MN1014 The Bank of England Monetary Policy Committee and Rise in the interest rate Assignment Sample

Introduction

The study initiates in bringing up with the initiation to the focus that needs to be made on The Bank of England Monetary Policy Committee. In the study on overall association related to the ways in which an overview of the bank would be formulated. In addition, the role and operations of the Bank shall be ignited. The UK inflation rate has been invited to be combated by means of the rising of the interests. Besides, the causes of the inflation rate increase need to be formulated with proper integration of theory as per the profile topic given. In addition, the proper assertion related to the agreement on the solution that MPC has made on the proposed assertion has been formulated properly.

Overview of the Bank of England Monetary Policy Committee

The Bank of England Monetary Policy Committee also called the MPC has been inserted to have a total of 9 members that includes the governor, chief economist, 4 external members who are elected by the chancellor directly, 3 deputy governors that are also elected by the chancellor itself. It includes deputy governors for monetary policy, market and backing, and financial stability (Haldane and McMahon, 2018). The banking body initiates in bringing up the decisions that are made for the official interest rates in the United Kingdom’s. In addition, the main initiative the body takes part in includes directing different governmental aspects that include a framework related to monetary policy. The Committee is responsible for taking decisions related to keeping up with the Consumer Price Index also called CPI (Hendry and Muellbauer, 2018). It helps in measuring the inflation rate that might take part within the target set by the government. In addition to that it has been seen that in the year 2019, the inflation rate was 2% in initiation to the reports (Bankofengland.co.uk, 2021).

The committee initiates in bringing up the purpose of taking forward with the primary aim of price stability. The inflation rate initiates in getting back with the decisions taken by the government. Asset Purchase Facility also called APF, was the decision made by the chancellor in the year 2009 that made greater liquidity in financial markets (Bankofengland.co.uk, 2021). In 2009, the committee faced issues related to a low level of inflation and it led to the fall of the interest rates to 0.5% (Bankofengland.co.uk, 2021). The main appointment of the external members takes place for the purpose of benefiting MPC with the purpose of thinning and expertise from outside the Bank of England. Besides, the overall evaluation of the MPC takes place in discussion related to the policy rates that might take place briefing on fiscal policy developments.

Role and operations of the Bank of England Monetary Policy Committee

The MNC tends to focus on various works and operations that are forwarded in order to have proper work structures.

The roles of the bank of England are as follows:

-

Taking in fund

Development in the fiscal policy holding is one of the roles that are taken forwarded by the Bank of England. In case of the roles that are taken forwarded by MPC includes Fiscal policy development. The fiscal policy helps in accelerating the economic growth rate in the ignition to rise in the rate of investment.

-

Creation of Money

The development and creation of money by the government tends to be another role of the MPC. In case of the policies taken forwarded shall take its turn into various other government policies being initiated. Many policies are subjected to the profiling basics and this comes under individuality.

-

Changes in the monetary policies

Any further change that takes place within a government body shall take its turn into validations of various prospects related to monetary policies. It can be said that the validations incorporated within various other prospects took part within variations taken into parts. The beneficial parts are incorporated within the thinking and expertise of HM Treasury.

Operations of the Bank of England that could be initiated are as follows:

-

Maintaining the monetary stability

It can be said that the proclamation to variations that could be taken forward regarding the operations of the Bank of England contains maintenance of monetary stability. It has been seen that the maintenance of stable prices and currencies initiate the proclamation. The obligatory role of formulating monetary policy is one of the operations taking place.

-

Overseeing financial stability

It is essential to evaluate the overseeing validations of financial stability as it includes monitoring of the financial system and affirmations of protecting the financial system against threats.

Rising interest in combating UK inflation

There has been a huge surge in the inflation rate in the UK and it has been a 10-year high of 4.2%. The surge has been even worse than expected and it is incorporated within various proclamations. The rise in the U.K.’s Consumer Prices Index has been detected to be 4.2% in the 12 months (Cnbc.com, 2021). It can be said that it was 4.2% in the month of October, then 3.1% in the month of September. The expectation of the range was made to be 3.9% by the economists and the rate of interest rates evacuated its justifications. The bank of England defends investors’ expectations. It can be said that the validations to proclaim the U.K. in October to be profiling with a high cost for living. In order to have proper access to the ways, the Bank of England targeted the figure.

