MSc Management Global Strategy and Sustainability Assignment Sample 2023

Introduction

Developing a sustainable and strategic business ecosystem is the key to retaining markets at present (França et al., 2017). All organisations have been transforming production and marketing strategies over the last few decades to address the socioeconomic and ecological needs of the age. Tesla is one such company in the automotive industry that has moved a long way with good and bad events and responses. The report will identify the market elements and recommend improving Tesla’s strategic performance in building a sustainable future.

Task 1: The External and Internal Environment

Analysis of Tesla’s external environment using PESTLE

The market factors include a range of aspects that determine Tesla’s performance per the case study.

Political Factors

The market of the United Kingdom is open to brands in expanding their businesses. Additionally, the government supports trade and production purposes (Sampson, 2017). However, Brexit has given several limitations on trade. For example, the new policies in the country put many customs that affect trade relationships with new partners of Tesla.

Economic Factors

Economically, Tesla can be regarded as a cost-effective producer in the UK market. This is because the country has a stable economic trajectory with a GDP of over 2 trillion (Makhmudov et al., 2021). Moreover, even sales performances show a lower expense in producing Tesla’s solar panels, which cost only 42 dollars, including materials and labour costs (Bloomberg. 2022).

Social Factors

The trend for sustainable items and efficient products is clear from the production trends in the case. Tesla’s new batteries and solar energy-based engines and vehicles are in high demand owing to the United Kingdom’s customers’ affordability. Stability in financing is another advantage that assists the production trends and trajectories.

Technological Factors

Technology is the key to producing new-age vehicles and sustainable cars. Therefore, throughout the United Kingdom, technological transformations have been prioritised. Additionally, Tesla has strategies to deal with external partners like Panasonic and Tencent, known for advanced productions (Cooke, 2020). As a result, even investment flows show stable performance in the industry.

Legal Factors

The legal framework of the United Kingdom has always been strict. Therefore, Tesla’s manufacturing and business in the country have been marked by strict rules. The company has been prioritising the country’s trade laws in pursuing every partnership, as deduced from the case. It is because any form of offence can tarnish a brand portfolio under legal obligations.

Environmental Factors

Ecological welfare is the sole criterion for the case of Tesla. Automatically, the need for eco-friendly technologies to sustain vehicular usage and manufacturing is also mandated in all parts of the country. Therefore, the company is duly engaged in building sustainable processes and aligning new ventures for all-around welfare in the United Kingdom.

Analysis of Tesla’s internal environment using SWOT

The SWOT framework is useful for understanding Tesla’s strengths and weaknesses. Additionally, the framework can help identify the opportunities and threats in the market concerned.

| Strengths

● The case details that the brand image of Tesla in the country has been a strong point with abundant customer interest. ● The partnerships issued by the brand have been strategic in building the technological infrastructure for sustainable production (Jiang, 2022, March). ● The open-source approach for Tesla’s patents is a strategic plan invested in expanding customer stakeholdership and shareholdings. |

Weaknesses

● Fund issues have been noted throughout the transitions from non-electric to electric vehicles. ● The company’s new venture of building and running hyper loops is not as effective as intended. ● Technical gaps are valid as the sustainable manufacturing of electric vehicles is new in the market (Jiang, 2022, March). ● Tesla’s battery business is ineffective due to trade customs. |

| Opportunities

● The expansion of Tesla’s production and partnerships via outsourcing could prove useful. ● Globalising production, assembling, and deliveries could help Tesla extend market acquisitions. ● Partnerships with other automotive brands can benefit Tesla in limiting competition worldwide. ● Government relations can benefit the trade with company-oriented policies and charge reductions. |

Threats

● Competition from rivals is a major threat to Tesla as many Asian manufacturers have successfully launched electric cars. ● Labour costs and other operational expenses are very high in the United Kingdom, which opposes the profitability of Tesla locally (Jiang, 2022, March). ● There is not much access to skills in the country which could hamper pricing strategies. |

Table 1: SWOT Analysis

(Source: Self-created)

It is clear from the above table that the development of internal capabilities is susceptible to several considerations. First, Tesla’s strengths are abundant, with many weaknesses to counteract. Therefore, expanding opportunities is crucial to combat Tesla’s risks and threats within and outside the country.

Discussing the 3 most critical factors

The first critical factor emerging from both PESTLE and SWOT is the funding system for Tesla. Even though the economic performance of the United Kingdom is stable, Tesla does have financial constraints in leading technical changes. Therefore, it is vital to stabilise the funding infrastructure to support the transformation processes.

The next critical factor determining the performance is customer acquisition and trends. Given that competition is growing in the electric car industry, Tesla needs to build cost-effective strategies for consumer affordability (Liu et al., 2020). However, Tesla’s manufacturing is affordable, given the solar panel costs in the case.

The last critical factor to note is innovation. Technical development in the United Kingdom is stabled with research investments and skills (Liu et al., 2020). However, expensive skill sets affect the performance of Tesla, for which the company vitalises outsourcing via partnerships. So, the potential to redesign old models could change competitiveness.

Determining Tesla’s current sources of competitive advantages

There are many sources that Tesla has built with time to transform the manufacturing system of electric vehicles. The case confirms that the transformation of the total company into solar energy-based functioning has been a major success for Tesla.

Accordingly, the evolving technological infrastructures in the country have added to the resources. The competitive advantages generated from access to a wide range of infrastructures remain undeniable. As a result, customers are willing to pay for the solar energy vehicles strategically included by Tesla.

Another source of competitiveness is the development of innovation and skills in producing batteries, also known as product attribute differentiation. As per the case, the Tesla Power Ball is run using solar panels and is a high-capacity battery manufactured in collaboration with Panasonic (Cooke, 2020).

In this respect, the partnerships have proven as an elementary source in building competitiveness for Tesla. The inclusion of prominent technical firms like Tencent and Panasonic since 2017 has proven beneficial for Tesla in boosting market presence and product standards.

A notable advantage in sourcing components from other nations through partnerships is the reduction of taxes and customs in the host countries. Tesla has also acquired the scope of building host countries a potential market space for sales as in China via Tencent collaborations (CNBC. 2022).

The Master Plan Deux is another source worth mentioning for the entry scopes. It has extended Tesla’s manufacturing into heavyweight vehicles trending worldwide (Lee and Schmidt, 2017). It has distinctive pricing of Tesla’s vehicles based on technologies and their cost-effective accessibility via outsourcing. Third, it has enabled the plan to acquire needful investments from interest shareholders and bankers, given the transformation causes.

Critical evaluation of how they maintain and build competitive advantage

Many areas contribute to the development and retention of competitive sources in Tesla’s case. First, product attribute differentiation is a unique approach the brand has included. Tesla has teamed up for batteries, engines, vehicular components and models to venture distinctive demanding elements. For example, solar panels and energy alteration are a necessary trend in the market of the United Kingdom (Leoncini, 2019). Interestingly, this source connects to the willingness of the consumers in the country to pay for such systems.

Similarly, the technical infrastructure has been outsourced strategically to reduce operational costs for long-term competitiveness. That way, Tesla has been able to invest in manufacturing and change the energy dynamics of the entire organisation. Therefore, critics rightfully claim that all processes in Tesla’s sustainability agenda are interconnected to align changes based on market requirements.

However, some gaps exist, like battery manufacturing is considered risky in the case study. Additionally, the manufacturing processes of Tesla are still a novice and are staged for fluctuations in future. Therefore, problems and manufacturing errors are not deniable for Tesla’s production, even though partnerships are being included for success.

Task 2: Strategy in the Global Environment

Analysing how organisations enter into foreign markets

The entry schemes of Tesla in the global market have explored multiple approaches since the company’s beginning.

