ISYS40091 Entrepreneurial Leadership and Project Management Assignment Sample

Explanation of Project Idea

In short-range wireless communications, radio frequency identification is one of the most commonly used technologies, and it is expected to play an increasing role in the future. RFID is becoming a popular technology in many different fields these days, including supply chain systems, community medical and transportation systems. RFID systems consist of an antenna, a reader, and a tag. Bands can be divided into three categories: low-frequency, high-frequency, and ultrahigh frequency (UHF). Several factors contribute to the success of UHF tags, including their high stability, long transmission range, and data capacity. There will be approximately 15 billion UHF tags sold by 2019 with a total market value of about USD 1 billion. The global market for UHF tags is increasing from 2017 to 2019. The aim of this paper is to investigate the digital baseband system of UHF RFID tags. During the communication process between the tag and the reader, the digital baseband processor is the tag’s core. Controls the time and manner in which data is received (and sent) by the tag.

Explanation of the design

The processor includes the “TPP decoding module, clock management module, encoding module, power management module (power), input data processing module (input), CRC verification/generation module (CRC), random number generation module (random), control module (control), output data processing module (output), command detection module (CDM), initialization module (INIT), state machine module (state machine) and memory control module (MC)”. The analog front-end circuit supplies the initialization module with power when the tag is near the reader. A baseband signal is generated by demodulating the modulated signal by the RF front-end, and the baseband signal is transmitted to the TPP decoding module after the tag has completed initialization. In the decoding module, the transmitted pre-synchronous code or frame-synchronized code of the baseband signal is detected first, and if it is successfully detected, the following segments of data are decoded. Once decoded, the data enters the data input module, which converts serial data into parallel data, as well as sending decoded data to the command detection module. Data decoded by TPP is comprised of a command header, data bits, and a CRC check digit. To check the header of the command, the decoded data of TPP enters the command detection module. In the state machine, signals are sent to control the state jump after parsing the command header to determine the command type. A parsing error in the command header will prevent further parsing, and corresponding flag bits will be set. In addition, the CRC check module no longer receives data from the user. It is verified that the data is transmitted to the CRC verification module after being parsed by the command detection module. CRC-16 verification is selected by the CRC module according to the protocol. According to the protocol, forward links utilize the CRC-16 data detection method, while reverse links use the CRC-16/CRC-5 data detection method. Upon successfully verifying the CRC, the controller follows the reader’s command.

The DDS-BT algorithm is used to complete the anti-collision algorithm when several tags are communicating with one reader at the same time. The random number generation module, the time slot counter, and the state machine work together to bring about the anti-collision algorithm.

During the read operation command, the control module communicates with the memory controlling module. The memory data is then transmitted to the output processing module, which converts the parallel data into serial and sends it to the CRC generation module, which generates the cyclic verification code. A verification code is then added to the final serial data, which is then sent to the coding module to generate a baseband signal using FM0 coding or subcarrier Miller coding. According to the Query command, the leading code will be added, and the signal will be transmitted to the RF front end for modulation. To complete communication between reader and tag, the tuned signal is sent to the antenna.

The memory control module writes data into the memory on behalf of the tag when it executes the write operation. The memory returns to the success symbol after completion, indicating that the reader and tag have successfully communicated.

Purpose, Aims and Objectives

The aim of the project is to bring to market a product that uses Baseband signal processing circuits in the application of Power Cognitive Communication ICs. In the world, of IT, miniaturising is a constant. With greater demands being placed on reduced energy usage. The project therefore aims to bring to market a product to be embedded in commercial use IOT devices that can help in power effective signal transmission.

The objectives of the project are:

- To establish the practical viability of the project through prototype design.

- To establish the commercial viability by scaling up the production

- To present the product to the market and establish sales channels

- To obtain profitability.

- Business Viability

-

Marketing Strategy

Depending on their urban services, we will need to hire different types of marketing skills to look different from other businesses. As a result, we can create a cohesive strategy that can be implemented around the globe. Among the approaches used for the advertisement are:

Basic PPC or Search Ads

Advertising is intended to help you or your potential customers find what you or they are looking for. This is exactly what Google search ads are intended to do. When you enter some keywords related to their website, you will see their search ads on the browser.

To get higher organic returns against keyword searches, we will also focus on steady and consistent SEO approaches on top of Google search ads.

Social Media Advertisement

Social media sites are quickly becoming the norm for Internet users. They provide a good way to communicate with the masses. By using Facebook and Instagram ads, they are trying to reach as many potential customers as possible.

Video Advertisement On Platforms Like YouTube

In addition to content creation for Facebook and YouTube, we will also have to create content in video form. Video content attracts more engagement and visibility than written content. Due to this, it is imperative that a special focus be placed on that aspect.

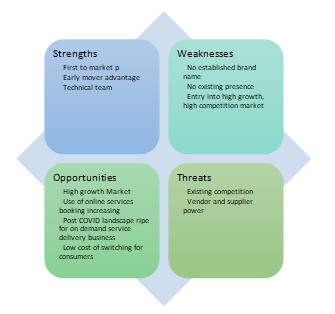

SWOT Analysis

Financial Justifications

Balance Sheet

| ASSETS | ||||||

| Current Assets | Initial balance | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Cash and short-term investments | 50,000.00 | 1,85,955.05 | 1,88,022.86 | 3,00,027.37 | 4,96,308.21 | 6,59,071.54 |

| Accounts receivable | 3,000.00 | 3,000.00 | 3,000.00 | 3,000.00 | 3,000.00 | 3,000.00 |

| Total inventory | 25,000.00 | 25,000.00 | 25,000.00 | 25,000.00 | 25,000.00 | 25,000.00 |

| Prepaid expenses | – | – | – | – | – | – |

| Deferred income tax | – | – | – | – | – | – |

| Other current assets | 5,000.00 | 5,000.00 | 5,000.00 | 5,000.00 | 5,000.00 | 5,000.00 |

| Total current assets | 83,000.00 | 2,18,955.05 | 2,21,022.86 | 3,33,027.37 | 5,29,308.21 | 6,92,071.54 |

| Property and Equipment | Initial balance | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Buildings | 20,000.00 | 20,000.00 | 20,000.00 | 20,000.00 | 20,000.00 | 20,000.00 |

| Land | 10,000.00 | 10,000.00 | 10,000.00 | 10,000.00 | 10,000.00 | 10,000.00 |

| Capital improvements | – | – | – | – | – | – |

| Machinery and equipment | 10,000.00 | 10,000.00 | 10,000.00 | 10,000.00 | 10,000.00 | 10,000.00 |

| Less Accumulated depreciation expense | 6,000.00 | 12,120.00 | 18,360.00 | 24,720.00 | 31,200.00 | |

| Total Property and Equipment | 40,000.00 | 34,000.00 | 27,880.00 | 21,640.00 | 15,280.00 | 8,800.00 |

| TOTAL ASSETS | 1,23,000.00 | 2,52,955.05 | 2,48,902.86 | 3,54,667.37 | 5,44,588.21 | 7,00,871.54 |

| LIABILITIES | ||||||

| Current Liabilities | Initial balance | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Accounts payable | 2,000.00 | 2,000.00 | 2,000.00 | 2,000.00 | 2,000.00 | 2,000.00 |

| Accrued expenses | – | – | – | – | – | – |

| Notes payable/short-term debt | – | – | – | – | – | – |

| Capital leases | – | – | – | – | – | – |

| Other current liabilities | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 |

| Total Current Liabilities | 2,100.00 | 2,100.00 | 2,100.00 | 2,100.00 | 2,100.00 | 2,100.00 |

| Debt | Initial balance | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Long-term debt/loan | 6,00,000.00 | 4,90,325.02 | 3,75,714.66 | 2,55,946.83 | 1,30,789.46 | – |

| Other long-term debt | 1,00,000.00 | 2,00,000.00 | 1,50,000.00 | 1,75,000.00 | 2,25,000.00 | 1,50,000.00 |

| Total Debt | 7,02,100.00 | 6,92,425.02 | 5,27,814.66 | 4,33,046.83 | 3,57,889.46 | 1,52,100.00 |

| Other Liabilities | Initial balance | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Other liabilities (specify) | – | – | – | – | – | – |

| Other liabilities (specify) | – | – | – | – | – | – |

| Total Other Liabilities | – | – | – | – | – | – |

| TOTAL LIABILITIES | 6,02,100.00 | 4,92,425.02 | 3,77,814.66 | 2,58,046.83 | 1,32,889.46 | 2,100.00 |

| EQUITY | ||||||

| Initial balance | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Owner’s equity (common) | 50,000.00 | 50,000.00 | 50,000.00 | 50,000.00 | 50,000.00 | 50,000.00 |

| Paid-in capital | 2,50,000.00 | 2,50,000.00 | 2,50,000.00 | 2,50,000.00 | 2,50,000.00 | 2,50,000.00 |

| Preferred equity | – | – | – | – | – | – |

| Retained earnings | – | 1,39,630.04 | 3,00,188.20 | 5,01,720.54 | 7,66,798.76 | 11,28,871.54 |

| TOTAL EQUITY | 3,00,000.00 | 4,39,630.04 | 6,00,188.20 | 8,01,720.54 | 10,66,798.76 | 14,28,871.54 |

| TOTAL LIABILITIES AND EQUITY | 9,02,100.00 | 9,32,055.05 | 9,78,002.86 | 10,59,767.37 | 11,99,688.21 | 14,30,971.54 |

Profit and Loss Statement

| PROFIT AND LOSS ASSUMPTION | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Annual cumulative price (revenue) increase | 0.00% | 4.00% | 8.00% | 12.00% | 16.00% |

| Annual cumulative inflation (expense) increase | 0.00% | 2.00% | 4.00% | 6.00% | 8.00% |

| INCOME | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Revenue | |||||

| Subscription | 5,00,000.00 | 5,20,000.00 | 5,61,600.00 | 6,28,992.00 | 7,29,630.72 |

| Sponsorship payment from vendors | 30,000.00 | 31,200.00 | 33,696.00 | 37,739.52 | 43,777.84 |

| Commissions | 4,00,000.00 | 4,16,000.00 | 4,49,280.00 | 5,03,193.60 | 5,83,704.58 |

| Total revenue | 9,30,000.00 | 9,67,200.00 | 10,44,576.00 | 11,69,925.12 | 13,57,113.14 |

| Cost of Sales | |||||

| Subscription | 3,25,000.00 | 3,31,500.00 | 3,44,760.00 | 3,65,445.60 | 3,94,681.25 |

| Sponsorship payment from vendors | 16,500.00 | 16,830.00 | 17,503.20 | 18,553.39 | 20,037.66 |

| Commissions | 3,20,000.00 | 3,26,400.00 | 3,39,456.00 | 3,59,823.36 | 3,88,609.23 |

| 0 | – | – | – | – | – |

| Cost of goods sold | 6,61,500.00 | 6,74,730.00 | 7,01,719.20 | 7,43,822.35 | 8,03,328.14 |

| Gross Profit | 2,68,500.00 | 2,92,470.00 | 3,42,856.80 | 4,26,102.77 | 5,53,785.00 |

| Non-Operation Income | |||||

| Rental | – | – | – | – | – |

| Interest income | – | – | – | – | – |

| Loss (gain) on sale of assets | – | – | 1,000.00 | – | – |

| Other income (specify) | – | – | – | – | – |

| Total Non-Operation Income | – | – | 1,000.00 | – | – |

| TOTAL INCOME | 2,68,500.00 | 2,92,470.00 | 3,43,856.80 | 4,26,102.77 | 5,53,785.00 |

| EXPENSES | |||||

| Operating expenses | |||||

| Sales and marketing | 15,000.00 | 15,300.00 | 15,912.00 | 16,866.72 | 18,216.06 |

| Depreciation | 6,000.00 | 6,120.00 | 6,240.00 | 6,360.00 | 6,480.00 |

| Insurance | 7,500.00 | 7,650.00 | 7,956.00 | 8,433.36 | 9,108.03 |

| Payroll and Payroll Tax | 21,000.00 | 21,420.00 | 22,276.80 | 23,613.41 | 25,502.48 |

| Property taxes | 2,500.00 | 2,550.00 | 2,652.00 | 2,811.12 | 3,036.01 |

| Maintenance, repair, and overhaul | 1,000.00 | 1,020.00 | 1,040.00 | 1,060.00 | 1,080.00 |

| Utilities | 5,000.00 | 5,100.00 | 5,304.00 | 5,622.24 | 6,072.02 |

| Administrative fees | 300.00 | 306.00 | 318.24 | 337.33 | 364.32 |

| Interest expense on long-term debt | 24,259.55 | 19,324.18 | 14,166.71 | 8,777.16 | 3,145.08 |

| Other | 1,000.00 | 1,020.00 | 1,060.80 | 1,124.45 | 1,214.40 |

| Total operating expenses | 83,559.55 | 79,810.18 | 76,926.55 | 75,005.79 | 74,218.40 |

| Non-Recurring Expenses | |||||

| Unexpected Expenses | – | – | – | – | |

| Other expenses | – | – | – | – | – |

| Total Non-Recurring Expenses | – | – | – | – | – |

| TOTAL EXPENSES | 83,559.55 | 79,810.18 | 76,926.55 | 75,005.79 | 74,218.40 |

| TAXES | |||||

| Income Tax | 45,310.41 | 52,101.66 | 65,397.91 | 86,018.76 | 1,17,493.82 |

| Other Tax (specify) | – | – | – | – | – |

| TOTAL TAXES | 45,310.41 | 52,101.66 | 65,397.91 | 86,018.76 | 1,17,493.82 |

| NET PROFIT | 1,39,630.04 | 1,60,558.16 | 2,01,532.34 | 2,65,078.22 | 3,62,072.78 |

Cash Flow Statement

| Operating activities | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Total |

| Net income | 1,39,630.04 | 1,60,558.16 | 2,01,532.34 | 2,65,078.22 | 3,62,072.78 | 11,28,871.54 |

| Depreciation | 6,000.00 | 6,120.00 | 6,240.00 | 6,360.00 | 6,480.00 | 31,200.00 |

| Accounts receivable | – | – | – | – | – | – |

| Inventories | – | – | – | – | – | – |

| Accounts payable | – | – | – | – | – | – |

| Amortization | – | – | – | – | – | – |

| Other liabilities | – | – | – | – | – | – |

| Other operating cash flow items | – | – | – | – | – | – |

| Total operating activities | 1,45,630.04 | 1,66,678.16 | 2,07,772.34 | 2,71,438.22 | 3,68,552.78 | 11,60,071.54 |

| Investing activities | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Total |

| Capital expenditures | – | – | – | – | – | – |

| Acquisition of business | – | – | – | – | – | |

| Sale of fixed assets | – | – | – 1,000.00 | – | – | – 1,000.00 |

| Other investing cash flow items | – | – | – | – | – | – |

| Total investing activities | – | – | – 1,000.00 | – | – | – 1,000.00 |

| Financing activities | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Total |

| Long-term debt/financing | – 9,674.98 | – 1,64,610.36 | – 94,767.82 | – 75,157.38 | – 2,05,789.46 | – 5,50,000.00 |

| Preferred stock | – | – | – | – | – | – |

| Total cash dividends paid | – | – | – | – | – | – |

| Common stock | – | – | – | – | – | – |

| Other financing cash flow items | – | – | – | – | – | – |

| Total financing activities | – 9,674.98 | – 1,64,610.36 | – 94,767.82 | – 75,157.38 | – 2,05,789.46 | – 5,50,000.00 |

| Cumulative cash flow | 1,35,955.05 | 2,067.81 | 1,12,004.51 | 1,96,280.84 | 1,62,763.32 | 6,09,071.54 |

| Beginning cash balance | 50,000.00 | 1,85,955.05 | 1,88,022.86 | 3,00,027.37 | 4,96,308.21 | |

| Ending cash balance | 1,85,955.05 | 1,88,022.86 | 3,00,027.37 | 4,96,308.21 | 6,59,071.54 |

Conclusion

In short-range wireless communications, radio frequency identification is one of the most commonly used technologies, and it is expected to play an increasing role in the future. RFID is becoming a popular technology in many different fields these days, including supply chain systems, community medical and transportation systems. RFID systems consist of an antenna, a reader, and a tag. Bands can be divided into three categories: low-frequency, high-frequency, and ultrahigh frequency (UHF). Several factors contribute to the success of UHF tags, including their high stability, long transmission range, and data capacity. There will be approximately 15 billion UHF tags sold by 2019 with a total market value of about USD 1 billion. The global market for UHF tags is increasing from 2017 to 2019. The aim of this paper is to investigate the digital baseband system of UHF RFID tags. During the communication process between the tag and the reader, the digital baseband processor is the tag’s core. Controls the time and manner in which data is received (and sent) by the tag.

The aim of the project is to bring to market a product that uses Baseband signal processing circuits in the application of Power Cognitive Communication ICs. In the world, of IT, miniaturising is a constant. With greater demands being placed on reduced energy usage. The project therefore aims to bring to market a product to be embedded in commercial use IOT devices that can help in power effective signal transmission.

This business presents a worthwhile investment in light of the market analysis and key trends observed. It is possible for this business to become a market leader within a few years, given the right capital boost and a proper management.

………………………………………………………………………………………………………………………..

Know more about UniqueSubmission’s other writing services: