MOD007667 010 Element Individual Assignment Sample

1. Introduction

1.1 Rationale for Report

HSBC’s Global Functions expect a essential element in helping the financial institution’s Global Businesses and deal an expansive scope of vocation treasured open doorways in areas from valid, chance and cash to HR, supportability, selling and correspondences.

1.2 Company Background

Our purposeful and realistic agencies everywhere in the planet help HSBC’s Global Businesses with running productively and in reality on a regular premise. They moreover middle round controls and management to decrease threat and protect the Group’s status.

1.3 Main Findings

Figure out greater approximately crafted through each certainly considered one among our Global Functions underneath. Our purposeful and beneficial agencies everywhere in the planet help HSBC’s Global Businesses with running proficiently and successfully.

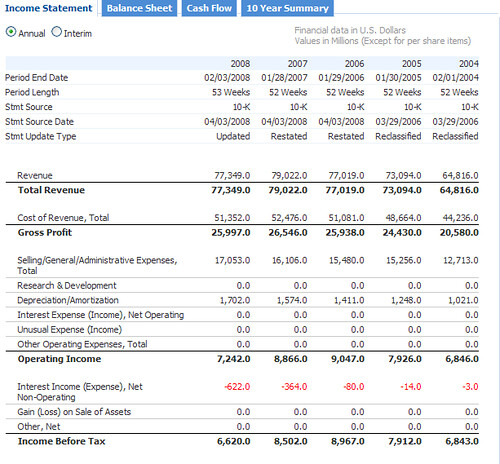

2. Evaluation of Current Financial Performance

Organisation Secretary

This capability leads, creates and oversees company management at some point of the Group. It is responsible for:

2.1 Profitability

Instructing the sheets concerning chiefs on company management troubles

Laying out and overseeing inventory change postings and coordinating and overseeing investor gatherings and cost raisings

Addressing the Group’s benefits withinside the development of guidelines and guidelines

Worldwide Communications

Worldwide Communications plans and executes correspondences strategies that assist HSBC’s commercial enterprise goals, according with our qualities, and that improve and protect the financial institution’s status amongst key partners.

2.2 Liquidity

Worldwide Finance assumes an vital element in making sure that HSBC oversees charges and sends capital withinside the fine way. The organization offers economic knowledge, exactness and manage, using clinical competencies to assist our Global Businesses and effect and assignment commercial enterprise choices (Kapmeier, et al. 2021).

Worldwide Internal Audit

Worldwide Internal Audit offers an autonomous, goal appraisal of HSBC’s gamble the board, manage and management processes. This empowers the executives and danger and overview panels to recognize whether or not they’re running successfully.

Worldwide Legal

Worldwide Legal assumes a widespread element in safeguarding HSBC’s status, helping with protecting the affiliation through giving effective and large recommend on lawful troubles and risks. Our lawyers spark off senior management and the Global Businesses and Functions. They provide a scope of valid competencies, jurisdictional enjoy and exercise specialisms throughout each one of the countries and areas wherein HSBC works.

2.3 Evaluation of Analysis Ratio

Worldwide Marketing assists our Global Businesses with increasing their earning through making sure that we take advantage of business middle open doorways, our photo energy and customer know-how. We have devoted selling agencies that paintings with our Global Businesses to help them with carrying out key needs, in addition to focuses of greatness that constitute massive authority in middle showcasing disciplines. Our agencies paintings in areas inclusive of:

2.4 Analysis of problems and limitations of financial ratios

Computerized customer commitment: overseeing webweb sites and different superior channels

Sponsorship and occasions

Statistical surveying and customer know-how

Showcasing arranging and planning

Branch plan

Showcasing management

Worldwide Risk

Worldwide Risk upholds HSBC universally in all components of chance the executives. It offers with a fluctuated scope of risks, inclusive of security, statistics security, possibility, international, purposeful, credit, advantages, protection, consistence, administrative, marketplace and reputational.

Monetary Crime Risk

Monetary Crime Risk is a global capability that unites all regions of economic wrongdoing threat the executives at HSBC. The capability empowers the Group to set the commercial enterprise wellknown for understanding our customers and recognizing, stopping and safeguarding towards economic wrongdoings, for example, unlawful tax avoidance, assents, and repay and defilement and misrepresentation.

Worldwide Sustainability

At HSBC, maintainability implies carrying out supported advantages for our investors, developing long lasting customer connections, and coping with the social and ecological impact of our commercial enterprise. Worldwide Sustainability is responsible for growing and executing supportability structures and preparations throughout the Group. It facilities round:

HR

HR is accountable for executing HSBC’s relatives procedure. It works with cappotential the board, development arranging and employee portability whilst characterizing and administering systems that assist consultant execution the executives, prize, getting to know and advancement, resourcing and commitment.

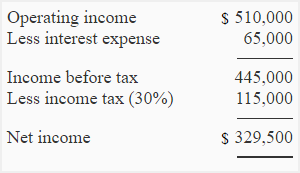

3. Future investment appraisal

To accomplish our motivation and produce our method in a way this is reasonably-priced, we’re directed with the aid of using our qualities: we esteem contrast; we be triumphant together; we count on liability; and we make it happen.

3.1 Evaluation of NPV techniques

We moreover want to gather stable institutions with our companions as, a the entire folks that paintings for us, store cash with us, personal us, manipulate us, and stay withinside the social orders we serve and the planet we as an entire occupy.

We preserve on gaining floor on our surroundings aspiration to assist our customers of their development to internet 0 and a supportable destiny, together with thru giving and running with affordable cash and speculation, as we set out at the accompanying pages.

In May 2021, an environmental trade purpose proposed with the aid of using the Board became upheld with the aid of using over the enormous majority of our traders at our Annual General Meeting (‘AGM’), together with a assure to set, find and execute a device with short-and medium-time period focuses to alter our association of cash to the goals and timetables of the Paris Agreement. It likewise integrated a pledge to distribute an technique

to step by step put off the assisting of coal-terminated strength and heat coal mining, with the aid of using 2030 withinside the EU/OECD, and 2040 in any closing commercial enterprise sectors (Sari and Hamzah 2021).

3.2 Evaluation of IRR techniques

We have unveiled our sample supported emanations for 2 want areas – oil and gas, and strength and utilities – and set focuses to lower on-financial report funded discharges in those areas. In comparing funded outflows, we’re zeroing in our research on the ones portions of the areas that we receive are maximum fabric concerning ozone harming substance emanations.

We are likewise running with buddies and enterprise to put together the financial framework to make a pass on environmental trade, biodiversity and nature.

Through a development of overviews, we imply to take note of our customers to position them at the focus of our navigation. Assuming matters simply do flip out badly, we imply to make a pass promptly.

3.3 Investment appraisal results

Our companions have anticipated to alter at tempo due to the impact of the Covid-19 pandemic. This has provided us the risk to reevaluate how our companions’ work, thinking of what functioned admirably all through the pandemic, and what demanding situations they face. Our eventual destiny of labour method will provide a device through which we are able to perform 1/2 of breed running requirements and include new improvements and running practice to enhance efficiency, dedication and prosperity.

We run a Snapshot evaluation at normal periods and file reviews to our Group Executive Committee and the Board. We were given 272,718 reactions to our Snapshot overviews in 2021, with report response rates. We will desire to preserve on zeroing in on the ones components of the consultant enjoy that we understand to greatestly have an effect on employee feeling: encouraging a stable stability among extreme and amusing sports, believe toward initiative, vocation motion open doorways and believe withinside the organization’s destiny.

We are on an tour to implant ESG requirements throughout the association, together with integrating environmental trade-associated gambles in the gamble structure, getting ready our hard work force, consolidating surroundings associated focuses interior chief scorecards, and drawing in with customers and providers.

We take note of our companions in diverse ways, which we set out in extra element in the ESG survey. We make use of the facts they provide us to differentiate the troubles which are imply pretty a chunk to them and eventually likewise make a distinction to our personal commercial enterprise.

Our ESG Committee (already the ESG Steering Committee) and different sizeable management our bodies continuously observe the brand new and present topics and troubles that make a distinction to our companions. Our supervisory team then makes use of this understanding, nearby the device of the ESG Guide (which alludes to our commitments below the Environmental, Social and Governance Reporting Guide contained in Appendix 27 to The Rules Governing the Listing of Securities at the Stock Exchange of Hong Kong Limited), and different suitable guidelines and recommendations to choose what we degree and freely file on this ESG survey.

3.4 Potential implications of investment

For 2021, PwC gave unbiased confined confirmation reviews as in step with International Standard on Assurance Engagements 3000 (Revised) ‘Confirmation Engagements apart from Audits or Reviews of Historical Financial Information’ and, in regard of the ozone harming substance outflows, as in step with International Standard on Assurance Engagements 3410 ‘Confirmation dedication on ozone harming substance proclamations’, gave with the aid of using the International Auditing and Assurance Standards Board.

4 important assist points. At its middle is a choice to assist our customers on their trade to internet 0, so the ozone harming substance emanations from our association of customers arrives at internet 0 with the aid of using 2050. We moreover plan to

be internet 0 in our sports and manufacturing community with the aid of using 2030.