Direct Exporting

Tesla’s initial entry after its first car’s launch in 2009 began through direct trading. The company exported cars to different parts in London and Munich in 2009 to extend to 35 countries under direct modes. Direct sales via exclusive stores and outlets of Tesla have always been strategically included in mainstream marketing.

Joint Ventures and Partnerships

The extension of Tesla into the markets of Asia and other developing economies has brought the need for pricing diversification. Moreover, strategic sourcing of technical advancements and new products is vital to sustaining competitiveness. It has led to partnerships and joint ventures, as listed in the Tencent, Panasonic, and Grohmann case study. In addition, the dealings with Tencent have proven highly useful in minimising trade customs in China.

Strategic Acquisitions

The innovative launch of electric vehicles and extension to heavyweight automobiles under the Deux plan has been advanced with customer acquisitions (Lee and Schmidt, 2017). The growth is marked by the development of cost-effective supplies with customer demands and a surge in sales. Moreover, even vehicles have earned improvements in automation under Grohmann.

Critical evaluation of the motives for Tesla expanding internationally

The case already clarifies that open patents are solely directed toward the swift adoption of electric vehicles (Forbes. 2022). The need is justified given the concerns of ecological and communal welfare for sustainability. Critics suggest that Tesla’s business motives have been inspired by the government’s commitment to profitability and stability.

Automatically, from pricing to manufacturing, Tesla has always focused on aligning conventional tactics differently. Additionally, the company is strict about implementing sustainable changes like battery production using solar cells. However, the total motive is difficult to procrastinate with limited funds and resources that Tesla also acknowledges. It is for this reason that outsourcing processes have been initiated.

The case, however, fails to justify the success attained given that battery production is incapable in Tesla’s unit. Additionally, local manufacturing in host economies is striking competitiveness for Tesla. These have cumulatively changed the plans and called for redesigning the brand’s global motives.

Explaining the impacts of their overall company strategy

The overall strategies of Tesla are directed toward changing the consumption of non-electric cars in the market. However, the expenses of production with the selling prices do contradict the affordability of customers globally. Therefore, resourcing is justified faulty and ineffective in Western and developed economies. Furthermore, limited skills with higher expenses make Tesla’s business opportunities feeble in profits.

Therefore, outsourcing is a rightful choice that has abled the brand to produce solar cells at only 42 dollars, as conceived from the case study (Bloomberg. 2022).

Justified recommendations for different strategies Tesla can use to compete in the global environment

Apart from direct selling, Tesla should try to explore joint sales ventures with mergers. The focus should be on merging Tesla’s business with local car manufacturers. For example, the market of Tencent has been used to expand Tesla’s business in China (CNBC. 2022).

However, combatting the competitors is difficult without aligning the requirements with local traders. This approach would help Tesla to understand the customers in the locality. Moreover, it would assist the interactions with buyers for feedback. All these are critical in global markets to adapt Tesla’s business and also reduce rivalries from local distributors in foreign countries.

Task 3: Corporate Strategy

Evaluation and critical analysis of the use of horizontal integration, vertical integration, outsourcing or strategic alliances

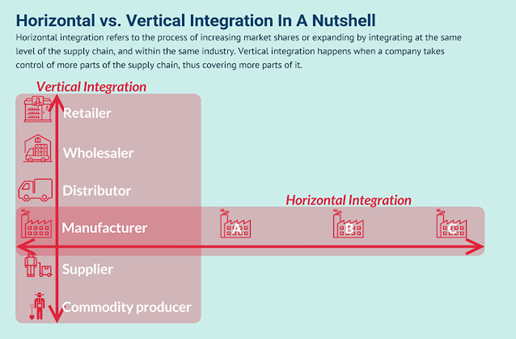

Figure 1: Horizontal and Vertical Integration

(Source: Horizontal-vs-vertical-integration. 2022)

The above figure is a gisted overview of both horizontal and vertical integration schemes used in businesses. Both of these are basically merger and takeover schemes that organisations use for enriching benefits. Horizontal integration is a takeover issued by companies among one another being at the same industrial levels.