The change in the inflation rate that has been happening in the UK seems to focus more on the purified interest rates that have taken place. As opined by Walter and Wansleben (2020), ignition to the ways the Bank of England thought that the inflation rate to increase by 5% by the year 2022 (Cnbc.com, 2021). In addition, the inflation rate was thought to fall apart by 2% by 2023 due to the impactful propagation of oil and gas price hikes. Besides, it was in the year 2011, it has been seen that a 12.2% hike was shown by Ofgem’s default tariff price cap. The jump in the price of motor fuels is intended to be 3% in October. It has been seen that the inflation rate to be 1.2%, from 0.8% with prospects of gap-closing regarding the producer prices and in October 2021, Eurozone inflation hit 4.1% (Cnbc.com, 2021).

Integration of theory

Liquidity preference theory

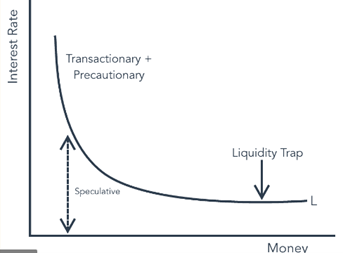

According to Liquidity Preference theory, the model profiles in bringing up with the incorporation of the investor in demanding higher interest rates within long term maturities. The initiation to bringing up with higher interest comes greater risks that are incorporated within factors of investors preferring cash and cash with other liquid holdings. The model focuses on providing the demands that are made by the investors in progressively higher premiums with respect to long term securities. As opined by Lavoie and Reissl (2019), it can be said that the initiation of the idea of the demand, in initiation to liquidity holding speculative power. In addition, the violation to the reciprocal of the theory formulates in liquid investment for proclaiming the cash for full value.

Figure 1: Liquidity preference theory

(Source: Lavoie and Reissl, 2019)

Cash is the only asset that is accepted everywhere without any constraints. According to the theory initiated by John Maynard Keynes, the interest rates of short-term securities are terms to be lower as the investors are not able to sacrifice the liquidity and it takes a higher frame of time. Besides, the long term securities turn around to be affirmative in the case of the theory (Brady, 2018). There are a total of three motives for a description of the theory and it includes, transactions motive, precautionary motive and speculative motive. In the case of transaction motive, it incorporates individual preferences upon liquidity for guaranteeing sufficient cash for day-to-day needs. Precautionary motive brings up an individual’s preference for additional liquidity, following up with unexpected issues related to the substantial outlay of cash (Bibow, 2019). In the case of speculative motive, interest rates are low when the demand for cash is high focusing on asset holding.

Causes of the UK inflation

There have been major changes that have been occurring in the inflation rate changes that have been seen in a sustained increase in the price level. The causes behind UK inflation are as follows:

Demand-pull inflation

Demand-pull inflation is one of the causes of inflation as in the economy, if the employment rate is at the verge of the full segment, aggregate demand (AD) increase leads to an increase in the price level (PL) (Schwarzer, 2018). In case the AD might take place in any of its components C+I+G+X-M. The Demand-pull inflation can be due to many factors that include higher wages, access to consumer confidence and rising house prices.

In addition to that in the case of the UK, in the year 1980, the rise in the economic growth was experienced by the country. It has led to the government cutting down the interest rates and also cutting taxes, price of the house rose up to 30% (Economicshelp.org, 2021). In addition, it leads to a rise in consumer confidence and it is further too forward with spending higher with fewer savings with an increase in borrowing purposes. The rate of the economic growth of the UK was initiated to 5% within a year and further, it took upon the UK’s long-run trend rate of 2.5% (Economicshelp.org, 2021).

Cost-push inflation

Cost-push inflation tends to be the natural cause of inflation as it intended to focus on the ways in which business shall react. In the case of the ways, there is an increase in the cost of the firms, the businesses would be assessed to the customers and it would lead to the shift to the left in the SRAS. There are various factors that are included within the cost-push inflation taking place. The factor incorporates to be raising wages, the importance of the process and the process of the raw materials.

In the case of the UK, in the years 2011 and 2012, there has been a rise in cost-push inflation. In addition to that, the reason behind incorporation is the depreciation of the Pound against the Euro. In the year 1974, the rise in the oil price initiated and it took a turn of 20% (Economicshelp.org, 2021). In the case of VAT and Excise duty, CPI-C tends to be less volatile and it leads to ignorance in the taxes effectiveness. In 2010, the inflation rate of UK CPI increase was the reason behind rising taxes.

Devaluation

Devaluation is one of the reasons behind the change that might take place in the rate of inflation and that could be stated as it leads to the declination of currency value. It also exports and imports more competitively and more expensively. As opined by Abuselidze (2019), stated that there could be many factors that might lead to Devaluation. They can be focused on fewer incentives, Demand-pull inflation and Cost-push inflation. In accordance with the year 2008, there has been an experience that the UK faced in falling off the sterling by 25%. Depreciation was one of the factors that took its turn and the rise of the UK inflation rate of government targets of 2% (Economicshelp.org, 2021).

Rising wages

Rising wages of the people is one of the reasons behind the change in the inflation rate. It can be said that the proclamation if the firms increase the wages of the people working, it leads to higher costs of production. In association with the increase in the wake of the people working it leads to the firms taking part in increasing the cost of the product and services onto the consumers. The increase in the prices is done by organizations to implant better maintenance to the profitability level (Martins and Skott, 2021).

It can be said that the accountability of labor costs could be up to 70% of an organization’s total costs. In addition, it can be assessed that it leads to the determination of the prices and hence leads to inflation. It can be said that it was in the year 1970, the rise in the nominal wages rapidly rose in the UK, EU and US and it led to the changes in the inflation rate in the countries. In 2021, wage-push inflation was initiated and it was a cooperative credit crunch in 2008 that led to long-term inflation being kept low.

Expectations of inflation

In association with the price rousing expectation leads to inflation ends this could be stated that it has been incubated within one of the key factors. As opined by Coibion et al. (2020), self-fulfilling prophecy councils are initiated within firms and consumers expecting a rise in the inflation rate. The increase in the high wages might take its turn due to an increase in the cost-push inflation and an increase in the demand-pull inflation. It was in the year 1997; the Bank of England was subjected to prove independence with respect to setting up of monetary policy. Besides, between the 1970s and 1980s, the inflation rate took a lower rate. Hence, it can be said by means of causes behind the change in the inflation rate gets his subjection over inflation expectations.

Evaluation of MPC’s proposed solution

It can be said that the validations to the proposed solutions that were proposed by the Bank of England. It has been validated that the solutions that have been proposed seem to be positive as per the inflation rate. The reasons behind the solution of increasing the interest rates can be affirmative because:

High interest’s rates come with low inflation

The initiation to the ways the song that has been made in initiation to the ways the interests takes, in turn, is inventory. As opined by Hang et al. (2020), with the proclamation of high in most, inflation rates take a lower initiation. This is because the inflation rate is low in the case of the viability of the economy. And to get upon the process of the ways inflation that shall be decreased, the increase in the rate of the industry is an imperial step. In addition, if the inflation rates take part in the increased evaluation of the economy following up with the increase in the general price levels of an economy.

Brings stability within the business

In order to evaluate the ways, stability could be bought within the business with a low inflation rate. The initiation to the bringing stability within business proclamation of inflation as it helps the farms in predicting the costs and processes of the products and services. As opined by Powell (2018), it can be said that with the intention to betterment in creating stability within businesses, it would be best in getting forward with the organizational future aspects. Hence, low inflation rats turn out to be positive from various steps to get forwarded with an inflation control method.

Investment criteria

It can be said that the variations that are created by means of procreating the ways investment criteria can be benefited. As stated by Conti (2021), the way variations can be initiated through low inflation and could be assisted within the assertive mode. As per the statement of Nam et al. (2021), it has been said that the variations of focusing of the investment criteria, more investment by the firms can refrain. Thus it can be said that those firms need to get into better investment stagnation by means of less inflation rate with a focus on ways to spend less money on goods and services.

Examines competitiveness

The help that the inflation rate brings upon is imperial as within the range of inflation rate. The competitiveness depends. As opined by Varma (2017), it can be said that with less inflation, there is high competitiveness. It can be said that by means of the ways countries are able to export better and with relatively implicated competitiveness. It means that with the inflation rate to be at a low level, countries can take part in both exports and imports to evaluate better prospects in their business through low inflation rate.

Price adjustments

The increase or decrease in the inflation rates could be subjected to the ways price adjustments could be taken forward. This can have subjective vibrations as most of the time inanition takes part within the adjustments taking place in price. Thus it can be said that less inflation gets up in the positivity that takes place within the general level of prices for goods and services. As per the report, it can be seen that has reduced from 1.79% in 2019 to 0.85% in 2020 (Statista.com, 2021)

Conclusion

From the above, it can be concluded that MPC is one of the renowned banking bodies in the United Kingdom that initiates in taking forward with decisions related to increment and a falling off of interest rates that lead to increase and decrease of the inflation rate. The study initiates in bringing up an overview regarding the banking body. In addition to that, the study focused on providing a clear vision of the roles of the committee along with the operations that are maintained by it in order to have proper access to the work the government could initiate. In order to evaluate the ways in which the rise in the interest has made the UK inflation rate increase has also been shown to get into proper profiling. Besides, integration of theory has also been shown; focusing on the causes that UK inflation has increased has been focused on the above study.

Reference List

Abuselidze, G., 2019. Modern challenges of monetary policy strategies: inflation and devaluation influence on economic development of the country. Academy of Strategic Management Journal, 18(4), pp.1-10.

