PGBM135 Global Strategy and Foresight Assignment Sample

Module code and Title: PGBM135 Global Strategy and Foresight Assignment Sample

ASSESSMENT 1

Introduction

“Global strategy” acts as strategy developed by organisations for expanding operations in global market. Main purpose of adopting a global strategy is to increase sales revenue across global market. This work sheds light on evaluation of innovation as part of driving internationalisation strategies, and organisation’s strategic resources, capabilities, & competencies. Porter’s diamond model, resource-based view and Porter’s generic model have been taken as theories of competitive advantage in the work. Moreover, Porter’s value chain and Porter’s five forces have been considered for evaluating the strategic resources and competencies of organisations.

Theories of competitive advantage and innovation in internationalisation strategies

Competitive advantage

“Competitive advantage” acts as process in which an organisation develops products and services better than its competitors. Professor Michael Porter is considered as most influential thinker about competitive advantage (Vlados, 2019). An organisation gets competitive advantage through three primary factors: cost advantage, offer advantage or niche advantage.

Theory of competitive advantage (Porter’s diamond theory) was proposed by Michael Porter in 1985 (Chowdhury and Zabeen, 2020). The theory highlights that businesses and states should develop policies which are efficient for creating high-quality goods and services for selling them at high prices in market. Productivity growth has been analysed as main focus of national strategy.

Figure 1: Porter Diamond Theory (Source: Vlados, 2019)

Figure 1: Porter Diamond Theory (Source: Vlados, 2019)

The theory rests on availability of natural resources not necessarily a sign of good economy and cheap labour that can be available in any country. Thus, competitive advantage can be created for organisations and economies by specialising in exporting primary goods and raw materials. For garnering premium prices, entities should stress maximising scale of economy in goods and services.

Michael Porter has also proposed a strategic model of competitive advantage which is called Porter’s generic model. It highlights that organisations have three basic strategic options available for getting competitive advantage. These options are differentiation, cost leadership, and focus (Kowo et al. 2018). It emphasises on choice of venture regarding narrow competitive scope in industry.

Porter’s diamond theory indicates that the competitive advantage of an organisation or industry works better than others in a particular region or country. Organisations have to determine their distinct strengths which makes them much more visible in a market or region. Effective utilisation of resources and technologies available in the region provides liberty of becoming important in the market. Some of the main elements which influence position of a company in a nation are demand conditions, governmental policies, and factor conditions. For instance, Coca-Cola, which is an American multinational beverage company, is huge part of Mexican life.

The drink rose in popularity by 1960s with help of “Vicente Fox”, former Mexico’s president. In current times, the average Mexican drinks 700 cups of Coca-Cola in a year (Businessinsider, 2022). This highlights that Coca-Cola has both demands and governmental support in Mexico which has helped it in getting a competitive edge.

Figure 2: Porter’s Generic Model (Source: Shao and Oinas-Kukkonen, 2018)

Figure 2: Porter’s Generic Model (Source: Shao and Oinas-Kukkonen, 2018)

Porter’s generic model highlights generic strategies that help organisations generate competitive edge in the market. These strategies are cost leadership, focus, and differentiation (Abdulwase et al. 2020). To achieve competitive edge organisations can focus on cost of operations by reducing costs or increasing market share. Differentiation strategy emphasises making offerings of company distinct from competitors’ offerings. Taking such an action can allow an organisation to attract a higher number of customers. Thus, a competitive edge can be achieved.

As per this model, focus can be divided into two subcategories: cost focus and differentiation focus. This helps in adding something extra to the offerings of company. For instance, there exist many fashion retailers including Next Plc, H&M, and Zara as biggest retailers in UK market. However, establishment of Asos Plc took place in 2000 which was the country’s first online fashion retailer (Theguardian, 2022). The company had an innovative idea to offer fashion products online. Thus, it can be said that Asos adopted a differentiation strategy for gaining competitive edge in UK fashion retail market.

“Resource-Based View” acts as another theory of competitive advantage which highlights that competitive advantage of an organisation is based on its inimitable, rare, valuable, and substitutable resources. The way an organisation acquires its unique resources makes its position districts in the market. The theory was first introduced by Penrose in 2009 as a model of effective management of firm’s resources.

An organisation can maintain different forms of resources which may have financial or non-financial impacts on its performance. Normally, environmental models of competitive advantage assume that organisations operating in identical markets may have similar types of resources and strategies. However, resource-based view argues that if an organisation maintains strategic resources which are distinct from other operators in the market, then competitive edge can be achieved.

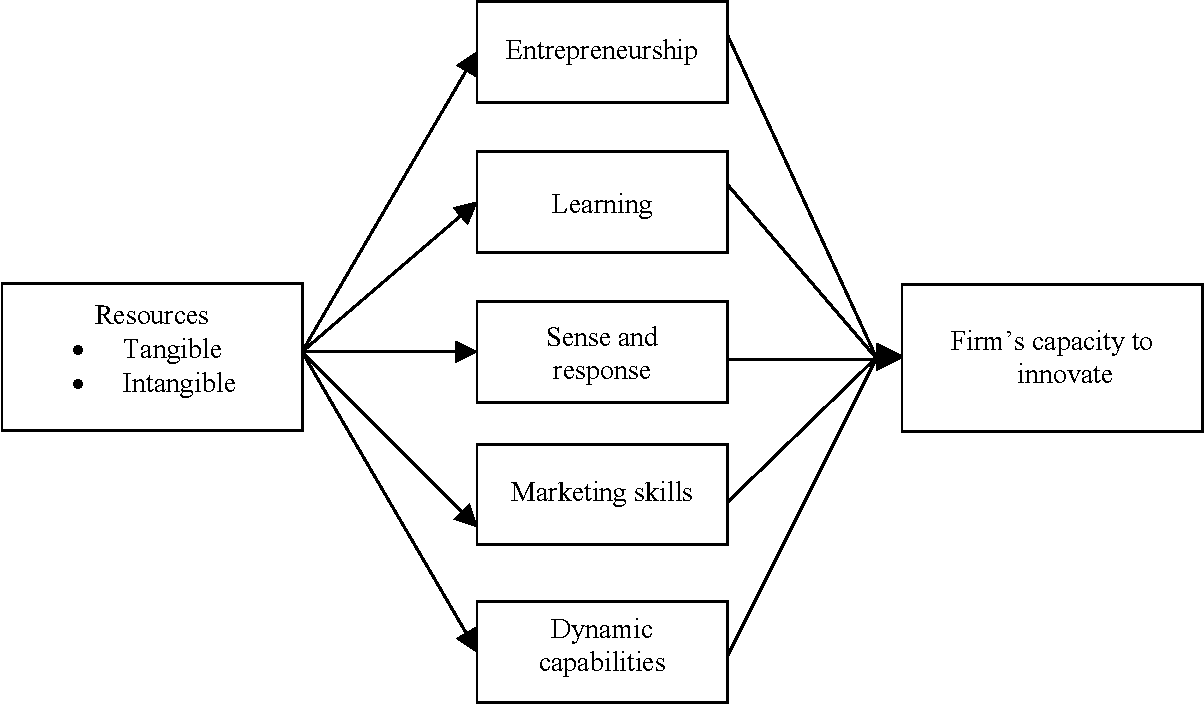

Figure 3: Resource-Based View (Source: Alonso, 2019)

Figure 3: Resource-Based View (Source: Alonso, 2019)

An organisation may have human, tangible, intangible, or financial resources that can give it competitive edge. Ensuring resources hold potential of sustaining competitive edge, it has some crucial attributes. The resources maintained by organisations must be “valuable”, “neutralising threats”, and “exploiting opportunities” (Alonso, 2019). The resources must be rare as compared to existing market players and they must be shared among large number of players. As argued by Min et al. (2021), resource-based views state that resources of an organisation must be imperfectly imitable.

For instance, BP which is a multinational oil and gas company has pledged to become a carbon-neutralised company by 2050 and has also changed its name from “British Petroleum” to “Beyond Petroleum” (Forbes, 2022). Making such changes for an oil and gas company is unique which is giving a competitive edge to BP. Therefore, it can be said that development of distinct resources helps an organisation exploit vast opportunities in market.

Innovation in internationalisation

Innovation is process of practically implementing ideas which result in introduction of new offerings or improvement in existing offerings. Innovation acts as crucial element in contemporary business world as it allows upgradation of operating system of business or introduces modern technology of automation in management (Shao and Oinas-Kukkonen, 2018). Internationalisation strategy acts as strategy through which an organisation can sell its offerings outside domestic market.

Operating in the international market can provide planetary opportunities to businesses for profitability and growth. Innovation has significant impact on long-term sustainability and competitiveness of an organisation. An organisation cannot sustainably innovate new offerings within its home country only given that each country has constraints and limitations (Du et al. 2020). Since Industrial Revolution, leveraging different innovation resources inside & outside home country of an organisation has become crucial source of developing innovation capabilities.

Innovation provides better understanding to organisations for making strategic decisions and augmenting innovative capabilities through internationalisation process. Innovation allows organisations to maintain enough diversity in their product, workforce and asset portfolio leading to positive influence on their image in international market. Hence, it can be stated that innovation is crucial part of driving internationalisation strategies within organisations.

In an environment where all organisations are competing with each other for getting competitive edge, innovation has an important role. Innovation makes an organisation much more visible in the market and helps in increasing market share. From increasing existing product lines, boosting customer satisfaction and increasing market share to boosting revenue, all these operations need innovation. Operating in the international market is an important move for a company which is associated with many positive and negative points.

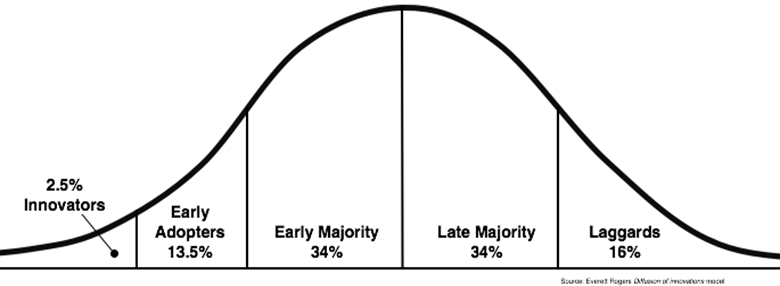

On one hand, operating in international market allows an increasing customer base and boosts company size, on the other hand, the company needs to compete with a large number of competitors and has to obey rules & regulations. Thus, organisations aim to maintain optimum innovation in their offerings and operations for obtaining optimum opportunities from international market operations. As per “Diffusion of Innovation Theory”, the adoption of new ideas is not an overnight phenomenon. There exist five categories of adopters which are “innovators”, “early majority”, “early adopters”, “late majority”, and “laggards” (Van Tonder et al. 2020).

Innovators act as first or individuals who want to be first to try innovation. Early adopters are those who are comfortable with new changes. Moreover, the early majority are those that adopt innovative ideas before average individuals or firms. Late majority are those who adopt change after it is accepted by everyone. Laggards are those who are very conservative and hesitate to change.

Figure 4: Diffusion of Innovation Theory (Source: Van Tonder et al. 2020)

Figure 4: Diffusion of Innovation Theory (Source: Van Tonder et al. 2020)

Organisations having significantly strong innovative ideas or products can disrupt the overall market. Thus, decision of expanding in international market is influenced by presence of innovative ideas. For instance, Amazon was one of the first e-commerce retailers in the market (Britannica, 2022). The innovative idea of Amazon could disrupt the overall market. Thus, it influences the decision to expand its operation around the world. Currently, the company operates across 5 continents with around 20 countries.

For any organisation, an internationalisation strategy acts as a process of selling goods and services in overseas markets. It provides plenty of new opportunities and growth possibilities to organisations which is the reason, the internationalisation strategy is adopted by ventures. As innovation in products and services positively influences the decision of organisations to move into international market, it can be considered one of crucial drivers of internationalisation. In essence, it can be said that innovation is a crucial driver of internationalisation strategy.

Organisation’s strategic resources, capabilities, and competencies & global environment and new sectors’

Strategic resources, competencies, and capabilities act as basic building blocks that a commercial entity uses for creation of sound performance. Maintaining a strong linkage between strategic resources competencies and capabilities allows organisations to develop strategies that can give competitive edge to companies (Khouroh et al. 2020). A “strategic resource” can be analysed as an asset which is available, rare, not easily imitable, and organised. These resources are valuable for organisations as it helps in development of strategies that can provide competitive edge in market.

As argued by Lintukangas et al. (2019), strategic resources allow companies to capitalise on opportunities and ward off threats. In addition, “strategic capabilities” can be analysed as competencies & resources which allow an organisation to compete in market. As per Jafari et al. (2022), strategic capabilities act as positive drivers of company’s growth. On the other hand, “strategic competencies” refers to ability of commercial entities to overcome difficult situations. Thus, it has a crucial role in strengthening financial and non-financial performance of the company in market.

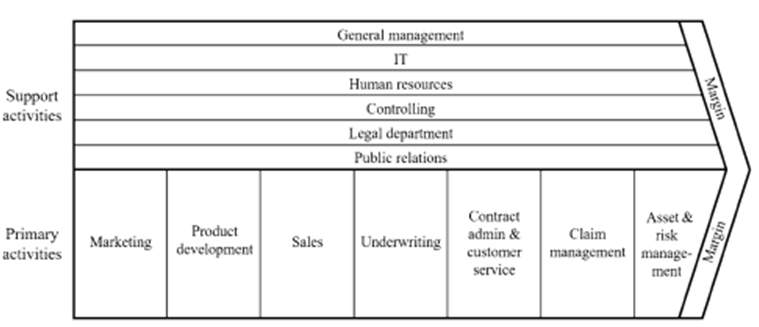

An organisation’s strategic resources, capabilities, and competencies can be evaluated through Porter’s Value Chain. This model acts as a concept that can provide a complete picture of a commercial entity. It comprises five primary activities including operations’ inbound logistics, marketing & sales, outbound logistics, and services (Eling and Lehmann, 2018). The idea behind this model is to view an organisation as per its strategies, capabilities, and resources.

The model emphasises supporting activities of an organisation which are firm infrastructure, technological development, human resource management, and procurement. As the model is efficient for getting a detailed overview of an organisation, it can be used for determining the strategic resources, competencies, and capabilities of a company. The model can be used for making a distinction between primary and supporting activities of a firm which are required for delivery of sound production services to customers.

Figure 5: Porter’s Value Chain (Source: Eling and Lehmann, 2018)

Figure 5: Porter’s Value Chain (Source: Eling and Lehmann, 2018)

The model was developed by Michael Porter 30 years ago, and since then the model has been used as a powerful tool for analysing strategic resources, and competencies of companies. Organisation’s value chain is a crucial part of largest value system which includes supporting companies which are either upstream or downstream. Here, downstream highlights distribution channels and upstream highlights suppliers.

Effective alignment of strategic resources, capabilities, and competencies helps in creating value for organisation (Gregory et al. 2021). Ventures create value by acquiring raw materials and utilising them to provide something useful for end users. Thus, the strategic resources, capabilities and competencies used within management can be analysed through porter’s value chain. The model highlights main activity of companies by dividing them into two sections: primary activity & supporting activities.

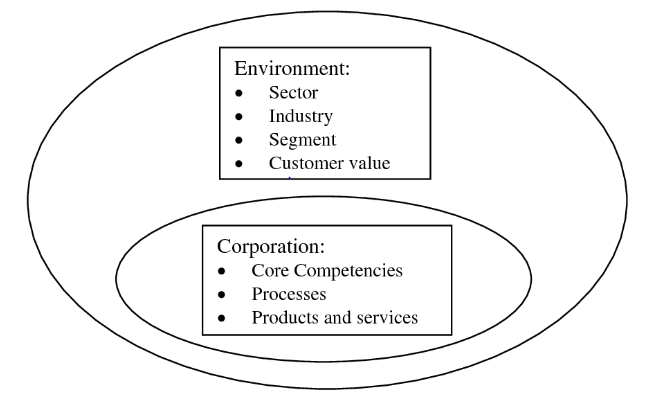

Figure 6: The core competency theory (Source: Gregory et al. 2021)

Figure 6: The core competency theory (Source: Gregory et al. 2021)

Another theory that can be used for analysing strategic resources, capabilities, and competencies of an organisation is “The core competency theory”. It acts as a management theory first introduced by “C. K. Prahalad” and “Gary Hamel”. The theory states that strategic resources of an organisation include a harmonised combination of skills and resources which makes the company distinct in the market. As per the theory, rather than concerning the weaknesses, an organisation must emphasise strengths for getting a competitive edge in the market.

Furthermore, organisations must orient their strategies for tapping into core competencies which aid in their value in the market. For instance, core competencies of Walt Disney lie in its ability to design and animate its shows. The way resources, capabilities, and competencies are being used by Walt Disney highlights its value in the market. The art of storytelling which is used by Walt Disney can be analysed as its strategic resources, and ability to cater to the needs of a large number of customers act as strategic competencies and capabilities of Walt Disney.