The merger between Heinz and Kraft foods is a useful example of horizontal integration with the purpose of linking value and operational chains (Wallstreetmojo.com. 2022). By contrast, the process of vertical integration is partial and directed towards streamlining some operations between two companies.

A good example of successful vertical strategies is Target, with individual store brands in different market regions (Wallstreetmojo.com. 2022). So, the supply and sales chains are integrated on a commission basis while the operations of brands remain distinctive. It is aimed to ease the interaction of brands for coexisting in the market as Tesla aims in the current environment.

Outsourcing is a common strategy that is already being applied via partnerships with Tesla. The process involves teaming up with other organisations outside the parent country for cost-effective production and supplies. The outsourcing business is schemed for company inputs only, meaning that core operations after the production or supplies are duly under the company’s control.

In the case of Tesla, Panasonic’s batteries and solar systems have been assembled by Tesla’s core engineering teams so far (Cooke, 2020). However, the system is evolving with the inclusion of Grohmann for specialised engineering of product assemblage.

Figure 2: Strategic Alliances

(Source: Viwizard.com. 2022)

The last option of strategic alliances, as detailed in the above figure, is defined as a strategic initiative for organisations to join forces to fulfil mutually beneficial goals. For example, Spotify and Uber have undergone a strategic alliance where Uber users can connect to Spotify and stream their favourites during rides (Viwizard.com. 2022).

It gives Spotify access to more customers, while Uber gives them a classic experience in rides. However, the business operation of the brands remains separate given the divergences in functions and performances Viwizard.com. 2022).

Recommendations for Tesla to increase their profitability

Tracing the core elements of the four approaches, Tesla should invest in joint ventures or strategic alliances. It should try to merge with the voice assistance systems of companies like Google or iPhones. It can help users to enhance travelling experiences in vehicles with advanced navigation and usability (Shaheen et al., 2017).

On the other hand, offers associated with the merger could help both companies attain a good market acquisition for future sales. Apart from outsourcing, the approach could help to upscale net earnings.

Task 4: Strategic Purpose; Ethics and CSR

Analysis and evaluation of Tesla’s CSR strategy

Based on the case, it is understood that Tesla is duly invested in improving CSR performance via deliverables and overall company imprints. The company’s zero marketing budget strategy is worth noting as the brand is focusing its investments on technical developments. These include the battery and engine infrastructure, designs, and even communal welfare purposes. Tesla’s goal is to go beyond business practices conventionally.

It is justified that the CSR is centred around the development of vehicular systems going beyond the petrol or diesel-run vehicles operating in the United Kingdom extensively. The open patent is another practice that strategises the focus on transparency (Forbes. 2022).

Critics have stated that ethical business and transparency go simultaneously, which accounts for customer access to patents and certifications issued for Tesla. It is also accountable that Tesla’s initiatives focus on making electric vehicles affordable to the larger sections of society. That way, non-electric cars and other vehicles can be replaced, which harms the environment with emissions and toxicities (Ibrahim and Jiang, 2021).

The case also details the need for ethical trade, which is issued via corporate dealings with technology firms. Even the selection processes can be regarded as crucial as only companies with clear histories, and successful launches are chosen.

Identification and critical discussion on the ethical issues Tesla faces

Even though Tesla has one of the best ratings under the Ethical Consumer’s Carbon Management and Reporting category, there are some prominent ethical challenges for the company. There are fraud allegations for the brand’s initiative of Solar City buyout. Elon Musk, the existing owner, has been aware of the failing solar city unit, which did not hinder the investment (Chatman, 2019).

There have been fraudulent sales ongoing, and employees pointing them are noted to have been fired in 2018. Even the funding processes are noted to violate business regulations repeatedly. A 2020 study shows that previously Musk has been warned to check investments and expenditures, which has not been undertaken properly.