Bankofengland.co.uk, 2021. Bank of England. Available at: https://www.bankofengland.co.uk/about/people/monetary-policy- [Accessed on: 15.12.2021] committee#:~:text=The%20Monetary%20Policy%20Committee%20(MPC,appointed%20directly%20by%20the%20Chancellor.

Bankofengland.co.uk, 2021. Bank Rate maintained at 0.1% – November 2021. Available at: https://www.bankofengland.co.uk/monetary-policy-summary-and-minutes/2021/november-2021[Accessed on: 15.12.2021]

Bibow, J., 2019. Evolving international monetary and financial architecture and the development challenge: A liquidity preference theoretical perspective.

Brady, M.E., 2018. The Pseudo Keynesians (Joan Robinson, Austin Robinson, Richard Kahn) Against JM Keynes on the Liquidity Preference Theory of the Rate of Interest: The Reliance of Joan Robinson on A. Robinson and R. Kahn. Robinson and R. Kahn (June 24, 2018).

Cnbc.com, 2021. UK inflation surges to a 10-year high of 4.2%, worse than expected. Available at: https://www.cnbc.com/2021/11/17/uk-inflation-surges-to-a-new-record-high-of-4point2percent-beating-expectations.html [Accessed on: 15.12.2021]

Coibion, O., Gorodnichenko, Y. and Ropele, T., 2020. Inflation expectations and firm decisions: New causal evidence. The Quarterly Journal of Economics, 135(1), pp.165-219.

Conti, A.M., 2021. Resurrecting the Phillips curve in low-inflation times. Economic Modelling, 96, pp.172-195.

Economicshelp.org, 2021. Causes of Inflation. Available at: https://www.economicshelp.org/macroeconomics/inflation/causes-inflation/ [Accessed on: 15.12.2021]

Haldane, A. and McMahon, M., 2018, May. Central bank communications and the general public. In AEA papers and proceedings (Vol. 108, pp. 578-83).

Hang, T.T.B., Nhung, D.T.H., Huy, D.T.N., Hung, N.M. and Pham, M.D., 2020. Where Beta is going–case of Viet Nam hotel, airlines and tourism company groups after the low inflation period. Entrepreneurship and Sustainability Issues, 7(3), p.2282.

Hendry, D.F. and Muellbauer, J.N., 2018. The future of macroeconomics: macro theory and models at the Bank of England. Oxford Review of Economic Policy, 34(1-2), pp.287-328.

Lavoie, M. and Reissl, S., 2019. Further insights on endogenous money and the liquidity preference theory of interest. Journal of Post Keynesian Economics, 42(4), pp.503-526.

Martins, G.K. and Skott, P., 2021. Sources of inflation and the effects of balanced budgets and inflation targeting in developing economies. Industrial and Corporate Change, 30(2), pp.409-444.

Nam, V.Q., Huy, D.T.N. and Dung, N.T., 2021. Suggested Risk Policies from Comparison of 2 Groups of Vietnam Banks-Previous SOE Banks and Private Banks During Post-Low Inflation Period 2015-2020. REVISTA GEINTEC-GESTAO INOVACAO E TECNOLOGIAS, 11(2), pp.531-546.

Powell, J.H., 2018. Monetary policy and risk management at a time of low inflation and low unemployment. Business Economics, 53(4), pp.173-183.

Schwarzer, J.A., 2018. Retrospectives: Cost-Push and Demand-Pull Inflation: Milton Friedman and the” Cruel Dilemma”. Journal of economic perspectives, 32(1), pp.195-210.

Statista.com, 2021. United Kingdom: Inflation rate from 1986 to 2026. Available at: https://www.statista.com/statistics/270384/inflation-rate-in-the-united-kingdom/ [Accessed on: 15.12.2021]

Theguardian.com, 2021. High Inflation. Available at: https://www.theguardian.com/business/2021/nov/17/uk-inflation-jumps-to-highest-level-in-10-years-as-energy-bills-soar [Accessed on: 15.12.2021]

Varma, R., INFLATION IN INDIAN ECONOMY: A STUDY OF CAUSES AND ITS EFFECTS. Research Perspectives in Commerce and Management, p.1.

Walter, T. and Wansleben, L., 2020. How central bankers learned to love financialization: The Fed, the Bank, and the enlisting of unfettered markets in the conduct of monetary policy. Socio-Economic Review, 18(3), pp.625-653.

………………………………………………………………………………………………………………………..

Know more about UniqueSubmission’s other writing services:

Assignment Writing Help

Essay Writing Help

Dissertation Writing Help

Case Studies Writing Help

MYOB Perdisco Assignment Help

Presentation Assignment Help

Proofreading & Editing Help