We intend to offer and paintings with $750bn to

$1tn of maintainable cash and project to assist our customers of their trade to internet 0 and an affordable destiny with the aid of using 2030.

To assist our aspiration of internet 0 supported emanations, beginning trade finance for our association of customers may be pivotal.

As we depict withinside the accompanying pages, we’ve set on-accounting file supported emanations focuses for the oil and gas, and strength and utilities areas, adjusted to the IEA’s internet 0 state of affairs, supported with the aid of using an unmistakable science-primarily based totally method.

Our manner to cope with surroundings chance

We understand that to perform our surroundings choice we actually need to extra improve our manner to cope with overseeing surroundings chance. We have laid out a dedicated software to foster a stable surroundings chance the board ability.

We oversee surroundings takes a risk according with our gamble the executives device and 3 strains of shield model. We likewise use strain checking out and state of affairs exam to assess what those risks will imply for our customers, commercial enterprise and foundation. This technique offers the

Board and senior management perceivability and oversight of the surroundings gambles with that might greatestly have an effect on HSBC, and assists us with spotting probabilities to deliver reasonably-priced improvement at the aspect of our surroundings aspiration. For extra subtleties on our manner to cope with surroundings chance the executives, see Environmental, social and management chance on web page a hundred twenty five and Climate-associated gambles on web page 131.

Sway on economic summaries

We have surveyed the impact of surroundings

chance on our financial report and feature reasoned that there may be no fabric impact at the finances reviews for the yr completed 31 December 2021. We idea approximately the impact on expected credit score misfortunes, characterization and estimation of financial instruments, our claimed properties, in addition to our drawn out reasonability and

going problem.

During the yr we likewise led a strain take a look at to realise the impact of surroundings chance. While the focus of the hobby became solely on economic ee-e book obstacles and RWAs,

no troubles had been identified to recognize the growing popularity of the Group. For extra subtleties on what surroundings risk can imply for HSBC withinside the medium to lengthy haul, together with credit score chance.

4. Potential acquisition of Oxley Wharf Property 1 Limited

The foremost intention of the document is to discover the enterprise weather of HSBC Holdings PLC. HSBC Holdings moreover is one of the marketplace chiefs withinside the gift economic world. HSBC head workplace it has a tendency to be located at London’s Canary Wharf at the HSBC tower.

HSBC represents Hong Kong and Shanghai Banking Corporation, which became laid out via means of a person from Scotland, named Thomas Sutherland, in 1865. The document affords statistics approximately the business enterprise’s exercises, economic execution and marketplace weather. Going via slightly any substantial topics will supply economic backers realistic outline.

The preliminary section of the essential frame will basically 0 in at the Company’s Profile and Activities, thereafter the exam of massive scale weather and the miniature weather of the business enterprise, evidence of a assessment of key abilities in the business enterprise observed with the recommendations and end.

4.1 Rationale for choosing target company

HSBC has over 7.500 places of work in 87 international locations. It is extraordinarily inescapable and has around 220.000 buyers in 124 international locations and domains. HSBC offers a complete scope of economic administrations being Personal Financial Services, Commercial Banking, Corporate Investment Banking and Markets Private Banking.

HSBC is mainly running in Europe, Hong Kong, Asia-pacific vicinity, Australia and America. HSBC is eager at the growing enterprise sectors of Asia-Pacific and is continuously intensely setting assets into those areas.

The substantial pinnacle UK contenders of HSBC are Barclays and Royal Bank of Scotland. Those are the groups pastime of which HSBC carefully explores and tracks continually. Anyway HSBC isn’t always a financial institution that follows the mind and the management behavior of its rivals.

HSBC Holdings PLC has proven constant improvement in proportion fee for the duration of the path of new years. This is an apparent signal that an business enterprise deserves setting assets into. HSBC Group moreover reveals constant improvement and is a completely stable enterprise. These empower us to signify setting assets into HSBC in mild of its capacity gaining knowledge of studies and excellent useful possibilities.

The HSBC banking enterprise is on 1/3 scenario on this planet with appreciate to assets proprietorship. Practically 22% of HSBC’s blessings were gotten from Hong Kong, that’s a exceptional purposeful focus.

Known because the world’s closest financial institution, HSBC has a beyond packed with assisting a massive quantity of customers across the world to perform their economic goals. They parent out the importance and running of diverse enterprise sectors via their involvement with international exchange.

Therefore, HSBC has evolved into a business enterprise or banking basis that has the maximum profound regard for diverse societies and people related to those societies. Their proverb is to view their customers as human beings and enterprise closer to giving them a custom designed management and Mastercard objects as a way to match each certainly considered one among their specific necessities.