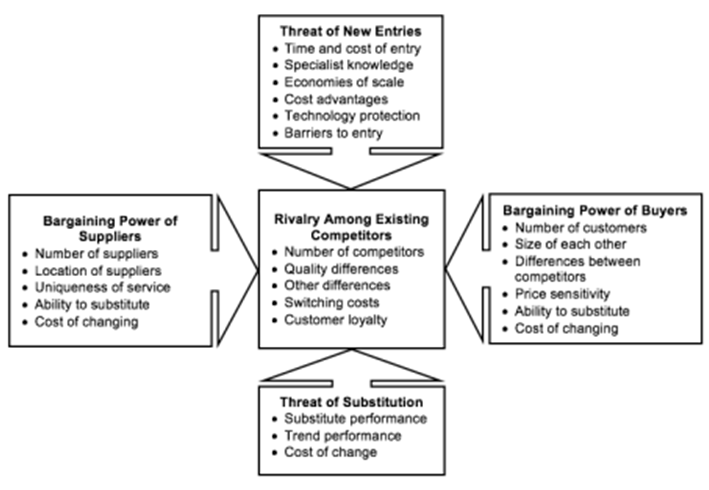

Global environment allows organisations to exploit opportunities available in overseas markets for achieving optimum growth and profitability. Exploitation of global environment benefits both nations and organisations as it offers a comprehensive platform for gaining more customers and products. One can develop greater understanding of global environment and new sectors by utilising a comprehensive model for reviewing it. Porter’s five forces act as comprehensive model which provides an overview of global environment and new sectors (Bruijl and Gerard, 2018).

Porter’s five forces analysis acts as framework for understanding a new operating environment through five crucial forces which are power of competitive rivals, potential new market entrants, customers, suppliers, and substitute products which can influence companies’ profitability. As per this model, there exist five competitive forces which are efficient for shaping every industry and helps in determining industries’ strength and weakness. As a result, focusing on these factors can help understand the industry in a global environment. To develop a corporate strategy, an organisation can use this framework for determining an industry’s structure.

The first force in this framework is competition in industry and its ability to undercut an organisation. The second factor focuses on force of new entrants into market and its influence on existing companies. Third and fourth factors focus on power of suppliers and power of customers on organisations. Threat of substitution is the last factor in Porter’s five forces which helps in determining threat post by offerings of competitors in the market.

Figure 7: Porter’s Five Forces (Source: Bruijl and Gerard, 2018)

Figure 7: Porter’s Five Forces (Source: Bruijl and Gerard, 2018)

Another model that can be utilised for analysing new sectors or industries is “PESTEL analysis”. It includes an analysis of key external factors which impact a particular industry or sector. It can be used in a range of different scenarios and can guide companies in making informed decisions. Main elements which are discussed in PESTEL analysis are “political”, “social”, “economic”, “legal”, “technological”, and “environmental” (Mihailova, 2020). It can be analysed as broad factor analysis as it helps in evaluating the external environment of ventures.

Thus, managers can take assistance from this model for supporting business expansion or development decisions. Thus, it can provide in-depth information on new sectors or industries which helps make informed decisions. Political factors highlight elements such as regulations, policies, political instability or labour laws in the market. Economic forces include consideration of GDP, inflation, or condition of capital market. Moreover, technological aspects shed light on technological advancement of the new sector or market.

Legal aspects highlight rules & regulations-related elements in the sector. Furthermore, environmental factors reflect rules and regulations in the market related to sustainability, and environment. As this model provides in-depth information regarding macro elements of new sectors or global environment, it can be used by organisations for developing greater understanding.

Figure 8: PESTEL Analysis (Source: Pan et al. 2019)

Figure 8: PESTEL Analysis (Source: Pan et al. 2019)

“SWOT analysis” is another framework that can be used for gaining an understanding of new industries or sectors. It stands for “strength”, “weakness”, “opportunity”, and “threats” (Pan et al. 2019). It helps in summarising different industry-related forces and assessing their consequences on an organisation’s operations. As argued by Benzaghta et al. (2021), industry analysis acts as a form of market assessment which is crucial for understanding market conditions.

It helps in forecasting demand and supply-related elements along with financial returns. Market analysis is usually conducted by organisations aiming to expand into new industries or markets. Usage of SWOT analysis helps in analysing own strengths and weaknesses and analysing opportunities and threats in the new market. As a result, it allows organisations to develop relevant strategies for expanding in new markets.

Figure 9: SWOT Analysis (Source: Benzaghta et al. 2021)

Figure 9: SWOT Analysis (Source: Benzaghta et al. 2021)

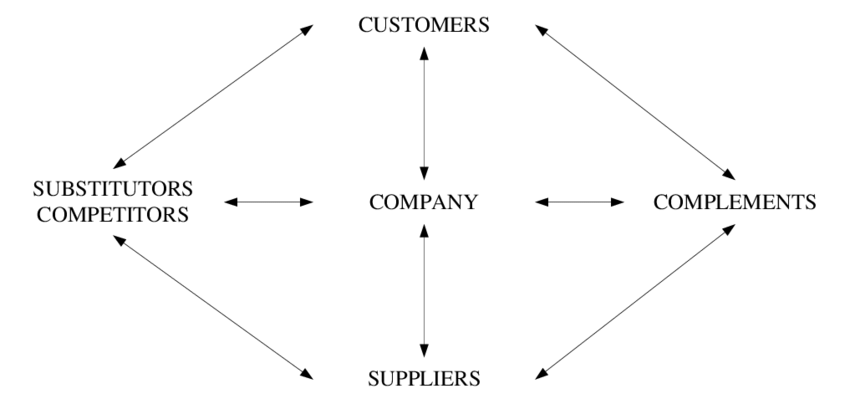

“The value net” acts as a model that helps in identifying players present in a particular industry or market that can have a significant impact on new entrants. As argued by Djellabi et al. (2021), value net acts as an analytical strategy developed by “Adam Brandenburger” and “Gary Nalebuff” in 1996. In a given industry or market, the theory helps in analysing behaviour of multiple players.

As per this theory, main players in a sector are customers, suppliers, complementors, and competitors. These players may have a positive or negative impact on an organisation. For instance, customers and complementors have positive value but competitors and suppliers may have negative value to the company.

Figure 10: The value net (Source: Djellabi et al. 2021)

Figure 10: The value net (Source: Djellabi et al. 2021)

Conclusion

The primary goal of implementing a global strategy is to boost sales revenue in the worldwide market. The two primary theories of competitive advantage are Porter’s generic model and Porter’s diamond theory. Porter’s Value Chain can be used to analyse an organisation’s strategic resources, capabilities, and competencies. Understanding the global environment and emerging sectors can be aided by the use of Porter’s Five Forces framework. Innovation helps in enhancing the products and services provided by a company. Thus, it helps in expanding operations in the international market. As a result, innovation acts as a positive driver in international strategy.

ASSESSMENT 2

Case – Netflix

Introduction

Netflix is an American online streaming service and production company that has headquarters in Los Gatos, California, US. The company was started in 1997 by “Reed Hastings” and “Marc Randolph” (Britannica, 2022). However, this company is facing ongoing threats from different sources. Thus, the work highlights threats and future scopes of Netflix.

1. Key threats to Netflix, and trends within online streaming

Global streaming industry has a size of US$70.59bn with a compound annual growth rate of 21.3%. The projected growth rate of this market is $1690.35bn by 2029 (Fortunebusinessinsights, 2022). The industry obtained significant growth since Covid situation when restrictions were posed on travelling and social gatherings. Especially in Covid situation, a massive acceleration of online streaming services’ demand has been found.

Netflix is a leading player in online streaming service industry which is currently struggling due to intense competition from other online streaming platforms in market. The company is facing tough competition from “Disney+”, “Apple TV+”, “HBO”, “Amazon”, “Hulu”, and “YouTube”. Another major issue which is faced by Netflix is content privacy. Majority of Netflix shows are collected by third-party applications for their own purpose which adversely impacted on financial and non-financial performance of Netflix.

2. Broader global factors crucial for Netflix

While operating in the global online streaming service market, megatrends which are important for Netflix are technological advancement, higher preferences of consumers for digital streaming applications, and AI. Development of AI has helped Netflix in providing personalised services to customers and protecting personal data of consumers using its application.

Besides, technological advancement is helping Netflix in developing creative content demanded by audiences. Further, effective usage of technology might allow Netflix in mitigating the issue of copyright content. Most crucial factor behind the success of Netflix is its culture and emphasis on consumer experience. Thus, catering to needs of consumers in different countries can help in gaining a competitive edge.

3. Ten-year scenarios for Netflix

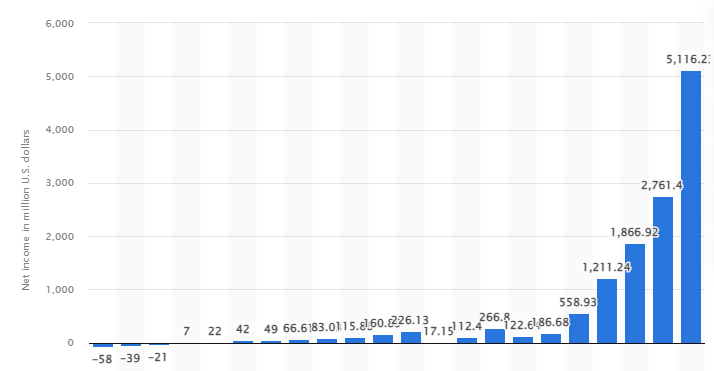

Netflix is one of the leading online streaming service companies in world. Currently, it is world’s largest streaming service having over 200 million subscribers (Weforum.org, 2022). During 2000, net income of Netflix was -$58m which has gradually improved to $160.85m in 2010. However, in 2021, net income of Netflix was $5116.23m (Statista, 2022). Besides, total subscribers of Netflix were 21.5mm which increased to 209mm in 2021. This highlights increasing trend in Netflix’s performance in last 10 years.

Netflix’s net profits for last 10 years (Source: Statista, 2022)

Netflix’s net profits for last 10 years (Source: Statista, 2022)

Netflix subscribers (Source: Businessofapps, 2022)

Netflix subscribers (Source: Businessofapps, 2022)

4. Potential impact of future environmental

Future environmental forces that can impact Netflix’s performance is further technological advancements which will help in avoiding content piracy. Thus, it will act as a strength of Netflix. Considering last year’s trend, it can be observed that subscribers and net profits of Netflix will rise with an increase in demand for digital content. Thus, it will act as a strength of Netflix. However, the rise in demand for digital intent may increase the number of new entrants in the market which may create a threat to Netflix.

Conclusion

Netflix is a leading operator in the online streaming service industry. The company has had an increasing trend of financial and non-financial performance in last 10 years. The company faces intense competition from “Disney+”, “Apple TV+”, “HBO”, “Amazon”, “Hulu”, and “YouTube”. Major issue which is faced by Netflix is content privacy.

References

Abdulwase, R., Ahmed, F., Nasr, F., Abdulwase, A., Alyousofi, A. and Yan, S., (2020). The role of business strategy to create a competitive advantage in the organization. Open Access J Sci, 4(4), pp.135-138.

Alonso, A.D., (2019). Resources, competitiveness, and socioeconomic development: The case of a South American emerging economy. Local Economy, 34(1), pp.68-87.

Benzaghta, M.A., Elwalda, A., Mousa, M.M., Erkan, I. and Rahman, M., (2021). SWOT analysis applications: An integrative literature review. Journal of Global Business Insights, 6(1), pp.55-73.

Britannica (2022). About Amazon in e-commerce platform. Available at: https://www.britannica.com/topic/Amazoncom[Accessed on 16th December 2022]

Britannica (2022). About Netflix. Available at: https://www.britannica.com/topic/Netflix-Inc#:~:text=Netflix%2C%20in%20full%20Netflix%2C%20Inc,are%20in%20Los%20Gatos%2C%20California.[Accessed on 15th December 2022]

Bruijl, D. and Gerard, H.T., (2018). The relevance of Porter’s five forces in today’s innovative and changing business environment, 2(3), pp.1-21.

Businessinsider (2022). About Coca-Cola in Mexico. Available at: https://www.businessinsider.com/retail/how-the-former-president-of-mexico-helped-make-coca-cola-such-a-huge-part-of-mexican-life-that-its-used-in-religious-ceremonies-and-as-medicine/articleshow/65505401.cms[Accessed on 17th December 2022]

Businessofapps (2022). About Netflix. Available at: https://www.businessofapps.com/data/netflix-statistics/[Accessed on 19th December 2022]

Chowdhury, S.H. and Zabeen, M., (2020). An Assessment of the Competitiveness of Bangladesh’s RMG Sector Using Porter’s Diamond. Theoretical Economics Letters, 10(04), pp.875-880.

Djellabi, R., Giannantonio, R., Falletta, E. and Bianchi, C.L., (2021). SWOT analysis of photocatalytic materials towards large scale environmental remediation. Current Opinion in Chemical Engineering, 3(3), pp.100-196.

Du, J., Zhu, S. and Li, W.H., (2022). Innovation through internationalization: A systematic review and research agenda. Asia Pacific Journal of Management, pp.1-35.

Eling, M. and Lehmann, M., (2018). The impact of digitalization on the insurance value chain and the insurability of risks. The Geneva papers on risk and insurance-issues and practice, 43(3), pp.359-396.

Forbes (2022). About BP rebranding. Available at: https://www.forbes.com/sites/scottcarpenter/(2020)/08/04/bps-new-renewables-push-redolent-of-abandoned-beyond-petroleum-rebrand/[Accessed on 15th December 2022]

Fortunebusinessinsights (2022). About video streaming market. Available at: https://www.fortunebusinessinsights.com/video-streaming-market-103057[Accessed on 16th December 2022]

Gregory, R.W., Henfridsson, O., Kaganer, E. and Kyriakou, H., (2021). The role of artificial intelligence and data network effects for creating user value. Academy of management review, 46(3), pp.534-551.

Jafari, H., Ghaderi, H., Eslami, M.H. and Malik, M., (2022). Leveraging supply integration, mass customization and manufacturing flexibility capabilities and the contingency of innovation orientation. Supply Chain Management: An International Journal, 27(7), pp.194-210.

Khouroh, U., Sudiro, A., Rahayu, M. and Indrawati, N., (2020). The mediating effect of entrepreneurial marketing in the relationship between environmental turbulence and dynamic capability with sustainable competitive advantage: An empirical study in Indonesian MSMEs. Management Science Letters, 10(3), pp.709-720.

Kowo, S., Sabitu, O. and Adegbite, G., (2018). Influence of competitive strategies on corporate performance of small and medium enterprises: a case from Nigeria. Agricultural and Resource Economics: International Scientific E-Journal, 4(1), pp.14-33.

Lintukangas, K., Kähkönen, A.K. and Hallikas, J., (2019). The role of supply management innovativeness and supplier orientation in firms’ sustainability performance. Journal of Purchasing and Supply Management, 25(4), pp.100-158.

Mihailova, M., (2020). The state of agriculture in Bulgaria-PESTLE analysis. Bulgarian Journal of Agricultural Science, 26(5), pp.935-943.

Min, S., So, K.K.F. and Jeong, M., (2021). Consumer adoption of the Uber mobile application: Insights from diffusion of innovation theory and technology acceptance model. In Future of Tourism Marketing, 3(2), pp. 2-15.

Pan, W., Chen, L. and Zhan, W., (2019). PESTEL analysis of construction productivity enhancement strategies: A case study of three economies. Journal of Management in Engineering, 35(1), pp.501-513.

Privacy.commonsense.org (2022). About Netflix content privacy issue. Available at: https://privacy.commonsense.org/evaluation/Netflix#:~:text=Data%20are%20collected%20by%20third,company%20can%20send%20marketing%20messages. [Accessed on 17th December 2022]

Shao, X. and Oinas-Kukkonen, H., (2018). Thinking about persuasive technology from the strategic business perspective: a call for research on cost-based competitive advantage. In International Conference on Persuasive Technology, 3(1), pp. 3-15.

Statista (2022). About Netflix net income. Available at: https://www.statista.com/statistics/272561/netflix-net-income/[Accessed on 18th December 2022]

Theguardian (2022). About Asos in fashion retail market. Available at: https://www.theguardian.com/business/2018/dec/17/asos-the-seesaw-history-of-a-global-online-fashion-giant[Accessed on 18th December 2022]

Van Tonder, C., Schachtebeck, C., Nieuwenhuizen, C. and Bossink, B., (2020). A framework for digital transformation and business model innovation. Management: Journal of Contemporary Management Issues, 25(2), pp.111-132.

Vlados, C., (2019). Porter’s diamond approaches and the competitiveness web. International Journal of Business Administration, 10(5), pp.33-52.

Weforum.org (2022). About Netflix subscriptions. Available at: https://www.weforum.org/agenda/2021/03/streaming-service-subscriptions-lockdown-demand-netflix-amazon-prime-spotify-disney-plus-apple-music-movie-tv/[Accessed on 20th December 2022]

Know more about UniqueSubmission’s other writing services: