/uk-trade-agreements-after-brexit/

AEB, 2021. BREXIT AND INTERNATIONAL TRADE. AEB [online]. Available at: https://www.aeb.com/media/docs/en/external/2021-09-14-brexit-and-international-trade-uk-report-raconteur-the-times-web.pdf

Bankofengland, 2020. Impact of Covid-19 on UK businesses – evidence from the Decision Maker Panel in 2020 Q4. Bank of England [online]. Available at: https://www.bankofengland.co.uk/agents-summary/2020/2020-q4/impact-of-covid-19-on-uk-businesses-evidence-from-the-decision-maker-panel-in-2020-q4

ONS, 2022. Early insights into the impacts of the coronavirus (COVID-19) pandemic and EU exit on business supply chains in the UK: February 2021 to February 2022. ONS [online]. Available at: https://www.ons.gov.uk/businessindustryandtrade/internationaltrade/articles/earlyinsightsintotheimpactsofthecoronaviruspandemicandeuexitonbusinesssupplychainsintheuk/february2021tofebruary2022

Know more about UniqueSubmission’s other writing services:

I may need your help. I tried many ways but couldn’t solve it, but after reading your article, I think you have a way to help me. I’m looking forward for your reply. Thanks.

Your article gave me a lot of inspiration, I hope you can explain your point of view in more detail, because I have some doubts, thank you.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://accounts.binance.com/de-CH/register?ref=VDVEQ78S