Another major ethical stake for Tesla is the false advertising claim for self-driving cars in the ‘Next Year’ campaign. The automatic package is being funded abundantly despite no work in the process actually. Even 100 per cent renewable energy sourcing is being debated as a false claim by Musk in the automotive industry.

There are many customer service issues with complaints about hardware upgrades. In China, customers buying Hardware Version 3 have been given 2.5 Versions at a higher expense (CNBC. 2022).

Recommendations to address these problems

Addressing the ethical and corporate social limitations, Tesla’s authority needs to be more engaged in core functioning. Therefore, Musk and the administrative team should directly indulge in the supplies and testing of models before their final sales. Apart from these, Tesla should also try to focus investments on skills that can actuate the claims being made rather than false advertising of features.

It is also important for Tesla to uplift its brand name, which is rather the opposite. So, transformations should be included in content marketing only after their verifications. The power limits from outside should be controlled with diplomacy.

Conclusion

It is conclusive from the analysis above that development of a strategic plan for Tesla in sustainability is a total journey in itself. The points discussed in separate tasks reiterate the good and bad aspects that Tesla has faced while transforming vehicular production and usage within the United Kingdom and worldwide. It is also notable that several areas could be improved, like the corporate grades of responsibilities and ethics while outsourcing.

Having said that, Tesla’s progress is also steady and slow, implying a mass transformation that is notable from case insights. Therefore, changes in business integrations can only advance the sustainability agendas and outputs of Tesla with partnered skills.

References

Bloomberg. 2022. [online] Available at: <https://www.bloomberg.com/news/articles/2017-01-04/tesla-flips-the-switch-on-the-gigafactory> [Accessed 6 September 2022].

Chatman, C.N., 2019. The myth of the Attorney Whistleblower. SMU L. Rev., 72, p.669.

CNBC. 2022. [online] Available at: <http://www.cnbc.com/2017/04/07/4-chinese-backed-electric-car-start-ups-planning-a-run-at-tesla.html.> [Accessed 6 September 2022].

Cooke, P., 2020. Gigafactory logistics in space and time: Tesla’s fourth gigafactory and its rivals. Sustainability, 12(5), p.2044.

França, C.L., Broman, G., Robert, K.H., Basile, G. and Trygg, L., 2017. An approach to business model innovation and design for sustainable strategic development. Journal of Cleaner Production, 140, pp.155-166.

Forbes. 2022. [online] Available at: <https://www.forbes.com/sites/briansolomon/2014/06/12/tesla-goes-open-source-elon-musk-releases-patents-to-good-faithuse/#71f513773c63> [Accessed 6 September 2022].

Horizontal-vs-vertical-integration. 2022. [online] Available at: <https://fourweekmba.com/horizontal-vs-vertical-integration/> [Accessed 6 September 2022].

Ibrahim, A. and Jiang, F., 2021. The electric vehicle energy management: An overview of the energy system and related modelling and simulation. Renewable and Sustainable Energy Reviews, 144, p.111049.

Jiang, T., 2022, March. A Business Model to Analyse the Tesla Based on SWOT Analysis and POCD. In 2022 7th International Conference on Financial Innovation and Economic Development (ICFIED 2022) (pp. 2896-2899). Atlantis Press.

Lee, H.L. and Schmidt, G., 2017. Using value chains to enhance innovation. Production and Operations Management, 26(4), pp.617-632.

Leoncini, L., 2019. European Union energy trends from 2020 to 2050. KEP Energy Paper, 3.

Liu, Z., Ahn, M.H.Y., Kurokawa, T., Ly, A., Zhang, G., Wang, F., Yamada, T., Sadagopan, A., Cheng, J., Ferrone, C.R. and Liss, A.S., 2020. A fast, simple, and cost-effective method of expanding patient-derived xenograft mouse models of pancreatic ductal adenocarcinoma. Journal of Translational Medicine, 18(1), pp.1-12.

Makhmudov, N.M., Alisherovna, A.G. and Kazakov, A.A., 2021. Analysis of the Effect of Coronavirus (Covid-19) on the Development of the World Economic System. International Journal on Integrated Education, 3(11), pp.143-156.

Sampson, T., 2017. Brexit: the economics of international disintegration. Journal of Economic Perspectives, 31(4), pp.163-84.

Shaheen, S., Cohen, A. and Martin, E., 2017. Smartphone app evolution and early understanding from a multimodal app user survey. In Disrupting Mobility (pp. 149-164). Springer, Cham.

Viwizard.com. 2022. [online] Available at: <https://www.viwizard.com/spotify-music-tips/connect-uber-and-spotify.html/> [Accessed 6 September 2022].

Wallstreetmojo.com. 2022. [online] Available at: <https://www.wallstreetmojo.com/horizontal-vs-vertical-integration/> [Accessed 6 September 2022].

Assessment Self-Evaluation

| Assignment task | Self-Evaluation |

| Task 1: Potential answers could include:

External analysis: ● Application of appropriate models to analyse the external influences on the Automobile Industry. ● The application of appropriate models performs an analysis of the structure and attractiveness of the Automobile Industry by identifying the key forces acting on the industry, including competitive industry conditions and Tesla’s main competitors. Internal analysis: ● Application of appropriate models to analyse the internal capabilities/resources of Tesla. ● Key opportunities and threats faced by Tesla. Tesla’s strengths as well as its key weakness. The answer should be logically linked to external and internal environment analysis. |

Analysis, in this case, is governed by the case study. However, I have also resorted to the market elements via external research. The total process was done by me alone. Hence, I have relied abundantly on online sources like websites and journals. I have also used case information to compile arguments and develop new ideas based on case insights. I have also focused on external and internal conditions and compared the sources to the case study given. It has helped me to identify the pros and cons of the market and manufacturing initiatives that Tesla has undertaken so far. |

| Task 2: Potential answers could include:

● Application of appropriate models to analyse the reasons and strategic benefits for Tesla to expand internationally. ● Internationalisation strategy options were available for Tesla and recommendations of which one(s) best suit its global expansion. ● Entry models that best suit Tesla’s global expansion strategy. Provide justified recommendations. |

A large portion of my research, in this case, has been based on the case study. There have been several pieces of information that I have compared with some external datasets, particularly journals. I have also used four entry models, direct selling, strategic alliances, and outsourcing, as the main options to enrol in foreign countries. Most of these are used by Tesla, but the ventures are not done rightfully. So, the recommendation is focused on partnerships with local automobile companies. |

| Task 3: Potential answers could include:

● Tesla’s supply chain analysis and key forward and backward components of Tesla’s supply chain. ● Tesla’s options for vertical and horizontal integration. Recommendations of which one(s) can improve the firm’s competitive strategy, including options for outsourcing and strategic alliances. Provide justified recommendations. |

Tesla’s main supply chains are based on direct selling and exports. So, I have identified the core concepts of horizontal and vertical integration. Additionally, I have also discussed outsourcing and strategic alliances and their core features. I have made sure that every concept has a specific and successful instance to cite for evidence. It has helped in registering the fact that a strategic alliance is the best recommendation for Tesla at this moment. It has been an easy analysis for me. |

| Task 4: Potential answers could include:

● Application of appropriate models to analyse Tesla’s CSR initiatives and the main ethical issues the firm currently faces. ● Justified recommendations as to how Tesla can address these issues and therefore reduce their impact on stakeholders. |

The CSR analysis has been totally external. Even though Tesla’s case study has some input on the process, there are not many details on the ethical issues Tesla faces. In this case, the new articles have proven useful in helping me to understand the problems and extended solutions. It is crucial to note that I have been focusing on the clarity and transparency of Tesla’s operations. The reason is that most of the ethical problems are directed towards the falsification of advertising content and fraudulent measures that have caused larger problems in branding. |