4.2 Synergistic gain of acquisition

All the while, HSBC Group has been trying to expand a respectable status withinside the US and vanquish the enterprise sectors of HSBC – North America, gladly stands one of the foremost 10 economic administrations businesses withinside the United States. Its joined institution arrived at an extra 53,000 representatives works with the shared goal of addressing the necessities for around one hundred million customers.

In the wake of conducting the goals in the US, the business enterprise zeroed in on agricultural international locations and is extra stimulated via means of the growing enterprise sectors of Asia-Pacific locale and is continually intensely setting assets into those districts (ING, et al. 2021).

4.3 Explanation and evaluation of financing of acquisition

Besides HSBC is considering shifting its place of job from London to Hong Kong. England’s maximum noteworthy financial institution, suggested key buyers that this became unacceptable complete 12 months consequences have made contentions for shifting HSBC’s habitation to Hong Kong “uninspiring”.

The economic backers were shocked via way of means of the short stuff alternate in HSBC’s audit of its residence but a few others have proactively allow the HSBC understand that they might aid the pass.

A few unique economic backers stated that they comprehended the pass and that the financial institution were a distinction in tone as HSBC surveys its habitation. UKs capital phrases for the number one banks, currently is one of the pleasant on this planet and as indicated via way of means of the Basel expressions, is meant to head appreciably higher.

Despite the reality that HSBC refine to the economic backers that assuming the phrases in Hong Kong is extra loosened up necessities, which could fee much less and foster extra gain via way of means of making it the pleasant usage of its asset document.

The deficiency of HSBC’s place of job in London, however the manner that manhandled for a simply long term as a result of the boost in economic guides of action, might be an severe disaster for the Coalition which, conceding a part of its broking evaluation is relying on a private-vicinity drove recuperation. In any case, HSBC upheld that it chooses to live in the UK and advised that an oncoming alternate in its role became altogether theoretical.

4.4 Analysis of risks and uncertainties

Under the ESG Guide, ‘materiality’ is considered because the restriction at which ESG troubles end up competently important to our economic backers and exclusive companions that they need to be freely revealed. We are likewise knowledgeable with the aid of using inventory exchange posting and publicity governs universally. We realise that what’s crucial to our companions advances over the lengthy haul and we intend to preserve on comparing our manner to cope with assure we live pertinent in what we degree and freely file.

Perceiving the requirement for a dependable and international association of ESG measurements, we started to file towards the middle World Economic Forum (‘WEF’) ‘Partner Capitalism Metrics’ in the Annual Report and Accounts 2021 interestingly.

Predictable with the volume of financial facts added in our Annual Report and Accounts, the ESG survey covers the duties of HSBC Holdings percent and its auxiliaries. Given the general youthfulness of the ESG statistics as a rule, we’re on a steady tour to assure achievement and strength.

4.5 Discussion of potential implications on firm performance

We understand the importance of ESG revelations and the character of statistics assisting it. Certain components of our

ESG revelations are established upon self sustaining affirmation and we are able to continue to improve our method according with outdoor assumptions.

5. Conclusion

Dealing with the problems of environmental exalternate and of social and herbal risks of ventures that the financial institution funds. Distinguishing commercial enterprises open doorways which have a herbal or social aspect. Directing global magnanimous projects (which include middle round education and the climate). Dealing with HSBC’s global herbal impression.

Worldwide Strategy and Planning Worldwide Strategy and Planning illuminates key navigation and is going approximately as an impetus and motive force for key exalternate. The organisation problems the Global Businesses and Functions with decisive reasoning and know-how to in addition increase the way wherein we work.

6. References

Decressin, J., Fonteyne, W. and Faruqee, H., 7 Internationally Active Large Banking Groups. In Integrating Europe’s Financial Markets. International Monetary Fund.

Kapmeier, F., Greenspan, A., Jones, A. and Sterman, J., 2021. Science-based analysis for climate action: how HSBC Bank uses the En-ROADS climate policy simulation. System dynamics review: the journal of the System Dynamics Society, 37(4), pp.333-352.

Sari, V. and Hamzah, H., 2021. VISUAL REPRESENTATION ANALYSIS OF MEANING IN BJB BANK AND HSBC BANK ADVERTISEMENTS. English Language and Literature, 10(4).

ING, B., Morgan, J.P. and Bank, B.N.S.C., Crédit Agricole CIB HSBC Société Genérale.

Duro, G.M.C., 2021. Modelling daily volatility with external regressors (Doctoral dissertation).

Know more about UniqueSubmission’s other writing services: